Key Insights

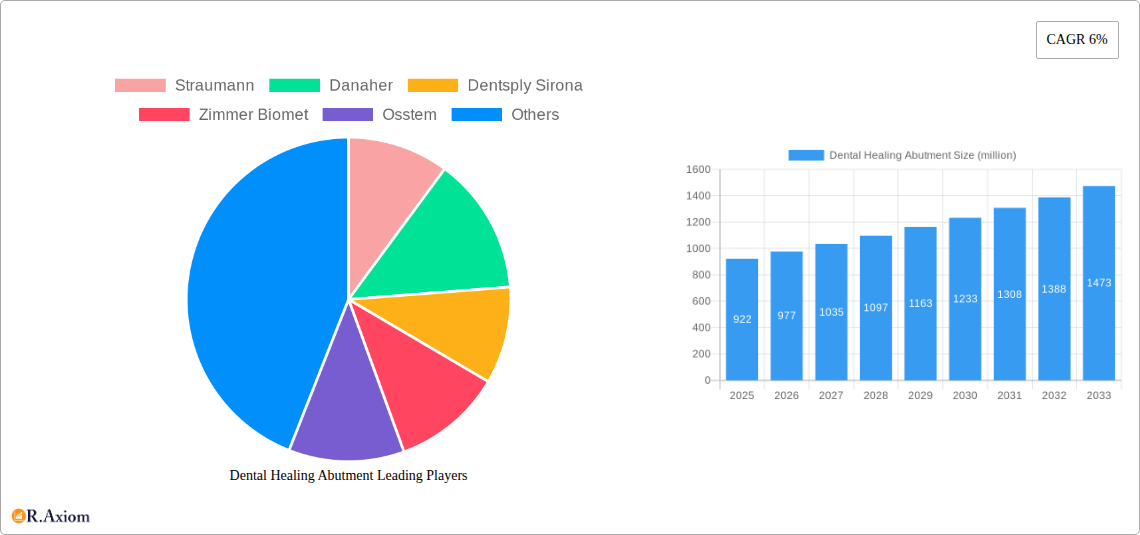

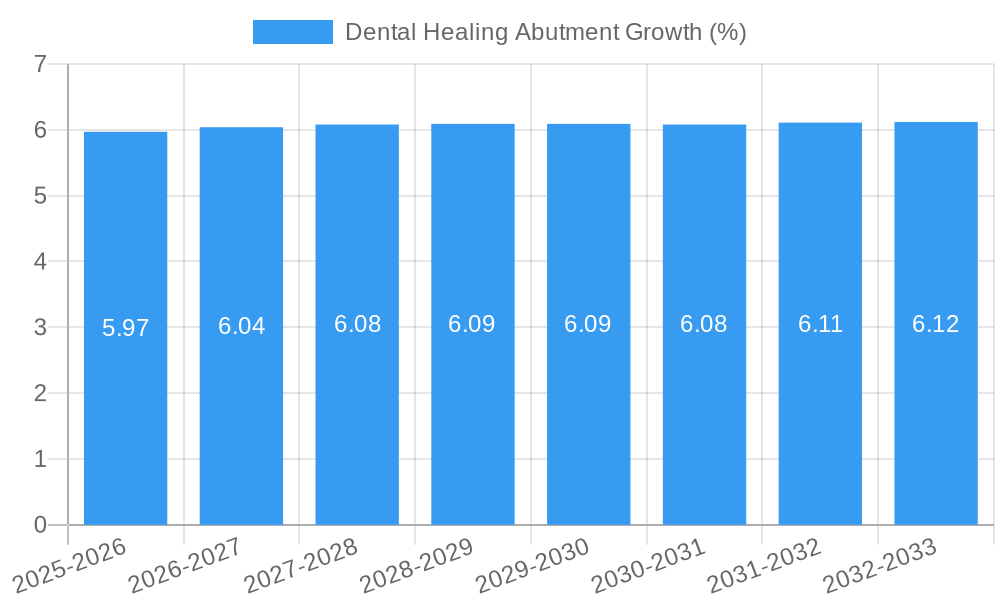

The global Dental Healing Abutment market is projected for robust growth, with an estimated market size of $922 million in 2025. This expansion is fueled by an anticipated Compound Annual Growth Rate (CAGR) of 6% over the forecast period of 2025-2033. The primary drivers of this growth include the increasing prevalence of dental implants globally, advancements in dental implantology techniques, and a rising demand for esthetic dental solutions. As more individuals seek to restore missing teeth, the need for high-quality healing abutments, crucial for proper tissue management and optimal implant integration, continues to surge. Furthermore, the growing disposable income and heightened awareness regarding oral health are contributing significantly to the market's upward trajectory. The market is segmented by application into Hospitals and Dental Clinics, with Dental Clinics expected to represent a larger share due to the decentralized nature of implant procedures. By type, Straight and Angled healing abutments cater to diverse anatomical and surgical requirements, with both segments experiencing steady demand.

Several key trends are shaping the Dental Healing Abutment market. These include the increasing adoption of digital dentistry technologies, such as 3D printing, for creating patient-specific healing abutments, thereby enhancing precision and reducing chair time. A growing emphasis on minimally invasive dental procedures also favors the use of advanced healing abutments that promote faster and smoother tissue healing. Moreover, the development of innovative materials and surface treatments for healing abutments is enhancing biocompatibility and reducing the risk of complications. Despite the positive outlook, certain restraints could temper growth. These include the high cost associated with dental implant procedures, which can be a barrier for a segment of the population, and the limited availability of trained dental professionals in certain developing regions. However, the overall market is poised for sustained expansion, driven by technological innovation, increasing patient acceptance of dental implants, and a global commitment to improving oral healthcare outcomes. Leading companies in this competitive landscape include Straumann, Danaher, Dentsply Sirona, and Zimmer Biomet, who are actively investing in research and development to maintain their market positions.

This in-depth report provides a thorough analysis of the global Dental Healing Abutment market, offering critical insights into its current landscape, future trajectory, and key growth drivers. Spanning the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this report is an indispensable resource for manufacturers, suppliers, investors, and other stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The report delves into market concentration, innovation trends, industry developments, dominant segments, product advancements, and strategic outlooks, providing actionable intelligence to navigate the evolving market.

Dental Healing Abutment Market Concentration & Innovation

The global Dental Healing Abutment market exhibits a moderate level of concentration, with key players like Straumann, Danaher, and Dentsply Sirona holding significant market shares, estimated to be collectively over 60%. Innovation serves as a primary catalyst for growth, driven by advancements in materials science, digital dentistry workflows, and improved implant designs. Regulatory frameworks, while generally supportive of dental device advancements, can also present hurdles, particularly concerning clinical validation and market access in different geographies. Product substitutes, such as alternative restorative materials and treatment protocols, exist but are unlikely to significantly displace the widespread adoption of healing abutments in conventional implantology. End-user trends are heavily influenced by increasing patient demand for minimally invasive procedures, aesthetic outcomes, and faster treatment times, all of which benefit from precise and reliable healing abutment solutions. Mergers and acquisitions (M&A) activity in the dental implant sector, with estimated deal values reaching hundreds of millions, indicates a trend towards consolidation and strategic expansion by larger players. For instance, key M&A activities over the study period have involved entities acquiring smaller innovative companies to bolster their product portfolios, with aggregated deal values exceeding USD 1,500 million.

Dental Healing Abutment Industry Trends & Insights

The Dental Healing Abutment industry is poised for significant growth, driven by a confluence of technological advancements, expanding patient access to dental care, and an increasing prevalence of tooth loss due to aging populations and lifestyle factors. The Compound Annual Growth Rate (CAGR) for the Dental Healing Abutment market is projected to be a robust 8.5% over the forecast period (2025-2033). Market penetration is steadily increasing, fueled by the widespread adoption of dental implants globally. Technological disruptions, including the integration of AI-powered design software for customized abutments and the development of novel biocompatible materials like advanced ceramics and titanium alloys, are revolutionizing product offerings. Consumer preferences are increasingly leaning towards personalized treatment plans, aesthetic restoration, and a desire for long-lasting, high-quality dental solutions, all of which are directly addressed by the precision and functionality of modern healing abutments. Competitive dynamics are characterized by a blend of established global leaders and agile regional players, each vying for market share through product innovation, strategic partnerships, and competitive pricing. The increasing sophistication of digital dentistry, from intraoral scanning to 3D printing of surgical guides and prosthetic components, further enhances the demand for accurately designed and manufactured healing abutments. Furthermore, rising disposable incomes in emerging economies are expanding the addressable market for advanced dental procedures, including dental implants, thereby creating a sustained demand for associated components like healing abutments. The continuous refinement of surgical techniques and prosthetic protocols also necessitates the availability of a diverse range of healing abutment designs and material properties to cater to various clinical scenarios. The market is witnessing a steady shift towards more esthetically conscious solutions, pushing manufacturers to develop abutments that contribute to superior gingival contouring and papilla preservation, enhancing the overall patient experience and outcome.

Dominant Markets & Segments in Dental Healing Abutment

The dominance within the Dental Healing Abutment market is clearly established by Dental Clinics as the leading application segment, accounting for an estimated 75% of the market share in 2025. This is driven by the sheer volume of dental implant procedures performed in these settings, where dentists directly manage patient treatment and prosthetic phases. Economic policies in developed nations that support healthcare access, coupled with robust dental insurance coverage, play a pivotal role in this dominance. Furthermore, the infrastructure in dental clinics, ranging from advanced digital imaging equipment to precision milling machines, is highly conducive to the utilization of modern healing abutments.

- Key Drivers for Dental Clinic Dominance:

- High Volume of Implant Procedures: Dental clinics are the primary sites for routine dental implant surgeries and subsequent restorations.

- Direct Patient Care: Dentists in these settings have direct control over treatment planning and material selection.

- Technological Adoption: Clinics are quick to adopt new digital dentistry tools that integrate seamlessly with healing abutment workflows.

- Reimbursement Policies: Favorable insurance coverage for dental implants in many countries incentivizes both practitioners and patients.

- Specialization: The increasing specialization within dentistry towards implantology further concentrates procedures in clinics.

While Hospitals represent a smaller but significant segment, particularly for complex cases and in regions with integrated healthcare systems, their market share in 2025 is estimated at 25%. The infrastructure and multidisciplinary approach in hospitals are well-suited for managing more challenging implant cases.

The Type segment is predominantly led by Straight healing abutments, estimated to capture approximately 65% of the market share in 2025, owing to their widespread applicability in standard implant placement. However, the Angled healing abutment segment is experiencing significant growth, projected to reach 35% by 2025, driven by the increasing demand for solutions that accommodate anatomical variations and prosthetic challenges, allowing for better restorative outcomes in complex implant positioning.

Dental Healing Abutment Product Developments

Product developments in the Dental Healing Abutment market are heavily focused on enhancing biocompatibility, precision, and patient comfort. Innovations include the use of advanced titanium alloys and zirconia for improved strength and aesthetics, as well as the development of multi-unit abutments designed for angled implant placements. The integration of digital design software allows for patient-specific abutment customization, leading to superior gingival contouring and prosthetic fit. These advancements contribute to faster healing times, reduced complications, and improved long-term implant success rates.

Report Scope & Segmentation Analysis

This report encompasses a comprehensive segmentation of the Dental Healing Abutment market. The Application segment is divided into Hospital and Dental Clinic. The Hospital segment, while smaller, caters to complex surgical cases and integrated healthcare settings, with projected growth driven by advancements in trauma and reconstructive dentistry. The Dental Clinic segment, representing the largest share, is characterized by routine implant procedures and high patient volumes, with growth fueled by technological adoption and increasing demand for aesthetic dentistry. The Type segment includes Straight and Angled healing abutments. The Straight segment, a market staple, offers broad applicability. The Angled segment is projected for substantial growth, addressing anatomical complexities and facilitating optimal prosthetic alignment for enhanced functional and esthetic outcomes.

Key Drivers of Dental Healing Abutment Growth

Several key drivers are propelling the growth of the Dental Healing Abutment market. The aging global population is a significant factor, leading to an increased incidence of tooth loss and a corresponding rise in demand for dental implants and their components. Advancements in digital dentistry, including intraoral scanners and CAD/CAM technology, enable more precise design and fabrication of custom healing abutments, leading to improved patient outcomes. The growing awareness among patients regarding the benefits of dental implants, such as improved chewing function and aesthetics, further stimulates market expansion. Favorable reimbursement policies for dental implant procedures in many developed countries also contribute to increased accessibility and demand.

Challenges in the Dental Healing Abutment Sector

Despite robust growth prospects, the Dental Healing Abutment sector faces several challenges. Stringent regulatory approvals and compliance requirements in different regions can pose significant hurdles for market entry and product launches, often requiring extensive clinical trials that can cost millions. The high cost of dental implant procedures, including the associated abutments, can limit affordability for a segment of the population, particularly in emerging economies. Intense competition among a large number of manufacturers can lead to price pressures, impacting profit margins. Furthermore, the need for specialized training and expertise among dental professionals to effectively utilize advanced healing abutment systems can create adoption barriers in certain markets. Supply chain disruptions, as experienced in recent global events, can also impact material availability and production schedules.

Emerging Opportunities in Dental Healing Abutment

Emerging opportunities in the Dental Healing Abutment market are abundant, particularly in the realm of personalized medicine and advanced biomaterials. The development of bioactive healing abutments that promote faster tissue integration and reduce inflammation presents a significant growth avenue. Expansion into underserved emerging markets, where awareness and access to dental implantology are growing, offers substantial untapped potential. Furthermore, advancements in nanotechnology for surface modifications of abutments to enhance osseointegration and prevent bacterial adhesion are opening new frontiers. The increasing demand for minimally invasive surgical techniques is also driving the need for more sophisticated and precise abutment designs.

Leading Players in the Dental Healing Abutment Market

- Straumann

- Danaher

- Dentsply Sirona

- Zimmer Biomet

- Osstem

- Henry Schein

- Dentium

- GC

- DIO

- Neobiotech

- Kyocera Medical

- Southern Implant

- Keystone Dental

- Bicon

- BEGO

- B & B Dental

- Dyna Dental

Key Developments in the Dental Healing Abutment Industry

- 2023 (Q4): Straumann launched a new line of patient-specific CAD/CAM abutments, enhancing customization and esthetic outcomes.

- 2023 (Q3): Danaher's subsidiary, Envista Holdings, completed the acquisition of a leading digital dentistry solutions provider, strengthening its digital workflow integration.

- 2023 (Q2): Dentsply Sirona introduced advanced zirconia abutments with improved mechanical properties and biocompatibility.

- 2022 (Q4): Zimmer Biomet expanded its implant portfolio with innovative healing abutment designs for complex restorative cases.

- 2022 (Q3): Osstem Implant reported significant growth in international markets, driven by its comprehensive implant solutions.

- 2022 (Q1): Henry Schein announced a strategic partnership to enhance its distribution network for dental implant components.

- 2021 (Q4): Dentium unveiled a new range of abutments designed for immediate loading protocols.

- 2021 (Q2): GC introduced a novel biomaterial for abutment fabrication, focusing on accelerated healing.

- 2020 (Q4): DIO Corporation expanded its manufacturing capacity to meet rising global demand.

- 2020 (Q1): Neobiotech focused on R&D for next-generation implant abutments with enhanced surface treatments.

Strategic Outlook for Dental Healing Abutment Market

The strategic outlook for the Dental Healing Abutment market is overwhelmingly positive, driven by sustained demand for dental implants and continuous technological innovation. Key growth catalysts include the increasing adoption of digital dentistry workflows, which streamline the design and fabrication process for precision-engineered abutments. The ongoing development of novel biomaterials with superior biocompatibility and osteoconductive properties will further enhance treatment success rates and patient satisfaction. Strategic collaborations between implant manufacturers and digital imaging/software providers are expected to intensify, creating integrated solutions. Furthermore, the expanding middle class in emerging economies, coupled with rising disposable incomes, will unlock new market potential. Manufacturers focusing on patient-centric solutions, such as aesthetically pleasing and minimally invasive treatment options, will be well-positioned for long-term success.

Dental Healing Abutment Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Dental Clinic

-

2. Type

- 2.1. Straight

- 2.2. Angled

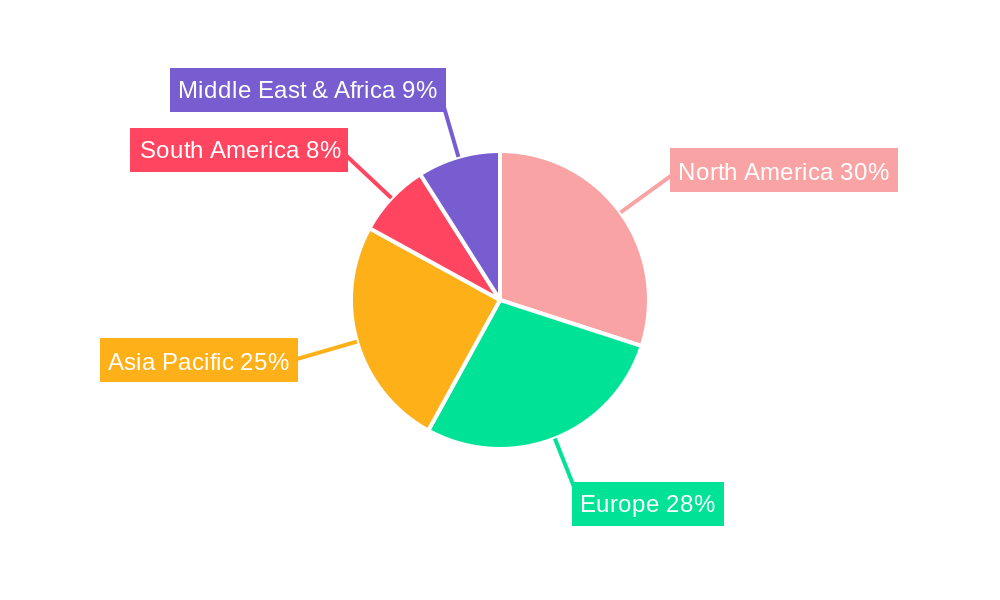

Dental Healing Abutment Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Dental Healing Abutment REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dental Healing Abutment Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Dental Clinic

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Straight

- 5.2.2. Angled

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Dental Healing Abutment Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Dental Clinic

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Straight

- 6.2.2. Angled

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Dental Healing Abutment Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Dental Clinic

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Straight

- 7.2.2. Angled

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Dental Healing Abutment Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Dental Clinic

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Straight

- 8.2.2. Angled

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Dental Healing Abutment Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Dental Clinic

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Straight

- 9.2.2. Angled

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Dental Healing Abutment Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Dental Clinic

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Straight

- 10.2.2. Angled

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Straumann

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Danaher

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dentsply Sirona

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Zimmer Biomet

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Osstem

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Henry Schein

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dentium

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DIO

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Neobiotech

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Kyocera Medical

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Southern Implant

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Keystone Dental

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Bicon

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 BEGO

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 B & B Dental

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Dyna Dental

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Straumann

List of Figures

- Figure 1: Global Dental Healing Abutment Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Dental Healing Abutment Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Dental Healing Abutment Revenue (million), by Application 2024 & 2032

- Figure 4: North America Dental Healing Abutment Volume (K), by Application 2024 & 2032

- Figure 5: North America Dental Healing Abutment Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Dental Healing Abutment Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Dental Healing Abutment Revenue (million), by Type 2024 & 2032

- Figure 8: North America Dental Healing Abutment Volume (K), by Type 2024 & 2032

- Figure 9: North America Dental Healing Abutment Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Dental Healing Abutment Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Dental Healing Abutment Revenue (million), by Country 2024 & 2032

- Figure 12: North America Dental Healing Abutment Volume (K), by Country 2024 & 2032

- Figure 13: North America Dental Healing Abutment Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Dental Healing Abutment Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Dental Healing Abutment Revenue (million), by Application 2024 & 2032

- Figure 16: South America Dental Healing Abutment Volume (K), by Application 2024 & 2032

- Figure 17: South America Dental Healing Abutment Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Dental Healing Abutment Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Dental Healing Abutment Revenue (million), by Type 2024 & 2032

- Figure 20: South America Dental Healing Abutment Volume (K), by Type 2024 & 2032

- Figure 21: South America Dental Healing Abutment Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Dental Healing Abutment Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Dental Healing Abutment Revenue (million), by Country 2024 & 2032

- Figure 24: South America Dental Healing Abutment Volume (K), by Country 2024 & 2032

- Figure 25: South America Dental Healing Abutment Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Dental Healing Abutment Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Dental Healing Abutment Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Dental Healing Abutment Volume (K), by Application 2024 & 2032

- Figure 29: Europe Dental Healing Abutment Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Dental Healing Abutment Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Dental Healing Abutment Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Dental Healing Abutment Volume (K), by Type 2024 & 2032

- Figure 33: Europe Dental Healing Abutment Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Dental Healing Abutment Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Dental Healing Abutment Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Dental Healing Abutment Volume (K), by Country 2024 & 2032

- Figure 37: Europe Dental Healing Abutment Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Dental Healing Abutment Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Dental Healing Abutment Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Dental Healing Abutment Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Dental Healing Abutment Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Dental Healing Abutment Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Dental Healing Abutment Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Dental Healing Abutment Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Dental Healing Abutment Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Dental Healing Abutment Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Dental Healing Abutment Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Dental Healing Abutment Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Dental Healing Abutment Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Dental Healing Abutment Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Dental Healing Abutment Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Dental Healing Abutment Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Dental Healing Abutment Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Dental Healing Abutment Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Dental Healing Abutment Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Dental Healing Abutment Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Dental Healing Abutment Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Dental Healing Abutment Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Dental Healing Abutment Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Dental Healing Abutment Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Dental Healing Abutment Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Dental Healing Abutment Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Dental Healing Abutment Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Dental Healing Abutment Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Dental Healing Abutment Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Dental Healing Abutment Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Dental Healing Abutment Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Dental Healing Abutment Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Dental Healing Abutment Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Dental Healing Abutment Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Dental Healing Abutment Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Dental Healing Abutment Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Dental Healing Abutment Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Dental Healing Abutment Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Dental Healing Abutment Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Dental Healing Abutment Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Dental Healing Abutment Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Dental Healing Abutment Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Dental Healing Abutment Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Dental Healing Abutment Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Dental Healing Abutment Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Dental Healing Abutment Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Dental Healing Abutment Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Dental Healing Abutment Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Dental Healing Abutment Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Dental Healing Abutment Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Dental Healing Abutment Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Dental Healing Abutment Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Dental Healing Abutment Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Dental Healing Abutment Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Dental Healing Abutment Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Dental Healing Abutment Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Dental Healing Abutment Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Dental Healing Abutment Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Dental Healing Abutment Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Dental Healing Abutment Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Dental Healing Abutment Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Dental Healing Abutment Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Dental Healing Abutment Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Dental Healing Abutment Volume K Forecast, by Country 2019 & 2032

- Table 81: China Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Dental Healing Abutment Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Dental Healing Abutment Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dental Healing Abutment?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Dental Healing Abutment?

Key companies in the market include Straumann, Danaher, Dentsply Sirona, Zimmer Biomet, Osstem, Henry Schein, Dentium, GC, DIO, Neobiotech, Kyocera Medical, Southern Implant, Keystone Dental, Bicon, BEGO, B & B Dental, Dyna Dental.

3. What are the main segments of the Dental Healing Abutment?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 922 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dental Healing Abutment," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dental Healing Abutment report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dental Healing Abutment?

To stay informed about further developments, trends, and reports in the Dental Healing Abutment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence