Key Insights

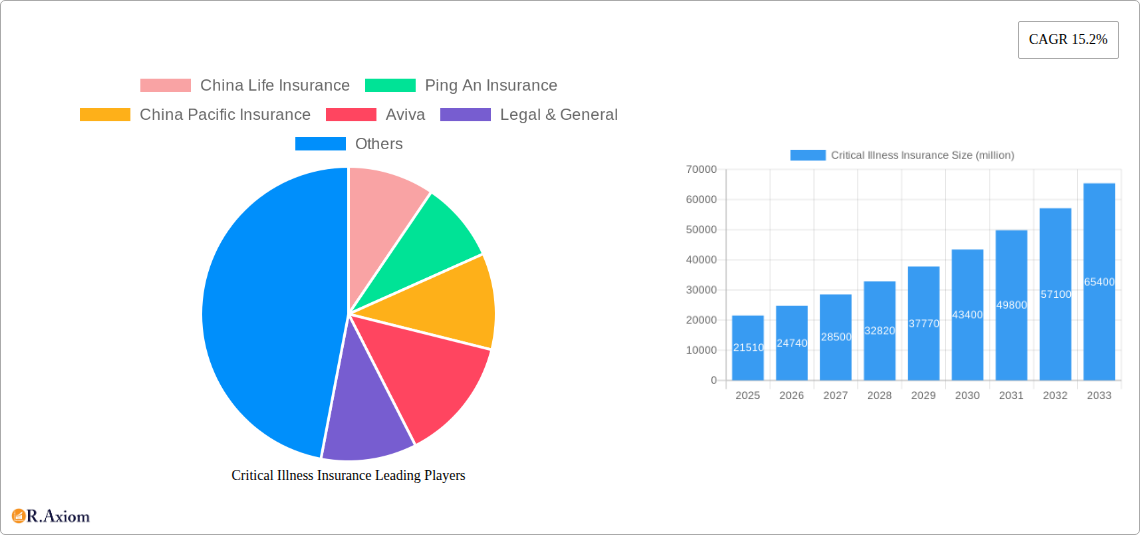

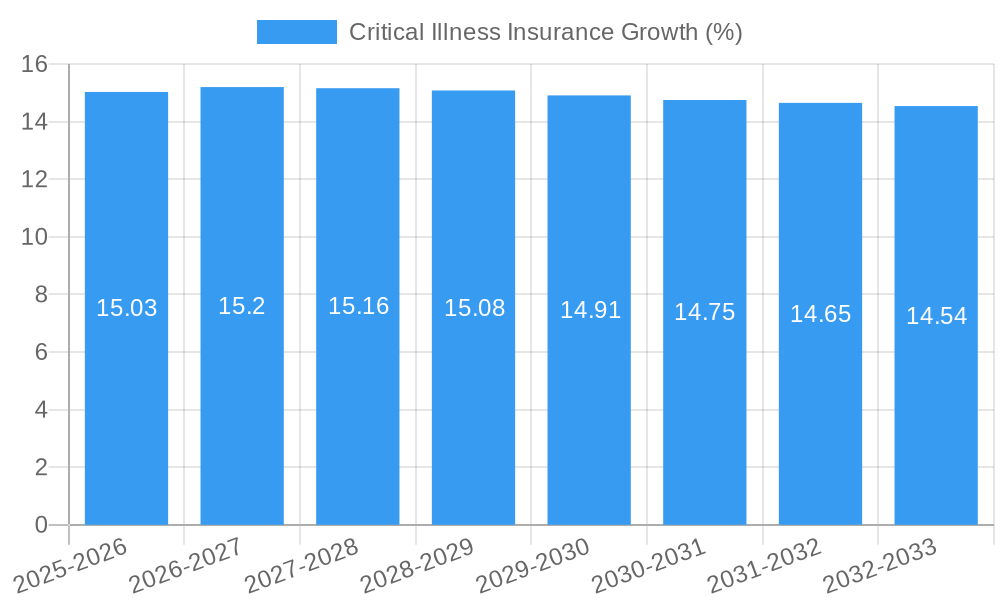

The global Critical Illness Insurance market is poised for substantial expansion, projected to reach an estimated USD 21,510 million by 2025. This robust growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 15.2%, indicating a dynamic and rapidly evolving sector. The increasing awareness among individuals regarding the financial implications of critical illnesses like cancer, heart attacks, and strokes is a primary driver. As healthcare costs continue to escalate, critical illness insurance offers a vital safety net, protecting individuals and families from significant financial burdens. Furthermore, evolving lifestyle patterns, an aging global population, and a proactive approach to personal financial planning are contributing to the heightened demand for these protective policies. The market is also benefiting from advancements in medical treatments, leading to increased survival rates from critical illnesses, which in turn bolsters the perceived value and necessity of comprehensive insurance coverage.

The market landscape for Critical Illness Insurance is characterized by a diverse range of applications and policy types, catering to a broad spectrum of consumer needs. Key applications include coverage for conditions such as cancer, heart attack, and stroke, alongside a broader "other" category encompassing a variety of serious illnesses. On the product front, the market is segmented into Fixed-term Insurance and Whole-life Insurance options, providing flexibility for policyholders to choose plans that best suit their long-term financial objectives and risk appetites. Major players like China Life Insurance, Ping An Insurance, and China Pacific Insurance are actively shaping the market, particularly in the Asia Pacific region. The competitive environment fosters innovation in product design and customer service, aiming to capture a larger share of this growing market. As the understanding of health risks and financial preparedness deepens globally, the critical illness insurance sector is set to witness sustained and accelerated growth throughout the forecast period.

Critical Illness Insurance Market Concentration & Innovation

The global Critical Illness Insurance market is characterized by moderate concentration, with key players like China Life Insurance, Ping An Insurance, China Pacific Insurance, Aviva, and Legal & General holding substantial market share. This concentration is driven by high capital requirements, established distribution networks, and brand recognition. Innovation is a critical differentiator, with companies investing heavily in developing customizable and digitally-enabled products to cater to evolving consumer needs and address the increasing incidence of critical illnesses such as cancer, heart attack, and stroke. Regulatory frameworks play a significant role, with governments implementing policies to enhance consumer protection and solvency requirements, influencing product design and pricing strategies. Product substitutes, including comprehensive health insurance and savings plans, present a competitive landscape, necessitating continuous product enhancement and value-added services. End-user trends are shifting towards preventative healthcare and early diagnosis, prompting insurers to incorporate wellness programs and health management features into their critical illness offerings. Mergers and Acquisitions (M&A) activity, while present, is often focused on consolidating market share, expanding geographical reach, or acquiring technological capabilities. M&A deal values are projected to be in the range of several hundred million to billions of dollars, depending on the strategic importance and scale of the transaction. The market share of leading players is estimated to be between 10% and 20% individually, with the top five companies collectively accounting for over 50% of the market.

Critical Illness Insurance Industry Trends & Insights

The Critical Illness Insurance industry is poised for robust growth, with a projected Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033. This expansion is fueled by a confluence of factors, including increasing global healthcare expenditure, a rising prevalence of chronic diseases, and growing awareness among individuals about the financial implications of critical illnesses. Market penetration, currently estimated at around 15% globally, is expected to climb steadily as more individuals seek financial protection against life-altering medical events. Technological disruptions are reshaping the industry, with the integration of artificial intelligence (AI) and machine learning (ML) for underwriting, claims processing, and personalized product recommendations. Insurtech startups are also playing a pivotal role in driving innovation, offering seamless digital experiences and more affordable solutions. Consumer preferences are evolving towards greater transparency, flexibility, and value-added services. This includes a demand for policies that cover a wider range of critical illnesses beyond the traditional definitions of cancer, heart attack, and stroke, as well as options for lump-sum payouts that can be used for any purpose, including medical expenses, income replacement, and lifestyle adjustments. Competitive dynamics are intensifying, with both established insurers and new entrants vying for market share. Insurers are focusing on building strong digital capabilities, expanding their distribution channels, and forging strategic partnerships with healthcare providers and employers to offer comprehensive financial and health solutions. The demographic shift towards an aging population also presents a significant growth opportunity, as older individuals are more susceptible to critical illnesses and thus have a greater need for critical illness coverage. The increasing disposable income in emerging economies is also a key driver, enabling a larger segment of the population to afford such insurance products. Furthermore, the economic uncertainty and rising healthcare costs globally underscore the importance of critical illness insurance as a financial safety net, further bolstering demand. The impact of pandemics and unforeseen health crises also heightens awareness and the perceived need for critical illness protection, acting as a significant catalyst for market expansion. The global market size for critical illness insurance is estimated to reach over $150 billion in 2025, with projections indicating it could exceed $250 billion by 2033.

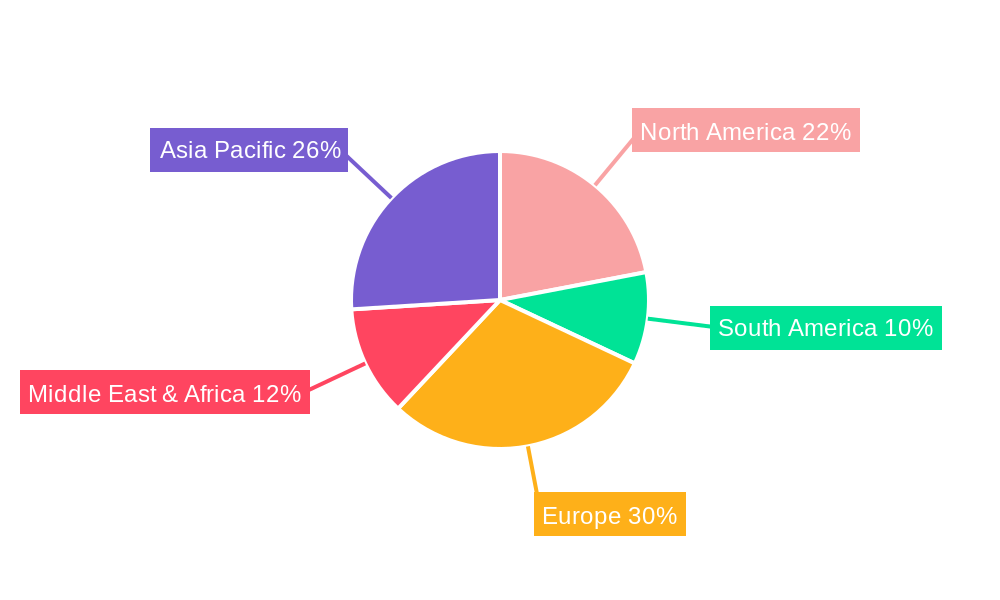

Dominant Markets & Segments in Critical Illness Insurance

The global Critical Illness Insurance market's dominance is driven by a combination of economic prowess, healthcare infrastructure, and consumer awareness, with North America and Europe currently leading the charge. Within these regions, countries like the United States, the United Kingdom, Germany, and Australia exhibit high market penetration rates, exceeding 25%. The Application segment of Cancer is the most dominant, accounting for an estimated 45% of all critical illness claims and policy sales. This is attributed to the high incidence rates of various cancers and the significant treatment costs associated with them. Heart Attack and Stroke follow as major contributors, representing approximately 25% and 15% of the market, respectively. The "Other" category, encompassing conditions like Alzheimer's disease, Parkinson's disease, and Multiple Sclerosis, is steadily growing in importance as medical advancements improve survival rates for these ailments, leading to a greater need for long-term financial support.

In terms of Types, Fixed-term Insurance policies hold a larger market share, estimated at around 60%, due to their typically lower premiums, making them more accessible to a broader demographic. However, Whole-life Insurance policies are gaining traction among individuals seeking lifelong coverage and the potential for cash value accumulation, especially in markets with a strong emphasis on long-term financial planning.

Key drivers for this dominance include:

- Advanced Healthcare Systems: Countries with sophisticated healthcare infrastructure and advanced medical technologies tend to have higher incidences of diagnosis and consequently, a greater demand for critical illness coverage.

- High Disposable Income: Regions with higher per capita income enable individuals to allocate a larger portion of their budget towards insurance products that provide financial security.

- Robust Regulatory Frameworks: Favorable regulatory environments that promote insurance penetration and consumer protection encourage market growth.

- Aging Population Demographics: An increasing proportion of elderly individuals in developed nations leads to a higher demand for critical illness protection due to age-related health risks.

- Public Health Awareness Campaigns: Effective campaigns highlighting the financial risks associated with critical illnesses significantly boost consumer demand.

The Asia-Pacific region, particularly China and India, represents a rapidly growing market, driven by a burgeoning middle class, increasing health consciousness, and the expanding presence of international insurers like China Life Insurance and Ping An Insurance. As these economies mature, their contribution to the global critical illness insurance market is expected to rise significantly, potentially shifting the regional dominance landscape in the coming decade. The focus on preventative healthcare and early detection initiatives in these regions is also expected to drive demand for comprehensive critical illness coverage.

Critical Illness Insurance Product Developments

Product innovation in critical illness insurance is rapidly evolving, driven by a desire to offer more comprehensive and adaptable coverage. Insurers are increasingly developing policies that cover a wider spectrum of conditions beyond the traditional critical illnesses, incorporating early-stage diagnosis benefits and living benefit riders. Technological trends are enabling personalized product design through advanced data analytics, allowing insurers to tailor premiums and coverage based on individual risk profiles and lifestyle factors. Competitive advantages are being forged through the integration of digital platforms for seamless application, claims processing, and customer service, as well as partnerships with healthcare providers for wellness programs and discounted medical services. The market fit is being enhanced by offering flexible payment options and multi-lingual customer support to cater to diverse customer bases.

Critical Illness Insurance Report Scope & Segmentation Analysis

This report delves into the global Critical Illness Insurance market, providing a comprehensive analysis of its dynamics. The segmentation includes:

- Application: This segment analyzes the demand for critical illness insurance based on the primary illnesses covered, including Cancer, Heart Attack, Stroke, and Other critical conditions. Growth projections and market sizes for each application are detailed, highlighting the competitive landscape and evolving consumer needs for specific disease coverage.

- Types: The report examines the market based on the type of critical illness insurance policies, categorizing them into Fixed-term Insurance and Whole-life Insurance. Detailed analyses of their respective market shares, growth trajectories, and the competitive advantages of each type are provided, alongside their respective market sizes and projected future growth.

Key Drivers of Critical Illness Insurance Growth

The growth of the critical illness insurance sector is propelled by several interconnected factors. Economically, rising disposable incomes and increasing awareness of financial planning for healthcare contingencies are primary drivers. Technologically, advancements in AI and data analytics are enabling more personalized underwriting and product development, while digital platforms are enhancing customer acquisition and service. Regulatory frameworks that promote consumer protection and solvency for insurance providers create a stable environment for growth. Furthermore, the increasing global prevalence of lifestyle-related diseases and chronic conditions, coupled with advancements in medical treatments that extend lifespans, naturally elevates the demand for financial support during extended recovery periods. The growing aging population in developed economies also significantly contributes to this demand, as older individuals face a higher risk of critical illnesses.

Challenges in the Critical Illness Insurance Sector

Despite its growth potential, the critical illness insurance sector faces several challenges. Regulatory hurdles, including varying compliance requirements across different jurisdictions and evolving solvency standards, can increase operational complexity and costs for insurers. The complexity of claims assessment, particularly for less common critical illnesses, can lead to delays and dissatisfaction. Additionally, rising healthcare costs, while driving demand, also put pressure on insurers' pricing strategies, potentially impacting profitability if not managed effectively. Competitive pressures from both established players and new Insurtech entrants necessitate continuous innovation and efficient cost management. Supply chain issues within the broader healthcare ecosystem, though not directly an insurance challenge, can indirectly affect the perceived value and accessibility of medical treatments covered by critical illness policies, impacting customer confidence.

Emerging Opportunities in Critical Illness Insurance

Emerging opportunities in critical illness insurance lie in several key areas. The underserved markets in emerging economies present significant untapped potential due to growing middle classes and increasing health awareness. Technological advancements offer opportunities for product innovation, such as embedding embedded insurance solutions within digital health platforms and wearable devices. The growing consumer preference for personalized and preventative healthcare creates a demand for policies that integrate wellness programs, early detection benefits, and health management services. Furthermore, exploring niche markets and developing specialized critical illness products for specific demographics or high-risk professions can unlock new revenue streams. The increasing focus on mental health awareness also opens avenues for critical illness policies that include coverage for severe mental health conditions.

Leading Players in the Critical Illness Insurance Market

- China Life Insurance

- Ping An Insurance

- China Pacific Insurance

- Aviva

- Legal & General

- New China Life Insurance

- AXA

- Prudential plc

- Aegon

- Allianz

- AIG

- UnitedHealthcare

- Zurich

- MetLife

- Dai-ichi Life Group

- Sun Life Financial

- Huaxia life Insurance

- Aflac

- Liberty Mutual

- HCF

- Generali Group

- Royal London

- Scottish Windows

- Livepool Victoria

- Vitality

Key Developments in Critical Illness Insurance Industry

- 2023 November: Aviva launches a new critical illness policy with enhanced coverage for early-stage cancers and mental health conditions.

- 2024 January: Ping An Insurance announces strategic partnerships with several leading hospitals to integrate its critical illness products with advanced medical screening services.

- 2024 March: Legal & General introduces AI-powered chatbot for instant critical illness policy quotations and customer queries.

- 2024 May: China Life Insurance expands its critical illness product portfolio to include coverage for rare diseases.

- 2024 July: AXA unveils a digital-first approach to critical illness claims processing, aiming for faster payouts.

- 2025 February: Prudential plc announces a significant investment in Insurtech to develop data-driven personalized critical illness plans.

Strategic Outlook for Critical Illness Insurance Market

The strategic outlook for the critical illness insurance market remains highly positive, driven by increasing global health consciousness and the need for robust financial protection against life-altering medical events. Growth catalysts include the expansion of digital distribution channels, the development of innovative and personalized products that cater to evolving consumer needs, and strategic partnerships with healthcare providers and employers. The underserved markets in emerging economies present substantial opportunities for market penetration. Insurers that can effectively leverage technology for seamless customer experiences, efficient claims management, and proactive health management will be best positioned for sustained success. The market's future potential is further amplified by demographic trends and the continuous advancement of medical science, which necessitates ongoing adaptation and innovation in critical illness coverage.

Critical Illness Insurance Segmentation

-

1. Application

- 1.1. Cancer

- 1.2. Heart Attack

- 1.3. Stroke

- 1.4. Other

-

2. Types

- 2.1. Fixed-term Insurance

- 2.2. Whole-life Insurance

Critical Illness Insurance Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Critical Illness Insurance REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.2% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Critical Illness Insurance Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cancer

- 5.1.2. Heart Attack

- 5.1.3. Stroke

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Fixed-term Insurance

- 5.2.2. Whole-life Insurance

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Critical Illness Insurance Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Cancer

- 6.1.2. Heart Attack

- 6.1.3. Stroke

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Fixed-term Insurance

- 6.2.2. Whole-life Insurance

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Critical Illness Insurance Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Cancer

- 7.1.2. Heart Attack

- 7.1.3. Stroke

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Fixed-term Insurance

- 7.2.2. Whole-life Insurance

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Critical Illness Insurance Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Cancer

- 8.1.2. Heart Attack

- 8.1.3. Stroke

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Fixed-term Insurance

- 8.2.2. Whole-life Insurance

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Critical Illness Insurance Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Cancer

- 9.1.2. Heart Attack

- 9.1.3. Stroke

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Fixed-term Insurance

- 9.2.2. Whole-life Insurance

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Critical Illness Insurance Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Cancer

- 10.1.2. Heart Attack

- 10.1.3. Stroke

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Fixed-term Insurance

- 10.2.2. Whole-life Insurance

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 China Life Insurance

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ping An Insurance

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 China Pacific Insurance

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aviva

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Legal & General

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 New China Life Insurance

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AXA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Prudential plc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aegon

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Allianz

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AIG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 UnitedHealthcare

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Zurich

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 MetLife

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Dai-ichi Life Group

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Sun Life Financial

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Huaxia life Insurance

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Aflac

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Liberty Mutual

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 HCF

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Generali Group

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Royal London

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Scottish Windows

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Livepool Victoria

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Vitality

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.1 China Life Insurance

List of Figures

- Figure 1: Global Critical Illness Insurance Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Critical Illness Insurance Revenue (million), by Application 2024 & 2032

- Figure 3: North America Critical Illness Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Critical Illness Insurance Revenue (million), by Types 2024 & 2032

- Figure 5: North America Critical Illness Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Critical Illness Insurance Revenue (million), by Country 2024 & 2032

- Figure 7: North America Critical Illness Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Critical Illness Insurance Revenue (million), by Application 2024 & 2032

- Figure 9: South America Critical Illness Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Critical Illness Insurance Revenue (million), by Types 2024 & 2032

- Figure 11: South America Critical Illness Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Critical Illness Insurance Revenue (million), by Country 2024 & 2032

- Figure 13: South America Critical Illness Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Critical Illness Insurance Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Critical Illness Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Critical Illness Insurance Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Critical Illness Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Critical Illness Insurance Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Critical Illness Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Critical Illness Insurance Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Critical Illness Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Critical Illness Insurance Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Critical Illness Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Critical Illness Insurance Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Critical Illness Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Critical Illness Insurance Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Critical Illness Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Critical Illness Insurance Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Critical Illness Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Critical Illness Insurance Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Critical Illness Insurance Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Critical Illness Insurance Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Critical Illness Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Critical Illness Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Critical Illness Insurance Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Critical Illness Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Critical Illness Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Critical Illness Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Critical Illness Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Critical Illness Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Critical Illness Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Critical Illness Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Critical Illness Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Critical Illness Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Critical Illness Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Critical Illness Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Critical Illness Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Critical Illness Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Critical Illness Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Critical Illness Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Critical Illness Insurance Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Critical Illness Insurance?

The projected CAGR is approximately 15.2%.

2. Which companies are prominent players in the Critical Illness Insurance?

Key companies in the market include China Life Insurance, Ping An Insurance, China Pacific Insurance, Aviva, Legal & General, New China Life Insurance, AXA, Prudential plc, Aegon, Allianz, AIG, UnitedHealthcare, Zurich, MetLife, Dai-ichi Life Group, Sun Life Financial, Huaxia life Insurance, Aflac, Liberty Mutual, HCF, Generali Group, Royal London, Scottish Windows, Livepool Victoria, Vitality.

3. What are the main segments of the Critical Illness Insurance?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 21510 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Critical Illness Insurance," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Critical Illness Insurance report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Critical Illness Insurance?

To stay informed about further developments, trends, and reports in the Critical Illness Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence