Key Insights

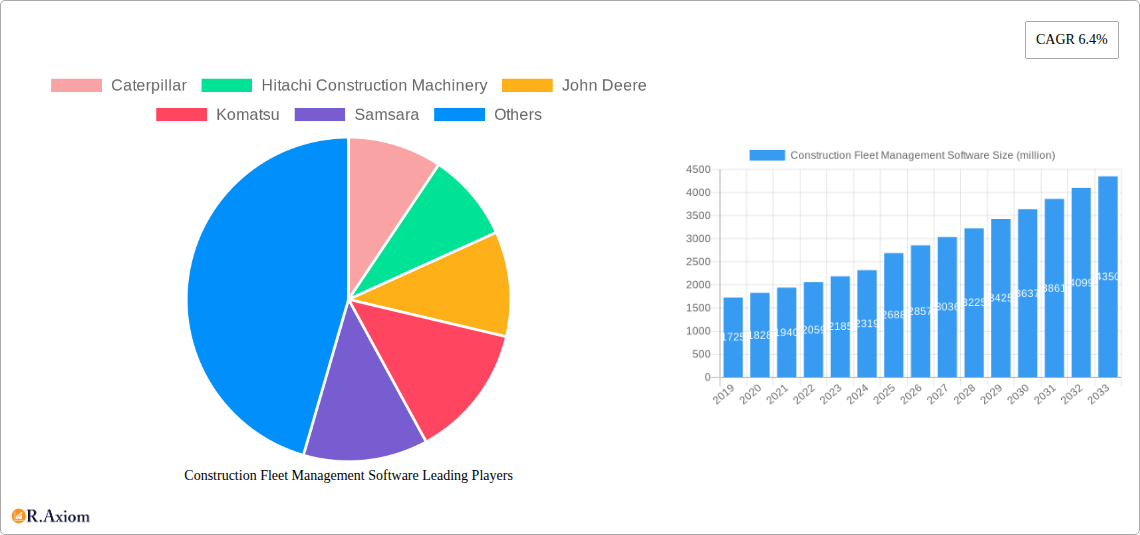

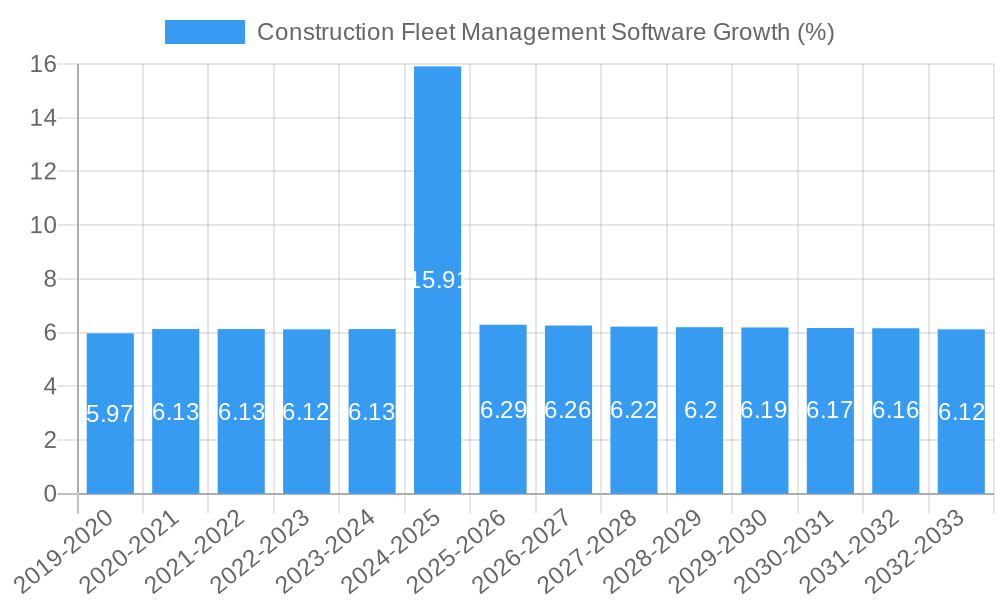

The global construction fleet management software market is experiencing robust growth, projected to reach $2,688 million by 2025 with a Compound Annual Growth Rate (CAGR) of 6.4% through 2033. This expansion is fueled by the increasing need for operational efficiency, cost reduction, and enhanced asset utilization within the construction industry. Key drivers include the growing adoption of IoT and telematics technologies for real-time tracking and monitoring of heavy machinery, enabling predictive maintenance and reducing downtime. Furthermore, the burgeoning infrastructure development projects worldwide necessitate sophisticated fleet management solutions to optimize resource allocation and streamline project timelines. The market is segmented into cloud-based and on-premise solutions, with a discernible shift towards cloud-based platforms due to their scalability, accessibility, and cost-effectiveness. Applications span across construction contractors, equipment rental companies, and infrastructure development firms, all seeking to leverage technology for improved profitability and competitive advantage.

The competitive landscape is characterized by the presence of major industry players such as Caterpillar, Komatsu, and Trimble, alongside specialized software providers like Samsara and Fleetio. These companies are actively innovating, offering integrated solutions that encompass telematics, maintenance management, fuel tracking, and operator behavior analysis. The demand for such comprehensive tools is further propelled by stringent safety regulations and the industry's growing focus on sustainability, which encourages the optimization of fuel consumption and equipment lifespan. While the market benefits from technological advancements and the imperative for enhanced operational control, potential restraints include the initial investment cost for some smaller firms and the ongoing need for training and adaptation to new software. However, the long-term benefits of improved productivity, reduced operational expenses, and enhanced asset longevity are compelling, positioning the construction fleet management software market for sustained and significant growth.

Construction Fleet Management Software Market Concentration & Innovation

The construction fleet management software market exhibits a moderate to high concentration, with key players like Caterpillar, Trimble, and John Deere wielding significant influence. Market share distribution is dynamic, with the top five companies collectively holding approximately 60% of the global market share. Innovation is a critical differentiator, driven by the demand for enhanced efficiency, safety, and compliance. Key innovation drivers include the integration of Artificial Intelligence (AI) for predictive maintenance, the proliferation of IoT devices for real-time asset tracking, and the development of advanced telematics solutions. Regulatory frameworks, particularly concerning emissions and driver safety, are also shaping product development, pushing for more robust compliance features. Product substitutes, such as manual tracking systems and generic ERP solutions, are gradually losing ground to specialized fleet management software due to their limited functionality and scalability. End-user trends are increasingly favoring cloud-based solutions for their accessibility and lower upfront costs. Mergers and acquisitions (M&A) activity is moderate, with significant deals like the acquisition of Samsara by a private equity firm valued at over $7,000 million, signaling consolidation and strategic expansion. M&A activity aims to broaden product portfolios, expand geographical reach, and acquire innovative technologies.

Construction Fleet Management Software Industry Trends & Insights

The global construction fleet management software market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 15% from 2025 to 2033. This sustained growth is fueled by the escalating need for operational efficiency in the construction industry, which is grappling with rising labor costs and project complexity. The market penetration of fleet management solutions is steadily increasing, moving from an estimated 40% in 2024 to over 70% by the end of the forecast period. Technological disruptions are a major catalyst, with the adoption of AI-powered predictive analytics revolutionizing maintenance schedules, reducing downtime by an estimated 20% and extending equipment lifespan by up to 15%. The integration of GPS tracking, telematics, and IoT sensors provides real-time visibility into asset location, utilization, and performance, enabling better resource allocation and enhanced project management. Consumer preferences are shifting towards integrated, user-friendly platforms that offer comprehensive fleet oversight, including fuel management, driver behavior monitoring, and compliance tracking. This demand is driving innovation in mobile applications and customizable dashboards. Competitive dynamics are characterized by intense rivalry among established players and emerging startups. Companies are differentiating themselves through superior feature sets, advanced analytics capabilities, and tailored solutions for specific construction segments. The market is also witnessing strategic partnerships between software providers and equipment manufacturers, creating bundled offerings that enhance value for end-users. The increasing adoption of Building Information Modeling (BIM) is also influencing fleet management, with future integrations expected to provide a more holistic view of project operations. The growing emphasis on sustainability and reduced carbon footprints is further driving the adoption of fleet management software that can optimize fuel consumption and monitor emissions.

Dominant Markets & Segments in Construction Fleet Management Software

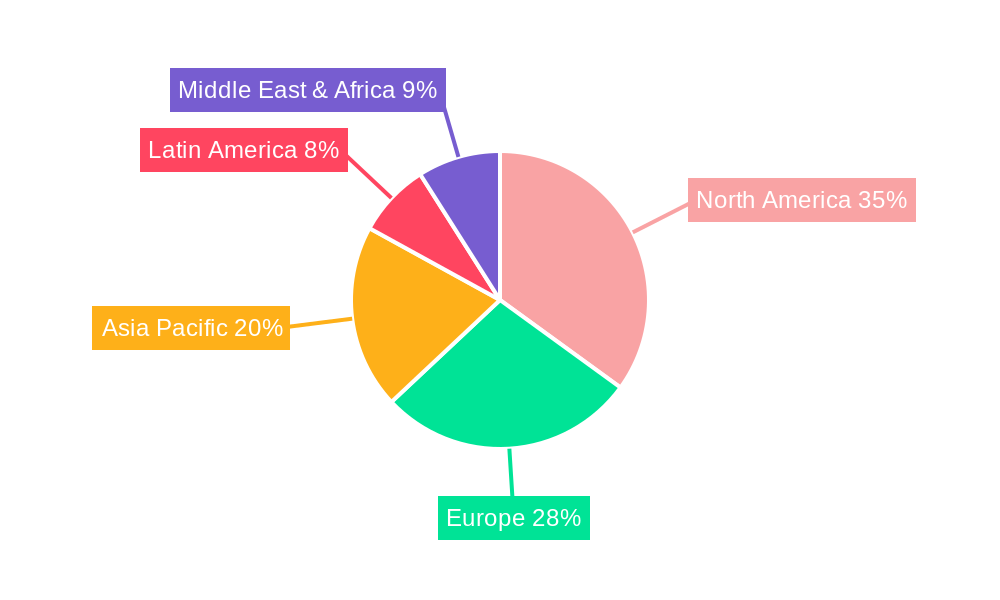

The North American region currently dominates the construction fleet management software market, accounting for an estimated 45% of the global revenue in 2025. This dominance is attributed to several key drivers, including strong economic policies supporting infrastructure development, a mature construction industry with high adoption rates of advanced technologies, and a significant presence of leading market players. Within North America, the United States leads by a substantial margin, driven by ongoing large-scale infrastructure projects and a proactive approach to adopting digital solutions for operational efficiency.

Application Segments:

- Construction Contractors: This segment represents the largest application, holding approximately 55% of the market share. Construction contractors rely heavily on fleet management software to optimize the deployment of heavy machinery, manage diverse fleets, track project timelines, and ensure worker safety. The need to reduce operational costs, improve project profitability, and enhance real-time decision-making are critical drivers for this segment. For example, a major infrastructure development firm utilizing fleet management software reported a 10% reduction in fuel costs and a 15% increase in equipment utilization.

- Equipment Rental Companies: This segment constitutes about 25% of the market. Rental companies leverage fleet management solutions for asset tracking, maintenance scheduling, damage assessment, and efficient customer service. The ability to monitor equipment location and status remotely is crucial for maximizing rental revenue and minimizing downtime.

- Infrastructure Development Firms: Holding the remaining 20%, these firms focus on large-scale public and private infrastructure projects. They use fleet management software for comprehensive oversight of numerous assets across multiple sites, ensuring compliance, optimizing logistics, and enhancing project management across complex operations.

Type Segments:

- Cloud-based: Cloud-based solutions command the largest market share, estimated at 75% in 2025, and are projected to continue their dominance. The key drivers for this segment include scalability, flexibility, lower upfront investment, and accessibility from any location with internet connectivity. The ease of software updates and reduced IT infrastructure burden makes it highly attractive for construction businesses of all sizes.

- On-premise: On-premise solutions account for the remaining 25% of the market. While less dominant, these solutions are favored by organizations with stringent data security requirements or those that prefer complete control over their IT infrastructure. The historical investment in existing on-premise systems also contributes to its continued, albeit declining, market presence.

Economic policies promoting infrastructure spending, such as government stimulus packages for road and bridge construction, significantly boost demand for construction fleet management software. The increasing emphasis on smart city initiatives also necessitates sophisticated fleet management for urban development projects.

Construction Fleet Management Software Product Developments

Product developments in construction fleet management software are rapidly advancing, focusing on enhanced integration and intelligence. Innovations include the seamless incorporation of AI for predictive maintenance, enabling companies to preemptively address equipment issues, thereby reducing downtime by an estimated 20% and extending asset lifespan. Real-time telematics are being refined to offer deeper insights into operational efficiency, fuel consumption, and driver behavior. Furthermore, the integration of IoT sensors for asset tracking and health monitoring provides unparalleled visibility. Competitive advantages are being gained through user-friendly interfaces, robust analytics dashboards, and specialized modules for compliance and safety management, making these solutions indispensable for modern construction operations.

Construction Fleet Management Software Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the construction fleet management software market, encompassing key applications and deployment types.

- Construction Contractors: This segment, representing a significant portion of the market, is characterized by a projected growth rate of 16% from 2025 to 2033, with an estimated market size of $2,500 million in 2025. Competitive dynamics are driven by features like real-time tracking, fuel management, and maintenance scheduling.

- Equipment Rental Companies: This segment is expected to grow at a CAGR of 14%, with a market size of $900 million in 2025. Key competitive factors include asset utilization monitoring and remote diagnostics.

- Infrastructure Development Firms: This segment, with an estimated market size of $700 million in 2025, is projected to grow at 15% CAGR. Dominant factors include large-scale project management capabilities and compliance tracking.

- Cloud-based: This deployment type, projected to reach a market size of $3,500 million in 2025, is expected to grow at 17% CAGR. Its rapid adoption is due to scalability and accessibility.

- On-premise: Valued at $1,200 million in 2025, this segment is forecast to grow at a CAGR of 10%. Competitive dynamics revolve around control and customization for specific enterprise needs.

Key Drivers of Construction Fleet Management Software Growth

The construction fleet management software market is propelled by several key drivers. Technological advancements, particularly in AI, IoT, and telematics, enable real-time data collection and analysis for optimized operations and predictive maintenance, leading to an estimated 25% increase in operational efficiency. Economic factors, including sustained global infrastructure investment and rising construction project volumes, create a direct demand for efficient fleet management. Regulatory mandates concerning safety, emissions, and data security also compel adoption, as businesses seek robust compliance solutions. The increasing cost of labor and equipment further incentivizes the adoption of software that enhances productivity and reduces waste.

Challenges in the Construction Fleet Management Software Sector

Despite its growth, the construction fleet management software sector faces several challenges. The high initial investment cost for implementing advanced systems can be a barrier for smaller businesses, with implementation costs sometimes reaching up to $100,000 for comprehensive solutions. Resistance to change and a lack of technical expertise among some workforce segments can hinder adoption. Data security concerns and the need for robust cybersecurity measures are paramount, especially with the increasing volume of sensitive operational data being collected. Integration complexities with existing legacy systems and the availability of skilled IT professionals to manage and maintain these solutions also present ongoing hurdles. Competitive pressures are intense, driving down prices and requiring continuous innovation.

Emerging Opportunities in Construction Fleet Management Software

Emerging opportunities in construction fleet management software lie in several key areas. The growing demand for integrated solutions that combine fleet management with project management, asset tracking, and workforce management presents a significant opportunity for software providers to offer comprehensive platforms. The expansion of the market into developing economies, driven by increasing infrastructure development and urbanization, offers new avenues for growth. Advancements in AI and machine learning are paving the way for more sophisticated predictive analytics, offering enhanced insights into equipment health and operational efficiency, potentially reducing maintenance costs by 30%. The development of specialized solutions for niche construction segments, such as mining or tunneling, also represents a growing opportunity, catering to unique operational needs and regulatory requirements.

Leading Players in the Construction Fleet Management Software Market

- Caterpillar

- Hitachi Construction Machinery

- John Deere

- Komatsu

- Samsara

- Teletrac Navman

- Topcon Positioning Systems

- Trimble

- Volvo Construction Equipment

- Zebra Technologies

- Texada

- Geotab

- Fleetio

- Tenna

- Chevin Fleet

- Fleet Complete

Key Developments in Construction Fleet Management Software Industry

- 2023/Q3: Trimble introduces enhanced AI-powered predictive maintenance features, aiming to reduce equipment downtime by an estimated 25%.

- 2023/Q2: Samsara expands its telematics offerings with advanced driver behavior monitoring, contributing to a projected 15% improvement in safety.

- 2022/Q4: John Deere announces strategic partnerships with leading IoT providers to integrate real-time asset tracking across its heavy machinery.

- 2022/Q3: Komatsu launches a new cloud-based platform offering enhanced fleet visibility and fuel management capabilities.

- 2021/Q4: Caterpillar acquires a specialized fleet analytics company to bolster its data-driven service offerings.

Strategic Outlook for Construction Fleet Management Software Market

The strategic outlook for the construction fleet management software market remains highly positive, driven by an insatiable demand for operational efficiency and digital transformation in the construction sector. Future growth catalysts will include the continued integration of advanced technologies like AI, IoT, and blockchain for enhanced security and predictive capabilities, potentially leading to a 20% reduction in operational costs. The increasing focus on sustainability will also drive demand for software solutions that optimize fuel consumption and monitor emissions. Furthermore, the expanding global infrastructure development initiatives, particularly in emerging economies, will unlock substantial new market opportunities, further solidifying the sector's growth trajectory.

Construction Fleet Management Software Segmentation

-

1. Application

- 1.1. Construction Contractors

- 1.2. Equipment Rental Companies

- 1.3. Infrastructure Development Firms

-

2. Type

- 2.1. Cloud-based

- 2.2. On-premise

Construction Fleet Management Software Segmentation By Geography

- 1. Global and United States

Construction Fleet Management Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.4% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Construction Fleet Management Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Construction Contractors

- 5.1.2. Equipment Rental Companies

- 5.1.3. Infrastructure Development Firms

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Cloud-based

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Global and United States

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Caterpillar

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hitachi Construction Machinery

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 John Deere

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Komatsu

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Samsara

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Teletrac Navman

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Topcon Positioning Systems

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trimble

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Volvo Construction Equipment

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zebra Technologies

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Texada

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Geotab

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Fleetio

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Tenna

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Chevin Fleet

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Fleet Complete

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Caterpillar

List of Figures

- Figure 1: Construction Fleet Management Software Revenue Breakdown (million, %) by Product 2024 & 2032

- Figure 2: Construction Fleet Management Software Share (%) by Company 2024

List of Tables

- Table 1: Construction Fleet Management Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Construction Fleet Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Construction Fleet Management Software Revenue million Forecast, by Type 2019 & 2032

- Table 4: Construction Fleet Management Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Construction Fleet Management Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Construction Fleet Management Software Revenue million Forecast, by Type 2019 & 2032

- Table 7: Construction Fleet Management Software Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Fleet Management Software?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Construction Fleet Management Software?

Key companies in the market include Caterpillar, Hitachi Construction Machinery, John Deere, Komatsu, Samsara, Teletrac Navman, Topcon Positioning Systems, Trimble, Volvo Construction Equipment, Zebra Technologies, Texada, Geotab, Fleetio, Tenna, Chevin Fleet, Fleet Complete.

3. What are the main segments of the Construction Fleet Management Software?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2688 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Fleet Management Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Fleet Management Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Fleet Management Software?

To stay informed about further developments, trends, and reports in the Construction Fleet Management Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence