Key Insights

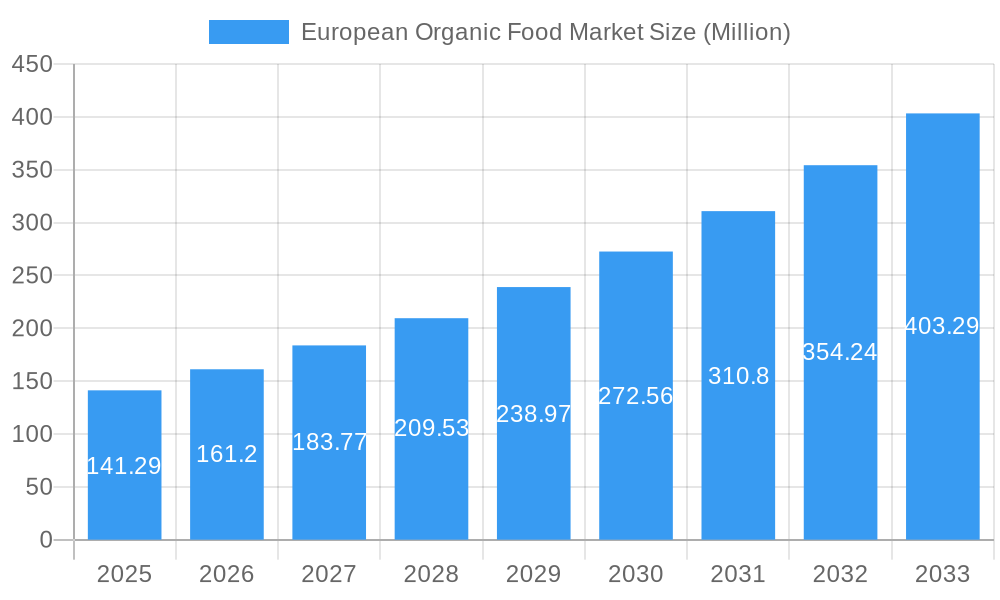

The European organic food market is experiencing robust growth, projected to reach a substantial $141.29 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 14.15% anticipated throughout the forecast period of 2025-2033. This significant expansion is fueled by a confluence of powerful drivers, chief among them being the escalating consumer awareness regarding health and wellness, a growing preference for sustainably sourced products, and increasing concerns about the environmental impact of conventional agriculture. Consumers are actively seeking out organic alternatives, recognizing their potential benefits for personal well-being and the planet. Furthermore, supportive government regulations and initiatives promoting organic farming practices across European nations are playing a pivotal role in fostering market development and increasing the accessibility of organic products. The expanding product portfolios offered by key players, encompassing a wider range of organic fruits and vegetables, meats, dairy, and processed foods, alongside a diverse selection of organic beverages, are catering to a broader consumer base and further stimulating demand.

European Organic Food Market Market Size (In Million)

The market's trajectory is also shaped by evolving consumer trends and strategic distribution channel expansion. The rise of online retailing is revolutionizing how consumers access organic food, offering convenience and wider product selection. Specialist stores continue to cater to a dedicated organic consumer base, while supermarkets and hypermarkets are increasingly dedicating prime shelf space to organic offerings. The increasing availability of organic options in convenience stores is also broadening accessibility. While growth is strong, potential restraints such as higher price points for organic products compared to conventional alternatives, and challenges in maintaining consistent supply chains, necessitate strategic approaches from market players. However, the overarching trend towards healthier lifestyles and environmental consciousness suggests a sustained upward momentum for the European organic food market.

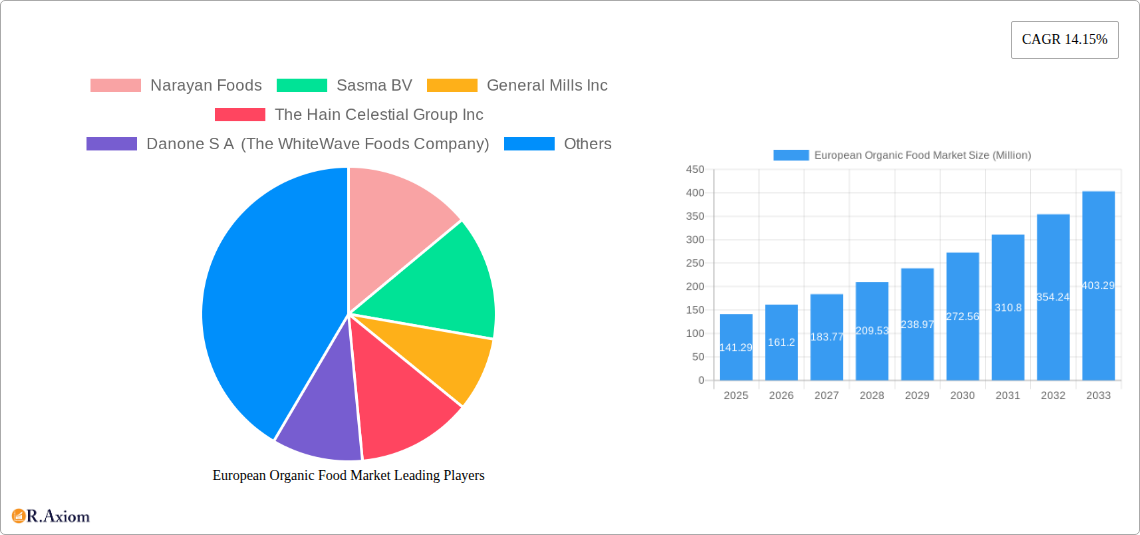

European Organic Food Market Company Market Share

Report Description:

This comprehensive report provides an in-depth analysis of the European Organic Food Market, encompassing market size, growth drivers, challenges, and future outlook. With a study period spanning from 2019 to 2033, including a base year of 2025, this report offers critical insights for industry stakeholders, including manufacturers, suppliers, retailers, and investors. It meticulously examines key segments such as Organic Foods (Fruit & Vegetables, Meat, Fish & Poultry, Dairy Products, Frozen & Processed Foods, Other Product Types) and Organic Beverages (Alcoholic and Non-alcoholic), along with organic distribution channels like Supermarkets/Hypermarkets, Convenience Stores, Specialist Stores, and Online Retailing. Detailed analysis of industry developments, market concentration, leading players, and strategic outlook provides a roadmap for navigating this dynamic and rapidly expanding market.

European Organic Food Market Market Concentration & Innovation

The European Organic Food Market exhibits a moderately concentrated landscape, with a mix of large multinational corporations and specialized organic producers. Innovation is a key differentiator, driven by increasing consumer demand for healthier, sustainable, and ethically sourced food products. Regulatory frameworks, such as the EU organic logo, play a crucial role in building consumer trust and ensuring product integrity. Product substitutes, while present in the broader food market, face increasing scrutiny as consumers prioritize organic certification. End-user trends are leaning towards plant-based organic options, allergen-free products, and ready-to-eat organic meals. Mergers and acquisitions (M&A) activities are prevalent as larger players seek to expand their organic portfolios and gain market share. For instance, the MeliBio and Narayan Foods partnership, aiming to introduce plant-based honey into 75,000 European stores, signals a significant strategic move. M&A deal values in the sector are expected to rise as companies consolidate to meet growing demand.

- Market Concentration: Moderate, with key players like General Mills Inc., Nestlé S.A., and The Hain Celestial Group Inc.

- Innovation Drivers: Health and wellness trends, environmental sustainability, ethical sourcing, demand for transparency.

- Regulatory Frameworks: EU organic regulations, national organic standards.

- Product Substitutes: Conventional food products, plant-based alternatives (though often not certified organic).

- End-User Trends: Demand for clean label, sustainable packaging, traceable ingredients, functional organic foods.

- M&A Activities: Strategic acquisitions to expand product lines and market reach.

European Organic Food Market Industry Trends & Insights

The European Organic Food Market is poised for significant growth, driven by a confluence of evolving consumer preferences, supportive government policies, and technological advancements. The compound annual growth rate (CAGR) is projected to be robust, reflecting the increasing penetration of organic products across all age demographics. Consumers are becoming more health-conscious, actively seeking out organic options to avoid synthetic pesticides, herbicides, and genetically modified organisms. This heightened awareness is coupled with a growing concern for environmental sustainability, with organic farming practices lauded for their positive impact on soil health, biodiversity, and reduced carbon footprint.

Technological disruptions are reshaping the industry, from precision agriculture enhancing organic crop yields to advanced supply chain management systems improving transparency and traceability. The proliferation of online retail channels has made organic food more accessible than ever, facilitating direct-to-consumer sales and reaching a wider customer base. Furthermore, the rise of the "flexitarian" and vegetarian/vegan movements has significantly boosted demand for organic plant-based foods and organic beverages, such as fruit and vegetable juices and dairy alternatives.

Competitive dynamics within the European organic market are intensifying, with both established food giants and agile startups vying for market share. Companies are investing heavily in product innovation, focusing on developing a diverse range of organic offerings, including convenient ready-to-eat meals, organic snacks, and specialized organic products for infants and children. The organic dairy market and organic fruit and vegetable market continue to be strong performers, but segments like organic meat, fish, and poultry are also witnessing considerable growth as consumer acceptance expands. The European organic beverage market, particularly non-alcoholic options like organic coffee and tea, is another area of significant expansion. This overall positive trajectory underscores the resilience and forward momentum of the European Organic Food Market.

Dominant Markets & Segments in European Organic Food Market

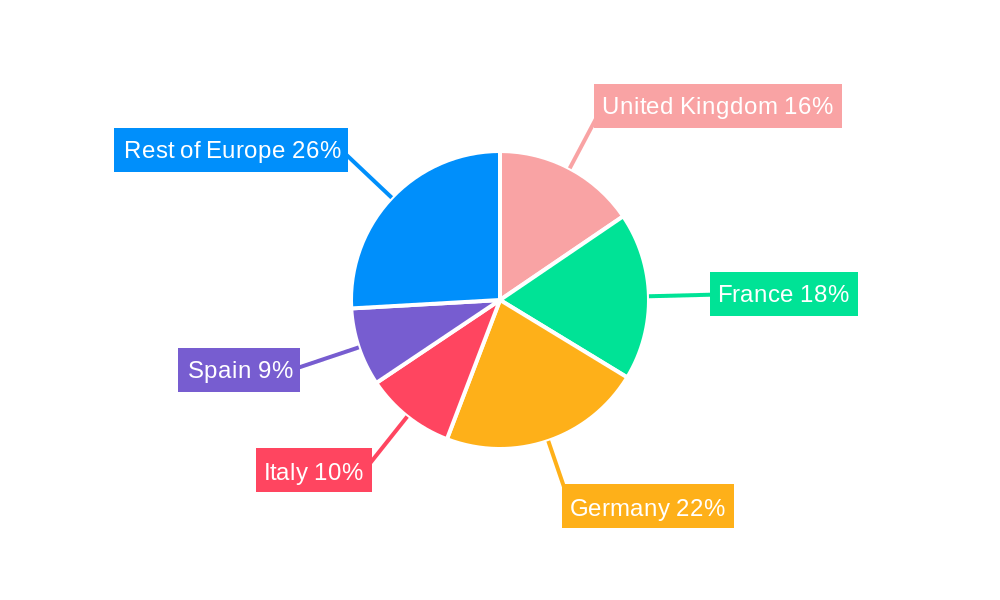

The European Organic Food Market is characterized by strong regional performances and a diversified segment landscape. Germany, France, and the United Kingdom consistently emerge as the dominant markets, driven by a strong consumer culture embracing organic lifestyles, favorable government subsidies for organic farming, and well-established retail infrastructure. Economic policies that support sustainable agriculture and robust infrastructure for the distribution of organic products further bolster these leading nations.

Within the Product Type segmentation, Organic Foods hold a significant market share. Among these, Fruit & Vegetables consistently lead due to their widespread consumption and perceived health benefits. The Organic Dairy Products segment also demonstrates substantial growth, fueled by innovation in plant-based alternatives and consumer preference for natural, additive-free dairy. The Frozen & Processed Foods segment is experiencing an upward trend as convenience-seeking consumers opt for ready-to-cook or ready-to-eat organic meals, with brands like Amy's Kitchen Inc. catering to this demand.

The Organic Beverages segment is equally dynamic. Non-alcoholic Organic Beverages are particularly dominant, with Fruit and Vegetable Juices and Coffee and Tea witnessing strong demand. Brands like Clipper Teas are at the forefront of this trend. The burgeoning health and wellness consciousness is propelling the consumption of these beverages. While Alcoholic Organic Beverages, such as wine and beer, represent a niche but growing market, the overall volume is significantly influenced by the non-alcoholic segment.

In terms of Distribution Channel, Supermarkets/Hypermarkets remain the primary avenue for organic product sales, offering wide accessibility and a broad selection. However, Online Retailing is rapidly gaining traction, driven by the convenience it offers and the expanding reach of online-only grocery retailers and direct-to-consumer platforms. Specialist organic stores also play a vital role in catering to dedicated organic consumers seeking a curated selection and expert advice.

- Dominant Countries: Germany, France, United Kingdom.

- Key Drivers: High consumer awareness, supportive government policies, developed retail infrastructure, strong purchasing power.

- Dominant Product Type Segments:

- Organic Foods:

- Fruit & Vegetables: High demand driven by health consciousness and perceived nutritional value.

- Dairy Products: Growing with plant-based alternatives and demand for natural ingredients.

- Frozen & Processed Foods: Increasing popularity due to convenience and extended shelf life.

- Organic Beverages:

- Non-alcoholic: Dominant, led by juices, coffee, and tea.

- Alcoholic: Niche but growing, particularly organic wine.

- Organic Foods:

- Dominant Distribution Channels:

- Supermarkets/Hypermarkets: Leading channel due to accessibility and product variety.

- Online Retailing: Rapidly expanding due to convenience and e-commerce growth.

European Organic Food Market Product Developments

Product innovation in the European Organic Food Market is characterized by a focus on health, sustainability, and convenience. Companies are actively developing new formulations and product lines to cater to evolving consumer preferences. Examples include the introduction of cold brew iced tea and baked, never-fried veggie puffs by The Hain Celestial Group Inc., offering healthier snack alternatives with non-GMO ingredients and no artificial flavors. The emergence of plant-based alternatives, such as MeliBio's bee-free honey, signifies a groundbreaking approach to meeting demand for sustainable food sources. These developments are driven by technological advancements in food processing and ingredient sourcing, creating competitive advantages through unique offerings and appealing to niche consumer groups seeking specific dietary benefits or ethical consumption choices.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the European Organic Food Market, segmented across various categories to offer granular insights. The Product Type segmentation covers Organic Foods, including Fruit & Vegetables, Meat, Fish & Poultry, Dairy Products, Frozen & Processed Foods, and Other Product Types. It also encompasses Organic Beverages, further divided into Alcoholic (Wine, Beer, Spirits) and Non-alcoholic (Fruit and Vegetable Juices, Dairy Beverages, Coffee, Tea, Carbonated Beverages, Other Non-alcoholic Beverages). The Distribution Channel segmentation includes Supermarkets/Hypermarkets, Convenience Stores, Specialist Stores, Online Retailing, and Other Distribution Channels. Each segment is analyzed for its market size, growth projections, and competitive dynamics, offering a detailed view of market penetration and future potential.

Key Drivers of European Organic Food Market Growth

The European Organic Food Market is experiencing robust growth driven by a multifaceted interplay of factors. A primary driver is the escalating consumer awareness regarding the health benefits associated with organic produce, including reduced exposure to pesticides and artificial additives. Growing environmental consciousness further fuels demand, as consumers increasingly choose organic products that support sustainable farming practices, biodiversity preservation, and reduced carbon footprints. Supportive government policies and subsidies for organic agriculture across European nations play a crucial role in incentivizing farmers and promoting organic production. Furthermore, technological advancements in organic farming and supply chain management enhance efficiency and product quality, making organic options more accessible and appealing.

Challenges in the European Organic Food Market Sector

Despite its strong growth trajectory, the European Organic Food Market faces several challenges that could impede its progress. One significant barrier is the higher price point of organic products compared to their conventional counterparts, which can limit accessibility for price-sensitive consumers. Ensuring consistent supply and managing the complexities of organic supply chains, which often involve specialized handling and shorter shelf lives for certain products, can also pose difficulties. Regulatory hurdles and the varying standards across different European countries can create complexities for businesses operating in multiple markets. Additionally, competition from conventional food producers offering "healthier" alternatives and combating misinformation or skepticism regarding organic claims remain ongoing challenges.

Emerging Opportunities in European Organic Food Market

The European Organic Food Market presents numerous emerging opportunities for growth and innovation. The increasing popularity of plant-based diets is driving significant demand for organic vegan and vegetarian products, opening avenues for new product development and market penetration. Technological advancements in precision agriculture and vertical farming offer potential solutions to enhance organic crop yields and reduce land usage, contributing to sustainability goals. The growing demand for ethically sourced and transparently produced food creates opportunities for brands that can effectively communicate their sustainable practices and supply chain integrity. Furthermore, the expansion of online retailing and direct-to-consumer models provides a platform for smaller organic producers to reach a wider audience and build direct relationships with consumers.

Leading Players in the European Organic Food Market Market

- Narayan Foods

- Sasma BV

- General Mills Inc.

- The Hain Celestial Group Inc.

- Danone S A (The WhiteWave Foods Company)

- Clipper Teas

- Amy's Kitchen Inc.

- Starbucks Corporation

- PureOrganic Drinks Limited

- Nestlé S.A.

Key Developments in European Organic Food Market Industry

- November 2022: MeliBio, in partnership with Narayan Foods, announced raising an additional USD 2.2 million in funding to sell its bee-free honey products in 75,000 European stores, with Narayan Foods planning to market it under the "Better Foodie" brand.

- November 2022: Ocado and Planet Organic became the first supermarkets to offer the plant-based meal brand allplants, featuring items like Protein Powder Buddha Bowl and Sticky Teriyaki Udon Noodles, with prices starting at EUR 5.50.

- July 2021: The Hain Celestial Group, Inc. launched new innovations in its snacks and teas segments, including Celestial Seasonings Cold Brew Iced Tea and Garden Veggie Puffs, which are baked, low-fat, and made with non-GMO ingredients, made available in the Europe market.

Strategic Outlook for European Organic Food Market Market

The European Organic Food Market is set for continued expansion, driven by a persistent consumer shift towards health, wellness, and environmental sustainability. Future growth catalysts include further innovation in plant-based organic offerings, the integration of advanced technologies for traceability and efficiency in organic supply chains, and the expansion of online and direct-to-consumer sales channels. Government support for organic farming practices and certifications will remain a crucial element. The market's strategic outlook is characterized by increasing product diversification, a focus on ethical sourcing, and a growing emphasis on premium and niche organic products. Companies that can effectively adapt to these evolving trends and address consumer demands for transparency and sustainability are well-positioned for success in this dynamic and promising market.

European Organic Food Market Segmentation

-

1. Product Type

-

1.1. Organic Foods

- 1.1.1. Fruit & Vegetables

- 1.1.2. Meat, Fish & Poultry

- 1.1.3. Dairy Products

- 1.1.4. Frozen & Processed Foods

- 1.1.5. Other Product Types

-

1.2. Organic Beverages

-

1.2.1. Alcoholic

- 1.2.1.1. Wine

- 1.2.1.2. Beer

- 1.2.1.3. Spirits

-

1.2.2. Non-alcoholic

- 1.2.2.1. Fruit and Vegetable Juices

- 1.2.2.2. Dairy Beverages

- 1.2.2.3. Coffee

- 1.2.2.4. Tea

- 1.2.2.5. Carbonated Beverages

- 1.2.2.6. Other Non-alcoholic Beverages

-

1.2.1. Alcoholic

-

1.1. Organic Foods

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Stores

- 2.4. Online Retailing

- 2.5. Other Distribution Channels

European Organic Food Market Segmentation By Geography

- 1. United Kingdom

- 2. France

- 3. Germany

- 4. Italy

- 5. Russia

- 6. Spain

- 7. Rest of Europe

European Organic Food Market Regional Market Share

Geographic Coverage of European Organic Food Market

European Organic Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Towards Reduced Sugar and Healthier Snacking Options; Surge in Demand for Organic Food Products

- 3.3. Market Restrains

- 3.3.1. Availability of Cheaper Snacking Options

- 3.4. Market Trends

- 3.4.1. Growing Demand for Clean-label Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Organic Food Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Organic Foods

- 5.1.1.1. Fruit & Vegetables

- 5.1.1.2. Meat, Fish & Poultry

- 5.1.1.3. Dairy Products

- 5.1.1.4. Frozen & Processed Foods

- 5.1.1.5. Other Product Types

- 5.1.2. Organic Beverages

- 5.1.2.1. Alcoholic

- 5.1.2.1.1. Wine

- 5.1.2.1.2. Beer

- 5.1.2.1.3. Spirits

- 5.1.2.2. Non-alcoholic

- 5.1.2.2.1. Fruit and Vegetable Juices

- 5.1.2.2.2. Dairy Beverages

- 5.1.2.2.3. Coffee

- 5.1.2.2.4. Tea

- 5.1.2.2.5. Carbonated Beverages

- 5.1.2.2.6. Other Non-alcoholic Beverages

- 5.1.2.1. Alcoholic

- 5.1.1. Organic Foods

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Stores

- 5.2.4. Online Retailing

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. France

- 5.3.3. Germany

- 5.3.4. Italy

- 5.3.5. Russia

- 5.3.6. Spain

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom European Organic Food Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Organic Foods

- 6.1.1.1. Fruit & Vegetables

- 6.1.1.2. Meat, Fish & Poultry

- 6.1.1.3. Dairy Products

- 6.1.1.4. Frozen & Processed Foods

- 6.1.1.5. Other Product Types

- 6.1.2. Organic Beverages

- 6.1.2.1. Alcoholic

- 6.1.2.1.1. Wine

- 6.1.2.1.2. Beer

- 6.1.2.1.3. Spirits

- 6.1.2.2. Non-alcoholic

- 6.1.2.2.1. Fruit and Vegetable Juices

- 6.1.2.2.2. Dairy Beverages

- 6.1.2.2.3. Coffee

- 6.1.2.2.4. Tea

- 6.1.2.2.5. Carbonated Beverages

- 6.1.2.2.6. Other Non-alcoholic Beverages

- 6.1.2.1. Alcoholic

- 6.1.1. Organic Foods

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialist Stores

- 6.2.4. Online Retailing

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. France European Organic Food Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Organic Foods

- 7.1.1.1. Fruit & Vegetables

- 7.1.1.2. Meat, Fish & Poultry

- 7.1.1.3. Dairy Products

- 7.1.1.4. Frozen & Processed Foods

- 7.1.1.5. Other Product Types

- 7.1.2. Organic Beverages

- 7.1.2.1. Alcoholic

- 7.1.2.1.1. Wine

- 7.1.2.1.2. Beer

- 7.1.2.1.3. Spirits

- 7.1.2.2. Non-alcoholic

- 7.1.2.2.1. Fruit and Vegetable Juices

- 7.1.2.2.2. Dairy Beverages

- 7.1.2.2.3. Coffee

- 7.1.2.2.4. Tea

- 7.1.2.2.5. Carbonated Beverages

- 7.1.2.2.6. Other Non-alcoholic Beverages

- 7.1.2.1. Alcoholic

- 7.1.1. Organic Foods

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialist Stores

- 7.2.4. Online Retailing

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Germany European Organic Food Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Organic Foods

- 8.1.1.1. Fruit & Vegetables

- 8.1.1.2. Meat, Fish & Poultry

- 8.1.1.3. Dairy Products

- 8.1.1.4. Frozen & Processed Foods

- 8.1.1.5. Other Product Types

- 8.1.2. Organic Beverages

- 8.1.2.1. Alcoholic

- 8.1.2.1.1. Wine

- 8.1.2.1.2. Beer

- 8.1.2.1.3. Spirits

- 8.1.2.2. Non-alcoholic

- 8.1.2.2.1. Fruit and Vegetable Juices

- 8.1.2.2.2. Dairy Beverages

- 8.1.2.2.3. Coffee

- 8.1.2.2.4. Tea

- 8.1.2.2.5. Carbonated Beverages

- 8.1.2.2.6. Other Non-alcoholic Beverages

- 8.1.2.1. Alcoholic

- 8.1.1. Organic Foods

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialist Stores

- 8.2.4. Online Retailing

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy European Organic Food Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Organic Foods

- 9.1.1.1. Fruit & Vegetables

- 9.1.1.2. Meat, Fish & Poultry

- 9.1.1.3. Dairy Products

- 9.1.1.4. Frozen & Processed Foods

- 9.1.1.5. Other Product Types

- 9.1.2. Organic Beverages

- 9.1.2.1. Alcoholic

- 9.1.2.1.1. Wine

- 9.1.2.1.2. Beer

- 9.1.2.1.3. Spirits

- 9.1.2.2. Non-alcoholic

- 9.1.2.2.1. Fruit and Vegetable Juices

- 9.1.2.2.2. Dairy Beverages

- 9.1.2.2.3. Coffee

- 9.1.2.2.4. Tea

- 9.1.2.2.5. Carbonated Beverages

- 9.1.2.2.6. Other Non-alcoholic Beverages

- 9.1.2.1. Alcoholic

- 9.1.1. Organic Foods

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Specialist Stores

- 9.2.4. Online Retailing

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia European Organic Food Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Organic Foods

- 10.1.1.1. Fruit & Vegetables

- 10.1.1.2. Meat, Fish & Poultry

- 10.1.1.3. Dairy Products

- 10.1.1.4. Frozen & Processed Foods

- 10.1.1.5. Other Product Types

- 10.1.2. Organic Beverages

- 10.1.2.1. Alcoholic

- 10.1.2.1.1. Wine

- 10.1.2.1.2. Beer

- 10.1.2.1.3. Spirits

- 10.1.2.2. Non-alcoholic

- 10.1.2.2.1. Fruit and Vegetable Juices

- 10.1.2.2.2. Dairy Beverages

- 10.1.2.2.3. Coffee

- 10.1.2.2.4. Tea

- 10.1.2.2.5. Carbonated Beverages

- 10.1.2.2.6. Other Non-alcoholic Beverages

- 10.1.2.1. Alcoholic

- 10.1.1. Organic Foods

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Specialist Stores

- 10.2.4. Online Retailing

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Spain European Organic Food Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Organic Foods

- 11.1.1.1. Fruit & Vegetables

- 11.1.1.2. Meat, Fish & Poultry

- 11.1.1.3. Dairy Products

- 11.1.1.4. Frozen & Processed Foods

- 11.1.1.5. Other Product Types

- 11.1.2. Organic Beverages

- 11.1.2.1. Alcoholic

- 11.1.2.1.1. Wine

- 11.1.2.1.2. Beer

- 11.1.2.1.3. Spirits

- 11.1.2.2. Non-alcoholic

- 11.1.2.2.1. Fruit and Vegetable Juices

- 11.1.2.2.2. Dairy Beverages

- 11.1.2.2.3. Coffee

- 11.1.2.2.4. Tea

- 11.1.2.2.5. Carbonated Beverages

- 11.1.2.2.6. Other Non-alcoholic Beverages

- 11.1.2.1. Alcoholic

- 11.1.1. Organic Foods

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Supermarkets/Hypermarkets

- 11.2.2. Convenience Stores

- 11.2.3. Specialist Stores

- 11.2.4. Online Retailing

- 11.2.5. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe European Organic Food Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Organic Foods

- 12.1.1.1. Fruit & Vegetables

- 12.1.1.2. Meat, Fish & Poultry

- 12.1.1.3. Dairy Products

- 12.1.1.4. Frozen & Processed Foods

- 12.1.1.5. Other Product Types

- 12.1.2. Organic Beverages

- 12.1.2.1. Alcoholic

- 12.1.2.1.1. Wine

- 12.1.2.1.2. Beer

- 12.1.2.1.3. Spirits

- 12.1.2.2. Non-alcoholic

- 12.1.2.2.1. Fruit and Vegetable Juices

- 12.1.2.2.2. Dairy Beverages

- 12.1.2.2.3. Coffee

- 12.1.2.2.4. Tea

- 12.1.2.2.5. Carbonated Beverages

- 12.1.2.2.6. Other Non-alcoholic Beverages

- 12.1.2.1. Alcoholic

- 12.1.1. Organic Foods

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Supermarkets/Hypermarkets

- 12.2.2. Convenience Stores

- 12.2.3. Specialist Stores

- 12.2.4. Online Retailing

- 12.2.5. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Narayan Foods

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Sasma BV

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 General Mills Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 The Hain Celestial Group Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Danone S A (The WhiteWave Foods Company)

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Clipper Teas

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Amy's Kitchen Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Starbucks Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 PureOrganic Drinks Limited*List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Nestlé S A

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Narayan Foods

List of Figures

- Figure 1: European Organic Food Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Organic Food Market Share (%) by Company 2025

List of Tables

- Table 1: European Organic Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: European Organic Food Market Volume Tons Forecast, by Product Type 2020 & 2033

- Table 3: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2020 & 2033

- Table 5: European Organic Food Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: European Organic Food Market Volume Tons Forecast, by Region 2020 & 2033

- Table 7: European Organic Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: European Organic Food Market Volume Tons Forecast, by Product Type 2020 & 2033

- Table 9: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2020 & 2033

- Table 11: European Organic Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: European Organic Food Market Volume Tons Forecast, by Country 2020 & 2033

- Table 13: European Organic Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: European Organic Food Market Volume Tons Forecast, by Product Type 2020 & 2033

- Table 15: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2020 & 2033

- Table 17: European Organic Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: European Organic Food Market Volume Tons Forecast, by Country 2020 & 2033

- Table 19: European Organic Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: European Organic Food Market Volume Tons Forecast, by Product Type 2020 & 2033

- Table 21: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2020 & 2033

- Table 23: European Organic Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: European Organic Food Market Volume Tons Forecast, by Country 2020 & 2033

- Table 25: European Organic Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: European Organic Food Market Volume Tons Forecast, by Product Type 2020 & 2033

- Table 27: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2020 & 2033

- Table 29: European Organic Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: European Organic Food Market Volume Tons Forecast, by Country 2020 & 2033

- Table 31: European Organic Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: European Organic Food Market Volume Tons Forecast, by Product Type 2020 & 2033

- Table 33: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2020 & 2033

- Table 35: European Organic Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: European Organic Food Market Volume Tons Forecast, by Country 2020 & 2033

- Table 37: European Organic Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: European Organic Food Market Volume Tons Forecast, by Product Type 2020 & 2033

- Table 39: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 40: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2020 & 2033

- Table 41: European Organic Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: European Organic Food Market Volume Tons Forecast, by Country 2020 & 2033

- Table 43: European Organic Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 44: European Organic Food Market Volume Tons Forecast, by Product Type 2020 & 2033

- Table 45: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 46: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2020 & 2033

- Table 47: European Organic Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: European Organic Food Market Volume Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Organic Food Market?

The projected CAGR is approximately 14.15%.

2. Which companies are prominent players in the European Organic Food Market?

Key companies in the market include Narayan Foods, Sasma BV, General Mills Inc, The Hain Celestial Group Inc, Danone S A (The WhiteWave Foods Company), Clipper Teas, Amy's Kitchen Inc, Starbucks Corporation, PureOrganic Drinks Limited*List Not Exhaustive, Nestlé S A.

3. What are the main segments of the European Organic Food Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 141.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Inclination Towards Reduced Sugar and Healthier Snacking Options; Surge in Demand for Organic Food Products.

6. What are the notable trends driving market growth?

Growing Demand for Clean-label Products.

7. Are there any restraints impacting market growth?

Availability of Cheaper Snacking Options.

8. Can you provide examples of recent developments in the market?

In November 2022, in a partnership with Narayan Foods, a renowned player in organic foods, MeliBio, the first company that claims to produce real honey without bees, announced that it raised an extra USD 2.2 million in funding and planned to sell its products in 75,000 European stores. Through the partnership, Narayan Foods announced its plans to market MeliBio's plant-based honey under the Better Foodie brand, starting in early 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Organic Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Organic Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Organic Food Market?

To stay informed about further developments, trends, and reports in the European Organic Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence