Key Insights

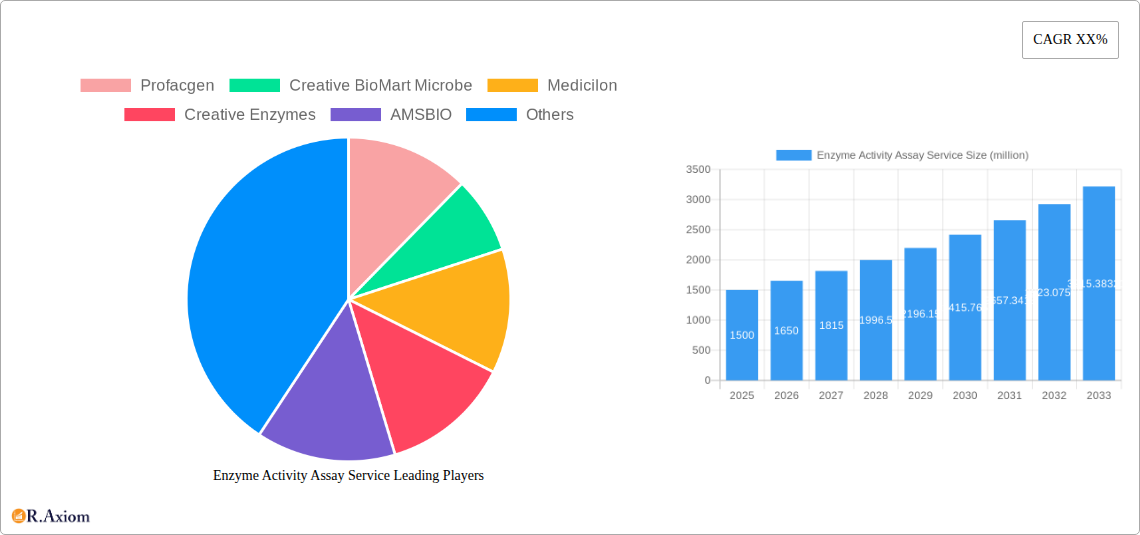

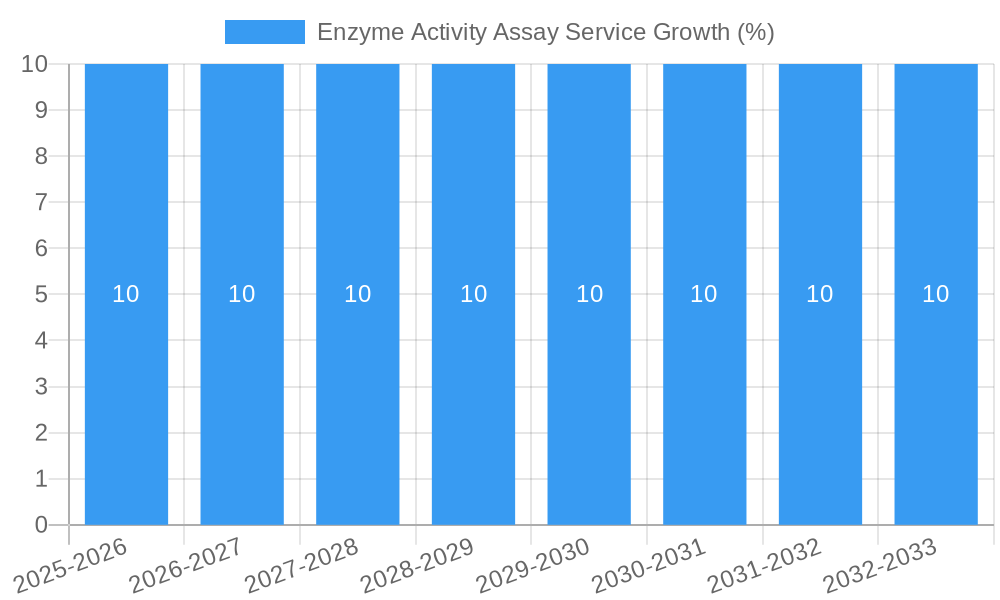

The Enzyme Activity Assay Service market is poised for substantial growth, projected to reach an estimated $1,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 10% anticipated from 2025 to 2033. This expansion is primarily fueled by the escalating demand for precise and reliable enzyme activity measurements across diverse sectors, most notably in drug development and disease diagnosis. The pharmaceutical industry's continuous pursuit of novel therapeutics and personalized medicine strategies directly translates into an increased reliance on enzyme activity assays for target validation, drug efficacy assessment, and toxicity screening. Furthermore, advancements in diagnostic technologies, enabling earlier and more accurate detection of various conditions through biomarker analysis, are significantly propelling market momentum. Scientific research, a foundational pillar of innovation, also contributes to this growth by employing these services for fundamental biological studies and the elucidation of complex metabolic pathways.

The market's trajectory is further shaped by key trends such as the increasing adoption of high-throughput screening (HTS) platforms, which accelerate the identification of promising drug candidates by enabling the simultaneous testing of numerous compounds. The development of more sensitive and specific assay kits and technologies is also a significant driver, allowing for the detection of even minute changes in enzyme activity. However, the market faces certain restraints, including the high cost associated with specialized equipment and skilled personnel required for conducting complex enzyme activity assays. Regulatory hurdles and the time-consuming validation processes for new assays can also present challenges. Despite these, the inherent value of enzyme activity assay services in advancing healthcare and scientific understanding ensures their continued and expanding relevance, with applications ranging from direct assays for enzyme kinetics to indirect assays for monitoring enzyme function within biological systems.

This comprehensive report provides an in-depth analysis of the Enzyme Activity Assay Service market, offering critical insights for stakeholders in drug development, disease diagnosis, and scientific research. Covering the period from 2019 to 2033, with a base year of 2025, this report details market concentration, industry trends, dominant segments, product developments, key drivers, challenges, and emerging opportunities.

Enzyme Activity Assay Service Market Concentration & Innovation

The Enzyme Activity Assay Service market exhibits moderate concentration, with a significant portion of the market share held by a few key players, including Profacgen, Creative BioMart Microbe, Medicilon, Creative Enzymes, AMSBIO, Merck Millipore, Kymos, Solis BioDyne, Pacific BioLabs, and Thermo Fisher. Innovation is a primary driver, fueled by advancements in high-throughput screening technologies, automation, and the increasing demand for personalized medicine and targeted therapies. Regulatory frameworks, particularly stringent quality control measures and evolving guidelines from bodies like the FDA and EMA, significantly shape market entry and product development. Product substitutes, such as in-house assay development or alternative analytical techniques, exist but often lack the specificity, efficiency, or cost-effectiveness of specialized assay services. End-user trends reveal a growing preference for outsourced services due to expertise, cost savings, and faster turnaround times, especially within the drug development and diagnostics sectors. Mergers and acquisitions (M&A) activities, with recent deal values estimated in the tens of millions, are observed as companies seek to expand their service portfolios, geographical reach, and technological capabilities.

Enzyme Activity Assay Service Industry Trends & Insights

The Enzyme Activity Assay Service market is experiencing robust growth, driven by a confluence of factors. The escalating prevalence of chronic diseases worldwide, coupled with the continuous pursuit of novel therapeutic interventions, acts as a significant market growth driver. Technological disruptions, including the integration of AI and machine learning for assay optimization and data analysis, are revolutionizing efficiency and accuracy. Furthermore, the growing understanding of enzyme functions in various biological processes is propelling scientific research, leading to increased demand for specialized assays. Consumer preferences are shifting towards providers offering comprehensive service packages, rapid turnaround times, and customized solutions tailored to specific research or diagnostic needs. Competitive dynamics are intense, with established players differentiating themselves through specialized expertise, proprietary technologies, and strategic partnerships. The market penetration of enzyme activity assay services is steadily increasing across academia, biotechnology, and pharmaceutical industries. The Compound Annual Growth Rate (CAGR) for this market is projected to be approximately 12% over the forecast period. The total market size is estimated to reach over 5,000 million by 2025 and is expected to grow to over 10,000 million by 2033.

Dominant Markets & Segments in Enzyme Activity Assay Service

The Drug Development segment stands as the dominant market within the enzyme activity assay service landscape, driven by the extensive need for enzyme characterization, drug target validation, and efficacy testing throughout the pharmaceutical R&D pipeline. This dominance is further bolstered by significant investment in novel drug discovery, particularly in areas like oncology, infectious diseases, and metabolic disorders. Key drivers for this segment's supremacy include:

- High R&D Expenditure: Pharmaceutical companies consistently allocate substantial budgets to R&D, with a significant portion dedicated to enzyme-related research and assay development. This translates to a sustained demand for specialized enzyme activity assay services.

- Therapeutic Target Identification: Enzymes are critical therapeutic targets for a vast array of diseases. Identifying and validating these targets, and subsequently assessing the activity of potential drug candidates against them, necessitates precise and reliable enzyme activity assays.

- Drug Efficacy and Safety Testing: Pre-clinical and clinical trials heavily rely on enzyme activity assays to evaluate the effectiveness and potential side effects of new drug compounds. This includes assessing enzyme inhibition or activation by drug candidates.

- Biologics Development: The burgeoning field of biologics, including monoclonal antibodies and enzyme-replacement therapies, also requires extensive enzyme activity characterization.

- Regulatory Requirements: Stringent regulatory pathways for drug approval necessitate comprehensive data on enzyme interactions, further driving the demand for high-quality assay services.

Within the Types of assays, Direct Assays currently hold a larger market share due to their straightforward methodology and immediate measurement of enzyme activity. However, Indirect Assays are gaining traction, particularly for complex enzymatic reactions or when direct measurement is challenging.

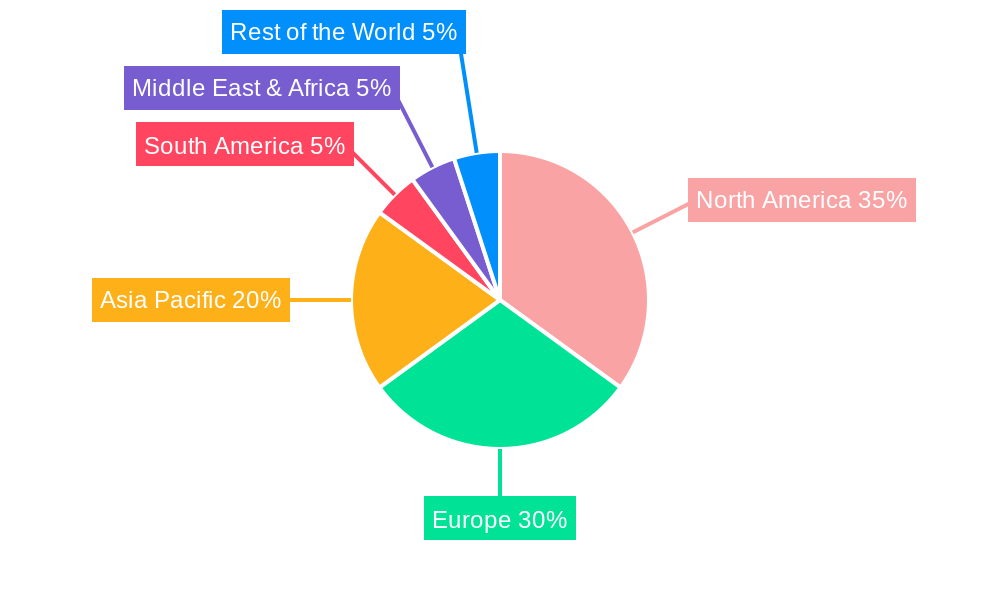

Geographically, North America currently dominates the enzyme activity assay service market, primarily due to the presence of a strong pharmaceutical and biotechnology hub, substantial government funding for research, and a high concentration of leading research institutions and CROs. The United States, in particular, is a powerhouse in drug development and boasts a robust ecosystem for assay services.

The Scientific Research segment also represents a significant and growing area, fueled by academic institutions and research organizations exploring fundamental biological processes, disease mechanisms, and novel biotechnological applications. While the individual project budgets in scientific research might be smaller than in drug development, the sheer volume of research activities contributes substantially to market demand.

Enzyme Activity Assay Service Product Developments

Product developments in the enzyme activity assay service market are characterized by a strong emphasis on enhanced sensitivity, specificity, and throughput. Innovations in assay design, such as the integration of advanced detection technologies like fluorescence and luminescence, allow for more precise quantification of enzyme activity even at low substrate concentrations. The development of multiplexed assays, enabling the simultaneous analysis of multiple enzymes from a single sample, significantly reduces assay time and sample volume requirements. Furthermore, there is a growing trend towards developing assays for novel or less characterized enzymes, catering to emerging research areas and rare diseases. These advancements offer competitive advantages by providing researchers and drug developers with more efficient, cost-effective, and informative tools for enzyme profiling and characterization.

Report Scope & Segmentation Analysis

This report segments the Enzyme Activity Assay Service market based on key applications and assay types. The Drug Development segment is projected to experience substantial growth, driven by the continuous need for enzyme characterization in preclinical and clinical stages of drug discovery and development. This segment is expected to contribute over 6,000 million to the market by 2025, with a projected CAGR of 13%. The Disease Diagnosis segment, while smaller, is anticipated to witness steady growth as advancements in diagnostic technologies increasingly incorporate enzyme-based biomarkers. This segment is estimated to reach over 1,500 million by 2025, with a CAGR of 10%. The Scientific Research segment is projected to remain a significant contributor, benefiting from ongoing academic and industrial research into fundamental biological mechanisms. This segment is expected to grow to over 2,500 million by 2025, with a CAGR of 11%.

In terms of assay types, Direct Assays currently represent a larger market share, estimated at over 7,000 million by 2025, due to their established methodologies and broad applicability. Indirect Assays, while holding a smaller current share, are expected to exhibit higher growth rates, driven by the need for analyzing complex enzymatic pathways and novel enzyme targets. This segment is projected to reach over 3,000 million by 2025, with a CAGR of 12%.

Key Drivers of Enzyme Activity Assay Service Growth

The growth of the enzyme activity assay service market is propelled by several key drivers. Technologically, advancements in sensitive detection methods, automation, and high-throughput screening platforms are enabling faster and more accurate enzyme analysis. Economically, the sustained high investment in pharmaceutical R&D, particularly in the biopharmaceutical sector, directly fuels demand for outsourced assay services. Regulatory factors, such as the increasing complexity of drug approval processes and the demand for robust data on enzyme interactions, also necessitate specialized assay services. Furthermore, the expanding research into enzyme function in disease pathogenesis and the growing interest in enzyme-based therapeutics and diagnostics are significant growth catalysts.

Challenges in the Enzyme Activity Assay Service Sector

Despite its growth, the enzyme activity assay service sector faces several challenges. Regulatory hurdles, including the need to comply with evolving Good Laboratory Practice (GLP) and Good Manufacturing Practice (GMP) standards, can be time-consuming and costly. Supply chain issues, particularly concerning the availability and cost of specialized reagents and enzymes, can impact service delivery and profitability. Intense competition among service providers can lead to price pressures, impacting profit margins. Furthermore, the development of novel and highly specific assays for rare enzymes or complex biological systems requires significant expertise and investment, posing a barrier to entry for smaller players. The need for continuous innovation to keep pace with scientific advancements also presents a challenge.

Emerging Opportunities in Enzyme Activity Assay Service

Emerging opportunities in the enzyme activity assay service market are abundant, particularly in the realm of personalized medicine and novel therapeutic modalities. The growing demand for companion diagnostics, which utilize enzyme activity to guide treatment decisions, presents a significant avenue for growth. The expansion of research into enzyme replacement therapies and gene therapies also requires sophisticated enzyme activity assessment. Furthermore, the increasing focus on the gut microbiome and its enzymatic activities offers new research and diagnostic possibilities. Advancements in point-of-care diagnostics leveraging enzyme activity assays also represent a promising, albeit developing, market. The integration of AI and machine learning for predictive assay optimization and data interpretation holds immense potential for streamlining research and improving outcomes.

Leading Players in the Enzyme Activity Assay Service Market

- Profacgen

- Creative BioMart Microbe

- Medicilon

- Creative Enzymes

- AMSBIO

- Merck Millipore

- Kymos

- Solis BioDyne

- Pacific BioLabs

- Thermo Fisher

Key Developments in Enzyme Activity Assay Service Industry

- 2024 (Q1): Profacgen launches a new suite of highly sensitive enzyme activity assays for oncology research, enhancing drug target validation capabilities.

- 2023 (Q4): Thermo Fisher Scientific acquires a leading provider of enzyme discovery and characterization services, expanding its comprehensive offerings.

- 2023 (Q2): Creative Enzymes develops novel multiplexed assay kits for analyzing a panel of metabolic enzymes, significantly reducing research time and cost.

- 2022 (Q4): AMSBIO introduces advanced assay services for studying enzyme kinetics in complex biological matrices, supporting drug discovery for challenging targets.

- 2022 (Q1): Medicilon expands its enzyme activity assay service portfolio to include a wider range of enzyme classes and custom assay development capabilities.

- 2021 (Q3): Merck Millipore releases a new generation of enzyme activity assay reagents with improved stability and signal amplification for increased sensitivity.

- 2020 (Q4): Solis BioDyne innovates with a proprietary enzyme immobilization technique, enhancing assay reproducibility and longevity for industrial applications.

- 2019 (Q2): Kymos enhances its enzyme activity assay services with advanced data analysis and interpretation, providing deeper biological insights to clients.

- 2019 (Q1): Pacific BioLabs invests in state-of-the-art robotic platforms to significantly increase throughput for routine enzyme activity testing.

Strategic Outlook for Enzyme Activity Assay Service Market

- 2024 (Q1): Profacgen launches a new suite of highly sensitive enzyme activity assays for oncology research, enhancing drug target validation capabilities.

- 2023 (Q4): Thermo Fisher Scientific acquires a leading provider of enzyme discovery and characterization services, expanding its comprehensive offerings.

- 2023 (Q2): Creative Enzymes develops novel multiplexed assay kits for analyzing a panel of metabolic enzymes, significantly reducing research time and cost.

- 2022 (Q4): AMSBIO introduces advanced assay services for studying enzyme kinetics in complex biological matrices, supporting drug discovery for challenging targets.

- 2022 (Q1): Medicilon expands its enzyme activity assay service portfolio to include a wider range of enzyme classes and custom assay development capabilities.

- 2021 (Q3): Merck Millipore releases a new generation of enzyme activity assay reagents with improved stability and signal amplification for increased sensitivity.

- 2020 (Q4): Solis BioDyne innovates with a proprietary enzyme immobilization technique, enhancing assay reproducibility and longevity for industrial applications.

- 2019 (Q2): Kymos enhances its enzyme activity assay services with advanced data analysis and interpretation, providing deeper biological insights to clients.

- 2019 (Q1): Pacific BioLabs invests in state-of-the-art robotic platforms to significantly increase throughput for routine enzyme activity testing.

Strategic Outlook for Enzyme Activity Assay Service Market

The strategic outlook for the enzyme activity assay service market remains highly positive, driven by sustained innovation and increasing demand across multiple sectors. The market's growth trajectory is set to be further accelerated by the confluence of advancements in biotechnology, personalized medicine, and diagnostic technologies. Companies focusing on developing highly specialized, sensitive, and multiplexed assay solutions will likely gain a competitive edge. Strategic partnerships, collaborations with academic institutions, and targeted acquisitions will be crucial for expanding service offerings, enhancing technological capabilities, and strengthening market presence. Emphasis on robust quality control, regulatory compliance, and customer-centric service delivery will be paramount for long-term success in this dynamic and evolving market.

Enzyme Activity Assay Service Segmentation

-

1. Application

- 1.1. Drug Development

- 1.2. Disease Diagnosis

- 1.3. Scientific Research

-

2. Types

- 2.1. Direct Assays

- 2.2. Indirect Assays

Enzyme Activity Assay Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Enzyme Activity Assay Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Enzyme Activity Assay Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Drug Development

- 5.1.2. Disease Diagnosis

- 5.1.3. Scientific Research

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Direct Assays

- 5.2.2. Indirect Assays

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Enzyme Activity Assay Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Drug Development

- 6.1.2. Disease Diagnosis

- 6.1.3. Scientific Research

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Direct Assays

- 6.2.2. Indirect Assays

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Enzyme Activity Assay Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Drug Development

- 7.1.2. Disease Diagnosis

- 7.1.3. Scientific Research

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Direct Assays

- 7.2.2. Indirect Assays

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Enzyme Activity Assay Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Drug Development

- 8.1.2. Disease Diagnosis

- 8.1.3. Scientific Research

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Direct Assays

- 8.2.2. Indirect Assays

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Enzyme Activity Assay Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Drug Development

- 9.1.2. Disease Diagnosis

- 9.1.3. Scientific Research

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Direct Assays

- 9.2.2. Indirect Assays

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Enzyme Activity Assay Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Drug Development

- 10.1.2. Disease Diagnosis

- 10.1.3. Scientific Research

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Direct Assays

- 10.2.2. Indirect Assays

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Profacgen

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Creative BioMart Microbe

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Medicilon

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Creative Enzymes

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AMSBIO

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Merck Millipore

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kymos

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Solis BioDyne

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pacific BioLabs

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Thermo Fisher

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Profacgen

List of Figures

- Figure 1: Global Enzyme Activity Assay Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Enzyme Activity Assay Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Enzyme Activity Assay Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Enzyme Activity Assay Service Revenue (million), by Types 2024 & 2032

- Figure 5: North America Enzyme Activity Assay Service Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Enzyme Activity Assay Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Enzyme Activity Assay Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Enzyme Activity Assay Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Enzyme Activity Assay Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Enzyme Activity Assay Service Revenue (million), by Types 2024 & 2032

- Figure 11: South America Enzyme Activity Assay Service Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Enzyme Activity Assay Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Enzyme Activity Assay Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Enzyme Activity Assay Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Enzyme Activity Assay Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Enzyme Activity Assay Service Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Enzyme Activity Assay Service Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Enzyme Activity Assay Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Enzyme Activity Assay Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Enzyme Activity Assay Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Enzyme Activity Assay Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Enzyme Activity Assay Service Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Enzyme Activity Assay Service Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Enzyme Activity Assay Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Enzyme Activity Assay Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Enzyme Activity Assay Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Enzyme Activity Assay Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Enzyme Activity Assay Service Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Enzyme Activity Assay Service Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Enzyme Activity Assay Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Enzyme Activity Assay Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Enzyme Activity Assay Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Enzyme Activity Assay Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Enzyme Activity Assay Service Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Enzyme Activity Assay Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Enzyme Activity Assay Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Enzyme Activity Assay Service Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Enzyme Activity Assay Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Enzyme Activity Assay Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Enzyme Activity Assay Service Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Enzyme Activity Assay Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Enzyme Activity Assay Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Enzyme Activity Assay Service Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Enzyme Activity Assay Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Enzyme Activity Assay Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Enzyme Activity Assay Service Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Enzyme Activity Assay Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Enzyme Activity Assay Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Enzyme Activity Assay Service Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Enzyme Activity Assay Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Enzyme Activity Assay Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Enzyme Activity Assay Service?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Enzyme Activity Assay Service?

Key companies in the market include Profacgen, Creative BioMart Microbe, Medicilon, Creative Enzymes, AMSBIO, Merck Millipore, Kymos, Solis BioDyne, Pacific BioLabs, Thermo Fisher.

3. What are the main segments of the Enzyme Activity Assay Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Enzyme Activity Assay Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Enzyme Activity Assay Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Enzyme Activity Assay Service?

To stay informed about further developments, trends, and reports in the Enzyme Activity Assay Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence