Key Insights

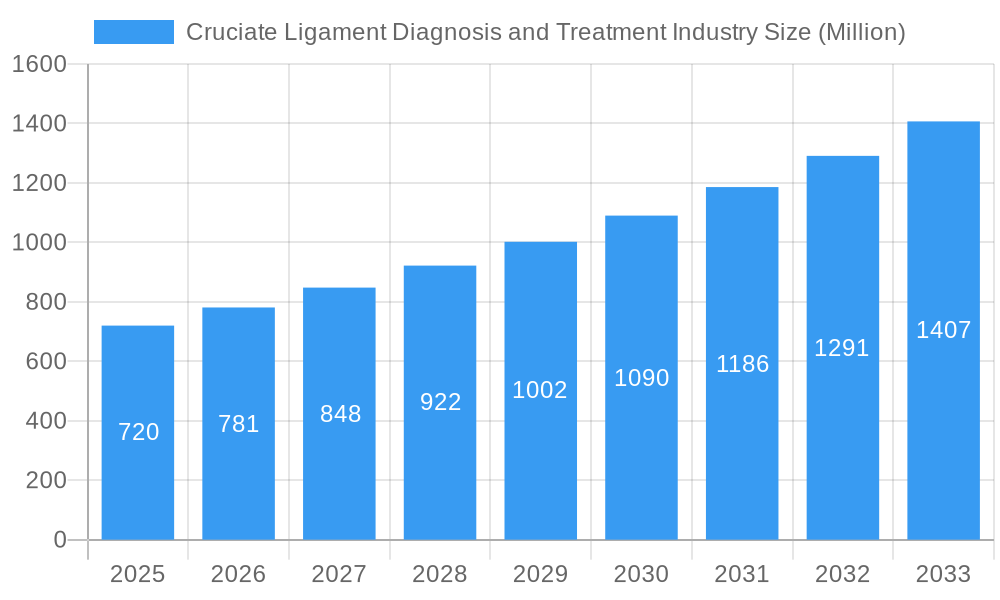

The global Cruciate Ligament Diagnosis and Treatment Market is set for significant expansion, projected to reach an estimated market size of $720 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 8.50% through 2033. This growth is driven by the increasing incidence of sports-related injuries, heightened awareness of proper diagnosis and timely intervention for cruciate ligament tears, particularly ACL injuries. Advancements in surgical techniques, innovative implantable devices, biomaterials, and a rising demand for minimally invasive procedures are also key growth catalysts. The expanding elderly population, susceptible to knee injuries from degenerative conditions, further sustains demand for advanced treatment solutions.

Cruciate Ligament Diagnosis and Treatment Industry Market Size (In Billion)

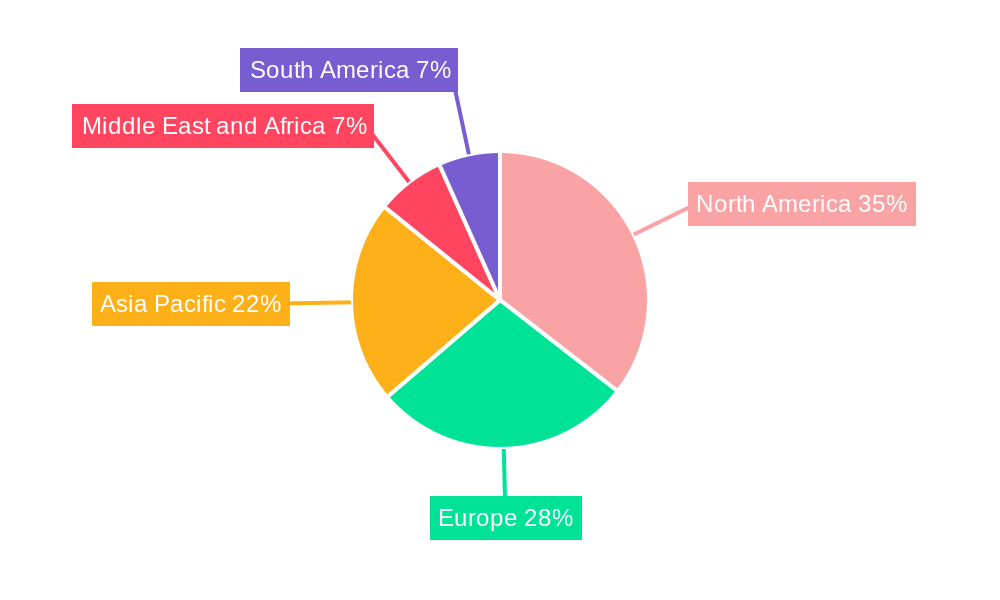

The market is segmented by procedure into Anterior Cruciate Ligament (ACL) Repair and Posterior Cruciate Ligament (PCL) Repair, with ACL repair holding the dominant share due to its higher prevalence. Hospitals and ambulatory surgical centers are key end-users, increasingly adopting sophisticated diagnostic tools and advanced surgical interventions. North America is expected to lead the market, attributed to high sports participation rates, robust healthcare infrastructure, and substantial investments in orthopedic R&D. Emerging economies in the Asia Pacific region offer significant growth opportunities due to expanding healthcare sectors and rising disposable incomes. Market growth may be tempered by the high cost of advanced treatments and the availability of skilled orthopedic surgeons in specific regions. Key industry players, including Medtronic, Stryker, and Johnson & Johnson Services Inc., are actively pursuing research, product innovation, and strategic collaborations to expand their market presence.

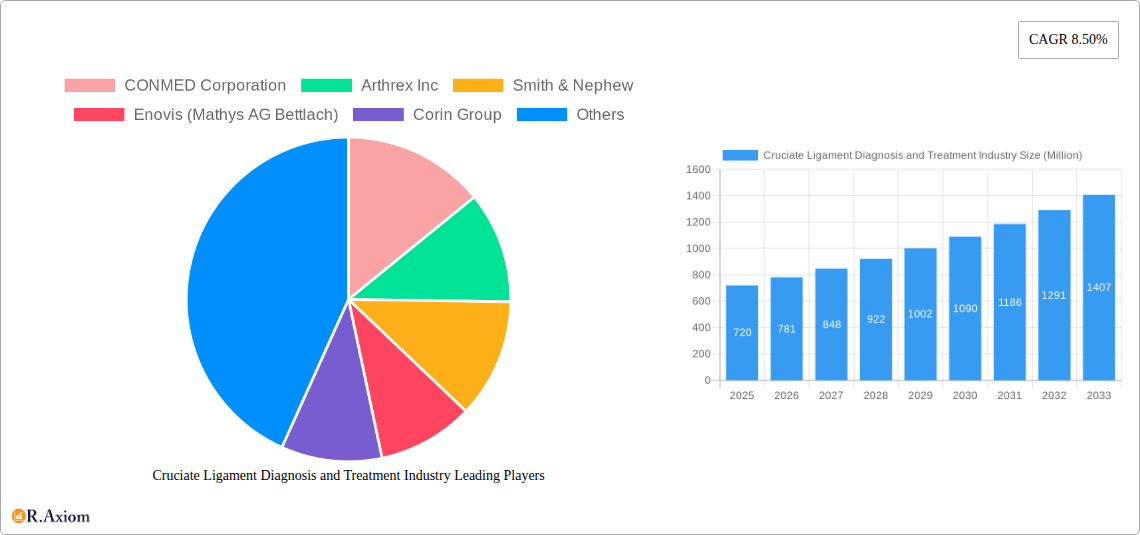

Cruciate Ligament Diagnosis and Treatment Industry Company Market Share

This comprehensive report offers an in-depth analysis of the global Cruciate Ligament Diagnosis and Treatment industry, providing critical insights into market dynamics, key trends, and future opportunities. The study covers the period from 2019 to 2033, with 2025 as the base year for forecasts extending to 2033, building upon historical data from 2019-2024. It examines the diagnosis, surgical procedures, and innovative treatments for ACL and PCL injuries. Market segmentation includes procedure type (ACL Repair, PCL Repair) and end-user sectors (Hospitals, Ambulatory Surgical Centers, Other End Users). The report details market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user preferences, and merger & acquisition activities, with estimated M&A deal values in the tens of millions. Furthermore, it analyzes industry trends, technological disruptions, consumer preferences, and competitive dynamics, projecting a substantial CAGR and robust market penetration.

Cruciate Ligament Diagnosis and Treatment Industry Market Concentration & Innovation

The Cruciate Ligament Diagnosis and Treatment market exhibits moderate to high concentration, with a significant market share held by leading global orthopedic companies. Innovation is primarily driven by advancements in biomaterials, surgical techniques, and diagnostic imaging, aiming to improve patient outcomes and reduce recovery times for ACL and PCL injuries. Key innovation drivers include the development of less invasive surgical procedures, advanced graft materials (biological and synthetic), and improved rehabilitation protocols. The regulatory landscape, overseen by bodies like the FDA and EMA, plays a crucial role in ensuring product safety and efficacy, impacting market access and product development timelines. Product substitutes, such as non-surgical management for partial tears or less severe injuries, and alternative treatment modalities, exist but often represent a niche within the broader market. End-user trends indicate a growing preference for minimally invasive procedures and faster recovery, fueling demand for innovative solutions. Merger and acquisition (M&A) activities are a significant feature of this industry, with estimated M&A deal values in the hundreds of millions, as companies seek to expand their product portfolios, gain market access, and consolidate their positions. For instance, strategic acquisitions of innovative technology startups by larger players are common.

Cruciate Ligament Diagnosis and Treatment Industry Industry Trends & Insights

The global Cruciate Ligament Diagnosis and Treatment market is experiencing robust growth, driven by a confluence of factors including the increasing prevalence of sports-related injuries, a growing aging population prone to degenerative ligament conditions, and rising global healthcare expenditure. The market penetration for advanced diagnostic and therapeutic solutions is steadily increasing, reflecting a higher awareness and demand for effective treatments. The Compound Annual Growth Rate (CAGR) is projected to be significant, estimated in the high single digits, as technological advancements continue to redefine treatment protocols.

Technological disruptions are at the forefront of market evolution. Innovations in arthroscopic surgery, including advanced imaging techniques and robotic-assisted procedures, are enhancing precision and reducing patient morbidity. The development of novel graft materials, such as bio-engineered tissues and advanced synthetic implants, offers improved integration and long-term durability. Furthermore, advancements in regenerative medicine, including platelet-rich plasma (PRP) therapy and stem cell treatments, are gaining traction as adjunct therapies to surgical interventions, promising enhanced healing and reduced recurrence rates.

Consumer preferences are shifting towards less invasive and faster-recovering treatment options. Patients, particularly athletes, are seeking solutions that minimize downtime and allow for a quicker return to their desired activity levels. This trend is driving the adoption of arthroscopic techniques over traditional open surgeries and fueling research into accelerated rehabilitation programs. The demand for personalized treatment plans, tailored to individual patient needs and injury severity, is also on the rise.

Competitive dynamics within the industry are characterized by intense R&D investment and strategic partnerships. Major orthopedic device manufacturers are actively investing in developing next-generation technologies and expanding their product pipelines. Collaborations between research institutions, biotechnology firms, and established players are crucial for bringing novel solutions to market. The competitive landscape also involves a constant drive for cost-effectiveness and improved reimbursement policies, influencing market access and adoption rates.

Dominant Markets & Segments in Cruciate Ligament Diagnosis and Treatment Industry

The Anterior Cruciate Ligament (ACL) Repair segment stands as a dominant force within the Cruciate Ligament Diagnosis and Treatment industry. This dominance is fueled by the higher incidence of ACL tears, particularly among athletic and active populations across various age groups. The economic policies supporting sports medicine and rehabilitation infrastructure in developed nations play a significant role in its leading position.

- Key Drivers for ACL Dominance:

- High prevalence in sports: Football, basketball, skiing, and other high-impact sports frequently lead to ACL injuries.

- Growing awareness and diagnostics: Improved diagnostic tools like MRI have increased the identification of ACL tears.

- Advancements in surgical techniques: Minimally invasive arthroscopic ACL reconstruction techniques offer faster recovery and better outcomes.

- Rehabilitation infrastructure: Robust sports medicine and physical therapy networks in leading economies support patient recovery and return to sport.

Among end-users, Hospitals represent the largest and most influential segment in the Cruciate Ligament Diagnosis and Treatment market. This is attributable to the comprehensive facilities, specialized surgical teams, and the capability to handle complex orthopedic cases that hospitals offer. The availability of advanced diagnostic equipment and post-operative care services within hospital settings makes them the primary destination for cruciate ligament surgeries.

- Key Drivers for Hospital Dominance:

- Comprehensive infrastructure: Hospitals possess operating rooms, intensive care units, and advanced imaging facilities required for complex ligament surgeries.

- Specialized medical professionals: Access to orthopedic surgeons, anesthesiologists, and rehabilitation specialists.

- Inpatient and outpatient services: Ability to manage both immediate post-operative care and longer-term rehabilitation.

- Reimbursement structures: Established insurance and reimbursement pathways for hospital-based procedures.

Geographically, North America is a dominant market for cruciate ligament diagnosis and treatment. This leadership is driven by high disposable incomes, a strong culture of sports participation, advanced healthcare infrastructure, and a proactive approach to sports injury management. The presence of leading orthopedic device manufacturers and research institutions in the region further bolsters its market dominance.

- Key Drivers for North American Dominance:

- High healthcare spending and insurance coverage.

- Significant investment in sports and related injury prevention/treatment research.

- Early adoption of innovative medical technologies.

- Dense network of specialized orthopedic clinics and hospitals.

Cruciate Ligament Diagnosis and Treatment Industry Product Developments

The Cruciate Ligament Diagnosis and Treatment industry is witnessing a continuous stream of product developments focused on enhancing surgical precision, improving graft integration, and accelerating patient recovery. Innovations include advanced arthroscopic instruments, next-generation graft materials like bio-enhanced synthetics and allografts with improved preservation techniques, and bio-regenerative products such as scaffolds and growth factors. These developments aim to provide surgeons with superior tools for accurate diagnosis and effective repair, offering patients reduced surgical trauma, faster healing times, and a higher probability of returning to pre-injury activity levels, thereby creating a significant competitive advantage for adopting companies.

Report Scope & Segmentation Analysis

This report segments the Cruciate Ligament Diagnosis and Treatment market based on Procedure and End User. The Procedure segmentation includes Anterior Cruciate Ligament (ACL) Repair and Posterior Cruciate Ligament (PCL) Repair, with ACL repair projected to hold a larger market share due to higher injury incidence. The End User segmentation encompasses Hospitals, Ambulatory Surgical Centers, and Other End Users. Hospitals are expected to dominate in terms of market size and growth, followed by Ambulatory Surgical Centers, which are increasingly handling routine ligament repair procedures. Growth projections for each segment are detailed, considering the evolving surgical landscape and patient preferences.

Key Drivers of Cruciate Ligament Diagnosis and Treatment Industry Growth

The growth of the Cruciate Ligament Diagnosis and Treatment industry is propelled by several key drivers. The escalating incidence of sports-related injuries, particularly among young athletes and active individuals, is a primary catalyst. Advancements in medical technology, including minimally invasive surgical techniques, sophisticated diagnostic imaging, and novel biomaterials for graft reconstruction, are enhancing treatment efficacy and patient outcomes. Furthermore, increased global healthcare expenditure, rising disposable incomes, and growing awareness about the importance of timely and effective treatment for ligament injuries are contributing to market expansion. Favorable reimbursement policies in many regions also support the adoption of advanced treatment modalities.

Challenges in the Cruciate Ligament Diagnosis and Treatment Industry Sector

Despite robust growth prospects, the Cruciate Ligament Diagnosis and Treatment industry faces several challenges. Stringent regulatory approvals for new medical devices and therapies can lead to lengthy development timelines and significant costs. High treatment costs, including surgical fees, implant prices, and rehabilitation expenses, can limit access for a segment of the population, particularly in regions with limited healthcare coverage. The complexity of some ligament injuries and the potential for complications or revision surgeries can also pose challenges. Moreover, the threat of product substitutes, such as advanced physical therapy protocols for less severe injuries, and the increasing competition among device manufacturers contribute to price pressures and the need for continuous innovation.

Emerging Opportunities in Cruciate Ligament Diagnosis and Treatment Industry

Emerging opportunities within the Cruciate Ligament Diagnosis and Treatment industry lie in the continuous innovation of regenerative medicine and biologics. The development of advanced cell-based therapies and growth factor-infused implants offers the potential for enhanced tissue healing and faster recovery, reducing the reliance on traditional grafts. The expansion of minimally invasive surgical techniques, including robotic-assisted surgery and new arthroscopic instrumentation, presents opportunities for improved precision and patient outcomes. Furthermore, the growing demand for personalized medicine, where treatments are tailored to individual patient genetics and biomechanics, opens avenues for specialized diagnostic tools and targeted therapeutic solutions. The increasing focus on preventative strategies and early intervention in sports medicine also presents a significant growth area.

Leading Players in the Cruciate Ligament Diagnosis and Treatment Industry Market

- CONMED Corporation

- Arthrex Inc

- Smith & Nephew

- Enovis (Mathys AG Bettlach)

- Corin Group

- Exactech Inc

- Medtronic

- Miach Orthopaedics

- Bauerfeind

- Stryker

- Tissue Regenix

- Integra LifeSciences

- Zimmer Biomet

- RTI Surgical

- Johnson & Johnson Services Inc (DePuy Synthes)

Key Developments in Cruciate Ligament Diagnosis and Treatment Industry Industry

- October 2022: Oregon Health & Science University Health provided a Bridge-Enhanced ACL Restoration implant or BEAR for a common athletic injury involving a torn anterior cruciate ligament (ACL), marking a significant advancement in biologic ACL reconstruction.

- January 2022: Symbios launched the ORIGIN CR Total Knee System, which completed the ORIGIN product range with both monobloc and modular cruciate-retaining versions that allowed surgeons to proceed to custom-made knee replacement preserving the posterior cruciate ligament (PCL), indicating a trend towards patient-specific orthopedic solutions.

Strategic Outlook for Cruciate Ligament Diagnosis and Treatment Industry Market

The strategic outlook for the Cruciate Ligament Diagnosis and Treatment industry is exceptionally positive, driven by ongoing technological advancements and a growing global demand for effective orthopedic solutions. The increasing prevalence of sports-related injuries, coupled with an aging population experiencing degenerative ligament issues, ensures a sustained patient pool. Key growth catalysts include further innovation in regenerative medicine and biomaterials, which promise enhanced healing and reduced recovery times. The expansion of minimally invasive surgical techniques and robotic assistance will continue to improve procedural outcomes and patient satisfaction. Furthermore, emerging markets offer significant untapped potential, as healthcare infrastructure and awareness improve. Strategic partnerships and acquisitions among key players will remain crucial for consolidating market share and accelerating the adoption of novel technologies, solidifying the industry's robust growth trajectory.

Cruciate Ligament Diagnosis and Treatment Industry Segmentation

-

1. Procedure

- 1.1. Anterior Cruciate Ligament (ACL) Repair

- 1.2. Posterior Cruciate Ligament (PCL) Repair

-

2. End User

- 2.1. Hospitals

- 2.2. Ambulatory Surgical Centers

- 2.3. Other End Users

Cruciate Ligament Diagnosis and Treatment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia acific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Cruciate Ligament Diagnosis and Treatment Industry Regional Market Share

Geographic Coverage of Cruciate Ligament Diagnosis and Treatment Industry

Cruciate Ligament Diagnosis and Treatment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Minimally Invasive Procedures; Rising Incidence of Sports-related Injuries

- 3.3. Market Restrains

- 3.3.1. High Cost of Procedures

- 3.4. Market Trends

- 3.4.1. Anterior Cruciate Ligament (ACL) Repair Segment Expected to Grow Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cruciate Ligament Diagnosis and Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Procedure

- 5.1.1. Anterior Cruciate Ligament (ACL) Repair

- 5.1.2. Posterior Cruciate Ligament (PCL) Repair

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals

- 5.2.2. Ambulatory Surgical Centers

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia acific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Procedure

- 6. North America Cruciate Ligament Diagnosis and Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Procedure

- 6.1.1. Anterior Cruciate Ligament (ACL) Repair

- 6.1.2. Posterior Cruciate Ligament (PCL) Repair

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals

- 6.2.2. Ambulatory Surgical Centers

- 6.2.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Procedure

- 7. Europe Cruciate Ligament Diagnosis and Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Procedure

- 7.1.1. Anterior Cruciate Ligament (ACL) Repair

- 7.1.2. Posterior Cruciate Ligament (PCL) Repair

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals

- 7.2.2. Ambulatory Surgical Centers

- 7.2.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Procedure

- 8. Asia acific Cruciate Ligament Diagnosis and Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Procedure

- 8.1.1. Anterior Cruciate Ligament (ACL) Repair

- 8.1.2. Posterior Cruciate Ligament (PCL) Repair

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals

- 8.2.2. Ambulatory Surgical Centers

- 8.2.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Procedure

- 9. Middle East and Africa Cruciate Ligament Diagnosis and Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Procedure

- 9.1.1. Anterior Cruciate Ligament (ACL) Repair

- 9.1.2. Posterior Cruciate Ligament (PCL) Repair

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals

- 9.2.2. Ambulatory Surgical Centers

- 9.2.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Procedure

- 10. South America Cruciate Ligament Diagnosis and Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Procedure

- 10.1.1. Anterior Cruciate Ligament (ACL) Repair

- 10.1.2. Posterior Cruciate Ligament (PCL) Repair

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospitals

- 10.2.2. Ambulatory Surgical Centers

- 10.2.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Procedure

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CONMED Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Arthrex Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Smith & Nephew

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Enovis (Mathys AG Bettlach)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Corin Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Exactech Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Medtronic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Miach Orthopaedics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bauerfeind

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Stryker

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Tissue Regenix

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Integra LifeSciences

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Zimmer Biomet

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 RTI Surgical

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Johnson & Johnson Services Inc (DePuy Synthes)

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 CONMED Corporation

List of Figures

- Figure 1: Global Cruciate Ligament Diagnosis and Treatment Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Cruciate Ligament Diagnosis and Treatment Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion), by Procedure 2025 & 2033

- Figure 4: North America Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit), by Procedure 2025 & 2033

- Figure 5: North America Cruciate Ligament Diagnosis and Treatment Industry Revenue Share (%), by Procedure 2025 & 2033

- Figure 6: North America Cruciate Ligament Diagnosis and Treatment Industry Volume Share (%), by Procedure 2025 & 2033

- Figure 7: North America Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion), by End User 2025 & 2033

- Figure 8: North America Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit), by End User 2025 & 2033

- Figure 9: North America Cruciate Ligament Diagnosis and Treatment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Cruciate Ligament Diagnosis and Treatment Industry Volume Share (%), by End User 2025 & 2033

- Figure 11: North America Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Cruciate Ligament Diagnosis and Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Cruciate Ligament Diagnosis and Treatment Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion), by Procedure 2025 & 2033

- Figure 16: Europe Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit), by Procedure 2025 & 2033

- Figure 17: Europe Cruciate Ligament Diagnosis and Treatment Industry Revenue Share (%), by Procedure 2025 & 2033

- Figure 18: Europe Cruciate Ligament Diagnosis and Treatment Industry Volume Share (%), by Procedure 2025 & 2033

- Figure 19: Europe Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion), by End User 2025 & 2033

- Figure 20: Europe Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit), by End User 2025 & 2033

- Figure 21: Europe Cruciate Ligament Diagnosis and Treatment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 22: Europe Cruciate Ligament Diagnosis and Treatment Industry Volume Share (%), by End User 2025 & 2033

- Figure 23: Europe Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Cruciate Ligament Diagnosis and Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Cruciate Ligament Diagnosis and Treatment Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia acific Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion), by Procedure 2025 & 2033

- Figure 28: Asia acific Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit), by Procedure 2025 & 2033

- Figure 29: Asia acific Cruciate Ligament Diagnosis and Treatment Industry Revenue Share (%), by Procedure 2025 & 2033

- Figure 30: Asia acific Cruciate Ligament Diagnosis and Treatment Industry Volume Share (%), by Procedure 2025 & 2033

- Figure 31: Asia acific Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion), by End User 2025 & 2033

- Figure 32: Asia acific Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit), by End User 2025 & 2033

- Figure 33: Asia acific Cruciate Ligament Diagnosis and Treatment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 34: Asia acific Cruciate Ligament Diagnosis and Treatment Industry Volume Share (%), by End User 2025 & 2033

- Figure 35: Asia acific Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia acific Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia acific Cruciate Ligament Diagnosis and Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia acific Cruciate Ligament Diagnosis and Treatment Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion), by Procedure 2025 & 2033

- Figure 40: Middle East and Africa Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit), by Procedure 2025 & 2033

- Figure 41: Middle East and Africa Cruciate Ligament Diagnosis and Treatment Industry Revenue Share (%), by Procedure 2025 & 2033

- Figure 42: Middle East and Africa Cruciate Ligament Diagnosis and Treatment Industry Volume Share (%), by Procedure 2025 & 2033

- Figure 43: Middle East and Africa Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion), by End User 2025 & 2033

- Figure 44: Middle East and Africa Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit), by End User 2025 & 2033

- Figure 45: Middle East and Africa Cruciate Ligament Diagnosis and Treatment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Middle East and Africa Cruciate Ligament Diagnosis and Treatment Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Middle East and Africa Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Middle East and Africa Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Cruciate Ligament Diagnosis and Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Cruciate Ligament Diagnosis and Treatment Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion), by Procedure 2025 & 2033

- Figure 52: South America Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit), by Procedure 2025 & 2033

- Figure 53: South America Cruciate Ligament Diagnosis and Treatment Industry Revenue Share (%), by Procedure 2025 & 2033

- Figure 54: South America Cruciate Ligament Diagnosis and Treatment Industry Volume Share (%), by Procedure 2025 & 2033

- Figure 55: South America Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion), by End User 2025 & 2033

- Figure 56: South America Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit), by End User 2025 & 2033

- Figure 57: South America Cruciate Ligament Diagnosis and Treatment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 58: South America Cruciate Ligament Diagnosis and Treatment Industry Volume Share (%), by End User 2025 & 2033

- Figure 59: South America Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion), by Country 2025 & 2033

- Figure 60: South America Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Cruciate Ligament Diagnosis and Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Cruciate Ligament Diagnosis and Treatment Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cruciate Ligament Diagnosis and Treatment Industry Revenue billion Forecast, by Procedure 2020 & 2033

- Table 2: Global Cruciate Ligament Diagnosis and Treatment Industry Volume K Unit Forecast, by Procedure 2020 & 2033

- Table 3: Global Cruciate Ligament Diagnosis and Treatment Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Global Cruciate Ligament Diagnosis and Treatment Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: Global Cruciate Ligament Diagnosis and Treatment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Cruciate Ligament Diagnosis and Treatment Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Cruciate Ligament Diagnosis and Treatment Industry Revenue billion Forecast, by Procedure 2020 & 2033

- Table 8: Global Cruciate Ligament Diagnosis and Treatment Industry Volume K Unit Forecast, by Procedure 2020 & 2033

- Table 9: Global Cruciate Ligament Diagnosis and Treatment Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 10: Global Cruciate Ligament Diagnosis and Treatment Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 11: Global Cruciate Ligament Diagnosis and Treatment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Cruciate Ligament Diagnosis and Treatment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Cruciate Ligament Diagnosis and Treatment Industry Revenue billion Forecast, by Procedure 2020 & 2033

- Table 20: Global Cruciate Ligament Diagnosis and Treatment Industry Volume K Unit Forecast, by Procedure 2020 & 2033

- Table 21: Global Cruciate Ligament Diagnosis and Treatment Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 22: Global Cruciate Ligament Diagnosis and Treatment Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 23: Global Cruciate Ligament Diagnosis and Treatment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Cruciate Ligament Diagnosis and Treatment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Germany Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: France Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Italy Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Spain Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Cruciate Ligament Diagnosis and Treatment Industry Revenue billion Forecast, by Procedure 2020 & 2033

- Table 38: Global Cruciate Ligament Diagnosis and Treatment Industry Volume K Unit Forecast, by Procedure 2020 & 2033

- Table 39: Global Cruciate Ligament Diagnosis and Treatment Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 40: Global Cruciate Ligament Diagnosis and Treatment Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 41: Global Cruciate Ligament Diagnosis and Treatment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Global Cruciate Ligament Diagnosis and Treatment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: China Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Japan Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: India Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Australia Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: South Korea Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Cruciate Ligament Diagnosis and Treatment Industry Revenue billion Forecast, by Procedure 2020 & 2033

- Table 56: Global Cruciate Ligament Diagnosis and Treatment Industry Volume K Unit Forecast, by Procedure 2020 & 2033

- Table 57: Global Cruciate Ligament Diagnosis and Treatment Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 58: Global Cruciate Ligament Diagnosis and Treatment Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 59: Global Cruciate Ligament Diagnosis and Treatment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Cruciate Ligament Diagnosis and Treatment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: GCC Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: South Africa Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Cruciate Ligament Diagnosis and Treatment Industry Revenue billion Forecast, by Procedure 2020 & 2033

- Table 68: Global Cruciate Ligament Diagnosis and Treatment Industry Volume K Unit Forecast, by Procedure 2020 & 2033

- Table 69: Global Cruciate Ligament Diagnosis and Treatment Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 70: Global Cruciate Ligament Diagnosis and Treatment Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 71: Global Cruciate Ligament Diagnosis and Treatment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 72: Global Cruciate Ligament Diagnosis and Treatment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: Brazil Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Argentina Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Cruciate Ligament Diagnosis and Treatment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Cruciate Ligament Diagnosis and Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cruciate Ligament Diagnosis and Treatment Industry?

The projected CAGR is approximately 11.9%.

2. Which companies are prominent players in the Cruciate Ligament Diagnosis and Treatment Industry?

Key companies in the market include CONMED Corporation, Arthrex Inc, Smith & Nephew, Enovis (Mathys AG Bettlach), Corin Group, Exactech Inc, Medtronic, Miach Orthopaedics, Bauerfeind, Stryker, Tissue Regenix, Integra LifeSciences, Zimmer Biomet, RTI Surgical, Johnson & Johnson Services Inc (DePuy Synthes).

3. What are the main segments of the Cruciate Ligament Diagnosis and Treatment Industry?

The market segments include Procedure, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.15 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Minimally Invasive Procedures; Rising Incidence of Sports-related Injuries.

6. What are the notable trends driving market growth?

Anterior Cruciate Ligament (ACL) Repair Segment Expected to Grow Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Procedures.

8. Can you provide examples of recent developments in the market?

October 2022: Oregon Health & Science University Health provided a Bridge-Enhanced ACL Restoration implant or BEAR for a common athletic injury involving a torn anterior cruciate ligament (ACL).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cruciate Ligament Diagnosis and Treatment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cruciate Ligament Diagnosis and Treatment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cruciate Ligament Diagnosis and Treatment Industry?

To stay informed about further developments, trends, and reports in the Cruciate Ligament Diagnosis and Treatment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence