Key Insights

The European Flavored Chocolate Milk Market is set for substantial growth, projected to reach $4699.03 million by 2025. This expansion is driven by a strong Compound Annual Growth Rate (CAGR) of 4.2% through the forecast period of 2025-2033. Key growth factors include rising consumer demand for convenient, ready-to-drink beverages offering indulgence and perceived nutritional value, particularly among younger demographics. The increasing variety of flavors beyond traditional chocolate, alongside innovative formulations like low-sugar, lactose-free, and plant-based options, broadens market appeal. Enhanced marketing strategies and expanding distribution networks further bolster market penetration.

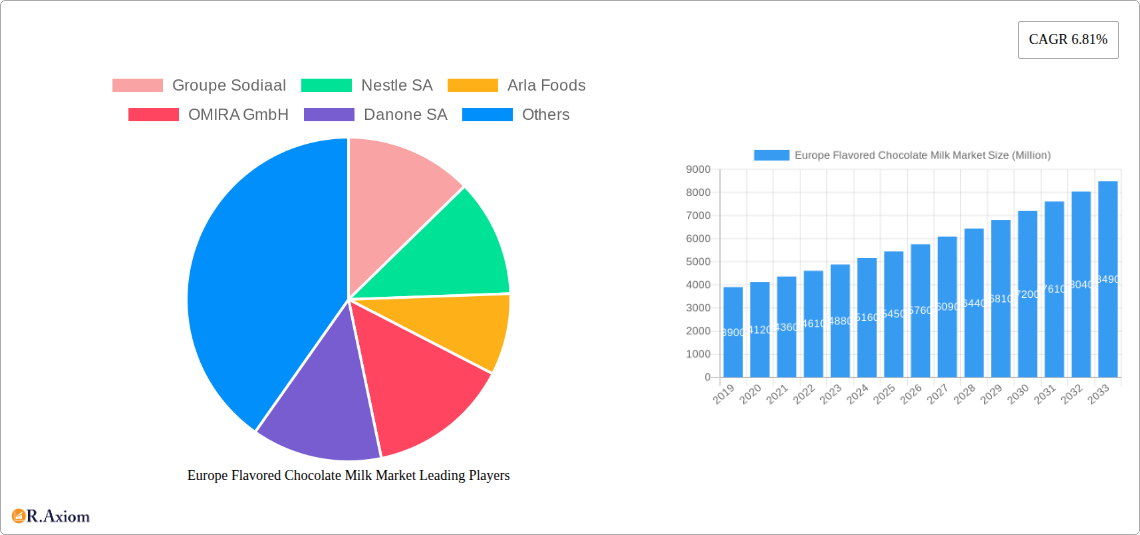

Europe Flavored Chocolate Milk Market Market Size (In Billion)

Market growth is also influenced by emerging trends such as the increasing popularity of premium and artisanal flavored chocolate milk, catering to a discerning consumer segment. E-commerce and direct-to-consumer (DTC) channels are becoming significant distribution avenues, enhancing consumer convenience and personalization. However, the market faces challenges including fluctuations in raw material prices (cocoa, dairy) impacting manufacturing costs, and competition from alternative beverage categories like plant-based milks and functional drinks. Stringent regulations on food labeling and health claims also require careful product development. The market is segmented by distribution channels, with Supermarkets/Hypermarkets currently leading, followed by Convenience Stores and other channels.

Europe Flavored Chocolate Milk Market Company Market Share

This comprehensive market research report offers critical insights into the Europe Flavored Chocolate Milk Market, covering the historical period (2019-2024), with 2025 as the base year and a forecast extending to 2033. Utilizing a robust methodology, the report provides accurate market estimations and strategic recommendations. The market dynamics are shaped by evolving consumer preferences, product innovation, and a competitive landscape featuring global and regional players. The study analyzes key market segments, industry trends, and growth drivers for a holistic view of the European flavored chocolate milk sector.

Europe Flavored Chocolate Milk Market Market Concentration & Innovation

The Europe Flavored Chocolate Milk Market exhibits a moderate to high level of concentration, with key players like Nestle SA, Groupe Sodiaal, and Arla Foods holding significant market shares. Innovation is a primary driver, fueled by continuous product development and the introduction of novel flavors and healthier formulations to cater to discerning European consumers. Regulatory frameworks, primarily focused on food safety and labeling standards, influence product development and market entry. While direct product substitutes are limited, the broader beverage market, including other flavored milk drinks and plant-based alternatives, presents indirect competitive pressures. End-user trends show a growing demand for convenient, on-the-go options and products perceived as healthier, with reduced sugar content and natural ingredients. Mergers and acquisitions (M&A) activities are strategic tools for market expansion and portfolio enhancement. For instance, recent M&A deals in the broader dairy and beverage sector have seen valuations in the hundreds of millions, indicating the financial significance of strategic consolidation. The market is anticipated to reach a size of approximately $6.5 billion by 2025, with a projected compound annual growth rate (CAGR) of approximately 4.8% during the forecast period.

Europe Flavored Chocolate Milk Market Industry Trends & Insights

The Europe Flavored Chocolate Milk Market is experiencing robust growth, driven by several interconnected factors. A primary growth driver is the increasing consumer demand for convenient and on-the-go beverage options, particularly among younger demographics and busy urban populations. This trend is supported by the widespread availability of flavored chocolate milk in supermarkets, convenience stores, and vending machines across the continent. Technological advancements in UHT processing and packaging have significantly improved shelf-life and portability, further bolstering market penetration. Consumer preferences are evolving, with a noticeable shift towards healthier product options. This includes a rising demand for reduced-sugar formulations, the incorporation of natural sweeteners and ingredients, and the availability of lactose-free and plant-based alternatives. Manufacturers are responding by innovating their product portfolios to align with these health-conscious trends, leading to a surge in product launches featuring enriched nutritional profiles and unique flavor combinations. The competitive landscape is dynamic, characterized by intense competition among established global players and agile regional brands. Partnerships and collaborations are becoming increasingly prevalent as companies seek to leverage each other's strengths in areas like distribution, product development, and market reach. For example, strategic alliances to co-develop and market specialized flavored milk products have been observed, aiming to capture niche market segments. The overall market penetration is steadily increasing, with flavored chocolate milk becoming a staple in many European households. The CAGR for the Europe Flavored Chocolate Milk Market is estimated to be around 4.8% for the forecast period of 2025-2033. The market size is projected to reach approximately $7.7 billion by 2030.

Dominant Markets & Segments in Europe Flavored Chocolate Milk Market

Within the Europe Flavored Chocolate Milk Market, the Supermarkets/Hypermarkets distribution channel undeniably dominates, accounting for an estimated 65% of the total market share in 2025. This dominance is attributed to several key factors.

- Extensive Reach and Accessibility: Supermarkets and hypermarkets are the primary grocery shopping destinations for a vast majority of European consumers. Their widespread presence across urban, suburban, and even rural areas ensures unparalleled accessibility to a broad consumer base.

- Product Variety and Shelf Space: These large retail formats offer extensive shelf space, allowing manufacturers to showcase a wider array of flavored chocolate milk products, including various brands, flavors, and pack sizes. This variety caters to diverse consumer preferences and encourages impulse purchases.

- Promotional Activities and Bundling: Retailers frequently engage in promotional activities, discounts, and multi-buy offers within supermarkets and hypermarkets, which significantly influence purchasing decisions and drive sales volume for flavored chocolate milk.

- One-Stop Shopping Convenience: Consumers often prefer the convenience of purchasing their dairy products alongside other household essentials, making supermarkets and hypermarkets the preferred choice for regular grocery shopping.

Conversely, Convenience Stores represent a significant secondary channel, capturing approximately 25% of the market share. Their strength lies in their localized presence and suitability for immediate consumption purchases.

- Impulse Purchases and On-the-Go Consumption: Convenience stores are ideally positioned to cater to impulse buys and the demand for ready-to-drink beverages for immediate consumption, particularly in high-traffic areas like train stations, city centers, and near educational institutions.

- Targeted Demographics: They effectively serve younger consumers, students, and office workers seeking quick refreshment.

The Other Distribution Channels segment, encompassing online retailers, specialty stores, and food service providers, accounts for the remaining 10% of the market. While smaller, this segment is experiencing rapid growth, particularly the online channel, driven by the convenience of e-commerce.

- E-commerce Growth: Online grocery platforms and direct-to-consumer (DTC) sales are rapidly expanding, offering consumers greater choice and doorstep delivery.

- Food Service Demand: Cafes, restaurants, and institutional food services also contribute to this segment, albeit with distinct purchasing patterns and volume requirements.

The economic policies across European nations, such as favorable trade agreements and supportive retail sector regulations, further bolster the dominance of traditional retail channels. Infrastructure development, particularly in logistics and supply chain management, ensures the efficient distribution of perishable goods like flavored chocolate milk to these diverse retail points.

Europe Flavored Chocolate Milk Market Product Developments

Product development in the Europe Flavored Chocolate Milk Market is heavily influenced by the pursuit of competitive advantages through enhanced taste profiles and consumer appeal. Innovations often revolve around introducing unique flavor fusions, such as salted caramel chocolate or spiced chocolate variants, to capture consumer interest beyond traditional options. Packaging innovations are also crucial, with a focus on sustainable materials, convenient formats like single-serve bottles and pouches, and visually appealing designs that stand out on retail shelves. Technological trends supporting these developments include advanced flavor encapsulation techniques and improved processing methods that maintain product quality and nutritional integrity. The market fit for these products is driven by evolving consumer preferences for novelty, convenience, and perceived value.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the Europe Flavored Chocolate Milk Market across key distribution channels. The Supermarkets/Hypermarkets segment is projected to continue its dominance, with an estimated market size of $5.0 billion in 2025, driven by high foot traffic and extensive product placement. Growth projections for this segment are around 4.5% CAGR. The Convenience Stores segment, valued at approximately $1.6 billion in 2025, is expected to experience a robust CAGR of 5.2%, fueled by increased on-the-go consumption and impulse purchases. Competitive dynamics within convenience stores are characterized by a need for faster inventory turnover and appealing impulse buys. The Other Distribution Channels segment, including e-commerce and food service, is forecast to be the fastest-growing, with a CAGR of 6.0% and a market size of $0.6 billion in 2025, indicating significant expansion potential.

Key Drivers of Europe Flavored Chocolate Milk Market Growth

Several key factors are propelling the growth of the Europe Flavored Chocolate Milk Market. The rising disposable incomes across many European nations translate into increased consumer spending on premium and convenience food and beverage products. Furthermore, a growing health-conscious consumer base is driving demand for reduced-sugar and fortified flavored milk options, creating opportunities for product innovation. Technological advancements in food processing and packaging enhance product shelf-life, safety, and portability, making flavored chocolate milk more accessible and appealing. The favorable regulatory environment in most European countries supports product development and market entry, provided safety and labeling standards are met.

Challenges in the Europe Flavored Chocolate Milk Market Sector

Despite its growth trajectory, the Europe Flavored Chocolate Milk Market faces certain challenges. Intense competition among numerous global and regional brands leads to price pressures and necessitates continuous product differentiation to maintain market share. Fluctuations in raw material prices, particularly cocoa and milk, can impact production costs and profit margins. Evolving consumer preferences towards healthier alternatives, such as plant-based beverages, pose a long-term challenge, requiring manufacturers to adapt their offerings. Stringent regulatory requirements concerning sugar content, additives, and labeling can also create barriers to entry and necessitate significant investment in research and development.

Emerging Opportunities in Europe Flavored Chocolate Milk Market

Emerging opportunities in the Europe Flavored Chocolate Milk Market are abundant, particularly in the development of innovative and niche product segments. The growing demand for premium and artisanal flavored chocolate milk presents a significant avenue for growth, allowing for higher price points and increased profit margins. Expansion into emerging markets within Eastern Europe, where per capita consumption of dairy beverages is still growing, offers substantial untapped potential. The rise of e-commerce platforms provides a direct-to-consumer channel, enabling brands to reach a wider audience and gather valuable customer data for personalized marketing. Furthermore, the integration of functional ingredients, such as vitamins, minerals, and probiotics, into flavored chocolate milk formulations caters to the increasing consumer interest in health and wellness products.

Leading Players in the Europe Flavored Chocolate Milk Market Market

- Groupe Sodiaal

- Nestle SA

- Arla Foods

- OMIRA GmbH

- Danone SA

- Mars Inc

- Royal FrieslandCampina NV

- Unternehmensgruppe Theo Muller

- FrieslandCampina

- Emmi Group

Key Developments in Europe Flavored Chocolate Milk Market Industry

- 2023/Q4: Nestle SA launched a new range of organic flavored chocolate milk with reduced sugar content and exotic fruit infusions, targeting health-conscious millennials.

- 2024/Q1: Arla Foods announced a strategic partnership with a leading European supermarket chain to promote its sustainable sourcing initiatives for dairy products, including flavored milk.

- 2024/Q2: Groupe Sodiaal acquired a smaller, regional dairy producer specializing in premium chocolate milk, aiming to expand its product portfolio and market reach in Western Europe.

- 2024/Q3: Danone SA introduced innovative, plant-based flavored chocolate milk options made from oat and pea proteins, responding to growing vegan and lactose-intolerant consumer demands.

- 2024/Q4: Mars Inc unveiled new, resealable packaging for its flavored chocolate milk drinks, focusing on enhanced convenience and reduced environmental impact.

Strategic Outlook for Europe Flavored Chocolate Milk Market Market

The strategic outlook for the Europe Flavored Chocolate Milk Market remains optimistic, driven by continuous innovation and evolving consumer demands. Companies are expected to focus on product diversification, particularly in healthier and more sustainable options, to capture a larger market share. The growing popularity of e-commerce will necessitate robust online presence and direct-to-consumer strategies. Furthermore, strategic partnerships and potential acquisitions will continue to shape the competitive landscape, enabling market players to expand their geographical reach and product offerings. The emphasis on clean labels, natural ingredients, and ethical sourcing will be crucial for long-term brand loyalty and market success, ensuring sustained growth in the coming years.

Europe Flavored Chocolate Milk Market Segmentation

-

1. Distribution Channel

- 1.1. Supermarkets/Hypermarkets

- 1.2. Convenience Stores

- 1.3. Other Distribution Channels

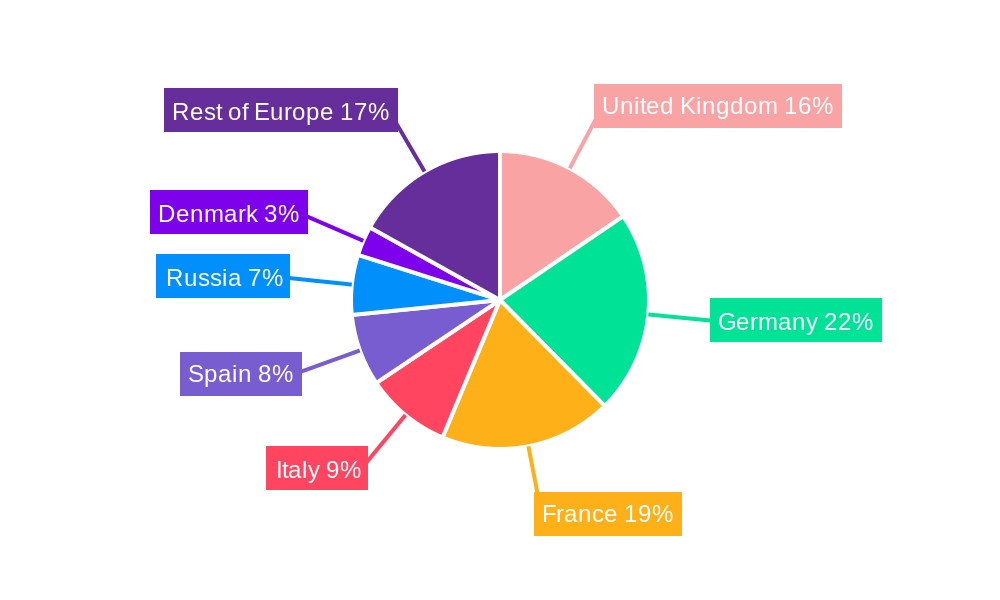

Europe Flavored Chocolate Milk Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

- 5. Spain

- 6. Russia

- 7. Denmark

- 8. Rest of Europe

Europe Flavored Chocolate Milk Market Regional Market Share

Geographic Coverage of Europe Flavored Chocolate Milk Market

Europe Flavored Chocolate Milk Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing awareness towards fitness among consumers; Demand for convenient fortified foods

- 3.3. Market Restrains

- 3.3.1. Increasing vegan culture in the market

- 3.4. Market Trends

- 3.4.1. Complying With "Better-for-you" and "Free-from" Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Flavored Chocolate Milk Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Supermarkets/Hypermarkets

- 5.1.2. Convenience Stores

- 5.1.3. Other Distribution Channels

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.2.2. Germany

- 5.2.3. France

- 5.2.4. Italy

- 5.2.5. Spain

- 5.2.6. Russia

- 5.2.7. Denmark

- 5.2.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. United Kingdom Europe Flavored Chocolate Milk Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.1.1. Supermarkets/Hypermarkets

- 6.1.2. Convenience Stores

- 6.1.3. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7. Germany Europe Flavored Chocolate Milk Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.1.1. Supermarkets/Hypermarkets

- 7.1.2. Convenience Stores

- 7.1.3. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8. France Europe Flavored Chocolate Milk Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.1.1. Supermarkets/Hypermarkets

- 8.1.2. Convenience Stores

- 8.1.3. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9. Italy Europe Flavored Chocolate Milk Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.1.1. Supermarkets/Hypermarkets

- 9.1.2. Convenience Stores

- 9.1.3. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10. Spain Europe Flavored Chocolate Milk Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.1.1. Supermarkets/Hypermarkets

- 10.1.2. Convenience Stores

- 10.1.3. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 11. Russia Europe Flavored Chocolate Milk Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.1.1. Supermarkets/Hypermarkets

- 11.1.2. Convenience Stores

- 11.1.3. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 12. Denmark Europe Flavored Chocolate Milk Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.1.1. Supermarkets/Hypermarkets

- 12.1.2. Convenience Stores

- 12.1.3. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 13. Rest of Europe Europe Flavored Chocolate Milk Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 13.1.1. Supermarkets/Hypermarkets

- 13.1.2. Convenience Stores

- 13.1.3. Other Distribution Channels

- 13.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Groupe Sodiaal

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Nestle SA

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Arla Foods

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 OMIRA GmbH

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Danone SA

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Mars Inc *List Not Exhaustive

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Royal FrieslandCampina NV

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Unternehmensgruppe Theo Muller

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 FrieslandCampina

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Emmi Group

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Groupe Sodiaal

List of Figures

- Figure 1: Europe Flavored Chocolate Milk Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Flavored Chocolate Milk Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Flavored Chocolate Milk Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 2: Europe Flavored Chocolate Milk Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 3: Europe Flavored Chocolate Milk Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Flavored Chocolate Milk Market Volume liter Forecast, by Region 2020 & 2033

- Table 5: Europe Flavored Chocolate Milk Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Flavored Chocolate Milk Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 7: Europe Flavored Chocolate Milk Market Revenue million Forecast, by Country 2020 & 2033

- Table 8: Europe Flavored Chocolate Milk Market Volume liter Forecast, by Country 2020 & 2033

- Table 9: Europe Flavored Chocolate Milk Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Europe Flavored Chocolate Milk Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 11: Europe Flavored Chocolate Milk Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Europe Flavored Chocolate Milk Market Volume liter Forecast, by Country 2020 & 2033

- Table 13: Europe Flavored Chocolate Milk Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Europe Flavored Chocolate Milk Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 15: Europe Flavored Chocolate Milk Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Europe Flavored Chocolate Milk Market Volume liter Forecast, by Country 2020 & 2033

- Table 17: Europe Flavored Chocolate Milk Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Europe Flavored Chocolate Milk Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 19: Europe Flavored Chocolate Milk Market Revenue million Forecast, by Country 2020 & 2033

- Table 20: Europe Flavored Chocolate Milk Market Volume liter Forecast, by Country 2020 & 2033

- Table 21: Europe Flavored Chocolate Milk Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Europe Flavored Chocolate Milk Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 23: Europe Flavored Chocolate Milk Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Europe Flavored Chocolate Milk Market Volume liter Forecast, by Country 2020 & 2033

- Table 25: Europe Flavored Chocolate Milk Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 26: Europe Flavored Chocolate Milk Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 27: Europe Flavored Chocolate Milk Market Revenue million Forecast, by Country 2020 & 2033

- Table 28: Europe Flavored Chocolate Milk Market Volume liter Forecast, by Country 2020 & 2033

- Table 29: Europe Flavored Chocolate Milk Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Europe Flavored Chocolate Milk Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 31: Europe Flavored Chocolate Milk Market Revenue million Forecast, by Country 2020 & 2033

- Table 32: Europe Flavored Chocolate Milk Market Volume liter Forecast, by Country 2020 & 2033

- Table 33: Europe Flavored Chocolate Milk Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Europe Flavored Chocolate Milk Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 35: Europe Flavored Chocolate Milk Market Revenue million Forecast, by Country 2020 & 2033

- Table 36: Europe Flavored Chocolate Milk Market Volume liter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Flavored Chocolate Milk Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Europe Flavored Chocolate Milk Market?

Key companies in the market include Groupe Sodiaal, Nestle SA, Arla Foods, OMIRA GmbH, Danone SA, Mars Inc *List Not Exhaustive, Royal FrieslandCampina NV, Unternehmensgruppe Theo Muller, FrieslandCampina , Emmi Group.

3. What are the main segments of the Europe Flavored Chocolate Milk Market?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4699.03 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing awareness towards fitness among consumers; Demand for convenient fortified foods.

6. What are the notable trends driving market growth?

Complying With "Better-for-you" and "Free-from" Products.

7. Are there any restraints impacting market growth?

Increasing vegan culture in the market.

8. Can you provide examples of recent developments in the market?

Product launches with unique flavors and packaging

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Flavored Chocolate Milk Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Flavored Chocolate Milk Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Flavored Chocolate Milk Market?

To stay informed about further developments, trends, and reports in the Europe Flavored Chocolate Milk Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence