Key Insights

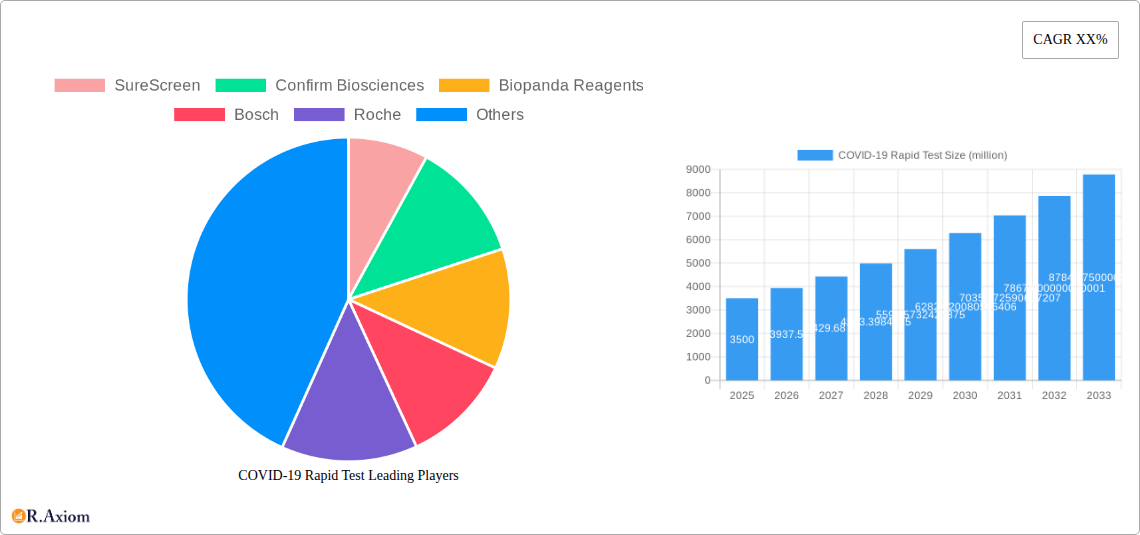

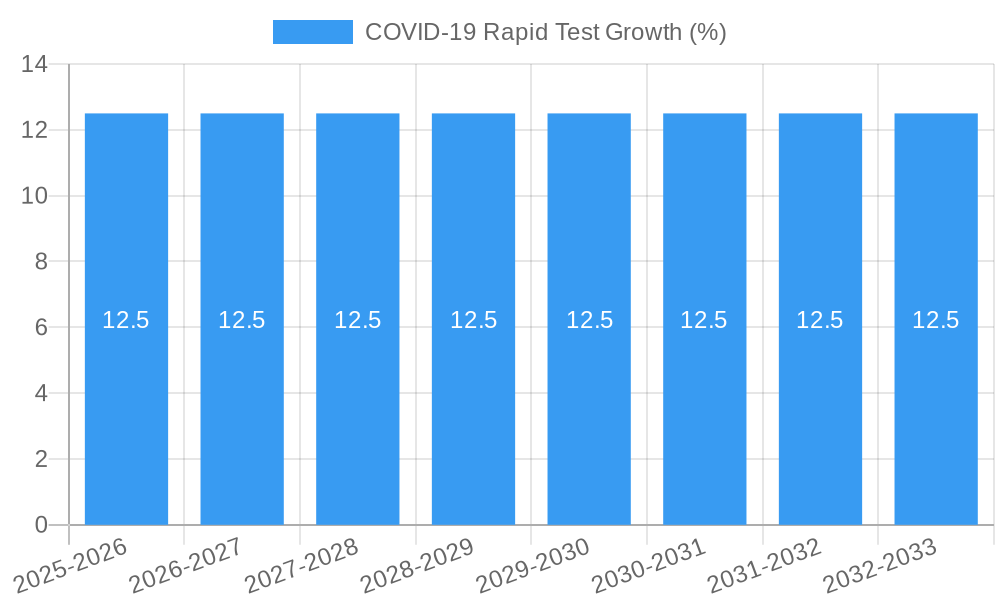

The COVID-19 Rapid Test market is poised for significant growth, projected to reach an estimated USD 3,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period of 2025-2033. This expansion is fueled by a persistent need for accessible and quick diagnostic solutions, particularly in hospitals, scientific research institutions, and diagnostic centers. The demand for COVID-19 Nucleic Acid Detection remains robust due to its high accuracy, while COVID-19 Antibody Detection plays a crucial role in understanding past infections and population immunity. Key market drivers include the ongoing threat of new variants, the necessity for regular screening in public and private sectors, and advancements in testing technologies leading to improved sensitivity and faster results. The global push for pandemic preparedness and the integration of rapid testing into routine healthcare practices further bolster this market's trajectory.

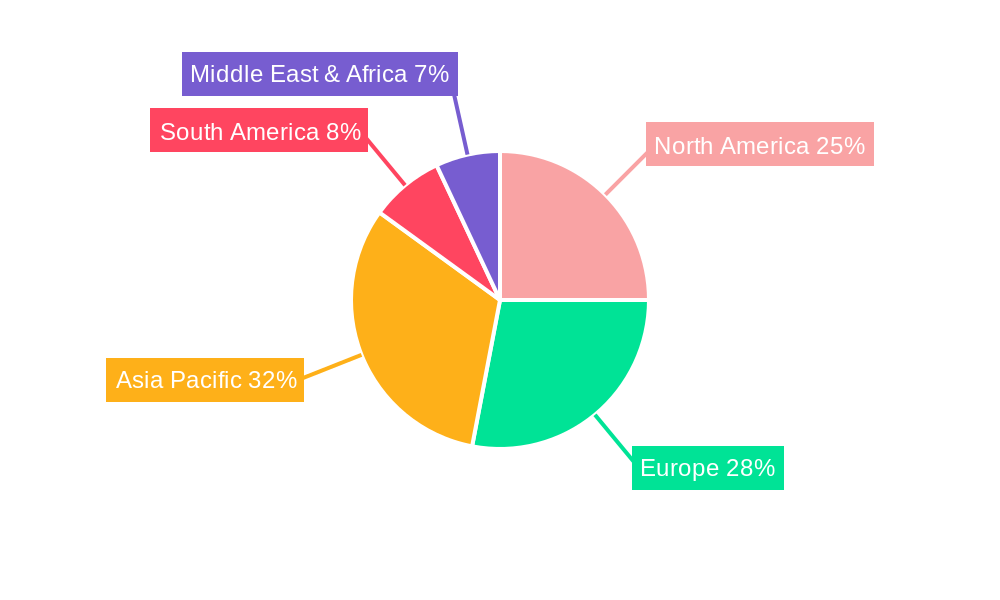

Despite the evolving landscape of the pandemic, the market is not without its restraints. Challenges such as stringent regulatory approvals, intense competition among prominent players like Abbott, Roche, and Seegene, and the development of more advanced, long-term immunity solutions may temper rapid expansion. However, the strategic focus on enhancing accessibility, developing multiplex tests capable of detecting multiple respiratory pathogens simultaneously, and the increasing adoption of point-of-care testing are expected to mitigate these restraints. Geographically, Asia Pacific, driven by countries like China and India, is anticipated to emerge as a leading region due to its large population, increasing healthcare expenditure, and rising awareness. North America and Europe are also expected to maintain significant market shares, supported by strong healthcare infrastructures and ongoing research and development activities.

COVID-19 Rapid Test Market Concentration & Innovation

The COVID-19 rapid test market, a critical component of global public health infrastructure, exhibits a dynamic interplay of market concentration and continuous innovation. Key players like Roche, Abbott, and Seegene have established significant market share through extensive research and development, robust manufacturing capabilities, and widespread distribution networks. Innovation in this sector is primarily driven by the relentless pursuit of higher sensitivity, increased specificity, reduced turnaround times, and cost-effectiveness. Regulatory frameworks, overseen by bodies such as the FDA and EMA, play a pivotal role in shaping market entry and product approval, influencing the pace of innovation and the introduction of new diagnostic tools. The threat of product substitutes, while present in the broader diagnostic landscape, is less pronounced for rapid tests due to their immediate point-of-care utility and ease of deployment. End-user trends are increasingly favoring at-home testing solutions and integration into broader public health surveillance programs. Mergers and acquisitions (M&A) activity, with deal values estimated to be in the hundreds of millions of dollars annually, are strategically employed by companies to acquire novel technologies, expand product portfolios, and consolidate market presence. For instance, acquisitions focused on next-generation immunoassay or molecular detection technologies have been prevalent, strengthening the competitive positioning of established entities. The market share of leading companies is estimated to be in the high double-digit percentages, indicating a degree of concentration, yet the entry of new innovators continues to foster a competitive environment.

COVID-19 Rapid Test Industry Trends & Insights

The COVID-19 rapid test industry is characterized by a sustained growth trajectory, driven by a confluence of evolving global health needs and technological advancements. The market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 12.5% from 2025 to 2033, reflecting its enduring importance. Market penetration continues to expand, moving beyond traditional hospital settings to include pharmacies, workplaces, and even individual households. Key growth drivers include the persistent threat of novel viral variants, the need for widespread surveillance and early detection, and the increasing demand for accessible diagnostic solutions. Technological disruptions are at the forefront of this evolution, with ongoing research into multiplex testing capabilities, enabling the simultaneous detection of multiple respiratory pathogens alongside SARS-CoV-2, and advancements in point-of-care molecular diagnostics that rival laboratory-based accuracy. Consumer preferences are shifting towards user-friendly, at-home testing kits that offer rapid results and integrate with digital health platforms for seamless reporting and management. Competitive dynamics are intense, with established players like Confirm Biosciences and SureScreen continuously innovating to maintain their market positions, while emerging companies are carving out niches through specialized technologies. The integration of AI and machine learning in interpreting test results and predicting outbreaks is also gaining traction, promising to enhance the predictive power of rapid diagnostics. Furthermore, government initiatives and public health mandates for regular testing in specific sectors, such as education and travel, continue to fuel demand. The global market size for COVID-19 rapid tests is estimated to reach over $50,000 million by 2033.

Dominant Markets & Segments in COVID-19 Rapid Test

The dominance within the COVID-19 rapid test market is influenced by a complex interplay of regional healthcare infrastructure, economic policies, and the specific needs of diverse end-user segments.

Leading Region:

- North America currently holds a significant market share, driven by robust government investment in public health, a high prevalence of diagnostic centers, and a proactive approach to disease surveillance. Economic policies supporting widespread testing initiatives and rapid adoption of new technologies have further solidified its leadership. The well-established healthcare infrastructure and advanced research institutions in countries like the United States contribute to this dominance.

Dominant Segments:

- Application: Hospital: This segment commands a substantial portion of the market due to the critical need for rapid and accurate diagnosis in acute care settings. Hospitals require high-throughput testing capabilities to manage patient flow, implement infection control measures, and initiate timely treatment. Factors contributing to this dominance include the presence of trained medical personnel for test administration and interpretation, and the integration of rapid tests into established clinical workflows.

- Types: COVID-19 Nucleic Acid Detection: While antibody tests played a crucial role in understanding infection history, nucleic acid detection tests (such as RT-PCR and rapid antigen tests) remain paramount for current infection diagnosis due to their higher sensitivity and ability to detect active viral presence. The continuous emergence of new variants, requiring precise identification, fuels the demand for these methods. Technological advancements in isothermal amplification and CRISPR-based diagnostics are further enhancing the accessibility and speed of nucleic acid detection.

Key Drivers of Dominance in These Segments:

- Government Funding and Public Health Mandates: Extensive government procurement programs and requirements for testing in healthcare settings are primary drivers for hospital-based nucleic acid detection.

- Technological Superiority: The inherent accuracy and reliability of nucleic acid detection methods for identifying active infections are critical for clinical decision-making in hospitals.

- Infrastructure and Accessibility: Well-developed healthcare infrastructure in regions like North America ensures the availability and efficient deployment of these tests in hospitals and diagnostic centers.

COVID-19 Rapid Test Product Developments

Recent product developments in the COVID-19 rapid test sector focus on enhancing user experience, improving diagnostic accuracy, and expanding applications. Innovations include the development of multiplex rapid tests capable of detecting multiple respiratory viruses simultaneously, reducing the need for separate testing. Further advancements have led to highly sensitive antigen tests with performance approaching that of molecular tests, while maintaining the speed and affordability of rapid diagnostics. The integration of smartphone-compatible readers for at-home tests is improving data accessibility and public health reporting. These developments offer significant competitive advantages by addressing unmet clinical needs and expanding the addressable market.

Report Scope & Segmentation Analysis

This report meticulously analyzes the global COVID-19 rapid test market across several key segments to provide comprehensive insights.

- Application: Hospital: This segment encompasses the use of rapid tests within hospital settings, including emergency departments, inpatient wards, and screening protocols. Projected growth in this segment is driven by ongoing healthcare preparedness and the need for rapid patient management. Market size is estimated to be in the range of $10,000 million to $15,000 million.

- Application: Scientific Research: This segment includes the utilization of rapid tests in academic and private research institutions for epidemiological studies, vaccine development, and viral characterization. Growth here is fueled by ongoing research into viral evolution and public health interventions. Market size is estimated between $1,000 million and $2,000 million.

- Application: Diagnostic Center: This segment covers the deployment of rapid tests in specialized diagnostic facilities, clinics, and public health screening centers. This segment is expected to experience robust growth due to the decentralization of testing. Market size is estimated to be in the range of $8,000 million to $12,000 million.

- Types: COVID-19 Nucleic Acid Detection: This category includes rapid molecular tests (e.g., RT-LAMP, rapid PCR) and antigen tests. These tests are critical for detecting active infections and are projected to maintain strong demand due to their diagnostic utility. Market size is estimated between $20,000 million and $30,000 million.

- Types: COVID-19 Antibody Detection: This category focuses on tests that detect antibodies produced by the immune system in response to infection or vaccination. While their role in current infection diagnosis is limited, they remain valuable for seroprevalence studies and assessing immune responses. Market size is estimated between $5,000 million and $8,000 million.

Key Drivers of COVID-19 Rapid Test Growth

The growth of the COVID-19 rapid test market is propelled by several critical factors. The persistent threat of new viral variants necessitates ongoing surveillance and rapid detection capabilities. Advancements in diagnostic technology, leading to increased sensitivity, specificity, and faster turnaround times, are making rapid tests more appealing and effective. Government initiatives and public health policies promoting widespread testing, particularly in schools, workplaces, and travel hubs, are significant demand drivers. Furthermore, the increasing consumer demand for convenient, at-home testing solutions, coupled with the growing acceptance of decentralized testing models, is expanding the market reach. Economic factors, including government stimulus packages and healthcare spending, also play a crucial role in market expansion.

Challenges in the COVID-19 Rapid Test Sector

Despite its growth, the COVID-19 rapid test sector faces several challenges. Regulatory hurdles, including lengthy approval processes and varying standards across different regions, can impede market entry and product adoption. Issues related to supply chain disruptions, particularly for raw materials and components, can impact manufacturing and availability. Intense competition among numerous players can lead to price erosion and pressure on profit margins. False positives and negatives, while decreasing with technological advancements, remain a concern affecting diagnostic accuracy and user confidence. The evolving nature of the virus and potential for new pandemic threats also create uncertainty in long-term market planning.

Emerging Opportunities in COVID-19 Rapid Test

Emerging opportunities in the COVID-19 rapid test market are abundant. The development of highly accurate, affordable, and easy-to-use at-home testing kits represents a significant growth area, catering to consumer convenience. Multiplex testing, allowing for the simultaneous detection of COVID-19 alongside other respiratory pathogens like influenza and RSV, offers enhanced diagnostic utility and market appeal. The expansion of rapid testing into non-traditional settings, such as pharmacies, workplaces, and community health centers, presents substantial untapped potential. Furthermore, the integration of rapid diagnostic platforms with digital health solutions for data management, contact tracing, and remote patient monitoring is a burgeoning field offering new revenue streams and enhanced public health outcomes.

Leading Players in the COVID-19 Rapid Test Market

- SureScreen

- Confirm Biosciences

- Biopanda Reagents

- Bosch

- Roche

- Seegene

- CVS Health

- Abbott

Key Developments in COVID-19 Rapid Test Industry

- 2023: Introduction of advanced multiplex antigen tests capable of detecting multiple respiratory viruses simultaneously.

- 2023: Increased focus on developing ultra-sensitive rapid antigen tests with performance parity to molecular assays.

- 2022: Launch of new smartphone-integrated rapid test platforms for home use, facilitating seamless data transmission.

- 2022: Significant M&A activity aimed at acquiring companies with novel isothermal amplification technologies.

- 2021: Rollout of widespread community-based rapid testing programs in various countries.

- 2020: Rapid development and emergency use authorization of numerous rapid antigen and antibody tests by regulatory bodies globally.

Strategic Outlook for COVID-19 Rapid Test Market

The strategic outlook for the COVID-19 rapid test market remains positive, driven by its indispensable role in public health and ongoing technological advancements. The market is poised for continued growth, fueled by the sustained need for viral surveillance, the increasing adoption of decentralized testing, and the expansion of at-home diagnostics. Companies that invest in innovation, focusing on improving accuracy, speed, and multiplexing capabilities, will likely secure a competitive advantage. Strategic partnerships and collaborations with governments, healthcare providers, and technology firms will be crucial for market penetration and the development of integrated health solutions. The long-term potential lies in repurposing these rapid diagnostic platforms for future pandemic preparedness and the management of other infectious diseases.

COVID-19 Rapid Test Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Scientific Research

- 1.3. Diagnostic Center

-

2. Types

- 2.1. COVID-19 Nucleic Acid Detection

- 2.2. COVID-19 Antibody Detection

COVID-19 Rapid Test Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

COVID-19 Rapid Test REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global COVID-19 Rapid Test Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Scientific Research

- 5.1.3. Diagnostic Center

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. COVID-19 Nucleic Acid Detection

- 5.2.2. COVID-19 Antibody Detection

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America COVID-19 Rapid Test Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Scientific Research

- 6.1.3. Diagnostic Center

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. COVID-19 Nucleic Acid Detection

- 6.2.2. COVID-19 Antibody Detection

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America COVID-19 Rapid Test Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Scientific Research

- 7.1.3. Diagnostic Center

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. COVID-19 Nucleic Acid Detection

- 7.2.2. COVID-19 Antibody Detection

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe COVID-19 Rapid Test Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Scientific Research

- 8.1.3. Diagnostic Center

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. COVID-19 Nucleic Acid Detection

- 8.2.2. COVID-19 Antibody Detection

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa COVID-19 Rapid Test Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Scientific Research

- 9.1.3. Diagnostic Center

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. COVID-19 Nucleic Acid Detection

- 9.2.2. COVID-19 Antibody Detection

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific COVID-19 Rapid Test Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Scientific Research

- 10.1.3. Diagnostic Center

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. COVID-19 Nucleic Acid Detection

- 10.2.2. COVID-19 Antibody Detection

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 SureScreen

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Confirm Biosciences

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Biopanda Reagents

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bosch

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Roche

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Seegene

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CVS Health

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Abbott

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 SureScreen

List of Figures

- Figure 1: Global COVID-19 Rapid Test Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America COVID-19 Rapid Test Revenue (million), by Application 2024 & 2032

- Figure 3: North America COVID-19 Rapid Test Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America COVID-19 Rapid Test Revenue (million), by Types 2024 & 2032

- Figure 5: North America COVID-19 Rapid Test Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America COVID-19 Rapid Test Revenue (million), by Country 2024 & 2032

- Figure 7: North America COVID-19 Rapid Test Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America COVID-19 Rapid Test Revenue (million), by Application 2024 & 2032

- Figure 9: South America COVID-19 Rapid Test Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America COVID-19 Rapid Test Revenue (million), by Types 2024 & 2032

- Figure 11: South America COVID-19 Rapid Test Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America COVID-19 Rapid Test Revenue (million), by Country 2024 & 2032

- Figure 13: South America COVID-19 Rapid Test Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe COVID-19 Rapid Test Revenue (million), by Application 2024 & 2032

- Figure 15: Europe COVID-19 Rapid Test Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe COVID-19 Rapid Test Revenue (million), by Types 2024 & 2032

- Figure 17: Europe COVID-19 Rapid Test Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe COVID-19 Rapid Test Revenue (million), by Country 2024 & 2032

- Figure 19: Europe COVID-19 Rapid Test Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa COVID-19 Rapid Test Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa COVID-19 Rapid Test Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa COVID-19 Rapid Test Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa COVID-19 Rapid Test Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa COVID-19 Rapid Test Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa COVID-19 Rapid Test Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific COVID-19 Rapid Test Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific COVID-19 Rapid Test Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific COVID-19 Rapid Test Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific COVID-19 Rapid Test Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific COVID-19 Rapid Test Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific COVID-19 Rapid Test Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global COVID-19 Rapid Test Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global COVID-19 Rapid Test Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global COVID-19 Rapid Test Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global COVID-19 Rapid Test Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global COVID-19 Rapid Test Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global COVID-19 Rapid Test Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global COVID-19 Rapid Test Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global COVID-19 Rapid Test Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global COVID-19 Rapid Test Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global COVID-19 Rapid Test Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global COVID-19 Rapid Test Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global COVID-19 Rapid Test Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global COVID-19 Rapid Test Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global COVID-19 Rapid Test Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global COVID-19 Rapid Test Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global COVID-19 Rapid Test Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global COVID-19 Rapid Test Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global COVID-19 Rapid Test Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global COVID-19 Rapid Test Revenue million Forecast, by Country 2019 & 2032

- Table 41: China COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific COVID-19 Rapid Test Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the COVID-19 Rapid Test?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the COVID-19 Rapid Test?

Key companies in the market include SureScreen, Confirm Biosciences, Biopanda Reagents, Bosch, Roche, Seegene, CVS Health, Abbott.

3. What are the main segments of the COVID-19 Rapid Test?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "COVID-19 Rapid Test," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the COVID-19 Rapid Test report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the COVID-19 Rapid Test?

To stay informed about further developments, trends, and reports in the COVID-19 Rapid Test, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence