Key Insights

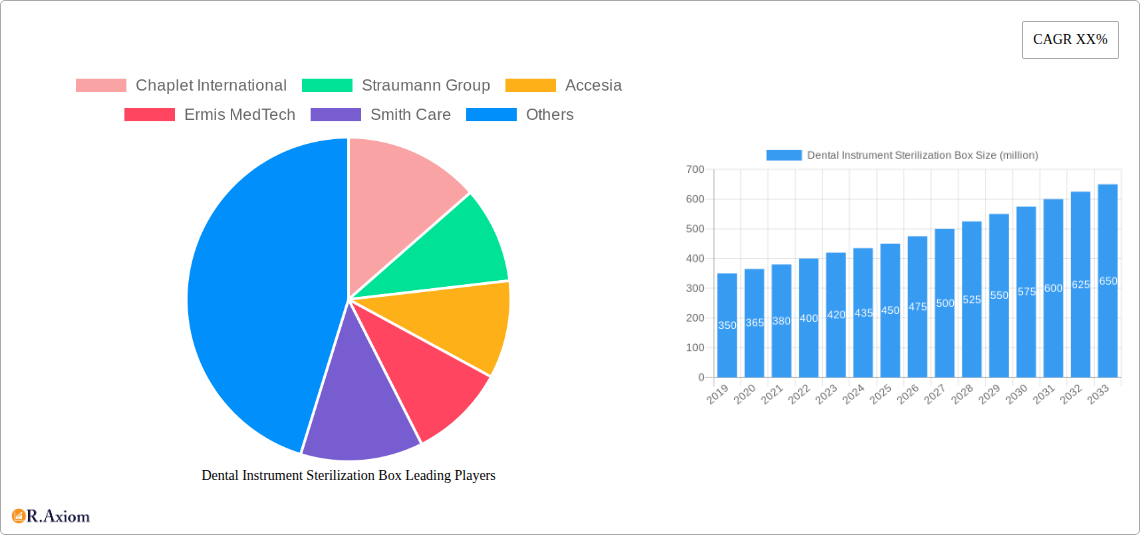

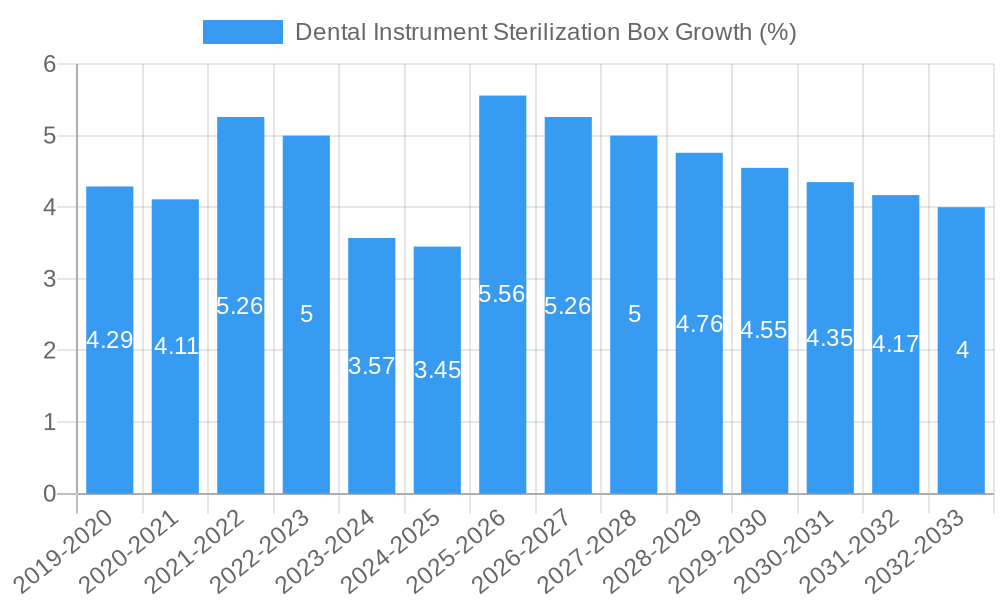

The global Dental Instrument Sterilization Box market is poised for significant growth, projected to reach approximately $650 million by 2033, with a Compound Annual Growth Rate (CAGR) of roughly 6.5% from its estimated 2025 valuation of $450 million. This expansion is largely propelled by the increasing emphasis on infection control and patient safety within dental practices worldwide. Stringent regulatory mandates concerning the sterilization of dental instruments, coupled with a growing awareness among both dental professionals and patients about the critical role of proper sterilization, are key drivers. Furthermore, the rising prevalence of dental procedures, fueled by an aging global population and an increasing demand for aesthetic dentistry, directly translates into a higher volume of instruments requiring sterilization. The market's growth is further bolstered by technological advancements leading to the development of more efficient, durable, and user-friendly sterilization boxes, catering to the evolving needs of hospitals and clinics.

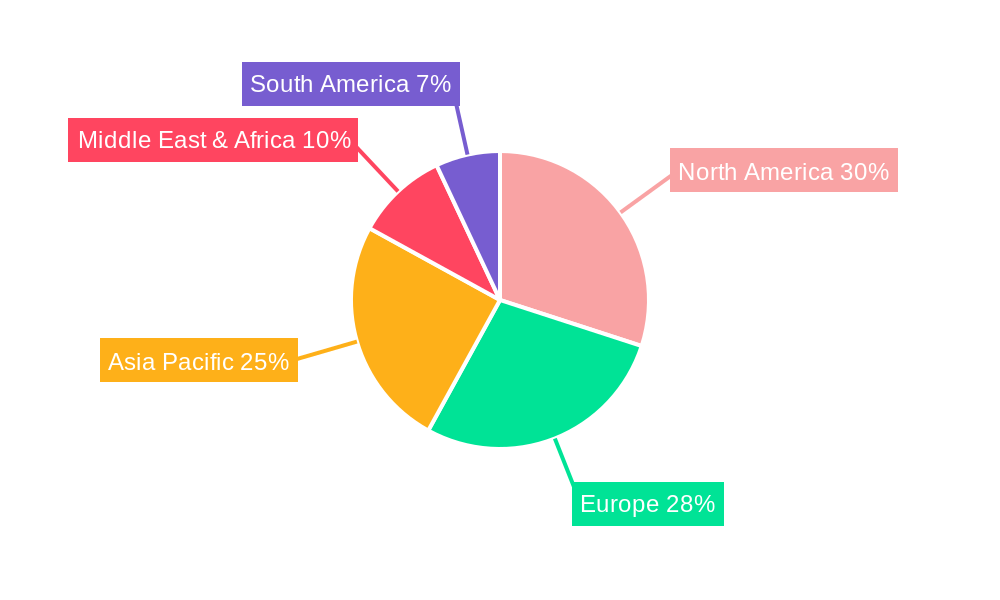

The market segmentation by application reveals a dominance of hospital settings, followed closely by clinics, reflecting the concentrated nature of advanced dental care facilities. In terms of types, both Aluminum and Stainless Steel containers are integral to the sterilization process, each offering distinct advantages in durability and resistance to corrosion. Key players like the Straumann Group, Chaplet International, and Nichrominox are actively shaping the market through product innovation and strategic partnerships. Geographically, North America and Europe currently lead the market due to well-established healthcare infrastructures and strong regulatory frameworks. However, the Asia Pacific region is expected to exhibit the fastest growth, driven by rapid urbanization, increasing disposable incomes, and a burgeoning dental tourism industry in countries like China and India. Despite the positive outlook, potential restraints include the high initial cost of some advanced sterilization systems and the availability of alternative sterilization methods, which could temper the market's full potential. Nevertheless, the overarching commitment to patient safety and the continuous need for effective instrument sterilization are expected to sustain a robust growth trajectory for the Dental Instrument Sterilization Box market.

Dental Instrument Sterilization Box Market Concentration & Innovation

The global Dental Instrument Sterilization Box market exhibits a moderate level of concentration, with a handful of key players accounting for a significant portion of the market share. Leading companies such as Chaplet International, Straumann Group, and Accesia are actively investing in research and development to drive innovation. The market is characterized by continuous advancements in sterilization technologies, including the development of more efficient and user-friendly sterilization containers. Regulatory frameworks, such as those established by the FDA and CE marking, play a crucial role in shaping product development and market entry, ensuring the safety and efficacy of dental sterilization solutions. Product substitutes, while present in the form of traditional sterilization methods, are increasingly being overshadowed by the convenience and reliability offered by advanced sterilization boxes. End-user trends indicate a growing preference for automated and integrated sterilization systems, driven by the need for enhanced patient safety and operational efficiency in dental practices. Mergers and acquisitions (M&A) activities, with recent deal values estimated to be in the tens of millions, are anticipated to continue as companies seek to expand their product portfolios and geographical reach. For instance, acquisitions valued at approximately $50 million have been observed, aimed at consolidating market positions and acquiring innovative technologies.

Dental Instrument Sterilization Box Industry Trends & Insights

The Dental Instrument Sterilization Box market is poised for robust growth, driven by an escalating demand for stringent infection control protocols in dental healthcare settings worldwide. This sector is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period of 2025–2033, with an estimated market size reaching over $1.5 billion by 2033. The historical period (2019–2024) saw steady growth, propelled by increased awareness of hospital-acquired infections and the critical role of proper instrument sterilization. The base year, 2025, stands as a pivotal point, with an estimated market valuation of around $1.2 billion. Technological disruptions are a significant trend, with manufacturers focusing on developing sterilization boxes that are compatible with various sterilization methods like autoclaving, ethylene oxide (EtO), and hydrogen peroxide plasma sterilization. The integration of smart features, such as tracking and traceability systems, is also gaining traction, enhancing inventory management and compliance. Consumer preferences are shifting towards reusable and durable sterilization containers made from high-grade materials like stainless steel and aluminum, offering cost-effectiveness and sustainability. The increasing prevalence of dental procedures, coupled with a rising number of dental clinics and hospitals globally, further fuels market expansion. The market penetration of advanced sterilization boxes is steadily increasing, particularly in developed economies, as dental professionals prioritize patient safety and seek to adhere to evolving regulatory standards. Investment in new product development and the expansion of manufacturing capacities are key strategies employed by industry players to capture a larger market share. The competitive landscape is dynamic, with companies like Ermis MedTech, Smith Care, and Wittex investing heavily in product innovation and market outreach. The growing emphasis on preventive healthcare and the rising disposable incomes in emerging economies are expected to unlock new growth avenues for the Dental Instrument Sterilization Box market in the coming years. The market penetration is currently estimated at around 60% for advanced sterilization boxes in developed regions, with projections to reach over 80% by 2033.

Dominant Markets & Segments in Dental Instrument Sterilization Box

The Dental Instrument Sterilization Box market is dominated by several key regions and segments, driven by a confluence of factors including healthcare infrastructure, economic policies, and regulatory adherence.

Leading Region: North America

- Economic Policies & Healthcare Spending: North America, particularly the United States, boasts a mature healthcare market with substantial government and private expenditure on healthcare. Robust economic policies encourage investment in advanced medical equipment, including sterilization solutions. The estimated healthcare expenditure in this region is in the billions, with a significant allocation towards infection control.

- Regulatory Frameworks: Stringent regulatory standards enforced by bodies like the FDA mandate the use of validated sterilization processes and equipment, driving the adoption of high-quality sterilization boxes. Compliance with these regulations is non-negotiable, leading to consistent demand.

- Technological Adoption: North American dental professionals are early adopters of new technologies, readily integrating advanced sterilization boxes into their workflows to enhance efficiency and patient safety. This willingness to invest in innovation contributes significantly to market leadership.

- Market Penetration: The market penetration of dental instrument sterilization boxes in North America is estimated to be over 70% for advanced solutions.

Dominant Application Segment: Clinic

- Volume of Procedures: Dental clinics constitute the largest consumer base due to the sheer volume of dental procedures performed daily. Each procedure necessitates the sterilization of instruments, creating a continuous demand for reliable sterilization boxes.

- Focus on Outpatient Care: The global trend towards outpatient care and the expansion of dental clinic networks further bolster the demand from this segment. The number of dental clinics worldwide is in the millions.

- Cost-Effectiveness & Scalability: For clinics, sterilization boxes offer a cost-effective and scalable solution for managing instrument sterilization needs. The ability to purchase and maintain these boxes efficiently is a key factor.

- Estimated Segment Share: The clinic segment is projected to hold approximately 65% of the total market share by value.

Dominant Type Segment: Stainless Steel Container

- Durability & Longevity: Stainless steel sterilization boxes are renowned for their exceptional durability, resistance to corrosion, and longevity. This makes them a preferred choice for dental practices seeking a long-term investment.

- Autoclave Compatibility: Stainless steel is highly compatible with steam sterilization (autoclaving), the most common sterilization method in dental settings, ensuring broad applicability.

- Ease of Cleaning & Maintenance: The smooth, non-porous surface of stainless steel facilitates easy cleaning and maintenance, crucial for infection control protocols.

- Market Value Contribution: Stainless steel containers are estimated to contribute over 70% to the total market revenue derived from sterilization box types.

The dominance of these segments is further supported by the presence of key manufacturers like Karl Hammacher, Jakobi Dental, and Nichrominox, who cater specifically to the needs of these high-demand areas with their product offerings.

Dental Instrument Sterilization Box Product Developments

The Dental Instrument Sterilization Box market is witnessing a surge in product innovation focused on enhancing sterilization efficacy, user convenience, and traceability. Manufacturers are introducing advanced designs with improved sealing mechanisms and material resilience, ensuring compatibility with a wider range of sterilization methods including steam, EtO, and low-temperature plasma. Key developments include the integration of smart features like RFID tags for inventory management and data logging, which significantly aids in compliance with regulatory standards. For instance, the introduction of containers with integrated temperature and humidity sensors aims to provide real-time sterilization process monitoring. These innovations are driven by the increasing emphasis on patient safety and the need for efficient workflow in dental practices, allowing for quicker turnaround times and reduced risk of cross-contamination.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Dental Instrument Sterilization Box market, encompassing detailed segmentation by Application and Type.

Application Segment: Hospital

Hospitals, with their complex infection control requirements and high patient volumes, represent a significant segment for dental instrument sterilization boxes. This segment is characterized by a strong demand for robust, high-capacity sterilization solutions that can handle a wide array of surgical instruments. Market growth in this segment is driven by the increasing number of surgical procedures and the stringent regulatory landscape governing hospital hygiene. Projections indicate a steady growth rate of approximately 6.8% for this segment, with an estimated market size of over $400 million by 2033. Competitive dynamics within the hospital segment are shaped by companies offering integrated sterilization systems and solutions that meet rigorous clinical standards.

Application Segment: Clinic

Dental clinics form the largest application segment, driven by the high frequency of routine dental procedures. The demand in this segment is for versatile, user-friendly, and cost-effective sterilization boxes that can be easily integrated into daily practice. Growth is fueled by the expanding global network of dental clinics and a growing awareness of infection control among practitioners. This segment is expected to witness a robust CAGR of around 7.2%, with an estimated market valuation exceeding $900 million by 2033. Key competitive factors include product affordability, ease of use, and compatibility with standard sterilization equipment.

Type Segment: Aluminum Container

Aluminum sterilization boxes offer a lightweight and cost-effective solution for dental instrument sterilization. While generally less durable than stainless steel, their affordability makes them attractive, particularly for smaller practices or those with specific sterilization needs. The growth of this segment is moderate, projected at around 5.5% CAGR, contributing an estimated market share of over $200 million by 2033. Competitive advantages lie in offering budget-friendly options and efficient thermal conductivity for certain sterilization processes.

Type Segment: Stainless Steel Container

Stainless steel sterilization boxes are the dominant type segment, favored for their superior durability, corrosion resistance, and long-term cost-effectiveness. They are highly compatible with all major sterilization methods, including autoclaving. This segment is expected to experience strong growth, with a CAGR of approximately 8.0%, and is projected to reach a market value of over $1.3 billion by 2033. The competitive landscape is characterized by a focus on material quality, ergonomic design, and adherence to international sterilization standards.

Key Drivers of Dental Instrument Sterilization Box Growth

The growth of the Dental Instrument Sterilization Box market is primarily propelled by several key factors:

- Increasing Global Dental Procedures: A rise in the number of dental procedures, driven by aging populations and growing oral health awareness, directly translates to higher demand for sterile instruments and thus, sterilization boxes.

- Stringent Infection Control Regulations: Evolving and tightening global regulations concerning infection prevention and control in healthcare settings mandate the use of validated sterilization methods and equipment, significantly boosting market adoption.

- Technological Advancements: Continuous innovation in sterilization technologies, leading to more efficient, user-friendly, and traceable sterilization boxes, encourages dentists and healthcare facilities to upgrade their existing equipment.

- Growing Awareness of Hospital-Acquired Infections (HAIs): Increased understanding of the risks associated with HAIs is pushing healthcare providers to invest more in robust infection control measures, including advanced sterilization solutions.

Challenges in the Dental Instrument Sterilization Box Sector

Despite the strong growth trajectory, the Dental Instrument Sterilization Box sector faces certain challenges:

- High Initial Investment Costs: The upfront cost of purchasing high-quality, advanced sterilization boxes can be a deterrent for smaller dental practices or those in price-sensitive markets.

- Reimbursement Policies: In some regions, reimbursement policies for dental procedures may not fully cover the costs associated with advanced sterilization equipment, impacting purchasing decisions.

- Availability of Skilled Personnel: Proper operation and maintenance of some advanced sterilization systems require trained personnel, and a shortage of such individuals can pose a challenge.

- Competition from Emerging Markets: While providing opportunities, the emergence of lower-cost alternatives from emerging markets can create pricing pressures for established manufacturers.

Emerging Opportunities in Dental Instrument Sterilization Box

The Dental Instrument Sterilization Box market is ripe with emerging opportunities:

- Smart Sterilization Solutions: The integration of IoT and AI into sterilization boxes, enabling real-time monitoring, data analytics, and predictive maintenance, presents a significant growth avenue.

- Expansion in Emerging Economies: The increasing healthcare expenditure and growing dental tourism in developing countries offer substantial untapped market potential for sterilization box manufacturers.

- Sustainable and Eco-Friendly Materials: Growing environmental consciousness is driving demand for sterilization boxes made from recycled or biodegradable materials, presenting an opportunity for innovation in this area.

- Customized Sterilization Solutions: The development of tailored sterilization boxes for specialized dental procedures or specific clinic needs can create niche market opportunities.

Leading Players in the Dental Instrument Sterilization Box Market

- Chaplet International

- Straumann Group

- Accesia

- Ermis MedTech

- Smith Care

- Wittex

- Karl Hammacher

- Jakobi Dental

- Nichrominox

- ZIRC

- Medical-One

- Transact International

Key Developments in Dental Instrument Sterilization Box Industry

- 2023/06: Chaplet International launches a new line of lightweight, corrosion-resistant aluminum sterilization boxes designed for enhanced portability and ease of use in mobile dental units.

- 2023/11: Straumann Group acquires a significant stake in a technology startup specializing in AI-driven sterilization monitoring systems, aiming to integrate smart features into their sterilization container portfolio.

- 2024/02: Accesia introduces a modular stainless steel sterilization box system that can be reconfigured to accommodate various instrument sets, offering greater flexibility to dental practices.

- 2024/05: Ermis MedTech receives CE certification for its advanced sterile barrier system for dental instruments, enhancing its market access in European countries.

- 2024/09: Wittex announces an expansion of its manufacturing facility to meet the growing demand for high-volume sterilization solutions, particularly from large dental chains and hospital networks.

Strategic Outlook for Dental Instrument Sterilization Box Market

The strategic outlook for the Dental Instrument Sterilization Box market is highly positive, driven by an unwavering global commitment to patient safety and infection control. The increasing adoption of advanced sterilization technologies, coupled with favorable regulatory environments, will continue to fuel market expansion. Key growth catalysts include the ongoing digitalization of healthcare, leading to smart sterilization solutions with enhanced traceability, and the expanding reach of dental services in emerging economies. Companies that focus on product innovation, strategic partnerships, and catering to the specific needs of diverse end-users, from individual clinics to large hospital networks, are well-positioned to capitalize on the significant growth opportunities expected in the forecast period. The market is anticipated to evolve towards more integrated, intelligent, and sustainable sterilization ecosystems.

Dental Instrument Sterilization Box Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinic

-

2. Types

- 2.1. Aluminum Container

- 2.2. Stainless Steel Container

Dental Instrument Sterilization Box Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Dental Instrument Sterilization Box REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dental Instrument Sterilization Box Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinic

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Aluminum Container

- 5.2.2. Stainless Steel Container

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Dental Instrument Sterilization Box Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinic

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Aluminum Container

- 6.2.2. Stainless Steel Container

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Dental Instrument Sterilization Box Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinic

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Aluminum Container

- 7.2.2. Stainless Steel Container

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Dental Instrument Sterilization Box Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinic

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Aluminum Container

- 8.2.2. Stainless Steel Container

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Dental Instrument Sterilization Box Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinic

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Aluminum Container

- 9.2.2. Stainless Steel Container

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Dental Instrument Sterilization Box Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinic

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Aluminum Container

- 10.2.2. Stainless Steel Container

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Chaplet International

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Straumann Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Accesia

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ermis MedTech

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Smith Care

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wittex

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Karl Hammacher

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jakobi Dental

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nichrominox

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ZIRC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Medical-One

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Transact International

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Chaplet International

List of Figures

- Figure 1: Global Dental Instrument Sterilization Box Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Dental Instrument Sterilization Box Revenue (million), by Application 2024 & 2032

- Figure 3: North America Dental Instrument Sterilization Box Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Dental Instrument Sterilization Box Revenue (million), by Types 2024 & 2032

- Figure 5: North America Dental Instrument Sterilization Box Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Dental Instrument Sterilization Box Revenue (million), by Country 2024 & 2032

- Figure 7: North America Dental Instrument Sterilization Box Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Dental Instrument Sterilization Box Revenue (million), by Application 2024 & 2032

- Figure 9: South America Dental Instrument Sterilization Box Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Dental Instrument Sterilization Box Revenue (million), by Types 2024 & 2032

- Figure 11: South America Dental Instrument Sterilization Box Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Dental Instrument Sterilization Box Revenue (million), by Country 2024 & 2032

- Figure 13: South America Dental Instrument Sterilization Box Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Dental Instrument Sterilization Box Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Dental Instrument Sterilization Box Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Dental Instrument Sterilization Box Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Dental Instrument Sterilization Box Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Dental Instrument Sterilization Box Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Dental Instrument Sterilization Box Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Dental Instrument Sterilization Box Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Dental Instrument Sterilization Box Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Dental Instrument Sterilization Box Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Dental Instrument Sterilization Box Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Dental Instrument Sterilization Box Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Dental Instrument Sterilization Box Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Dental Instrument Sterilization Box Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Dental Instrument Sterilization Box Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Dental Instrument Sterilization Box Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Dental Instrument Sterilization Box Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Dental Instrument Sterilization Box Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Dental Instrument Sterilization Box Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Dental Instrument Sterilization Box Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Dental Instrument Sterilization Box Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Dental Instrument Sterilization Box Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Dental Instrument Sterilization Box Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Dental Instrument Sterilization Box Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Dental Instrument Sterilization Box Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Dental Instrument Sterilization Box Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Dental Instrument Sterilization Box Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Dental Instrument Sterilization Box Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Dental Instrument Sterilization Box Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Dental Instrument Sterilization Box Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Dental Instrument Sterilization Box Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Dental Instrument Sterilization Box Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Dental Instrument Sterilization Box Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Dental Instrument Sterilization Box Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Dental Instrument Sterilization Box Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Dental Instrument Sterilization Box Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Dental Instrument Sterilization Box Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Dental Instrument Sterilization Box Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Dental Instrument Sterilization Box Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dental Instrument Sterilization Box?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Dental Instrument Sterilization Box?

Key companies in the market include Chaplet International, Straumann Group, Accesia, Ermis MedTech, Smith Care, Wittex, Karl Hammacher, Jakobi Dental, Nichrominox, ZIRC, Medical-One, Transact International.

3. What are the main segments of the Dental Instrument Sterilization Box?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dental Instrument Sterilization Box," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dental Instrument Sterilization Box report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dental Instrument Sterilization Box?

To stay informed about further developments, trends, and reports in the Dental Instrument Sterilization Box, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence