Key Insights

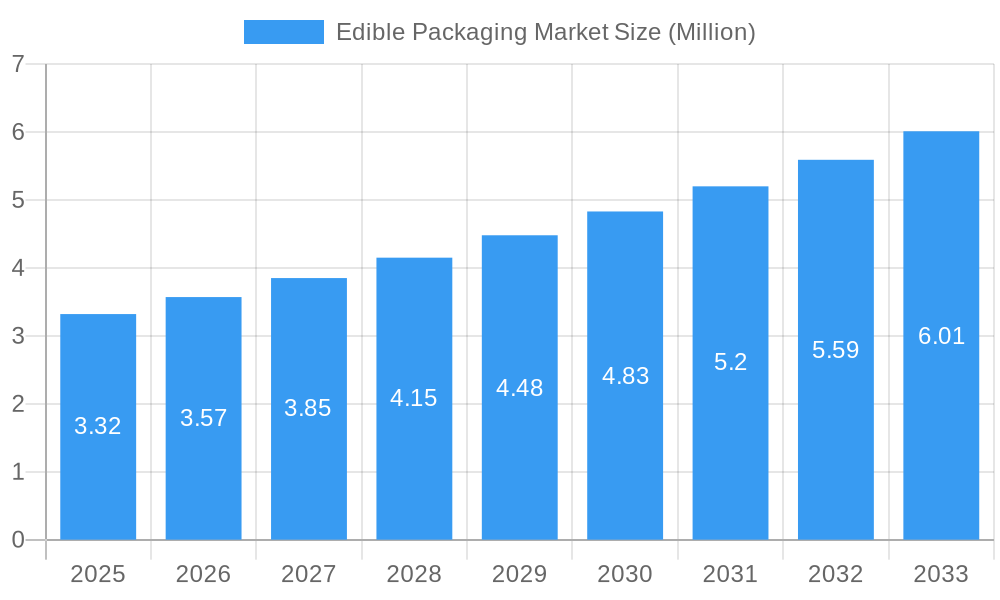

The global Edible Packaging Market is poised for significant expansion, projected to reach an estimated $3.32 million in 2025 with a robust Compound Annual Growth Rate (CAGR) of 7.64% through 2033. This impressive growth is fueled by an increasing consumer demand for sustainable packaging solutions and a growing awareness of the environmental impact of traditional plastics. Key drivers for this market include advancements in food-grade material science, leading to the development of innovative edible films and coatings derived from natural sources like proteins, polysaccharides, and lipids. Furthermore, the inherent benefits of edible packaging – reducing food waste, enhancing product shelf-life, and offering a convenient, waste-free consumption experience – are strong catalysts for adoption across various food segments. The market is witnessing a surge in research and development to overcome limitations such as barrier properties and cost-effectiveness, ensuring broader applicability and commercial viability.

Edible Packaging Market Market Size (In Million)

The Edible Packaging Market is strategically segmented across diverse ingredient types, with Proteins, Polysaccharides, and Lipids emerging as dominant categories due to their excellent film-forming capabilities and nutritional profiles. Applications are widespread, spanning dairy products, bakery and confectionery, fruits and vegetables, and meat, poultry, and seafood. The demand for cleaner labels and natural ingredients further propels the adoption of edible packaging in these sectors. Geographically, North America and Europe are leading the market due to stringent environmental regulations and a strong consumer preference for sustainable products. However, the Asia Pacific region is expected to exhibit the fastest growth, driven by a burgeoning population, increasing disposable incomes, and a growing emphasis on food safety and waste reduction initiatives. Major industry players are actively investing in R&D and strategic collaborations to innovate and capture market share, indicating a dynamic and competitive landscape focused on delivering sustainable and functional edible packaging solutions.

Edible Packaging Market Company Market Share

Edible Packaging Market Market Concentration & Innovation

The edible packaging market, projected to reach $XX Billion by 2033, exhibits a moderate to high concentration, driven by significant innovation and increasing industry consolidation. Key players like Cargill Incorporated, DuPont de Nemours Inc., and Ingredion Incorporated command substantial market share, leveraging their extensive R&D capabilities and global distribution networks. Innovation is primarily fueled by the growing consumer demand for sustainable and waste-reducing packaging solutions, alongside advancements in material science for improved shelf-life extension and functional properties. Regulatory frameworks are evolving to support the adoption of biodegradable and edible materials, albeit with varying timelines and stringency across regions. Product substitutes, primarily conventional plastic packaging, still represent a significant competitive challenge, though their market dominance is gradually eroding. End-user trends strongly favor applications in fruits and vegetables, bakery, and confectionery, where the benefits of extended freshness and reduced spoilage are most apparent. Mergers and acquisitions (M&A) activity, with estimated deal values in the hundreds of millions of dollars, are increasing as larger companies seek to acquire innovative technologies and expand their portfolios in this burgeoning sector. Examples of recent strategic partnerships and acquisitions highlight the strategic importance of this market.

Edible Packaging Market Industry Trends & Insights

The global edible packaging market is experiencing robust growth, propelled by a confluence of escalating environmental consciousness, stringent government regulations against single-use plastics, and a burgeoning demand for convenient, food-preserving solutions. The market is poised for significant expansion, with an estimated Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025–2033). This impressive growth is underpinned by several critical trends. Firstly, the increasing consumer awareness regarding the detrimental environmental impact of traditional packaging materials is a primary catalyst. Shoppers are actively seeking brands that demonstrate a commitment to sustainability, driving the adoption of eco-friendly alternatives like edible packaging. Secondly, technological advancements in material science are continuously enhancing the functionality and applicability of edible packaging. Innovations in creating barriers against moisture, oxygen, and microbial contamination are extending the shelf life of perishable goods, thereby reducing food waste – a major global concern. For instance, edible coatings derived from polysaccharides and proteins are proving highly effective in preserving the freshness and texture of produce, dairy, and meat products. Thirdly, the food and beverage industry itself is a significant driver, actively investing in research and development to integrate edible packaging solutions across a wider range of products. This includes applications in ready-to-eat meals, beverages, and confectionery, where the added benefit of edibility can enhance consumer experience and convenience. The competitive landscape is characterized by both established chemical and food ingredient giants and agile startups, all vying for market dominance through product differentiation, strategic alliances, and continuous innovation. The market penetration of edible packaging, while still in its nascent stages for some applications, is steadily increasing as production costs decrease and consumer acceptance grows. The economic viability of edible packaging is further bolstered by its potential to reduce logistics costs associated with spoilage and the need for complex cold chain management.

Dominant Markets & Segments in Edible Packaging Market

The edible packaging market exhibits distinct regional dominance and segment-specific growth. North America and Europe currently lead in market adoption, driven by well-established sustainability initiatives, robust consumer demand for eco-friendly products, and supportive regulatory environments. Within these regions, countries like the United States and Germany are at the forefront of edible packaging innovation and commercialization.

Ingredient Type Dominance:

- Polysaccharides: This segment holds a significant share due to the abundance, cost-effectiveness, and versatile functional properties of polysaccharides derived from sources like starch, cellulose, and alginates. Their ability to form films with good barrier properties against moisture and oxygen makes them ideal for a wide range of food applications. Key drivers include their biodegradability and natural origin, aligning with consumer preferences.

- Proteins: Protein-based edible packaging, derived from sources like whey, casein, and soy, is gaining traction for its excellent barrier properties and potential for fortification with active ingredients. Their application in extending the shelf life of meats and dairy products is a key growth driver.

- Lipids: While less dominant, lipid-based edible packaging, often used as coatings or emulsifiers, plays a crucial role in providing moisture resistance and improving texture. Their application in confectionery and baked goods is noteworthy.

- Composites: Composite materials, combining different ingredient types to achieve synergistic properties, represent a rapidly growing segment. These materials offer enhanced barrier functionalities and structural integrity, catering to more demanding packaging requirements.

Application Dominance:

- Fruits and Vegetables: This application segment is the current leader, benefiting from the direct impact of edible coatings on extending freshness, reducing spoilage, and minimizing the need for traditional plastics. The economic incentive to reduce waste in this highly perishable category is a major driver.

- Bakery and Confectionery: The convenience and extended shelf life offered by edible packaging in these segments are highly appealing to consumers. Edible wrappers for individual confectionery items and coatings for baked goods are becoming increasingly popular.

- Dairy Products: Edible films and coatings are being developed to protect dairy products from moisture loss and oxidation, thereby enhancing their shelf life and maintaining quality.

- Meat, Poultry, and Seafood: This segment presents a significant growth opportunity, with edible packaging offering solutions to improve the preservation and presentation of these protein-rich foods.

- Other Applications: This includes emerging uses in pharmaceuticals, nutraceuticals, and even non-food items, showcasing the versatility of edible packaging technologies.

Economic policies promoting green manufacturing and consumer awareness campaigns highlighting the environmental benefits of edible packaging are significant catalysts for dominance in these segments. Furthermore, advancements in processing technologies that enable cost-effective production of edible packaging materials contribute to their widespread adoption.

Edible Packaging Market Product Developments

Product development in the edible packaging market is characterized by a strong focus on enhancing functionality, sustainability, and consumer appeal. Innovations are centered around creating edible films and coatings with superior barrier properties against moisture, oxygen, and aroma, thereby significantly extending the shelf life of food products. Key technological trends include the development of multi-functional coatings that can incorporate antimicrobial agents, antioxidants, and even flavor enhancers, providing added value beyond simple packaging. For example, plant-based edible coatings are being engineered to reduce dehydration in fresh produce, lock in moisture, and maintain optimal texture and appearance. These developments offer a competitive advantage by addressing critical industry needs for waste reduction and improved product quality, aligning perfectly with evolving consumer preferences for healthier and more sustainable food options.

Report Scope & Segmentation Analysis

The edible packaging market report provides a comprehensive analysis across key segmentation parameters. The Ingredient Type segmentation includes:

- Protein: Analyzing the market share and growth prospects of edible packaging derived from animal and plant-based proteins, focusing on applications where high barrier properties are crucial.

- Polysaccharides: Examining the dominance of starch, cellulose, alginate, and chitosan-based edible packaging, highlighting their broad applicability and cost-effectiveness.

- Lipids: Assessing the role of fats and oils in edible films and coatings, particularly for moisture barrier properties and applications in confectionery.

- Composites: Investigating the synergistic benefits and growing market share of multi-component edible packaging solutions designed for enhanced performance.

The Application segmentation covers:

- Dairy products: Projecting market growth for edible packaging in cheese, yogurt, and other dairy items, considering their sensitivity to spoilage.

- Bakery and Confectionery: Analyzing the demand for edible wrappers and coatings in cakes, biscuits, chocolates, and candies, emphasizing convenience and extended shelf life.

- Fruits and Vegetables: Detail growth projections for edible coatings and films that preserve the freshness and appearance of fresh produce, minimizing post-harvest losses.

- Meat, Poultry, and Seafood: Assessing the market penetration of edible packaging for extending the shelf life and improving the safety of these high-value perishable goods.

- Other Applications: Including niche markets and emerging uses for edible packaging in beverages, ready-to-eat meals, and pharmaceuticals, reflecting the expanding utility of this technology.

Key Drivers of Edible Packaging Market Growth

The edible packaging market is propelled by several powerful drivers. Growing consumer demand for sustainable and eco-friendly products is paramount, leading to increased adoption of alternatives to traditional plastics. Stringent government regulations aimed at reducing plastic waste and promoting circular economy principles further accelerate market penetration. Technological advancements in material science are crucial, enabling the development of edible packaging with enhanced barrier properties, improved shelf life, and greater functionality. The rising global concern over food waste also plays a significant role, as edible packaging offers a direct solution by preserving product freshness for longer periods. Additionally, the cost-effectiveness and scalability of producing certain edible packaging materials are becoming increasingly attractive to manufacturers.

Challenges in the Edible Packaging Market Sector

Despite its promising outlook, the edible packaging market faces several challenges. Scalability and cost-effectiveness remain significant hurdles, with production costs for some advanced edible packaging materials still higher than conventional plastics. Regulatory frameworks are still evolving, and varying standards across different regions can create complexities for global manufacturers. Consumer perception and acceptance can also be a barrier, as some consumers may harbor concerns about the edibility, safety, or taste of packaging materials. Limited shelf-life extension capabilities for certain highly perishable food items and challenges in achieving desired barrier properties equivalent to conventional packaging also pose technical constraints. Supply chain integration and ensuring consistent quality across diverse raw material sources are ongoing operational challenges.

Emerging Opportunities in Edible Packaging Market

Emerging opportunities in the edible packaging market are abundant and diverse. The development of novel, high-performance edible materials with superior barrier properties and functionalities, such as active packaging incorporating antimicrobials or antioxidants, presents a significant avenue for growth. The expansion of edible packaging into new application areas, including ready-to-eat meals, beverages, and even pharmaceuticals, offers substantial market potential. Furthermore, advancements in biotechnology and fermentation processes could lead to more sustainable and cost-effective production of edible packaging materials. The increasing global focus on reducing food waste will continue to drive demand for solutions that extend product shelf life. The exploration of bio-based composite materials offering enhanced mechanical strength and barrier properties is another key area for future development.

Leading Players in the Edible Packaging Market Market

- Sufresca

- Sumitomo Chemical Co Ltd

- Cargill Incorporated

- Akorn Technology Inc

- AgroFresh Solutions Inc

- DuPont de Nemours Inc

- Nagase & Co Ltd

- Tate & Lyle PLC

- Koninklijke DSM N V

- RPM International Inc (Mantrose-Haeuser Co Inc )

- Ingredion Incorporated

- Pace International LLC

- DÖHler Group Se

Key Developments in Edible Packaging Market Industry

- January 2022: In the United States, Akorn Technology announced the commercial launch of its edible coatings for fresh produce. Akorn's smart and multi-functional edible food coatings double the shelf life of most fruits and vegetables, minimize cold chain losses by 30% or more and provide products with better flavor, texture, and appearance.

- November 2021: Sufresca, an Agri-Tech Startup, launched an edible coating that is a biodegradable, water-based emulsion that is made entirely of natural food ingredients and built with advanced modified atmosphere properties.

- February 2021: Vita Fresh, an Agrofresh Solutions Inc. subsidiary, launched plant-based edible coatings for fresh produce. The produced coatings are sustainable and created using certified ISO14001 "Environmental Management System" standards. The coatings reduce dehydration, lock moisture in the products, and keep the food fresh for a longer time.

Strategic Outlook for Edible Packaging Market Market

The strategic outlook for the edible packaging market is exceptionally positive, driven by an intrinsic alignment with global sustainability goals and a growing consumer preference for environmentally responsible products. Key growth catalysts include continued innovation in material science to enhance barrier properties and reduce production costs, making edible packaging more competitive with traditional alternatives. Expansion into untapped application segments, such as ready-to-eat meals and beverages, alongside further penetration into existing markets like fruits, vegetables, and confectionery, will fuel market expansion. Strategic partnerships and collaborations between material suppliers, food manufacturers, and research institutions will be crucial for accelerating product development and market adoption. Governments and international organizations are expected to play an increasingly supportive role through favorable policies and funding for sustainable packaging solutions. The market's potential for significant growth is undeniable as it addresses critical global challenges like plastic pollution and food waste.

Edible Packaging Market Segmentation

-

1. Ingredient Type

- 1.1. Protein

- 1.2. Polysaccharides

- 1.3. Lipids

- 1.4. Composites

-

2. Application

- 2.1. Dairy products

- 2.2. Bakery and Confectionery

- 2.3. Fruits and Vegetables

- 2.4. Meat, Poultry, and Seafood

- 2.5. Other Applications

Edible Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Edible Packaging Market Regional Market Share

Geographic Coverage of Edible Packaging Market

Edible Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Diabetic Population drives sweetener market; Growing demand for natural sweetener-infused beverage products

- 3.3. Market Restrains

- 3.3.1. Stringent government regulations on food product claims

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Edible Packaging from Natural Resources

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Edible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 5.1.1. Protein

- 5.1.2. Polysaccharides

- 5.1.3. Lipids

- 5.1.4. Composites

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy products

- 5.2.2. Bakery and Confectionery

- 5.2.3. Fruits and Vegetables

- 5.2.4. Meat, Poultry, and Seafood

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6. North America Edible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6.1.1. Protein

- 6.1.2. Polysaccharides

- 6.1.3. Lipids

- 6.1.4. Composites

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Dairy products

- 6.2.2. Bakery and Confectionery

- 6.2.3. Fruits and Vegetables

- 6.2.4. Meat, Poultry, and Seafood

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7. Europe Edible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7.1.1. Protein

- 7.1.2. Polysaccharides

- 7.1.3. Lipids

- 7.1.4. Composites

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Dairy products

- 7.2.2. Bakery and Confectionery

- 7.2.3. Fruits and Vegetables

- 7.2.4. Meat, Poultry, and Seafood

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8. Asia Pacific Edible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8.1.1. Protein

- 8.1.2. Polysaccharides

- 8.1.3. Lipids

- 8.1.4. Composites

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Dairy products

- 8.2.2. Bakery and Confectionery

- 8.2.3. Fruits and Vegetables

- 8.2.4. Meat, Poultry, and Seafood

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9. South America Edible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9.1.1. Protein

- 9.1.2. Polysaccharides

- 9.1.3. Lipids

- 9.1.4. Composites

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Dairy products

- 9.2.2. Bakery and Confectionery

- 9.2.3. Fruits and Vegetables

- 9.2.4. Meat, Poultry, and Seafood

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 10. Middle East and Africa Edible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 10.1.1. Protein

- 10.1.2. Polysaccharides

- 10.1.3. Lipids

- 10.1.4. Composites

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Dairy products

- 10.2.2. Bakery and Confectionery

- 10.2.3. Fruits and Vegetables

- 10.2.4. Meat, Poultry, and Seafood

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sufresca

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sumitomo Chemical Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cargill Incorporated

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Akorn Technology Inc *List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AgroFresh Solutions Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DuPont de Nemours Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nagase & Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tate & Lyle PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Koninklijke DSM N V

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 RPM International Inc (Mantrose-Haeuser Co Inc )

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ingredion Incorporated

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Pace International LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 DÖHler Group Se

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Sufresca

List of Figures

- Figure 1: Global Edible Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Edible Packaging Market Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 3: North America Edible Packaging Market Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 4: North America Edible Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Edible Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Edible Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Edible Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Edible Packaging Market Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 9: Europe Edible Packaging Market Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 10: Europe Edible Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Edible Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Edible Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Edible Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Edible Packaging Market Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 15: Asia Pacific Edible Packaging Market Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 16: Asia Pacific Edible Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Edible Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Edible Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Edible Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Edible Packaging Market Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 21: South America Edible Packaging Market Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 22: South America Edible Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Edible Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Edible Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Edible Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Edible Packaging Market Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 27: Middle East and Africa Edible Packaging Market Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 28: Middle East and Africa Edible Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Edible Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Edible Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Edible Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Edible Packaging Market Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 2: Global Edible Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Edible Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Edible Packaging Market Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 5: Global Edible Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Edible Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Edible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Edible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Edible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Edible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Edible Packaging Market Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 12: Global Edible Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global Edible Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Edible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Germany Edible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Edible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Italy Edible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Edible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Edible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Edible Packaging Market Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 21: Global Edible Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Edible Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: India Edible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: China Edible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Edible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia Edible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Edible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Edible Packaging Market Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 29: Global Edible Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Edible Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Brazil Edible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Argentina Edible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Edible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Edible Packaging Market Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 35: Global Edible Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Edible Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: South Africa Edible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Saudi Arabia Edible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Middle East and Africa Edible Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Edible Packaging Market?

The projected CAGR is approximately 7.64%.

2. Which companies are prominent players in the Edible Packaging Market?

Key companies in the market include Sufresca, Sumitomo Chemical Co Ltd, Cargill Incorporated, Akorn Technology Inc *List Not Exhaustive, AgroFresh Solutions Inc, DuPont de Nemours Inc, Nagase & Co Ltd, Tate & Lyle PLC, Koninklijke DSM N V, RPM International Inc (Mantrose-Haeuser Co Inc ), Ingredion Incorporated, Pace International LLC, DÖHler Group Se.

3. What are the main segments of the Edible Packaging Market?

The market segments include Ingredient Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Surge in Diabetic Population drives sweetener market; Growing demand for natural sweetener-infused beverage products.

6. What are the notable trends driving market growth?

Increasing Demand for Edible Packaging from Natural Resources.

7. Are there any restraints impacting market growth?

Stringent government regulations on food product claims.

8. Can you provide examples of recent developments in the market?

In January 2022, In the United States, Akorn Technology announced the commercial launch of its edible coatings for fresh produce. Akorn's smart and multi-functional edible food coatings double the shelf life of most fruits and vegetables, minimize cold chain losses by 30% or more and provide products with better flavor, texture, and appearance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Edible Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Edible Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Edible Packaging Market?

To stay informed about further developments, trends, and reports in the Edible Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence