Key Insights

The Europe Personal Care Plastic Tube Packaging Market is projected to reach 3055.7 million by 2025, exhibiting a CAGR of 6.1% through 2033. This growth is driven by increasing demand for sophisticated and sustainable packaging in the personal care sector. Key factors include consumer preference for convenient and hygienic product application, particularly in oral care and skincare. Innovations in eco-friendly materials and advanced dispensing mechanisms further boost market adoption. The trend towards premium personal care products necessitates packaging that reflects quality and brand aesthetics, positioning plastic tubes as a versatile and cost-effective solution.

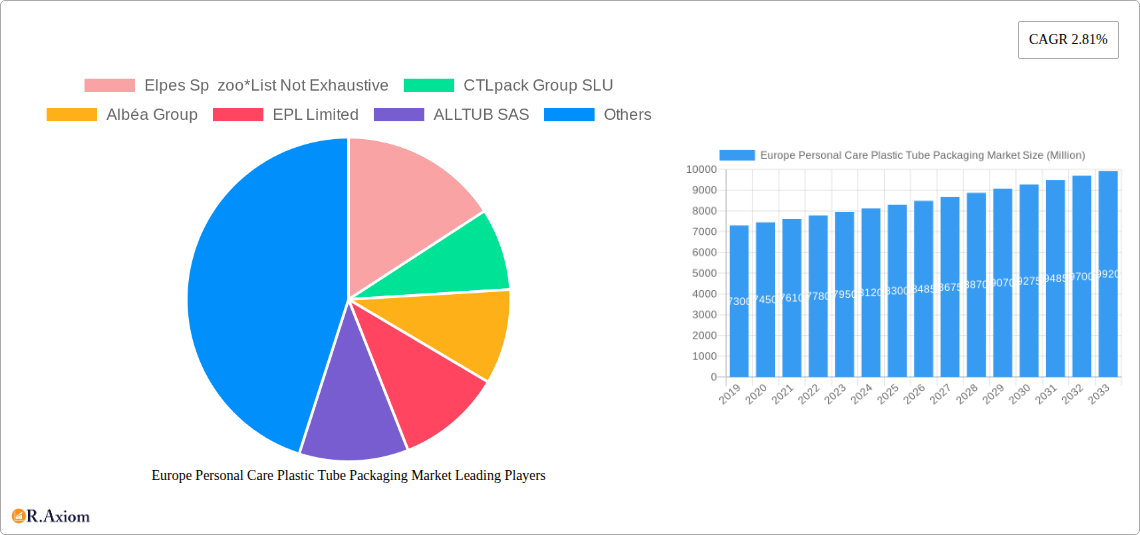

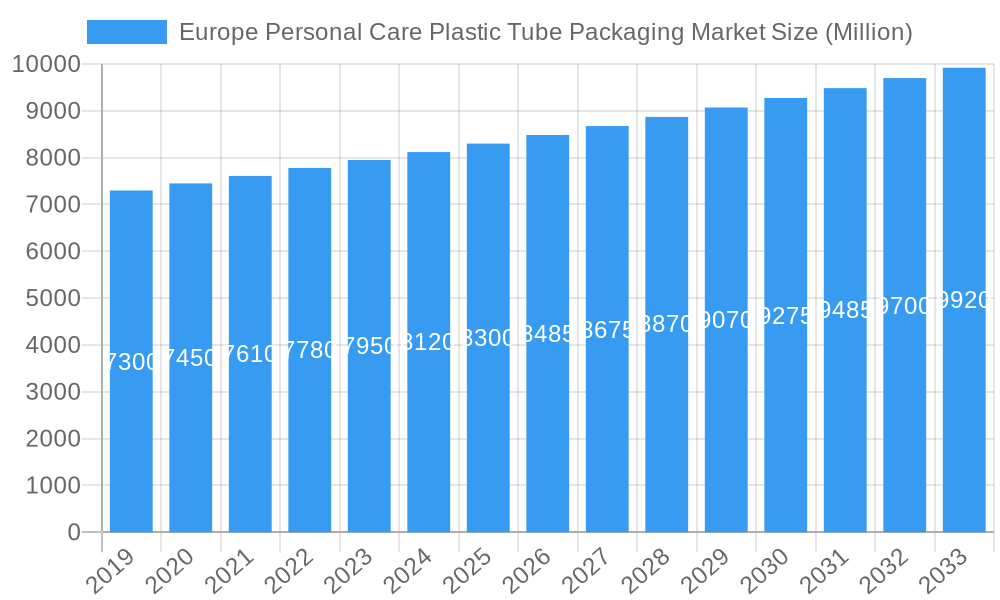

Europe Personal Care Plastic Tube Packaging Market Market Size (In Billion)

Extruded tubes currently dominate due to their versatility and cost-effectiveness, while laminated tubes are gaining traction for premium cosmetic and skincare applications requiring enhanced barrier properties. The oral care segment remains a significant contributor, with skincare and haircare applications showing robust growth. Restraints include rising raw material costs and regulatory scrutiny on plastic waste. However, recycling initiatives, biodegradable plastics, and circular economy principles are expected to mitigate these challenges. Europe's emphasis on environmental regulations and consumer awareness of sustainability will shape product innovation and market strategies.

Europe Personal Care Plastic Tube Packaging Market Company Market Share

This report offers a granular analysis of the Europe Personal Care Plastic Tube Packaging Market from 2019 to 2033, with a base year of 2025. It provides critical insights into market dynamics, key players, emerging trends, and future growth trajectories. Leveraging keywords such as "personal care packaging," "plastic tubes Europe," "cosmetic packaging solutions," "oral care tubes," and "skin care packaging innovations," the report aims to enhance search visibility for industry stakeholders. The segmentation by product type (Laminated Tubes, Extruded Tubes) and application (Oral Care, Skin Care, Hair Care, Make-up & Cosmetics, Other Applications) ensures a detailed understanding of market nuances.

Europe Personal Care Plastic Tube Packaging Market Market Concentration & Innovation

The Europe Personal Care Plastic Tube Packaging Market exhibits a moderate to high level of market concentration, characterized by the presence of both established global players and specialized regional manufacturers. Innovation is a primary driver, fueled by escalating consumer demand for sustainable, functional, and aesthetically pleasing packaging. Key innovation trends include the development of mono-material solutions, enhanced barrier properties, and the integration of smart packaging features. Regulatory frameworks, particularly those focusing on circular economy principles and plastic reduction, are increasingly shaping product development and material choices. Product substitutes, such as rigid containers and alternative packaging materials, pose a competitive challenge, but the inherent advantages of plastic tubes in terms of user experience and cost-effectiveness maintain their dominance. End-user trends heavily influence innovation, with a growing preference for eco-friendly packaging and convenient dispensing systems. Mergers and acquisitions (M&A) activities are strategically employed by leading companies to expand their product portfolios, geographical reach, and technological capabilities. For instance, major M&A deals in the broader packaging industry, with estimated values often in the hundreds of millions of Euros, reflect the strategic importance and consolidation within this sector. The market share of key players is a crucial indicator, with the top five companies estimated to hold approximately 60% of the market share in 2025.

Europe Personal Care Plastic Tube Packaging Market Industry Trends & Insights

The Europe Personal Care Plastic Tube Packaging Market is witnessing robust growth, driven by a confluence of factors including rising disposable incomes, an expanding middle class, and a heightened consumer focus on personal well-being and hygiene. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period of 2025–2033. This expansion is underpinned by the persistent demand for premium and effective personal care products, where packaging plays a pivotal role in brand perception and product integrity. Technological advancements are revolutionizing the manufacturing processes, leading to the development of more sustainable materials and innovative designs. For example, the increasing adoption of advanced extrusion and lamination techniques allows for the production of tubes with superior performance characteristics, such as improved chemical resistance and extended shelf life for sensitive formulations. Consumer preferences are shifting towards convenience and sustainability; hence, brands are increasingly opting for packaging that is lightweight, easy to use, and recyclable. The penetration of eco-friendly packaging solutions is expected to surge, driven by both consumer awareness and stringent environmental regulations. Competitive dynamics are intensifying, with companies vying for market share through product differentiation, strategic partnerships, and a focus on customer-centric solutions. The trend towards personalized and niche beauty products also fuels demand for specialized tube packaging with unique aesthetic appeals and dispensing mechanisms. The overall market penetration of plastic tubes in the personal care sector in Europe stands at an estimated 75% in 2025, indicating a mature yet still growing market.

Dominant Markets & Segments in Europe Personal Care Plastic Tube Packaging Market

The Skin Care segment is the dominant application within the Europe Personal Care Plastic Tube Packaging Market, accounting for an estimated 35% of the total market value in 2025. This dominance is driven by a vast array of products, including moisturizers, sunscreens, anti-aging creams, and serums, all of which commonly utilize tube packaging for user convenience and hygiene. Economic policies in key European nations, such as Germany, France, and the UK, that support the growth of the cosmetics and personal care industries, alongside well-developed retail and e-commerce infrastructure, further bolster the Skin Care segment.

- Key Drivers for Skin Care Dominance:

- High Product Variety: A wide spectrum of skin care formulations necessitates diverse packaging solutions.

- Consumer Preference for Convenience: Tubes offer easy dispensing and controlled application.

- Brand Differentiation: Aesthetic appeal and innovative designs in tube packaging enhance brand visibility.

- Evolving Consumer Demands: Growing interest in natural and organic ingredients often requires protective packaging.

In terms of product type, Laminated Tubes hold a significant share, estimated at 55% of the market in 2025, primarily due to their superior barrier properties and versatility in accommodating various cosmetic formulations.

- Key Drivers for Laminated Tube Dominance:

- Excellent Barrier Properties: Protection against moisture, light, and oxygen, crucial for product stability.

- Aesthetic Versatility: Ability to accommodate high-quality printing and finishes, enhancing brand appeal.

- Material Flexibility: Can be combined with different materials to achieve specific performance characteristics.

Geographically, Germany is the largest market in Europe for personal care plastic tube packaging, representing approximately 20% of the total market value in 2025. This is attributed to its strong economy, a large and affluent consumer base, and a robust domestic manufacturing sector for cosmetics and personal care products.

- Key Drivers for Germany's Dominance:

- Strong Economy and High Disposable Income: Supports premium product consumption.

- Leading Cosmetics Manufacturers: Presence of major global and local players in the personal care industry.

- Focus on Sustainability: Growing demand for eco-friendly packaging solutions aligns with German environmental policies.

Europe Personal Care Plastic Tube Packaging Market Product Developments

Product development in the Europe Personal Care Plastic Tube Packaging Market is actively focused on sustainability and enhanced functionality. Innovations include the introduction of mono-material tubes designed for improved recyclability within existing streams, such as the Polyfoil EcoPro by Hoffmann Neopac, which is recyclable in the HDPE stream. Companies are also investing in lightweighting technologies, reducing material usage without compromising structural integrity, and developing tubes with advanced dispensing features for precise application and reduced product wastage. The integration of recycled content and bio-based plastics is another significant trend, addressing the growing environmental concerns of consumers and regulatory bodies. These developments not only cater to market demands but also provide a competitive advantage by offering eco-conscious solutions.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Europe Personal Care Plastic Tube Packaging Market across key segmentation parameters to provide a comprehensive market overview. The study encompasses two primary product types: Laminated Tubes and Extruded Tubes. Laminated tubes, often constructed from multiple layers of plastic and aluminum or other barrier materials, offer superior protection and are projected to capture a market share of approximately 55% in 2025 due to their suitability for sensitive formulations. Extruded tubes, typically made from a single plastic material, are known for their cost-effectiveness and versatility, expected to hold around 45% of the market share in 2025. The market is further segmented by application, including Oral Care, Skin Care, Hair Care, Make-up & Cosmetics, and Other Applications. The Skin Care segment is anticipated to be the largest, driven by a wide range of products and consumer demand for convenient packaging. Oral Care is also a significant segment due to the extensive use of toothpaste.

Key Drivers of Europe Personal Care Plastic Tube Packaging Market Growth

Several key drivers are propelling the growth of the Europe Personal Care Plastic Tube Packaging Market. Firstly, the burgeoning demand for natural and organic personal care products necessitates advanced packaging solutions that can preserve product integrity and extend shelf life, a role plastic tubes excel in. Secondly, evolving consumer lifestyles are increasing the demand for convenient and portable packaging, making tubes an ideal choice for on-the-go use. Furthermore, stringent environmental regulations in Europe, while posing challenges, are also driving innovation towards sustainable packaging solutions, such as tubes made from recycled content and mono-material designs that enhance recyclability. Technological advancements in manufacturing processes are leading to cost efficiencies and the development of aesthetically superior tubes, further boosting market adoption. Finally, the continuous product launches and innovations within the personal care industry itself, particularly in premium segments like anti-aging and specialized skincare, directly translate to increased demand for sophisticated tube packaging.

Challenges in the Europe Personal Care Plastic Tube Packaging Market Sector

The Europe Personal Care Plastic Tube Packaging Market faces several significant challenges that impact its growth trajectory. The most prominent is the increasing pressure from regulatory bodies and consumers to reduce plastic waste and promote a circular economy. This includes stricter regulations on single-use plastics and extended producer responsibility schemes, which can increase operational costs for manufacturers. Supply chain disruptions, exacerbated by geopolitical events and raw material price volatility, can lead to production delays and increased costs. Intense competition from alternative packaging materials, such as glass and sustainable alternatives like paper-based tubes, also poses a threat. Furthermore, the high cost of investing in new sustainable technologies and the infrastructure required for advanced recycling processes can be a barrier for smaller players. Ensuring consistent quality and performance across different plastic types and manufacturing processes also remains a technical challenge.

Emerging Opportunities in Europe Personal Care Plastic Tube Packaging Market

Emerging opportunities in the Europe Personal Care Plastic Tube Packaging Market are primarily centered around sustainability and technological innovation. The growing consumer and regulatory demand for eco-friendly packaging presents a significant opportunity for manufacturers to develop and market tubes made from post-consumer recycled (PCR) plastics, bio-based materials, and mono-material designs that facilitate easier recycling. The trend towards personalized beauty and niche product categories is creating demand for smaller, more specialized tube formats with unique aesthetic finishes and dispensing mechanisms. The development of smart packaging solutions, incorporating features like anti-counterfeiting technology or usage tracking, also presents a future growth avenue. Furthermore, collaborations between packaging manufacturers and personal care brands to co-develop innovative and sustainable packaging solutions can unlock new market potential and strengthen customer loyalty. The increasing online retail of personal care products also drives the need for robust yet lightweight packaging, where tubes offer a distinct advantage.

Leading Players in the Europe Personal Care Plastic Tube Packaging Market Market

- Elpes Sp zoo

- CTLpack Group SLU

- Albéa Group

- EPL Limited

- ALLTUB SAS

- Hoffmann Neopac AG

- Global Tube SpA

- ALPLA GROUP

- Berry Global Inc

- HCT Group

- Petroplast Sa (Induplast Group)

Key Developments in Europe Personal Care Plastic Tube Packaging Market Industry

- September 2023: Berry Global Group Inc. announced a five-year power purchase agreement (PPA) with ACCIONA Energía. This agreement aims to power all four of Berry's facilities in Mexico with wind and solar power, procuring nearly 100,000 megawatt hours (MWh) of renewable energy annually. This initiative is projected to avoid approximately 40,000 metric tons of carbon dioxide equivalent (CO2) annually, supporting Berry's climate goals and enabling its customers to advance their sustainability objectives through lower-carbon solutions.

- May 2023: Hoffmann Neopac launched Polyfoil EcoPro, a mono-material double barrier tube designed for the personal care and cosmetics industry. This high-performance packaging solution is fully recyclable in the high-density polyethylene (HDPE) stream and has received approval from RecyClass and a Suez Grade A rating. The new Polyfoil EcoPro tube is available in diameters from 30-50 mm and capacities of 50-200 ml, featuring a body wall thickness of 0.35 mm, which represents a 30% reduction compared to the company's standard Polyfoil tubes.

Strategic Outlook for Europe Personal Care Plastic Tube Packaging Market Market

The strategic outlook for the Europe Personal Care Plastic Tube Packaging Market is characterized by a strong emphasis on sustainable innovation and circular economy principles. Manufacturers are strategically investing in R&D to develop advanced materials, including higher percentages of PCR content and bio-based alternatives, to meet stringent environmental regulations and evolving consumer demands for eco-friendly products. The focus on lightweighting and mono-material designs will continue to grow, facilitating improved recyclability and reduced carbon footprints. Furthermore, companies are exploring opportunities in personalization and premiumization, offering customized tube designs and dispensing solutions that cater to niche market segments and enhance brand value. Strategic collaborations and partnerships with raw material suppliers and recycling infrastructure providers will be crucial for driving systemic change and ensuring the long-term viability of plastic tube packaging. The integration of digital technologies for enhanced supply chain visibility and traceability will also play a significant role in shaping the market's future.

Europe Personal Care Plastic Tube Packaging Market Segmentation

-

1. Product Type

- 1.1. Laminated Tubes

- 1.2. Extruded Tubes

-

2. Application

- 2.1. Oral Care

- 2.2. Skin Care

- 2.3. Hair Care

- 2.4. Make-up & Cosmetics

- 2.5. Other Applications

Europe Personal Care Plastic Tube Packaging Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Personal Care Plastic Tube Packaging Market Regional Market Share

Geographic Coverage of Europe Personal Care Plastic Tube Packaging Market

Europe Personal Care Plastic Tube Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Growth of the Cosmetics Sector in the European Union; Increase in Demand for Flexible and Portable Packaging

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Price can Hinder the Growth of the Market.

- 3.4. Market Trends

- 3.4.1. Skin Care to Witness the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Personal Care Plastic Tube Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Laminated Tubes

- 5.1.2. Extruded Tubes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Oral Care

- 5.2.2. Skin Care

- 5.2.3. Hair Care

- 5.2.4. Make-up & Cosmetics

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Elpes Sp zoo*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CTLpack Group SLU

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Albéa Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EPL Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ALLTUB SAS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hoffmann Neopac AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Global Tube SpA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ALPLA GROUP

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Berry Global Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 HCT Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Petroplast Sa (Induplast Group)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Elpes Sp zoo*List Not Exhaustive

List of Figures

- Figure 1: Europe Personal Care Plastic Tube Packaging Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Personal Care Plastic Tube Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Personal Care Plastic Tube Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Europe Personal Care Plastic Tube Packaging Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Europe Personal Care Plastic Tube Packaging Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: Europe Personal Care Plastic Tube Packaging Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Europe Personal Care Plastic Tube Packaging Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Europe Personal Care Plastic Tube Packaging Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Europe Personal Care Plastic Tube Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 8: Europe Personal Care Plastic Tube Packaging Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: Europe Personal Care Plastic Tube Packaging Market Revenue million Forecast, by Application 2020 & 2033

- Table 10: Europe Personal Care Plastic Tube Packaging Market Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Europe Personal Care Plastic Tube Packaging Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Europe Personal Care Plastic Tube Packaging Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Personal Care Plastic Tube Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Personal Care Plastic Tube Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Personal Care Plastic Tube Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Personal Care Plastic Tube Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Personal Care Plastic Tube Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Personal Care Plastic Tube Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Personal Care Plastic Tube Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Personal Care Plastic Tube Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Personal Care Plastic Tube Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Personal Care Plastic Tube Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Personal Care Plastic Tube Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Personal Care Plastic Tube Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Personal Care Plastic Tube Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Personal Care Plastic Tube Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Personal Care Plastic Tube Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Personal Care Plastic Tube Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Personal Care Plastic Tube Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Personal Care Plastic Tube Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Personal Care Plastic Tube Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Personal Care Plastic Tube Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Personal Care Plastic Tube Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Personal Care Plastic Tube Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Personal Care Plastic Tube Packaging Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Europe Personal Care Plastic Tube Packaging Market?

Key companies in the market include Elpes Sp zoo*List Not Exhaustive, CTLpack Group SLU, Albéa Group, EPL Limited, ALLTUB SAS, Hoffmann Neopac AG, Global Tube SpA, ALPLA GROUP, Berry Global Inc, HCT Group, Petroplast Sa (Induplast Group).

3. What are the main segments of the Europe Personal Care Plastic Tube Packaging Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3055.7 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Growth of the Cosmetics Sector in the European Union; Increase in Demand for Flexible and Portable Packaging.

6. What are the notable trends driving market growth?

Skin Care to Witness the Growth.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Price can Hinder the Growth of the Market..

8. Can you provide examples of recent developments in the market?

September 2023 - Berry Global Group Inc. announced a five-year power purchase agreement (PPA) with multinational renewable energy leader ACCIONA Energía to power all four of its facilities in Mexico with wind and solar power. Procuring nearly 100,000 megawatt hours (MWh) of cost-effective, renewable energy annually, this agreement is projected to avoid around 40,000 metric tons of carbon dioxide equivalent, or CO2, annually. This not only helps Berry meet its climate goals, but it also helps Berry's customers advance their ambitious sustainability goals by providing lower-carbon solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Personal Care Plastic Tube Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Personal Care Plastic Tube Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Personal Care Plastic Tube Packaging Market?

To stay informed about further developments, trends, and reports in the Europe Personal Care Plastic Tube Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence