Key Insights

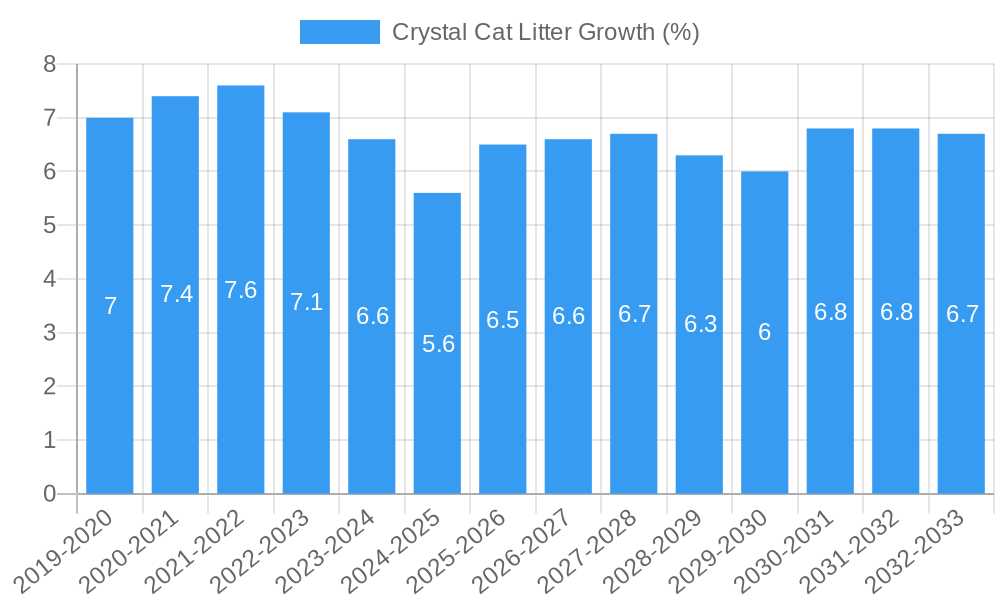

The global Crystal Cat Litter market is poised for significant expansion, projected to reach a substantial market size of approximately $850 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 7.5% expected through 2033. This impressive growth trajectory is primarily fueled by an escalating global pet ownership trend, coupled with an increasing humanization of pets, leading owners to invest more in premium pet care products. Crystal cat litter's inherent benefits, such as superior odor control, exceptional absorbency, and dust-free properties, are resonating strongly with consumers seeking cleaner and more convenient litter box solutions. The growing awareness among pet owners regarding the health and hygiene advantages of silica gel-based litters further bolsters market demand. Key applications within this market span both retail pet stores and household use, with consumers increasingly opting for these advanced litter types in their own homes.

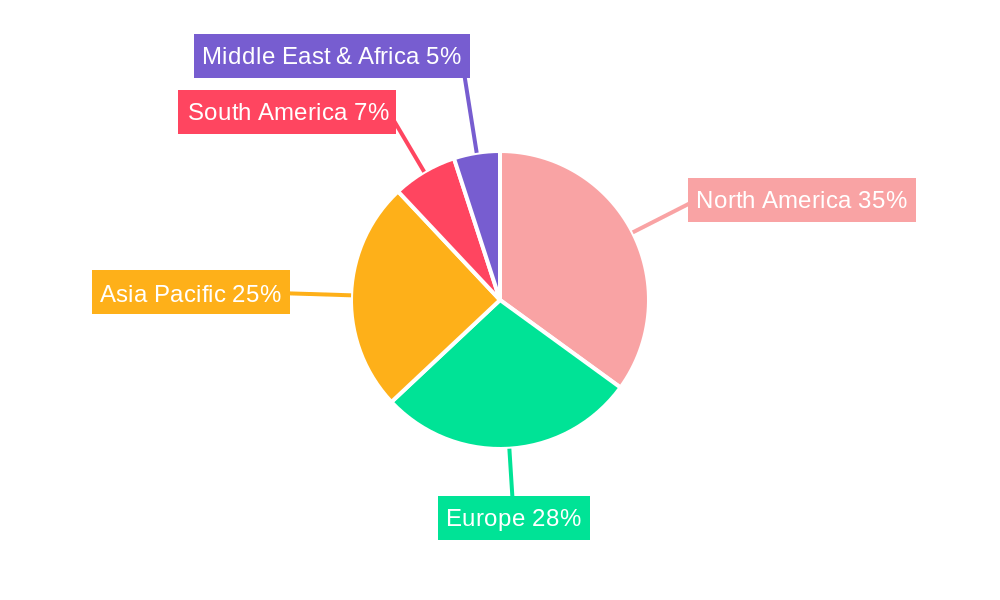

The market dynamics are further shaped by a growing emphasis on sustainable and eco-friendly pet products, although the production of crystal litter involves certain energy-intensive processes. Nonetheless, its long-lasting nature and reduced frequency of replacement compared to traditional litters contribute to a more sustainable consumption pattern for many pet owners. While the initial cost of crystal cat litter may be higher than conventional options, its cost-effectiveness over time due to reduced usage and fewer cleanings is a significant driver for adoption. Leading companies like Nestle, Clorox, and Mars are actively innovating and expanding their product portfolios to cater to this burgeoning demand, introducing specialized formulations and advanced features to capture market share. Regional analyses indicate strong growth potential across North America, Europe, and the Asia Pacific, driven by similar demographic and lifestyle shifts in pet ownership.

Crystal Cat Litter Market Concentration & Innovation

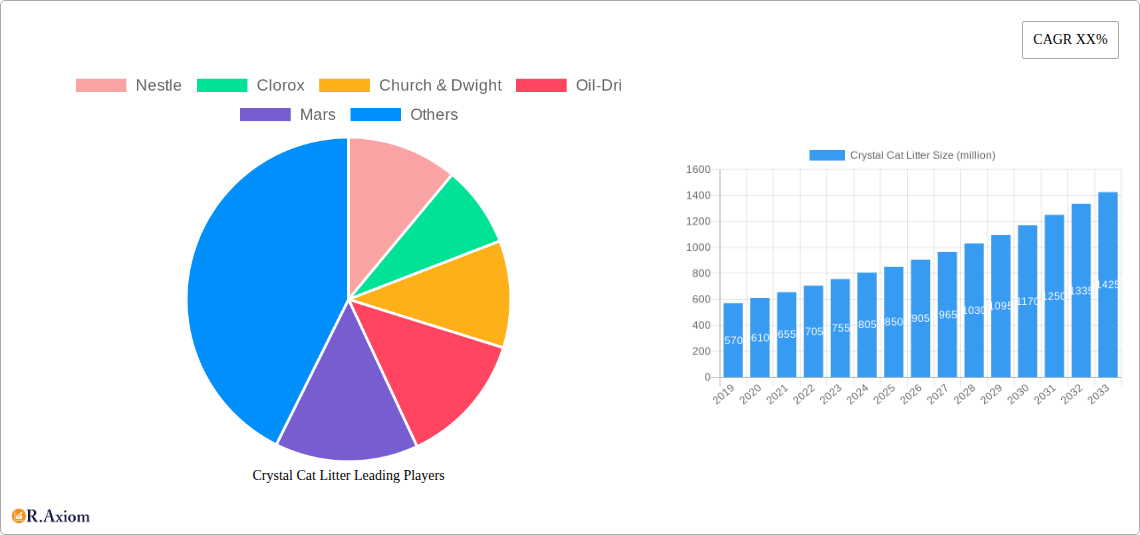

The global Crystal Cat Litter market exhibits moderate concentration, with a few major players dominating a significant portion of the market share. Nestle, Clorox, and Church & Dwight are identified as key players, each holding an estimated market share of approximately 15-20% as of the base year 2025. Mars and Oil-Dri are also significant contributors, with estimated market shares around 10-12% and 8-10% respectively. Innovation is a critical driver, fueled by the increasing demand for eco-friendly, odor-controlling, and dust-free cat litter solutions. Companies are investing heavily in research and development to enhance the absorbency, clumping capabilities, and biodegradability of crystal cat litter. Regulatory frameworks, primarily focused on pet product safety and environmental impact, are also shaping innovation. Stricter regulations regarding chemical additives and waste disposal are pushing manufacturers towards sustainable sourcing and production methods. Product substitutes, such as traditional clay litter and plant-based litters, present ongoing competition, necessitating continuous product differentiation and value proposition enhancement for crystal cat litter. End-user trends lean towards convenience, hygiene, and aesthetic appeal, with a growing preference for silica gel-based crystal litters due to their superior odor control and low dust properties. Mergers and acquisitions (M&A) activities, while not extensive, are strategically employed by larger entities to acquire niche technologies or expand their market reach. The estimated value of M&A deals in this segment over the forecast period is expected to reach upwards of $500 million, driven by consolidation and the pursuit of market dominance.

Crystal Cat Litter Industry Trends & Insights

The Crystal Cat Litter market is poised for robust growth, driven by a confluence of accelerating market growth drivers, transformative technological disruptions, evolving consumer preferences, and dynamic competitive landscapes. Over the historical period from 2019 to 2024, the market has witnessed a steady expansion, with an estimated Compound Annual Growth Rate (CAGR) of approximately 7.5%. This upward trajectory is projected to continue throughout the forecast period of 2025 to 2033, with an anticipated CAGR of around 8.2%. Market penetration, while already substantial in developed economies, is expected to see significant increases in emerging markets, driven by rising pet ownership and disposable incomes.

Technological advancements are at the forefront of industry trends. The refinement of silica gel manufacturing processes has led to more efficient and effective crystal cat litter products. Innovations in odor absorption technologies, such as the incorporation of activated carbon and other proprietary formulations, are enhancing product performance and consumer satisfaction. Furthermore, advancements in packaging and distribution logistics are improving product accessibility and reducing environmental impact. The trend towards healthier and safer pet products is a major consumer preference driver. Pet owners are increasingly scrutinizing product ingredients, seeking out litters that are dust-free, hypoallergenic, and free from harsh chemicals. This demand is directly benefiting crystal cat litter, particularly silica gel variants, which are naturally low in dust and non-toxic. The convenience factor also plays a crucial role, with crystal litter requiring less frequent changes and offering superior odor control, appealing to busy pet owners.

The competitive dynamics within the crystal cat litter market are characterized by both established giants and agile startups. Companies like Nestle, Clorox, and Church & Dwight leverage their extensive distribution networks and brand recognition to maintain market leadership. However, smaller, specialized manufacturers are also carving out significant niches by focusing on premium, eco-friendly, or niche product offerings. The market is becoming increasingly globalized, with a growing presence of players from Asia, particularly China, with companies like Ruijia Cat Litter and SINCHEM emerging as notable contributors. The strategic alliances and partnerships between raw material suppliers and cat litter manufacturers are also a significant trend, ensuring supply chain stability and cost optimization. The estimated market size for crystal cat litter is projected to surpass $1.5 billion by 2025 and is expected to reach over $3.0 billion by the end of the forecast period in 2033, indicating substantial growth potential.

Dominant Markets & Segments in Crystal Cat Litter

The crystal cat litter market is experiencing significant dominance from the Household application segment, which accounts for an estimated 70% of the total market share in the base year 2025. This widespread adoption in homes is driven by a confluence of factors including increasing pet ownership, urbanization leading to smaller living spaces where odor control is paramount, and a general rise in disposable incomes allowing for premium pet care products. The economic policies in developed nations, such as the United States, Europe, and Australia, have fostered a robust pet-loving culture, further bolstering the household segment. Infrastructure supporting direct-to-consumer sales and widespread retail availability also plays a crucial role in this segment's dominance.

Within the application types, the Bentonite Cat Litter segment, though a traditional staple, is now facing increasing competition from crystal variants. However, its established market presence and lower price point continue to ensure its significant market share, estimated at around 60% of the broader cat litter market. Conversely, the Wood Sand Cat Litter segment is a rapidly growing niche, driven by the demand for eco-friendly and biodegradable alternatives. Its market share is estimated to be around 15% and is expected to grow at a faster pace than Bentonite. The Crystal Cat Litter segment itself, particularly silica gel-based products, is projected to witness the highest growth rate, capturing an estimated 25% of the total market by 2025 and expanding to over 35% by 2033. This growth is attributed to superior performance in odor control, absorbency, and dust reduction, directly addressing key consumer pain points.

Geographically, North America, led by the United States, represents the largest and most mature market for crystal cat litter, accounting for an estimated 35% of the global market share. This dominance is underpinned by high pet ownership rates, advanced consumer awareness regarding pet health and hygiene, and the presence of major industry players like Clorox and Nestle. Europe follows with a significant market share of approximately 28%, driven by strong demand for premium and eco-friendly pet products in countries like Germany, the UK, and France. Asia-Pacific, particularly China, is emerging as a high-growth region, with an estimated market share of 20% and a projected CAGR of over 10% during the forecast period. This growth is fueled by a rapidly expanding middle class, increasing urbanization, and a growing adoption of Western pet-care practices. Key drivers in this region include favorable economic policies promoting consumer spending, expanding retail infrastructure, and the rise of e-commerce platforms making diverse pet products accessible.

Crystal Cat Litter Product Developments

Product innovation in the crystal cat litter market is primarily focused on enhancing odor control, reducing dust, and improving biodegradability. Manufacturers are developing advanced silica gel formulations that offer superior moisture absorption and exceptional odor neutralization, often incorporating activated charcoal or specialized antimicrobial agents. The development of larger, more porous crystal granules is also a key trend, leading to reduced tracking and improved comfort for feline users. Furthermore, there is a growing emphasis on creating biodegradable and compostable crystal litter alternatives, aligning with the increasing consumer demand for sustainable pet products. Competitive advantages are being carved out through unique scent profiles, hypoallergenic formulations, and visually appealing crystal aesthetics.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Crystal Cat Litter market, encompassing key segments to offer actionable insights. The market is segmented by Application into Pet Store and Household. The Household segment, projected to reach a market size of approximately $2.2 billion by 2025, is expected to exhibit a CAGR of 8.5% throughout the forecast period, driven by widespread adoption and increasing pet ownership. The Pet Store segment, valued at an estimated $0.8 billion in 2025, is anticipated to grow at a CAGR of 7.8%, influenced by bulk purchasing and specialized product offerings.

Further segmentation by Type includes Bentonite Cat Litter, Wood Sand Cat Litter, and Crystal Cat Litter. The Bentonite Cat Litter segment, though mature, is expected to reach $1.5 billion by 2025 with a modest CAGR of 5.0%. Wood Sand Cat Litter, a rapidly expanding eco-friendly option, is projected to grow from an estimated $0.4 billion in 2025 to over $1.2 billion by 2033, with a CAGR of 12.0%. The Crystal Cat Litter segment, the focus of this report, is forecast to grow from an estimated $1.1 billion in 2025 to over $2.5 billion by 2033, driven by its superior performance characteristics and a CAGR of 9.5%. Competitive dynamics within each segment vary, with established brands holding strong positions in Bentonite and emerging players leading innovation in Wood Sand and Crystal categories.

Key Drivers of Crystal Cat Litter Growth

The crystal cat litter market is experiencing significant growth driven by a multitude of factors. Increasing global pet ownership, particularly in urban areas, directly translates to a higher demand for effective and convenient pet care solutions. The rising awareness among pet owners about hygiene and odor control is a paramount driver, pushing consumers towards advanced litter technologies like crystal litter. Technological innovations in silica gel manufacturing have led to more efficient, dust-free, and superior odor-neutralizing crystal litters, enhancing their appeal. The growing preference for aesthetically pleasing and low-maintenance pet products aligns perfectly with the characteristics of crystal litter. Furthermore, the increasing availability of crystal cat litter through online retail channels and a growing number of specialized pet stores are expanding market access. Government initiatives promoting pet welfare and responsible pet ownership also indirectly support the demand for high-quality cat litter products.

Challenges in the Crystal Cat Litter Sector

Despite the promising growth, the crystal cat litter sector faces several challenges. The primary restraint is the higher price point of crystal cat litter compared to traditional clay litters, which can deter price-sensitive consumers, especially in emerging markets. Regulatory hurdles related to the disposal of silica gel waste, while not a major concern currently, could become more prominent as market volumes increase, necessitating sustainable waste management solutions. Supply chain disruptions, particularly concerning the availability and cost of raw materials like silica sand, can impact production and profitability. Intense competition from established traditional litter brands and the emergence of other eco-friendly alternatives, such as plant-based litters, also pose a significant competitive pressure. Consumer education on the benefits of crystal litter over cheaper alternatives remains an ongoing challenge for market expansion. The estimated impact of these challenges on market growth is a potential reduction of 5-7% in projected CAGR if not effectively addressed.

Emerging Opportunities in Crystal Cat Litter

The crystal cat litter market is ripe with emerging opportunities. The growing trend of premiumization in pet care presents a significant avenue for the expansion of high-end, feature-rich crystal litter products, such as those with advanced odor-locking technologies or natural attractants. The untapped potential in emerging economies in Asia-Pacific and Latin America, with their rapidly growing middle class and increasing pet adoption rates, offers substantial growth prospects. The development of innovative, eco-friendly crystal litter variants, perhaps incorporating biodegradable elements or utilizing recycled materials in packaging, will cater to the burgeoning demand for sustainable pet products. Furthermore, the integration of smart technologies, such as litter tracking sensors or odor detection systems within litter boxes, could create new product categories and revenue streams. Exploring niche markets like single-cat households or multi-cat households with specific odor control needs can also unlock specialized growth opportunities.

Leading Players in the Crystal Cat Litter Market

- Nestle

- Clorox

- Church & Dwight

- Oil-Dri

- Mars

- Drelseys

- Blue

- Pettex

- PMC

- Ruijia Cat Litter

- SINCHEM

Key Developments in Crystal Cat Litter Industry

- 2023 Q4: Nestle launches a new line of silica gel crystal cat litter with enhanced odor control technology, aiming to capture a larger share of the premium market.

- 2024 Q1: Clorox announces a strategic partnership with a leading raw material supplier to ensure a stable supply chain for its crystal cat litter production, mitigating potential disruptions.

- 2024 Q2: Church & Dwight introduces a new biodegradable crystal cat litter formulation, responding to growing consumer demand for sustainable pet products.

- 2024 Q3: Ruijia Cat Litter expands its production capacity in China to meet the increasing domestic and international demand for its crystal cat litter products.

- 2024 Q4: Mars invests in R&D for advanced clumping technologies in crystal cat litter, aiming to improve user experience and reduce litter box maintenance.

Strategic Outlook for Crystal Cat Litter Market

The strategic outlook for the crystal cat litter market is highly optimistic, driven by sustained growth in pet ownership, escalating consumer demand for advanced hygiene solutions, and continuous product innovation. The market is expected to benefit from a growing preference for convenience and low-maintenance pet care products, where crystal litter excels. Manufacturers are strategically focusing on expanding their product portfolios to include eco-friendly and premium offerings, catering to diverse consumer needs and preferences. The increasing penetration of e-commerce platforms is further enhancing market accessibility, particularly in developing regions. Investments in research and development to create even more effective odor control and dust-free formulations will be crucial for maintaining competitive advantage. Companies that can successfully navigate pricing sensitivities and effectively communicate the long-term value proposition of crystal cat litter are well-positioned for significant market share gains and sustained profitability throughout the forecast period, reaching an estimated market size of over $3.0 billion by 2033.

Crystal Cat Litter Segmentation

-

1. Application

- 1.1. Pet Store

- 1.2. Household

-

2. Types

- 2.1. Bentonite Cat Litter

- 2.2. Wood Sand Cat Litter Cat Litter

Crystal Cat Litter Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Crystal Cat Litter REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Crystal Cat Litter Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pet Store

- 5.1.2. Household

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Bentonite Cat Litter

- 5.2.2. Wood Sand Cat Litter Cat Litter

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Crystal Cat Litter Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pet Store

- 6.1.2. Household

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Bentonite Cat Litter

- 6.2.2. Wood Sand Cat Litter Cat Litter

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Crystal Cat Litter Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pet Store

- 7.1.2. Household

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Bentonite Cat Litter

- 7.2.2. Wood Sand Cat Litter Cat Litter

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Crystal Cat Litter Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pet Store

- 8.1.2. Household

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Bentonite Cat Litter

- 8.2.2. Wood Sand Cat Litter Cat Litter

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Crystal Cat Litter Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pet Store

- 9.1.2. Household

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Bentonite Cat Litter

- 9.2.2. Wood Sand Cat Litter Cat Litter

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Crystal Cat Litter Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pet Store

- 10.1.2. Household

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Bentonite Cat Litter

- 10.2.2. Wood Sand Cat Litter Cat Litter

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Nestle

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clorox

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Church & Dwight

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Oil-Dri

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mars

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Drelseys

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Blue

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pettex

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PMC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ruijia Cat Litter

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SINCHEM

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Nestle

List of Figures

- Figure 1: Global Crystal Cat Litter Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Crystal Cat Litter Revenue (million), by Application 2024 & 2032

- Figure 3: North America Crystal Cat Litter Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Crystal Cat Litter Revenue (million), by Types 2024 & 2032

- Figure 5: North America Crystal Cat Litter Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Crystal Cat Litter Revenue (million), by Country 2024 & 2032

- Figure 7: North America Crystal Cat Litter Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Crystal Cat Litter Revenue (million), by Application 2024 & 2032

- Figure 9: South America Crystal Cat Litter Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Crystal Cat Litter Revenue (million), by Types 2024 & 2032

- Figure 11: South America Crystal Cat Litter Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Crystal Cat Litter Revenue (million), by Country 2024 & 2032

- Figure 13: South America Crystal Cat Litter Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Crystal Cat Litter Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Crystal Cat Litter Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Crystal Cat Litter Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Crystal Cat Litter Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Crystal Cat Litter Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Crystal Cat Litter Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Crystal Cat Litter Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Crystal Cat Litter Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Crystal Cat Litter Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Crystal Cat Litter Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Crystal Cat Litter Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Crystal Cat Litter Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Crystal Cat Litter Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Crystal Cat Litter Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Crystal Cat Litter Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Crystal Cat Litter Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Crystal Cat Litter Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Crystal Cat Litter Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Crystal Cat Litter Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Crystal Cat Litter Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Crystal Cat Litter Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Crystal Cat Litter Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Crystal Cat Litter Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Crystal Cat Litter Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Crystal Cat Litter Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Crystal Cat Litter Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Crystal Cat Litter Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Crystal Cat Litter Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Crystal Cat Litter Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Crystal Cat Litter Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Crystal Cat Litter Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Crystal Cat Litter Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Crystal Cat Litter Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Crystal Cat Litter Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Crystal Cat Litter Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Crystal Cat Litter Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Crystal Cat Litter Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Crystal Cat Litter Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Crystal Cat Litter?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Crystal Cat Litter?

Key companies in the market include Nestle, Clorox, Church & Dwight, Oil-Dri, Mars, Drelseys, Blue, Pettex, PMC, Ruijia Cat Litter, SINCHEM.

3. What are the main segments of the Crystal Cat Litter?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Crystal Cat Litter," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Crystal Cat Litter report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Crystal Cat Litter?

To stay informed about further developments, trends, and reports in the Crystal Cat Litter, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence