Key Insights

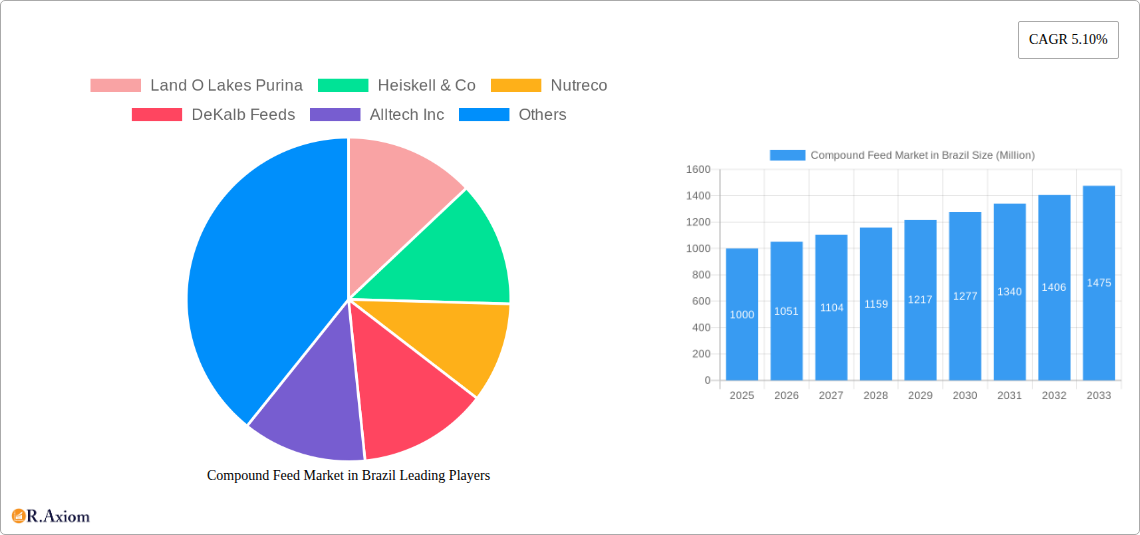

The Brazilian compound feed market, valued at approximately $X million in 2025 (assuming a logical extrapolation from the provided data and considering typical market growth in similar economies), is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 5.10% from 2025 to 2033. This growth is fueled by several key drivers. Increasing demand for animal protein, particularly poultry and swine, due to a growing population and rising consumption of meat, is a significant factor. Furthermore, advancements in feed technology leading to improved animal feed efficiency and productivity contribute to market expansion. The growing adoption of sustainable farming practices and a focus on animal health also play a crucial role. While the market faces challenges such as fluctuating raw material prices and potential regulatory changes impacting feed formulation, the overall outlook remains positive. The market is segmented by animal type (ruminants, poultry, swine, aquaculture, others) and ingredient type (cereals, cakes & meals, by-products, supplements). Poultry and swine segments are expected to dominate, driven by high demand for their respective products. Key players like Land O Lakes Purina, Heiskell & Co, Nutreco, DeKalb Feeds, Alltech Inc, Archer Daniels Midland, Cargill Inc, and Kent Feeds are vying for market share through product innovation and strategic partnerships. Brazil’s robust agricultural sector and government support for livestock farming further bolster market growth.

Compound Feed Market in Brazil Market Size (In Billion)

The competitive landscape is characterized by both large multinational corporations and smaller regional players. Large companies leverage their extensive distribution networks and advanced technologies to maintain a strong presence, while smaller players often focus on niche markets and specialized products. Future growth will likely be driven by innovations in feed formulation, focusing on enhanced nutritional value, improved digestibility, and reduced environmental impact. Strategic mergers and acquisitions could also reshape the market landscape. In summary, the Brazilian compound feed market presents significant opportunities for growth, underpinned by strong domestic demand and ongoing technological advancements, while navigating challenges related to cost management and regulatory compliance.

Compound Feed Market in Brazil Company Market Share

Compound Feed Market in Brazil: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Compound Feed Market in Brazil, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, competitive landscapes, and future growth potential, making it an essential resource for industry stakeholders, investors, and strategic decision-makers. The report leverages extensive primary and secondary research, incorporating data from various reliable sources to offer a precise and current picture of the Brazilian compound feed market. With a focus on key segments, leading players, and emerging trends, this report provides actionable intelligence for navigating this dynamic market. The base year for this report is 2025, with the forecast period extending to 2033.

Compound Feed Market in Brazil: Market Concentration & Innovation

The Brazilian compound feed market exhibits a moderately concentrated structure, with a few major players holding significant market share. While precise market share figures for individual companies fluctuate and require further specific research, companies like Cargill Inc, Nutreco, and Archer Daniels Midland command substantial portions of the market. The market's competitive intensity is further amplified by the presence of several regional and smaller players actively vying for market share.

Innovation Drivers:

- Technological advancements: Automation in feed production, precision feeding technologies, and the incorporation of novel feed additives are key innovation drivers.

- Focus on sustainable practices: Growing emphasis on environmentally friendly production methods and animal welfare is pushing innovation in feed formulations and sourcing.

- Product diversification: Companies are diversifying their product portfolios to cater to the evolving needs of different animal types and farming practices.

Regulatory Landscape:

Brazil's regulatory framework governing animal feed production and quality is continuously evolving, impacting both domestic and international players. Stricter regulations on feed safety and environmental standards present both challenges and opportunities for innovation and market consolidation.

M&A Activities:

The market has witnessed significant mergers and acquisitions (M&A) activity in recent years, driven by companies aiming to expand their market reach, diversify their product offerings, and improve their efficiency. Recent examples include Cargill's acquisition of Integral Animal Nutrition (October 2022) for an undisclosed value, showcasing the strategic importance of the Brazilian market. Such transactions often involve values in the tens or hundreds of Millions, depending on the size and assets of the acquired company.

Product Substitutes & End-User Trends:

The primary substitute for compound feed is self-mixed rations, especially in smaller farms. However, the trend favors compound feed due to its convenience, consistent quality, and specialized formulations for optimal animal performance. End-user trends highlight a growing demand for value-added products, such as functional feeds incorporating specific ingredients for improved animal health and productivity.

Compound Feed Market in Brazil: Industry Trends & Insights

The Brazilian compound feed market is characterized by steady growth, driven by increasing demand for animal protein, expanding livestock farming operations, and improvements in animal farming techniques. The market has demonstrated consistent expansion throughout the historical period (2019-2024), with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fuelled by several key factors:

- Rising meat consumption: Brazil's burgeoning population and increasing per capita meat consumption drive demand for animal feed.

- Expansion of livestock farming: The country's livestock sector is undergoing expansion, with investments in larger-scale farming operations boosting feed demand.

- Technological advancements: Enhanced feed formulations, precision feeding technologies, and improved feed manufacturing processes enhance productivity and profitability.

- Government initiatives: Government policies supporting the agricultural sector indirectly contribute to the growth of the feed industry.

- Changing consumer preferences: Increased awareness of animal welfare and sustainable farming practices are influencing feed preferences.

Market penetration of high-quality, specialized compound feeds remains relatively high in regions with advanced farming infrastructure and practices, while there's still room for expansion in other areas. However, competitive pressures from local and multinational players continuously reshape the market landscape.

Dominant Markets & Segments in Compound Feed Market in Brazil

The Brazilian compound feed market is geographically diverse, with varying levels of demand and production across different regions. While precise regional dominance data requires specific market research, the South and Southeast regions, due to their higher concentration of livestock farms and better infrastructure, generally show stronger market activity.

Dominant Animal Types:

- Poultry: The poultry segment dominates the Brazilian compound feed market due to the large-scale poultry farming industry and high consumption of poultry products. Key drivers include:

- High demand for poultry meat

- Efficient poultry production systems

- Government support for the poultry industry

- Swine: The swine segment holds a significant share, driven by growing pork consumption and the expansion of hog farms.

- Ruminants: The ruminant segment (cattle, sheep, goats) also shows significant demand, although possibly smaller than poultry and swine.

- Aquaculture: This segment shows promising growth potential due to increasing demand for fish and seafood.

Dominant Ingredients:

- Cereals: Maize and soybeans represent the backbone of compound feed formulations, representing the largest share of the ingredient segment.

- Cakes & Meals: By-products from the processing of oilseeds (soybean meal, etc.) are essential components.

- By-products: The usage of by-products from various agricultural industries contributes to the cost-effectiveness of feed production.

- Supplements: The demand for supplements like vitamins, minerals, and amino acids is steadily increasing to enhance animal health and productivity.

Compound Feed Market in Brazil: Product Developments

Recent product developments in the Brazilian compound feed market center on improved nutritional profiles, specialized formulations targeting specific animal types and production stages, and incorporating functional additives to enhance animal health, immunity, and growth performance. Technological advancements include precise feed mixing and delivery systems, alongside the adoption of advanced analytical techniques for quality control. The focus remains on providing cost-effective, efficient, and sustainable feed solutions that cater to the evolving needs of the livestock and aquaculture industries.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the Brazilian compound feed market based on animal type (ruminants, poultry, swine, aquaculture, other animal types) and ingredient type (cereals, cakes & meals, by-products, supplements). Each segment is analyzed in detail, with growth projections, market size estimations (in Millions), and competitive dynamics provided for each sub-segment. For example, the poultry segment is expected to exhibit a xx% CAGR, while the swine segment might see a xx% CAGR, showcasing variations in growth across the animal type classification. Similarly, ingredient-based segmentation analysis shows market shares and growth trajectories for each category, factoring in various factors like pricing, availability, and nutritional value. The report also analyzes competitive intensity within each segment, identifying key players and their strategies.

Key Drivers of Compound Feed Market in Brazil Growth

Several factors propel the growth of Brazil's compound feed market. Strong economic growth and increased disposable incomes contribute to higher meat consumption. The expansion of the livestock and aquaculture industries fuels the demand for higher-quality feed. Government initiatives supporting the agricultural sector, technological advancements in feed production and formulation, and improvements in animal husbandry practices also play critical roles. The increasing awareness of animal health and welfare further drives the adoption of sophisticated feed formulations with added supplements and improved nutritional balance.

Challenges in the Compound Feed Market in Brazil Sector

The Brazilian compound feed market faces several challenges, including fluctuations in raw material prices (e.g., corn and soybeans), which can significantly impact production costs. Regulatory compliance and evolving environmental regulations can increase operational costs. The intense competition from both domestic and multinational companies exerts pressure on profit margins. Supply chain disruptions due to factors like weather patterns and infrastructure limitations can impact the timely availability of raw materials. Finally, the need to balance affordability with nutritional quality is a continuous challenge. Quantifiable impacts are difficult to present without dedicated market research, but overall, these challenges impact the overall cost of production and, consequently, the market's profitability.

Emerging Opportunities in Compound Feed Market in Brazil

Emerging opportunities lie in the increasing demand for specialized feed formulations designed to address specific animal health needs (e.g., disease prevention, improved immune function). The growing adoption of precision feeding technologies and digital solutions for optimizing feed management offers potential for growth. The rising demand for sustainable and environmentally friendly feed production practices presents further opportunities. Finally, exploring new protein sources and alternative ingredients to reduce reliance on traditional commodities is another significant development that the market will need to adapt to in the long term.

Leading Players in the Compound Feed Market in Brazil Market

- Land O Lakes Purina

- Heiskell & Co

- Nutreco

- DeKalb Feeds

- Alltech Inc

- Archer Daniels Midland

- Cargill Inc

- Kent Feeds

Key Developments in Compound Feed Market in Brazil Industry

- October 2022: Cargill acquired Integral Animal Nutrition, significantly expanding its presence in the Brazilian cattle feed market and enhancing its Free Choice Mineral and premix capabilities.

- January 2022: Archer Daniels Midland (ADM) opened its Aquaculture Innovation Lab, bolstering its research and development efforts in Brazil and enhancing its ability to innovate and improve its aquaculture feed offerings.

Strategic Outlook for Compound Feed Market in Brazil Market

The Brazilian compound feed market is poised for continued growth, driven by increasing demand for animal protein, advancements in feed technology, and supportive government policies. Opportunities abound in developing specialized feed solutions, adopting sustainable practices, and capitalizing on technological advancements for improved efficiency and productivity. The market's long-term outlook remains positive, provided that challenges related to raw material price volatility and regulatory compliance are effectively addressed. Continued strategic investments in research, development, and sustainable practices will be crucial for companies to thrive in this dynamic market.

Compound Feed Market in Brazil Segmentation

-

1. Animal Type

- 1.1. Ruminants

- 1.2. Poultry

- 1.3. Swine

- 1.4. Aquaculture

- 1.5. Other Animal Types

-

2. Ingredient

- 2.1. Cereals

- 2.2. Cakes & Meals

- 2.3. By-products

- 2.4. Supplements

Compound Feed Market in Brazil Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Compound Feed Market in Brazil Regional Market Share

Geographic Coverage of Compound Feed Market in Brazil

Compound Feed Market in Brazil REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Demand for Quality Compound Feed to boost Balanced Diet in Animals

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Compound Feed Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Ruminants

- 5.1.2. Poultry

- 5.1.3. Swine

- 5.1.4. Aquaculture

- 5.1.5. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredient

- 5.2.1. Cereals

- 5.2.2. Cakes & Meals

- 5.2.3. By-products

- 5.2.4. Supplements

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. North America Compound Feed Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 6.1.1. Ruminants

- 6.1.2. Poultry

- 6.1.3. Swine

- 6.1.4. Aquaculture

- 6.1.5. Other Animal Types

- 6.2. Market Analysis, Insights and Forecast - by Ingredient

- 6.2.1. Cereals

- 6.2.2. Cakes & Meals

- 6.2.3. By-products

- 6.2.4. Supplements

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 7. South America Compound Feed Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 7.1.1. Ruminants

- 7.1.2. Poultry

- 7.1.3. Swine

- 7.1.4. Aquaculture

- 7.1.5. Other Animal Types

- 7.2. Market Analysis, Insights and Forecast - by Ingredient

- 7.2.1. Cereals

- 7.2.2. Cakes & Meals

- 7.2.3. By-products

- 7.2.4. Supplements

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 8. Europe Compound Feed Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 8.1.1. Ruminants

- 8.1.2. Poultry

- 8.1.3. Swine

- 8.1.4. Aquaculture

- 8.1.5. Other Animal Types

- 8.2. Market Analysis, Insights and Forecast - by Ingredient

- 8.2.1. Cereals

- 8.2.2. Cakes & Meals

- 8.2.3. By-products

- 8.2.4. Supplements

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 9. Middle East & Africa Compound Feed Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 9.1.1. Ruminants

- 9.1.2. Poultry

- 9.1.3. Swine

- 9.1.4. Aquaculture

- 9.1.5. Other Animal Types

- 9.2. Market Analysis, Insights and Forecast - by Ingredient

- 9.2.1. Cereals

- 9.2.2. Cakes & Meals

- 9.2.3. By-products

- 9.2.4. Supplements

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 10. Asia Pacific Compound Feed Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 10.1.1. Ruminants

- 10.1.2. Poultry

- 10.1.3. Swine

- 10.1.4. Aquaculture

- 10.1.5. Other Animal Types

- 10.2. Market Analysis, Insights and Forecast - by Ingredient

- 10.2.1. Cereals

- 10.2.2. Cakes & Meals

- 10.2.3. By-products

- 10.2.4. Supplements

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Land O Lakes Purina

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Heiskell & Co

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nutreco

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DeKalb Feeds

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alltech Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Archer Daniels Midland

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cargill Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kent Feeds

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Land O Lakes Purina

List of Figures

- Figure 1: Global Compound Feed Market in Brazil Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Compound Feed Market in Brazil Revenue (undefined), by Animal Type 2025 & 2033

- Figure 3: North America Compound Feed Market in Brazil Revenue Share (%), by Animal Type 2025 & 2033

- Figure 4: North America Compound Feed Market in Brazil Revenue (undefined), by Ingredient 2025 & 2033

- Figure 5: North America Compound Feed Market in Brazil Revenue Share (%), by Ingredient 2025 & 2033

- Figure 6: North America Compound Feed Market in Brazil Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Compound Feed Market in Brazil Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Compound Feed Market in Brazil Revenue (undefined), by Animal Type 2025 & 2033

- Figure 9: South America Compound Feed Market in Brazil Revenue Share (%), by Animal Type 2025 & 2033

- Figure 10: South America Compound Feed Market in Brazil Revenue (undefined), by Ingredient 2025 & 2033

- Figure 11: South America Compound Feed Market in Brazil Revenue Share (%), by Ingredient 2025 & 2033

- Figure 12: South America Compound Feed Market in Brazil Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Compound Feed Market in Brazil Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Compound Feed Market in Brazil Revenue (undefined), by Animal Type 2025 & 2033

- Figure 15: Europe Compound Feed Market in Brazil Revenue Share (%), by Animal Type 2025 & 2033

- Figure 16: Europe Compound Feed Market in Brazil Revenue (undefined), by Ingredient 2025 & 2033

- Figure 17: Europe Compound Feed Market in Brazil Revenue Share (%), by Ingredient 2025 & 2033

- Figure 18: Europe Compound Feed Market in Brazil Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Compound Feed Market in Brazil Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Compound Feed Market in Brazil Revenue (undefined), by Animal Type 2025 & 2033

- Figure 21: Middle East & Africa Compound Feed Market in Brazil Revenue Share (%), by Animal Type 2025 & 2033

- Figure 22: Middle East & Africa Compound Feed Market in Brazil Revenue (undefined), by Ingredient 2025 & 2033

- Figure 23: Middle East & Africa Compound Feed Market in Brazil Revenue Share (%), by Ingredient 2025 & 2033

- Figure 24: Middle East & Africa Compound Feed Market in Brazil Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Compound Feed Market in Brazil Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Compound Feed Market in Brazil Revenue (undefined), by Animal Type 2025 & 2033

- Figure 27: Asia Pacific Compound Feed Market in Brazil Revenue Share (%), by Animal Type 2025 & 2033

- Figure 28: Asia Pacific Compound Feed Market in Brazil Revenue (undefined), by Ingredient 2025 & 2033

- Figure 29: Asia Pacific Compound Feed Market in Brazil Revenue Share (%), by Ingredient 2025 & 2033

- Figure 30: Asia Pacific Compound Feed Market in Brazil Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Compound Feed Market in Brazil Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 2: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Ingredient 2020 & 2033

- Table 3: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 5: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Ingredient 2020 & 2033

- Table 6: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 11: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Ingredient 2020 & 2033

- Table 12: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 17: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Ingredient 2020 & 2033

- Table 18: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 29: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Ingredient 2020 & 2033

- Table 30: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 38: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Ingredient 2020 & 2033

- Table 39: Global Compound Feed Market in Brazil Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Compound Feed Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Compound Feed Market in Brazil?

The projected CAGR is approximately 3.78%.

2. Which companies are prominent players in the Compound Feed Market in Brazil?

Key companies in the market include Land O Lakes Purina, Heiskell & Co, Nutreco, DeKalb Feeds, Alltech Inc, Archer Daniels Midland, Cargill Inc, Kent Feeds.

3. What are the main segments of the Compound Feed Market in Brazil?

The market segments include Animal Type, Ingredient.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Demand for Quality Compound Feed to boost Balanced Diet in Animals.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

October 2022: Cargill has acquired Integral Animal Nutrition, a cattle feed producer in Brazil with this the company will purchase 100 percent of Integral's assets, including a production plant located in Brazil, a portfolio of products ranging from Free Choice minerals to premixes, will help the company further develop its Free Choice Mineral and premix capabilities to better serve its customers across the country's mid-west region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Compound Feed Market in Brazil," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Compound Feed Market in Brazil report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Compound Feed Market in Brazil?

To stay informed about further developments, trends, and reports in the Compound Feed Market in Brazil, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence