Key Insights

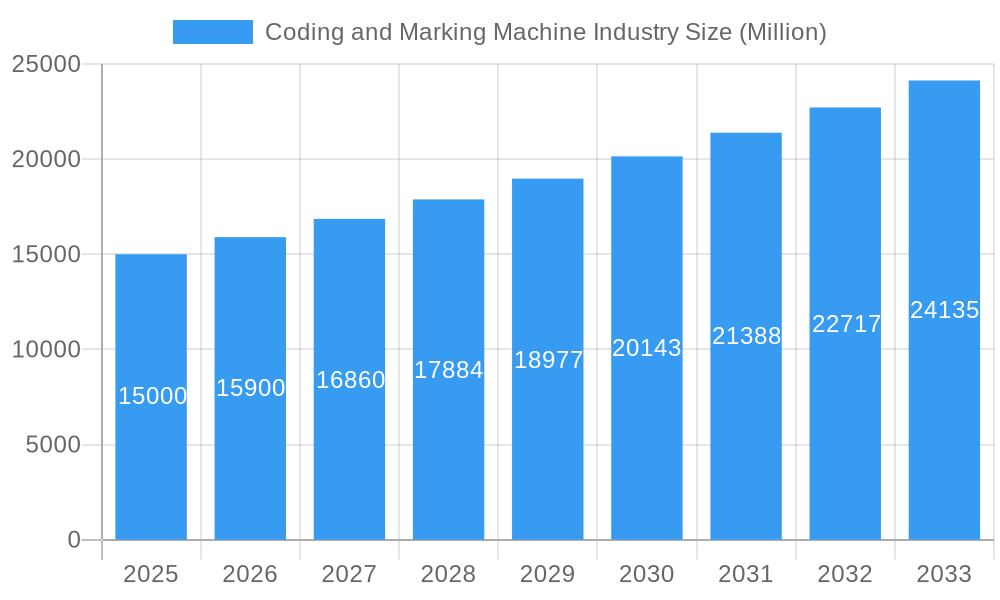

The global coding and marking machine market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 5.64% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for efficient and reliable product identification across diverse industries like pharmaceuticals (driven by stringent regulatory compliance), food and beverage (focused on traceability and safety), and cosmetics (emphasizing branding and anti-counterfeiting measures) is a major catalyst. Automation trends in manufacturing and the growing adoption of advanced printing technologies, such as thermal inkjet (TIJ) and continuous inkjet (CIJ), further fuel market growth. The shift towards sophisticated, high-speed printing solutions that enhance production efficiency and minimize operational costs is also a significant driver. While the market faces certain restraints, such as the high initial investment associated with advanced equipment and the need for skilled operators, the long-term benefits of improved product traceability and reduced waste outweigh these challenges. The market segmentation reveals a strong preference for thermal inkjet printers and a significant contribution from the pharmaceutical and food & beverage end-user industries. Key players like Keyence, Domino, and Danaher are leveraging technological advancements and strategic partnerships to consolidate their market positions and capitalize on emerging opportunities.

Coding and Marking Machine Industry Market Size (In Billion)

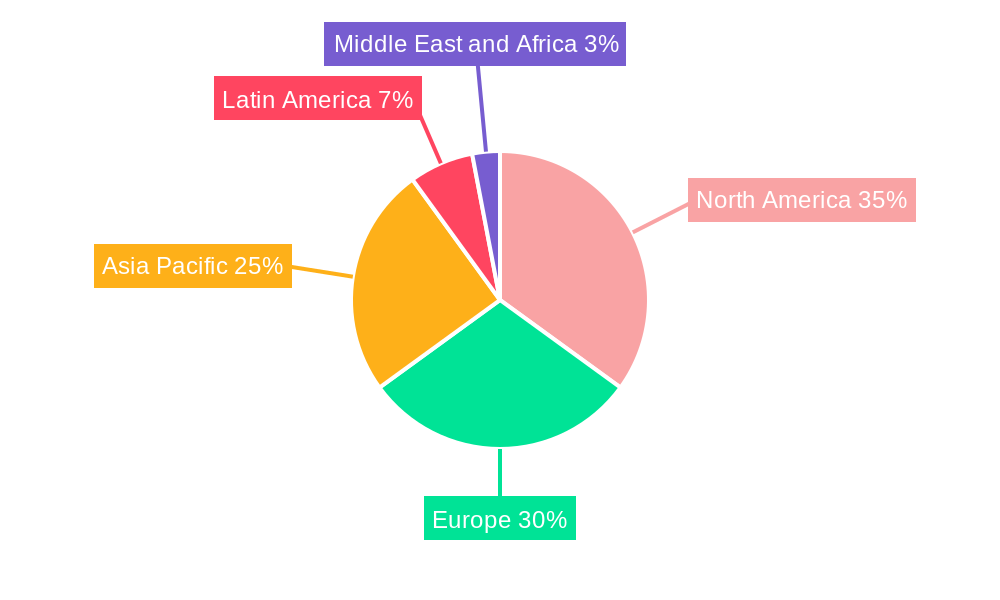

The market's regional distribution shows a considerable concentration in North America and Europe, driven by established industrial bases and stringent regulatory frameworks. However, the Asia-Pacific region is poised for significant growth owing to the increasing manufacturing activities and rising disposable incomes in developing economies. The forecast period (2025-2033) anticipates a continuous expansion, with the market size exceeding its 2025 value considerably, reflecting a sustained demand for efficient and reliable coding and marking solutions. Continuous innovation in printing technologies, coupled with the rising adoption of Industry 4.0 principles, promises to further reshape the market landscape in the coming years. The competitive landscape remains dynamic, with established players and emerging companies competing on technological capabilities, pricing strategies, and after-sales services.

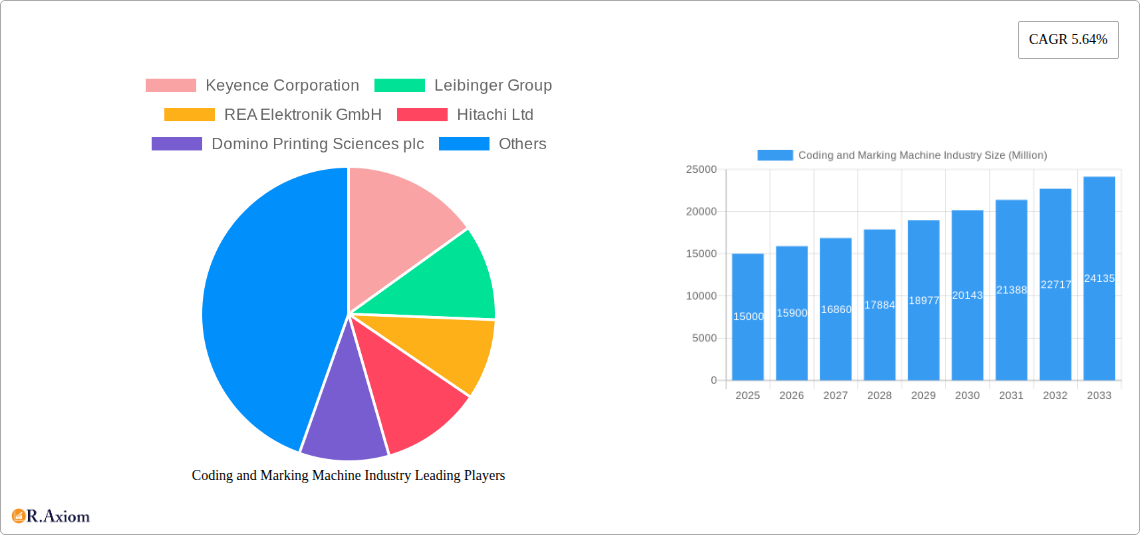

Coding and Marking Machine Industry Company Market Share

Coding and Marking Machine Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the global Coding and Marking Machine industry, covering market size, segmentation, key players, growth drivers, challenges, and future opportunities. The report utilizes data from 2019-2024 (Historical Period), with 2025 as the Base and Estimated Year, and projects the market's trajectory from 2025-2033 (Forecast Period). The total market value is estimated to reach xx Million by 2033.

Coding and Marking Machine Industry Market Concentration & Innovation

The Coding and Marking Machine industry exhibits a moderately concentrated market structure, with several key players holding significant market share. Keyence Corporation, Domino Printing Sciences plc, Danaher Corporation, and Dover Corporation are among the leading players, collectively accounting for an estimated xx% of the global market share in 2025. However, the presence of numerous smaller, specialized companies indicates a competitive landscape.

Innovation is a critical driver in this sector, fueled by increasing demand for high-speed, high-quality coding solutions and stringent regulatory requirements related to product traceability and authenticity. Major innovations include advancements in inkjet technology (Thermal Inkjet (TIJ) and Continuous Inkjet (CIJ)), laser marking, and software solutions for integration and data management. Regulatory frameworks, particularly those related to food safety and pharmaceutical traceability, exert significant influence, driving adoption of advanced coding technologies. Product substitution is limited, as each technology caters to specific needs, although competitive pressure encourages continuous improvement and diversification of offerings. End-user trends towards automation and Industry 4.0 principles further accelerate innovation. Mergers and acquisitions (M&A) activity, as seen with Dover's acquisition of Markem-Imaje, consolidate market share and integrate technologies. The value of these M&A deals within the last five years has totaled an estimated xx Million.

- Market Concentration: High (xx% by top 4 players in 2025)

- Key Innovation Drivers: Regulatory compliance, automation, Industry 4.0

- M&A Activity: Significant consolidation, totaling xx Million in the last five years.

Coding and Marking Machine Industry Industry Trends & Insights

The Coding and Marking Machine market is experiencing robust growth, driven by the increasing demand for product traceability and enhanced supply chain efficiency across various sectors. The market is witnessing a CAGR of xx% during the forecast period (2025-2033). Technological advancements, such as the development of high-resolution inkjet printers and advanced laser coders, are significantly impacting market dynamics. Consumer preferences for authentic and traceable products are driving adoption across industries like food and beverages, pharmaceuticals, and cosmetics. The competitive landscape is characterized by both established players and emerging innovators striving for market share through product differentiation and technological innovation. Market penetration is highest in developed economies, with emerging markets presenting significant growth opportunities.

Dominant Markets & Segments in Coding and Marking Machine Industry

The Food and Beverage sector currently dominates the end-user industry segment, driven by stringent regulations and consumer demand for clear and accurate product information. The Equipment solution segment holds the largest market share by solution, followed by Fluids and Ribbons. Within equipment types, Continuous Inkjet (CIJ) printers currently maintain a dominant position due to their versatility and adaptability for various applications.

- Dominant End-user Industry: Food and Beverage (driven by stringent regulations and consumer demand for traceability).

- Dominant Solution: Equipment (due to the core need for marking and coding machines).

- Dominant Equipment Type: Continuous Inkjet (CIJ) printers (owing to their versatility).

- Key Drivers (by Region): North America and Europe benefit from established regulatory frameworks and high technological adoption rates. Asia-Pacific presents significant growth potential fueled by increasing manufacturing activity and rising consumer awareness.

Coding and Marking Machine Industry Product Developments

Recent product developments showcase a strong emphasis on high-speed, high-resolution printing capabilities, enhanced connectivity, and improved user-friendliness. The launch of the Markem-Imaje 9750 CIJ printer and the Linx SL3 laser coder exemplify this trend. These advancements enhance traceability, enabling better supply chain management and reducing product counterfeiting. The market fit for these new products is excellent, given the increasing demands for efficient and reliable marking and coding systems across various industries.

Report Scope & Segmentation Analysis

This report segments the Coding and Marking Machine market across multiple dimensions:

By End-user Industry: Pharmaceutical, Construction, Food and Beverage, Cosmetics, Others. Each segment exhibits unique growth trajectories based on industry-specific regulations and technological adoption rates. The Food and Beverage segment is projected to maintain the largest market share throughout the forecast period.

By Solution: Equipment, Fluids and Ribbons, Spares. The Equipment segment dominates, while Fluids and Ribbons are closely tied to Equipment sales. The Spares segment experiences steady growth driven by the need for maintenance and repair.

By Equipment: Thermal Inkjet (TIJ) Printer, Continuous Inkjet (CIJ) Printer, Laser Printer, Others. CIJ printers hold the largest market share due to their versatility, while TIJ printers and laser printers cater to specific applications. The "Others" category comprises specialized niche technologies.

Key Drivers of Coding and Marking Machine Industry Growth

Several factors contribute to the industry's growth: increasing demand for product traceability and authenticity (driven by both regulatory requirements and consumer preferences), rising adoption of automation and Industry 4.0 technologies across various industries, and technological advancements in printing technologies leading to higher resolution, speed, and efficiency. Government regulations mandating traceability in sectors like pharmaceuticals and food further propel market growth.

Challenges in the Coding and Marking Machine Industry Sector

The industry faces challenges such as the high initial investment cost of advanced equipment, the need for specialized technical expertise for installation and maintenance, and intense competition among established and emerging players. Supply chain disruptions can also impact the availability of components and consumables, affecting production and timelines. Stringent regulatory compliance requirements can increase costs and complexity for manufacturers. These factors collectively constrain market growth and profitability.

Emerging Opportunities in Coding and Marking Machine Industry

Growing adoption of smart packaging and integration with blockchain technology presents significant opportunities. Expansion into emerging economies with high manufacturing growth offers substantial potential. Development of sustainable and environmentally friendly inks and consumables aligns with broader industry trends towards sustainability. The increasing demand for customized and specialized coding solutions for niche industries also creates niche market opportunities.

Leading Players in the Coding and Marking Machine Industry Market

- Keyence Corporation

- Leibinger Group

- REA Elektronik GmbH

- Hitachi Ltd

- Domino Printing Sciences plc

- Koenig & Bauer Coding GmbH

- Danaher Corporation

- Dover Corporation

- Control Print Ltd

- Matthews International Corporation

Key Developments in Coding and Marking Machine Industry Industry

- September 2021: Linx Printing Technologies launched the Linx SL3 laser coder, offering customizable features for diverse marking needs.

- May 2022: Markem-Imaje (Dover Corporation) launched the 9750 continuous inkjet printer, focusing on robust traceability coding for various packaging types.

Strategic Outlook for Coding and Marking Machine Industry Market

The Coding and Marking Machine industry is poised for continued growth, driven by technological advancements, stringent regulations, and increasing demand for efficient and reliable coding solutions. The focus on advanced features, integration with smart packaging, and expansion into emerging markets will shape the industry's future. Companies investing in R&D and strategic partnerships will be best positioned to capitalize on the market's growth potential.

Coding and Marking Machine Industry Segmentation

-

1. Solution

- 1.1. Equipment

- 1.2. Fluids and Ribbons

- 1.3. Spares

-

2. Equipment

- 2.1. Thermal Inkjet (TIJ) Printer

- 2.2. Continuous Inkjet (CIJ) Printer

- 2.3. Laser Printer

- 2.4. Others

-

3. End-user Industry

- 3.1. Pharmaceutical

- 3.2. Construction

- 3.3. Food and Beverage

- 3.4. Cosmetics

- 3.5. Others

Coding and Marking Machine Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Coding and Marking Machine Industry Regional Market Share

Geographic Coverage of Coding and Marking Machine Industry

Coding and Marking Machine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of the production and packaging industry and increasing adoption of creative packaging techniques; Increasing demand for product traceability solutions across supply chain of various industries

- 3.3. Market Restrains

- 3.3.1. High upfront and operational cost for deploying coding and making equipment

- 3.4. Market Trends

- 3.4.1. Food and Beverage Industry is Analyzed To Hold Highest Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 5.1.1. Equipment

- 5.1.2. Fluids and Ribbons

- 5.1.3. Spares

- 5.2. Market Analysis, Insights and Forecast - by Equipment

- 5.2.1. Thermal Inkjet (TIJ) Printer

- 5.2.2. Continuous Inkjet (CIJ) Printer

- 5.2.3. Laser Printer

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Pharmaceutical

- 5.3.2. Construction

- 5.3.3. Food and Beverage

- 5.3.4. Cosmetics

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 6. North America Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 6.1.1. Equipment

- 6.1.2. Fluids and Ribbons

- 6.1.3. Spares

- 6.2. Market Analysis, Insights and Forecast - by Equipment

- 6.2.1. Thermal Inkjet (TIJ) Printer

- 6.2.2. Continuous Inkjet (CIJ) Printer

- 6.2.3. Laser Printer

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Pharmaceutical

- 6.3.2. Construction

- 6.3.3. Food and Beverage

- 6.3.4. Cosmetics

- 6.3.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 7. Europe Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 7.1.1. Equipment

- 7.1.2. Fluids and Ribbons

- 7.1.3. Spares

- 7.2. Market Analysis, Insights and Forecast - by Equipment

- 7.2.1. Thermal Inkjet (TIJ) Printer

- 7.2.2. Continuous Inkjet (CIJ) Printer

- 7.2.3. Laser Printer

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Pharmaceutical

- 7.3.2. Construction

- 7.3.3. Food and Beverage

- 7.3.4. Cosmetics

- 7.3.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 8. Asia Pacific Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 8.1.1. Equipment

- 8.1.2. Fluids and Ribbons

- 8.1.3. Spares

- 8.2. Market Analysis, Insights and Forecast - by Equipment

- 8.2.1. Thermal Inkjet (TIJ) Printer

- 8.2.2. Continuous Inkjet (CIJ) Printer

- 8.2.3. Laser Printer

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Pharmaceutical

- 8.3.2. Construction

- 8.3.3. Food and Beverage

- 8.3.4. Cosmetics

- 8.3.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 9. Latin America Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 9.1.1. Equipment

- 9.1.2. Fluids and Ribbons

- 9.1.3. Spares

- 9.2. Market Analysis, Insights and Forecast - by Equipment

- 9.2.1. Thermal Inkjet (TIJ) Printer

- 9.2.2. Continuous Inkjet (CIJ) Printer

- 9.2.3. Laser Printer

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Pharmaceutical

- 9.3.2. Construction

- 9.3.3. Food and Beverage

- 9.3.4. Cosmetics

- 9.3.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 10. Middle East and Africa Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 10.1.1. Equipment

- 10.1.2. Fluids and Ribbons

- 10.1.3. Spares

- 10.2. Market Analysis, Insights and Forecast - by Equipment

- 10.2.1. Thermal Inkjet (TIJ) Printer

- 10.2.2. Continuous Inkjet (CIJ) Printer

- 10.2.3. Laser Printer

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Pharmaceutical

- 10.3.2. Construction

- 10.3.3. Food and Beverage

- 10.3.4. Cosmetics

- 10.3.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Keyence Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Leibinger Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 REA Elektronik GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hitachi Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Domino Printing Sciences plc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Koenig & Bauer Coding GmbH*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Danaher Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dover Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Control Print Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Matthews International Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Keyence Corporation

List of Figures

- Figure 1: Global Coding and Marking Machine Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Coding and Marking Machine Industry Revenue (Million), by Solution 2025 & 2033

- Figure 3: North America Coding and Marking Machine Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 4: North America Coding and Marking Machine Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 5: North America Coding and Marking Machine Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 6: North America Coding and Marking Machine Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Coding and Marking Machine Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Coding and Marking Machine Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Coding and Marking Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Coding and Marking Machine Industry Revenue (Million), by Solution 2025 & 2033

- Figure 11: Europe Coding and Marking Machine Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 12: Europe Coding and Marking Machine Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 13: Europe Coding and Marking Machine Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 14: Europe Coding and Marking Machine Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe Coding and Marking Machine Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Coding and Marking Machine Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Coding and Marking Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Coding and Marking Machine Industry Revenue (Million), by Solution 2025 & 2033

- Figure 19: Asia Pacific Coding and Marking Machine Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 20: Asia Pacific Coding and Marking Machine Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 21: Asia Pacific Coding and Marking Machine Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 22: Asia Pacific Coding and Marking Machine Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Coding and Marking Machine Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Coding and Marking Machine Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Coding and Marking Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Coding and Marking Machine Industry Revenue (Million), by Solution 2025 & 2033

- Figure 27: Latin America Coding and Marking Machine Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 28: Latin America Coding and Marking Machine Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 29: Latin America Coding and Marking Machine Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 30: Latin America Coding and Marking Machine Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Latin America Coding and Marking Machine Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Coding and Marking Machine Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Coding and Marking Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Coding and Marking Machine Industry Revenue (Million), by Solution 2025 & 2033

- Figure 35: Middle East and Africa Coding and Marking Machine Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 36: Middle East and Africa Coding and Marking Machine Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 37: Middle East and Africa Coding and Marking Machine Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 38: Middle East and Africa Coding and Marking Machine Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Coding and Marking Machine Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Coding and Marking Machine Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Coding and Marking Machine Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 2: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 3: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Coding and Marking Machine Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 6: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 7: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Coding and Marking Machine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 10: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 11: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Coding and Marking Machine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 14: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 15: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Coding and Marking Machine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 18: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 19: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Coding and Marking Machine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 22: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 23: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Coding and Marking Machine Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Coding and Marking Machine Industry?

The projected CAGR is approximately 5.64%.

2. Which companies are prominent players in the Coding and Marking Machine Industry?

Key companies in the market include Keyence Corporation, Leibinger Group, REA Elektronik GmbH, Hitachi Ltd, Domino Printing Sciences plc, Koenig & Bauer Coding GmbH*List Not Exhaustive, Danaher Corporation, Dover Corporation, Control Print Ltd, Matthews International Corporation.

3. What are the main segments of the Coding and Marking Machine Industry?

The market segments include Solution, Equipment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of the production and packaging industry and increasing adoption of creative packaging techniques; Increasing demand for product traceability solutions across supply chain of various industries.

6. What are the notable trends driving market growth?

Food and Beverage Industry is Analyzed To Hold Highest Share.

7. Are there any restraints impacting market growth?

High upfront and operational cost for deploying coding and making equipment.

8. Can you provide examples of recent developments in the market?

May 2022- Markem-Imaje, a subsidiary of Dover and a global provider of end-to-end supply chain solutions and industrial marking and coding systems, has announced the launch of the 9750 continuous inkjet printer. The 9750 is the first of a new generation of printers that can print robust traceability coding on a wide range of packaging, including up to five-line text messages, logos, and high-resolution 1D and 2D codes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Coding and Marking Machine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Coding and Marking Machine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Coding and Marking Machine Industry?

To stay informed about further developments, trends, and reports in the Coding and Marking Machine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence