Key Insights

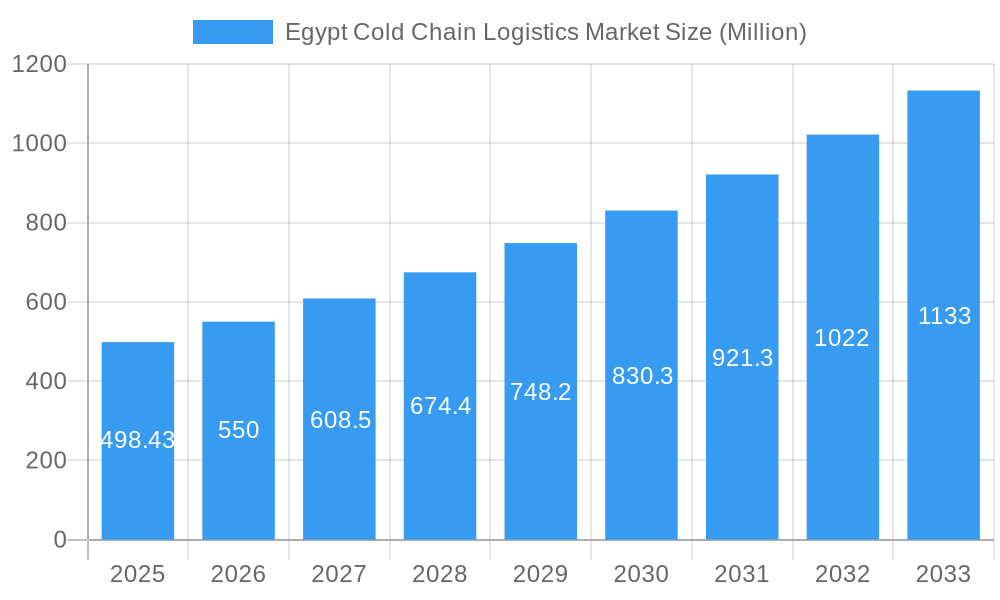

The Egypt cold chain logistics market, valued at $498.43 million in 2025, is experiencing robust growth, projected to expand at a CAGR exceeding 10.28% from 2025 to 2033. This significant expansion is driven by several key factors. The burgeoning horticulture sector, particularly the production and export of fresh fruits and vegetables, necessitates efficient cold chain solutions for maintaining product quality and extending shelf life. Similarly, the growing demand for dairy products, meats, and processed foods fuels the need for reliable cold storage and transportation networks. Furthermore, the pharmaceutical and life sciences industries rely heavily on temperature-controlled logistics for the safe handling of sensitive goods. Increased consumer awareness of food safety and hygiene standards also contributes to market growth, pushing businesses to adopt advanced cold chain technologies. The market is segmented by temperature (chilled and frozen), end-user (horticulture, dairy, meats, etc.), and service type (storage, transportation, and value-added services like blast freezing and inventory management). Key players like Multi fruit Egypt, Naql Masr, and ACFIC are leveraging technological advancements and strategic partnerships to enhance their service offerings and cater to the rising market demand.

Egypt Cold Chain Logistics Market Market Size (In Million)

The continued growth trajectory of the Egyptian cold chain logistics market is expected to be influenced by several evolving trends. The increasing adoption of temperature-monitoring technologies and real-time tracking systems will enhance supply chain visibility and efficiency. Government initiatives promoting food security and infrastructure development are expected to further stimulate market growth. However, challenges such as the need for improved infrastructure, especially in remote areas, and fluctuations in energy prices may pose some restraints. The expansion of e-commerce and the increasing demand for fresh produce in urban areas will likely drive further growth in the coming years, creating substantial opportunities for businesses operating within the Egyptian cold chain logistics sector. The market's diverse segments present various opportunities for specialized service providers catering to specific industry needs.

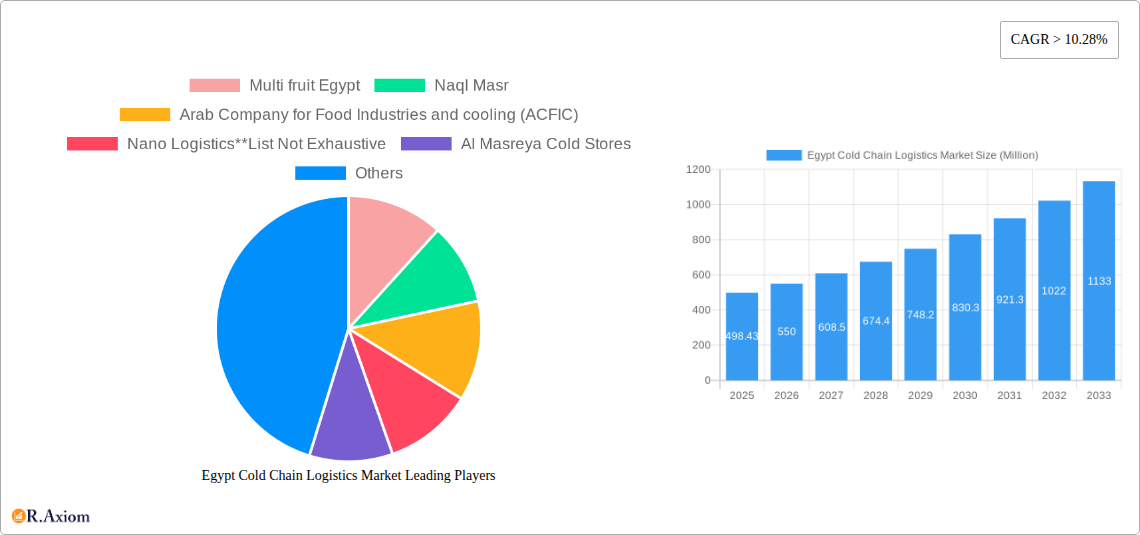

Egypt Cold Chain Logistics Market Company Market Share

Egypt Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Egypt Cold Chain Logistics Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with 2025 as the base and estimated year. We project the market's future trajectory from 2025 to 2033, leveraging data from the historical period (2019-2024). The report segments the market by temperature (chilled, frozen), end-user (horticulture, dairy, meats, fish, poultry, processed food, pharma/life sciences, chemicals, others), and service (storage, transportation, value-added services). Key players like Multi fruit Egypt, Naql Masr, Arab Company for Food Industries and cooling (ACFIC), Nano Logistics, Al Masreya Cold Stores, Green Line Logistics, EPx Logistics, Custom Storage Company (CSC), Logistica, and Logistics for Storage services (S A E) are analyzed.

Egypt Cold Chain Logistics Market Market Concentration & Innovation

The Egyptian cold chain logistics market exhibits a moderately fragmented structure, with no single dominant player commanding a significant market share. While larger companies like Naql Masr and ACFIC hold substantial positions, numerous smaller, regional players cater to specific niches. Market share data for 2025 estimates ACFIC at approximately 15%, Naql Masr at 12%, and the remaining market share is divided amongst other players. Innovation is driven by the increasing demand for temperature-sensitive products, technological advancements in transportation and storage, and the growing adoption of digital solutions for supply chain management. The regulatory framework is gradually evolving to improve infrastructure and standards, though challenges persist. Product substitutes are limited, primarily involving alternative preservation techniques, but these often lack the efficiency and scale of cold chain solutions. Consolidation through mergers and acquisitions (M&A) is expected to increase, particularly among smaller players seeking economies of scale. Recent M&A activity has seen relatively small deal values, averaging around xx Million in the past three years, but larger transactions are anticipated as the market matures. End-user trends reflect a growing preference for high-quality, fresh products, pushing the demand for advanced cold chain solutions.

- Market Concentration: Moderately fragmented.

- Innovation Drivers: Technological advancements, increasing demand for temperature-sensitive goods, digitalization.

- Regulatory Framework: Evolving, with ongoing improvements in infrastructure and standards.

- M&A Activity: Increasing, with an average deal value of approximately xx Million in recent years.

Egypt Cold Chain Logistics Market Industry Trends & Insights

The Egyptian cold chain logistics market is experiencing robust growth, driven primarily by rising disposable incomes, urbanization, and a growing preference for fresh and processed food products. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) is estimated to be 8%, and is projected to reach 9% during the forecast period (2025-2033). Technological advancements, such as the adoption of GPS tracking, temperature monitoring systems, and advanced refrigeration technologies, are improving efficiency and reducing losses. Consumer preferences are shifting towards convenience, quality, and safety, fueling demand for reliable cold chain solutions. Competitive dynamics are characterized by increasing competition among existing players and the emergence of new entrants, creating a dynamic market landscape. Market penetration of advanced cold chain technologies remains relatively low, particularly in rural areas, presenting significant growth opportunities. Growth is expected to continue due to significant investment in infrastructure and growing international trade.

Dominant Markets & Segments in Egypt Cold Chain Logistics Market

The dominant segment within the Egyptian cold chain logistics market is currently the Horticulture (Fresh Fruits & Vegetables) sector, driven by Egypt's significant agricultural output and its position as a major exporter of fresh produce. The Frozen segment is also demonstrating rapid growth, fueled by the rising popularity of frozen foods and the increasing demand for long-term food preservation solutions. Within services, Storage currently holds the largest market share, while Value-added services, including blast freezing and labeling, are projected to experience the highest growth rate.

- Key Drivers for Horticulture Segment:

- Strong agricultural production and export.

- Growing domestic consumption of fresh produce.

- Development of modern retail infrastructure.

- Key Drivers for Frozen Segment:

- Rising demand for frozen foods for convenience and preservation.

- Increased availability of frozen food products in retail channels.

- Expansion of food processing and manufacturing industries.

Geographical dominance is observed in regions surrounding major urban centers like Cairo and Alexandria, due to higher population density, better infrastructure, and proximity to major consumption points.

Egypt Cold Chain Logistics Market Product Developments

Product innovations focus on enhancing temperature control, improving tracking capabilities, and optimizing logistics efficiency. Advances in refrigeration technologies, including the use of more energy-efficient equipment and sustainable refrigerants, are gaining traction. The integration of IoT (Internet of Things) devices and advanced analytics is improving real-time monitoring and proactive management of the cold chain. These developments are enhancing the reliability and cost-effectiveness of cold chain logistics, while enhancing product safety and quality. These solutions are meeting the need for improved efficiency, reduced waste, and enhanced supply chain visibility.

Report Scope & Segmentation Analysis

The report comprehensively segments the Egyptian cold chain logistics market in three key ways:

By Temperature: The market is divided into chilled and frozen segments, with growth projections and market size estimates provided for each. Competitive dynamics vary between these segments, with chilled logistics experiencing higher competition due to shorter shelf life requirements.

By End-User: The market is segmented by end-user, analyzing horticulture, dairy, meats, fish, poultry, processed foods, pharmaceuticals, life sciences, chemicals, and other sectors. Each segment is characterized by specific cold chain requirements and competitive landscapes. The pharmaceutical and life science sectors are expected to drive growth due to stringent quality requirements.

By Service: The report further categorizes the market by service type: storage, transportation, and value-added services (blast freezing, labeling, inventory management, etc.). Growth projections and market size estimates are provided for each service segment. Value-added services are a high growth area driven by increasing consumer demand for convenient products and stringent quality control.

Key Drivers of Egypt Cold Chain Logistics Market Growth

The Egyptian cold chain logistics market is experiencing strong growth due to several key factors. Increased investment in infrastructure, including the development of modern warehousing facilities and improved transportation networks, is playing a vital role. Growing urbanization and rising disposable incomes are boosting consumer demand for fresh and processed foods, driving the need for efficient cold chain solutions. Government initiatives aimed at promoting food safety and quality standards are further supporting market growth. The expansion of the food processing and manufacturing industries is also creating increased demand for reliable cold chain services.

Challenges in the Egypt Cold Chain Logistics Market Sector

The Egyptian cold chain logistics sector faces several challenges. Inadequate infrastructure in certain regions, particularly in rural areas, leads to increased transportation costs and product losses. Limited access to financing and technology adoption can hinder the growth of smaller players. The high cost of energy and lack of skilled labor remain significant hurdles. Furthermore, inconsistent regulatory frameworks can pose challenges to compliance and efficient operation. These challenges can cause increased operational costs and ultimately impact the market’s profitability. For example, inadequate infrastructure may lead to an estimated xx% loss in perishable goods annually.

Emerging Opportunities in Egypt Cold Chain Logistics Market

The Egyptian cold chain logistics market presents numerous opportunities for growth. The expanding e-commerce sector is driving the demand for last-mile delivery solutions, including specialized cold chain delivery services. The growing focus on sustainable and eco-friendly cold chain practices is opening avenues for green technology adoption. Investment in modernizing the existing infrastructure and expanding into underserved areas, particularly rural regions, can unlock significant growth potential. The increased adoption of technology and logistics optimization can further enhance efficiency and reduce costs.

Leading Players in the Egypt Cold Chain Logistics Market Market

- Multi fruit Egypt

- Naql Masr

- Arab Company for Food Industries and cooling (ACFIC)

- Nano Logistics

- Al Masreya Cold Stores

- Green Line Logistics

- EPx Logistics

- Custom Storage Company (CSC)

- Logistica

- Logistics for Storage services (S A E)

Key Developments in Egypt Cold Chain Logistics Market Industry

- January 2022: Sinovac and Vaccera signed an agreement to establish a cold storage warehouse for vaccines in Sixth of October City. This development signifies the growing importance of the pharmaceutical cold chain segment.

- December 2022: Cairo 3A partnered with Driscoll's International to distribute their berries in Egypt. This partnership highlights the increasing involvement of international players in the Egyptian market and the growing demand for high-quality imported produce.

Strategic Outlook for Egypt Cold Chain Logistics Market Market

The Egyptian cold chain logistics market holds significant potential for future growth. Continued investments in infrastructure, technological advancements, and government support will be key drivers. Focus on sustainable practices and the integration of innovative technologies will be essential for maintaining competitiveness. Expansion into underserved markets and the development of specialized services tailored to specific industries will offer further growth opportunities. The market's future prospects remain positive, driven by the factors outlined above and supported by a growing demand for fresh, high-quality products.

Egypt Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

-

3. End User

- 3.1. Horticulture (Fresh Fruits & Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meats, Fish, Poultry

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Other End Users

Egypt Cold Chain Logistics Market Segmentation By Geography

- 1. Egypt

Egypt Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Egypt Cold Chain Logistics Market

Egypt Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 10.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Evolving consumer preferences towards fresh and frozen products4.; Innovations in temperature monitoring systems

- 3.2.2 fleet management solutions

- 3.2.3 and warehouse automation

- 3.3. Market Restrains

- 3.3.1 4.; Limited cold storage facilities

- 3.3.2 inadequate transportation networks

- 3.3.3 and a lack of skilled personnel hinder the efficient functioning of the cold chain logistics sector.

- 3.4. Market Trends

- 3.4.1. Improving local food products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Horticulture (Fresh Fruits & Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meats, Fish, Poultry

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Multi fruit Egypt

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Naql Masr

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arab Company for Food Industries and cooling (ACFIC)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nano Logistics**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Al Masreya Cold Stores

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Green Line Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 EPx Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Custom Storage Company (CSC)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Logistica

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Logistics for Storage services (S A E)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Multi fruit Egypt

List of Figures

- Figure 1: Egypt Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Egypt Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Egypt Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Egypt Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 3: Egypt Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Egypt Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Egypt Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Egypt Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 7: Egypt Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Egypt Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Cold Chain Logistics Market?

The projected CAGR is approximately > 10.28%.

2. Which companies are prominent players in the Egypt Cold Chain Logistics Market?

Key companies in the market include Multi fruit Egypt, Naql Masr, Arab Company for Food Industries and cooling (ACFIC), Nano Logistics**List Not Exhaustive, Al Masreya Cold Stores, Green Line Logistics, EPx Logistics, Custom Storage Company (CSC), Logistica, Logistics for Storage services (S A E).

3. What are the main segments of the Egypt Cold Chain Logistics Market?

The market segments include Service, Temperature, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 498.43 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Evolving consumer preferences towards fresh and frozen products4.; Innovations in temperature monitoring systems. fleet management solutions. and warehouse automation.

6. What are the notable trends driving market growth?

Improving local food products.

7. Are there any restraints impacting market growth?

4.; Limited cold storage facilities. inadequate transportation networks. and a lack of skilled personnel hinder the efficient functioning of the cold chain logistics sector..

8. Can you provide examples of recent developments in the market?

December 2022: Cairo 3A - an affiliate of Cairo 3A Group - recently announced the signing of a partnership contract with Driscoll’s International to distribute their goods in the local market. Driscoll is the world’s leading company in cultivating, producing, and exporting blackberries, blueberries, raspberries, berries, and strawberries. Under the partnership agreement, Cairo 3A will be the sole representative for the marketing and sales of these goods in the Egyptian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Egypt Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence