Key Insights

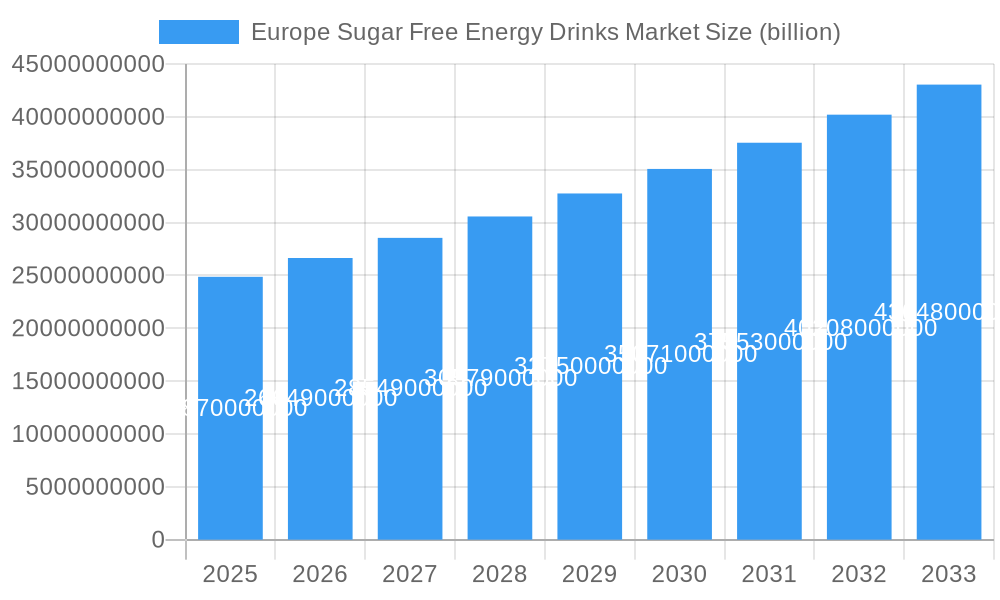

The Europe Sugar Free Energy Drinks Market is poised for robust expansion, projected to reach $24.87 billion by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 7.17% during the forecast period of 2025-2033. This substantial growth is propelled by a confluence of escalating consumer health consciousness and a surging demand for functional beverages that offer performance enhancement without the caloric burden of sugar. The increasing prevalence of lifestyle diseases and a growing awareness of the detrimental effects of excessive sugar intake are key drivers, prompting consumers to actively seek healthier alternatives. This shift in consumer preference is further amplified by aggressive marketing strategies from leading players and the continuous introduction of innovative sugar-free formulations that cater to a wider palate. The market's dynamism is also fueled by evolving distribution channels, with off-trade segments, particularly online retail and convenience stores, witnessing significant traction due to their accessibility and convenience, while on-trade channels continue to offer a premium experience.

Europe Sugar Free Energy Drinks Market Market Size (In Billion)

The market's trajectory is further shaped by key trends such as the incorporation of natural sweeteners, the inclusion of functional ingredients like vitamins and adaptogens, and the development of diverse flavor profiles to appeal to a broad consumer base. While the market presents a lucrative landscape, certain restraints, such as fluctuating raw material costs and intense competition from both established brands and emerging players, necessitate strategic agility. However, the overarching demand for healthier beverage options, coupled with significant investments in research and development by key companies like Monster Beverage Corporation, Red Bull GmbH, PepsiCo Inc, and The Coca-Cola Company, is expected to overcome these challenges. The European region, with its developed economies and health-conscious populace, particularly the United Kingdom, Germany, and France, is anticipated to be a dominant force in this expanding market.

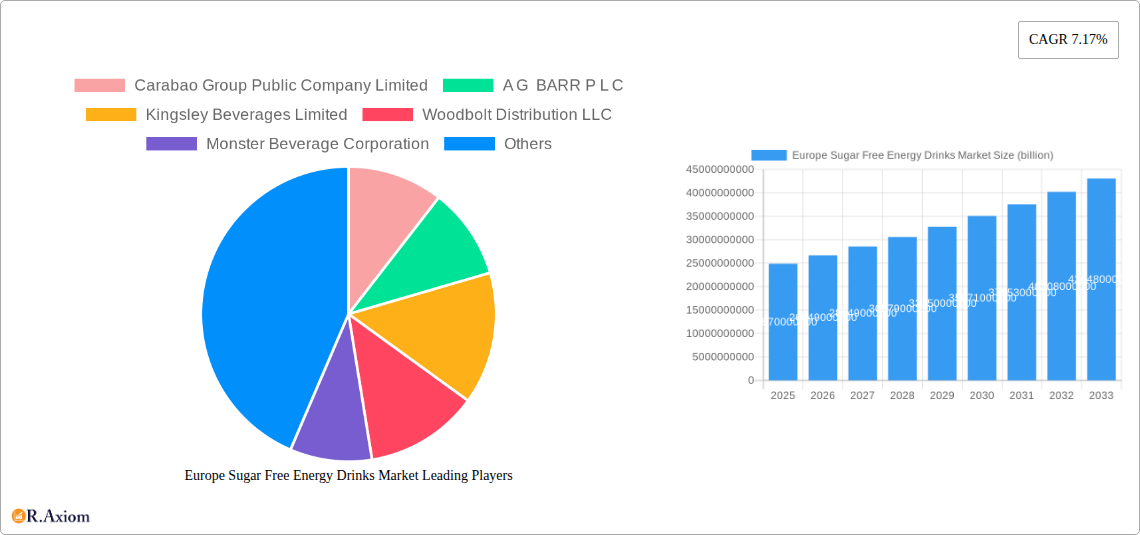

Europe Sugar Free Energy Drinks Market Company Market Share

This in-depth report provides a comprehensive analysis of the Europe Sugar Free Energy Drinks Market, offering critical insights into market dynamics, growth drivers, challenges, and competitive landscape. With a study period spanning from 2019 to 2033, and a base year of 2025, this report is an indispensable resource for industry stakeholders, including manufacturers, suppliers, investors, and market research firms. Leveraging high-traffic keywords such as "sugar-free energy drinks Europe," "zero sugar beverages market," "healthy energy drinks," and "European beverage industry trends," this report aims to enhance search visibility and engagement. The global market is projected to reach an estimated value of $20.5 billion in 2025, with significant contributions from the European region.

Europe Sugar Free Energy Drinks Market Market Concentration & Innovation

The Europe Sugar Free Energy Drinks Market exhibits a moderate to high level of concentration, with a few dominant players holding substantial market share. Leading entities like Monster Beverage Corporation, Red Bull GmbH, and The Coca-Cola Company consistently invest in research and development, driving innovation in product formulations and ingredient technologies. Key innovation drivers include the increasing consumer demand for healthier beverage options, the pursuit of novel flavor profiles, and the integration of functional ingredients such as vitamins, amino acids, and natural energizers. Regulatory frameworks across European countries, while generally supportive of functional beverages, also impose stringent guidelines on ingredient labeling, health claims, and marketing practices, influencing product development strategies. Product substitutes, such as functional waters, electrolyte drinks, and coffee beverages, pose a competitive threat, necessitating continuous product differentiation. End-user trends are heavily influenced by health and wellness consciousness, with a growing preference for "clean label" products and sugar-free alternatives. Merger and acquisition (M&A) activities, though not as frequent as in some other consumer goods sectors, play a crucial role in market consolidation and expansion. The estimated M&A deal value in the broader European beverage market in the historical period (2019-2024) is projected to be in the range of $5.2 billion.

Europe Sugar Free Energy Drinks Market Industry Trends & Insights

The Europe Sugar Free Energy Drinks Market is experiencing robust growth, driven by a confluence of evolving consumer preferences, technological advancements, and favorable market dynamics. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7.8% from 2025 to 2033. This expansion is primarily fueled by the escalating consumer awareness regarding the adverse health effects of high sugar consumption, leading to a pronounced shift towards sugar-free and low-sugar beverage alternatives. The health and wellness trend continues to permeate the food and beverage industry, with consumers actively seeking products that offer functional benefits beyond simple hydration and energy. Sugar-free energy drinks, often fortified with vitamins, minerals, and natural energizers, align perfectly with this demand, positioning them as a healthier choice compared to their traditional, sugar-laden counterparts. Technological disruptions in beverage formulation and production are also playing a significant role. Advances in natural sweeteners, flavor masking technologies, and ingredient encapsulation are enabling manufacturers to develop more palatable and effective sugar-free energy drinks, enhancing their appeal to a wider consumer base.

Consumer preferences are rapidly evolving, with a distinct inclination towards convenience and on-the-go consumption. The busy lifestyles prevalent across Europe necessitate ready-to-drink (RTD) beverage solutions that can be easily incorporated into daily routines. Sugar-free energy drinks, offered in convenient packaging formats like cans and PET bottles, cater to this demand effectively. Furthermore, there is a growing appetite for diverse and exciting flavor profiles. Beyond traditional fruit flavors, consumers are increasingly open to exploring exotic and sophisticated taste experiences, pushing manufacturers to innovate with unique ingredient combinations. The competitive dynamics within the market are intense, characterized by aggressive product launches, extensive marketing campaigns, and strategic partnerships. Established beverage giants are vying for market share alongside agile, niche brands specializing in functional and health-oriented beverages. This competitive environment fosters continuous innovation and necessitates a keen understanding of consumer needs to maintain market relevance. The estimated market penetration of sugar-free energy drinks in the European beverage market is projected to reach 22% by 2025, indicating significant room for further growth.

Dominant Markets & Segments in Europe Sugar Free Energy Drinks Market

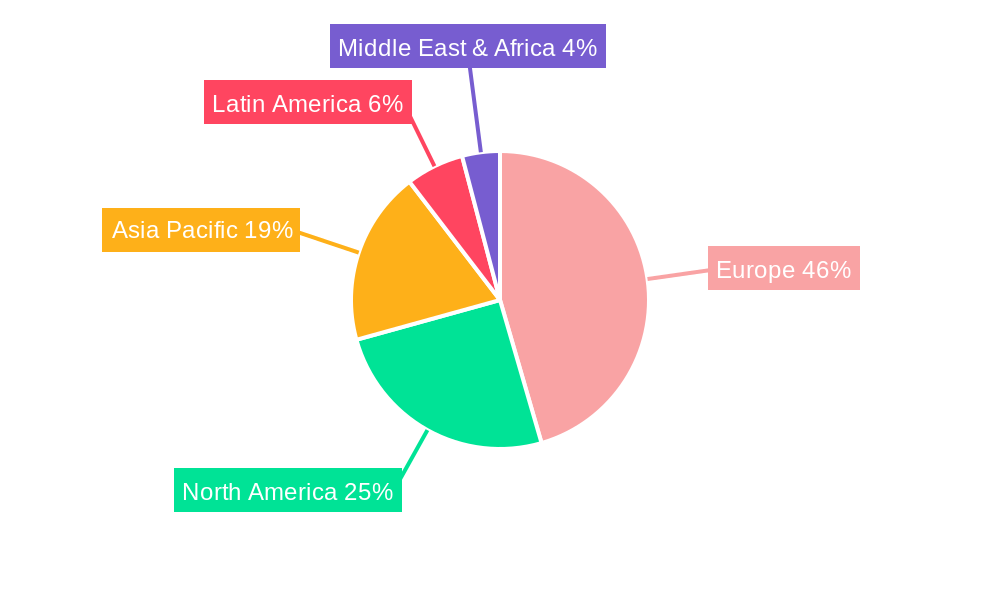

The Europe Sugar Free Energy Drinks Market exhibits distinct regional and segmental dominance. Geographically, Western European countries, including the United Kingdom, Germany, France, and Spain, represent the largest and most mature markets due to higher disposable incomes, greater health consciousness, and well-established retail infrastructure. The economic policies in these regions often support the growth of healthy lifestyle products. Infrastructure for distribution is highly developed, facilitating widespread availability.

Within packaging types, Metal Cans are the dominant segment, accounting for an estimated 65% of the market share in 2025. This preference is driven by their excellent barrier properties, recyclability, and suitability for on-the-go consumption. Metal cans also offer efficient cooling and a premium perception for many brands. PET Bottles follow, capturing approximately 25% of the market, prized for their lightweight nature and affordability, particularly for larger formats. Glass Bottles, while offering a premium appeal, represent a smaller but stable segment, primarily catering to niche markets and specific on-trade occasions.

In terms of distribution channels, the Off-trade segment is the primary driver of sales, projected to hold a 78% market share in 2025. Within off-trade, Supermarkets/Hypermarkets are the leading channel, benefiting from high foot traffic and the ability to offer a wide variety of brands and pack sizes. Convenience Stores represent another significant channel, crucial for impulse purchases and immediate consumption. Online Retail is experiencing rapid growth, driven by the convenience of e-commerce and the increasing digital penetration across Europe. The On-trade segment, including bars, restaurants, and cafes, contributes the remaining 22%, often catering to specific occasions and a more discerning consumer seeking premium or specialized energy drinks. The growth in online retail is significantly influenced by digital marketing strategies and last-mile delivery innovations.

Europe Sugar Free Energy Drinks Market Product Developments

Product developments in the Europe Sugar Free Energy Drinks Market are characterized by a strong emphasis on functional benefits and appealing taste profiles. Innovations are focused on enhancing energy delivery through ingredients like natural caffeine sources, B vitamins, and adaptogens, while also incorporating nootropics for cognitive enhancement. The competitive advantage lies in unique flavor fusions, such as tropical blends and botanical infusions, which differentiate brands in a crowded market. Technological trends like the use of novel, natural sweeteners and the development of "clean label" formulations with minimal artificial ingredients are gaining prominence, catering to the health-conscious European consumer.

Report Scope & Segmentation Analysis

This report segmentizes the Europe Sugar Free Energy Drinks Market across key dimensions.

Packaging Type: The market is analyzed by Glass Bottles, Metal Can, and PET Bottles. The Metal Can segment is anticipated to witness substantial growth due to its convenience and widespread adoption.

Distribution Channel: The analysis covers Off-trade (including Convenience Stores, Online Retail, Supermarket/Hypermarket, and Others) and On-trade. The Off-trade channel, particularly online retail and supermarkets, is expected to drive significant market expansion, reflecting evolving shopping habits.

Each segment's market size, growth projections, and competitive dynamics are detailed to provide a granular understanding of the market landscape.

Key Drivers of Europe Sugar Free Energy Drinks Market Growth

The Europe Sugar Free Energy Drinks Market is propelled by several key drivers. The pervasive health and wellness trend, with consumers actively seeking reduced sugar intake, is a primary catalyst. Advances in beverage technology, enabling the creation of great-tasting sugar-free formulations, are crucial. The convenience factor associated with RTD formats caters to busy lifestyles. Furthermore, increasing disposable incomes across many European nations allow for premium beverage choices. Regulatory support for healthier alternatives and aggressive marketing by leading players also contribute significantly.

Challenges in the Europe Sugar Free Energy Drinks Market Sector

Despite its growth, the Europe Sugar Free Energy Drinks Market faces several challenges. Stringent regulatory frameworks concerning health claims and ingredient transparency can pose hurdles for product innovation and marketing. Intense competition from established brands and emerging players necessitates continuous differentiation and marketing investment. Fluctuations in raw material costs, particularly for sweeteners and functional ingredients, can impact profitability. Consumer skepticism regarding the taste and perceived healthiness of artificial sweeteners in some segments also presents a barrier.

Emerging Opportunities in Europe Sugar Free Energy Drinks Market

Emerging opportunities in the Europe Sugar Free Energy Drinks Market are diverse. The growing demand for plant-based and natural ingredients presents an avenue for product innovation. Expansion into under-penetrated Eastern European markets offers significant growth potential. The development of function-specific energy drinks, such as those for focus, relaxation, or hydration, can cater to niche consumer needs. Strategic partnerships with fitness centers and lifestyle brands can enhance market reach and brand perception.

Leading Players in the Europe Sugar Free Energy Drinks Market Market

- Carabao Group Public Company Limited

- A G BARR P L C

- Kingsley Beverages Limited

- Woodbolt Distribution LLC

- Monster Beverage Corporation

- Vitamin Well Limited

- PepsiCo Inc

- Suntory Holdings Limited

- Red Bull GmbH

- Xite Energy Limite

- The Coca-Cola Company

- Grenade (UK) Limited

- Vital Pharmaceuticals Inc

Key Developments in Europe Sugar Free Energy Drinks Market Industry

- July 2023: WWE and Nutrabolt, owner of the C4 brand, announced an expansion to their multi-year partnership with the launch of their first-ever co-branded product collaboration: WWE-inspired flavors of C4 Ultimate Pre-Workout Powder and C4 Ultimate Energy Drink.

- May 2023: Coca-Cola Europacific Partners (CCEP) is bolstering its Relentless Zero Sugar range to maintain momentum behind the brand with its latest flavor launch, watermelon. The new, refreshingly fruity, zero-sugar flavor is designed to fuel additional growth of the Relentless brand.

- January 2023: Vitamin Well-owned functional beverage brand Nocco has expanded its portfolio with the launch of the new Focus range-Focus ramonade. Focus Ramonade features flavours of rambutan, apple and melon and contains 180mg of caffeine.

Strategic Outlook for Europe Sugar Free Energy Drinks Market Market

The strategic outlook for the Europe Sugar Free Energy Drinks Market is highly promising, driven by sustained consumer demand for healthier and functional beverage options. Future growth will likely be fueled by continued innovation in flavor profiles, the incorporation of novel natural ingredients, and advancements in sustainable packaging. Manufacturers will focus on expanding distribution networks, particularly through e-commerce channels, and strengthening brand positioning through targeted marketing campaigns and strategic partnerships. The market's resilience and adaptability to evolving consumer preferences, coupled with a growing awareness of the benefits of sugar-free alternatives, position it for continued robust expansion in the coming years.

Europe Sugar Free Energy Drinks Market Segmentation

-

1. Packaging Type

- 1.1. Glass Bottles

- 1.2. Metal Can

- 1.3. PET Bottles

-

2. Distribution Channel

-

2.1. Off-trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Supermarket/Hypermarket

- 2.1.4. Others

- 2.2. On-trade

-

2.1. Off-trade

Europe Sugar Free Energy Drinks Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Sugar Free Energy Drinks Market Regional Market Share

Geographic Coverage of Europe Sugar Free Energy Drinks Market

Europe Sugar Free Energy Drinks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Supplement Nutrition; Growing Casein Application in Processed Food Products

- 3.3. Market Restrains

- 3.3.1. Competition from Vegan/Plant-based Protein Powders

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Sugar Free Energy Drinks Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Glass Bottles

- 5.1.2. Metal Can

- 5.1.3. PET Bottles

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Supermarket/Hypermarket

- 5.2.1.4. Others

- 5.2.2. On-trade

- 5.2.1. Off-trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Carabao Group Public Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 A G BARR P L C

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kingsley Beverages Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Woodbolt Distribution LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Monster Beverage Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vitamin Well Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PepsiCo Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Suntory Holdings Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Red Bull GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Xite Energy Limite

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Coca-Cola Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Grenade (UK) Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Vital Pharmaceuticals Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Carabao Group Public Company Limited

List of Figures

- Figure 1: Europe Sugar Free Energy Drinks Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Sugar Free Energy Drinks Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Sugar Free Energy Drinks Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 2: Europe Sugar Free Energy Drinks Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Europe Sugar Free Energy Drinks Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Sugar Free Energy Drinks Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 5: Europe Sugar Free Energy Drinks Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Sugar Free Energy Drinks Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Sugar Free Energy Drinks Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Sugar Free Energy Drinks Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Sugar Free Energy Drinks Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Sugar Free Energy Drinks Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Sugar Free Energy Drinks Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Sugar Free Energy Drinks Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Sugar Free Energy Drinks Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Sugar Free Energy Drinks Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Sugar Free Energy Drinks Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Sugar Free Energy Drinks Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Sugar Free Energy Drinks Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Sugar Free Energy Drinks Market?

The projected CAGR is approximately 7.17%.

2. Which companies are prominent players in the Europe Sugar Free Energy Drinks Market?

Key companies in the market include Carabao Group Public Company Limited, A G BARR P L C, Kingsley Beverages Limited, Woodbolt Distribution LLC, Monster Beverage Corporation, Vitamin Well Limited, PepsiCo Inc, Suntory Holdings Limited, Red Bull GmbH, Xite Energy Limite, The Coca-Cola Company, Grenade (UK) Limited, Vital Pharmaceuticals Inc.

3. What are the main segments of the Europe Sugar Free Energy Drinks Market?

The market segments include Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.87 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Supplement Nutrition; Growing Casein Application in Processed Food Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition from Vegan/Plant-based Protein Powders.

8. Can you provide examples of recent developments in the market?

July 2023: WWE and Nutrabolt, owner of the C4 brand, announced an expansion to their multi-year partnership with the launch of their first-ever co-branded product collaboration: WWE-inspired flavors of C4 Ultimate Pre-Workout Powder and C4 Ultimate Energy Drink.May 2023: Coca-Cola Europacific Partners (CCEP) is bolstering its Relentless Zero Sugar range to maintain momentum behind the brand with its latest flavor launch, watermelon. The new, refreshingly fruity, zero-sugar flavor is designed to fuel additional growth of the Relentless brand.January 2023: Vitamin Well-owned functional beverage brand Nocco has expanded its portfolio with the launch of the new Focus range-Focus ramonade. Focus Ramonade features flavours of rambutan, apple and melon and contains 180mg of caffeine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Sugar Free Energy Drinks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Sugar Free Energy Drinks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Sugar Free Energy Drinks Market?

To stay informed about further developments, trends, and reports in the Europe Sugar Free Energy Drinks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence