Key Insights

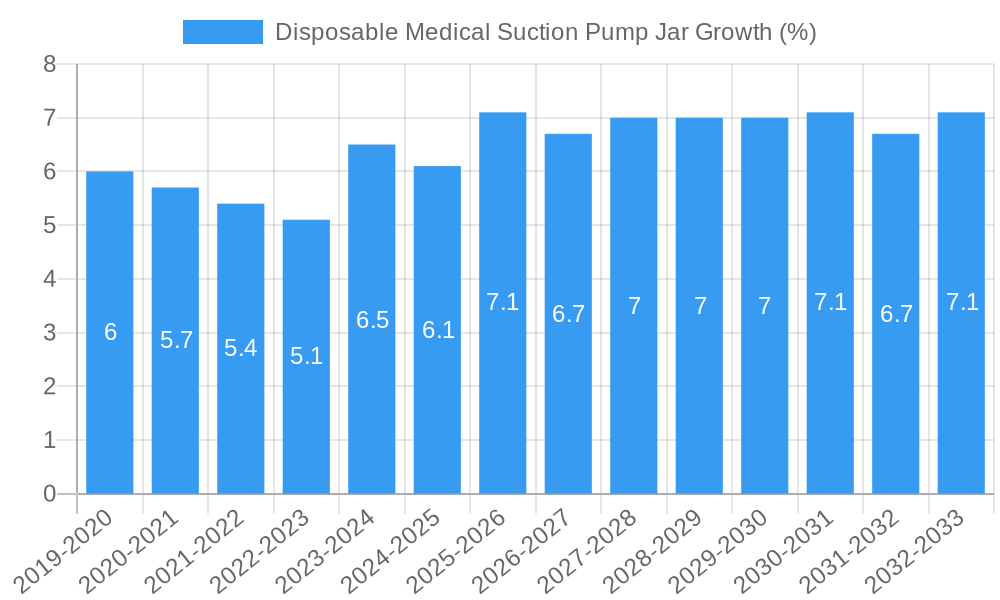

The global Disposable Medical Suction Pump Jar market is poised for significant expansion, projected to reach an estimated market size of $350 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.5% anticipated through 2033. This growth is primarily fueled by the escalating prevalence of chronic diseases, the increasing volume of surgical procedures, and the rising demand for advanced healthcare infrastructure, particularly in emerging economies. The inherent need for sterile, single-use medical devices to prevent cross-contamination and ensure patient safety further underpins market expansion. Furthermore, technological advancements leading to improved designs and materials for these jars, offering enhanced durability and functionality, are also contributing factors. The expanding healthcare sector, driven by government initiatives and private investments, is creating a fertile ground for the adoption of disposable suction pump jars across a wide spectrum of healthcare settings.

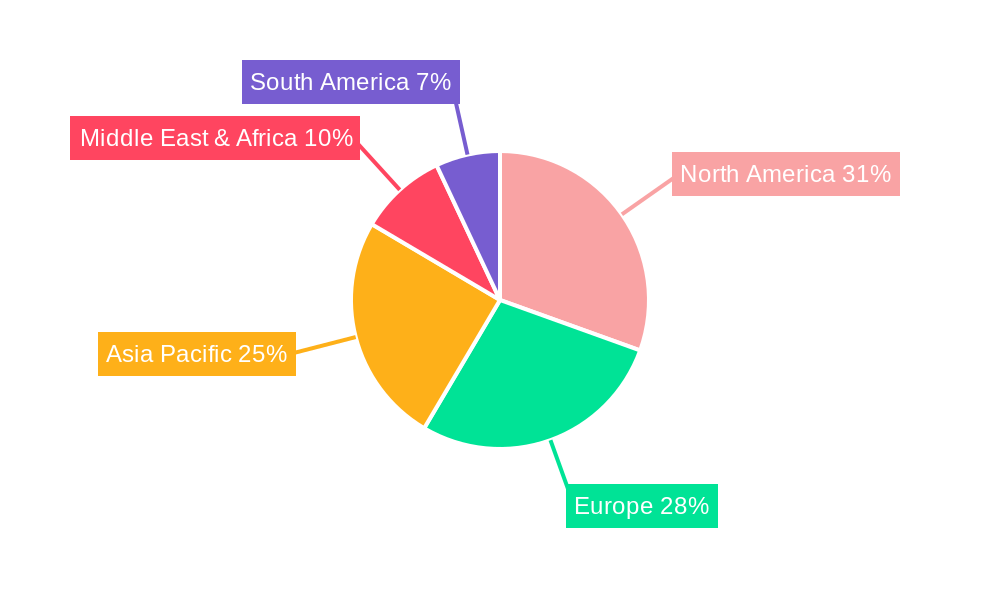

The market segmentation reveals a dynamic landscape. In terms of application, hospitals are expected to dominate, accounting for the largest share due to their high patient throughput and extensive use of suction devices. Clinics, however, represent a rapidly growing segment, driven by the decentralization of healthcare services and an increase in outpatient procedures. By type, polypropylene jars are projected to lead the market, owing to their cost-effectiveness, chemical resistance, and suitability for a broad range of medical applications. Polycarbonate jars will also hold a significant share, particularly in specialized applications requiring greater impact resistance. Geographically, North America and Europe currently hold substantial market shares, driven by established healthcare systems and high adoption rates of medical disposables. However, the Asia Pacific region is anticipated to witness the fastest growth, propelled by a burgeoning population, increasing healthcare expenditure, and improving medical infrastructure. Restraints such as the stringent regulatory landscape and the initial cost of adoption in some developing regions could pose challenges, but the overarching demand for hygiene and efficiency is expected to mitigate these.

Disposable Medical Suction Pump Jar Market Concentration & Innovation

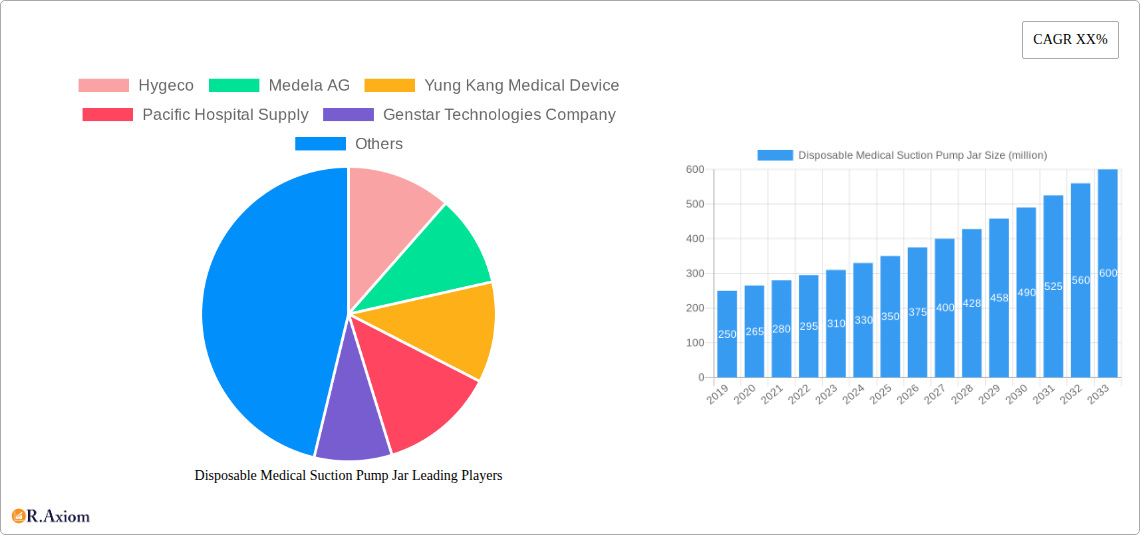

The disposable medical suction pump jar market exhibits a moderate to high concentration, with key players like Medela AG, Allied Healthcare Products, and Ohio Medical holding significant market share, estimated to be upwards of 30 million units annually. Innovation within this sector is primarily driven by the increasing demand for enhanced patient safety, infection control, and convenience in clinical settings. Regulatory frameworks, such as those established by the FDA and EMA, play a crucial role in shaping product development and market entry, focusing on material safety, biocompatibility, and sterile packaging. Product substitutes, while limited in immediate applications, can include reusable suction systems that require extensive cleaning and sterilization protocols, though their adoption is declining due to cost-effectiveness and infection risks associated with disposables. End-user trends are strongly influenced by the growing prevalence of chronic diseases, the increasing number of surgical procedures, and the expansion of home healthcare services, all of which necessitate reliable and sterile suction solutions. Merger and acquisition (M&A) activities, while not dominating the landscape, are strategic moves aimed at consolidating market presence and expanding product portfolios. Recent M&A deals in related medical device segments have seen values ranging from 50 million to 150 million, indicating potential for future consolidation in the disposable suction jar market as companies seek to enhance their competitive edge and operational efficiencies.

Disposable Medical Suction Pump Jar Industry Trends & Insights

The disposable medical suction pump jar market is experiencing robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% over the forecast period (2025-2033). This sustained expansion is underpinned by several interconnected trends and insights shaping the industry landscape. A primary growth driver is the escalating global demand for efficient and sterile fluid management in healthcare settings, ranging from hospitals and clinics to ambulatory surgical centers and home healthcare environments. The increasing volume of surgical procedures, particularly minimally invasive ones, and the rising incidence of respiratory conditions and chronic diseases that require airway clearance and fluid aspiration are directly contributing to the demand for disposable suction jars. Technological advancements are another significant catalyst. Manufacturers are continuously innovating to develop jars that are not only leak-proof and shatter-resistant but also incorporate features like integrated filters to prevent overflow and contamination, and enhanced ergonomics for easier handling and disposal. The shift towards single-use medical devices, driven by stringent infection control protocols and a desire to minimize the risk of hospital-acquired infections (HAIs), is a fundamental behavioral change favoring disposable suction jars. This trend is further amplified by healthcare providers’ increasing focus on reducing the labor and costs associated with reprocessing reusable devices. Consumer preferences, in this context, translate to healthcare professionals valuing disposables for their reliability, convenience, and cost-effectiveness in terms of infection prevention. The competitive dynamics within the market are characterized by a blend of established global players and emerging regional manufacturers. Companies are differentiating themselves through product quality, material innovation, supply chain efficiency, and competitive pricing strategies. The market penetration of disposable medical suction pump jars is already substantial, particularly in developed economies, with significant potential for growth in emerging markets due to improving healthcare infrastructure and increasing healthcare expenditure. The market size is projected to reach over 500 million units by 2025, with steady expansion anticipated.

Dominant Markets & Segments in Disposable Medical Suction Pump Jar

The disposable medical suction pump jar market is experiencing significant dominance from specific regions and segments, driven by a confluence of economic, demographic, and healthcare infrastructure factors. Geographically, North America and Europe currently hold the largest market share, largely due to their well-established healthcare systems, high per capita healthcare spending, and the early adoption of advanced medical technologies. The United States, in particular, stands out as a dominant country due to its extensive hospital network, the high volume of surgical procedures performed annually, and stringent regulatory mandates for infection control.

Application Dominance: Hospitals

Hospitals represent the most significant application segment for disposable medical suction pump jars. This dominance is fueled by several key drivers:

- High Patient Volume and Acuity: Hospitals manage a vast number of patients with diverse medical needs, many of whom require continuous or intermittent suctioning for airway management, post-operative drainage, and wound care. The sheer volume of procedures and patient admissions translates into a consistent and substantial demand.

- Complex Surgical Procedures: The increasing complexity and frequency of surgical interventions, from routine appendectomies to intricate neurosurgery and cardiac procedures, necessitate reliable and sterile suctioning capabilities throughout the operative and recovery phases.

- Infection Control Mandates: Hospitals are at the forefront of implementing rigorous infection control protocols to combat hospital-acquired infections. Disposable suction jars eliminate the risks associated with reusable systems, such as cross-contamination and inadequate sterilization, making them the preferred choice.

- Efficiency and Cost-Effectiveness: While individual units are disposable, the overall cost-effectiveness for hospitals in terms of reduced labor for cleaning and sterilization, decreased risk of equipment failure due to wear and tear on reusable systems, and minimized liability from infection outbreaks makes disposables a pragmatic choice.

- Technological Integration: Modern hospitals are equipped with advanced suction pumps that are designed to seamlessly integrate with disposable jar systems, further enhancing operational efficiency and patient care.

Type Dominance: Polypropylene

Within the types of disposable medical suction pump jars, polypropylene (PP) dominates the market. This material preference is driven by a combination of its inherent properties and its suitability for healthcare applications:

- Chemical Inertness and Biocompatibility: Polypropylene is chemically inert, meaning it does not react with bodily fluids or medications, ensuring the integrity of the aspirated material and preventing contamination of the sample. It is also biocompatible, posing no adverse reactions when in contact with human tissues.

- Durability and Shatter Resistance: While disposable, PP jars offer a good balance of rigidity and flexibility, making them resistant to cracking or shattering during use or handling, which is crucial for preventing leaks and potential injuries. This contrasts with glass jars, which pose a significant breakage hazard.

- Autoclavability (where applicable for some sterilization processes): While the primary appeal is disposability, some PP jars might be designed to withstand certain sterilization processes if needed for specific supply chain or sterilization hub operations, offering flexibility.

- Cost-Effectiveness and Manufacturability: Polypropylene is a relatively inexpensive raw material to produce, and its properties allow for efficient injection molding, leading to cost-effective manufacturing at scale. This contributes to competitive pricing, a significant factor in the high-volume disposable medical device market.

- Transparency and Visibility: Many PP jars offer sufficient transparency, allowing healthcare professionals to easily monitor fluid levels and the nature of the aspirated material, which is vital for clinical assessment.

- Environmental Considerations (Recyclability): While disposability is the primary function, PP is generally recyclable, which is an increasingly important consideration for healthcare institutions aiming to improve their environmental footprint, although proper medical waste disposal protocols take precedence.

While Polycarbonate (PC) is also used and offers high impact resistance and clarity, its higher cost and certain chemical compatibility concerns in specific applications often position PP as the preferred choice for standard disposable suction pump jars. The economic policies supporting domestic manufacturing and the robust supply chain infrastructure for PP further solidify its dominance.

Disposable Medical Suction Pump Jar Product Developments

Product development in the disposable medical suction pump jar market is characterized by a focus on enhancing safety, efficiency, and user convenience. Innovations include the integration of advanced hydrophobic filters to prevent overflow and protect vacuum pumps from contamination, significantly reducing maintenance and improving device longevity. Manufacturers are also introducing jars with improved sealing mechanisms to prevent leaks during transport and handling, alongside clearer volume markings for more accurate fluid monitoring. Ergonomic designs, such as integrated handles and easy-to-use lid mechanisms, are becoming standard, facilitating faster setup and disposal by healthcare professionals. The use of advanced, shatter-resistant materials ensures greater patient and clinician safety.

Report Scope & Segmentation Analysis

This report meticulously analyzes the disposable medical suction pump jar market, offering comprehensive insights across its key segments. The segmentation encompasses:

- Application: The market is segmented into Hospitals and Clinics. Hospitals represent the largest segment due to higher patient volumes and the complexity of procedures requiring suction. Clinics, while smaller, are a growing segment with increasing outpatient surgical services.

- Type: The analysis further breaks down the market by material type, specifically Polypropylene (PP) and Polycarbonate (PC). Polypropylene jars are projected to maintain their dominance due to cost-effectiveness and favorable material properties for this application. Polycarbonate jars, while offering superior impact resistance, are expected to cater to niche applications where extreme durability is paramount.

Each segment's growth projections, current market sizes, and competitive dynamics are detailed to provide a holistic view of the market landscape.

Key Drivers of Disposable Medical Suction Pump Jar Growth

Several critical factors are propelling the growth of the disposable medical suction pump jar market. A primary driver is the escalating global incidence of respiratory illnesses and the increasing number of surgical procedures performed worldwide, both of which necessitate efficient and sterile fluid aspiration. The growing emphasis on infection control and the prevention of hospital-acquired infections (HAIs) is a significant impetus for the adoption of disposable devices over reusable ones. Furthermore, advancements in healthcare infrastructure, particularly in emerging economies, coupled with rising healthcare expenditure, are expanding access to modern medical devices, including disposable suction pump jars. Technological innovations leading to improved product features, such as enhanced filtration systems and leak-proof designs, also contribute to market expansion by offering superior performance and safety.

Challenges in the Disposable Medical Suction Pump Jar Sector

Despite robust growth, the disposable medical suction pump jar sector faces several challenges. Stringent regulatory compliance requirements for medical devices, including material safety, sterilization validation, and labeling, can increase development costs and time-to-market for manufacturers. Fluctuations in raw material prices, particularly for plastics like polypropylene, can impact profit margins and pricing strategies. Intense price competition among manufacturers, especially for high-volume products, can put pressure on profitability. Supply chain disruptions, as witnessed in recent global events, can affect the availability of essential raw materials and finished goods, leading to potential shortages. Furthermore, increasing environmental concerns regarding medical waste disposal necessitate responsible manufacturing and disposal practices, adding another layer of complexity.

Emerging Opportunities in Disposable Medical Suction Pump Jar

The disposable medical suction pump jar market is ripe with emerging opportunities. The expanding home healthcare sector presents a significant growth avenue, as more patients requiring suction therapy are managed outside traditional hospital settings. The increasing adoption of minimally invasive surgical techniques globally, which often require precise fluid management, is another key opportunity. Moreover, the development of smart suction systems, integrating features like real-time monitoring and data logging, offers a future growth trajectory. Focus on biodegradable or more environmentally sustainable materials for disposable jars, while challenging, could also represent a future competitive advantage. Expansion into underserved emerging markets with rapidly developing healthcare infrastructures also presents substantial untapped potential.

Leading Players in the Disposable Medical Suction Pump Jar Market

- Hygeco

- Medela AG

- Yung Kang Medical Device

- Pacific Hospital Supply

- Genstar Technologies Company

- Allied Healthcare Products

- Lily Medical Corporation

- Amcaremed Technology

- Reanimed Teknik Tibbi Sistemler

- Ohio Medical

- Precision Medical

- Henry Schein

- Bioseal

- flow-meter SpA

Key Developments in Disposable Medical Suction Pump Jar Industry

- 2023/Q4: Introduction of advanced hydrophobic filters in suction jars to prevent overflow and protect vacuum sources.

- 2024/Q1: Launch of shatter-resistant polypropylene suction jars with improved ergonomic designs for enhanced clinician handling.

- 2024/Q2: Strategic partnerships formed to expand distribution networks in emerging healthcare markets.

- 2024/Q3: Increased focus on sustainability initiatives, exploring options for reduced plastic usage in packaging.

- 2025/Q1 (Projected): Potential for new product introductions with integrated antimicrobial properties for enhanced infection control.

Strategic Outlook for Disposable Medical Suction Pump Jar Market

The strategic outlook for the disposable medical suction pump jar market remains highly positive, driven by sustained demand from the healthcare sector. Key growth catalysts include the ongoing global increase in surgical procedures and the rising prevalence of respiratory and chronic conditions. Manufacturers are expected to continue investing in product innovation, focusing on advanced filtration, leak-proof designs, and user-friendly features to enhance patient safety and operational efficiency. The expansion of home healthcare services and the increasing penetration in emerging markets will provide significant avenues for market growth. Companies that can effectively navigate regulatory landscapes, manage supply chain complexities, and offer cost-effective, high-quality disposable suction solutions will be well-positioned for long-term success in this dynamic and essential segment of the medical device industry.

Disposable Medical Suction Pump Jar Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinic

-

2. Types

- 2.1. Polypropylene

- 2.2. Polycarbonate

Disposable Medical Suction Pump Jar Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Disposable Medical Suction Pump Jar REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Disposable Medical Suction Pump Jar Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinic

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Polypropylene

- 5.2.2. Polycarbonate

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Disposable Medical Suction Pump Jar Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinic

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Polypropylene

- 6.2.2. Polycarbonate

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Disposable Medical Suction Pump Jar Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinic

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Polypropylene

- 7.2.2. Polycarbonate

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Disposable Medical Suction Pump Jar Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinic

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Polypropylene

- 8.2.2. Polycarbonate

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Disposable Medical Suction Pump Jar Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinic

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Polypropylene

- 9.2.2. Polycarbonate

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Disposable Medical Suction Pump Jar Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinic

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Polypropylene

- 10.2.2. Polycarbonate

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Hygeco

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Medela AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Yung Kang Medical Device

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pacific Hospital Supply

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Genstar Technologies Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Allied Healthcare Products

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lily Medical Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Amcaremed Technology

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Reanimed Teknik Tibbi Sistemler

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ohio Medical

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Precision Medical

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Henry Schein

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Bioseal

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 flow-meter SpA

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Hygeco

List of Figures

- Figure 1: Global Disposable Medical Suction Pump Jar Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Disposable Medical Suction Pump Jar Revenue (million), by Application 2024 & 2032

- Figure 3: North America Disposable Medical Suction Pump Jar Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Disposable Medical Suction Pump Jar Revenue (million), by Types 2024 & 2032

- Figure 5: North America Disposable Medical Suction Pump Jar Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Disposable Medical Suction Pump Jar Revenue (million), by Country 2024 & 2032

- Figure 7: North America Disposable Medical Suction Pump Jar Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Disposable Medical Suction Pump Jar Revenue (million), by Application 2024 & 2032

- Figure 9: South America Disposable Medical Suction Pump Jar Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Disposable Medical Suction Pump Jar Revenue (million), by Types 2024 & 2032

- Figure 11: South America Disposable Medical Suction Pump Jar Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Disposable Medical Suction Pump Jar Revenue (million), by Country 2024 & 2032

- Figure 13: South America Disposable Medical Suction Pump Jar Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Disposable Medical Suction Pump Jar Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Disposable Medical Suction Pump Jar Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Disposable Medical Suction Pump Jar Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Disposable Medical Suction Pump Jar Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Disposable Medical Suction Pump Jar Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Disposable Medical Suction Pump Jar Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Disposable Medical Suction Pump Jar Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Disposable Medical Suction Pump Jar Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Disposable Medical Suction Pump Jar Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Disposable Medical Suction Pump Jar Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Disposable Medical Suction Pump Jar Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Disposable Medical Suction Pump Jar Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Disposable Medical Suction Pump Jar Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Disposable Medical Suction Pump Jar Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Disposable Medical Suction Pump Jar Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Disposable Medical Suction Pump Jar Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Disposable Medical Suction Pump Jar Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Disposable Medical Suction Pump Jar Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Disposable Medical Suction Pump Jar Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Disposable Medical Suction Pump Jar Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Disposable Medical Suction Pump Jar Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Disposable Medical Suction Pump Jar Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Disposable Medical Suction Pump Jar Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Disposable Medical Suction Pump Jar Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Disposable Medical Suction Pump Jar Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Disposable Medical Suction Pump Jar Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Disposable Medical Suction Pump Jar Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Disposable Medical Suction Pump Jar Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Disposable Medical Suction Pump Jar Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Disposable Medical Suction Pump Jar Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Disposable Medical Suction Pump Jar Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Disposable Medical Suction Pump Jar Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Disposable Medical Suction Pump Jar Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Disposable Medical Suction Pump Jar Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Disposable Medical Suction Pump Jar Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Disposable Medical Suction Pump Jar Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Disposable Medical Suction Pump Jar Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Disposable Medical Suction Pump Jar Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Disposable Medical Suction Pump Jar?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Disposable Medical Suction Pump Jar?

Key companies in the market include Hygeco, Medela AG, Yung Kang Medical Device, Pacific Hospital Supply, Genstar Technologies Company, Allied Healthcare Products, Lily Medical Corporation, Amcaremed Technology, Reanimed Teknik Tibbi Sistemler, Ohio Medical, Precision Medical, Henry Schein, Bioseal, flow-meter SpA.

3. What are the main segments of the Disposable Medical Suction Pump Jar?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Disposable Medical Suction Pump Jar," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Disposable Medical Suction Pump Jar report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Disposable Medical Suction Pump Jar?

To stay informed about further developments, trends, and reports in the Disposable Medical Suction Pump Jar, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence