Key Insights

The European luxury residential real estate market, valued at $12.25 billion in 2025, is projected for substantial expansion. This segment is anticipated to achieve a compound annual growth rate (CAGR) of over 4% through 2033. Key drivers include the rising affluence of high-net-worth individuals (HNWIs) in major European economies like Germany, the UK, and France, fueling demand for premium properties. A consistent deficit of luxury residences in prime urban and coastal areas, combined with infrastructure development and improved living standards, is also contributing to price appreciation. Emerging trends highlight a growing preference for sustainable and smart homes, alongside demand for properties offering unique wellness amenities and exclusive services. Despite potential headwinds from economic volatility and regulatory shifts, the market's strong outlook is underpinned by luxury real estate's appeal as a stable and appreciating asset. Villas and landed houses represent a dominant segment, though luxury condominiums and apartments in prime urban centers are showing notable growth.

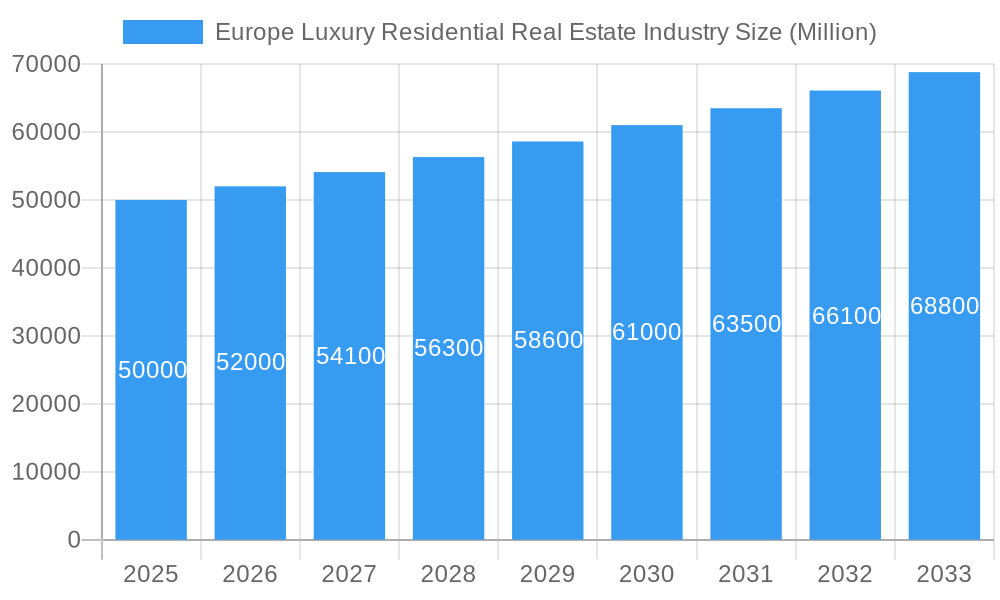

Europe Luxury Residential Real Estate Industry Market Size (In Billion)

Continued robust growth is anticipated, propelled by Europe's increasing prominence as an international investment hub, attracting HNWIs seeking secure and diversified portfolios. A heightened focus on lifestyle and wellness further enhances demand for luxury properties featuring upscale amenities, prime locations, and bespoke services. The competitive landscape features established international brands such as Mansion Global, Sotheby's International Realty, and Barnes International Realty, alongside agile regional specialists. Market consolidation is expected, with larger entities likely to acquire smaller agencies to broaden their reach and geographic presence. Germany, the UK, and France remain leading markets, with Italy and other European nations demonstrating steady growth. The forecast period suggests sustained positive momentum, though market saturation in certain premium locations may moderate the pace of growth.

Europe Luxury Residential Real Estate Industry Company Market Share

Europe Luxury Residential Real Estate Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe luxury residential real estate industry, offering valuable insights for investors, developers, and industry stakeholders. Covering the period 2019-2033, with a focus on 2025, this report unveils market trends, growth drivers, challenges, and opportunities within this dynamic sector. The report leverages extensive data analysis and expert insights to deliver actionable intelligence.

Europe Luxury Residential Real Estate Industry Market Concentration & Innovation

The European luxury residential real estate market exhibits a moderately concentrated structure, with a few key players commanding significant market share. While precise market share figures for each company are unavailable (xx%), industry giants like Sotheby's International Realty Affiliates LLC and Barnes International Realty hold substantial positions through their extensive global networks and brand recognition. Emerging players like Slate Asset Management are also actively reshaping the landscape through strategic acquisitions. Innovation in this sector is driven by technological advancements, such as virtual tours and online property platforms (e.g., Mansion Global), which enhance the buyer experience and streamline transactions. However, regulatory frameworks, including building codes and environmental regulations, significantly impact development and construction. Product substitutes, such as luxury vacation rentals, exert some competitive pressure. End-user trends, characterized by increasing demand for sustainable and technologically advanced properties, are shaping the market. Mergers and acquisitions (M&A) activity is prominent, with deal values varying significantly depending on the asset size and location. For instance, Slate Asset Management’s acquisition of 36 properties in Norway for USD 0.15 Billion highlights the considerable investment in this segment.

Europe Luxury Residential Real Estate Industry Industry Trends & Insights

The European luxury residential real estate market is witnessing robust growth, driven by several key factors. Increased high-net-worth individual (HNWI) wealth, particularly in key markets like the UK, Germany, and France, fuels demand for premium properties. Furthermore, favorable economic conditions in certain regions and low-interest rates (in the historical period) have stimulated investment. Technological disruptions, including the rise of proptech and online platforms, have transformed how properties are marketed and sold, increasing transparency and efficiency. Consumer preferences are shifting towards sustainable, smart homes incorporating energy-efficient features and advanced technology. However, competitive dynamics remain intense, with established players facing challenges from both large international firms and smaller, specialized boutiques. The CAGR (Compound Annual Growth Rate) for the luxury residential market during the forecast period (2025-2033) is estimated at xx%, reflecting a strong but potentially moderated growth compared to the historical period (2019-2024), where CAGR was xx%. Market penetration of sustainable features in new luxury developments is projected to reach xx% by 2033.

Dominant Markets & Segments in Europe Luxury Residential Real Estate Industry

The United Kingdom, France, and Germany remain dominant markets in the European luxury residential real estate sector.

Key Drivers:

- United Kingdom: Strong economy (pre-2022), established luxury market, high concentration of HNWIs, and attractive investment opportunities.

- France: Iconic properties, desirable lifestyle, robust tourism sector driving demand for second homes, and government initiatives promoting luxury real estate development.

- Germany: Strong economy, growing HNWIs, increasing demand for luxury apartments in major cities, and robust infrastructure.

Dominance Analysis:

While the UK and France traditionally hold stronger positions in terms of high-value transactions and prestigious properties, Germany is experiencing rapid growth in luxury apartment sales in urban areas. Italy and other regions are also witnessing increased investment, particularly in areas with unique natural or cultural appeal. Villas/Landed Houses generally command higher prices compared to Condominiums/Apartments, but the latter segment has seen a surge in popularity in urban centers. The “Rest of Europe” segment displays a diverse set of smaller, localized markets showing varied trends depending on economic conditions and regional factors. Russia is currently experiencing significant uncertainty affecting its market performance.

Europe Luxury Residential Real Estate Industry Product Developments

Recent product innovations focus on enhancing sustainability, integrating smart home technology, and improving energy efficiency. These developments cater to the evolving preferences of discerning buyers who seek both luxury and environmental responsibility. Key innovations include the use of eco-friendly building materials, smart home automation systems, and energy-efficient appliances. The competitive advantage lies in offering unique and bespoke features that cater to individual client preferences, combining luxurious finishes with cutting-edge technology.

Report Scope & Segmentation Analysis

This report segments the European luxury residential real estate market by property type (Villas/Landed Houses and Condominiums/Apartments) and by country (Germany, United Kingdom, France, Italy, Russia, and Rest of Europe). Growth projections vary across segments; Villas/Landed Houses are anticipated to experience robust growth driven by high demand from HNWIs. The condominium/apartment segment is showing marked growth in urban centers driven by increased population and high demand in desirable areas. By country, the UK, France, and Germany are projected to dominate market size, while Italy and the “Rest of Europe” segment also exhibit promising but less dominant growth trajectories. Competitive dynamics differ across segments and countries, with varying degrees of market concentration and the presence of both established international players and smaller local firms.

Key Drivers of Europe Luxury Residential Real Estate Industry Growth

Growth is fueled by increasing HNWIs wealth, low-interest rates (historically), government incentives for real estate investments in specific regions, and technological advancements enhancing the buying experience. Additionally, the desire for unique, sustainable, and technologically advanced homes drives innovation and market growth.

Challenges in the Europe Luxury Residential Real Estate Industry Sector

Regulatory hurdles, including planning permissions and environmental regulations, can significantly delay projects and increase development costs. Supply chain disruptions, particularly those related to building materials, add to construction costs. Increased competition, particularly from emerging players and online platforms, and fluctuating macroeconomic conditions impacting consumer confidence and investment are additional challenges.

Emerging Opportunities in Europe Luxury Residential Real Estate Industry

Emerging opportunities lie in targeting sustainable and eco-friendly luxury properties, exploiting growing demand in secondary markets with high tourism appeal, integrating smart home technologies, and using innovative marketing strategies (such as metaverse integration).

Leading Players in the Europe Luxury Residential Real Estate Industry Market

- Mansion Global

- Haussmann Real Estate

- Sotheby's International Realty Affiliates LLC

- Proprietes Le Figaro

- Barnes International Realty

- Rodgaard Ejendomme

- John Taylor

- BellesDemeures

- Juvel Ejendomme

- Luxury places SA

Key Developments in Europe Luxury Residential Real Estate Industry Industry

- August 2022: Slate Asset Management acquired a portfolio of 36 key real estate properties in Norway for USD 0.15 Billion, expanding its presence significantly.

- January 2022: Instone Real Estate sold approximately 330 apartments to LEG, highlighting the robust activity in the German market.

Strategic Outlook for Europe Luxury Residential Real Estate Industry Market

The future of the European luxury residential real estate market looks positive, with sustained growth projected, albeit possibly at a more moderate rate than historically observed. Continued demand from HNWIs, coupled with technological innovation and sustainable development initiatives, will shape the industry’s trajectory. Strategic partnerships and acquisitions will likely remain key strategies for market players aiming to consolidate their positions and expand their reach within this competitive and lucrative segment.

Europe Luxury Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Villas/Landed Houses

- 1.2. Condominiums/Apartments

Europe Luxury Residential Real Estate Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Luxury Residential Real Estate Industry Regional Market Share

Geographic Coverage of Europe Luxury Residential Real Estate Industry

Europe Luxury Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Commercial Property Development; Rapid Digitalization of Commercial Construction

- 3.3. Market Restrains

- 3.3.1. Emerging Safety and Labour Issues; Rise in Cost of Construction

- 3.4. Market Trends

- 3.4.1. Largest Real Estate Companies in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas/Landed Houses

- 5.1.2. Condominiums/Apartments

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mansion Global

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Haussmann Real Estate

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sotheby's International Realty Affiliates LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Proprietes Le Figaro

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Barnes International Realty

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rodgaard Ejendomme

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 John Taylor

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BellesDemeures**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Juvel Ejendomme

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Luxury places SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Mansion Global

List of Figures

- Figure 1: Europe Luxury Residential Real Estate Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Luxury Residential Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Luxury Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Luxury Residential Real Estate Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Europe Luxury Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Europe Luxury Residential Real Estate Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: France Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Luxury Residential Real Estate Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Luxury Residential Real Estate Industry?

The projected CAGR is approximately 10.36%.

2. Which companies are prominent players in the Europe Luxury Residential Real Estate Industry?

Key companies in the market include Mansion Global, Haussmann Real Estate, Sotheby's International Realty Affiliates LLC, Proprietes Le Figaro, Barnes International Realty, Rodgaard Ejendomme, John Taylor, BellesDemeures**List Not Exhaustive, Juvel Ejendomme, Luxury places SA.

3. What are the main segments of the Europe Luxury Residential Real Estate Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.25 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Commercial Property Development; Rapid Digitalization of Commercial Construction.

6. What are the notable trends driving market growth?

Largest Real Estate Companies in Europe.

7. Are there any restraints impacting market growth?

Emerging Safety and Labour Issues; Rise in Cost of Construction.

8. Can you provide examples of recent developments in the market?

August 2022: Slate Asset Management, a global alternative investment platform that focuses on real assets, stated that it had paid more than NOK 1.5 billion (USD 0.15 billion) for a portfolio of 36 key real estate properties in Norway. Following closely on the heels of the company's initial two portfolio purchases in the area in December 2021 and March 2022, this deal increases Slate's presence in Norway to a total of 63 critical real estate assets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Luxury Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Luxury Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Luxury Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Europe Luxury Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence