Key Insights

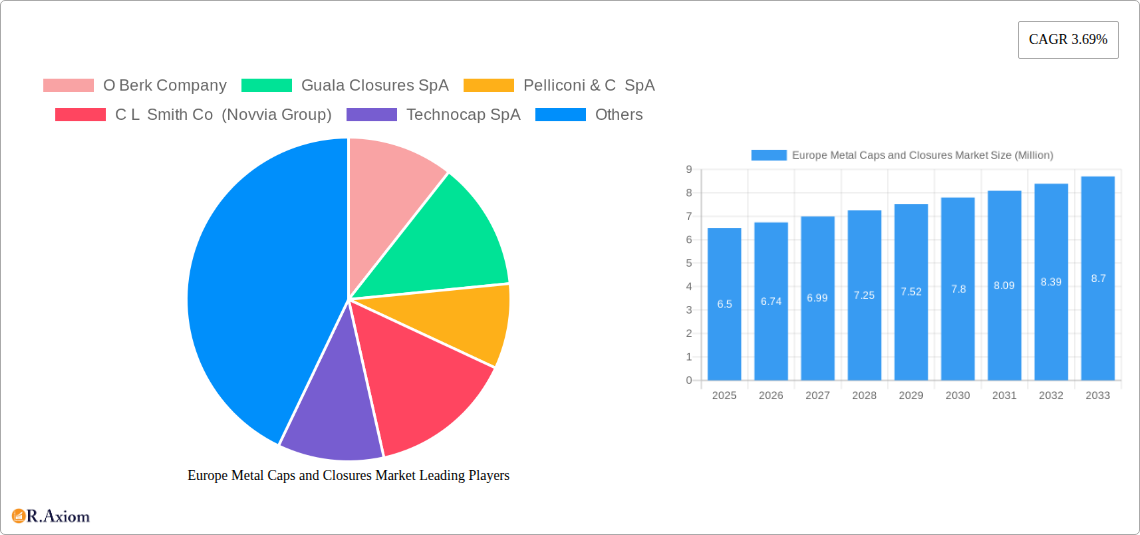

The European metal caps and closures market is poised for steady growth, projected to reach approximately USD 6.5 million in 2025 with a Compound Annual Growth Rate (CAGR) of 3.69% through 2033. This expansion is primarily driven by the robust demand from the food and beverage sectors, encompassing both alcoholic and non-alcoholic drinks, which constitute a significant portion of end-user consumption. The pharmaceutical industry also plays a crucial role, demanding high-quality and secure closures for its products, further bolstering market value. Moreover, the personal care segment, with its increasing reliance on aesthetically pleasing and functional metal closures, contributes to this positive trajectory. Aluminum and steel remain the dominant material types, with crown caps and screw caps leading in closures type, reflecting their widespread application and cost-effectiveness. The market's inherent stability is further supported by established players like Guala Closures SpA, Amcor PLC, and Silgan Closures, who consistently innovate and cater to evolving industry needs.

Europe Metal Caps and Closures Market Market Size (In Million)

Despite the positive outlook, the market faces certain restraints. Fluctuations in raw material prices, particularly for aluminum and steel, can impact manufacturing costs and subsequently affect pricing strategies for metal caps and closures. Furthermore, increasing environmental concerns and a growing preference for sustainable packaging solutions are pushing for the development of lighter, more recyclable, or even alternative material closures. However, the inherent durability, tamper-evident features, and premium perception associated with metal closures continue to ensure their relevance. Technological advancements in manufacturing processes, such as enhanced sealing technologies and innovative designs for twist metal caps, are expected to drive market penetration and customer adoption, especially within the diverse European landscape, encompassing key markets like the United Kingdom, Germany, France, and Italy.

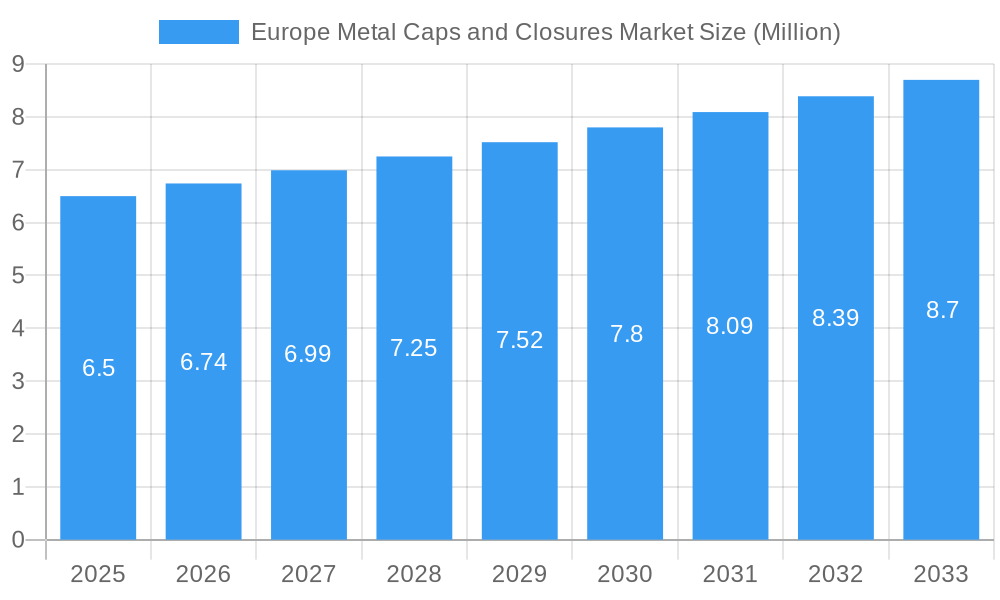

Europe Metal Caps and Closures Market Company Market Share

This in-depth report provides a definitive analysis of the Europe Metal Caps and Closures Market, covering the period from 2019 to 2033, with a base year of 2025. Delving into crucial market dynamics, this report offers actionable insights for stakeholders seeking to navigate the evolving landscape of metal packaging solutions. With a focus on high-traffic keywords such as "Europe metal caps," "metal closures," "packaging market," "aluminum caps," "steel closures," "food packaging," "beverage packaging," and "pharmaceutical packaging," this report is designed to enhance search visibility and provide unparalleled value to industry professionals.

Europe Metal Caps and Closures Market Market Concentration & Innovation

The Europe Metal Caps and Closures Market exhibits a moderate level of market concentration, with several key players dominating market share. Major companies like Amcor PLC, Silgan Closures (Silgan Holdings Inc), and Guala Closures SpA hold significant portions of the market, driving innovation through substantial investments in research and development. Innovation in this sector is primarily fueled by the increasing demand for sustainable packaging solutions, advanced barrier properties, and enhanced product security. Regulatory frameworks, particularly those focused on environmental impact and food safety, play a pivotal role in shaping product development and material choices. For instance, stringent regulations on recyclability are pushing manufacturers towards higher recycled content. Product substitutes, such as plastic and glass closures, present competition, but the superior durability and recyclability of metal often give it an edge. End-user trends, including a preference for premium and convenient packaging, are also key innovation drivers. Mergers and acquisitions (M&A) are strategically shaping the market. For example, the acquisition of Coropoulis Packaging SA by Berlin Packaging in July 2023, with an undisclosed deal value, signals consolidation and expansion of service offerings. The market is characterized by a focus on value-added features, including tamper-evident seals and child-resistant designs.

Europe Metal Caps and Closures Market Industry Trends & Insights

The Europe Metal Caps and Closures Market is experiencing robust growth, projected to continue its upward trajectory with a Compound Annual Growth Rate (CAGR) of approximately 5.2% from 2025 to 2033. This expansion is primarily driven by the escalating demand from the food and beverage sectors, which constitute the largest end-user industries. The non-alcoholic beverage segment, in particular, is witnessing a surge in the adoption of metal caps and closures for products like juices, bottled water, and carbonated soft drinks, fueled by consumer preference for healthier options and enhanced shelf life. Alcoholic beverages, including beer and spirits, also represent a significant market share, with crown caps and screw caps being prevalent. The pharmaceutical industry's increasing reliance on secure and sterile packaging for medications is another key growth driver. The personal care sector, while smaller, is contributing to market growth with innovative metal closures for premium cosmetic and personal hygiene products. Technological advancements in manufacturing processes, such as high-speed capping machines and advanced coating technologies that enhance corrosion resistance and aesthetic appeal, are improving product quality and efficiency. Consumer preferences are increasingly leaning towards sustainable and recyclable packaging, pushing manufacturers to invest in eco-friendly materials and production methods. The introduction of lightweight aluminum caps and closures is gaining traction as a cost-effective and environmentally conscious alternative. Market penetration is high across major European economies, with a growing emphasis on customization and brand differentiation through specialized closure designs and finishes. The competitive dynamics are characterized by intense price competition and a continuous drive for product innovation and service excellence. The increasing adoption of e-commerce also necessitates robust packaging solutions that can withstand the rigors of shipping, further bolstering the demand for reliable metal closures.

Dominant Markets & Segments in Europe Metal Caps and Closures Market

The Beverages end-user industry stands as the dominant segment within the Europe Metal Caps and Closures Market, accounting for an estimated XX Million in market value in 2025. This dominance is largely attributed to the vast and diverse nature of the European beverage market, encompassing both alcoholic and non-alcoholic categories. Within beverages, non-alcoholic drinks, including juices, water, and soft drinks, are experiencing significant growth due to rising health consciousness and on-the-go consumption patterns. The Food industry is the second-largest segment, driven by the demand for secure and tamper-evident closures for a wide array of products like jams, sauces, spreads, and dairy items. The Pharmaceuticals sector is a high-value segment, characterized by strict regulatory requirements and a demand for specialized, high-security metal closures to ensure product integrity and patient safety. The Personal Care segment, though smaller, is growing, with a focus on premium aesthetics and functionality for cosmetics, perfumes, and toiletries.

In terms of material type, Aluminum is emerging as a dominant material, driven by its lightweight nature, excellent recyclability, and cost-effectiveness. It is widely used for beverage cans and closures. Steel continues to hold a significant share, particularly for larger containers and where higher strength is required.

Among closure types, Screw Caps are experiencing the highest demand due to their ease of use and resealability, making them popular across beverage, food, and personal care applications. Crown Caps remain indispensable for the beer and beverage industry. Twist Metal Caps are also a popular choice, especially for food products.

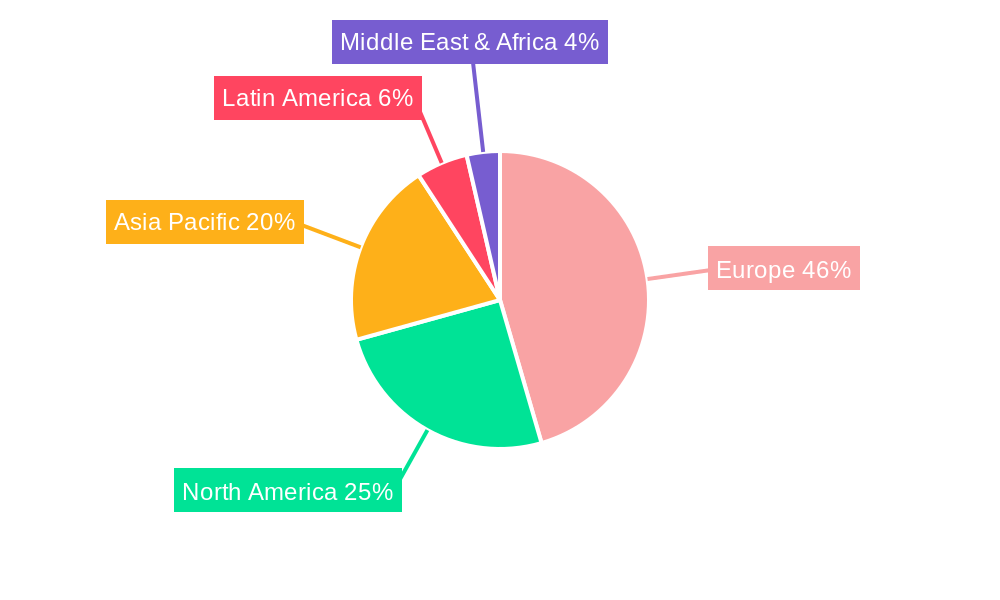

Geographically, Germany is the leading market in Europe, owing to its strong industrial base, significant manufacturing output in the food and beverage sectors, and a high level of consumer spending. The UK and France also represent substantial markets. Economic policies supporting manufacturing and packaging innovation, coupled with advanced logistics infrastructure, are key drivers for the dominance of these regions.

Europe Metal Caps and Closures Market Product Developments

Product development in the Europe Metal Caps and Closures Market is increasingly focused on sustainability, functionality, and enhanced consumer experience. Innovations include the development of lightweight aluminum closures with improved barrier properties, reducing material usage and environmental impact. Advancements in tamper-evident technologies ensure product security and consumer confidence. Manufacturers are also exploring decorative finishes and branding options to enhance product appeal. For instance, Amcor Capsules' recent initiative to incorporate over 90% recycled tin into its premium tin capsules highlights the industry's commitment to circular economy principles. These developments aim to provide a competitive edge by meeting evolving consumer preferences for eco-friendly and high-performance packaging solutions.

Report Scope & Segmentation Analysis

This report meticulously segments the Europe Metal Caps and Closures Market by Material Type, including Aluminum and Steel. The Closures Type segmentation covers Crown Caps, Screw Caps, Twist Metal Caps, and Other Closure Types. The End-user Industry segmentation encompasses Food, Beverages (Alcoholic, Non-alcoholic), Pharmaceuticals, Personal Care, and Other End-user Industries. Each segment is analyzed in detail, providing market size estimations, growth projections, and competitive dynamics. The Aluminum segment is projected to witness substantial growth due to its recyclability and lightweight properties, estimated at a market size of XX Million in 2025. Screw Caps are expected to maintain their lead in the Closures Type segment, driven by their versatility. The Beverages segment will continue to dominate the End-user Industry classification, with an estimated market size of XX Million in 2025.

Key Drivers of Europe Metal Caps and Closures Market Growth

The growth of the Europe Metal Caps and Closures Market is propelled by several key factors. Increasing consumer preference for sustainable and recyclable packaging is a primary driver, pushing manufacturers to adopt eco-friendly materials like aluminum. The robust growth of the food and beverage industries, particularly the non-alcoholic beverage sector, directly fuels demand for a wide range of metal closures. Technological advancements in manufacturing, leading to enhanced product quality, security features, and aesthetic appeal, also contribute significantly. Furthermore, stringent regulations promoting product safety and integrity in the pharmaceutical sector necessitate the use of reliable metal closures. The growing demand for premium and convenient packaging across various consumer goods segments further supports market expansion.

Challenges in the Europe Metal Caps and Closures Market Sector

Despite its growth, the Europe Metal Caps and Closures Market faces several challenges. Fluctuating raw material prices, particularly for aluminum and steel, can impact profitability and pricing strategies. Intensifying competition from alternative packaging materials, such as advanced plastics, poses a constant threat. Increasingly stringent environmental regulations and recycling mandates require continuous investment in process upgrades and material innovation to meet compliance standards. Supply chain disruptions, as witnessed in recent years, can affect production schedules and lead times. Economic slowdowns and geopolitical uncertainties in Europe can also dampen consumer spending and, consequently, demand for packaged goods.

Emerging Opportunities in Europe Metal Caps and Closures Market

The Europe Metal Caps and Closures Market presents several promising emerging opportunities. The growing demand for innovative and customized packaging solutions in premium food and beverage segments offers avenues for value-added product development. The expansion of e-commerce logistics creates a need for robust and damage-resistant packaging, a domain where metal closures excel. The increasing focus on health and wellness drives demand for metal closures that ensure product safety and hygiene in the food and beverage sectors. Furthermore, advancements in smart packaging technologies, integrating features like QR codes and NFC tags into metal closures, present an opportunity for enhanced traceability and consumer engagement. The ongoing push towards a circular economy also encourages the development of more efficient recycling processes and the use of higher percentages of recycled content.

Leading Players in the Europe Metal Caps and Closures Market Market

- O Berk Company

- Guala Closures SpA

- Pelliconi & C SpA

- C L Smith Co (Novvia Group)

- Technocap SpA

- Can-Pack SA

- Amcor PLC

- P Wilkinson Containers Ltd

- Silgan Closures (Silgan Holdings Inc )

- ACTEGA (A member of ALTANA)

- Berlin Packaging

Key Developments in Europe Metal Caps and Closures Market Industry

- May 2024: Amcor Capsules, a leader in closures, elevated its commitment to sustainability by incorporating over 90% recycled tin into its premium tin capsules and sparkling foils. The company has set up innovative sourcing channels, tapping into recycled tin from diverse sources like car radiators, batteries, ship propellers, and even bronze scraps from ornaments and statues. Highlighting their dedication to the environment, Amcor emphasizes that its tin products are not only recyclable but have also been endorsed by the independent third party, Institute Cyclos-HTP, certifying a remarkable 99% recyclability rate for their tin capsules. This development underscores a strong market trend towards enhanced sustainability and a circular economy.

- July 2023: Coropoulis Packaging SA, a renowned packaging supplier of closures, corks, and glass containers, was acquired by Berlin Packaging, a leading Hybrid Packaging Supplier. Established in 1893, the Athens-based company thoroughly understands the local market and offers packaging solutions to various industries such as wine, spirits, food, beverages, pharmaceuticals, and cosmetics. Coropoulis Packaging specializes in closures, corks, and glass packaging and provides technical support, bottling, and capping machinery services. This acquisition signifies consolidation within the market and expansion of service portfolios, impacting competitive dynamics and geographical reach.

Strategic Outlook for Europe Metal Caps and Closures Market Market

The strategic outlook for the Europe Metal Caps and Closures Market remains highly positive, driven by persistent consumer demand for safe, sustainable, and convenient packaging. Key growth catalysts include the continued expansion of the food and beverage sectors, coupled with the pharmaceutical industry's unwavering need for high-integrity closures. Manufacturers that invest in innovative materials with enhanced recyclability, such as advanced aluminum alloys and improved tin coatings, will be well-positioned for future success. The integration of smart technologies into closures to enhance traceability and consumer engagement also represents a significant opportunity. Strategic partnerships and mergers and acquisitions are expected to continue shaping the market landscape, fostering consolidation and expanding operational efficiencies. The ongoing commitment to sustainability and the circular economy will remain a cornerstone of market strategy, driving innovation and consumer loyalty.

Europe Metal Caps and Closures Market Segmentation

-

1. Material Type

- 1.1. Aluminum

- 1.2. Steel

-

2. Closures Type

- 2.1. Crown Caps

- 2.2. Screw Caps

- 2.3. Twist Metal Caps

- 2.4. Other Closure Type

-

3. End-user Industry

- 3.1. Food

-

3.2. Beverages

- 3.2.1. Alcoholic

- 3.2.2. Non-alcoholic

- 3.3. Pharmaceuticals

- 3.4. Personal Care

- 3.5. Other End-user Industries

Europe Metal Caps and Closures Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Metal Caps and Closures Market Regional Market Share

Geographic Coverage of Europe Metal Caps and Closures Market

Europe Metal Caps and Closures Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Cosmetics and Personal Care Industry; Superior Properties Compared to Other Closure Materials

- 3.3. Market Restrains

- 3.3.1. Growing Cosmetics and Personal Care Industry; Superior Properties Compared to Other Closure Materials

- 3.4. Market Trends

- 3.4.1. The Beverage Industry is Expected to Adopt Metal Closures Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Metal Caps and Closures Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Aluminum

- 5.1.2. Steel

- 5.2. Market Analysis, Insights and Forecast - by Closures Type

- 5.2.1. Crown Caps

- 5.2.2. Screw Caps

- 5.2.3. Twist Metal Caps

- 5.2.4. Other Closure Type

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverages

- 5.3.2.1. Alcoholic

- 5.3.2.2. Non-alcoholic

- 5.3.3. Pharmaceuticals

- 5.3.4. Personal Care

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 O Berk Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Guala Closures SpA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pelliconi & C SpA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 C L Smith Co (Novvia Group)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Technocap SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Can-Pack SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Amcor PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 P Wilkinson Containers Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Silgan Closures (Silgan Holdings Inc )

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ACTEGA (A member of ALTANA)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Berlin Packaging*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 O Berk Company

List of Figures

- Figure 1: Europe Metal Caps and Closures Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Metal Caps and Closures Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Metal Caps and Closures Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Europe Metal Caps and Closures Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 3: Europe Metal Caps and Closures Market Revenue Million Forecast, by Closures Type 2020 & 2033

- Table 4: Europe Metal Caps and Closures Market Volume Billion Forecast, by Closures Type 2020 & 2033

- Table 5: Europe Metal Caps and Closures Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Europe Metal Caps and Closures Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 7: Europe Metal Caps and Closures Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Europe Metal Caps and Closures Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Europe Metal Caps and Closures Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 10: Europe Metal Caps and Closures Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 11: Europe Metal Caps and Closures Market Revenue Million Forecast, by Closures Type 2020 & 2033

- Table 12: Europe Metal Caps and Closures Market Volume Billion Forecast, by Closures Type 2020 & 2033

- Table 13: Europe Metal Caps and Closures Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Europe Metal Caps and Closures Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Europe Metal Caps and Closures Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Metal Caps and Closures Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Europe Metal Caps and Closures Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Europe Metal Caps and Closures Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Germany Europe Metal Caps and Closures Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Europe Metal Caps and Closures Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: France Europe Metal Caps and Closures Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: France Europe Metal Caps and Closures Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Italy Europe Metal Caps and Closures Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Europe Metal Caps and Closures Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Spain Europe Metal Caps and Closures Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Spain Europe Metal Caps and Closures Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Netherlands Europe Metal Caps and Closures Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Netherlands Europe Metal Caps and Closures Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Belgium Europe Metal Caps and Closures Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Belgium Europe Metal Caps and Closures Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Sweden Europe Metal Caps and Closures Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Sweden Europe Metal Caps and Closures Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Norway Europe Metal Caps and Closures Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Norway Europe Metal Caps and Closures Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Poland Europe Metal Caps and Closures Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Poland Europe Metal Caps and Closures Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Denmark Europe Metal Caps and Closures Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Denmark Europe Metal Caps and Closures Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Metal Caps and Closures Market?

The projected CAGR is approximately 3.69%.

2. Which companies are prominent players in the Europe Metal Caps and Closures Market?

Key companies in the market include O Berk Company, Guala Closures SpA, Pelliconi & C SpA, C L Smith Co (Novvia Group), Technocap SpA, Can-Pack SA, Amcor PLC, P Wilkinson Containers Ltd, Silgan Closures (Silgan Holdings Inc ), ACTEGA (A member of ALTANA), Berlin Packaging*List Not Exhaustive.

3. What are the main segments of the Europe Metal Caps and Closures Market?

The market segments include Material Type, Closures Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Cosmetics and Personal Care Industry; Superior Properties Compared to Other Closure Materials.

6. What are the notable trends driving market growth?

The Beverage Industry is Expected to Adopt Metal Closures Significantly.

7. Are there any restraints impacting market growth?

Growing Cosmetics and Personal Care Industry; Superior Properties Compared to Other Closure Materials.

8. Can you provide examples of recent developments in the market?

May 2024: Amcor Capsules, a leader in closures, elevated its commitment to sustainability by incorporating over 90% recycled tin into its premium tin capsules and sparkling foils. The company has set up innovative sourcing channels, tapping into recycled tin from diverse sources like car radiators, batteries, ship propellers, and even bronze scraps from ornaments and statues. Highlighting their dedication to the environment, Amcor emphasizes that its tin products are not only recyclable but have also been endorsed by the independent third party, Institute Cyclos-HTP, certifying a remarkable 99% recyclability rate for their tin capsules.July 2023: Coropoulis Packaging SA, a renowned packaging supplier of closures, corks, and glass containers, was acquired by Berlin Packaging, a leading Hybrid Packaging Supplier. Established in 1893, the Athens-based company thoroughly understands the local market and offers packaging solutions to various industries such as wine, spirits, food, beverages, pharmaceuticals, and cosmetics. Coropoulis Packaging specializes in closures, corks, and glass packaging and provides technical support, bottling, and capping machinery services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Metal Caps and Closures Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Metal Caps and Closures Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Metal Caps and Closures Market?

To stay informed about further developments, trends, and reports in the Europe Metal Caps and Closures Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence