Key Insights

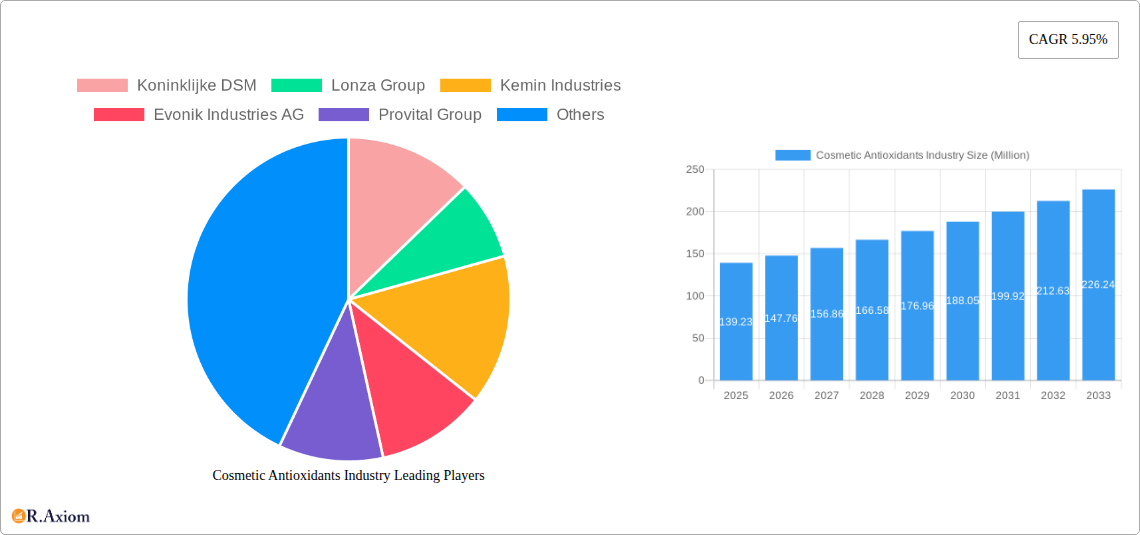

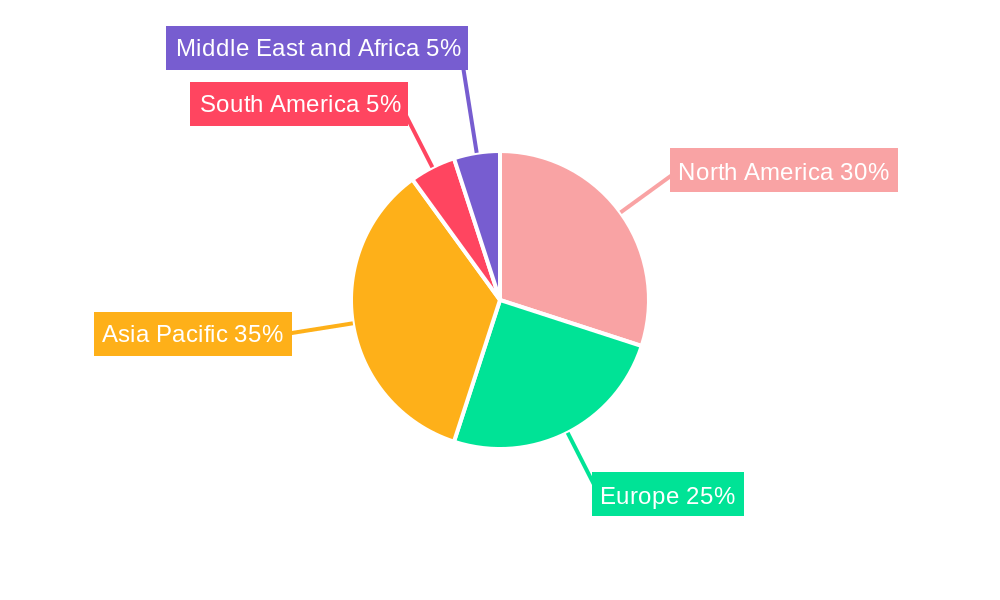

The global cosmetic antioxidants market, valued at $139.23 million in 2025, is projected to experience robust growth, driven by increasing consumer awareness of skincare benefits and the rising prevalence of skin aging and related concerns. The market's Compound Annual Growth Rate (CAGR) of 5.95% from 2019 to 2024 indicates a steady expansion, and this positive trajectory is expected to continue throughout the forecast period (2025-2033). Key drivers include the growing demand for natural and organic cosmetic products, fueled by heightened consumer preference for sustainable and ethically sourced ingredients. The increasing use of antioxidants in diverse applications, including skincare, hair care, and injectables, further contributes to market expansion. While the precise composition of each segment (Natural vs. Chemically Derived; Vitamins, Polyphenols, etc.) is not specified, it's reasonable to infer that the natural segment enjoys higher growth due to consumer preference, while the chemically derived segment maintains a substantial presence due to cost-effectiveness and specific functional properties. Geographical distribution likely shows a strong presence in the Asia-Pacific region, driven by significant population size and rising disposable incomes, with North America and Europe maintaining significant market shares due to established consumer markets and product innovation.

Cosmetic Antioxidants Industry Market Size (In Million)

The market's growth, however, may face certain restraints. Fluctuations in raw material prices and the complexities of regulatory compliance in the cosmetic industry can impact profitability and expansion strategies. Furthermore, the development and validation of new, high-performing antioxidants alongside the introduction of innovative delivery systems will be crucial for sustained market growth. Key players like Koninklijke DSM, Lonza Group, and BASF SE are likely to leverage their research and development capabilities to introduce advanced antioxidant formulations and cater to the evolving demands of the market. This competition drives innovation and offers consumers a wider range of high-quality options. Analyzing regional variations in consumer preferences and regulatory frameworks will be crucial for companies aiming to optimize their market strategies and capture substantial market share.

Cosmetic Antioxidants Industry Company Market Share

This in-depth report provides a comprehensive analysis of the global cosmetic antioxidants market, offering valuable insights for industry stakeholders, investors, and researchers. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, competitive landscapes, and future growth potential. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Cosmetic Antioxidants Industry Market Concentration & Innovation

This section analyzes the level of market concentration, identifying key players and their respective market shares. We examine the innovative drivers shaping the industry, including advancements in formulation technologies and the rising demand for natural and sustainable ingredients. Regulatory frameworks and their impact on product development and market access are also assessed. Further analysis includes exploring substitute products and the evolving end-user trends that influence market demand. Finally, we examine significant mergers and acquisitions (M&A) activities, analyzing their impact on market consolidation and competitive dynamics.

- Market Concentration: The market is characterized by a moderately concentrated landscape with a few dominant players holding significant market shares. Koninklijke DSM, Lonza Group, and BASF SE are amongst the leading companies. The precise market share of each player is detailed in the full report. The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx.

- Innovation Drivers: Growing consumer awareness of skincare benefits of antioxidants and advancements in ingredient extraction and formulation technologies are significant innovation drivers. The demand for clean beauty products fuels the development of natural antioxidants.

- M&A Activities: The report details major M&A deals in the industry during the study period (2019-2024), including the deal values and their strategic implications for market consolidation. For example, xx Million was invested in mergers of xx companies.

- Regulatory Landscape: Stringent regulations concerning the use of certain chemicals in cosmetics impact ingredient selection and product formulation. Compliance costs and differing regulatory requirements across geographies are challenges faced by companies.

Cosmetic Antioxidants Industry Industry Trends & Insights

This section examines the overarching trends shaping the cosmetic antioxidants market. Market growth is driven by increasing consumer demand for anti-aging and skin protection products, coupled with a rising awareness of the benefits of antioxidants. Technological advancements, including nanotechnology and encapsulation techniques, are improving the efficacy and stability of antioxidant ingredients. Consumer preferences are shifting toward natural and organic ingredients, impacting product development strategies. Finally, we detail the competitive landscape, with an analysis of companies' strategies for market share gains.

The market is segmented by source (natural and chemically derived), type (vitamins, polyphenols, enzymes, carotenoids, and other types including flavonoids, synthetic vitamins, and terpenes), and application (skincare, haircare, injectables, and other applications like makeup and body care).

Dominant Markets & Segments in Cosmetic Antioxidants Industry

This section pinpoints the leading regions, countries, and market segments within the cosmetic antioxidants industry. North America and Europe currently dominate the market due to high consumer spending on beauty and personal care products. Within product types, Vitamins and Polyphenols constitute major segments, while Skincare remains the dominant application area.

Key Drivers of Regional Dominance:

- North America: High disposable incomes, strong consumer demand for premium skincare products, and the presence of major cosmetic and personal care companies.

- Europe: Growing awareness of the benefits of antioxidants and stringent regulations promoting natural and sustainable ingredients.

- Asia-Pacific: Rapidly growing middle class, increasing disposable incomes, and rising demand for cosmetic products.

Segment-Specific Analysis: Detailed analysis of each segment is provided in the full report including market size, growth projections, and competitive dynamics.

Cosmetic Antioxidants Industry Product Developments

Recent product innovations focus on enhanced efficacy, improved stability, and sustainable sourcing. Encapsulation technologies are enhancing the delivery and absorption of antioxidants, while the demand for natural ingredients is driving the development of novel extraction methods. Companies are focusing on differentiating their products through unique formulations, targeted benefits, and sustainable packaging.

Report Scope & Segmentation Analysis

The report segments the cosmetic antioxidants market by:

Source: Natural and Chemically Derived. The natural segment is experiencing faster growth due to growing consumer preference for natural cosmetics. The market size for the natural segment is projected to reach xx Million by 2033.

Type: Vitamins, Polyphenols, Enzymes, Carotenoids, and Other Types (Flavonoids, Synthetic Vitamins, and Terpenes). Vitamins and Polyphenols represent the largest segments by volume and value.

Application: Skin Care, Hair Care, Injectables, and Other Applications (Makeup and Body Care). Skin care constitutes the largest application segment.

Key Drivers of Cosmetic Antioxidants Industry Growth

Several factors are driving market growth, including:

- Rising consumer awareness: Increased awareness of the benefits of antioxidants for skin health and anti-aging is a major driver.

- Technological advancements: Innovations in extraction, formulation, and delivery technologies are enhancing product efficacy and appeal.

- Growing demand for natural and sustainable products: Consumers are increasingly seeking natural and sustainably sourced cosmetic ingredients.

Challenges in the Cosmetic Antioxidants Industry Sector

The industry faces several challenges:

- Stringent regulations: Compliance with evolving regulations related to ingredient safety and labeling adds to costs and complexities.

- Supply chain disruptions: Fluctuations in raw material prices and supply chain disruptions can impact profitability.

- Intense competition: The market is competitive, with companies vying for market share through innovation and branding.

Emerging Opportunities in Cosmetic Antioxidants Industry

Emerging opportunities include:

- Personalized cosmetics: The growing demand for personalized skincare products presents opportunities for customized antioxidant formulations.

- Expansion into new markets: Untapped markets in developing economies present significant growth potential.

- Development of novel antioxidant ingredients: Research into new and effective antioxidant ingredients can lead to competitive advantage.

Leading Players in the Cosmetic Antioxidants Industry Market

- Koninklijke DSM

- Lonza Group

- Kemin Industries

- Evonik Industries AG

- Provital Group

- Croda International Plc

- BASF SE

- Eastman Chemical Company

- BTSA Biotecnologias Aplicadas

- Wacker Chemie AG

Key Developments in Cosmetic Antioxidants Industry Industry

October 2023: BASF's Care Chemicals division invests in a new plant to produce emollient specialties for skin and sun protection products. This expansion strengthens BASF's position in the market and enhances its capacity to meet growing demand.

June 2023: DKSH signs an exclusive distribution agreement with Bitop for cosmetic ingredients in Australia, New Zealand, Malaysia, and Singapore. This strategic partnership expands Bitop's market reach and distribution network in key Asian and Oceania markets.

Strategic Outlook for Cosmetic Antioxidants Industry Market

The cosmetic antioxidants market is poised for significant growth, driven by continued consumer demand for anti-aging and skin protection products, the increasing popularity of natural and organic ingredients, and ongoing technological advancements. Companies that successfully adapt to evolving consumer preferences, leverage technological innovations, and navigate regulatory complexities will be well-positioned to capture significant market share. The market's future potential is substantial, particularly in emerging markets with a growing middle class and increasing disposable incomes.

Cosmetic Antioxidants Industry Segmentation

-

1. Source

- 1.1. Natural

- 1.2. Chemically Derived

-

2. Type

- 2.1. Vitamins

- 2.2. Polyphenols

- 2.3. Enzymes

- 2.4. Carotenoids

- 2.5. Other Ty

-

3. Application

- 3.1. Skin Care

- 3.2. Hair Care

- 3.3. Injectables

- 3.4. Other Applications (Makeup and Body care)

Cosmetic Antioxidants Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Cosmetic Antioxidants Industry Regional Market Share

Geographic Coverage of Cosmetic Antioxidants Industry

Cosmetic Antioxidants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Online Purcahse of Cosmetics; Increasing Use of Beauty Products and Personal Care Products; Other Drivers

- 3.3. Market Restrains

- 3.3.1. High Cost of Natural Antioxidants; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Usage of Natural Antioxidants in Cosmetics Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cosmetic Antioxidants Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Natural

- 5.1.2. Chemically Derived

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Vitamins

- 5.2.2. Polyphenols

- 5.2.3. Enzymes

- 5.2.4. Carotenoids

- 5.2.5. Other Ty

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Skin Care

- 5.3.2. Hair Care

- 5.3.3. Injectables

- 5.3.4. Other Applications (Makeup and Body care)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Asia Pacific Cosmetic Antioxidants Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Natural

- 6.1.2. Chemically Derived

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Vitamins

- 6.2.2. Polyphenols

- 6.2.3. Enzymes

- 6.2.4. Carotenoids

- 6.2.5. Other Ty

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Skin Care

- 6.3.2. Hair Care

- 6.3.3. Injectables

- 6.3.4. Other Applications (Makeup and Body care)

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. North America Cosmetic Antioxidants Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Natural

- 7.1.2. Chemically Derived

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Vitamins

- 7.2.2. Polyphenols

- 7.2.3. Enzymes

- 7.2.4. Carotenoids

- 7.2.5. Other Ty

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Skin Care

- 7.3.2. Hair Care

- 7.3.3. Injectables

- 7.3.4. Other Applications (Makeup and Body care)

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Europe Cosmetic Antioxidants Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Natural

- 8.1.2. Chemically Derived

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Vitamins

- 8.2.2. Polyphenols

- 8.2.3. Enzymes

- 8.2.4. Carotenoids

- 8.2.5. Other Ty

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Skin Care

- 8.3.2. Hair Care

- 8.3.3. Injectables

- 8.3.4. Other Applications (Makeup and Body care)

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. South America Cosmetic Antioxidants Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Natural

- 9.1.2. Chemically Derived

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Vitamins

- 9.2.2. Polyphenols

- 9.2.3. Enzymes

- 9.2.4. Carotenoids

- 9.2.5. Other Ty

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Skin Care

- 9.3.2. Hair Care

- 9.3.3. Injectables

- 9.3.4. Other Applications (Makeup and Body care)

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. Middle East and Africa Cosmetic Antioxidants Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Source

- 10.1.1. Natural

- 10.1.2. Chemically Derived

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Vitamins

- 10.2.2. Polyphenols

- 10.2.3. Enzymes

- 10.2.4. Carotenoids

- 10.2.5. Other Ty

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Skin Care

- 10.3.2. Hair Care

- 10.3.3. Injectables

- 10.3.4. Other Applications (Makeup and Body care)

- 10.1. Market Analysis, Insights and Forecast - by Source

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Koninklijke DSM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lonza Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kemin Industries

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Evonik Industries AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Provital Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Croda International Plc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BASF SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Eastman Chemical Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BTSA Biotecnologias Aplicadas

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wacker Chemie AG*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Koninklijke DSM

List of Figures

- Figure 1: Global Cosmetic Antioxidants Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Cosmetic Antioxidants Industry Revenue (Million), by Source 2025 & 2033

- Figure 3: Asia Pacific Cosmetic Antioxidants Industry Revenue Share (%), by Source 2025 & 2033

- Figure 4: Asia Pacific Cosmetic Antioxidants Industry Revenue (Million), by Type 2025 & 2033

- Figure 5: Asia Pacific Cosmetic Antioxidants Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Cosmetic Antioxidants Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: Asia Pacific Cosmetic Antioxidants Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific Cosmetic Antioxidants Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Asia Pacific Cosmetic Antioxidants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Cosmetic Antioxidants Industry Revenue (Million), by Source 2025 & 2033

- Figure 11: North America Cosmetic Antioxidants Industry Revenue Share (%), by Source 2025 & 2033

- Figure 12: North America Cosmetic Antioxidants Industry Revenue (Million), by Type 2025 & 2033

- Figure 13: North America Cosmetic Antioxidants Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: North America Cosmetic Antioxidants Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: North America Cosmetic Antioxidants Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: North America Cosmetic Antioxidants Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Cosmetic Antioxidants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Cosmetic Antioxidants Industry Revenue (Million), by Source 2025 & 2033

- Figure 19: Europe Cosmetic Antioxidants Industry Revenue Share (%), by Source 2025 & 2033

- Figure 20: Europe Cosmetic Antioxidants Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Europe Cosmetic Antioxidants Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Cosmetic Antioxidants Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Europe Cosmetic Antioxidants Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Cosmetic Antioxidants Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Cosmetic Antioxidants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Cosmetic Antioxidants Industry Revenue (Million), by Source 2025 & 2033

- Figure 27: South America Cosmetic Antioxidants Industry Revenue Share (%), by Source 2025 & 2033

- Figure 28: South America Cosmetic Antioxidants Industry Revenue (Million), by Type 2025 & 2033

- Figure 29: South America Cosmetic Antioxidants Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: South America Cosmetic Antioxidants Industry Revenue (Million), by Application 2025 & 2033

- Figure 31: South America Cosmetic Antioxidants Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Cosmetic Antioxidants Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Cosmetic Antioxidants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Cosmetic Antioxidants Industry Revenue (Million), by Source 2025 & 2033

- Figure 35: Middle East and Africa Cosmetic Antioxidants Industry Revenue Share (%), by Source 2025 & 2033

- Figure 36: Middle East and Africa Cosmetic Antioxidants Industry Revenue (Million), by Type 2025 & 2033

- Figure 37: Middle East and Africa Cosmetic Antioxidants Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East and Africa Cosmetic Antioxidants Industry Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Cosmetic Antioxidants Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Cosmetic Antioxidants Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Cosmetic Antioxidants Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Source 2020 & 2033

- Table 2: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Source 2020 & 2033

- Table 6: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Cosmetic Antioxidants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Cosmetic Antioxidants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Japan Cosmetic Antioxidants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Cosmetic Antioxidants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Cosmetic Antioxidants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Source 2020 & 2033

- Table 15: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 16: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: United States Cosmetic Antioxidants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Canada Cosmetic Antioxidants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Mexico Cosmetic Antioxidants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Source 2020 & 2033

- Table 22: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Germany Cosmetic Antioxidants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Cosmetic Antioxidants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Italy Cosmetic Antioxidants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Cosmetic Antioxidants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Cosmetic Antioxidants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Source 2020 & 2033

- Table 31: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Brazil Cosmetic Antioxidants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Cosmetic Antioxidants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Cosmetic Antioxidants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Source 2020 & 2033

- Table 38: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 39: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global Cosmetic Antioxidants Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Cosmetic Antioxidants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: South Africa Cosmetic Antioxidants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Cosmetic Antioxidants Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cosmetic Antioxidants Industry?

The projected CAGR is approximately 5.95%.

2. Which companies are prominent players in the Cosmetic Antioxidants Industry?

Key companies in the market include Koninklijke DSM, Lonza Group, Kemin Industries, Evonik Industries AG, Provital Group, Croda International Plc, BASF SE, Eastman Chemical Company, BTSA Biotecnologias Aplicadas, Wacker Chemie AG*List Not Exhaustive.

3. What are the main segments of the Cosmetic Antioxidants Industry?

The market segments include Source, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 139.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Online Purcahse of Cosmetics; Increasing Use of Beauty Products and Personal Care Products; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Usage of Natural Antioxidants in Cosmetics Products.

7. Are there any restraints impacting market growth?

High Cost of Natural Antioxidants; Other Restraints.

8. Can you provide examples of recent developments in the market?

October 2023: BASF's Care Chemicals division is investing in a new plant to produce emollient specialties at its Düsseldorf site targeted for skin and sun protection products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cosmetic Antioxidants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cosmetic Antioxidants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cosmetic Antioxidants Industry?

To stay informed about further developments, trends, and reports in the Cosmetic Antioxidants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence