Key Insights

The Europe Long Haul Transport Market is projected to achieve a market size of 554.8 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 1.9% from 2025 to 2033. This growth is fueled by increasing e-commerce adoption and the demand for efficient continental deliveries. Key drivers include expansion in construction, sustained investments in oil and gas, and the essential supply chains of agriculture, fishing, and forestry. The manufacturing, automotive, and distributive trade sectors also significantly contribute to freight volumes, reinforcing the need for robust long-haul solutions. Emerging trends focus on sustainable logistics, with a growing emphasis on alternative fuels and electric vehicles to enhance environmental performance and operational efficiency.

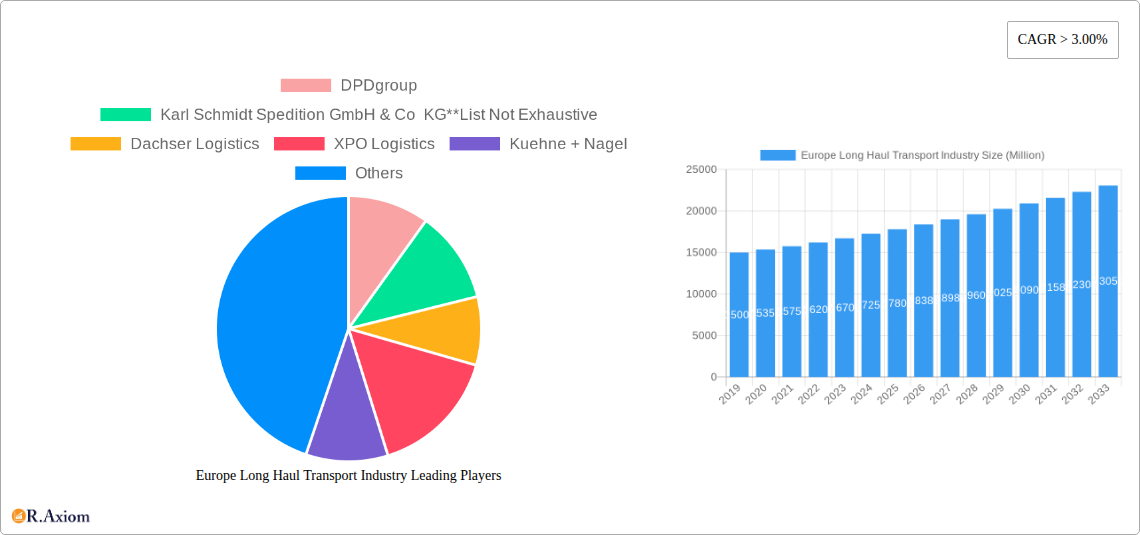

Europe Long Haul Transport Industry Market Size (In Billion)

Challenges such as stringent environmental regulations and escalating fuel costs necessitate continuous innovation and investment in eco-friendly technologies. Labor shortages within the transport sector present a significant operational hurdle. Major industry players, including Deutsche Post DHL Group, Kuehne + Nagel, and DSV Panalpina, are strategically investing in technology, automation, and workforce development to mitigate these issues. The market serves diverse end-users such as construction, oil and gas, agriculture, manufacturing, and distributive trade, underscoring the broad economic dependence on long-haul transport. Europe, characterized by strong economic activity in Germany, France, and the United Kingdom, remains a pivotal and dynamic market.

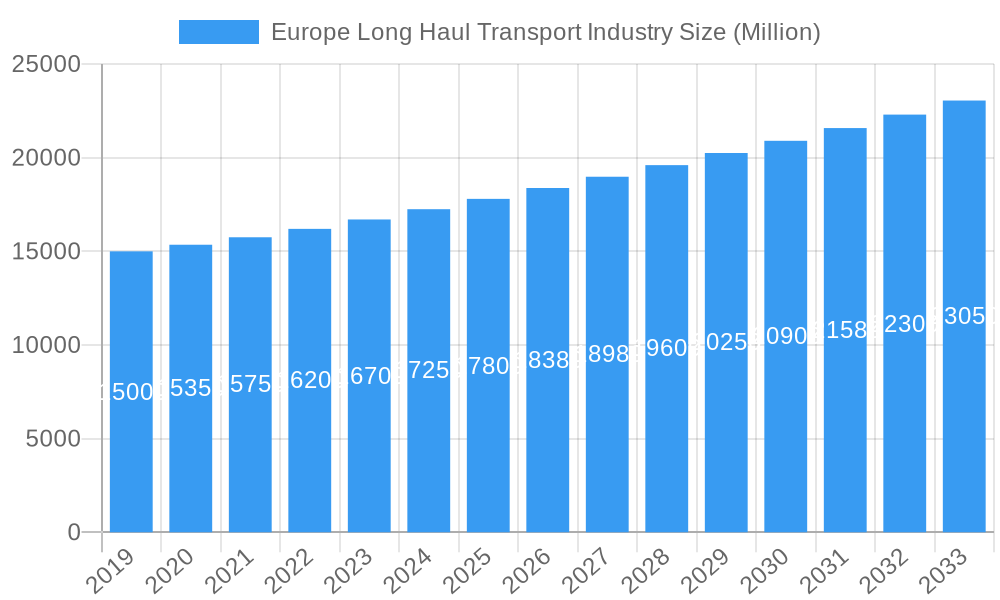

Europe Long Haul Transport Industry Company Market Share

This report provides an in-depth analysis of the Europe Long Haul Transport Market, detailing its size, growth trajectory, and future projections.

Europe Long Haul Transport Industry Market Concentration & Innovation

The Europe Long Haul Transport Industry is characterized by moderate to high market concentration, with several key players dominating significant market share. Leading companies such as Deutsche Post DHL Group, Kuehne + Nagel, and DSV Panalpina command substantial portions of the market, indicating an evolving competitive landscape. Innovation is a critical driver, propelled by the increasing demand for efficient, sustainable, and technologically advanced logistics solutions. Regulatory frameworks across European nations are increasingly focused on environmental standards and digital transformation, influencing operational strategies. Product substitutes, while present in the form of rail and sea freight for certain routes, are generally less agile for time-sensitive long-haul road transport. End-user demand is diversifying, with manufacturing and automotive segments showing robust growth, alongside increasing needs from the distributive trade and pharmaceutical sectors. Mergers and acquisitions (M&A) remain a strategic tool for consolidation and expansion. For instance, notable M&A deals in recent years have seen transaction values ranging from tens of millions to several billion Euros, facilitating market share gains and access to new technologies. The average market share of the top five players is estimated to be around 60%, highlighting the concentration of power within the industry. M&A activities are expected to continue as companies seek to optimize their networks and leverage economies of scale in the €200 Billion+ market.

Europe Long Haul Transport Industry Industry Trends & Insights

The Europe Long Haul Transport Industry is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period of 2025–2033. This growth is underpinned by several key trends and insights. Technological advancements, particularly in Artificial Intelligence (AI) and big data analytics, are revolutionizing route optimization, fleet management, and predictive maintenance. This leads to enhanced operational efficiency and reduced costs, crucial for long-haul operations that traverse vast distances and diverse terrains. The push for sustainability is a significant market disruptor. Increased adoption of electric and alternative fuel vehicles, coupled with the development of low-carbon energy solutions for trucking terminals, is reshaping the industry's environmental footprint. Consumer preferences are increasingly leaning towards faster, more reliable, and transparent delivery services, driving demand for integrated logistics solutions and real-time tracking. Competitive dynamics are intensifying, with established players investing heavily in digital infrastructure and sustainable technologies to maintain their market position. New entrants, often leveraging innovative business models and advanced technologies, are challenging traditional operators. Market penetration of advanced tracking and fleet management systems is estimated to be above 70% for leading companies, signifying a high level of technological adoption. The overall market size is projected to reach well over €300 Million by 2033, driven by expanding e-commerce and evolving supply chain demands. The focus on reducing transit times and improving delivery accuracy is paramount.

Dominant Markets & Segments in Europe Long Haul Transport Industry

The Europe Long Haul Transport Industry is dominated by Cross-border transportation, which accounts for an estimated 70% of the total market volume due to the integrated nature of the European Union and extensive trade networks. This dominance is driven by the elimination of trade barriers, harmonized regulations in many areas, and the sheer volume of goods moved between member states. The Manufacturing and Automotive sector stands out as a primary end-user, representing approximately 30% of the long-haul transport demand. This is due to the complex and often continent-wide supply chains required for producing and distributing vehicles and manufactured goods.

Cross-border Transportation:

- Key Drivers: EU single market, free movement of goods, economic interdependence between member states, demand for specialized components across borders.

- Dominance Analysis: The ease of movement within the EU, coupled with specific trade agreements with non-EU European countries, fuels continuous cross-border freight. Major trade corridors, such as those connecting Germany with France, the UK, and Eastern European countries, are hubs of intense long-haul activity. The increasing specialization of manufacturing within Europe also necessitates extensive cross-border logistics.

Manufacturing and Automotive End-User:

- Key Drivers: Just-in-time (JIT) production models, globalized supply chains for automotive components, demand for finished vehicle transport across the continent.

- Dominance Analysis: The automotive industry's intricate network of suppliers and assembly plants spread across Europe makes long-haul road transport essential for timely delivery of parts and finished vehicles. Manufacturers rely on efficient long-haul carriers to maintain production schedules and meet consumer demand for new cars. This segment's sustained demand contributes significantly to the overall volume of long-haul freight.

Distributive Trade: This segment also plays a crucial role, driven by the growth of retail and e-commerce, demanding efficient movement of goods from distribution centers to various retail outlets and directly to consumers.

Oil and Gas and Quarrying, Agriculture, Fishing, and Forestry, and Other End-Users (Pharmaceutical and Healthcare): While these sectors contribute, their long-haul transport needs are more specialized and less voluminous compared to manufacturing and distributive trade. However, the pharmaceutical and healthcare sector is showing a strong growth trajectory due to increasing demand for specialized, temperature-controlled logistics.

Europe Long Haul Transport Industry Product Developments

Product developments in the Europe Long Haul Transport Industry are heavily focused on enhancing efficiency, sustainability, and digitalization. Innovations include the advancement of AI-powered route optimization software that dynamically adjusts to traffic and weather conditions, reducing transit times and fuel consumption. The development of autonomous driving technologies for long-haul trucks is on the horizon, promising increased safety and reduced labor costs. Furthermore, advancements in telematics and IoT sensors are enabling real-time monitoring of cargo conditions, providing greater transparency and security for sensitive goods. The introduction of electric long-haul trucks and the development of supporting charging infrastructure are pivotal, offering a sustainable alternative to traditional diesel fleets and aligning with stringent emission regulations. These developments provide competitive advantages by lowering operational expenses, improving environmental credentials, and meeting evolving customer demands for greener logistics.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Europe Long Haul Transport Industry, segmenting the market by Destination and End-User.

Destination Segmentation: The market is divided into Domestic and Cross-border transport. Cross-border logistics is projected to maintain its dominant share due to integrated European trade networks, with a forecasted CAGR of 4.8% for the forecast period. Domestic transport, while significant, exhibits a slightly lower CAGR of 4.0%, driven by regional economic activity.

End-User Segmentation: Key end-users analyzed include Construction, Oil and Gas and Quarrying, Agriculture, Fishing, and Forestry, Manufacturing and Automotive, Distributive Trade, and Other End-Users (Pharmaceutical and Healthcare). The Manufacturing and Automotive segment is expected to continue leading, with an estimated market size of €80 Million in 2025, growing at a CAGR of 4.5%. The Distributive Trade segment also shows strong growth prospects, driven by e-commerce, with a projected CAGR of 4.7%. The Pharmaceutical and Healthcare segment, while smaller, is anticipated to experience the highest growth rate due to specialized logistics requirements.

Key Drivers of Europe Long Haul Transport Industry Growth

The growth of the Europe Long Haul Transport Industry is propelled by several interconnected factors. Firstly, the ongoing expansion of e-commerce and a rising consumer demand for fast and reliable deliveries are significantly increasing freight volumes. Secondly, technological advancements, particularly in AI, big data, and IoT, are enabling more efficient route planning, fleet management, and supply chain visibility, thereby reducing operational costs and improving service quality. Thirdly, increasing globalization and the complex interdependencies of European manufacturing supply chains necessitate robust long-haul transport solutions. Lastly, supportive government initiatives and regulatory frameworks aimed at decarbonization and promoting sustainable logistics are driving investments in cleaner technologies and alternative fuels, creating new market opportunities. The overall economic growth within the EU also plays a pivotal role.

Challenges in the Europe Long Haul Transport Industry Sector

Despite robust growth prospects, the Europe Long Haul Transport Industry faces several significant challenges. Regulatory complexities and variations across different European countries can create operational hurdles and increase compliance costs. The persistent shortage of skilled truck drivers across the continent poses a major constraint on capacity and service delivery. Increasing fuel costs and volatility, alongside the substantial investment required for fleet electrification and the development of charging infrastructure, present considerable financial barriers. Furthermore, intense competition within the sector, including the rise of new digitally-enabled logistics providers, puts pressure on pricing and profit margins. Supply chain disruptions, such as port congestion and geopolitical events, can also have a cascading impact on long-haul operations, affecting transit times and reliability. The estimated cost of driver shortages alone is in the hundreds of millions of Euros annually.

Emerging Opportunities in Europe Long Haul Transport Industry

Emerging opportunities in the Europe Long Haul Transport Industry are primarily centered around sustainability and digitalization. The substantial shift towards electric and alternative fuel vehicles presents a significant opportunity for investment in charging infrastructure and the deployment of green fleets, attracting environmentally conscious clients. The integration of advanced AI and machine learning for predictive logistics, autonomous trucking technologies, and enhanced supply chain visibility offers avenues for operational optimization and the creation of premium, data-driven services. The growing demand for temperature-controlled logistics, especially for pharmaceuticals and perishable goods, opens up specialized market niches. Furthermore, the development of multimodal transport solutions, integrating road freight with rail and maritime services for longer distances, can offer cost and environmental benefits. The evolving trade landscape and the need for resilient supply chains post-pandemic also create opportunities for agile and innovative transport providers.

Leading Players in the Europe Long Haul Transport Industry Market

- DPDgroup

- Karl Schmidt Spedition GmbH & Co KG

- Dachser Logistics

- XPO Logistics

- Kuehne + Nagel

- FIEGE Logistics

- Ceva Logistics Limited

- Deutsche Post DHL Group

- Bollore Logistics

- Rhenus Logistics

- DSV Panalpina

Key Developments in Europe Long Haul Transport Industry Industry

July 2023: Trucksters, a Spanish road freight operator, closed a Series B round of €33 million. This capital injection aims to accelerate its strategic objectives, including the potential electrification of its routes, positioning it as a pioneer in electric long-haul transport in Europe. This development signifies a strong push towards sustainable long-haul solutions driven by technological innovation and significant investor confidence.

March 2023: CEVA Logistics, ENGIE, and SANEF formed the ECTN Alliance. This alliance envisions building and operating a network of truck terminals equipped with low-carbon energy solutions. Tailored for the specific needs of electric trucks, such as limited range and charging requirements, the ECTN Alliance is a concrete step towards decarbonizing road freight transport and fighting climate change by creating a European Clean Transport Network.

Strategic Outlook for Europe Long Haul Transport Industry Market

The strategic outlook for the Europe Long Haul Transport Industry is one of continued growth, driven by an imperative shift towards sustainability and digital transformation. Investments in electric vehicle technology, charging infrastructure, and alternative fuels will be crucial for market leaders to meet stringent environmental regulations and consumer demand for green logistics. The adoption of AI and big data will further refine operational efficiencies, enabling predictive maintenance, optimized routing, and enhanced supply chain transparency. Consolidation through strategic mergers and acquisitions will likely continue as companies seek to expand their networks, gain market share, and leverage economies of scale. The industry's ability to adapt to evolving regulatory landscapes, address driver shortages, and embrace technological innovation will determine its success in navigating the complexities and capitalizing on the significant opportunities present in the coming decade, ensuring robust market expansion beyond the €300 Million mark.

Europe Long Haul Transport Industry Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. Cross-border

-

2. End User

- 2.1. Construction

- 2.2. Oil and Gas and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Manufacturing and Automotive

- 2.5. Distributive Trade

- 2.6. Other End-Users (Pharmaceutical and Healthcare)

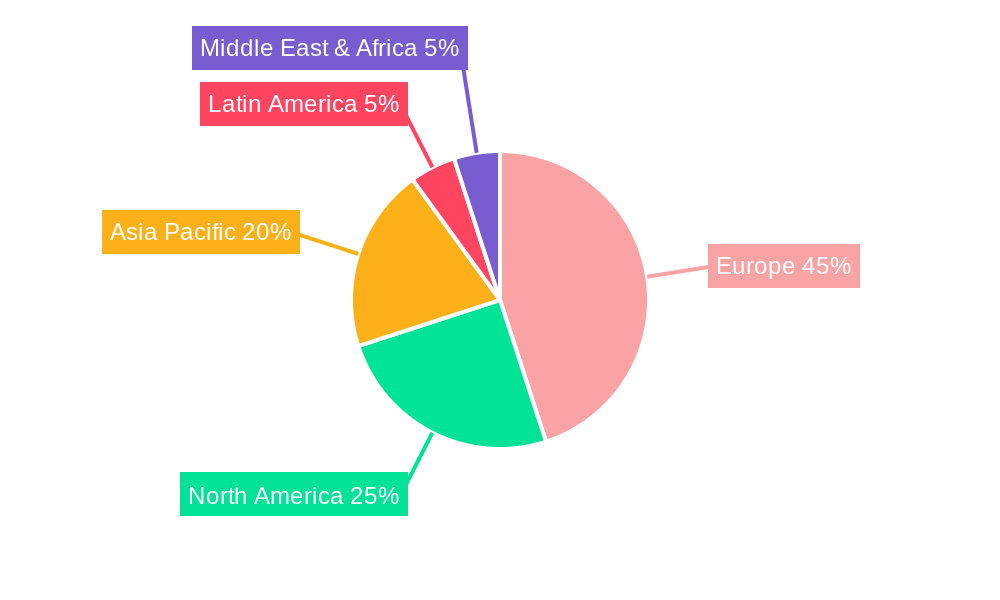

Europe Long Haul Transport Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Long Haul Transport Industry Regional Market Share

Geographic Coverage of Europe Long Haul Transport Industry

Europe Long Haul Transport Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth In E-commerce is driving the market4.; Growing in Cross Border Activities is driving the market

- 3.3. Market Restrains

- 3.3.1. 4.; Shortage of Skilled labor

- 3.4. Market Trends

- 3.4.1. Shrinking Automotive Sector May Impact the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Long Haul Transport Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. Cross-border

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Construction

- 5.2.2. Oil and Gas and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Manufacturing and Automotive

- 5.2.5. Distributive Trade

- 5.2.6. Other End-Users (Pharmaceutical and Healthcare)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DPDgroup

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Karl Schmidt Spedition GmbH & Co KG**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dachser Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 XPO Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kuehne + Nagel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FIEGE Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ceva Logistics Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Deutsche Post DHL Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bollore Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rhenus Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DSV Panalpina

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DPDgroup

List of Figures

- Figure 1: Europe Long Haul Transport Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Long Haul Transport Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Long Haul Transport Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 2: Europe Long Haul Transport Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Europe Long Haul Transport Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Long Haul Transport Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 5: Europe Long Haul Transport Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Europe Long Haul Transport Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Long Haul Transport Industry?

The projected CAGR is approximately 1.9%.

2. Which companies are prominent players in the Europe Long Haul Transport Industry?

Key companies in the market include DPDgroup, Karl Schmidt Spedition GmbH & Co KG**List Not Exhaustive, Dachser Logistics, XPO Logistics, Kuehne + Nagel, FIEGE Logistics, Ceva Logistics Limited, Deutsche Post DHL Group, Bollore Logistics, Rhenus Logistics, DSV Panalpina.

3. What are the main segments of the Europe Long Haul Transport Industry?

The market segments include Destination, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 554.8 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth In E-commerce is driving the market4.; Growing in Cross Border Activities is driving the market.

6. What are the notable trends driving market growth?

Shrinking Automotive Sector May Impact the Market Growth.

7. Are there any restraints impacting market growth?

4.; Shortage of Skilled labor.

8. Can you provide examples of recent developments in the market?

July 2023: Trucksters, a Spanish road freight operator which has disrupted the long-haul sector with the use of AI and big data, has closed a Series B round of €33 million. The new capital injection, backed up by new and existing investors, will be used to fulfil some of the company’s strategic objectives including electrifying its routes, potentially making Trucksters the first electric long-haul operator in Europe

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Long Haul Transport Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Long Haul Transport Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Long Haul Transport Industry?

To stay informed about further developments, trends, and reports in the Europe Long Haul Transport Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence