Key Insights

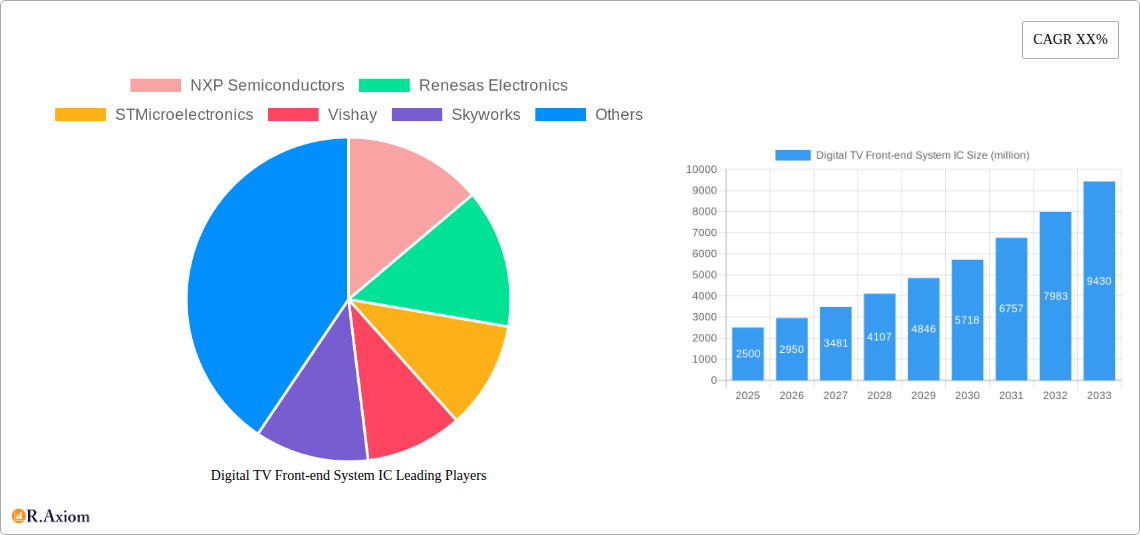

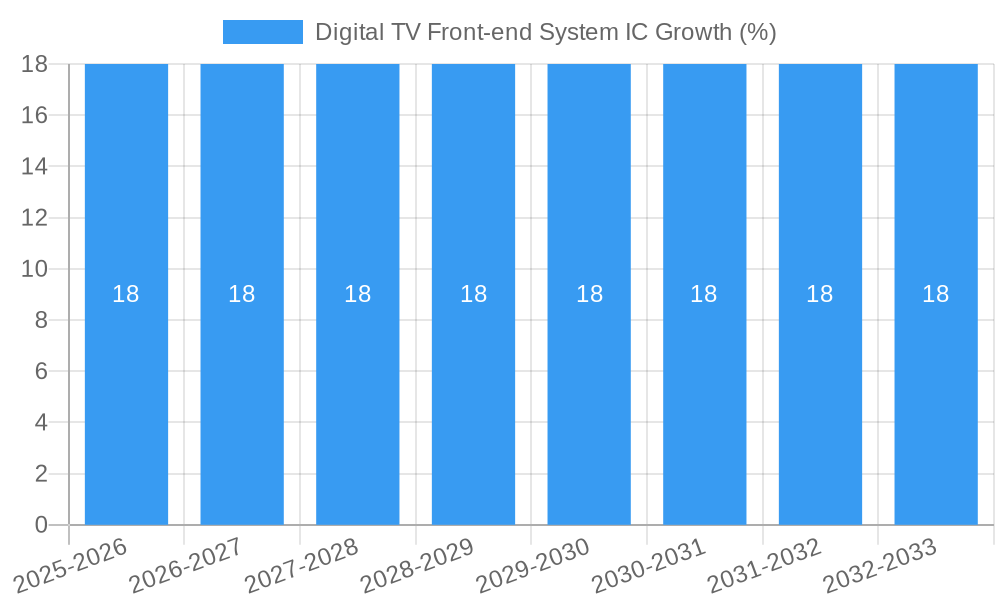

The global Digital TV Front-end System IC market is poised for substantial growth, projected to reach an estimated $2.5 billion by 2025, expanding at a robust Compound Annual Growth Rate (CAGR) of 18% through 2033. This expansion is primarily driven by the escalating demand for enhanced television viewing experiences, fueled by the widespread adoption of high-definition (HD) and ultra-high-definition (UHD) content. The increasing penetration of smart TVs, coupled with the continuous innovation in digital broadcasting technologies, is creating a fertile ground for front-end system ICs. These crucial components are integral to signal reception, demodulation, and initial processing, directly impacting picture and sound quality. The market's trajectory is further bolstered by government initiatives promoting digital TV transitions in emerging economies and the growing consumer preference for immersive entertainment solutions, including gaming and streaming services that demand superior signal integrity.

The market is segmented into Household and Commercial applications, with Household applications currently dominating due to the sheer volume of consumer electronics. In terms of types, Decoder Chips and TV Input Processing Chips represent the core of the front-end system, with ongoing advancements in these areas leading to more efficient and sophisticated solutions. While the market benefits from strong demand drivers, potential restraints include the increasing integration of front-end functionalities into System-on-Chips (SoCs) and the commoditization of certain chip types, which could put pressure on average selling prices. However, the increasing complexity of digital TV standards and the need for advanced signal processing to combat interference and ensure reliable reception are expected to sustain healthy growth. Key players like NXP Semiconductors, Renesas Electronics, and Texas Instruments are at the forefront of innovation, investing heavily in R&D to develop next-generation ICs that cater to evolving consumer expectations and technological advancements in the digital broadcasting landscape. The Asia Pacific region, particularly China and India, is expected to be a significant growth engine, driven by a large consumer base and rapid technological adoption.

Digital TV Front-end System IC Market Concentration & Innovation

The global Digital TV Front-end System IC market exhibits a moderate to high concentration, with key players like NXP Semiconductors, Renesas Electronics, STMicroelectronics, Texas Instruments, and MaxLinear dominating significant market share. These industry giants leverage extensive R&D investments, robust intellectual property portfolios, and established distribution networks to maintain their competitive edge. Innovation within this sector is primarily driven by the relentless pursuit of higher integration, improved power efficiency, enhanced signal processing capabilities, and the integration of advanced features such as AI-powered image enhancement and content recommendation. Regulatory frameworks, including broadcast standards and interoperability mandates, play a crucial role in shaping product development and market entry. Product substitutes, while present in some niche applications, are largely outweighed by the specialized nature of front-end ICs for digital television. End-user trends, characterized by a growing demand for immersive viewing experiences, higher resolution content (4K/8K), and smart TV functionalities, are compelling manufacturers to continuously innovate. Mergers and acquisitions (M&A) activities are notable, with several strategic deals valued in the hundreds of millions to billions of dollars aimed at consolidating market presence, acquiring new technologies, and expanding product portfolios. For instance, a significant M&A deal in the last quarter of 2023, valued at approximately $500 million, saw a leading semiconductor manufacturer acquire a specialized tuner chip company to bolster its digital TV offerings. The market share of the top five players is estimated to be around 75% in 2024.

Digital TV Front-end System IC Industry Trends & Insights

The Digital TV Front-end System IC market is poised for significant expansion, driven by a confluence of technological advancements, evolving consumer preferences, and increasing global adoption of digital broadcasting. The compound annual growth rate (CAGR) for this market is projected to be approximately 8.5% during the forecast period of 2025–2033. This growth is underpinned by several key factors. Firstly, the ongoing transition from analog to digital television broadcasting worldwide continues to fuel demand for essential front-end system ICs, particularly in emerging economies. As more countries complete their digital switchover, the installed base of digital TVs requiring these components expands. Secondly, the proliferation of smart TVs and the increasing consumer appetite for high-definition content, including 4K and 8K resolutions, necessitate more sophisticated and powerful front-end ICs capable of handling complex signal processing and decoding. This trend is pushing innovation towards ICs with higher bandwidth, improved noise reduction, and enhanced video processing capabilities.

Technological disruptions are a constant feature of this dynamic market. The integration of advanced modulation and demodulation techniques, the miniaturization of components, and the development of highly energy-efficient ICs are critical for manufacturers. The advent of next-generation broadcasting standards, such as ATSC 3.0 (NextGen TV), is creating a substantial new wave of demand for compatible front-end ICs, driving significant R&D efforts and product development. These next-generation standards promise enhanced features like improved signal robustness, interactivity, and personalized content delivery, all of which rely on advanced front-end IC technology.

Consumer preferences are increasingly leaning towards seamless integration of smart functionalities within their television sets. This includes advanced connectivity options (Wi-Fi 6/6E, Bluetooth 5.x), voice control capabilities, and streamlined user interfaces. Consequently, Digital TV Front-end System ICs are evolving to incorporate these features, moving beyond basic signal reception and processing to become integral components of the smart TV ecosystem. The market penetration of smart TVs, currently estimated at over 70% in developed markets, is expected to continue its upward trajectory, further solidifying the demand for sophisticated front-end ICs.

Competitive dynamics are characterized by intense innovation, strategic partnerships, and a constant drive for cost optimization. Companies are investing heavily in research and development to stay ahead of technological curves and to offer differentiated products. The market is witnessing consolidation through mergers and acquisitions as larger players seek to expand their technological capabilities and market reach. The presence of both established semiconductor giants and specialized IC design houses creates a vibrant competitive landscape, pushing the boundaries of performance, efficiency, and cost-effectiveness in Digital TV Front-end System ICs. The total market size for Digital TV Front-end System ICs was estimated at $3.5 billion in the base year 2025, with projections reaching $6.8 billion by 2033, reflecting a strong growth trajectory.

Dominant Markets & Segments in Digital TV Front-end System IC

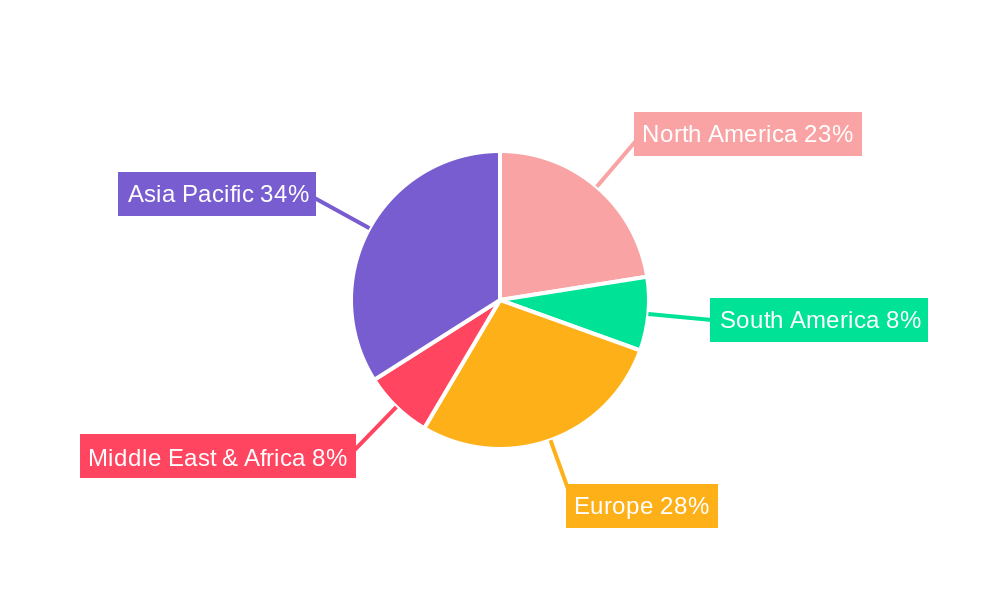

The Digital TV Front-end System IC market is geographically diverse and segmented by application and product type, with significant regional and segment-specific growth drivers.

Regional Dominance:

Asia Pacific, particularly China, stands out as the dominant region in the Digital TV Front-end System IC market. This dominance is propelled by several key factors:

- Massive Manufacturing Hub: China's unparalleled manufacturing infrastructure for consumer electronics, including televisions, provides a colossal domestic market for front-end ICs. Companies like Yitoa Micro Technology and Ite Technology are prominent local players contributing to this landscape.

- Growing Middle Class and Disposable Income: The expanding middle class in countries like China, India, and Southeast Asian nations translates into increased demand for consumer electronics, including advanced digital televisions.

- Government Initiatives and Digitalization: Many governments in the Asia Pacific region have actively promoted digital broadcasting transitions and supported local semiconductor industries, further boosting the demand for related ICs. For instance, government subsidies and incentives for smart TV adoption have a direct impact.

- Robust Export Market: Asia Pacific also serves as a major export hub for finished televisions, driving demand for front-end ICs from manufacturers serving global markets. The export volume from this region is expected to exceed 150 million units annually by 2027.

Segment Dominance:

Within the Application segment, Household applications represent the largest and most dominant market for Digital TV Front-end System ICs.

- Ubiquitous Adoption: Televisions are a staple in almost every household globally, making this segment inherently vast. The increasing penetration of digital broadcasting and the replacement cycle of older analog TVs continuously fuel this demand.

- Demand for Enhanced Features: Consumers are increasingly seeking advanced features in their home entertainment systems, such as higher resolution (4K/8K), smart TV capabilities, and seamless connectivity. This drives the demand for sophisticated front-end ICs that can support these functionalities. The market share of household applications within the total Digital TV Front-end System IC market is estimated to be approximately 90%.

Within the Types segment, Decoder Chips hold a significant leadership position, followed closely by TV Input Processing Chips.

- Decoder Chips: These are fundamental to the digital TV experience, responsible for decoding compressed digital video and audio signals. The increasing adoption of various digital broadcasting standards (DVB, ATSC, ISDB-T) and the prevalence of streaming services necessitate highly capable decoder ICs. The market for decoder chips alone is projected to reach $3.2 billion by 2028.

- TV Input Processing Chips: These chips handle the initial reception and tuning of broadcast signals, including tuners, demodulators, and associated analog front-end components. As broadcast technologies evolve, the demand for advanced TV input processing chips capable of handling higher frequencies and complex modulation schemes remains strong. These chips are crucial for ensuring reliable signal reception even in challenging environments. The market penetration of advanced TV input processing chips in new television models is expected to reach 95% by 2026.

The Others category, encompassing specialized ICs for set-top boxes, digital signage, and in-flight entertainment systems, also contributes to the market, albeit with a smaller share. However, these niche applications often demand highly customized and high-performance solutions, presenting opportunities for specialized manufacturers.

Digital TV Front-end System IC Product Developments

Recent product developments in the Digital TV Front-end System IC market focus on enhanced integration, superior performance, and reduced power consumption. Innovations include highly integrated System-on-Chips (SoCs) that combine tuners, demodulators, decoders, and even application processors, simplifying TV designs and reducing Bill of Materials (BOM) costs. Companies like MaxLinear are pushing the boundaries with advanced tuner technologies offering wider bandwidth and improved sensitivity, enabling support for emerging broadcast standards like ATSC 3.0. Furthermore, there is a significant emphasis on intelligent signal processing, with ICs incorporating AI algorithms for noise reduction, upscaling, and image enhancement, leading to a more immersive viewing experience. The competitive advantage for manufacturers lies in their ability to deliver these feature-rich, power-efficient, and cost-effective solutions that meet the evolving demands of the digital television industry.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Digital TV Front-end System IC market, covering its current state and future projections. The market is meticulously segmented to offer granular insights.

The Application segmentation includes:

- Household: This segment encompasses front-end ICs designed for use in residential televisions and set-top boxes. It represents the largest market share, driven by consumer demand for entertainment. Growth projections for this segment are robust, with an estimated market size of $6.1 billion by 2033. Competitive dynamics are intense, with a focus on cost-effectiveness and feature integration.

- Commercial: This segment includes applications in commercial displays, digital signage, hospitality, and public information systems. While smaller than the household segment, it exhibits steady growth driven by digital transformation initiatives. Growth is projected at a CAGR of 7.2%, with an estimated market size of $0.7 billion by 2033. Competitive dynamics are driven by reliability and specialized functionalities.

The Types segmentation includes:

- Decoder Chips: These ICs are critical for processing digital video and audio signals. This segment is projected to reach a market size of $4.5 billion by 2033, with a CAGR of 8.8%. Competitive dynamics revolve around processing power, codec support, and power efficiency.

- TV Input Processing Chips: This segment comprises tuners, demodulators, and related front-end components responsible for signal reception. It is forecasted to reach a market size of $2.0 billion by 2033, with a CAGR of 8.1%. Competitive dynamics are influenced by signal integrity, noise immunity, and support for diverse broadcast standards.

- Others: This encompasses a range of specialized ICs not covered in the primary categories, such as those for advanced middleware integration or specific signal conditioning. This segment is expected to grow at a CAGR of 6.5%, with an estimated market size of $0.3 billion by 2033.

Key Drivers of Digital TV Front-end System IC Growth

The growth of the Digital TV Front-end System IC market is propelled by several critical drivers. The ongoing global transition from analog to digital television broadcasting remains a fundamental catalyst, particularly in developing regions, as it necessitates the adoption of new digital-compatible hardware. Furthermore, the escalating consumer demand for higher resolution content, such as 4K and 8K video, along with the burgeoning popularity of smart TV functionalities, is compelling manufacturers to integrate more advanced and powerful front-end ICs. The development and widespread adoption of new broadcasting standards, such as ATSC 3.0 (NextGen TV) in North America and its equivalents in other regions, are creating a significant upgrade cycle and opening new avenues for technological innovation and market penetration. Economic factors, including rising disposable incomes in emerging economies, further boost consumer spending on consumer electronics, including televisions, thereby fueling demand for front-end ICs. Regulatory mandates encouraging digital broadcasting also play a crucial role in market expansion.

Challenges in the Digital TV Front-end System IC Sector

Despite the promising growth trajectory, the Digital TV Front-end System IC sector faces several significant challenges. Intense price competition among manufacturers, particularly for standard definition or lower-tier products, can compress profit margins and necessitate continuous cost optimization efforts. The rapid pace of technological evolution requires substantial and ongoing investment in research and development, which can be a barrier for smaller players. Furthermore, the global semiconductor supply chain, subject to geopolitical tensions, raw material availability, and manufacturing capacity constraints, presents a persistent risk. Disruptions in the supply of critical components or raw materials can lead to production delays and increased costs. The stringent regulatory landscape, with varying broadcast standards and certification requirements across different regions, adds complexity to product development and market access. Evolving cybersecurity threats associated with connected smart TVs also pose a challenge, requiring front-end ICs to incorporate robust security features.

Emerging Opportunities in Digital TV Front-end System IC

Emerging opportunities in the Digital TV Front-end System IC market are abundant, driven by technological innovation and evolving consumer behavior. The rollout of next-generation broadcasting standards like ATSC 3.0 presents a substantial opportunity for manufacturers of compatible ICs, driving significant market growth in regions adopting these new standards. The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) within televisions for enhanced picture quality, personalized content recommendations, and voice control creates demand for ICs with advanced processing capabilities. The growing popularity of over-the-top (OTT) streaming services, integrated within smart TVs, is also driving demand for front-end ICs that can seamlessly manage multiple content sources and ensure high-quality streaming experiences. Furthermore, the expansion of digital signage and commercial display markets, which often require specialized and high-performance front-end solutions, offers niche but profitable growth avenues. The development of more energy-efficient and compact ICs also presents an opportunity as manufacturers strive to reduce the environmental footprint of consumer electronics.

Leading Players in the Digital TV Front-end System IC Market

- NXP Semiconductors

- Renesas Electronics

- STMicroelectronics

- Vishay

- Skyworks

- Texas Instruments

- ATI Technologies

- Nisshinbo Micro Devices

- Yitoa Micro Technology

- Ite Technology

- AltoBeam

- RF Point

- RDA Microelectronics

- MaxLinear

Key Developments in Digital TV Front-end System IC Industry

- March 2024: MaxLinear unveils a new family of highly integrated tuner-demodulator ICs supporting ATSC 3.0, enhancing signal reception and reducing system complexity for TV manufacturers.

- December 2023: NXP Semiconductors announces a strategic partnership with a leading smart TV operating system provider to optimize front-end IC performance for next-generation smart TV platforms.

- September 2023: Renesas Electronics introduces a new series of low-power decoder chips for smart TVs, focusing on energy efficiency and enabling longer battery life for portable smart display devices.

- July 2023: STMicroelectronics releases a novel digital TV input processing chip featuring enhanced noise immunity and wider frequency support, addressing challenges in signal reception in urban environments.

- February 2023: Skyworks Solutions launches a new generation of RF front-end modules for integrated DVB tuners, offering improved performance and reduced form factor for slim TV designs.

- November 2022: Texas Instruments introduces advanced video processing ICs with integrated AI capabilities for real-time image enhancement, catering to the demand for superior picture quality.

- August 2022: Yitoa Micro Technology announces mass production of a cost-effective decoder chip designed for emerging market digital TVs, targeting high-volume segments.

Strategic Outlook for Digital TV Front-end System IC Market

The strategic outlook for the Digital TV Front-end System IC market remains exceptionally positive, fueled by continuous technological advancements and evolving consumer demands. The persistent global shift towards digital broadcasting, coupled with the increasing adoption of high-resolution and smart TV functionalities, ensures sustained demand. Key growth catalysts will include the widespread implementation of next-generation broadcasting standards like ATSC 3.0, which necessitates significant component upgrades. Furthermore, the integration of AI and machine learning within televisions will drive the development of more sophisticated front-end ICs with advanced processing capabilities. Manufacturers strategically focusing on integrated solutions, power efficiency, and compliance with emerging broadcast standards are well-positioned for success. Strategic partnerships, mergers, and acquisitions will continue to shape the market landscape, enabling companies to expand their technological offerings and market reach. The market is expected to witness continued innovation, leading to more immersive, intelligent, and energy-efficient digital television experiences for consumers worldwide.

Digital TV Front-end System IC Segmentation

-

1. Application

- 1.1. Household

- 1.2. Commercial

-

2. Types

- 2.1. Decoder Chips

- 2.2. TV Input Processing Chips

- 2.3. Others

Digital TV Front-end System IC Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Digital TV Front-end System IC REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital TV Front-end System IC Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Household

- 5.1.2. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Decoder Chips

- 5.2.2. TV Input Processing Chips

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Digital TV Front-end System IC Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Household

- 6.1.2. Commercial

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Decoder Chips

- 6.2.2. TV Input Processing Chips

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Digital TV Front-end System IC Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Household

- 7.1.2. Commercial

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Decoder Chips

- 7.2.2. TV Input Processing Chips

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Digital TV Front-end System IC Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Household

- 8.1.2. Commercial

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Decoder Chips

- 8.2.2. TV Input Processing Chips

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Digital TV Front-end System IC Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Household

- 9.1.2. Commercial

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Decoder Chips

- 9.2.2. TV Input Processing Chips

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Digital TV Front-end System IC Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Household

- 10.1.2. Commercial

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Decoder Chips

- 10.2.2. TV Input Processing Chips

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 NXP Semiconductors

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Renesas Electronics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 STMicroelectronics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Vishay

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Skyworks

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Texas Instruments

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ATI Technologies

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nisshinbo Micro Devices

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Yitoa Micro Technology

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ite Technology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AltoBeam

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 RF Point

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 RDA Microelectronics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 MaxLinear

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 NXP Semiconductors

List of Figures

- Figure 1: Global Digital TV Front-end System IC Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Digital TV Front-end System IC Revenue (million), by Application 2024 & 2032

- Figure 3: North America Digital TV Front-end System IC Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Digital TV Front-end System IC Revenue (million), by Types 2024 & 2032

- Figure 5: North America Digital TV Front-end System IC Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Digital TV Front-end System IC Revenue (million), by Country 2024 & 2032

- Figure 7: North America Digital TV Front-end System IC Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Digital TV Front-end System IC Revenue (million), by Application 2024 & 2032

- Figure 9: South America Digital TV Front-end System IC Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Digital TV Front-end System IC Revenue (million), by Types 2024 & 2032

- Figure 11: South America Digital TV Front-end System IC Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Digital TV Front-end System IC Revenue (million), by Country 2024 & 2032

- Figure 13: South America Digital TV Front-end System IC Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Digital TV Front-end System IC Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Digital TV Front-end System IC Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Digital TV Front-end System IC Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Digital TV Front-end System IC Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Digital TV Front-end System IC Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Digital TV Front-end System IC Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Digital TV Front-end System IC Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Digital TV Front-end System IC Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Digital TV Front-end System IC Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Digital TV Front-end System IC Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Digital TV Front-end System IC Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Digital TV Front-end System IC Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Digital TV Front-end System IC Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Digital TV Front-end System IC Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Digital TV Front-end System IC Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Digital TV Front-end System IC Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Digital TV Front-end System IC Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Digital TV Front-end System IC Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Digital TV Front-end System IC Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Digital TV Front-end System IC Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Digital TV Front-end System IC Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Digital TV Front-end System IC Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Digital TV Front-end System IC Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Digital TV Front-end System IC Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Digital TV Front-end System IC Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Digital TV Front-end System IC Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Digital TV Front-end System IC Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Digital TV Front-end System IC Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Digital TV Front-end System IC Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Digital TV Front-end System IC Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Digital TV Front-end System IC Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Digital TV Front-end System IC Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Digital TV Front-end System IC Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Digital TV Front-end System IC Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Digital TV Front-end System IC Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Digital TV Front-end System IC Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Digital TV Front-end System IC Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Digital TV Front-end System IC Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital TV Front-end System IC?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Digital TV Front-end System IC?

Key companies in the market include NXP Semiconductors, Renesas Electronics, STMicroelectronics, Vishay, Skyworks, Texas Instruments, ATI Technologies, Nisshinbo Micro Devices, Yitoa Micro Technology, Ite Technology, AltoBeam, RF Point, RDA Microelectronics, MaxLinear.

3. What are the main segments of the Digital TV Front-end System IC?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital TV Front-end System IC," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital TV Front-end System IC report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital TV Front-end System IC?

To stay informed about further developments, trends, and reports in the Digital TV Front-end System IC, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence