Key Insights

The Denmark Mobile Payments Market is projected to achieve substantial growth, reaching an estimated market size of 115.8 billion by 2025. This expansion is driven by a significant Compound Annual Growth Rate (CAGR) of 3.2%. Key factors fueling this growth include rising smartphone adoption, increasing integration of contactless payment technologies, and a growing consumer preference for secure and convenient digital transactions. Government initiatives promoting a cashless society and the expanding e-commerce sector further accelerate market development. Enhanced security features such as tokenization and biometrics, the widespread adoption of mobile wallets, and their integration across retail and service industries are critical growth catalysts.

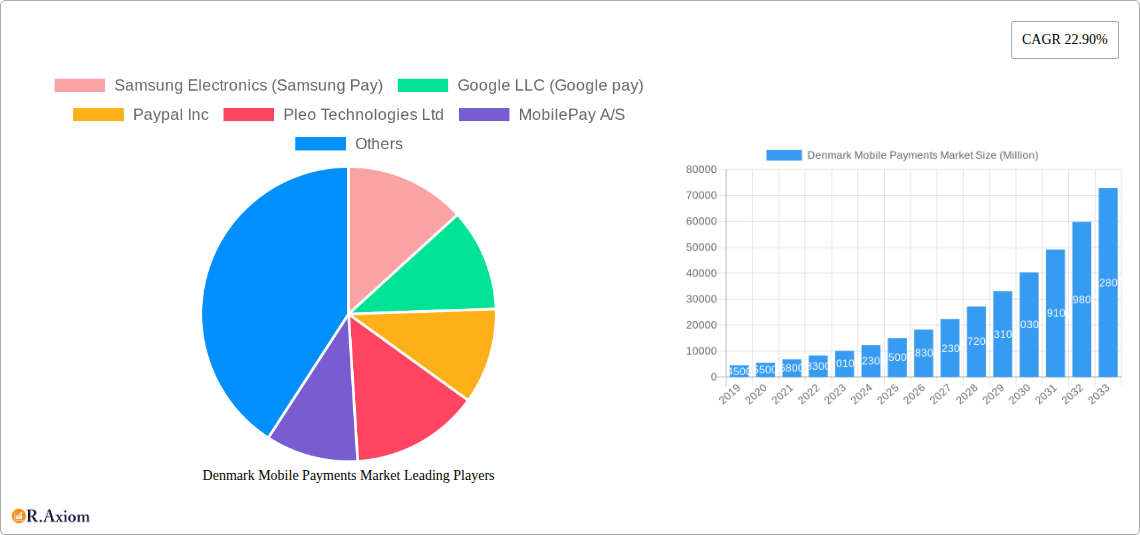

Denmark Mobile Payments Market Market Size (In Billion)

Market segmentation reveals the dominance of proximity payments due to the prevalence of NFC-enabled point-of-sale terminals. Remote payments are also experiencing rapid adoption, propelled by the growth of online retail and in-app purchases. Major industry players, including Samsung Electronics (Samsung Pay), Google LLC (Google Pay), and Apple Inc (Apple Pay), are actively innovating and forging strategic partnerships, intensifying market competition. While the market offers considerable opportunities, evolving data privacy regulations and the imperative for robust cybersecurity investments to ensure consumer trust present potential challenges. The sustained high growth rate indicates a dynamic and evolving market for mobile payment solutions in Denmark.

Denmark Mobile Payments Market Company Market Share

This comprehensive report provides an in-depth analysis of the Denmark Mobile Payments Market. It covers the historical period (2019-2024) and forecasts future trends through 2033, offering granular insights into market evolution. The base year of 2025 serves as a critical benchmark for assessing current market standing and future trajectory. Focusing on mobile payment solutions in Denmark, this report examines key market players, emerging technologies, and critical growth drivers. The forecast period (2025-2033) anticipates significant shifts in consumer behavior and technological adoption, making this report vital for strategic planning within the rapidly evolving fintech sector.

Denmark Mobile Payments Market Market Concentration & Innovation

The Denmark Mobile Payments Market exhibits a moderate level of market concentration, with several key players vying for dominance. Innovation is a primary driver, fueled by advancements in contactless technology, QR code payments, and the increasing adoption of digital wallets. Regulatory frameworks, such as those promoting open banking and data security, are shaping the competitive landscape. Key companies like Samsung Electronics (Samsung Pay), Google LLC (Google pay), Paypal Inc, Pleo Technologies Ltd, MobilePay A/S, Apple Inc (Apple Pay), Amazon Payments Inc, Nets Denmark A/S (Dankort App), and Bancore A/S are continuously introducing new features and enhancing user experience. While specific market share data is proprietary, prominent players like MobilePay hold a significant portion of the consumer market. The M&A landscape, though not extensively documented with public deal values for this specific market, indicates strategic investments and potential consolidation as companies seek to expand their offerings and customer base. The competitive intensity encourages continuous innovation in areas such as loyalty programs integrated into payment apps and enhanced security features to build consumer trust.

Denmark Mobile Payments Market Industry Trends & Insights

The Denmark Mobile Payments Market is poised for robust growth, driven by a confluence of factors including increasing smartphone penetration, a digitally savvy population, and a supportive regulatory environment. The compound annual growth rate (CAGR) is projected to be substantial, reflecting the accelerating adoption of mobile payment solutions across various consumer segments. Market penetration is steadily increasing, with a growing percentage of the Danish population utilizing mobile wallets for everyday transactions. Technological disruptions, such as the evolution of near-field communication (NFC) and the integration of biometric authentication, are enhancing the security and convenience of mobile payments. Consumer preferences are shifting towards seamless, contactless, and card-less payment experiences, favoring digital solutions that offer speed and ease of use. The competitive dynamics are characterized by intense innovation from both established tech giants and specialized fintech companies, each striving to capture market share through superior user experience and value-added services. This environment fosters a continuous drive for developing more integrated and personalized payment functionalities, from loyalty program integration to instant peer-to-peer transfers, further solidifying the market's upward trajectory.

Dominant Markets & Segments in Denmark Mobile Payments Market

Within the Denmark Mobile Payments Market, the Proximity segment currently holds a dominant position, largely driven by the widespread adoption of contactless payment terminals in retail and hospitality sectors. This dominance is further bolstered by the convenience and speed offered by solutions like MobilePay and Apple Pay for in-store purchases.

- Proximity Payments:

- Key Drivers:

- Ubiquitous availability of NFC-enabled point-of-sale (POS) terminals across Denmark.

- High consumer trust and familiarity with mobile payment apps for everyday transactions.

- Government initiatives promoting digital transactions and reducing cash usage.

- Integration of loyalty programs and discounts within proximity payment applications, enhancing their attractiveness.

- Dominance Analysis: The widespread acceptance of contactless payments at physical locations makes Proximity the go-to segment for immediate transactions. MobilePay's strong brand recognition and user base have been instrumental in this segment's success, enabling consumers to make quick payments using their smartphones or smartwatches. The Dankort App, while primarily a debit card app, also facilitates contactless payments, further solidifying this segment's lead.

- Key Drivers:

The Remote segment, while growing, is yet to surpass the Proximity segment in terms of transaction volume. This segment encompasses online purchases, in-app payments, and bill payments made through mobile devices.

- Remote Payments:

- Key Drivers:

- Growth of e-commerce and online service subscriptions.

- Increasing demand for convenient ways to pay bills and transfer funds remotely.

- Development of secure and user-friendly payment gateways for online merchants.

- The rise of "buy now, pay later" (BNPL) options integrated into mobile payment platforms.

- Dominance Analysis: While Proximity leads in day-to-day transactions, the Remote segment is experiencing significant growth, especially with the expansion of online retail and digital services. PayPal's established presence in online transactions and the increasing integration of various payment providers into e-commerce platforms are key contributors. The upcoming P27 Nordic Payments initiative also has the potential to streamline cross-border remote payments, further boosting this segment.

- Key Drivers:

Denmark Mobile Payments Market Product Developments

Product innovation in the Denmark Mobile Payments Market is characterized by a focus on user experience, security, and integration. Companies are developing advanced features such as tokenization for enhanced security, biometric authentication (fingerprint and facial recognition), and seamless integration with loyalty programs and e-commerce platforms. Wearable payment technology is also gaining traction, allowing for contactless payments directly from smartwatches. The competitive advantage lies in offering intuitive interfaces, robust security protocols, and a broad acceptance network, making mobile payments a convenient and reliable alternative to traditional methods.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Denmark Mobile Payments Market, segmented by Type, encompassing Proximity and Remote payment methods.

- Proximity: This segment includes payments made through mobile devices at physical points of sale, such as contactless card payments initiated via smartphones or smartwatches. It is projected to maintain a significant market share due to its inherent convenience and widespread acceptance.

- Remote: This segment covers payments made for online transactions, in-app purchases, bill payments, and peer-to-peer transfers initiated through mobile devices. This segment is expected to witness substantial growth driven by the increasing digitalization of services and e-commerce expansion.

Key Drivers of Denmark Mobile Payments Market Growth

Several key drivers are propelling the growth of the Denmark Mobile Payments Market. Technologically, the widespread adoption of smartphones, advancements in NFC and QR code technology, and the increasing sophistication of mobile wallet features are paramount. Economically, a robust digital infrastructure, high disposable income, and a growing e-commerce sector contribute significantly. Regulatory factors, including government support for digital payments and initiatives promoting financial inclusion, create a conducive environment for market expansion. Furthermore, changing consumer preferences for convenience, speed, and security in transactions are fundamentally shifting towards mobile-first payment solutions.

Challenges in the Denmark Mobile Payments Market Sector

Despite the positive growth trajectory, the Denmark Mobile Payments Market Sector faces certain challenges. Regulatory hurdles, although generally supportive, can sometimes involve complex compliance requirements for new entrants. Security concerns and the potential for data breaches, while mitigated by advanced technologies, remain a persistent concern for some consumers, impacting adoption rates. Intense competition among established players and agile fintech startups can lead to price wars and pressure on profit margins. Ensuring widespread merchant adoption and educating consumers about the benefits and security of mobile payments are ongoing challenges that require continuous effort from market participants.

Emerging Opportunities in Denmark Mobile Payments Market

The Denmark Mobile Payments Market presents numerous emerging opportunities. The expansion of wearable payment technology offers a new avenue for seamless transactions. The growing adoption of contactless payment solutions in public transportation and ticketing systems is a significant growth area. Furthermore, the increasing demand for integrated financial services within payment apps, such as budgeting tools, loyalty programs, and investment options, presents opportunities for differentiation. The P27 Nordic Payments initiative holds the potential to revolutionize cross-border payments, opening new markets and simplifying international transactions for both businesses and consumers.

Leading Players in the Denmark Mobile Payments Market Market

- Samsung Electronics

- Google LLC

- Paypal Inc

- Pleo Technologies Ltd

- MobilePay A/S

- Apple Inc

- Amazon Payments Inc

- Nets Denmark A/S

- Bancore A/S

Key Developments in Denmark Mobile Payments Market Industry

- June 2022: Following approval by Finance Denmark, P27 Nordic Payments is set to become the new national clearinghouse in Denmark for both traditional and smart payments for businesses and private consumers. This initiative aims to replace multiple national clearing systems in the Nordics, promising to make cross-border payments as seamless as sending a text message. P27 Nordic Payments is owned by Nordic commercial banks: Danske Bank, Svenska Handelsbanken, Nordea, OP Financial Group, SEB, and Swedbank.

- May 2022: Google announced its "Tap to Pay" feature for smartphones, allowing users to make payments wherever Google Pay is accepted. Google Wallet, designed to store payment and non-payment assets in a virtual cloud-based space, will include credit cards, debit cards, and more. The app will be available in 39 markets worldwide, including Denmark.

Strategic Outlook for Denmark Mobile Payments Market Market

The Denmark Mobile Payments Market is characterized by a promising strategic outlook, driven by the ongoing digital transformation and evolving consumer behavior. The increasing demand for convenient, secure, and integrated payment solutions will continue to fuel market expansion. Key growth catalysts include the further development and adoption of contactless technologies, the seamless integration of mobile payments into e-commerce and everyday services, and the potential impact of initiatives like P27 Nordic Payments on streamlining cross-border transactions. Companies that focus on enhancing user experience, investing in robust security measures, and offering value-added services beyond basic payments are well-positioned to capitalize on the burgeoning opportunities in this dynamic market. The strategic focus on innovation and customer-centricity will be crucial for sustained success.

Denmark Mobile Payments Market Segmentation

-

1. Type

- 1.1. Proximity

- 1.2. Remote

Denmark Mobile Payments Market Segmentation By Geography

- 1. Denmark

Denmark Mobile Payments Market Regional Market Share

Geographic Coverage of Denmark Mobile Payments Market

Denmark Mobile Payments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High internet penetration and High smartphone usage encourages mobile-commerce; Growing use of Digital wallet use in E-commerce; Government initiatives engenders trust online

- 3.3. Market Restrains

- 3.3.1. Cybersecurity and Data Breaches for Mobile Payments

- 3.4. Market Trends

- 3.4.1. High internet penetration and high smartphone usage encourages mobile-commerce

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark Mobile Payments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Proximity

- 5.1.2. Remote

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Denmark

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Samsung Electronics (Samsung Pay)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Google LLC (Google pay)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Paypal Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Pleo Technologies Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MobilePay A/S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Apple Inc (Apple Pay)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Amazon Payments Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nets Denmark A/S (Dankort App)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bancore A/S

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Samsung Electronics (Samsung Pay)

List of Figures

- Figure 1: Denmark Mobile Payments Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Denmark Mobile Payments Market Share (%) by Company 2025

List of Tables

- Table 1: Denmark Mobile Payments Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Denmark Mobile Payments Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Denmark Mobile Payments Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Denmark Mobile Payments Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark Mobile Payments Market?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the Denmark Mobile Payments Market?

Key companies in the market include Samsung Electronics (Samsung Pay), Google LLC (Google pay), Paypal Inc, Pleo Technologies Ltd, MobilePay A/S, Apple Inc (Apple Pay), Amazon Payments Inc, Nets Denmark A/S (Dankort App), Bancore A/S.

3. What are the main segments of the Denmark Mobile Payments Market?

The market segments include Type .

4. Can you provide details about the market size?

The market size is estimated to be USD 115.8 billion as of 2022.

5. What are some drivers contributing to market growth?

High internet penetration and High smartphone usage encourages mobile-commerce; Growing use of Digital wallet use in E-commerce; Government initiatives engenders trust online.

6. What are the notable trends driving market growth?

High internet penetration and high smartphone usage encourages mobile-commerce.

7. Are there any restraints impacting market growth?

Cybersecurity and Data Breaches for Mobile Payments.

8. Can you provide examples of recent developments in the market?

June 2022: After the approval by Finance Denmark, the Danish financial services central organization, the plan would see P27 Nordic Payments become the new national clearinghouse in Denmark for traditional and smart payments for businesses and private consumers. P27 could replace multiple national clearing systems in Nordics, as it promises to make cross-border payments as easy as sending a text message. P27 Nordic Payments is owned by the Nordic region's commercial banks - Danske Bank, Svenska Handelsbanken, Nordea, OP Financial Group, SEB, and Swedbank.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark Mobile Payments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark Mobile Payments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark Mobile Payments Market?

To stay informed about further developments, trends, and reports in the Denmark Mobile Payments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence