Key Insights

The European digital forensics market is projected to exhibit significant expansion, propelled by the escalating incidence of cybercrime, stringent data privacy mandates such as GDPR, and the widespread adoption of cloud computing and mobile technologies. The market, valued at $2.19 billion in 2025, is anticipated to achieve a robust Compound Annual Growth Rate (CAGR) of 10.25% during the forecast period (2025-2033). This growth trajectory is underpinned by the escalating demand for advanced cybersecurity solutions across critical sectors including government, law enforcement, BFSI, and IT & telecommunications. The increasing sophistication of cyber threats and their resultant legal implications are further stimulating the need for cutting-edge digital forensics capabilities. Mobile forensics, in particular, is experiencing accelerated growth due to the pervasive use of smartphones and the vast quantities of sensitive data they contain.

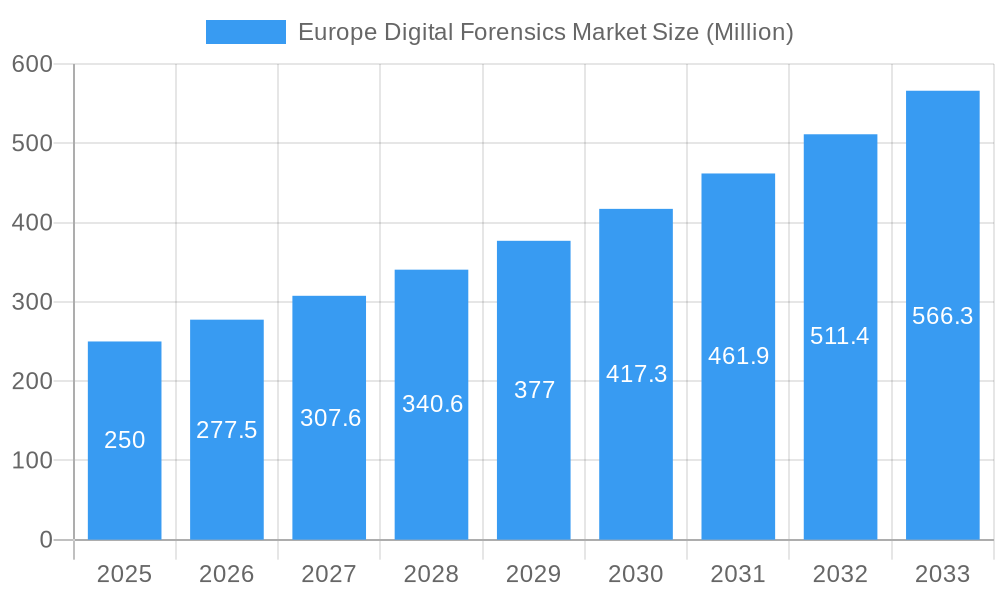

Europe Digital Forensics Market Market Size (In Billion)

Key market drivers include heightened awareness of data breach impacts and the evolving nature of cybercriminal tactics. While the market encounters challenges such as the cost of specialized tools and a scarcity of skilled professionals, these are being addressed through technological innovations like AI-driven forensics and scalable, cost-effective cloud-based platforms. Germany, France, and the UK are leading European markets, owing to their advanced digital infrastructure and strong legal frameworks for digital evidence. The competitive environment features established entities such as IBM and PwC, alongside specialized firms like Nuix and MSAB, signifying a dynamic market ripe with opportunities for established and nascent companies.

Europe Digital Forensics Market Company Market Share

Europe Digital Forensics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Digital Forensics Market, covering the period 2019-2033. It offers actionable insights for industry stakeholders, investors, and businesses operating in this dynamic sector. The report leverages detailed market segmentation, competitive analysis, and key industry developments to paint a clear picture of current market dynamics and future growth projections. The Base Year for this report is 2025, with estimations for 2025 and forecasts extending to 2033, and historical data spanning 2019-2024.

Europe Digital Forensics Market Concentration & Innovation

The Europe Digital Forensics Market exhibits a moderately consolidated structure, with several key players holding significant market share. However, the presence of numerous smaller specialized firms indicates a competitive landscape with opportunities for both established players and new entrants. Innovation is driven by the constant evolution of digital technologies, necessitating continuous advancements in forensic techniques and tools. The market witnesses significant mergers and acquisitions (M&A) activity, further shaping market concentration. For instance, the acquisition of Eurofins Forensics Services' digital forensics division by Eurofins Cyber Security UK in March 2022 exemplifies this trend. The value of such deals varies significantly, ranging from millions to tens of millions of Euros, depending on the size and strategic importance of the acquired entity. Regulatory frameworks, such as GDPR, significantly influence the market by dictating data handling protocols and impacting the demand for compliant digital forensic solutions. End-user trends towards cloud-based solutions and increasing adoption of mobile devices influence innovation and the development of specialized forensic tools.

- Market Share: The top 5 players hold approximately xx% of the market share (2025).

- M&A Deal Values: Average deal value ranges from xx Million to xx Million Euros.

- Key Innovation Drivers: Advancement in AI, Cloud Computing, Mobile Forensics Technologies.

- Regulatory Impact: GDPR and other data protection laws influence market growth and technological development.

Europe Digital Forensics Market Industry Trends & Insights

The Europe Digital Forensics Market is experiencing robust growth, fueled by rising cybercrime, increasing data breaches, and stringent regulatory requirements demanding robust digital forensics capabilities. The market is witnessing a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by several factors, including the increasing sophistication of cyberattacks, the growing adoption of cloud-based technologies and their related security challenges, and escalating government investments in cybersecurity infrastructure. The market penetration of digital forensics solutions is steadily increasing across various sectors, particularly in Government and Law Enforcement, BFSI, and IT & Telecom. Technological disruptions such as the adoption of Artificial Intelligence (AI) and Machine Learning (ML) are streamlining forensic investigations and increasing efficiency. Consumer preferences are shifting towards cloud-based and software-as-a-service (SaaS) solutions, impacting the market's demand for such offerings. Competitive dynamics are intense, with companies focusing on product innovation, strategic partnerships, and acquisitions to gain a market advantage.

Dominant Markets & Segments in Europe Digital Forensics Market

The Government and Law Enforcement Agencies segment dominates the Europe Digital Forensics Market due to significant investments in cybersecurity and the need to combat cybercrime effectively. The UK and Germany are the leading countries in the European market, driven by robust economic conditions, advanced digital infrastructure, and strict regulatory frameworks.

- Leading Region: Western Europe

- Leading Country: UK and Germany

- Dominant Component: Services segment enjoys a sizable market share due to the complexity of investigations, requiring expert consultation and analysis.

- Dominant Type: Computer Forensics currently dominates, reflecting the prevalence of computer-related crime.

- Key Drivers for Government & Law Enforcement: Growing cybercrime rates, stringent regulations, and increasing government budgets for cybersecurity.

- Key Drivers for BFSI: Rising financial fraud, data privacy regulations (GDPR), and the need to protect sensitive customer data.

- Key Drivers for IT & Telecom: Protecting critical infrastructure and data from cyberattacks, adhering to industry regulations and standards, and meeting consumer expectations for data security.

Europe Digital Forensics Market Product Developments

Recent product innovations focus on AI-powered analysis tools, cloud-based forensic platforms, and specialized mobile forensics solutions. These advancements are improving investigation efficiency, expanding the scope of data analysis, and enhancing the overall accuracy of forensic findings. The integration of AI and ML technologies is significantly reducing the time and resources required for digital forensic investigations, providing a competitive advantage to companies offering such solutions. The market is seeing a growing demand for integrated solutions that offer comprehensive coverage across various forensic domains, enabling a more holistic approach to investigations.

Report Scope & Segmentation Analysis

This report segments the Europe Digital Forensics Market based on component (Hardware, Software, Services), type (Mobile Forensics, Computer Forensics, Network Forensics, Other Types), and end-user industry (Government and Law Enforcement Agencies, BFSI, IT and Telecom, Other End-user Industries). Each segment's growth projections, market size, and competitive dynamics are analyzed. The services segment is expected to experience significant growth, while mobile forensics is predicted to show strong expansion due to the pervasive use of smartphones.

- Component: Hardware, Software, Services. Each segment comprises a specific share of the overall market, with Services projected to experience the highest growth. Software solutions, while growing at a lower rate, are still significant.

- Type: Mobile Forensics, Computer Forensics, Network Forensics, Other Types. Computer forensics remains the most dominant type, while mobile forensics is expected to see the most rapid growth.

- End-user Industry: Government and Law Enforcement Agencies, BFSI, IT and Telecom, Other End-user Industries. Government and Law Enforcement Agencies constitute the largest segment, indicating the high level of cybersecurity threats faced by this sector.

Key Drivers of Europe Digital Forensics Market Growth

The Europe Digital Forensics Market's growth is primarily driven by increasing cybercrime, stringent data protection regulations (e.g., GDPR), rising investments in cybersecurity infrastructure by governments and private companies, and the increasing sophistication of cyberattacks. Technological advancements in AI and ML are also significantly accelerating the market’s growth by improving investigation speed and efficiency.

Challenges in the Europe Digital Forensics Market Sector

The Europe Digital Forensics Market faces challenges such as the high cost of specialized software and hardware, the complexity of digital investigations, the shortage of skilled professionals, and the evolving nature of cybercrime. Supply chain disruptions can also impact the availability of certain hardware and software components, limiting market growth. Moreover, intense competition among vendors requires constant innovation and adaptability to maintain market share.

Emerging Opportunities in Europe Digital Forensics Market

Emerging opportunities include the growing adoption of cloud-based forensic solutions, the increasing demand for AI-powered forensic tools, and the expansion into new markets such as the Internet of Things (IoT) security. Specialized forensic solutions catering to specific industries and the development of advanced data analytics capabilities for faster, more precise investigations represent promising areas for growth.

Leading Players in the Europe Digital Forensics Market Market

- Envista Forensics

- FireEye Inc

- Nuix

- IBM Corporation

- MSAB Inc

- LogRhythm Inc

- Guidance Software Inc (Opentext)

- PricewaterhouseCoopers

Key Developments in Europe Digital Forensics Market Industry

- December 2022: The European Commission's EUR 7.25 Million agreement with the ICC enhances the court's digital evidence handling capacity, particularly relevant for investigations into the Ukraine conflict.

- March 2022: Eurofins Cyber Security UK expands its digital forensics offerings by acquiring Eurofins Forensics Services' digital forensics division, broadening its service portfolio.

Strategic Outlook for Europe Digital Forensics Market Market

The Europe Digital Forensics Market holds significant potential for growth, driven by persistent cyber threats, regulatory pressures, and technological advancements. Companies that strategically focus on innovation, particularly in AI-driven solutions and cloud-based platforms, while addressing the skilled professional shortage are poised to capitalize on emerging opportunities and secure a strong market position. The market is expected to continue its expansion, driven by the increasing reliance on digital technologies and the rising number of cybercrimes across all sectors.

Europe Digital Forensics Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Type

- 2.1. Mobile Forensics

- 2.2. Computer Forensics

- 2.3. Network Forensics

- 2.4. Other Types

-

3. End-user Industry

- 3.1. Government and Law Enforcement Agencies

- 3.2. BFSI

- 3.3. IT and Telecom

- 3.4. Other End-user Industries

Europe Digital Forensics Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

- 5. Rest of Europe

Europe Digital Forensics Market Regional Market Share

Geographic Coverage of Europe Digital Forensics Market

Europe Digital Forensics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of IoT Devices Driving the Demand for Digital Forensic Solutions and Services; Growing Cybercrimes and Security Concerns across Industries

- 3.3. Market Restrains

- 3.3.1. Consumers Desire for Fine Dining Experience

- 3.4. Market Trends

- 3.4.1. Growing Adoption of IoT Devices is Driving the Demand for Digital Forensic Solutions and Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Digital Forensics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Mobile Forensics

- 5.2.2. Computer Forensics

- 5.2.3. Network Forensics

- 5.2.4. Other Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Government and Law Enforcement Agencies

- 5.3.2. BFSI

- 5.3.3. IT and Telecom

- 5.3.4. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Germany

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. United Kingdom Europe Digital Forensics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Mobile Forensics

- 6.2.2. Computer Forensics

- 6.2.3. Network Forensics

- 6.2.4. Other Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Government and Law Enforcement Agencies

- 6.3.2. BFSI

- 6.3.3. IT and Telecom

- 6.3.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Germany Europe Digital Forensics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Mobile Forensics

- 7.2.2. Computer Forensics

- 7.2.3. Network Forensics

- 7.2.4. Other Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Government and Law Enforcement Agencies

- 7.3.2. BFSI

- 7.3.3. IT and Telecom

- 7.3.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. France Europe Digital Forensics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Mobile Forensics

- 8.2.2. Computer Forensics

- 8.2.3. Network Forensics

- 8.2.4. Other Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Government and Law Enforcement Agencies

- 8.3.2. BFSI

- 8.3.3. IT and Telecom

- 8.3.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Italy Europe Digital Forensics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Mobile Forensics

- 9.2.2. Computer Forensics

- 9.2.3. Network Forensics

- 9.2.4. Other Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Government and Law Enforcement Agencies

- 9.3.2. BFSI

- 9.3.3. IT and Telecom

- 9.3.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Rest of Europe Europe Digital Forensics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Mobile Forensics

- 10.2.2. Computer Forensics

- 10.2.3. Network Forensics

- 10.2.4. Other Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Government and Law Enforcement Agencies

- 10.3.2. BFSI

- 10.3.3. IT and Telecom

- 10.3.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Envista Forensics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 FireEye Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nuix*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IBM Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 MSAB Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LogRhythm Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Guidance Software Inc (Opentext)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PricewaterhouseCoopers

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Envista Forensics

List of Figures

- Figure 1: Europe Digital Forensics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Digital Forensics Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Digital Forensics Market Revenue billion Forecast, by Component 2020 & 2033

- Table 2: Europe Digital Forensics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Europe Digital Forensics Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe Digital Forensics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Digital Forensics Market Revenue billion Forecast, by Component 2020 & 2033

- Table 6: Europe Digital Forensics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Europe Digital Forensics Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Europe Digital Forensics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Europe Digital Forensics Market Revenue billion Forecast, by Component 2020 & 2033

- Table 10: Europe Digital Forensics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Europe Digital Forensics Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Europe Digital Forensics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Digital Forensics Market Revenue billion Forecast, by Component 2020 & 2033

- Table 14: Europe Digital Forensics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 15: Europe Digital Forensics Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 16: Europe Digital Forensics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Europe Digital Forensics Market Revenue billion Forecast, by Component 2020 & 2033

- Table 18: Europe Digital Forensics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 19: Europe Digital Forensics Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Europe Digital Forensics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Europe Digital Forensics Market Revenue billion Forecast, by Component 2020 & 2033

- Table 22: Europe Digital Forensics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Europe Digital Forensics Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 24: Europe Digital Forensics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Digital Forensics Market?

The projected CAGR is approximately 10.25%.

2. Which companies are prominent players in the Europe Digital Forensics Market?

Key companies in the market include Envista Forensics, FireEye Inc, Nuix*List Not Exhaustive, IBM Corporation, MSAB Inc, LogRhythm Inc, Guidance Software Inc (Opentext), PricewaterhouseCoopers.

3. What are the main segments of the Europe Digital Forensics Market?

The market segments include Component, Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.19 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of IoT Devices Driving the Demand for Digital Forensic Solutions and Services; Growing Cybercrimes and Security Concerns across Industries.

6. What are the notable trends driving market growth?

Growing Adoption of IoT Devices is Driving the Demand for Digital Forensic Solutions and Services.

7. Are there any restraints impacting market growth?

Consumers Desire for Fine Dining Experience.

8. Can you provide examples of recent developments in the market?

December 2022 - An agreement was reached between the European Commission and the Office of the Prosecutor of the International Criminal Court (ICC), which improves the court's capacity to handle digital evidence. Investigations into Russia's aggressiveness against Ukraine will also benefit from this. By the agreement, the EU would provide EUR 7.25 million to assist the ICC in more quickly processing new types of evidence.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Digital Forensics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Digital Forensics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Digital Forensics Market?

To stay informed about further developments, trends, and reports in the Europe Digital Forensics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence