Key Insights

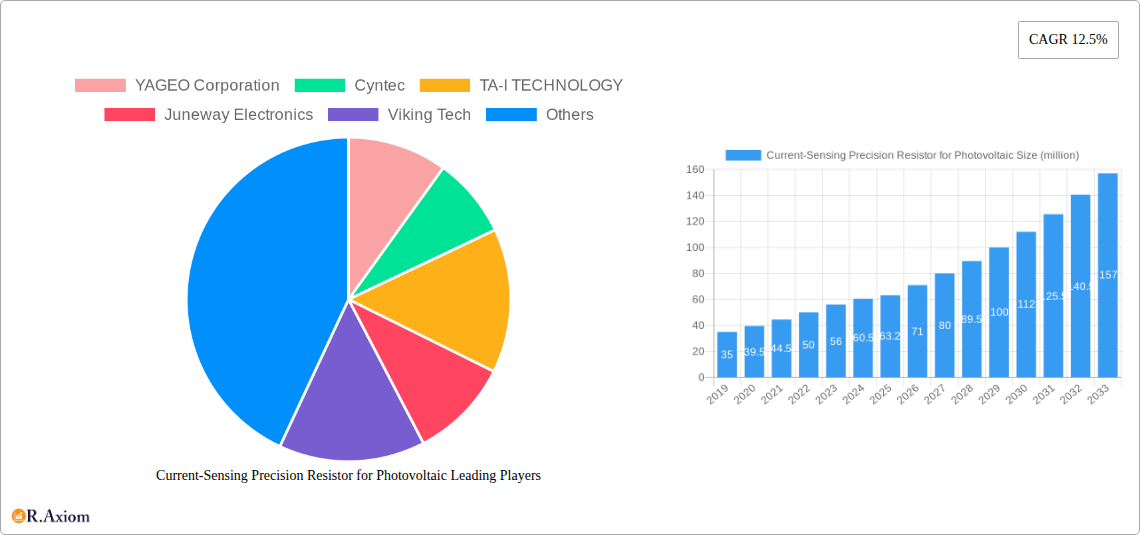

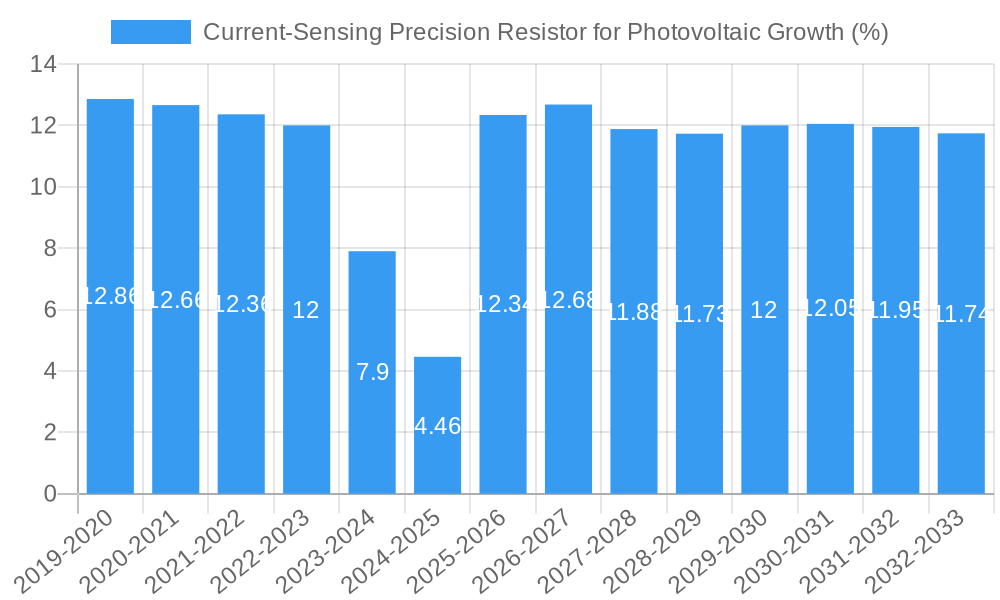

The global market for Current-Sensing Precision Resistors in Photovoltaic applications is experiencing robust growth, projected to reach an estimated USD 63.2 million by 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 12.5% expected to continue through 2033. This significant expansion is primarily fueled by the accelerating global adoption of solar energy. Governments worldwide are implementing supportive policies and incentives to encourage renewable energy integration, directly boosting the demand for solar power generation systems. The increasing efficiency and decreasing costs of photovoltaic technology further enhance its attractiveness, driving substantial investment in new solar installations and upgrades. As solar energy becomes a cornerstone of sustainable energy strategies, the need for accurate and reliable current sensing in photovoltaic inverters, battery management systems (BMS), and power generation control systems becomes paramount. These precision resistors are critical for optimizing energy harvesting, ensuring system safety, and maximizing the lifespan of solar energy infrastructure.

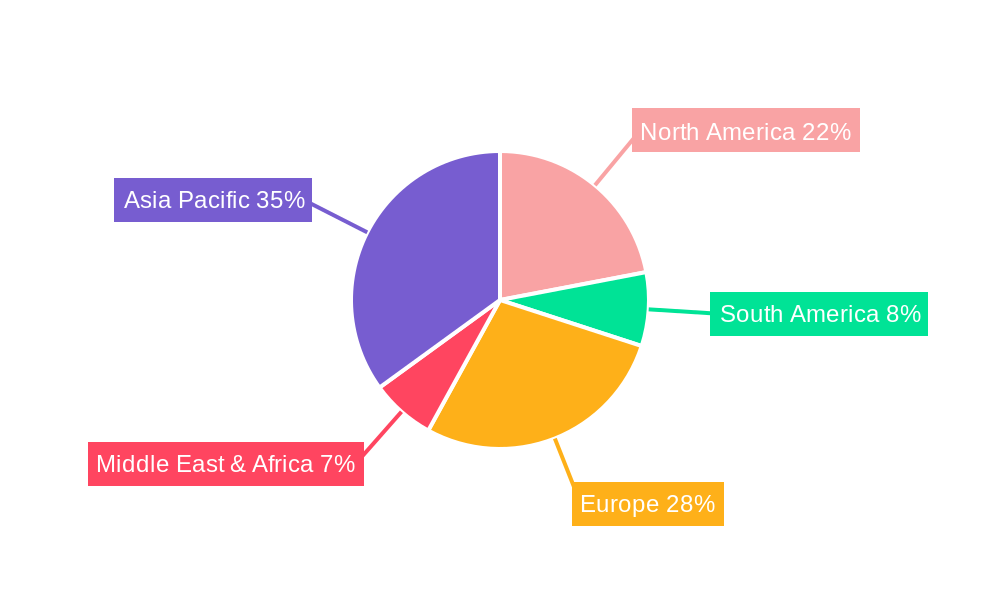

The market is segmented by application, with Photovoltaic Inverters emerging as the dominant segment, followed closely by Battery Management Systems and Photovoltaic Power Generation Control Systems. The increasing complexity and power output of inverters, coupled with the growing integration of energy storage solutions like batteries in solar systems, necessitate highly accurate current measurement. The two-terminal and four-terminal resistor types cater to diverse design requirements within these applications. Geographically, the Asia Pacific region, particularly China and India, is anticipated to lead market growth due to aggressive solar energy targets and a burgeoning manufacturing base. North America and Europe also represent significant markets, driven by strong renewable energy mandates and technological advancements. Leading companies such as YAGEO Corporation, Cyntec, and Littelfuse are actively innovating to meet the evolving demands for higher precision, enhanced thermal performance, and miniaturized solutions in this dynamic sector.

Current-Sensing Precision Resistor for Photovoltaic Market Concentration & Innovation

The current-sensing precision resistor for photovoltaic market exhibits a moderate level of concentration, with a few key players dominating a significant portion of the global share. Innovation is a primary driver, fueled by the increasing demand for highly efficient and reliable photovoltaic systems. Manufacturers are continuously investing in research and development to enhance resistor accuracy, thermal stability, and power handling capabilities, crucial for photovoltaic inverters and battery management systems. Regulatory frameworks, particularly those promoting renewable energy adoption and grid stability, play a pivotal role in shaping market dynamics. The ongoing drive for cleaner energy solutions and government incentives are creating a favorable environment for advanced current-sensing solutions. Product substitutes, while present in the broader resistor market, are less impactful in this specialized photovoltaic segment due to the stringent performance requirements. End-user trends lean towards miniaturization, higher power density, and enhanced durability to withstand diverse environmental conditions. Mergers and acquisitions (M&A) activities, while not at an extreme level, are observed as companies seek to expand their product portfolios and geographical reach. Notable M&A deal values are in the range of tens of millions to hundreds of millions of dollars, reflecting strategic consolidations and technology acquisitions.

- Market Share: Leading companies hold market shares ranging from 5% to 15%.

- Innovation Focus: High accuracy (0.1% to 1%), low temperature coefficient, and high power dissipation.

- Regulatory Influence: Supportive government policies for solar energy deployment.

- End-User Demand: Miniaturization, enhanced thermal management, and increased lifespan.

- M&A Activity: Strategic acquisitions to bolster technological capabilities and market presence, with deal values often exceeding fifty million dollars.

Current-Sensing Precision Resistor for Photovoltaic Industry Trends & Insights

The current-sensing precision resistor for photovoltaic market is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer preferences, and supportive global energy policies. The increasing adoption of solar energy worldwide, coupled with ambitious renewable energy targets set by governments, is the primary catalyst for this expansion. Photovoltaic inverters, critical components in converting DC power from solar panels to AC power for the grid or household use, require highly precise current-sensing resistors to monitor and control power flow, optimize efficiency, and ensure system safety. Similarly, the burgeoning battery management system (BMS) market, essential for the efficient and safe operation of energy storage solutions in photovoltaic systems, relies heavily on accurate current measurements for battery state monitoring, charge/discharge control, and overall system health.

Technological disruptions are continuously reshaping the landscape. Advancements in material science have led to the development of low-resistance, high-precision resistors with superior thermal performance and greater durability, capable of withstanding the harsh operational environments often encountered in photovoltaic installations. Surface-mount technology (SMT) integration allows for smaller, lighter, and more cost-effective solutions, aligning with the trend towards miniaturization in electronic components. The development of advanced sensing technologies, including shunt resistors with enhanced linearity and reduced temperature drift, further contributes to improved system performance and reliability.

Consumer preferences are increasingly focused on energy efficiency, long-term reliability, and cost-effectiveness. As the cost of solar energy continues to decline, the demand for high-performance, low-maintenance photovoltaic systems is growing. This translates directly to a need for components that offer optimal performance over their entire lifespan. Manufacturers are responding by developing resistors that minimize power loss, reduce heat generation, and offer extended operational life.

Competitive dynamics within the industry are characterized by a mix of established global players and emerging specialized manufacturers. Companies are differentiating themselves through product innovation, superior quality, competitive pricing, and robust customer support. Strategic partnerships and collaborations are also becoming more prevalent as companies aim to leverage each other's expertise and expand their market reach. The market penetration of advanced current-sensing resistors is steadily increasing as the benefits of their precision and reliability become more apparent to system designers and integrators. The compound annual growth rate (CAGR) for this market is projected to be robust, in the range of 8% to 12% over the forecast period, reflecting the strong underlying growth drivers and the critical role of these resistors in the evolving renewable energy ecosystem. The overall market size is expected to reach several billion dollars by 2033.

Dominant Markets & Segments in Current-Sensing Precision Resistor for Photovoltaic

The global market for current-sensing precision resistors for photovoltaic applications is experiencing significant growth, with Asia Pacific emerging as the dominant region. This dominance is largely attributable to the region's aggressive expansion in solar power generation capacity, driven by supportive government policies, substantial investments in renewable energy infrastructure, and a rapidly growing demand for electricity. China, in particular, stands as a powerhouse, leading in both the manufacturing and deployment of solar energy solutions, which in turn fuels the demand for high-quality current-sensing components.

Within the Asia Pacific region, key countries like China, India, and South Korea are major contributors. China's ambitious renewable energy targets and its position as a global manufacturing hub for solar panels and inverters create an immense market for these precision resistors. India's focus on expanding its solar power capacity to meet growing energy demands and reduce its carbon footprint further bolsters this segment. South Korea's technological prowess and its investment in advanced energy storage solutions also contribute to the regional demand.

In terms of applications, the Photovoltaic Inverter segment commands the largest market share. Inverters are the heart of photovoltaic systems, responsible for efficiently converting the direct current (DC) generated by solar panels into alternating current (AC) usable by the grid or household appliances. The precision and reliability of current-sensing resistors are paramount in these devices for tasks such as Maximum Power Point Tracking (MPPT), overcurrent protection, and grid synchronization. The increasing complexity and efficiency demands of modern inverters directly translate to a higher need for advanced current-sensing solutions.

The Battery Management System (BMS) segment is another significant and rapidly growing area. As energy storage solutions become increasingly integrated into photovoltaic systems for load balancing, grid stability, and backup power, the role of accurate current sensing in BMS becomes critical. These resistors are essential for monitoring battery charge and discharge currents, enabling precise state-of-charge (SoC) and state-of-health (SoH) estimations, and ensuring the longevity and safety of battery packs.

The Photovoltaic Power Generation Control System segment also contributes to the market, encompassing a broader range of control and monitoring functions within larger solar power plants. This includes systems that manage the overall operation of solar farms, optimize energy harvest, and ensure grid compliance.

Among the types of resistors, Four Terminals configurations are gaining prominence, especially in high-power photovoltaic applications. The four-terminal design, often referred to as a Kelvin connection, significantly reduces measurement errors caused by contact resistance and lead wire impedance, leading to more accurate current readings. This precision is crucial for optimizing system performance and ensuring reliable operation. Two Terminals resistors, while still relevant for less demanding applications or in situations where cost is a primary factor, are gradually being superseded by four-terminal solutions for critical functions in advanced photovoltaic systems.

- Dominant Region: Asia Pacific, driven by China's extensive solar manufacturing and deployment.

- Key Countries: China, India, South Korea.

- Leading Application Segment: Photovoltaic Inverter, essential for power conversion and MPPT.

- High-Growth Application Segment: Battery Management System, crucial for energy storage integration.

- Dominant Resistor Type: Four Terminals, offering superior accuracy for critical measurements.

- Economic Factors: Government subsidies for solar energy, decreasing solar panel costs, and rising electricity demand.

- Infrastructure Development: Significant investment in solar power plants and grid infrastructure.

Current-Sensing Precision Resistor for Photovoltaic Product Developments

Product developments in the current-sensing precision resistor for photovoltaic sector are focused on enhancing performance and meeting evolving industry demands. Manufacturers are introducing ultra-low resistance values (e.g., below 0.1 milliohm) to minimize power loss and improve energy efficiency in photovoltaic systems. Advancements in materials like Manganin and Nichrome alloys enable resistors with exceptionally low temperature coefficients of resistance (TCR), ensuring stable and accurate measurements across a wide operational temperature range, critical for outdoor photovoltaic installations. Miniaturization through advanced packaging techniques like surface-mount technology (SMT) allows for higher power density and easier integration into compact inverter and BMS designs. Enhanced thermal management capabilities, including improved heat dissipation, are also key features, preventing performance degradation and extending product lifespan. These innovations provide a competitive advantage by enabling more efficient, reliable, and cost-effective photovoltaic solutions.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global current-sensing precision resistor for photovoltaic market. The segmentation covers key application areas, including Photovoltaic Inverter, where high precision is vital for energy conversion and optimization; Battery Management System, crucial for accurate monitoring of charge and discharge cycles in energy storage; Photovoltaic Power Generation Control System, encompassing broader operational management of solar assets; and Others, which includes niche applications like solar chargers and microgrid control systems.

The market is also segmented by resistor type: Two Terminals, typically used in less critical applications or cost-sensitive designs, and Four Terminals, which offer superior accuracy for demanding photovoltaic environments through Kelvin connections. Growth projections for each segment indicate a strong upward trend, with the Photovoltaic Inverter and Battery Management System segments expected to lead in market size and growth rates due to their integral role in modern solar energy solutions. Competitive dynamics within each segment vary, with established players focusing on high-performance solutions and newer entrants vying for market share with cost-effective alternatives.

Key Drivers of Current-Sensing Precision Resistor for Photovoltaic Growth

The growth of the current-sensing precision resistor for photovoltaic market is propelled by several key drivers. Foremost is the global surge in solar energy adoption, fueled by governmental policies and incentives aimed at reducing carbon emissions and enhancing energy security. Technological advancements in photovoltaic systems, particularly in the efficiency and power density of inverters and the integration of energy storage solutions, necessitate highly accurate and reliable current-sensing components. The declining cost of solar power installations makes it increasingly competitive with traditional energy sources, further stimulating demand. Furthermore, the growing complexity of grid management and the rise of smart grids require precise monitoring capabilities that current-sensing resistors provide.

- Governmental Support: Policies promoting renewable energy, tax incentives, and renewable energy targets.

- Technological Advancement: Increased efficiency and power density in photovoltaic inverters and battery management systems.

- Cost Competitiveness: Declining solar energy costs making it an attractive alternative.

- Grid Modernization: Demand for smart grids and advanced energy management systems.

Challenges in the Current-Sensing Precision Resistor for Photovoltaic Sector

Despite robust growth, the current-sensing precision resistor for photovoltaic sector faces several challenges. Intense price competition from numerous manufacturers, especially in high-volume segments, can put pressure on profit margins. Fluctuations in raw material costs, such as copper and precious metals, can impact production expenses and lead to pricing instability. Supply chain disruptions, as witnessed in recent years, can lead to lead time extensions and affect product availability. Moreover, the stringent performance requirements for photovoltaic applications, demanding high accuracy, low temperature drift, and long-term reliability, necessitate significant R&D investment and rigorous quality control, which can be costly. Evolving technical standards and certifications within the renewable energy sector also require continuous adaptation by manufacturers.

- Price Competition: High volume production leads to aggressive pricing strategies.

- Raw Material Volatility: Fluctuations in the cost of key metals impacting manufacturing expenses.

- Supply Chain Disruptions: Global logistics issues affecting lead times and availability.

- High R&D Costs: Continuous investment required to meet stringent performance standards.

Emerging Opportunities in Current-Sensing Precision Resistor for Photovoltaic

Emerging opportunities in the current-sensing precision resistor for photovoltaic market are abundant, driven by the dynamic nature of the renewable energy sector. The rapidly expanding energy storage market, particularly the integration of batteries with solar systems for grid stabilization and off-grid applications, presents a significant growth avenue for high-precision BMS components. The development of advanced microinverters and power optimizers for distributed solar generation, requiring highly integrated and miniaturized current-sensing solutions, also opens new markets. Furthermore, the increasing adoption of electric vehicles (EVs) and the subsequent demand for smart charging infrastructure, which often integrates with solar power, will indirectly boost the need for precision current sensing. Innovations in emerging technologies like perovskite solar cells and floating solar farms may also create unique application requirements for specialized current-sensing resistors.

- Energy Storage Integration: Growing demand for accurate current sensing in battery management systems.

- Microinverters & Optimizers: Opportunities for miniaturized, high-performance solutions.

- EV Charging Infrastructure: Synergistic growth with solar power integration.

- New Solar Technologies: Development of specialized resistors for emerging solar cell types.

Leading Players in the Current-Sensing Precision Resistor for Photovoltaic Market

- YAGEO Corporation

- Cyntec

- TA-I TECHNOLOGY

- Juneway Electronics

- Viking Tech

- Fenghua Advanced Technology

- Littelfuse

- IET Labs

- EATON

- VISHAY

- Panasonic

- ROHM

Key Developments in Current-Sensing Precision Resistor for Photovoltaic Industry

- 2023/01: Launch of ultra-low resistance shunt resistors with improved thermal management for advanced photovoltaic inverters.

- 2022/11: YAGEO Corporation announces acquisition of a competitor to expand its precision resistor portfolio for renewable energy.

- 2022/07: Cyntec introduces new four-terminal resistors with enhanced accuracy for battery management systems in solar energy storage.

- 2021/12: Fenghua Advanced Technology invests in expanding production capacity for high-power current-sensing resistors.

- 2021/06: Viking Tech develops miniaturized current-sensing solutions for microinverter applications.

Strategic Outlook for Current-Sensing Precision Resistor for Photovoltaic Market

The strategic outlook for the current-sensing precision resistor for photovoltaic market remains exceptionally positive. Continued global commitment to renewable energy targets, coupled with ongoing technological advancements in solar energy capture and storage, will drive sustained demand. Companies that focus on innovation, particularly in developing components with ultra-low resistance, superior temperature stability, and higher power density, will be well-positioned for growth. Strategic partnerships and acquisitions will likely continue as players aim to consolidate market share and expand their technological capabilities. The increasing integration of photovoltaic systems with energy storage and smart grids will create new avenues for specialized and high-performance current-sensing solutions, ensuring a robust future for this critical market segment.

Current-Sensing Precision Resistor for Photovoltaic Segmentation

-

1. Application

- 1.1. Photovoltaic Inverter

- 1.2. Battery Management System

- 1.3. Photovoltaic Power Generation Control System

- 1.4. Others

-

2. Types

- 2.1. Two Terminals

- 2.2. Four Terminals

Current-Sensing Precision Resistor for Photovoltaic Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Current-Sensing Precision Resistor for Photovoltaic REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Current-Sensing Precision Resistor for Photovoltaic Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Photovoltaic Inverter

- 5.1.2. Battery Management System

- 5.1.3. Photovoltaic Power Generation Control System

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Two Terminals

- 5.2.2. Four Terminals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Current-Sensing Precision Resistor for Photovoltaic Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Photovoltaic Inverter

- 6.1.2. Battery Management System

- 6.1.3. Photovoltaic Power Generation Control System

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Two Terminals

- 6.2.2. Four Terminals

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Current-Sensing Precision Resistor for Photovoltaic Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Photovoltaic Inverter

- 7.1.2. Battery Management System

- 7.1.3. Photovoltaic Power Generation Control System

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Two Terminals

- 7.2.2. Four Terminals

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Current-Sensing Precision Resistor for Photovoltaic Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Photovoltaic Inverter

- 8.1.2. Battery Management System

- 8.1.3. Photovoltaic Power Generation Control System

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Two Terminals

- 8.2.2. Four Terminals

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Current-Sensing Precision Resistor for Photovoltaic Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Photovoltaic Inverter

- 9.1.2. Battery Management System

- 9.1.3. Photovoltaic Power Generation Control System

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Two Terminals

- 9.2.2. Four Terminals

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Current-Sensing Precision Resistor for Photovoltaic Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Photovoltaic Inverter

- 10.1.2. Battery Management System

- 10.1.3. Photovoltaic Power Generation Control System

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Two Terminals

- 10.2.2. Four Terminals

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 YAGEO Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cyntec

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TA-I TECHNOLOGY

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Juneway Electronics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Viking Tech

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fenghua Advanced Technology

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Littelfuse

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 IET Labs

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 EATON

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 VISHAY

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Panasonic

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ROHM

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 YAGEO Corporation

List of Figures

- Figure 1: Global Current-Sensing Precision Resistor for Photovoltaic Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Current-Sensing Precision Resistor for Photovoltaic Revenue (million), by Application 2024 & 2032

- Figure 3: North America Current-Sensing Precision Resistor for Photovoltaic Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Current-Sensing Precision Resistor for Photovoltaic Revenue (million), by Types 2024 & 2032

- Figure 5: North America Current-Sensing Precision Resistor for Photovoltaic Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Current-Sensing Precision Resistor for Photovoltaic Revenue (million), by Country 2024 & 2032

- Figure 7: North America Current-Sensing Precision Resistor for Photovoltaic Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Current-Sensing Precision Resistor for Photovoltaic Revenue (million), by Application 2024 & 2032

- Figure 9: South America Current-Sensing Precision Resistor for Photovoltaic Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Current-Sensing Precision Resistor for Photovoltaic Revenue (million), by Types 2024 & 2032

- Figure 11: South America Current-Sensing Precision Resistor for Photovoltaic Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Current-Sensing Precision Resistor for Photovoltaic Revenue (million), by Country 2024 & 2032

- Figure 13: South America Current-Sensing Precision Resistor for Photovoltaic Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Current-Sensing Precision Resistor for Photovoltaic Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Current-Sensing Precision Resistor for Photovoltaic Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Current-Sensing Precision Resistor for Photovoltaic Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Current-Sensing Precision Resistor for Photovoltaic Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Current-Sensing Precision Resistor for Photovoltaic Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Current-Sensing Precision Resistor for Photovoltaic Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Current-Sensing Precision Resistor for Photovoltaic Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Current-Sensing Precision Resistor for Photovoltaic Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Current-Sensing Precision Resistor for Photovoltaic Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Current-Sensing Precision Resistor for Photovoltaic Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Current-Sensing Precision Resistor for Photovoltaic Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Current-Sensing Precision Resistor for Photovoltaic Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Current-Sensing Precision Resistor for Photovoltaic Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Current-Sensing Precision Resistor for Photovoltaic Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Current-Sensing Precision Resistor for Photovoltaic Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Current-Sensing Precision Resistor for Photovoltaic Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Current-Sensing Precision Resistor for Photovoltaic Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Current-Sensing Precision Resistor for Photovoltaic Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Current-Sensing Precision Resistor for Photovoltaic Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Current-Sensing Precision Resistor for Photovoltaic Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Current-Sensing Precision Resistor for Photovoltaic Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Current-Sensing Precision Resistor for Photovoltaic Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Current-Sensing Precision Resistor for Photovoltaic Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Current-Sensing Precision Resistor for Photovoltaic Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Current-Sensing Precision Resistor for Photovoltaic Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Current-Sensing Precision Resistor for Photovoltaic Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Current-Sensing Precision Resistor for Photovoltaic Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Current-Sensing Precision Resistor for Photovoltaic Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Current-Sensing Precision Resistor for Photovoltaic Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Current-Sensing Precision Resistor for Photovoltaic Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Current-Sensing Precision Resistor for Photovoltaic Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Current-Sensing Precision Resistor for Photovoltaic Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Current-Sensing Precision Resistor for Photovoltaic Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Current-Sensing Precision Resistor for Photovoltaic Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Current-Sensing Precision Resistor for Photovoltaic Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Current-Sensing Precision Resistor for Photovoltaic Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Current-Sensing Precision Resistor for Photovoltaic Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Current-Sensing Precision Resistor for Photovoltaic Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Current-Sensing Precision Resistor for Photovoltaic?

The projected CAGR is approximately 12.5%.

2. Which companies are prominent players in the Current-Sensing Precision Resistor for Photovoltaic?

Key companies in the market include YAGEO Corporation, Cyntec, TA-I TECHNOLOGY, Juneway Electronics, Viking Tech, Fenghua Advanced Technology, Littelfuse, IET Labs, EATON, VISHAY, Panasonic, ROHM.

3. What are the main segments of the Current-Sensing Precision Resistor for Photovoltaic?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.2 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Current-Sensing Precision Resistor for Photovoltaic," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Current-Sensing Precision Resistor for Photovoltaic report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Current-Sensing Precision Resistor for Photovoltaic?

To stay informed about further developments, trends, and reports in the Current-Sensing Precision Resistor for Photovoltaic, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence