Key Insights

The European digestive health supplements market is projected to reach €2.95 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 6.17% from 2025 to 2033. This significant growth is attributed to increasing consumer awareness of digestive health issues, including the rising incidence of conditions such as Irritable Bowel Syndrome (IBS) and lactose intolerance. Heightened health consciousness across Europe, alongside a growing understanding of the gut-brain axis and the impact of gut microbiota on overall wellness, are further driving market expansion. The market benefits from a diverse and expanding product portfolio, encompassing prebiotics, probiotics, enzymes, and specialized formulations. Enhanced accessibility through e-commerce platforms, alongside traditional distribution channels like supermarkets and pharmacies, is also contributing to market growth. Key market participants are actively engaged in research and development to launch innovative products.

Europe Digestive Health Supplements Market Market Size (In Billion)

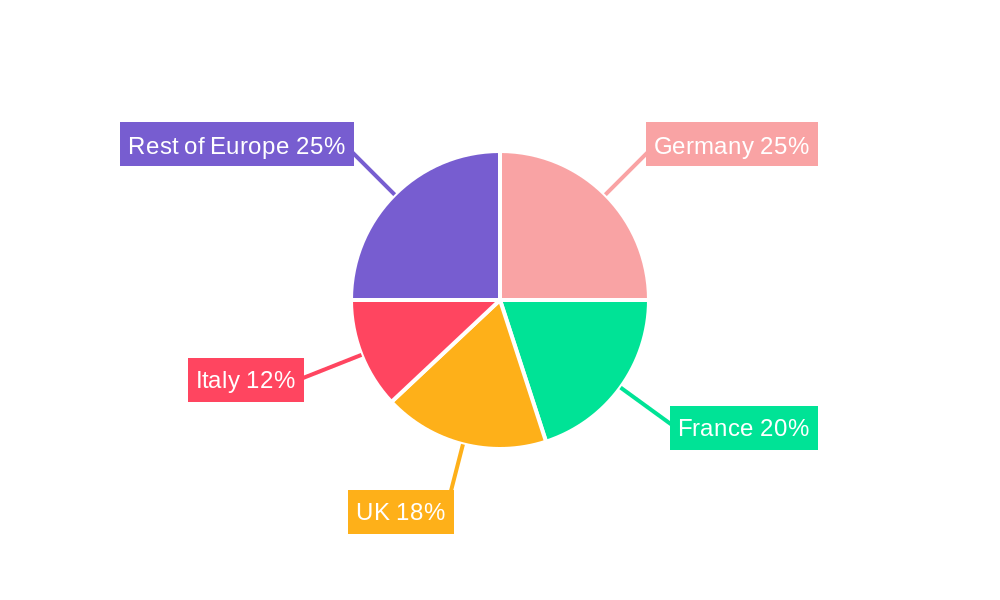

Market segmentation indicates substantial demand for probiotics and prebiotics, recognized for their effectiveness in enhancing digestive function. Geographically, leading European economies such as Germany, France, the UK, and Italy demonstrate robust market performance, supported by high healthcare spending and widespread consumer awareness. Potential challenges include navigating regulatory approvals for novel products and managing raw material price fluctuations. Nevertheless, the European digestive health supplements market presents a promising outlook, driven by ongoing scientific advancements, product innovation, and a proactive approach to preventative healthcare, offering significant opportunities for market stakeholders.

Europe Digestive Health Supplements Market Company Market Share

Europe Digestive Health Supplements Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Digestive Health Supplements Market, covering the period 2019-2033. With a focus on market size, segmentation, competitive landscape, and future growth prospects, this report is an essential resource for industry stakeholders, investors, and market researchers. The study period spans from 2019 to 2033, with 2025 serving as both the base year and estimated year. The forecast period extends from 2025 to 2033, while the historical period covers 2019-2024.

Europe Digestive Health Supplements Market Concentration & Innovation

This section analyzes the level of market concentration within the European digestive health supplements sector, identifying key players and their respective market shares (precise figures unavailable, estimated at xx%). We examine the role of innovation, including the development of new product formulations (e.g., vegan gummies, capsules), technological advancements in manufacturing and delivery systems, and the impact of regulatory frameworks on market dynamics. The report also explores the presence of substitute products, prevalent end-user trends (e.g., increasing health consciousness, demand for convenient formats), and significant mergers & acquisitions (M&A) activities within the market, including deal values (estimated at xx Million). The competitive landscape is further analyzed through a Porter's Five Forces framework.

- Market Concentration: Highly fragmented, with a few major players holding significant shares but numerous smaller players contributing to the overall market volume.

- Innovation Drivers: Growing consumer awareness of gut health, advancements in probiotic strains, and the rise of convenient delivery formats.

- Regulatory Framework: EU regulations on food supplements and health claims influence product development and marketing strategies.

- Product Substitutes: Traditional remedies, dietary changes, and other functional foods compete with supplements.

- End-User Trends: Increased demand for natural, organic, and vegan products.

- M&A Activities: Consolidation is expected with larger companies acquiring smaller innovative firms, with deal values predicted to reach xx Million in the coming years.

Europe Digestive Health Supplements Market Industry Trends & Insights

This section delves into the key trends shaping the European digestive health supplements market. We examine market growth drivers (estimated CAGR of xx% during the forecast period), exploring factors such as rising consumer awareness of gut health’s role in overall well-being, increasing prevalence of digestive disorders, and the growing popularity of personalized nutrition. The analysis also covers technological disruptions impacting product development and distribution, including e-commerce expansion and advancements in prebiotic and probiotic research. Market penetration rates are examined across different product types and distribution channels. Competitive dynamics, including pricing strategies and marketing efforts, are also thoroughly assessed. Consumer preferences, notably towards natural ingredients, specific delivery formats (e.g., gummies), and tailored solutions, heavily influence market trends.

Dominant Markets & Segments in Europe Digestive Health Supplements Market

This section pinpoints the leading regions, countries, and segments within the European digestive health supplements market. The analysis identifies the dominant segments by product type (prebiotics, probiotics, enzymes, other types) and distribution channel (supermarkets/hypermarkets, pharmacies and drugstores, online retailers, other distribution channels). Key drivers for each dominant segment are highlighted using bullet points, followed by a detailed dominance analysis through paragraphs. For instance, the growth of online retailers is analyzed in the context of e-commerce penetration and consumer behavior.

- By Product Type: Probiotics are expected to remain dominant due to established consumer acceptance and extensive research.

- By Distribution Channel: Online retailers show the highest growth potential driven by increasing e-commerce adoption, consumer convenience, and targeted marketing opportunities.

Key Drivers:

- Germany: Strong consumer base, established health and wellness market.

- UK: High consumer spending on health and wellness products, developed e-commerce infrastructure.

- France: Growing interest in natural and organic supplements.

Europe Digestive Health Supplements Market Product Developments

Recent years have witnessed significant innovations in digestive health supplements, including the introduction of novel delivery systems (e.g., gummies, targeted release capsules) and improved formulations utilizing advanced probiotic strains with enhanced efficacy. Technological trends such as personalized nutrition and microbiome analysis are driving product development, allowing for tailored solutions catering to specific consumer needs and health goals. These developments create competitive advantages for companies offering differentiated products.

Report Scope & Segmentation Analysis

This report comprehensively segments the Europe Digestive Health Supplements Market by product type (prebiotics, probiotics, enzymes, other types) and distribution channel (supermarkets/hypermarkets, pharmacies and drugstores, online retailers, other distribution channels). Each segment's growth projections, market sizes (in Million), and competitive dynamics are analyzed. For instance, the probiotics segment is further explored with respect to different bacterial strains and their respective applications, while the online retail channel is assessed based on factors like website traffic, online sales data, and digital marketing strategies. Each segment's market size is projected from 2025 to 2033, with estimations for each year provided.

Key Drivers of Europe Digestive Health Supplements Market Growth

Several factors contribute to the growth of the European digestive health supplements market. Increasing awareness of gut health's importance, rising prevalence of digestive disorders, and growing consumer demand for natural and functional foods are key drivers. Additionally, technological advancements in probiotic research and delivery systems are continuously improving product efficacy and consumer acceptance. Government regulations encouraging healthier lifestyles also contribute to the market's expansion.

Challenges in the Europe Digestive Health Supplements Market Sector

The European digestive health supplements market faces certain challenges, including strict regulatory requirements for product labeling and health claims. Supply chain disruptions and fluctuating raw material prices can also impact profitability. Intense competition among numerous players and maintaining consumer trust in the face of conflicting information pose significant hurdles.

Emerging Opportunities in Europe Digestive Health Supplements Market

The market presents several emerging opportunities, including the growing demand for personalized nutrition and the integration of digital health technologies. Expanding into new market segments, such as children’s digestive health and specialized formulations for specific conditions, offers significant potential. The development of novel delivery systems and the utilization of AI-driven insights to improve product efficacy and personalization represent key opportunities.

Leading Players in the Europe Digestive Health Supplements Market Market

- Herbalife Nutrition Ltd (Herbalife Nutrition Ltd)

- Bayer AG (Bayer AG)

- Probi AB (Probi AB)

- Purolabs Nutrition Ltd

- Amway (Amway)

- BioGaia (BioGaia)

- The Really Healthy Company

- Pfizer Inc (Pfizer Inc)

- Bulk Powders

Key Developments in Europe Digestive Health Supplements Market Industry

- February 2022: Optibac Probiotics launched its first vegan gummy, impacting the market with a convenient and appealing format.

- October 2021: Vegums expanded into Germany, signaling further European market penetration.

- March 2019: BioGaia Protectis capsules were launched in the European market, increasing product variety.

Strategic Outlook for Europe Digestive Health Supplements Market Market

The European digestive health supplements market is poised for continued growth, driven by increasing consumer awareness, technological advancements, and the expanding e-commerce sector. Future market potential is high, especially in the segments of personalized nutrition and functional foods. Companies adopting innovative strategies focused on product differentiation, targeted marketing, and strong supply chain management will be well-positioned to capitalize on the market's growth opportunities.

Europe Digestive Health Supplements Market Segmentation

-

1. Product Type

- 1.1. Prebiotics

- 1.2. Probiotics

- 1.3. Enzymes

- 1.4. Other Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Pharmacies and Drugstores

- 2.3. Online Retailers

- 2.4. Other Distribution Channel

Europe Digestive Health Supplements Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. Spain

- 4. France

- 5. Italy

- 6. Russia

- 7. Rest of Europe

Europe Digestive Health Supplements Market Regional Market Share

Geographic Coverage of Europe Digestive Health Supplements Market

Europe Digestive Health Supplements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularity of Convenient and On the Go Snacking Options; Product Differentiation Playing a Key Role in Market Expansion

- 3.3. Market Restrains

- 3.3.1. Associated Health Risks; Easy Availability of Healthy Substitutes

- 3.4. Market Trends

- 3.4.1. Consumers Awareness Regarding Gut Health

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Prebiotics

- 5.1.2. Probiotics

- 5.1.3. Enzymes

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Pharmacies and Drugstores

- 5.2.3. Online Retailers

- 5.2.4. Other Distribution Channel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. Spain

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom Europe Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Prebiotics

- 6.1.2. Probiotics

- 6.1.3. Enzymes

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Pharmacies and Drugstores

- 6.2.3. Online Retailers

- 6.2.4. Other Distribution Channel

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Germany Europe Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Prebiotics

- 7.1.2. Probiotics

- 7.1.3. Enzymes

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Pharmacies and Drugstores

- 7.2.3. Online Retailers

- 7.2.4. Other Distribution Channel

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Spain Europe Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Prebiotics

- 8.1.2. Probiotics

- 8.1.3. Enzymes

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Pharmacies and Drugstores

- 8.2.3. Online Retailers

- 8.2.4. Other Distribution Channel

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. France Europe Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Prebiotics

- 9.1.2. Probiotics

- 9.1.3. Enzymes

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Pharmacies and Drugstores

- 9.2.3. Online Retailers

- 9.2.4. Other Distribution Channel

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Italy Europe Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Prebiotics

- 10.1.2. Probiotics

- 10.1.3. Enzymes

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Pharmacies and Drugstores

- 10.2.3. Online Retailers

- 10.2.4. Other Distribution Channel

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Russia Europe Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Prebiotics

- 11.1.2. Probiotics

- 11.1.3. Enzymes

- 11.1.4. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Supermarkets/Hypermarkets

- 11.2.2. Pharmacies and Drugstores

- 11.2.3. Online Retailers

- 11.2.4. Other Distribution Channel

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Europe Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Prebiotics

- 12.1.2. Probiotics

- 12.1.3. Enzymes

- 12.1.4. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Supermarkets/Hypermarkets

- 12.2.2. Pharmacies and Drugstores

- 12.2.3. Online Retailers

- 12.2.4. Other Distribution Channel

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Herbalife Nutrition Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Bayer AG

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Probi AB

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Purolabs Nutrition Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Amway

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 BioGaia

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 The Really Healthy Company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Pfizer Inc *List Not Exhaustive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Bulk Powders

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Herbalife Nutrition Ltd

List of Figures

- Figure 1: Europe Digestive Health Supplements Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Digestive Health Supplements Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Digestive Health Supplements Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Europe Digestive Health Supplements Market Volume Liters Forecast, by Product Type 2020 & 2033

- Table 3: Europe Digestive Health Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Digestive Health Supplements Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 5: Europe Digestive Health Supplements Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Digestive Health Supplements Market Volume Liters Forecast, by Region 2020 & 2033

- Table 7: Europe Digestive Health Supplements Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Europe Digestive Health Supplements Market Volume Liters Forecast, by Product Type 2020 & 2033

- Table 9: Europe Digestive Health Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Europe Digestive Health Supplements Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 11: Europe Digestive Health Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe Digestive Health Supplements Market Volume Liters Forecast, by Country 2020 & 2033

- Table 13: Europe Digestive Health Supplements Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Europe Digestive Health Supplements Market Volume Liters Forecast, by Product Type 2020 & 2033

- Table 15: Europe Digestive Health Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 16: Europe Digestive Health Supplements Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 17: Europe Digestive Health Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Europe Digestive Health Supplements Market Volume Liters Forecast, by Country 2020 & 2033

- Table 19: Europe Digestive Health Supplements Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Europe Digestive Health Supplements Market Volume Liters Forecast, by Product Type 2020 & 2033

- Table 21: Europe Digestive Health Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 22: Europe Digestive Health Supplements Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 23: Europe Digestive Health Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Digestive Health Supplements Market Volume Liters Forecast, by Country 2020 & 2033

- Table 25: Europe Digestive Health Supplements Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: Europe Digestive Health Supplements Market Volume Liters Forecast, by Product Type 2020 & 2033

- Table 27: Europe Digestive Health Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: Europe Digestive Health Supplements Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 29: Europe Digestive Health Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Europe Digestive Health Supplements Market Volume Liters Forecast, by Country 2020 & 2033

- Table 31: Europe Digestive Health Supplements Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 32: Europe Digestive Health Supplements Market Volume Liters Forecast, by Product Type 2020 & 2033

- Table 33: Europe Digestive Health Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 34: Europe Digestive Health Supplements Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 35: Europe Digestive Health Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Europe Digestive Health Supplements Market Volume Liters Forecast, by Country 2020 & 2033

- Table 37: Europe Digestive Health Supplements Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 38: Europe Digestive Health Supplements Market Volume Liters Forecast, by Product Type 2020 & 2033

- Table 39: Europe Digestive Health Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 40: Europe Digestive Health Supplements Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 41: Europe Digestive Health Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Europe Digestive Health Supplements Market Volume Liters Forecast, by Country 2020 & 2033

- Table 43: Europe Digestive Health Supplements Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 44: Europe Digestive Health Supplements Market Volume Liters Forecast, by Product Type 2020 & 2033

- Table 45: Europe Digestive Health Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 46: Europe Digestive Health Supplements Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 47: Europe Digestive Health Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Europe Digestive Health Supplements Market Volume Liters Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Digestive Health Supplements Market?

The projected CAGR is approximately 6.17%.

2. Which companies are prominent players in the Europe Digestive Health Supplements Market?

Key companies in the market include Herbalife Nutrition Ltd, Bayer AG, Probi AB, Purolabs Nutrition Ltd, Amway, BioGaia, The Really Healthy Company, Pfizer Inc *List Not Exhaustive, Bulk Powders.

3. What are the main segments of the Europe Digestive Health Supplements Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.95 billion as of 2022.

5. What are some drivers contributing to market growth?

Popularity of Convenient and On the Go Snacking Options; Product Differentiation Playing a Key Role in Market Expansion.

6. What are the notable trends driving market growth?

Consumers Awareness Regarding Gut Health.

7. Are there any restraints impacting market growth?

Associated Health Risks; Easy Availability of Healthy Substitutes.

8. Can you provide examples of recent developments in the market?

In February 2022, Optibac Probiotics launched its first vegan gummy to support gut health and immune health among adults. The gummies are a mixed berry all-in-one supplement that contains probiotic strain bacillus coagulans unique IS-2, as well as daily doses of vitamin D, zinc, and calcium.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Liters.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Digestive Health Supplements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Digestive Health Supplements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Digestive Health Supplements Market?

To stay informed about further developments, trends, and reports in the Europe Digestive Health Supplements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence