Key Insights

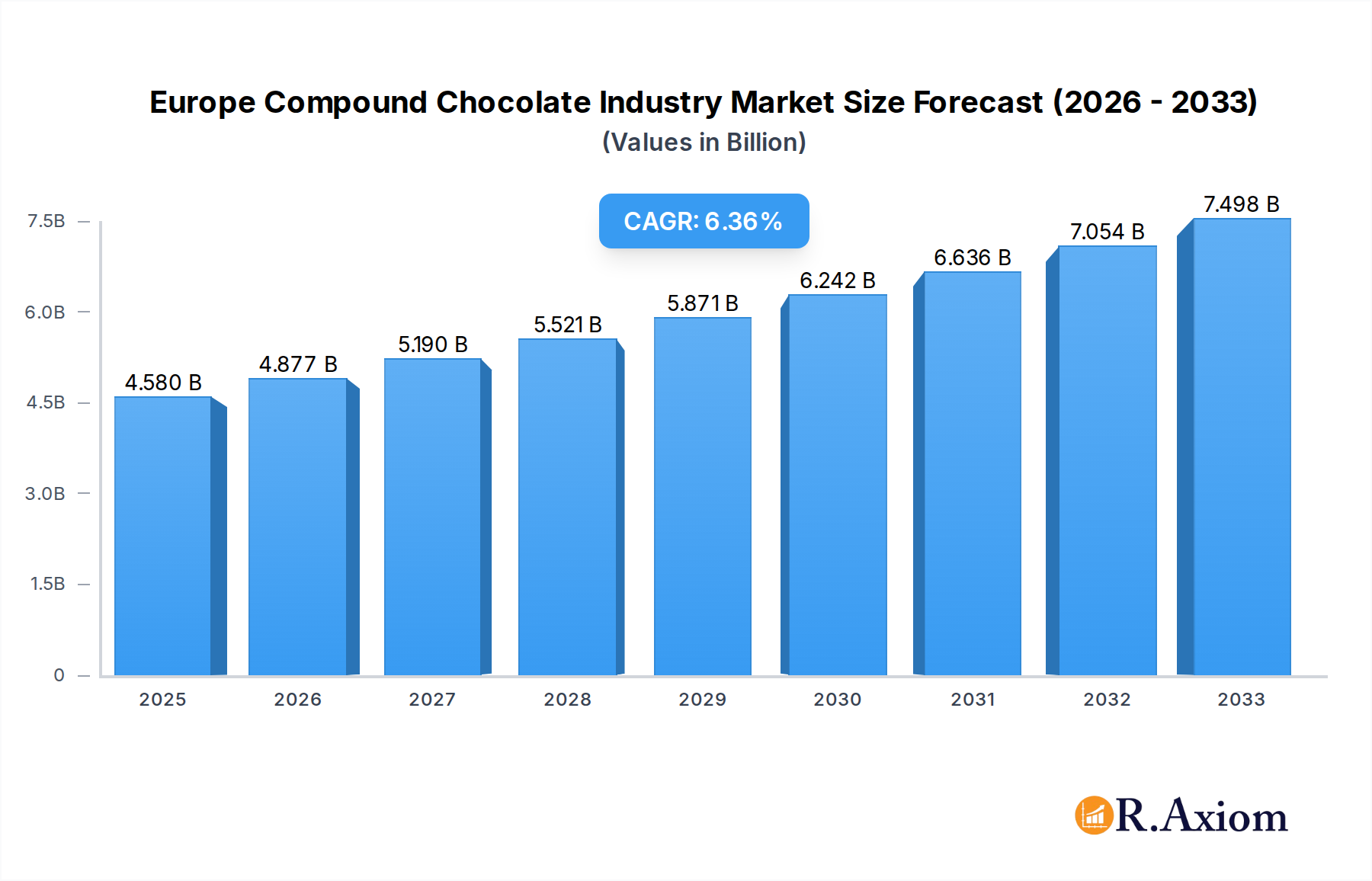

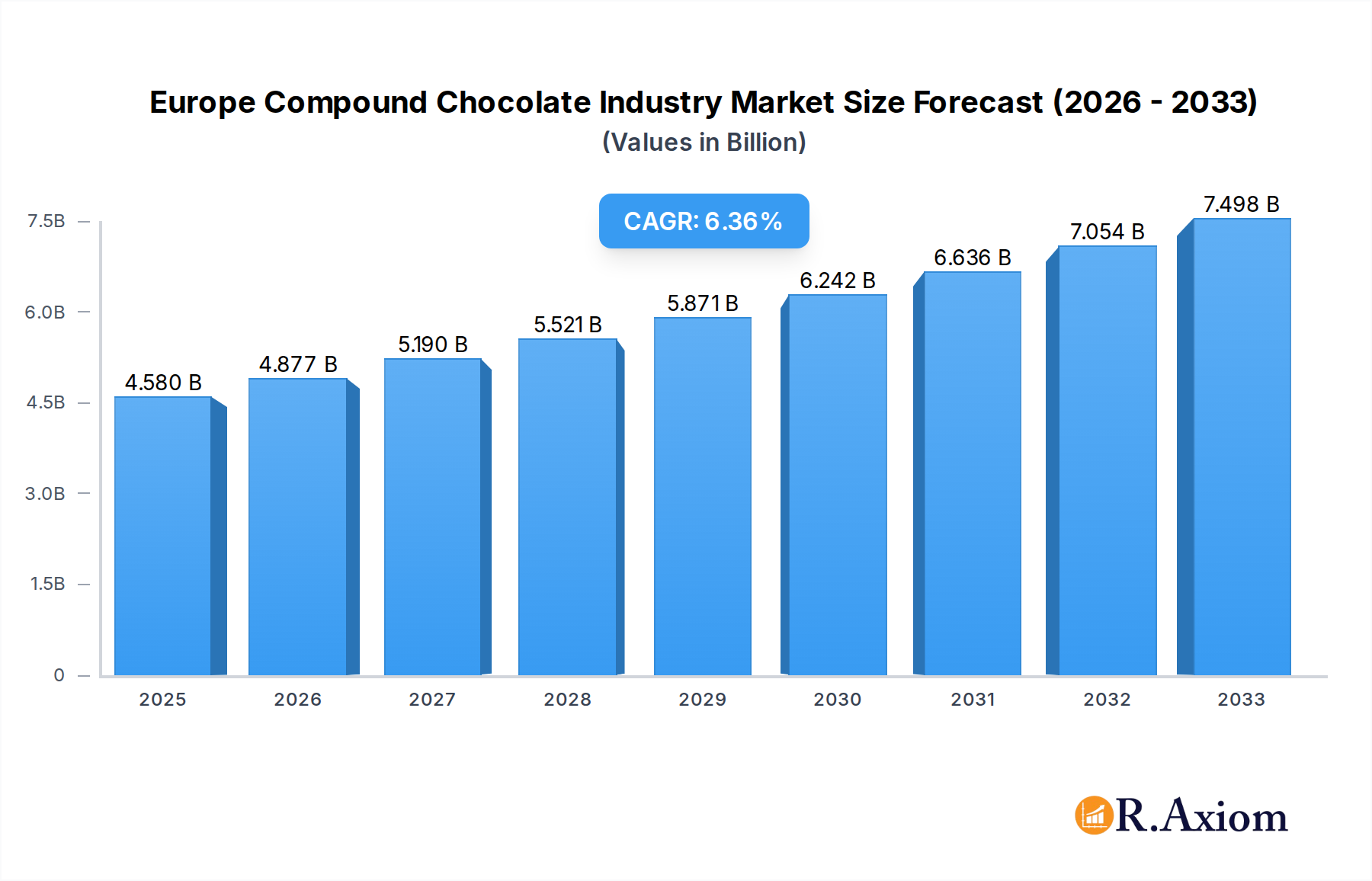

The Europe Compound Chocolate Industry is poised for significant expansion, projected to reach an estimated USD 4.58 billion in 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 6.58% throughout the forecast period (2025-2033). The industry's dynamism is driven by several key factors, including the increasing demand for convenience food products, particularly in the bakery and confectionery sectors, where compound chocolates offer cost-effectiveness and ease of use. Innovations in product formulations, such as the development of vegan and allergen-free compound chocolates, are also expanding consumer appeal and market reach. Furthermore, the rising popularity of premium and artisanal chocolate products, coupled with the growing influence of e-commerce in chocolate sales, are contributing to this upward trajectory.

Europe Compound Chocolate Industry Market Size (In Billion)

The compound chocolate market in Europe is further segmented by product type, with Milk/White chocolate variants and Dark chocolate holding substantial shares, catering to diverse consumer preferences. In terms of form, Chocolate Chips/Drops/Chunks are expected to dominate due to their widespread application in baking. The application landscape is diverse, with Bakery and Confectionery segments leading the demand, followed closely by Ice Cream and Frozen Desserts. While the market exhibits strong growth, certain restraints may emerge, such as fluctuating raw material prices for cocoa and sugar, and increasing regulatory scrutiny regarding sugar content and labeling. Despite these challenges, strategic investments in research and development, coupled with an emphasis on sustainable sourcing and ethical production practices by leading companies like The Barry Callebaut Group and Cargill Incorporated, are expected to mitigate these issues and ensure continued market prosperity.

Europe Compound Chocolate Industry Company Market Share

This comprehensive report delves into the dynamic Europe Compound Chocolate Industry, offering an in-depth analysis of market size, growth drivers, key trends, and future outlook. Covering the historical period from 2019 to 2024 and projecting forward to 2033, with a base year of 2025, this study provides invaluable insights for stakeholders, including manufacturers, suppliers, distributors, and investors. The Europe compound chocolate market is anticipated to reach $XX billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period.

Europe Compound Chocolate Industry Market Concentration & Innovation

The Europe Compound Chocolate Industry is characterized by a moderate to high level of market concentration, with a few dominant players holding significant market share. Leading entities such as The Barry Callebaut Group, Cargill Incorporated, and Puratos NV are at the forefront, driving innovation and shaping market dynamics. Innovation in this sector is primarily fueled by evolving consumer preferences for healthier, more sustainable, and ethically sourced ingredients, alongside technological advancements in processing and formulation. Key innovation drivers include:

- Product Differentiation: Development of compound chocolates with unique flavor profiles, functional ingredients (e.g., added vitamins, plant-based proteins), and improved textural properties.

- Sustainable Sourcing: Increased investment and transparency in cocoa sourcing to meet growing consumer demand for ethical and environmentally responsible products.

- Technological Advancements: Adoption of advanced manufacturing techniques to enhance efficiency, reduce costs, and improve product quality.

Regulatory frameworks, particularly concerning food safety, labeling, and ingredient standards, play a crucial role in shaping the industry's competitive landscape. Product substitutes, such as sugar-free chocolates or alternative confectionery ingredients, pose a growing challenge. End-user trends are increasingly shifting towards indulgence coupled with perceived health benefits and ethical considerations. Mergers and acquisitions (M&A) activities are significant, with deal values often reaching hundreds of millions of dollars, reflecting consolidation and strategic expansion. Notable M&A activities include the acquisition of Aalst Chocolate by Fuji Oil Europe.

Europe Compound Chocolate Industry Industry Trends & Insights

The Europe Compound Chocolate Industry is poised for significant expansion, driven by a confluence of robust market growth drivers, disruptive technological advancements, evolving consumer preferences, and an increasingly competitive landscape. The market is projected to witness a substantial upward trajectory, with a projected market size of $XX billion by 2033. This growth is underpinned by a healthy CAGR of XX% between the estimated year of 2025 and the forecast period ending in 2033. Historical data from 2019 to 2024 indicates a steady rise in demand, setting a strong foundation for future growth.

Key growth drivers for the Europe compound chocolate market include the increasing consumption of convenience foods and impulse purchases, where compound chocolates are a staple ingredient. The versatility of compound chocolate in various applications, from bakery and confectionery to ice cream and beverages, fuels its demand across diverse end-use industries. Furthermore, the rising disposable incomes across European nations contribute to increased consumer spending on premium and indulgence products, a category where compound chocolate plays a pivotal role.

Technological disruptions are revolutionizing the production and formulation of compound chocolates. Innovations in ingredient processing, such as improved emulsification techniques and the development of novel fat systems, are enabling manufacturers to create products with enhanced taste, texture, and shelf life. The integration of advanced automation and data analytics in manufacturing processes is optimizing production efficiency, reducing operational costs, and ensuring consistent product quality.

Consumer preferences are undergoing a significant transformation. There is a growing demand for compound chocolates that offer both indulgence and perceived health benefits. This has led to a surge in the development and marketing of products with reduced sugar content, added functional ingredients like fiber or protein, and plant-based formulations. Sustainability and ethical sourcing are no longer niche concerns; they are becoming mainstream purchasing criteria. Consumers are increasingly scrutinizing the origin of cocoa beans, demanding transparency in supply chains, and favoring brands committed to fair trade practices and environmental stewardship. This trend is pushing manufacturers to invest in sustainable cocoa sourcing initiatives, thereby building consumer trust and brand loyalty.

The competitive dynamics within the Europe compound chocolate industry are intensifying. Leading global players like The Barry Callebaut Group, Cargill Incorporated, and Puratos NV are continuously investing in research and development, expanding their product portfolios, and pursuing strategic acquisitions to enhance their market presence. Regional manufacturers are also leveraging their agility and understanding of local market nuances to carve out significant market shares. The industry is witnessing a rise in private-label brands and the entry of niche players focusing on specialized segments, such as vegan or allergen-free compound chocolates, further diversifying the competitive landscape. Market penetration is expected to deepen across all application segments, driven by product innovation and targeted marketing strategies aimed at capitalizing on evolving consumer needs and preferences.

Dominant Markets & Segments in Europe Compound Chocolate Industry

The Europe Compound Chocolate Industry exhibits distinct dominance across various geographical regions and product segments, shaped by economic policies, infrastructure development, and evolving consumer behaviors. Germany emerges as a leading market, driven by its robust industrial base, significant per capita consumption of confectionery products, and a strong demand from its substantial bakery and ice cream sectors. The country's advanced manufacturing infrastructure and a consumer base that values quality and innovation contribute to its leadership position. Other significant markets include the United Kingdom, France, and Italy, each with its unique consumption patterns and industrial applications.

Within the Type segmentation, Milk/White compound chocolates command a substantial market share. This dominance is attributed to their widespread appeal in confectioneries, bakery fillings, and as a versatile ingredient in dairy-based desserts. Their inherent sweetness and milder flavor profile make them a preferred choice for a broad consumer base, including children and adults. However, Dark compound chocolates are experiencing robust growth, fueled by increasing consumer awareness of potential health benefits associated with dark chocolate and a growing preference for richer, more intense flavor profiles in premium products.

In terms of Form, Chocolate Chips/Drops/Chunks represent a dominant segment. Their convenience and ease of use make them indispensable ingredients in bakery applications, including cookies, muffins, and cakes, as well as in ice cream toppings and granola bars. The Chocolate Coatings segment also holds significant importance, catering to the confectionery industry for enrobing candies, biscuits, and other sweet treats, providing both aesthetic appeal and a satisfying textural contrast. Chocolate Slab forms are crucial for direct consumption and in artisanal chocolate making, while Other Forms, such as buttons and callets, cater to specific industrial and artisanal needs.

The Application segmentation reveals Confectionery as the largest end-use sector. Compound chocolate is a fundamental ingredient in a vast array of confectionery products, from bars and truffles to candies and seasonal treats. The Bakery segment is another major contributor, utilizing compound chocolate in cakes, pastries, bread, and fillings. The Ice Cream and Frozen Desserts sector is a significant growth area, with compound chocolate being used as inclusions, swirls, and coatings to enhance flavor and texture. The Beverages segment, particularly in hot chocolate and specialty coffee drinks, also presents a growing demand. Cereals and Other Applications, including industrial baking mixes and decorative elements, further diversify the market.

Key drivers for the dominance of these segments include:

- Economic Policies: Favorable trade agreements and stable economic conditions in leading European nations boost disposable income, leading to higher consumption of confectionery and baked goods.

- Infrastructure Development: Well-established logistics and supply chains ensure efficient distribution of compound chocolate ingredients across the continent, supporting the growth of all application segments.

- Consumer Preferences: The ingrained cultural appreciation for sweet treats and a growing interest in premium and innovative dessert options continue to drive demand across all application categories.

- Product Innovation: Manufacturers continuously innovate within each segment, offering specialized compound chocolates tailored to the specific requirements of bakers, chocolatiers, and ice cream producers, thereby solidifying their dominance.

Europe Compound Chocolate Industry Product Developments

Product innovation in the Europe Compound Chocolate Industry is primarily focused on enhancing nutritional profiles, improving sustainability, and expanding sensory experiences. Manufacturers are actively developing compound chocolates with reduced sugar content, incorporating functional ingredients like plant-based proteins and fibers to cater to the health-conscious consumer. The demand for vegan and dairy-free options is driving the development of innovative plant-based chocolate alternatives. Furthermore, there is a growing emphasis on the ethical sourcing of cocoa beans, with companies investing in transparent supply chains and fair-trade practices, which translates into product claims that resonate with environmentally aware consumers. Competitive advantages are increasingly derived from unique flavor combinations, novel textural attributes, and certifications related to sustainability and health.

Report Scope & Segmentation Analysis

This report provides a granular analysis of the Europe Compound Chocolate Industry, segmented by Type, Form, and Application. The Type segmentation includes Dark, Milk/White compound chocolates, and their respective market sizes and growth projections. The Form segmentation covers Chocolate Chips/Drops/Chunks, Chocolate Slab, Chocolate Coatings, and Other Forms, detailing their market penetration and competitive dynamics. The Application segmentation examines Bakery, Confectionery, Ice Cream and Frozen Desserts, Beverages, Cereals, and Other Applications, outlining their respective growth forecasts and market share within the broader industry. Each segment's analysis is informed by current market trends and future demand estimations, providing a comprehensive view of the industry's structure and potential.

Key Drivers of Europe Compound Chocolate Industry Growth

The Europe Compound Chocolate Industry's growth is propelled by several interconnected factors. Rising consumer demand for indulgence and convenience is a primary driver, with compound chocolate being a staple in numerous popular food products. Increasing health consciousness is paradoxically driving innovation towards healthier formulations, such as reduced-sugar and plant-based options, expanding market appeal. Technological advancements in manufacturing and formulation enable cost-effective production and the creation of novel textures and flavors. Growing emphasis on sustainable and ethical sourcing is a significant trend, with consumers actively seeking out brands that align with their values, prompting greater investment in responsible supply chains.

Challenges in the Europe Compound Chocolate Industry Sector

Despite robust growth, the Europe Compound Chocolate Industry faces several challenges. Volatility in cocoa bean prices due to climatic conditions, geopolitical instability, and agricultural challenges poses a significant economic restraint. Increasing regulatory scrutiny regarding food safety, labeling, and the use of certain ingredients can impact production costs and product development. Intense competition from both established players and emerging niche brands necessitates continuous innovation and strategic pricing. Supply chain disruptions, as experienced globally, can impact the availability and cost of raw materials. Negative consumer perceptions regarding the health aspects of chocolate, particularly regarding sugar content, require ongoing efforts in product reformulation and consumer education.

Emerging Opportunities in Europe Compound Chocolate Industry

The Europe Compound Chocolate Industry is ripe with emerging opportunities. The expanding market for plant-based and vegan alternatives presents a significant avenue for growth, catering to a rapidly growing consumer segment. Innovations in functional ingredients, such as adaptogens and prebiotics, incorporated into compound chocolates, offer opportunities for health-focused product development. The increasing demand for personalized and premium confectionery experiences opens doors for artisanal and specialty compound chocolate offerings. Furthermore, growth in emerging European economies and the increasing adoption of compound chocolate in diverse applications like savory dishes and beverages signal untapped market potential.

Leading Players in the Europe Compound Chocolate Industry Market

- Cargill Incorporated

- Aalst Chocolate Pte Ltd

- Flanders Filings & Compounds (backed by Fuji Oil Europe)

- Sephra LP

- The Barry Callebaut Group

- Puratos NV

- Clasen Quality Chocolate

- AAK

Key Developments in Europe Compound Chocolate Industry Industry

- 2021: Acquisition of Aalst Chocolate by Fuji Oil Europe, a strategic move to expand Fuji Oil's global confectionery ingredients business and strengthen its presence in the European market.

- Ongoing: Launch of new dark chocolate products with health claims by leading manufacturers, responding to growing consumer interest in dark chocolate's perceived health benefits and the demand for functional ingredients.

- Ongoing: Investment in sustainable cocoa sourcing initiatives by industry players, driven by increasing consumer and regulatory pressure for ethical and environmentally responsible practices in the cocoa supply chain.

Strategic Outlook for Europe Compound Chocolate Industry Market

The strategic outlook for the Europe Compound Chocolate Industry remains highly positive, driven by an evolving consumer landscape and persistent demand for indulgent yet increasingly health-conscious and sustainably produced confectionery. Key growth catalysts include the continued expansion of the plant-based and vegan compound chocolate segment, capitalizing on rising ethical and environmental concerns. Innovations in functional ingredient integration, offering added health benefits beyond basic nutrition, will further differentiate products and capture niche markets. The industry's ability to adapt to evolving regulatory requirements and supply chain challenges through robust risk management and diversification strategies will be crucial. Ultimately, a focus on premiumization, transparent sourcing, and innovative product development will cement the sector's growth trajectory, promising significant market potential and attractive opportunities for stakeholders.

Europe Compound Chocolate Industry Segmentation

-

1. Type

- 1.1. Dark

- 1.2. Milk/White

-

2. Form

- 2.1. Chocolate Chips/Drops/Chunks

- 2.2. Chocolate Slab

- 2.3. Chocolate Coatings

- 2.4. Other Forms

-

3. Application

- 3.1. Bakery

- 3.2. Confectionery

- 3.3. Ice Cream and Frozen Desserts

- 3.4. Beverages

- 3.5. Cereals

- 3.6. Other Applications

Europe Compound Chocolate Industry Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. United Kingdom

- 1.3. France

- 1.4. Russia

- 1.5. Italy

- 1.6. Spain

- 1.7. Rest of Europe

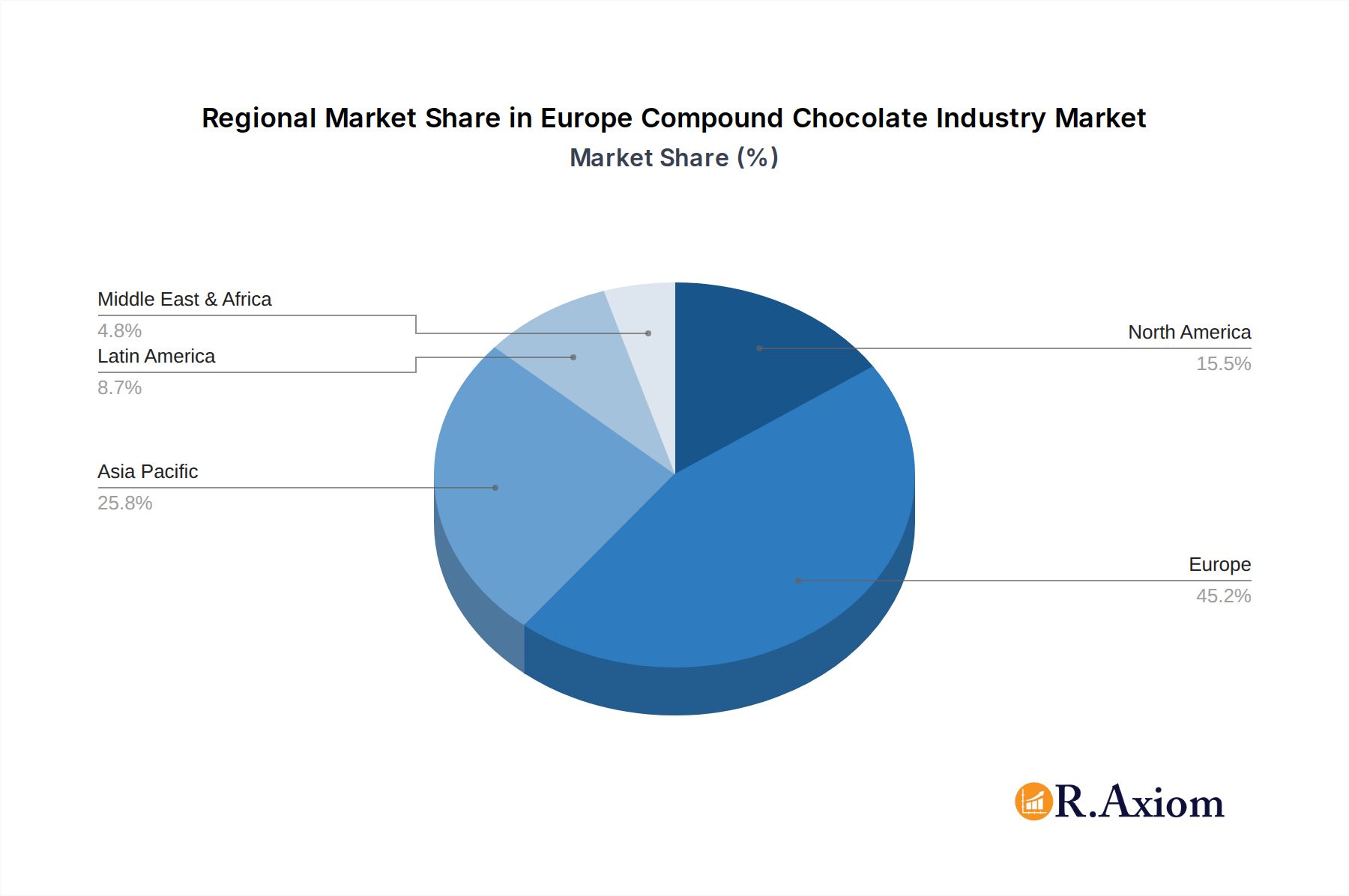

Europe Compound Chocolate Industry Regional Market Share

Geographic Coverage of Europe Compound Chocolate Industry

Europe Compound Chocolate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.58% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Dark Compound Chocolate Becoming the Fastest Growing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Compound Chocolate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Dark

- 5.1.2. Milk/White

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Chocolate Chips/Drops/Chunks

- 5.2.2. Chocolate Slab

- 5.2.3. Chocolate Coatings

- 5.2.4. Other Forms

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Bakery

- 5.3.2. Confectionery

- 5.3.3. Ice Cream and Frozen Desserts

- 5.3.4. Beverages

- 5.3.5. Cereals

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cargill Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aalst Chocolate Pte Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Flanders Filings & Compounds (backed by Fuji Oil Europe)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sephra LP

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Barry Callebaut Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Puratos NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Clasen Quality Chocolate*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AAK

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Cargill Incorporated

List of Figures

- Figure 1: Europe Compound Chocolate Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Compound Chocolate Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Compound Chocolate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Compound Chocolate Industry Revenue billion Forecast, by Form 2020 & 2033

- Table 3: Europe Compound Chocolate Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Europe Compound Chocolate Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Compound Chocolate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Europe Compound Chocolate Industry Revenue billion Forecast, by Form 2020 & 2033

- Table 7: Europe Compound Chocolate Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Europe Compound Chocolate Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Germany Europe Compound Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Europe Compound Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Compound Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Russia Europe Compound Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Italy Europe Compound Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Spain Europe Compound Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Europe Compound Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Compound Chocolate Industry?

The projected CAGR is approximately 6.58%.

2. Which companies are prominent players in the Europe Compound Chocolate Industry?

Key companies in the market include Cargill Incorporated, Aalst Chocolate Pte Ltd, Flanders Filings & Compounds (backed by Fuji Oil Europe), Sephra LP, The Barry Callebaut Group, Puratos NV, Clasen Quality Chocolate*List Not Exhaustive, AAK.

3. What are the main segments of the Europe Compound Chocolate Industry?

The market segments include Type, Form, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.58 billion as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Dark Compound Chocolate Becoming the Fastest Growing Market.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

1. Acquisition of Aalst Chocolate by Fuji Oil Europe in 2021 2. Launch of new dark chocolate products with health claims by leading manufacturers 3. Investment in sustainable cocoa sourcing initiatives by industry players

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Compound Chocolate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Compound Chocolate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Compound Chocolate Industry?

To stay informed about further developments, trends, and reports in the Europe Compound Chocolate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence