Key Insights

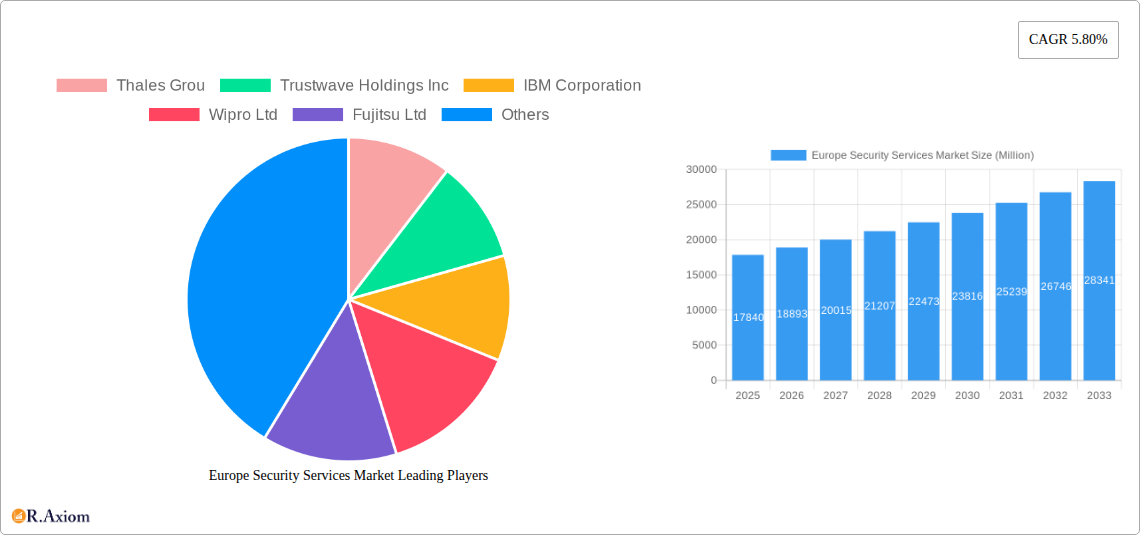

The European security services market, valued at €17.84 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.80% from 2025 to 2033. This expansion is driven by several key factors. Increasing cyber threats targeting critical infrastructure and businesses necessitate enhanced cybersecurity measures, fueling demand for managed security services, threat intelligence, and professional consulting. The growing adoption of cloud-based technologies, while offering scalability and efficiency, also introduces new vulnerabilities, thereby boosting the cloud security services segment. Furthermore, stringent government regulations aimed at protecting sensitive data across various sectors, including healthcare, finance, and government, are mandating robust security implementations. The rising incidence of data breaches and cyberattacks further contributes to market growth, prompting organizations to invest heavily in preventative and reactive security solutions. Germany, the United Kingdom, and France represent the largest national markets within Europe, benefiting from a strong technological infrastructure and high cybersecurity awareness.

Europe Security Services Market Market Size (In Billion)

The market segmentation reveals a diverse landscape. The cloud-based deployment model is expected to witness faster growth compared to on-premise solutions, reflecting the ongoing digital transformation across European industries. Among end-user industries, IT and infrastructure, banking, and government sectors are major contributors to market revenue, owing to their higher reliance on sensitive data and sophisticated IT systems. The managed security services segment holds a significant market share, reflecting the growing preference for outsourcing security management to specialized providers. Competition is fierce, with established players like Thales Group, IBM, and Wipro competing alongside specialized security firms and regional providers. The market's future trajectory will be influenced by technological advancements like AI and machine learning in security solutions, evolving regulatory frameworks, and the increasing sophistication of cyber threats. The consistent adoption of hybrid security models, integrating on-premise and cloud solutions, will also shape market dynamics over the forecast period.

Europe Security Services Market Company Market Share

This detailed report provides a comprehensive analysis of the Europe Security Services Market, covering market size, growth drivers, key players, and future trends. The study period spans 2019-2033, with 2025 as the base and estimated year. This report is invaluable for industry stakeholders, investors, and strategic decision-makers seeking a deep understanding of this dynamic market.

Europe Security Services Market Market Concentration & Innovation

The European security services market exhibits moderate concentration, with several large multinational corporations holding significant market share. Thales Group, IBM Corporation, and G4S Limited are among the leading players, commanding a combined xx% of the market in 2025. However, the market also accommodates numerous smaller, specialized firms, particularly in niche areas like cybersecurity consulting and threat intelligence. Market share fluctuations are influenced by M&A activities, with deal values exceeding xx Million in the past five years, predominantly driven by consolidation within cybersecurity and managed services segments.

Innovation in the sector is propelled by evolving cyber threats, increasing data privacy regulations (like GDPR), and rising adoption of cloud technologies. Key innovation drivers include:

- Artificial Intelligence (AI) and Machine Learning (ML): AI-powered threat detection and response systems are gaining traction.

- Advanced Analytics: Sophisticated data analytics solutions are used for proactive threat identification.

- Blockchain Technology: Blockchain's secure and transparent nature is being explored for enhancing security management.

- Internet of Things (IoT) Security: Growing IoT adoption necessitates robust security solutions for connected devices.

Regulatory frameworks, such as the NIS2 Directive and GDPR, significantly impact market dynamics by mandating enhanced security measures for organizations. Product substitutes, such as open-source security tools, present challenges to established vendors, while end-user trends favor integrated, cloud-based solutions and managed security services.

Europe Security Services Market Industry Trends & Insights

The European security services market is experiencing robust growth, projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors:

- Rising Cyberattacks: The increasing frequency and sophistication of cyberattacks across various sectors drive demand for enhanced security solutions.

- Data Privacy Regulations: Stringent regulations, such as GDPR, necessitate robust security measures and compliance solutions, boosting market growth.

- Cloud Adoption: The increasing shift toward cloud computing creates new security challenges and opportunities for cloud-based security services.

- Growing Awareness of Cybersecurity Risks: Heightened awareness among businesses and consumers regarding cybersecurity threats fosters greater investment in security services.

- Digital Transformation: The ongoing digital transformation across all industries necessitates comprehensive security solutions to protect digital assets and data.

Market penetration of advanced security solutions like AI-powered threat detection and endpoint detection and response (EDR) remains relatively low, representing a significant growth opportunity. However, competitive dynamics are intense, with established players facing competition from agile startups and specialized firms.

Dominant Markets & Segments in Europe Security Services Market

The United Kingdom currently holds the largest market share within Europe, driven by its robust IT infrastructure, a thriving financial sector, and strong regulatory environment. Germany and France follow as significant markets.

By Mode of Deployment:

- Cloud: The cloud-based segment is experiencing the fastest growth, driven by scalability, cost-effectiveness, and ease of deployment.

- On-Premise: While on-premise solutions still hold a significant share, their growth is comparatively slower.

By End-user Industry:

- IT and Infrastructure: This sector is a key driver due to the high concentration of sensitive data and critical infrastructure.

- Banking and Finance: The financial industry's stringent regulatory requirements and high-value data make it a dominant segment.

- Government: Government agencies are significantly investing in security infrastructure due to national security concerns.

By Service Type:

- Managed Security Services (MSS): The MSS market is experiencing significant growth due to its cost-effectiveness and expertise.

- Professional Security Services: This segment includes consulting, penetration testing, and vulnerability assessments.

Economic policies supporting digital transformation initiatives across Europe further boost market growth. Government investments in cybersecurity infrastructure and initiatives to improve digital literacy also contribute to segment dominance.

Europe Security Services Market Product Developments

Recent product innovations focus on AI-driven threat intelligence, automated security response systems, and cloud-native security solutions. These developments offer enhanced threat detection, reduced response times, and improved scalability, addressing the evolving cybersecurity landscape's needs. Companies are emphasizing integration capabilities to provide comprehensive security solutions, offering customers a unified security posture.

Report Scope & Segmentation Analysis

This report segments the Europe Security Services Market based on mode of deployment (on-premise and cloud), end-user industry (IT and Infrastructure, Government, Industrial, Healthcare, Transportation and Logistics, Banking, and Other End-User Industries), country (United Kingdom, Germany, France, Italy, and Spain), and service type (Managed Security Services, Professional Security Services, Consulting Services, and Threat Intelligence Security Services). Each segment's growth projections, market size, and competitive landscape are analyzed in detail, providing granular insights into market dynamics. Growth projections vary by segment, with cloud-based solutions and managed security services demonstrating higher growth rates.

Key Drivers of Europe Security Services Market Growth

Several factors drive market growth:

- The increasing prevalence of sophisticated cyberattacks targeting businesses and critical infrastructure.

- Stringent data privacy regulations mandating robust security measures.

- Rising adoption of cloud computing and the associated security challenges.

- Growing awareness of cybersecurity risks among organizations and individuals.

- Government initiatives promoting cybersecurity awareness and investment.

Challenges in the Europe Security Services Market Sector

The market faces challenges, including:

- The shortage of skilled cybersecurity professionals.

- The ever-evolving nature of cyber threats, requiring constant adaptation of security solutions.

- High initial investments required for implementing robust security infrastructure.

- Integration complexities between various security solutions from different vendors.

- The risk of vendor lock-in with certain security solutions.

Emerging Opportunities in Europe Security Services Market

Opportunities exist in:

- The expanding Internet of Things (IoT) security market.

- The increasing demand for AI-powered security solutions.

- The growing adoption of cloud-based security services.

- The development of innovative security solutions tailored to specific industry needs.

- Expanding into underserved markets within Europe.

Leading Players in the Europe Security Services Market Market

- Thales Group

- Trustwave Holdings Inc

- IBM Corporation

- Wipro Ltd

- Fujitsu Ltd

- Allied Universal

- Broadcom Inc

- Palo Alto Networks

- Digital Pathways Ltd

- G4S Limited

- SecurityHQ

- Cybaverse Ltd

- Fortra LLC

- Securitas Inc

Key Developments in Europe Security Services Market Industry

- August 2023: Fortra announced new integrations to its offensive security solutions, enhancing vulnerability management and penetration testing capabilities. This proactive approach helps identify and remediate vulnerabilities before exploitation.

- June 2023: Thales Group launched a new data security platform as a service, enabling businesses to deploy and scale data security solutions efficiently without significant upfront investment. This addresses the growing need for secure data management in cloud environments.

Strategic Outlook for Europe Security Services Market Market

The Europe Security Services Market is poised for continued growth, driven by increasing digitalization, rising cyber threats, and stringent data privacy regulations. Emerging technologies like AI and blockchain will play a crucial role in shaping the future of the market. Companies that can offer integrated, cloud-based solutions and leverage AI-driven threat intelligence will be best positioned to capitalize on future opportunities.

Europe Security Services Market Segmentation

-

1. Service Type

- 1.1. Managed Security Services

- 1.2. Professional Security Services

- 1.3. Consulting Services

- 1.4. Threat Intelligence Security Services

-

2. Mode of Deployment

- 2.1. On-premise

- 2.2. Cloud

-

3. End-user Industry

- 3.1. IT and Infrastructure

- 3.2. Government

- 3.3. Industrial

- 3.4. Healthcare

- 3.5. Transportation and Logistics

- 3.6. Banking

- 3.7. Other End-User Industries

Europe Security Services Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Security Services Market Regional Market Share

Geographic Coverage of Europe Security Services Market

Europe Security Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increasing Proliferation of Internet of Things (IoT) Devices; The Integration of Artificial Intelligence (AI) and Automation in Security Services; Increasing Investments by Organizations to Protect Against Country-sponsored Attacks

- 3.3. Market Restrains

- 3.3.1 Moderation

- 3.3.2 Privacy

- 3.3.3 accessibility & regulatory challenges

- 3.4. Market Trends

- 3.4.1. Cloud Adoption to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Security Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Managed Security Services

- 5.1.2. Professional Security Services

- 5.1.3. Consulting Services

- 5.1.4. Threat Intelligence Security Services

- 5.2. Market Analysis, Insights and Forecast - by Mode of Deployment

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. IT and Infrastructure

- 5.3.2. Government

- 5.3.3. Industrial

- 5.3.4. Healthcare

- 5.3.5. Transportation and Logistics

- 5.3.6. Banking

- 5.3.7. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Thales Grou

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Trustwave Holdings Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IBM Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wipro Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fujitsu Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Allied Universal

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Broadcom Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Palo Alto Networks

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Digital Pathways Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 G4S Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SecurityHQ

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Cybaverse Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Fortra LLC

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Securitas Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Thales Grou

List of Figures

- Figure 1: Europe Security Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Security Services Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Security Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Europe Security Services Market Revenue Million Forecast, by Mode of Deployment 2020 & 2033

- Table 3: Europe Security Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe Security Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Security Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: Europe Security Services Market Revenue Million Forecast, by Mode of Deployment 2020 & 2033

- Table 7: Europe Security Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Europe Security Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Security Services Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Europe Security Services Market?

Key companies in the market include Thales Grou, Trustwave Holdings Inc, IBM Corporation, Wipro Ltd, Fujitsu Ltd, Allied Universal, Broadcom Inc, Palo Alto Networks, Digital Pathways Ltd, G4S Limited, SecurityHQ, Cybaverse Ltd, Fortra LLC, Securitas Inc.

3. What are the main segments of the Europe Security Services Market?

The market segments include Service Type, Mode of Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.84 Million as of 2022.

5. What are some drivers contributing to market growth?

The Increasing Proliferation of Internet of Things (IoT) Devices; The Integration of Artificial Intelligence (AI) and Automation in Security Services; Increasing Investments by Organizations to Protect Against Country-sponsored Attacks.

6. What are the notable trends driving market growth?

Cloud Adoption to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Moderation. Privacy. accessibility & regulatory challenges.

8. Can you provide examples of recent developments in the market?

August 2023: Fortra announced new integrations to its offensive security solutions. These integrations streamline the ability to manage vulnerabilities, conduct penetration testing, and conduct red teaming. By working together, the solutions leverage the same tactics threat actors employ to detect and exploit vulnerabilities in an organization's security posture. This proactive security strategy allows customers to identify and remediate vulnerabilities before they are used. The layered approach unifies the capabilities of each solution for a more comprehensive security evaluation, testing, and control.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Security Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Security Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Security Services Market?

To stay informed about further developments, trends, and reports in the Europe Security Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence