Key Insights

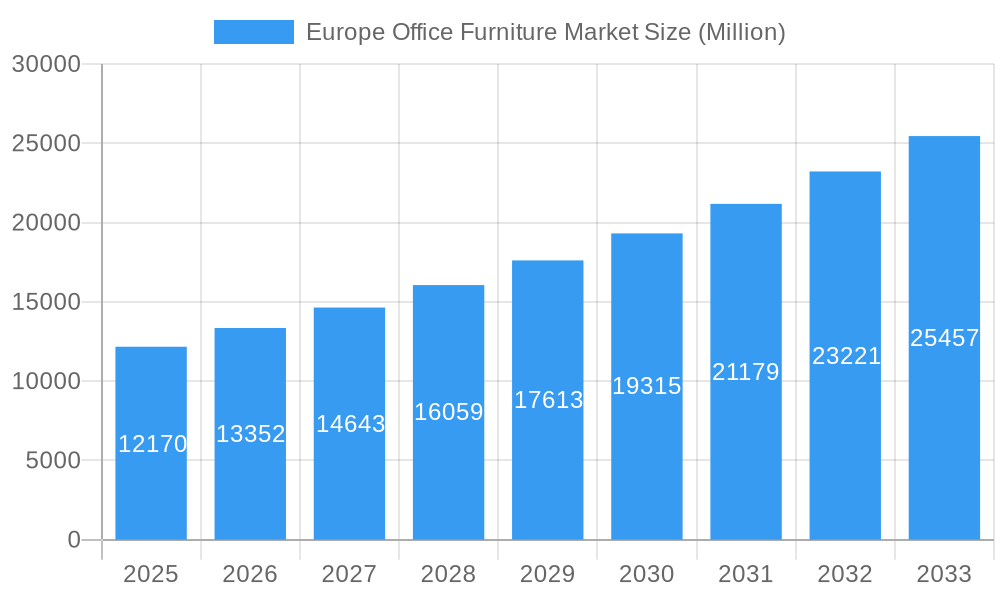

The European office furniture market is poised for robust growth, projected to reach a substantial USD 12.17 billion by 2025, driven by a compelling compound annual growth rate (CAGR) of 9.78% from 2019 to 2033. This expansion is primarily fueled by the evolving nature of workspaces, with a significant emphasis on ergonomic and flexible furniture solutions designed to enhance employee well-being and productivity. The resurgence of hybrid and in-office work models post-pandemic has reignited demand for high-quality, aesthetically pleasing, and functional office furniture that caters to a diverse range of user needs and spatial configurations. Furthermore, increasing investments in office renovations and the establishment of new commercial spaces across Europe are acting as significant catalysts for market expansion. Companies are prioritizing the creation of collaborative environments and individual focus zones, leading to a greater demand for modular furniture systems, smart office solutions, and furniture made from sustainable and eco-friendly materials.

Europe Office Furniture Market Market Size (In Billion)

Key trends shaping the market include a strong inclination towards sustainable and circular economy principles in furniture manufacturing, with an increasing preference for recycled materials and durable designs. The integration of technology, such as built-in charging ports and adjustable height desks with digital controls, is becoming a standard feature, enhancing user convenience and adapting to the digital-first work environment. Moreover, the demand for personalized office spaces, reflecting corporate branding and employee preferences, is on the rise, prompting manufacturers to offer customizable options. However, the market also faces certain restraints, including the volatility of raw material prices, which can impact production costs and subsequently, pricing strategies. Supply chain disruptions, though gradually easing, can also pose challenges to timely delivery and market responsiveness. Despite these hurdles, the sustained focus on creating healthier, more engaging, and technologically advanced workspaces across Europe ensures a dynamic and expanding market for office furniture.

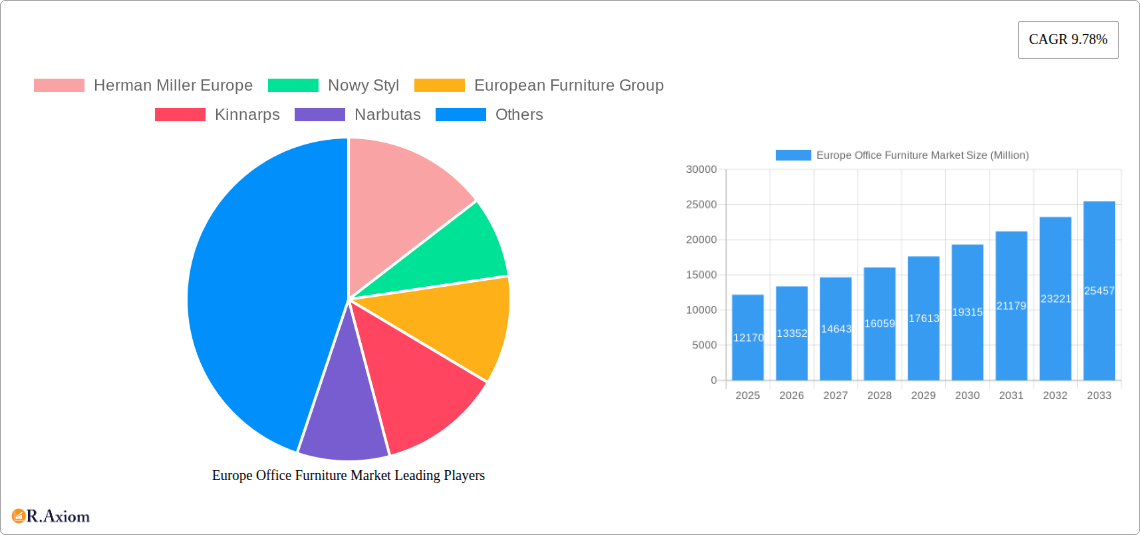

Europe Office Furniture Market Company Market Share

This in-depth report provides a definitive analysis of the Europe office furniture market, offering critical insights into its current landscape and future trajectory. Covering the study period of 2019–2033, with a base year of 2025, this report delves into the intricacies of production analysis, consumption analysis, import market analysis (value & volume), export market analysis (value & volume), and price trend analysis. We meticulously examine key market dynamics, competitive strategies, and emerging opportunities within the European region. This report is an indispensable resource for manufacturers, suppliers, distributors, investors, and industry stakeholders seeking to understand and capitalize on the evolving European office furniture market trends.

Europe Office Furniture Market Market Concentration & Innovation

The Europe office furniture market exhibits a moderate level of market concentration, with a blend of large global players and agile regional manufacturers vying for market share. Innovation is a key differentiator, driven by evolving workplace designs, sustainability mandates, and the increasing demand for ergonomic and technologically integrated furniture solutions. Regulatory frameworks, particularly concerning environmental impact and safety standards, significantly influence product development and manufacturing processes. The threat of product substitutes, such as shared workspace solutions and alternative furnishing materials, is present but largely countered by the enduring need for dedicated and customized office environments. End-user trends are heavily influenced by hybrid work models, which are spurring demand for adaptable and multi-functional furniture that supports both in-office collaboration and individual focus. Mergers and acquisitions (M&A) are strategic tools for expansion and consolidation. While specific M&A deal values are proprietary, key activities like HNI Corporation's acquisition of Kimball International in January 2023 highlight a trend towards portfolio expansion and enhanced market reach. The market share of leading companies is influenced by their product portfolios, distribution networks, and brand reputation, with major players like Herman Miller Europe, Nowy Styl, and Steelcase consistently holding significant positions.

Europe Office Furniture Market Industry Trends & Insights

The Europe office furniture market is on a robust growth trajectory, fueled by a confluence of factors that are reshaping modern workplaces. The persistent adoption of hybrid work models has accelerated the demand for flexible and adaptable office spaces, prompting businesses to invest in furniture that can seamlessly transition between collaborative zones and individual workstations. This has led to a surge in demand for modular furniture, ergonomic seating, and smart furniture integrated with technology, such as charging ports and adjustable height desks. The increasing emphasis on employee well-being and productivity is a paramount driver, with companies recognizing the direct link between comfortable and functional office environments and their workforce's overall performance. This translates into a growing preference for furniture that prioritizes ergonomics, lumbar support, and user-adjustable features.

Technological disruptions are also playing a pivotal role. The integration of IoT (Internet of Things) in office furniture, enabling features like space utilization tracking and personalized comfort settings, is an emerging trend. Furthermore, the rise of e-commerce and digital platforms for procurement is streamlining the buying process for businesses, offering greater accessibility and a wider selection of products. The market penetration of sustainable and eco-friendly furniture solutions is also on the rise, driven by increasing corporate social responsibility initiatives and consumer awareness. Manufacturers are actively investing in recycled materials, energy-efficient production processes, and durable designs to meet these evolving demands. The competitive dynamics within the European office furniture market are characterized by intense innovation, strategic partnerships, and a focus on customer-centric solutions. Companies are differentiating themselves through superior design, customization options, and comprehensive service offerings, including space planning and installation. The overall CAGR is projected to be substantial, reflecting the sustained demand for office furniture across various business sectors.

Dominant Markets & Segments in Europe Office Furniture Market

The Europe office furniture market is characterized by distinct regional strengths and segment dominance.

Production Analysis:

- Dominant Region: Western Europe, particularly Germany, the UK, and France, leads in production due to established manufacturing capabilities, access to skilled labor, and a strong industrial base.

- Key Drivers: Advanced manufacturing technologies, a focus on high-quality craftsmanship, and adherence to stringent European quality and environmental standards are crucial.

- Emerging Hubs: Eastern European countries, including Poland, are witnessing significant growth in production capabilities, often driven by cost-effectiveness and strategic proximity to Western European markets.

Consumption Analysis:

- Dominant Markets: Germany, the UK, and France also represent the largest consumption markets, driven by their robust economies, significant corporate presence, and continuous investment in office infrastructure.

- Key Drivers: The adoption of hybrid work models, corporate expansion, and the renovation of existing office spaces are primary consumption drivers. The demand for ergonomic and sustainable furniture solutions is also a significant factor.

- Growth Areas: Southern and Eastern European countries are showing increasing consumption as economies strengthen and businesses invest more in modernizing their office environments.

Import Market Analysis (Value & Volume):

- Dominant Importers: The UK and Germany are major import markets for office furniture, often seeking specialized designs, premium brands, or specific functionalities not readily available domestically.

- Key Drivers: Demand for innovative designs, specific product categories like executive office furniture, and products from countries with unique manufacturing expertise contribute to import volumes and values.

- Value vs. Volume: While volume might be higher for more standardized items, the import value is significantly influenced by high-end, designer, and technologically advanced furniture pieces.

Export Market Analysis (Value & Volume):

- Dominant Exporters: Germany, Italy, and Scandinavian countries are prominent exporters, renowned for their design innovation, quality, and brand prestige in the office furniture sector.

- Key Drivers: Strong brand recognition, superior product quality, and unique design aesthetics are key to successful exports. Countries like Poland are also significant exporters, leveraging competitive pricing and efficient production.

- Market Reach: Exports often target countries within and outside Europe, capitalizing on global demand for European-designed office furniture.

Price Trend Analysis:

- Key Influencers: Raw material costs (wood, metal, plastics), manufacturing labor, energy prices, transportation logistics, and currency exchange rates significantly impact price trends.

- Segment Variation: Premium and designer office furniture commands higher prices due to brand value, innovative design, and superior materials. Mass-produced, standard office furniture tends to be more price-sensitive.

- Sustainability Premium: Environmentally friendly and sustainably sourced furniture often carries a slight premium, reflecting the increased costs of production and certifications.

Europe Office Furniture Market Product Developments

Recent product developments in the Europe office furniture market are heavily influenced by the demand for ergonomic, sustainable, and technologically integrated solutions. Innovations include smart desks with integrated charging and adjustable height features, modular seating systems that can be reconfigured to suit diverse spatial needs, and the extensive use of recycled and biodegradable materials in furniture construction. Companies are also focusing on acoustic solutions and biophilic design elements to enhance employee well-being and productivity in shared workspaces. Competitive advantages are being gained through customizable product lines, user-friendly digital configuration tools, and furniture designed for easy assembly and disassembly, aligning with circular economy principles.

Europe Office Furniture Market Report Scope & Segmentation Analysis

This report offers a comprehensive segmentation of the Europe office furniture market. The analysis covers Production Analysis:, detailing manufacturing capacities and regional output. Consumption Analysis: examines the demand patterns across various end-user segments and geographical regions. Import Market Analysis (Value & Volume): scrutinizes the flow of office furniture into Europe, identifying key source countries and product categories. Export Market Analysis (Value & Volume): highlights Europe's outbound trade, showcasing its export strengths and target markets. Lastly, Price Trend Analysis: provides insights into the pricing dynamics of different office furniture segments. Growth projections and market sizes are meticulously detailed for each segment, alongside an analysis of the competitive dynamics that shape their evolution.

Key Drivers of Europe Office Furniture Market Growth

The Europe office furniture market growth is propelled by several key drivers. The ongoing evolution of the workplace, with a significant shift towards hybrid and flexible working arrangements, necessitates modern, adaptable, and ergonomic office furniture. Increased corporate investment in creating productive and employee-centric work environments, driven by a focus on well-being and talent retention, is a major catalyst. Furthermore, government initiatives promoting sustainability and circular economy principles are encouraging the adoption of eco-friendly furniture materials and manufacturing processes. Technological advancements, leading to the integration of smart features and enhanced functionality in furniture, are also driving demand for innovative solutions.

Challenges in the Europe Office Furniture Market Sector

Despite its growth, the Europe office furniture market faces several challenges. Fluctuations in raw material costs, particularly for wood, metal, and plastics, can significantly impact profit margins. Supply chain disruptions, exacerbated by geopolitical events and logistics issues, can lead to increased lead times and production delays. Intense competition among a wide range of manufacturers, from global giants to niche players, puts pressure on pricing and necessitates continuous innovation. Evolving regulatory landscapes concerning sustainability and product safety require ongoing compliance efforts and investment in research and development. Furthermore, the adaptation to rapid changes in workspace design and the economic uncertainty impacting corporate spending can pose significant hurdles.

Emerging Opportunities in Europe Office Furniture Market

The Europe office furniture market presents numerous emerging opportunities. The sustained demand for home office furniture, driven by remote work trends, offers a significant growth avenue. The increasing focus on employee well-being and mental health is creating opportunities for furniture that incorporates biophilic design, acoustic solutions, and customizable ergonomic features. The growing emphasis on sustainability and the circular economy is spurring demand for furniture made from recycled materials, designed for longevity, and amenable to repair and refurbishment. Digitalization and e-commerce platforms are opening new sales channels and improving customer accessibility. Furthermore, emerging markets within Europe are showing increasing potential for investment and expansion as economies develop.

Leading Players in the Europe Office Furniture Market Market

- Herman Miller Europe

- Nowy Styl

- European Furniture Group

- Kinnarps

- Narbutas

- Steelcase

- Ahrend Group

- Haworth Europe

- Poltrona Frou

- Sedus Stoll

- Vitra

- Senator

Key Developments in Europe Office Furniture Market Industry

- January 2023: HNI Corporation acquired Kimball International to expand its product offerings and tailor products to cater to the company's requirements and expand its reach.

- February 2022: NexGen Workspace, the premiere resource for commercial office furniture, announced the launch of its new website, providing potential buyers with instant quotes for commercial office furniture and several pricing options.

Strategic Outlook for Europe Office Furniture Market Market

The strategic outlook for the Europe office furniture market is overwhelmingly positive, driven by the fundamental shift in how and where people work. The sustained demand for flexible, ergonomic, and technologically integrated furniture solutions will continue to shape product development and investment strategies. Companies that can effectively address the growing imperative for sustainability and circularity in their operations and product lifecycles will gain a significant competitive advantage. Strategic partnerships, digital transformation of sales and distribution channels, and a keen understanding of evolving end-user preferences will be crucial for market players. The market is poised for continued growth, with opportunities for innovation in smart furniture, well-being-focused designs, and the expansion into new market segments and geographies.

Europe Office Furniture Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Office Furniture Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Office Furniture Market Regional Market Share

Geographic Coverage of Europe Office Furniture Market

Europe Office Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Corporate Office Expansions and Renovations Drives Market Growth; Increasing Focus On Sustainability Drives The Market

- 3.3. Market Restrains

- 3.3.1. Intense Competition Leading To Price Wars And Reduced Profitability; Challenges in Implementing Sustainable Practices4.3.2.1; Market Oppurtunities4.; Technological Advancements In Office Furniture Market

- 3.4. Market Trends

- 3.4.1. Growing Environmental Awareness And Sustainability Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Office Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Herman Miller Europe

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nowy Styl

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 European Furniture Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kinnarps

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Narbutas

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Steelcase

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ahrend Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Haworth Europe

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Poltrona Frou**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sedus Stoll

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Vitra

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Senator

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Herman Miller Europe

List of Figures

- Figure 1: Europe Office Furniture Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Office Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Office Furniture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Office Furniture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Office Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Office Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Office Furniture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Office Furniture Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Europe Office Furniture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Office Furniture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Office Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Office Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Office Furniture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Office Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Office Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Office Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Europe Office Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Office Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Office Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Office Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Office Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Office Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Office Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Office Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Office Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Office Furniture Market?

The projected CAGR is approximately 9.78%.

2. Which companies are prominent players in the Europe Office Furniture Market?

Key companies in the market include Herman Miller Europe, Nowy Styl, European Furniture Group, Kinnarps, Narbutas, Steelcase, Ahrend Group, Haworth Europe, Poltrona Frou**List Not Exhaustive, Sedus Stoll, Vitra, Senator.

3. What are the main segments of the Europe Office Furniture Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Corporate Office Expansions and Renovations Drives Market Growth; Increasing Focus On Sustainability Drives The Market.

6. What are the notable trends driving market growth?

Growing Environmental Awareness And Sustainability Drive the Market.

7. Are there any restraints impacting market growth?

Intense Competition Leading To Price Wars And Reduced Profitability; Challenges in Implementing Sustainable Practices4.3.2.1; Market Oppurtunities4.; Technological Advancements In Office Furniture Market.

8. Can you provide examples of recent developments in the market?

In January 2023, HNI Corporation acquired Kimball International to expand its product offerings and tailor products to cater to the company's requirements and expand its reach.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Office Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Office Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Office Furniture Market?

To stay informed about further developments, trends, and reports in the Europe Office Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence