Key Insights

The European Industrial Computed Tomography (ICT) market is projected for significant expansion. Anticipating robust growth, the market size is estimated at 404.38 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 6. This growth is propelled by increasing adoption in automotive, aerospace, and energy sectors, driven by the demand for superior quality control and the inspection of complex manufactured goods. Technological advancements, including higher resolution imaging, accelerated scan times, and advanced data analysis software, will further expand ICT applications across industries through 2033.

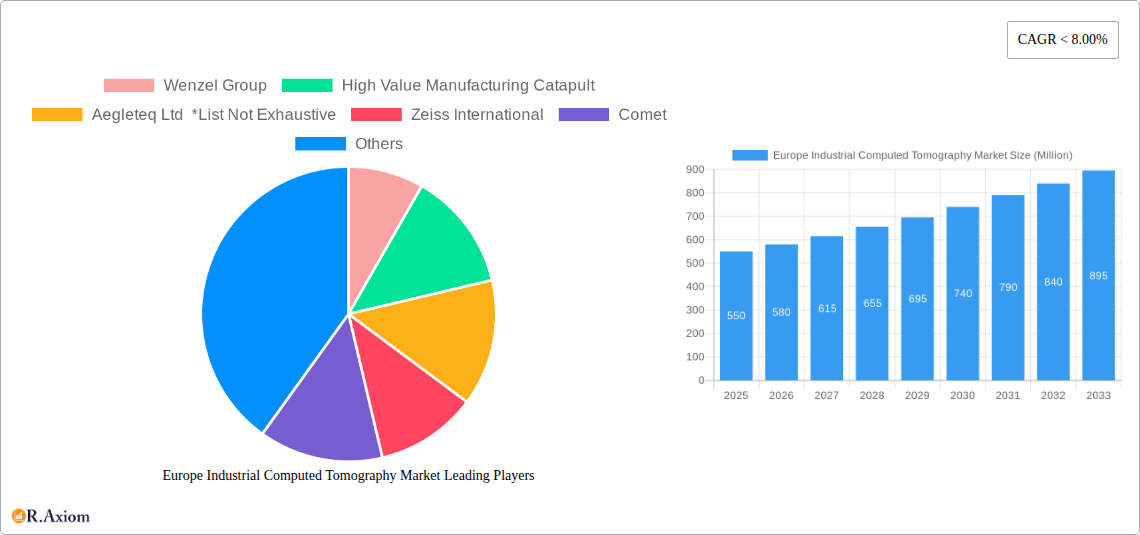

Europe Industrial Computed Tomography Market Market Size (In Million)

Key growth drivers include the escalating need for enhanced product quality and reliability, alongside the adoption of advanced materials such as composites and lightweight alloys. ICT's capability for precise, non-destructive evaluation is critical in these areas. Continuous innovation in ICT systems, complemented by advancements in artificial intelligence and machine learning for automated defect detection and data analysis, will accelerate market expansion, promising continued growth beyond the current forecast period.

Europe Industrial Computed Tomography Market Company Market Share

Europe Industrial Computed Tomography Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Industrial Computed Tomography (ICT) market, offering valuable insights for stakeholders across the value chain. Covering the period from 2019 to 2033, with a focus on 2025, this report analyzes market trends, competitive dynamics, and future growth potential. The study segments the market by application, end-user industry, and country, providing granular data for informed decision-making.

Europe Industrial Computed Tomography Market Market Concentration & Innovation

The European industrial computed tomography market exhibits a moderately concentrated landscape, with a few major players holding significant market share. While precise market share figures for each company are proprietary, leading players like Zeiss International, Wenzel Group, and Baker Hughes Company command substantial portions of the market. Smaller players like Aegleteq Ltd and VJ Group Inc. cater to niche segments or offer specialized solutions. The market’s innovation is driven by advancements in X-ray source technology, detector sensitivity, and reconstruction algorithms. Regulatory frameworks, particularly those related to safety and environmental compliance, play a crucial role. Product substitutes, such as ultrasonic testing or magnetic resonance imaging, exist but often lack the detailed 3D imaging capabilities of ICT. End-user trends favor non-destructive testing (NDT) methods for quality control and process optimization. M&A activity has been relatively moderate in recent years, with deal values typically in the xx Million range. However, strategic partnerships and collaborations are becoming increasingly common as companies strive to enhance their technological capabilities and market reach.

Europe Industrial Computed Tomography Market Industry Trends & Insights

The European industrial computed tomography market is experiencing robust growth, driven by increasing demand for quality control and assurance across various industries. The market's CAGR during the historical period (2019-2024) is estimated at xx%, and is projected to reach xx% during the forecast period (2025-2033). This growth is fueled by factors such as rising adoption of advanced manufacturing techniques, stringent product safety regulations, and the need for efficient failure analysis. Technological disruptions, including the development of faster, higher-resolution scanners and advanced image processing software, are significantly impacting market dynamics. Consumer preferences are shifting towards more user-friendly, compact systems that offer faster scan times and improved image quality. The competitive landscape is characterized by intense rivalry, with established players investing heavily in R&D and new product development to maintain market share. Market penetration remains relatively high in established sectors such as aerospace and automotive but offers significant potential in emerging areas like electronics and renewable energy.

Dominant Markets & Segments in Europe Industrial Computed Tomography Market

The German market currently holds the largest share of the European ICT market, driven by a strong automotive sector and a high concentration of advanced manufacturing facilities. The United Kingdom and France also represent substantial markets.

By Application: Flaw detection and inspection is the dominant application segment, driven by the need for high-quality component assurance across various industries. Failure analysis is a growing segment, particularly in aerospace and automotive, due to the importance of understanding component failures for product improvement and safety. Assembly analysis is gaining traction, as manufacturers leverage ICT to analyze the quality of complex assemblies and identify potential issues early in the production process.

By End-User Industry: The aerospace and automotive industries remain the dominant end-user segments, owing to their stringent quality control requirements and the complexity of their components. The electronics industry presents a growing market opportunity due to the increasing miniaturization of components and the need for thorough inspection. The oil and gas sector represents a niche but important segment, particularly for the inspection of pipelines and other critical infrastructure.

Key Drivers:

- Germany: Strong automotive and manufacturing base, favorable government policies supporting industrial innovation.

- UK: Significant aerospace and oil & gas sectors, investment in advanced manufacturing technologies.

- France: Strong presence in aerospace, automotive, and energy sectors, government initiatives promoting industrial competitiveness.

Europe Industrial Computed Tomography Market Product Developments

Recent product innovations emphasize improved image resolution, faster scan speeds, and more user-friendly interfaces. Zeiss's entry-level Metrotom system exemplifies this trend, making advanced ICT technology more accessible to a broader range of users. The launch of Nikon Metrology's offset computed tomography reconstruction algorithm signifies advancements in image processing, leading to enhanced image quality and scan efficiency. This focus on user-friendliness and efficiency is crucial for broadening market adoption and increasing market penetration. The competitive advantage hinges on factors such as image quality, speed, ease of use, and cost-effectiveness.

Report Scope & Segmentation Analysis

This report segments the European industrial computed tomography market based on application (Flaw Detection and Inspection, Failure Analysis, Assembly Analysis, Other Applications), end-user industry (Aerospace, Automotive, Electronics, Oil and Gas, Other End-user Industries), and country (United Kingdom, Germany, France, Italy, Rest of Europe). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. For example, the Flaw Detection and Inspection segment is expected to show strong growth due to increased demand for quality control, while the aerospace segment is projected to exhibit high growth driven by stringent safety and performance requirements. Market size estimates for each segment are available within the full report.

Key Drivers of Europe Industrial Computed Tomography Market Growth

The European ICT market's growth is fueled by several key factors: Firstly, the increasing demand for higher quality control and assurance in manufacturing is paramount. Secondly, stringent industry regulations and safety standards mandate non-destructive testing methods such as ICT. Thirdly, technological advancements leading to improved resolution, speed, and user-friendliness are driving adoption. Finally, the growth of industries such as aerospace and automotive, with their need for precise component inspection, fuels market expansion.

Challenges in the Europe Industrial Computed Tomography Market Sector

Challenges include the high initial investment costs of ICT systems, which may be prohibitive for smaller businesses. Supply chain disruptions related to component sourcing can impact production and lead times. Competition from alternative NDT methods and the need to comply with evolving safety and environmental regulations also pose significant challenges. These factors, along with ongoing economic uncertainty, could impact market growth projections. The precise quantifiable impacts of these challenges are detailed in the full report.

Emerging Opportunities in Europe Industrial Computed Tomography Market

Emerging opportunities include the expansion of ICT applications in new industries, such as renewable energy and medical devices. Advancements in artificial intelligence and machine learning offer potential for improved automation and data analysis. The development of more portable and cost-effective systems could further broaden market adoption among small and medium-sized enterprises (SMEs). Furthermore, the integration of ICT with other digital technologies, such as cloud computing and the industrial internet of things (IIoT), presents significant growth potential.

Leading Players in the Europe Industrial Computed Tomography Market Market

- Wenzel Group

- High Value Manufacturing Catapult

- Aegleteq Ltd

- Zeiss International

- Comet

- VJ Group Inc

- Hamamatsu Photonics

- Werth Inc

- Baker Hughes Company

Key Developments in Europe Industrial Computed Tomography Market Industry

- June 2021: Zeiss unveiled its entry-level Zeiss Metrotom CT system, expanding market accessibility.

- May 2021: Nikon Metrology launched a new offset computed tomography reconstruction algorithm, enhancing image quality and speed.

Strategic Outlook for Europe Industrial Computed Tomography Market Market

The European industrial computed tomography market is poised for continued growth driven by technological advancements, increased demand for high-quality components, and stringent industry regulations. The focus on innovation, specifically in user-friendliness and cost-effectiveness, will be crucial for expanding market penetration. The development of new applications and the integration with other digital technologies will create new opportunities for growth and market expansion in the coming years. The market is expected to experience considerable expansion across all segments, creating lucrative opportunities for established and emerging players alike.

Europe Industrial Computed Tomography Market Segmentation

-

1. Application

- 1.1. Flaw Detection and Inspection

- 1.2. Failure Analysis

- 1.3. Assembly Analysis

- 1.4. Other Applications

-

2. End User Industry

- 2.1. Aerospace

- 2.2. Automotive

- 2.3. Electronics

- 2.4. Oil and Gas

- 2.5. Other End-user Industries

Europe Industrial Computed Tomography Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

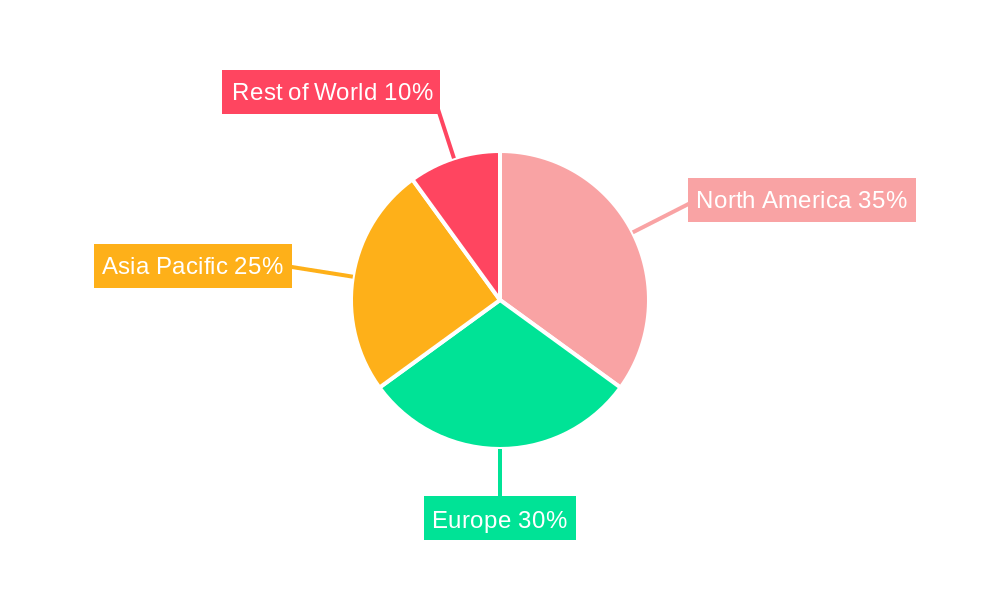

Europe Industrial Computed Tomography Market Regional Market Share

Geographic Coverage of Europe Industrial Computed Tomography Market

Europe Industrial Computed Tomography Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Improvements in Resolution and Image Processing; Intensifying Demand for Portable Radiography Equipment

- 3.3. Market Restrains

- 3.3.1. High Product Cost

- 3.4. Market Trends

- 3.4.1. Aerospace to Witness Significant Adoption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Industrial Computed Tomography Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Flaw Detection and Inspection

- 5.1.2. Failure Analysis

- 5.1.3. Assembly Analysis

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Aerospace

- 5.2.2. Automotive

- 5.2.3. Electronics

- 5.2.4. Oil and Gas

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Wenzel Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 High Value Manufacturing Catapult

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aegleteq Ltd *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zeiss International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Comet

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 VJ Group Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hamamatsu Photonics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Werth Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Baker Hughes Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Wenzel Group

List of Figures

- Figure 1: Europe Industrial Computed Tomography Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Industrial Computed Tomography Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Industrial Computed Tomography Market Revenue million Forecast, by Application 2020 & 2033

- Table 2: Europe Industrial Computed Tomography Market Revenue million Forecast, by End User Industry 2020 & 2033

- Table 3: Europe Industrial Computed Tomography Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Industrial Computed Tomography Market Revenue million Forecast, by Application 2020 & 2033

- Table 5: Europe Industrial Computed Tomography Market Revenue million Forecast, by End User Industry 2020 & 2033

- Table 6: Europe Industrial Computed Tomography Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Industrial Computed Tomography Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Europe Industrial Computed Tomography Market?

Key companies in the market include Wenzel Group, High Value Manufacturing Catapult, Aegleteq Ltd *List Not Exhaustive, Zeiss International, Comet, VJ Group Inc, Hamamatsu Photonics, Werth Inc, Baker Hughes Company.

3. What are the main segments of the Europe Industrial Computed Tomography Market?

The market segments include Application, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 404.38 million as of 2022.

5. What are some drivers contributing to market growth?

Technological Improvements in Resolution and Image Processing; Intensifying Demand for Portable Radiography Equipment.

6. What are the notable trends driving market growth?

Aerospace to Witness Significant Adoption.

7. Are there any restraints impacting market growth?

High Product Cost.

8. Can you provide examples of recent developments in the market?

June 2021 - Zeiss Company unveiled Zeiss Metrotom, its entry-level computed tomography product. The non-destructive inspection of components using this solution is at the entry level. Additionally, this system is a compact computed tomography system that yields precise results and is simple to use.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Industrial Computed Tomography Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Industrial Computed Tomography Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Industrial Computed Tomography Market?

To stay informed about further developments, trends, and reports in the Europe Industrial Computed Tomography Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence