Key Insights

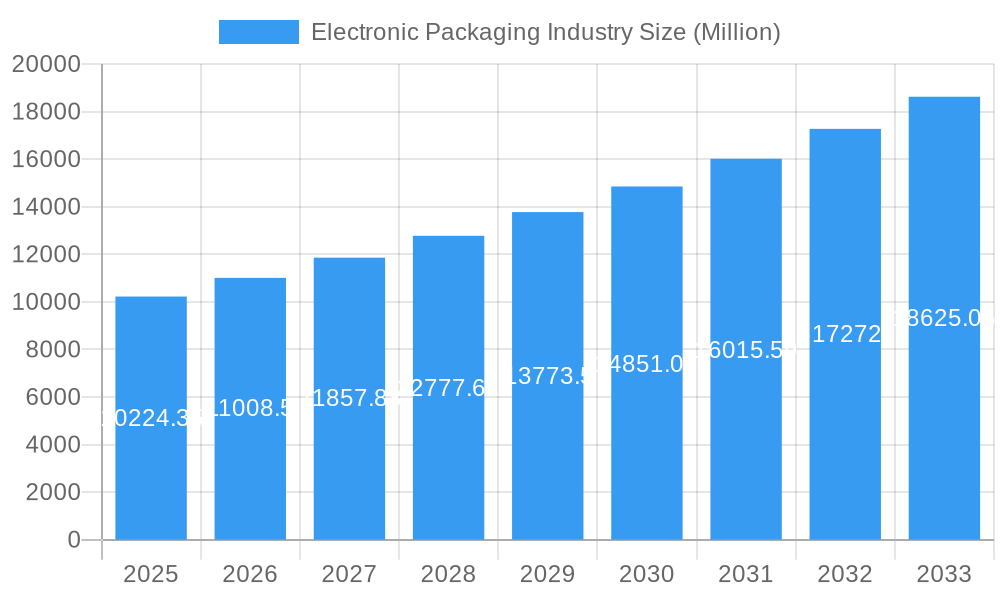

The global Electronic Packaging Market is poised for robust expansion, projected to reach a significant $10,224.35 million in 2025. This growth trajectory is underpinned by a Compound Annual Growth Rate (CAGR) of 7.48% over the forecast period of 2025-2033, indicating a dynamic and thriving industry. Key market drivers are expected to include the escalating demand for consumer electronics, the increasing complexity and miniaturization of electronic components, and the growing emphasis on sustainable and eco-friendly packaging solutions. Innovations in material science, such as the development of advanced bioplastics and recyclable paper-based materials, are anticipated to play a crucial role in meeting evolving regulatory requirements and consumer preferences for environmentally responsible packaging. Furthermore, the rapid adoption of advanced packaging technologies like protective foams and thermoformed trays designed to safeguard sensitive electronic devices during transit will continue to fuel market expansion.

Electronic Packaging Industry Market Size (In Billion)

The market segments reveal a strong reliance on both plastic and paper-based solutions, reflecting diverse application needs. Within plastics, thermoformed trays are likely to dominate due to their customizable nature and protective qualities for devices like smartphones and computing equipment. In the paper segment, corrugated boxes are expected to remain a cornerstone for shipping larger electronic items, while folding cartons will serve the primary packaging of consumer electronics. The dominant applications are anticipated to be smartphones and computing devices, driven by their widespread consumer adoption and continuous product innovation. Geographically, the Asia Pacific region is expected to lead in market share, fueled by its status as a major manufacturing hub for electronics and a rapidly growing consumer base. North America and Europe will also represent substantial markets, driven by high disposable incomes and a strong demand for premium electronic products and advanced packaging solutions. Emerging economies in Latin America and the Middle East will present significant growth opportunities as their electronics markets mature.

Electronic Packaging Industry Company Market Share

Electronic Packaging Industry Market Concentration & Innovation

The electronic packaging industry exhibits a moderate to high market concentration, with a few prominent players dominating significant market share. Key companies like Stora Enso Oyj, Sonoco Products Company, Johns Byne Company, DS Smith PLC, Pregis Corporation, International Paper Company, DunaPack Packaging Group, Dordan Manufacturing, Smurfit Kappa Group PLC, and Sealed Air Corporation, collectively hold a substantial portion of the global market. Innovation is a critical driver, fueled by the relentless demand for lighter, more protective, and sustainable packaging solutions for consumer electronics, computing devices, and wearable technology. Regulatory frameworks, particularly concerning environmental sustainability and material sourcing, are increasingly influencing product development and market entry strategies. Product substitutes, such as advanced cushioning materials and eco-friendly paper-based alternatives, are continuously emerging, posing a competitive challenge to traditional plastics. End-user trends are shifting towards smart packaging, enhanced unboxing experiences, and a strong preference for recyclable and compostable materials. Mergers and acquisitions (M&A) activity remains robust, with deal values estimated in the hundreds of millions, as companies seek to expand their product portfolios, geographic reach, and technological capabilities. For instance, strategic acquisitions in the millions are focused on integrating advanced material science and sustainable packaging technologies to cater to the evolving needs of the electronics sector.

Electronic Packaging Industry Industry Trends & Insights

The electronic packaging industry is poised for significant growth, driven by a projected Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period of 2025–2033. This robust expansion is underpinned by several interconnected trends and insights. The escalating global demand for consumer electronics, including smartphones, computing devices, and smart home gadgets, directly translates into a higher requirement for specialized electronic packaging. As technological advancements lead to smaller, more sophisticated, and often more delicate electronic components, the need for advanced protective packaging solutions intensifies. Furthermore, the burgeoning market for electronic wearables, from smartwatches to health trackers, introduces unique packaging challenges and opportunities, requiring miniaturized yet highly protective designs.

Technological disruptions are a constant theme, with innovations in material science playing a pivotal role. The development of advanced protective foams, biodegradable plastics, and high-strength corrugated structures is reshaping the industry. Automation and Industry 4.0 principles are being integrated into packaging manufacturing processes, leading to increased efficiency, reduced costs, and improved quality control. This includes the adoption of intelligent packaging systems that offer enhanced tracking, traceability, and tamper-evidence features, crucial for high-value electronic goods.

Consumer preferences are increasingly dictating packaging strategies. Sustainability has moved from a niche concern to a mainstream expectation. Consumers are actively seeking brands that utilize eco-friendly, recyclable, and compostable packaging materials. This has spurred a significant shift away from single-use plastics and towards paper-based solutions, such as folding cartons and corrugated boxes, as well as innovative bio-plastics. The "unboxing experience" has also become a critical brand differentiator, with consumers expecting premium and aesthetically pleasing packaging that enhances the perceived value of the electronic product. Brands are investing in customized inserts, elegant finishes, and user-friendly designs to create memorable unboxing moments.

Competitive dynamics are characterized by a blend of established global players and agile regional manufacturers. Strategic partnerships and collaborations are becoming more common as companies aim to leverage each other's expertise in material innovation, supply chain management, and market access. The industry is also witnessing a rise in specialized packaging providers catering to specific electronic device categories, offering tailored solutions that address unique protection and logistical requirements. Market penetration for advanced and sustainable packaging solutions is steadily increasing, driven by both consumer demand and regulatory mandates that encourage environmentally responsible practices. The overall market penetration of these advanced solutions is projected to reach over 60% by 2033, up from approximately 45% in 2025.

Dominant Markets & Segments in Electronic Packaging Industry

The electronic packaging industry is characterized by a diverse and dynamic landscape of dominant markets and segments. Geographically, North America and Asia-Pacific stand out as leading regions, driven by their robust electronics manufacturing sectors and high consumer spending on electronic devices. Within these regions, countries like the United States, China, South Korea, and Japan are pivotal hubs for both production and consumption of electronic packaging. Economic policies that support manufacturing, coupled with significant investments in infrastructure, including advanced logistics and warehousing, further bolster the dominance of these markets.

In terms of material, Plastics currently hold a substantial market share, with Foam and Thermoformed Trays being particularly dominant for their superior cushioning and protective properties, essential for safeguarding sensitive electronic components during transit and handling.

- Foam: Its excellent shock absorption and vibration dampening capabilities make it ideal for protecting fragile electronic devices like smartphones and computing devices. The market for foam packaging in this sector is estimated to be over 5,000 million.

- Thermoformed Trays: These offer customized, precise fitting for individual electronic components or entire devices, ensuring a snug and secure hold. Their application is widespread across various electronic products, with a market size exceeding 4,500 million.

- Other Plastics: This category includes a range of flexible plastics, films, and specialized polymer-based packaging that offer barrier properties and tamper-evidence, contributing to a market segment valued at over 3,000 million.

However, the Paper segment is experiencing rapid growth, driven by sustainability initiatives and evolving consumer preferences.

- Corrugated Boxes: These are the workhorses of electronic packaging, offering a balance of strength, cost-effectiveness, and recyclability. Their dominance in shipping and distribution for almost all electronic product categories is undeniable, with a market size surpassing 7,000 million.

- Folding Cartons: Widely used for retail packaging of smaller electronic devices, accessories, and components, folding cartons provide brand visibility and a premium look and feel. This segment is valued at over 4,000 million.

- Other Papers: This includes specialized paperboards, molded pulp, and paper-based cushioning materials, offering sustainable alternatives with growing market acceptance, projected to reach over 2,500 million.

Across applications, Smartphones and Computing Devices remain the largest segments, demanding sophisticated packaging solutions that ensure product integrity and enhance the unboxing experience.

- Smartphones: The sheer volume of smartphone production and sales, coupled with the high value of these devices, makes them a primary driver for advanced electronic packaging. The market for smartphone packaging alone is estimated to be over 8,000 million.

- Computing Devices: This encompasses laptops, desktops, tablets, and their accessories, requiring robust packaging to withstand the rigors of shipping and retail handling. This segment is valued at over 6,500 million.

- Television/DTH Box: While mature, this segment still represents a significant market for protective and often larger-scale packaging solutions, estimated at over 3,500 million.

- Electronic Wearables: This rapidly growing segment, including smartwatches, fitness trackers, and VR headsets, presents unique packaging challenges due to their compact size and often premium nature, with a market size exceeding 3,000 million.

- Other Applications: This broad category includes packaging for gaming consoles, smart home devices, automotive electronics, and industrial electronics, collectively representing a significant and growing market worth over 4,000 million.

Key drivers for dominance in these segments include the constant innovation in material science to provide better protection against shock, vibration, and environmental factors. The emphasis on sustainable materials, the increasing complexity of electronic devices, and the growing importance of brand perception through packaging are also critical factors shaping market dominance.

Electronic Packaging Industry Product Developments

Product innovations in the electronic packaging industry are heavily focused on enhancing protection, sustainability, and user experience. Advances in protective foams are yielding lighter yet more impact-resistant materials, while molded pulp and biodegradable plastics are gaining traction as eco-friendly alternatives to traditional polystyrene and PET. Smart packaging solutions, incorporating RFID tags or QR codes, are emerging to provide enhanced traceability and inventory management for high-value electronics. The trend towards minimal packaging, while maintaining optimal protection, is also driving innovation in the design of inserts and cushioning systems for smartphones and wearables. These developments not only offer competitive advantages through superior performance and reduced environmental impact but also cater to the evolving consumer demand for premium and sustainable product unboxing experiences.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global electronic packaging industry, covering the forecast period from 2025 to 2033, with a base year of 2025 and historical data from 2019 to 2024. The market is segmented by Material and Application.

Material Segmentation:

- Plastics: This segment encompasses Foam packaging, valued at over 5,000 million, providing exceptional cushioning; Thermoformed Trays, over 4,500 million, offering custom-fit protection; and Other Plastics, exceeding 3,000 million, including films and specialized polymers. Growth projections for plastics are moderate, driven by performance.

- Paper: This segment includes Corrugated Boxes, over 7,000 million, dominating transit packaging; Folding Cartons, over 4,000 million, for retail appeal; and Other Papers, projected to exceed 2,500 million, encompassing molded pulp and eco-friendly paper solutions. Paper is expected to witness higher growth rates due to sustainability demands.

Application Segmentation:

- Smartphones: The largest segment, exceeding 8,000 million, driven by high unit volumes and premium packaging expectations.

- Computing Devices: Valued at over 6,500 million, this segment includes laptops, desktops, and tablets requiring robust protection.

- Television/DTH Box: A mature but significant segment, over 3,500 million, necessitating protective solutions for larger electronics.

- Electronic Wearables: A rapidly growing segment, over 3,000 million, with unique demands for miniaturized and protective packaging.

- Other Applications: This broad category, over 4,000 million, encompasses gaming consoles, smart home devices, and industrial electronics, showing consistent growth.

Key Drivers of Electronic Packaging Industry Growth

The electronic packaging industry's growth is propelled by a confluence of technological, economic, and regulatory factors. The rapid evolution of the electronics sector, marked by miniaturization and increased complexity of devices like smartphones and wearables, necessitates advanced protective packaging solutions. The burgeoning demand for sustainable packaging, driven by consumer awareness and governmental regulations, is pushing manufacturers towards eco-friendly materials such as recycled paper and biodegradable plastics. Economic growth, particularly in emerging markets, fuels consumer spending on electronics, thereby increasing the demand for packaging. Furthermore, innovations in material science, leading to lighter, stronger, and more cost-effective packaging options, act as significant catalysts for market expansion.

Challenges in the Electronic Packaging Industry Sector

Despite robust growth, the electronic packaging industry faces several challenges. Fluctuating raw material prices, particularly for plastics and paper pulp, can impact profitability and pricing strategies. Stringent environmental regulations and the increasing demand for sustainable alternatives can necessitate significant investment in new technologies and materials, posing a barrier for smaller players. Supply chain disruptions, exacerbated by global events, can lead to material shortages and increased lead times. Intense competition from both established players and new entrants, coupled with the constant pressure to innovate while maintaining cost-effectiveness, further intensifies the competitive landscape. The evolving demands for specialized packaging for niche electronic products also require continuous adaptation and investment.

Emerging Opportunities in Electronic Packaging Industry

Emerging opportunities in the electronic packaging industry are primarily centered around sustainability, technological advancements, and evolving consumer preferences. The growing global emphasis on the circular economy presents a significant opportunity for companies developing and implementing recyclable, compostable, and biodegradable packaging solutions. The expansion of the Internet of Things (IoT) and smart home devices creates a demand for innovative packaging that can accommodate these interconnected technologies. The "unboxing experience" continues to be a key differentiator, offering opportunities for premium and customized packaging designs that enhance brand perception. Furthermore, the growth of e-commerce necessitates specialized packaging that ensures product protection during extended shipping durations and provides a positive delivery experience.

Leading Players in the Electronic Packaging Industry Market

- Stora Enso Oyj

- Sonoco Products Company

- Johns Byne Company

- DS Smith PLC

- Pregis Corporation

- International Paper Company

- DunaPack Packaging Group

- Dordan Manufacturing

- Smurfit Kappa Group PLC

- Sealed Air Corporation

Key Developments in Electronic Packaging Industry Industry

- 2023: Stora Enso Oyj launched a new range of paper-based protective packaging solutions for electronics, focusing on recyclability and reduced environmental impact.

- 2023: Sealed Air Corporation acquired a leading provider of sustainable packaging solutions, strengthening its portfolio for the electronics sector.

- 2024: Sonoco Products Company expanded its advanced materials division, introducing innovative foam alternatives for high-protection electronic packaging.

- 2024: DS Smith PLC invested heavily in new corrugated packaging technologies to meet the growing demand for sustainable solutions in the electronics supply chain.

- 2024: Pregis Corporation introduced a new line of biodegradable cushioning materials specifically designed for fragile electronic components.

- 2024: Smurfit Kappa Group PLC announced strategic partnerships to enhance its sustainable packaging offerings for consumer electronics.

Strategic Outlook for Electronic Packaging Industry Market

The strategic outlook for the electronic packaging industry is overwhelmingly positive, driven by sustained demand for electronics and a strong shift towards sustainable practices. Key growth catalysts include continuous innovation in material science, enabling lighter, more protective, and eco-friendly packaging options. The increasing consumer and regulatory pressure for sustainable solutions will continue to drive market penetration for paper-based and biodegradable materials. Furthermore, the ongoing expansion of e-commerce and the burgeoning market for wearables and IoT devices present significant opportunities for specialized and customized packaging solutions. Companies that can effectively integrate sustainability, advanced material technologies, and a focus on enhanced unboxing experiences are well-positioned for substantial growth in the coming years, with a projected market size exceeding 50,000 million by 2033.

Electronic Packaging Industry Segmentation

-

1. Material

-

1.1. Plastics

- 1.1.1. Foam

- 1.1.2. Thermoformed Trays

- 1.1.3. Other Plastics

-

1.2. Paper

- 1.2.1. Folding Cartons

- 1.2.2. Corrugated Boxes

- 1.2.3. Other Papers

-

1.1. Plastics

-

2. Application

- 2.1. Smartphones

- 2.2. Computing Devices

- 2.3. Television/DTH Box

- 2.4. Electronic Wearables

- 2.5. Other Applications

Electronic Packaging Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Electronic Packaging Industry Regional Market Share

Geographic Coverage of Electronic Packaging Industry

Electronic Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Prompting a Strong Demand in the Anti-Counterfeit in Electronics Packaging; Adoption of Eco-Friendly Packaging

- 3.3. Market Restrains

- 3.3.1. ; Regulations in Pertaining the Use of Plastics

- 3.4. Market Trends

- 3.4.1. Paper Packaging Accounted For Significant Market Share in Smartphone

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electronic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastics

- 5.1.1.1. Foam

- 5.1.1.2. Thermoformed Trays

- 5.1.1.3. Other Plastics

- 5.1.2. Paper

- 5.1.2.1. Folding Cartons

- 5.1.2.2. Corrugated Boxes

- 5.1.2.3. Other Papers

- 5.1.1. Plastics

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Smartphones

- 5.2.2. Computing Devices

- 5.2.3. Television/DTH Box

- 5.2.4. Electronic Wearables

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Electronic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Plastics

- 6.1.1.1. Foam

- 6.1.1.2. Thermoformed Trays

- 6.1.1.3. Other Plastics

- 6.1.2. Paper

- 6.1.2.1. Folding Cartons

- 6.1.2.2. Corrugated Boxes

- 6.1.2.3. Other Papers

- 6.1.1. Plastics

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Smartphones

- 6.2.2. Computing Devices

- 6.2.3. Television/DTH Box

- 6.2.4. Electronic Wearables

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Electronic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Plastics

- 7.1.1.1. Foam

- 7.1.1.2. Thermoformed Trays

- 7.1.1.3. Other Plastics

- 7.1.2. Paper

- 7.1.2.1. Folding Cartons

- 7.1.2.2. Corrugated Boxes

- 7.1.2.3. Other Papers

- 7.1.1. Plastics

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Smartphones

- 7.2.2. Computing Devices

- 7.2.3. Television/DTH Box

- 7.2.4. Electronic Wearables

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Electronic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Plastics

- 8.1.1.1. Foam

- 8.1.1.2. Thermoformed Trays

- 8.1.1.3. Other Plastics

- 8.1.2. Paper

- 8.1.2.1. Folding Cartons

- 8.1.2.2. Corrugated Boxes

- 8.1.2.3. Other Papers

- 8.1.1. Plastics

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Smartphones

- 8.2.2. Computing Devices

- 8.2.3. Television/DTH Box

- 8.2.4. Electronic Wearables

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Latin America Electronic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Plastics

- 9.1.1.1. Foam

- 9.1.1.2. Thermoformed Trays

- 9.1.1.3. Other Plastics

- 9.1.2. Paper

- 9.1.2.1. Folding Cartons

- 9.1.2.2. Corrugated Boxes

- 9.1.2.3. Other Papers

- 9.1.1. Plastics

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Smartphones

- 9.2.2. Computing Devices

- 9.2.3. Television/DTH Box

- 9.2.4. Electronic Wearables

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East Electronic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Plastics

- 10.1.1.1. Foam

- 10.1.1.2. Thermoformed Trays

- 10.1.1.3. Other Plastics

- 10.1.2. Paper

- 10.1.2.1. Folding Cartons

- 10.1.2.2. Corrugated Boxes

- 10.1.2.3. Other Papers

- 10.1.1. Plastics

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Smartphones

- 10.2.2. Computing Devices

- 10.2.3. Television/DTH Box

- 10.2.4. Electronic Wearables

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Stora Enso Oyj

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sonoco Products Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Johns Byne Company*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DS Smith PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pregis Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 International Paper Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DunaPack Packaging Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dordan Manufacturing

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Smurfit Kappa Group PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sealed Air Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Stora Enso Oyj

List of Figures

- Figure 1: Global Electronic Packaging Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Electronic Packaging Industry Revenue (undefined), by Material 2025 & 2033

- Figure 3: North America Electronic Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Electronic Packaging Industry Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America Electronic Packaging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Electronic Packaging Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Electronic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Electronic Packaging Industry Revenue (undefined), by Material 2025 & 2033

- Figure 9: Europe Electronic Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 10: Europe Electronic Packaging Industry Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Electronic Packaging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Electronic Packaging Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Electronic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Electronic Packaging Industry Revenue (undefined), by Material 2025 & 2033

- Figure 15: Asia Pacific Electronic Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 16: Asia Pacific Electronic Packaging Industry Revenue (undefined), by Application 2025 & 2033

- Figure 17: Asia Pacific Electronic Packaging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Electronic Packaging Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Electronic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Electronic Packaging Industry Revenue (undefined), by Material 2025 & 2033

- Figure 21: Latin America Electronic Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 22: Latin America Electronic Packaging Industry Revenue (undefined), by Application 2025 & 2033

- Figure 23: Latin America Electronic Packaging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Electronic Packaging Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Electronic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Electronic Packaging Industry Revenue (undefined), by Material 2025 & 2033

- Figure 27: Middle East Electronic Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 28: Middle East Electronic Packaging Industry Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East Electronic Packaging Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East Electronic Packaging Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Electronic Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electronic Packaging Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 2: Global Electronic Packaging Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Electronic Packaging Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Electronic Packaging Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 5: Global Electronic Packaging Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Electronic Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Electronic Packaging Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 8: Global Electronic Packaging Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 9: Global Electronic Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Electronic Packaging Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 11: Global Electronic Packaging Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Electronic Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Electronic Packaging Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 14: Global Electronic Packaging Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Global Electronic Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Electronic Packaging Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 17: Global Electronic Packaging Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global Electronic Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electronic Packaging Industry?

The projected CAGR is approximately 7.48%.

2. Which companies are prominent players in the Electronic Packaging Industry?

Key companies in the market include Stora Enso Oyj, Sonoco Products Company, Johns Byne Company*List Not Exhaustive, DS Smith PLC, Pregis Corporation, International Paper Company, DunaPack Packaging Group, Dordan Manufacturing, Smurfit Kappa Group PLC, Sealed Air Corporation.

3. What are the main segments of the Electronic Packaging Industry?

The market segments include Material, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Prompting a Strong Demand in the Anti-Counterfeit in Electronics Packaging; Adoption of Eco-Friendly Packaging.

6. What are the notable trends driving market growth?

Paper Packaging Accounted For Significant Market Share in Smartphone.

7. Are there any restraints impacting market growth?

; Regulations in Pertaining the Use of Plastics.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electronic Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electronic Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electronic Packaging Industry?

To stay informed about further developments, trends, and reports in the Electronic Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence