Key Insights

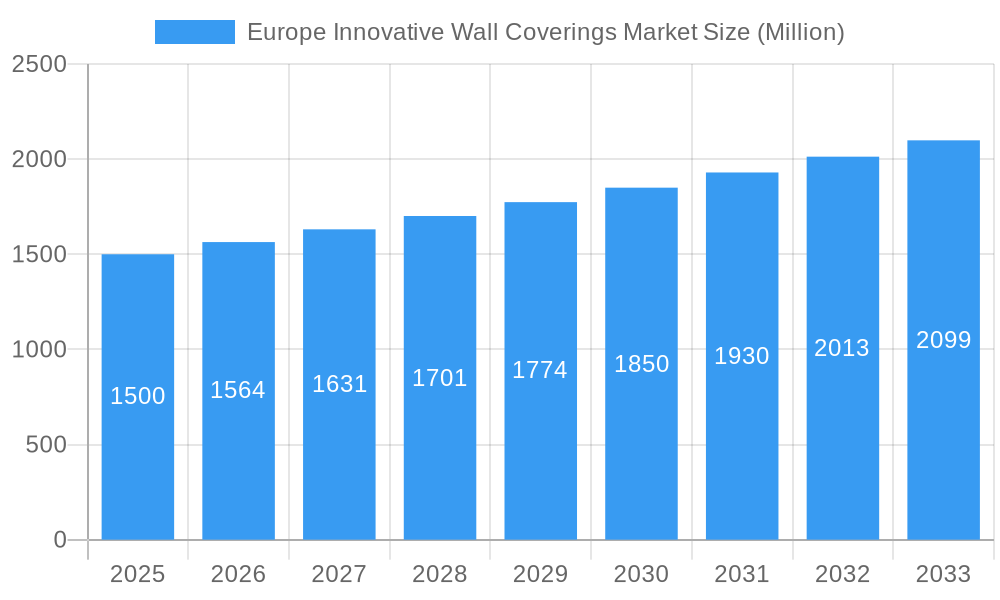

The European Innovative Wall Coverings Market, projected at 6.6 billion in 2025, is forecasted to grow at a CAGR of 3.8% from 2025 to 2033. Key growth drivers include escalating demand for sophisticated interior design solutions that transcend conventional paint and wallpaper. A rising eco-conscious consumer base is also accelerating the adoption of sustainable wall covering materials. Technological advancements are further enhancing product innovation, offering improved durability, simpler installation, and superior acoustic properties. The commercial sector, especially hospitality and retail, remains a significant contributor, prioritizing visually appealing and durable wall solutions for brand enhancement.

Europe Innovative Wall Coverings Market Market Size (In Billion)

Market segmentation indicates a strong preference for wallpaper and wall panels. While commercial applications dominate, the "other products" segment, encompassing custom murals and 3D panels, demonstrates significant growth potential driven by personalization trends. Despite challenges like raw material price volatility and substitute material competition, the market's positive outlook is supported by the sustained demand for premium, innovative wall coverings in both residential and commercial environments. Leading companies are actively influencing market dynamics through innovation and expansion. Germany, France, and the UK are anticipated to exhibit robust growth, supported by strong construction sectors and higher consumer spending.

Europe Innovative Wall Coverings Market Company Market Share

Europe Innovative Wall Coverings Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Europe Innovative Wall Coverings Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this study meticulously examines market dynamics, growth drivers, challenges, and emerging opportunities. The report segments the market by product (Wallpaper, Wall Panel, Decorative Tile, Metal Panel, Other Products) and application (Commercial, Non-Commercial), providing granular data and forecasts for each segment. The total market size is projected to reach xx Million by 2033, showcasing significant growth potential.

Europe Innovative Wall Coverings Market Concentration & Innovation

This section delves into the competitive landscape of the European innovative wall coverings market. We analyze market concentration, revealing the market share held by key players such as Nippon Paint Group, Adfors (Saint Gobain), Walker Greenbank PLC, and others. The report assesses the level of innovation within the industry, examining factors driving new product development, including technological advancements, evolving consumer preferences, and sustainability concerns. Furthermore, we evaluate the impact of regulatory frameworks, the availability of product substitutes, and emerging end-user trends. The analysis also incorporates an overview of mergers and acquisitions (M&A) activity within the sector, including deal values and their impact on market dynamics. For example, the acquisition of Company X by Company Y in 2022 resulted in a xx% increase in market share for Company Y. The average M&A deal value in the past 5 years was approximately xx Million. The market concentration is moderately high, with the top 5 players controlling approximately xx% of the market share. Innovation is driven primarily by the demand for sustainable materials, smart home integration capabilities, and enhanced design aesthetics.

Europe Innovative Wall Coverings Market Industry Trends & Insights

This section offers a comprehensive overview of the key trends and insights shaping the European innovative wall coverings market. We examine the market’s Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) and project the CAGR for the forecast period (2025-2033). The analysis explores the factors driving market growth, including rising disposable incomes, increasing urbanization, and the growing popularity of home renovation and interior design projects. The impact of technological disruptions, such as the introduction of 3D-printed wall coverings and smart materials, is also assessed. We analyze consumer preferences, focusing on shifts towards sustainable, eco-friendly products, personalized designs, and advanced functionalities. The competitive dynamics are scrutinized, highlighting the strategies employed by major players to maintain their market position, including product differentiation, pricing strategies, and marketing campaigns. The market penetration of innovative wall coverings, particularly in the commercial sector, is projected to significantly increase over the forecast period.

Dominant Markets & Segments in Europe Innovative Wall Coverings Market

This section identifies the leading regions, countries, and segments within the European innovative wall coverings market.

By Product:

- Wallpaper: Remains the dominant segment due to its affordability and wide design availability. Growth is driven by increasing demand for high-quality, eco-friendly wallpaper options.

- Wall Panels: Experiencing significant growth fueled by ease of installation, durability, and soundproofing properties.

- Decorative Tiles: A stable segment with continuous demand, driven by its aesthetic appeal and suitability for diverse interior designs.

- Metal Panels: A niche but growing segment, driven by its unique aesthetic appeal and suitability for modern and industrial design styles.

- Other Products: Includes specialized wall coverings like fabrics and natural materials, showcasing niche market growth opportunities.

By Application:

- Commercial: Strong growth driven by the renovation and construction of commercial buildings, particularly in major urban centers.

- Non-Commercial: A substantial market driven by the rising popularity of home renovations and interior design.

Germany is the leading market, driven by strong economic growth and a preference for high-quality interior design products. Key drivers include robust construction activity, government initiatives promoting sustainable building practices, and the prevalence of home renovation projects.

Europe Innovative Wall Coverings Market Product Developments

Recent innovations in wall coverings include the introduction of self-adhesive wallpapers, antimicrobial coatings for improved hygiene, and sound-absorbing panels for enhanced acoustic performance. These developments cater to the increasing demand for functional and aesthetically pleasing wall coverings. The integration of smart technologies, such as embedded lighting and sensors, is also gaining traction, creating new opportunities for product differentiation and market expansion. Manufacturers are focusing on eco-friendly and sustainable materials, responding to growing environmental awareness.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the European innovative wall coverings market, categorized by product type (Wallpaper, Wall Panel, Decorative Tile, Metal Panel, Other Products) and application (Commercial, Residential, and Public). Detailed analysis includes growth projections, market size estimations for 2025, and a thorough examination of the competitive landscape within each segment. The wallpaper segment is projected to maintain the largest market share in 2025, reaching an estimated value of [Insert Precise Figure] Million, followed by wall panels at [Insert Precise Figure] Million. The commercial application segment is anticipated to demonstrate robust growth exceeding that of the residential and public sectors, driven by increased construction and renovation activity within the commercial building sector. Competitive dynamics are shaped by factors such as pricing strategies, brand reputation, product differentiation through innovation, and established market share.

Key Drivers of Europe Innovative Wall Coverings Market Growth

The expansion of the European innovative wall coverings market is fueled by several key factors. Significant advancements in material science and manufacturing technologies have resulted in a wider array of innovative designs and durable products. Rising disposable incomes across many European nations contribute to increased spending on home improvements and commercial renovations, boosting demand for aesthetically pleasing and functional wall coverings. Furthermore, the growing emphasis on sustainable building practices, supported by government regulations and consumer preference, drives demand for eco-friendly and responsibly sourced materials. The surge in popularity of home renovation projects, coupled with consistent construction activity in major European cities, significantly contributes to market expansion.

Challenges in the Europe Innovative Wall Coverings Market Sector

The European innovative wall coverings market faces several challenges that impact growth and profitability. Fluctuations in raw material prices, particularly for key components such as wood pulp, metals, and polymers, directly influence production costs and pricing strategies. Stringent environmental regulations regarding manufacturing processes, waste disposal, and the use of specific materials introduce compliance costs and operational complexities. The market is characterized by intense competition among established industry players and new entrants, necessitating continuous innovation and effective marketing to maintain a competitive advantage. Supply chain disruptions, exacerbated by geopolitical events and global economic conditions, can lead to material shortages, production delays, and price increases.

Emerging Opportunities in Europe Innovative Wall Coverings Market

Despite the challenges, significant opportunities exist for growth within the European innovative wall coverings market. The increasing consumer demand for personalized and customizable wall coverings presents a compelling opportunity for manufacturers to provide bespoke design solutions and cater to individual preferences. The integration of smart home technologies into wall coverings, incorporating functionalities like integrated lighting, soundproofing, or even temperature regulation, presents a potentially lucrative avenue for market expansion. Untapped market potential exists in less developed regions of Eastern Europe, offering significant scope for market penetration and growth through targeted strategies.

Leading Players in the Europe Innovative Wall Coverings Market Market

- Nippon Paint Group

- Adfors (Saint Gobain)

- Walker Greenbank PLC

- Grandeco Wallfashion Group

- A S Création Tapten AG

- Benjamin Moore & Co

- Brewster Home Fashions LLC

- Grespania Cerámica

- Ahlstrom-munksjö Oyj

- AkzoNobel NV

Key Developments in Europe Innovative Wall Coverings Market Industry

- January 2023: Nippon Paint Group launched a new line of sustainable wallpaper made from recycled materials.

- March 2022: Walker Greenbank PLC acquired a smaller competitor, expanding its product portfolio and market share.

- June 2021: New EU regulations regarding VOC emissions in wall coverings came into effect.

Strategic Outlook for Europe Innovative Wall Coverings Market Market

The European innovative wall coverings market is poised for continued growth, driven by factors such as increasing urbanization, rising disposable incomes, and technological advancements. The focus on sustainable and eco-friendly products will be a key trend, while the integration of smart technologies will create new opportunities for product differentiation and market expansion. Manufacturers who effectively adapt to evolving consumer preferences and invest in research and development will be best positioned for success in this dynamic market.

Europe Innovative Wall Coverings Market Segmentation

-

1. Product

- 1.1. Wallpaper

- 1.2. Wall Panel

- 1.3. Decorative Tile

- 1.4. Metal Panel

- 1.5. Other Products

- 2. Interior Paints Market

-

3. Application

- 3.1. Commercial

- 3.2. Non-commercial

Europe Innovative Wall Coverings Market Segmentation By Geography

-

1. Europe

- 1.1. UK

- 1.2. France

- 1.3. Germany

- 1.4. Spain

- 1.5. The Netherlands

- 1.6. Belgium

- 1.7. Portugal

- 1.8. Russia

- 1.9. Poland

- 1.10. Italy

Europe Innovative Wall Coverings Market Regional Market Share

Geographic Coverage of Europe Innovative Wall Coverings Market

Europe Innovative Wall Coverings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Higher Demand for Home Furnishing among the European Countries; Availability of Styled Products

- 3.3. Market Restrains

- 3.3.1. ; High Inventory Costs and Premium Pricing

- 3.4. Market Trends

- 3.4.1. Non-commercial is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Innovative Wall Coverings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Wallpaper

- 5.1.2. Wall Panel

- 5.1.3. Decorative Tile

- 5.1.4. Metal Panel

- 5.1.5. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Interior Paints Market

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Commercial

- 5.3.2. Non-commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nippon Paint Group*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Adfors (Saint Gobain)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Walker Greenbank PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Grandeco Wallfashion Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 A S Création Tapten AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Benjamin Moore & Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Brewster Home Fashions LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Grespania Cerámica

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ahlstrom-munksjö Oyj

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AkzoNobel NV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nippon Paint Group*List Not Exhaustive

List of Figures

- Figure 1: Europe Innovative Wall Coverings Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Innovative Wall Coverings Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Innovative Wall Coverings Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Europe Innovative Wall Coverings Market Revenue billion Forecast, by Interior Paints Market 2020 & 2033

- Table 3: Europe Innovative Wall Coverings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Europe Innovative Wall Coverings Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Innovative Wall Coverings Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: Europe Innovative Wall Coverings Market Revenue billion Forecast, by Interior Paints Market 2020 & 2033

- Table 7: Europe Innovative Wall Coverings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Europe Innovative Wall Coverings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: UK Europe Innovative Wall Coverings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: France Europe Innovative Wall Coverings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Germany Europe Innovative Wall Coverings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Spain Europe Innovative Wall Coverings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: The Netherlands Europe Innovative Wall Coverings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Belgium Europe Innovative Wall Coverings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Portugal Europe Innovative Wall Coverings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Russia Europe Innovative Wall Coverings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Poland Europe Innovative Wall Coverings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Europe Innovative Wall Coverings Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Innovative Wall Coverings Market?

The projected CAGR is approximately 3.8%.

2. Which companies are prominent players in the Europe Innovative Wall Coverings Market?

Key companies in the market include Nippon Paint Group*List Not Exhaustive, Adfors (Saint Gobain), Walker Greenbank PLC, Grandeco Wallfashion Group, A S Création Tapten AG, Benjamin Moore & Co, Brewster Home Fashions LLC, Grespania Cerámica, Ahlstrom-munksjö Oyj, AkzoNobel NV.

3. What are the main segments of the Europe Innovative Wall Coverings Market?

The market segments include Product, Interior Paints Market, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.6 billion as of 2022.

5. What are some drivers contributing to market growth?

; Higher Demand for Home Furnishing among the European Countries; Availability of Styled Products.

6. What are the notable trends driving market growth?

Non-commercial is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

; High Inventory Costs and Premium Pricing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Innovative Wall Coverings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Innovative Wall Coverings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Innovative Wall Coverings Market?

To stay informed about further developments, trends, and reports in the Europe Innovative Wall Coverings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence