Key Insights

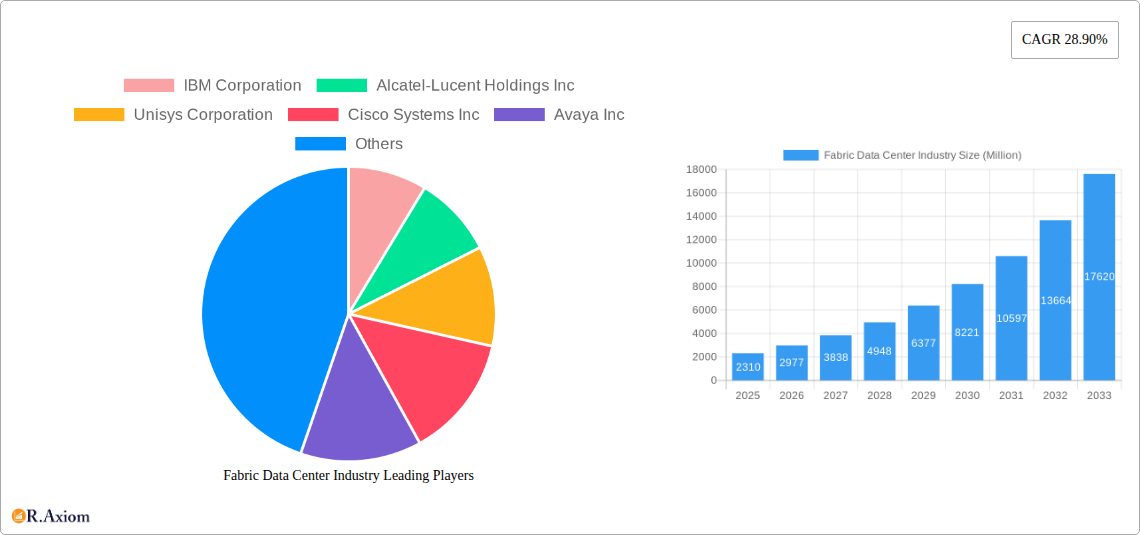

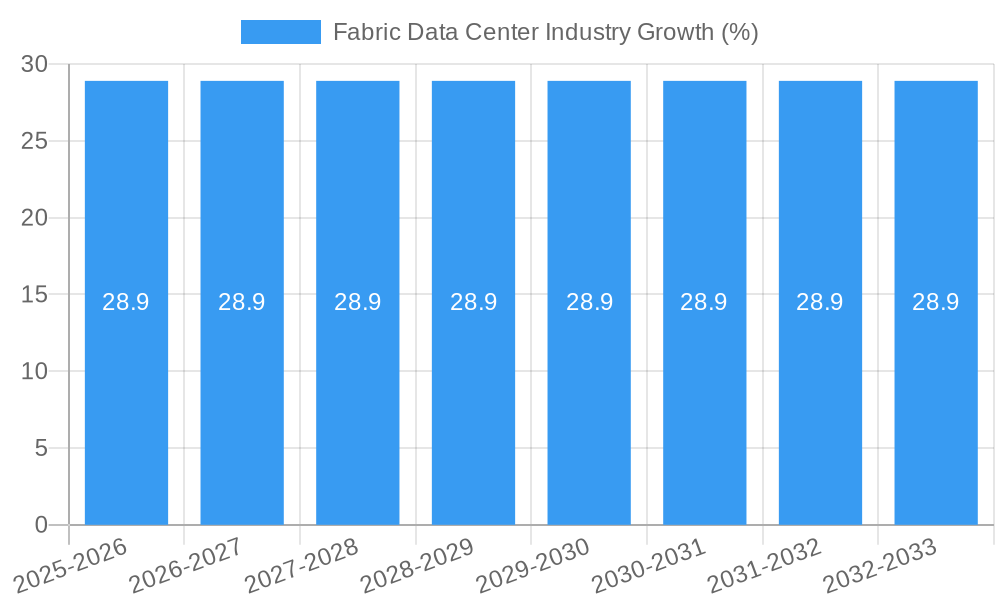

The global Fabric Data Center market is experiencing robust expansion, projected to reach a substantial USD 2.31 billion in value. This significant growth is fueled by a remarkable Compound Annual Growth Rate (CAGR) of 28.90% during the forecast period of 2025-2033. The increasing demand for high-speed, low-latency data transfer, driven by the proliferation of cloud computing, big data analytics, and the Internet of Things (IoT), serves as a primary catalyst. Enterprises are continually investing in upgrading their data center infrastructure to support these burgeoning digital workloads, making fabric architectures an essential component for seamless data flow and improved operational efficiency. The adoption of advanced networking solutions like high-performance routers, switches, and robust storage area networking technologies is critical for meeting the evolving needs of modern data centers.

Key drivers for this market expansion include the escalating digital transformation across various industries and the inherent need for scalable, agile, and reliable data center networks. While the adoption of fabric data center solutions presents immense opportunities, certain restraints, such as the initial high cost of implementation and the complexity of integrating new technologies with legacy systems, may pose challenges. However, the compelling benefits of enhanced performance, simplified management, and increased network agility are expected to outweigh these concerns. The market is segmented across diverse solutions, applications, and end-users, with IT & Communication, Banking & Financial Services, and Healthcare sectors showing significant adoption. Cloud service providers and telecom service providers are pivotal end-users, driving innovation and demand for advanced fabric data center technologies. The competitive landscape features prominent players like Cisco Systems Inc., Dell Inc., and Huawei Technologies Co. Ltd., all actively contributing to market development through strategic partnerships and product innovation.

Here is the SEO-optimized, detailed report description for the Fabric Data Center Industry, incorporating high-traffic keywords and adhering to all specified requirements:

Fabric Data Center Industry Market Concentration & Innovation

The Fabric Data Center Industry exhibits a moderate to high degree of market concentration, with a few dominant players controlling a significant portion of the market share. Leading companies like Cisco Systems Inc., Dell Inc., and Huawei Technologies Co Ltd. are at the forefront, driving innovation through substantial investments in research and development. Innovation is primarily fueled by the escalating demand for high-speed, low-latency connectivity within data centers, the proliferation of cloud computing, and the rise of Big Data analytics. Regulatory frameworks, while generally supportive of data center growth, can vary by region, influencing investment decisions and operational standards. Product substitutes, such as traditional networking solutions, are increasingly being phased out in favor of more agile and scalable fabric architectures. End-user trends lean towards hyper-converged infrastructure and software-defined networking (SDN) to enhance flexibility and manageability. Mergers and acquisition (M&A) activities are prevalent as larger entities seek to consolidate their market position and acquire complementary technologies. Recent M&A deals in the broader IT infrastructure space have seen values in the xx Million range, underscoring the strategic importance of this sector. Key innovation drivers include advancements in network virtualization, AI-driven network management, and the ongoing evolution of Ethernet standards to support higher bandwidths.

Fabric Data Center Industry Industry Trends & Insights

The Fabric Data Center Industry is poised for significant expansion, driven by a confluence of technological advancements and burgeoning demand from diverse sectors. Market growth is primarily propelled by the relentless surge in data generation and consumption, necessitating more robust and efficient data center infrastructures. The increasing adoption of cloud services by enterprises, including public, private, and hybrid cloud models, directly fuels the demand for scalable and high-performance fabric solutions. Furthermore, the ongoing digital transformation across industries, from banking and healthcare to retail and telecommunications, requires underlying data center capabilities that can support complex applications and real-time data processing.

Technological disruptions are playing a pivotal role in shaping the industry. Software-Defined Networking (SDN) and Network Functions Virtualization (NFV) are transforming how data centers are built and managed, offering greater agility, automation, and cost-effectiveness. These technologies enable dynamic provisioning of network resources, simplifying management and reducing operational overhead. The proliferation of edge computing is also creating new demands for localized data processing, leading to the development of smaller, distributed data center fabrics closer to end-users.

Consumer preferences are shifting towards solutions that offer enhanced security, seamless scalability, and superior performance with minimal latency. Businesses are increasingly prioritizing fabric architectures that can support the evolving needs of AI/ML workloads, IoT deployments, and high-frequency trading applications. The competitive dynamics within the industry are intense, with established networking giants and emerging technology providers vying for market share. Companies are differentiating themselves through specialized solutions, advanced analytics, and comprehensive support services. The projected Compound Annual Growth Rate (CAGR) for the fabric data center market is estimated to be around xx% over the forecast period, with market penetration expected to rise significantly as more organizations embrace advanced data center architectures. The overall market size is projected to reach xx Million by 2033, demonstrating a robust upward trajectory.

Dominant Markets & Segments in Fabric Data Center Industry

The IT & Communication segment stands out as a dominant force within the Fabric Data Center Industry, driven by the intrinsic need for robust and scalable infrastructure to support ever-increasing data traffic and evolving communication technologies. Cloud Service Providers represent a substantial end-user segment, heavily investing in high-performance fabric solutions to cater to the diverse needs of their clientele. Their continuous expansion and the demand for hyperscale data centers necessitate sophisticated networking capabilities for seamless service delivery and efficient resource allocation.

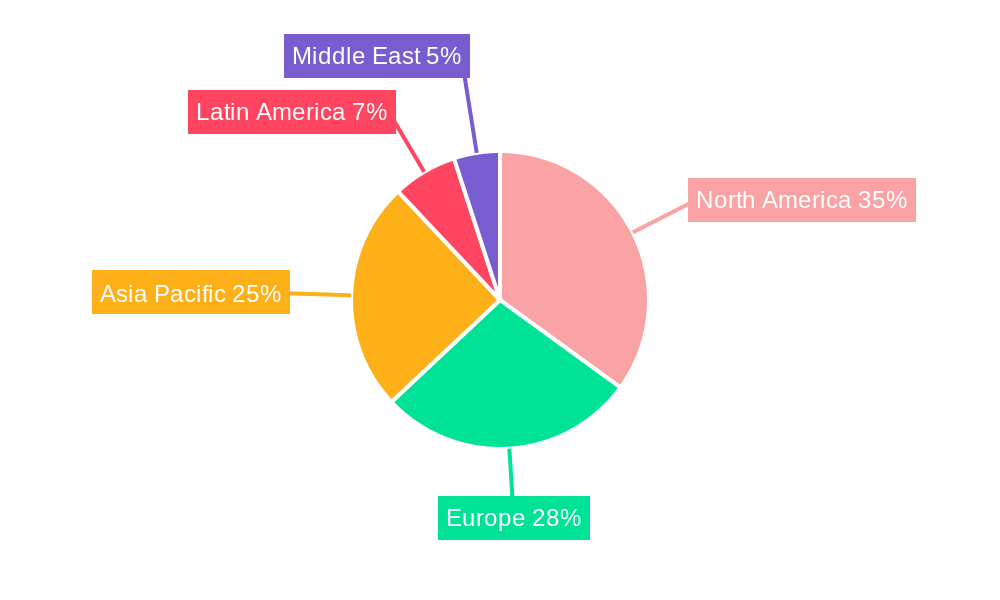

- Leading Region: North America, particularly the United States, continues to be a dominant market due to its advanced technological infrastructure, significant concentration of hyperscale cloud providers, and early adoption of cutting-edge data center technologies. Favorable economic policies and substantial investments in digital transformation initiatives further bolster its leading position.

- Dominant Solution: Switches are a cornerstone of fabric data center architecture, enabling high-speed interconnections and efficient data flow. The demand for high-density, low-latency switches is paramount for supporting the demands of modern data centers. Routers are also critical for inter-data center connectivity and network edge functions, ensuring efficient traffic management and routing.

- Dominant Application: The IT & Communication sector's dominance is intrinsically linked to the need for reliable and performant data center fabrics for cloud services, content delivery networks, and telecommunications infrastructure.

- Dominant End User: Cloud Service Providers are the primary drivers of fabric data center adoption, investing heavily in solutions that offer scalability, flexibility, and cost-efficiency to meet the dynamic demands of their global customer base.

- Key Drivers for Dominance:

- Technological Innovation: Continuous advancements in networking hardware and software, particularly in SDN and AI-driven automation, are key to enabling more sophisticated and efficient data center fabrics.

- Economic Policies: Government initiatives promoting digital infrastructure development and data sovereignty in various regions encourage significant investment in data center expansion and modernization.

- Infrastructure Development: The ongoing build-out of hyperscale and enterprise data centers, fueled by the exponential growth of data, necessitates advanced fabric solutions.

- Consumer Preferences: The increasing reliance on cloud-based services, real-time data analytics, and high-bandwidth applications by businesses and individuals drives the demand for the underlying fabric infrastructure.

Within the Banking & Financial Services sector, fabric data centers are critical for enabling high-frequency trading, real-time transaction processing, and robust fraud detection systems. The need for ultra-low latency and stringent security measures makes advanced fabric solutions indispensable. Similarly, the Healthcare industry leverages fabric data centers for electronic health records, telemedicine, and the analysis of vast medical datasets, emphasizing data integrity and accessibility. The Retail sector utilizes these fabrics for e-commerce platforms, inventory management, and customer analytics, requiring scalable infrastructure to handle peak loads and personalized customer experiences.

Fabric Data Center Industry Product Developments

Recent product developments in the fabric data center industry are focused on enhancing performance, agility, and manageability. Innovations in high-speed switching and routing technologies are enabling lower latency and higher bandwidth, critical for demanding workloads. Software-defined networking (SDN) solutions are maturing, offering greater programmability and automation for network management. Furthermore, advancements in cooling technologies, such as indirect evaporative cooling, are addressing the growing power and thermal challenges in dense data center environments. These developments aim to provide data center operators with more efficient, scalable, and cost-effective solutions to meet the ever-increasing demands of digital services.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Fabric Data Center Industry, segmenting the market by Solution, Application, and End User. The Solution segmentation includes Router, Switches, Storage Area Networking, and Other Solutions. The Application segmentation covers IT & Communication, Banking & Financial Services, Healthcare, Retail, and Other Applications. Finally, the End User segmentation encompasses Cloud Service Providers and Telecom Service Providers. Each segment is analyzed for its market size, growth projections, and competitive dynamics, offering granular insights into the industry's structure and future trajectory. Projections indicate substantial growth across all segments, with particular emphasis on solutions and applications supporting cloud infrastructure and digital transformation initiatives.

Key Drivers of Fabric Data Center Industry Growth

The Fabric Data Center Industry's growth is propelled by several key factors. The exponential increase in data generation and consumption, fueled by the proliferation of IoT devices, AI/ML applications, and digital content, necessitates more sophisticated data center infrastructure. The widespread adoption of cloud computing, encompassing public, private, and hybrid models, directly drives demand for scalable and high-performance fabric solutions. Digital transformation initiatives across all industries are compelling businesses to upgrade their IT infrastructure, with data centers forming the core of these transformations. Furthermore, advancements in networking technologies, such as SDN and NFV, are enabling greater efficiency, automation, and flexibility in data center operations.

Challenges in the Fabric Data Center Industry Sector

Despite its robust growth, the Fabric Data Center Industry faces several challenges. The increasing complexity of data center architectures requires highly skilled personnel for design, deployment, and management, leading to talent shortages. Escalating power consumption and thermal management issues in high-density data centers present significant operational and environmental challenges. Security threats and the need for robust data protection measures demand continuous investment in advanced security solutions. Furthermore, the rapid pace of technological evolution requires significant capital investment to keep infrastructure up-to-date, posing a barrier for some organizations. Supply chain disruptions, as seen in recent years, can also impact the availability of critical hardware components.

Emerging Opportunities in Fabric Data Center Industry

Emerging opportunities within the Fabric Data Center Industry lie in several key areas. The growing demand for edge computing solutions, which require distributed and intelligent data center fabrics closer to end-users, presents a significant growth avenue. The integration of Artificial Intelligence (AI) and Machine Learning (ML) for network automation, predictive maintenance, and intelligent traffic management offers substantial potential for enhanced operational efficiency. The development of greener and more sustainable data center technologies, driven by environmental regulations and corporate responsibility, is creating opportunities for innovative cooling and power management solutions. Furthermore, the increasing adoption of 5G technology is driving the need for enhanced data center capabilities to support its high bandwidth and low latency requirements.

Leading Players in the Fabric Data Center Industry Market

- IBM Corporation

- Alcatel-Lucent Holdings Inc

- Unisys Corporation

- Cisco Systems Inc

- Avaya Inc

- Extreme Networks Inc

- Dell Inc

- Huawei Technologies Co Ltd

- Hewlett-Packard Enterprise Company

- Oracle Corporation

- Brocade Communications Systems

Key Developments in Fabric Data Center Industry Industry

- July 2023: Huawei announced three innovative data center facility solutions, including the next-generation indirect evaporative cooling solution EHU and the mobile intelligent management solution iManager-M. These scenario-based data center solutions promise optimal reliability throughout the lifecycle and aim to drive the high-quality development of the data center industry.

- December 2022: The Nokia 7220 IXR D2/D3 interconnect routers were selected as core switching datacentre leaf platforms for North's datacentre fabric, running the Nokia SR Linux network operating system (NOS). The data center is built on bare metal servers running OpenStack Ironic, which interfaces with NOS using open-source upstream code.

- October 2022: Cloudera announced new hybrid data capabilities, enabling enterprises to more easily migrate data, metadata, data workloads, and data applications between clouds and on-premises to optimize for performance, cost, and security.

Strategic Outlook for Fabric Data Center Industry Market

The strategic outlook for the Fabric Data Center Industry remains exceptionally strong, characterized by continuous innovation and expansion. The ongoing digital transformation across global economies, coupled with the ever-increasing data volumes, will sustain high demand for robust and scalable data center fabrics. Key growth catalysts include the continued dominance of cloud computing, the emergence of edge computing as a significant trend, and the integration of AI/ML into network management and operations. Companies that focus on developing agile, secure, and energy-efficient fabric solutions, while adeptly navigating evolving technological landscapes and regulatory environments, will be well-positioned for substantial market gains. The industry is poised for sustained growth, driven by the fundamental need for powerful and flexible data processing and storage capabilities.

Fabric Data Center Industry Segmentation

-

1. Solution

- 1.1. Router

- 1.2. Switches

- 1.3. Storage Area Networking

- 1.4. Other Solutions

-

2. Application

- 2.1. IT & Communication

- 2.2. Banking & Financial Services

- 2.3. Healthcare

- 2.4. Retail

- 2.5. Other Applications

-

3. End User

- 3.1. Cloud Service Providers

- 3.2. Telecom Service Providers

Fabric Data Center Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Fabric Data Center Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 28.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Data Storage and Adoption of Cloud Computing; Need for High Speed Data Transfer; Increasing Demand of Fabric Switches

- 3.3. Market Restrains

- 3.3.1. Security issues

- 3.4. Market Trends

- 3.4.1. Increasing Demand of Fabric Switches is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fabric Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 5.1.1. Router

- 5.1.2. Switches

- 5.1.3. Storage Area Networking

- 5.1.4. Other Solutions

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. IT & Communication

- 5.2.2. Banking & Financial Services

- 5.2.3. Healthcare

- 5.2.4. Retail

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Cloud Service Providers

- 5.3.2. Telecom Service Providers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 6. North America Fabric Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 6.1.1. Router

- 6.1.2. Switches

- 6.1.3. Storage Area Networking

- 6.1.4. Other Solutions

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. IT & Communication

- 6.2.2. Banking & Financial Services

- 6.2.3. Healthcare

- 6.2.4. Retail

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Cloud Service Providers

- 6.3.2. Telecom Service Providers

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 7. Europe Fabric Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 7.1.1. Router

- 7.1.2. Switches

- 7.1.3. Storage Area Networking

- 7.1.4. Other Solutions

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. IT & Communication

- 7.2.2. Banking & Financial Services

- 7.2.3. Healthcare

- 7.2.4. Retail

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Cloud Service Providers

- 7.3.2. Telecom Service Providers

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 8. Asia Pacific Fabric Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 8.1.1. Router

- 8.1.2. Switches

- 8.1.3. Storage Area Networking

- 8.1.4. Other Solutions

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. IT & Communication

- 8.2.2. Banking & Financial Services

- 8.2.3. Healthcare

- 8.2.4. Retail

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Cloud Service Providers

- 8.3.2. Telecom Service Providers

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 9. Latin America Fabric Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 9.1.1. Router

- 9.1.2. Switches

- 9.1.3. Storage Area Networking

- 9.1.4. Other Solutions

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. IT & Communication

- 9.2.2. Banking & Financial Services

- 9.2.3. Healthcare

- 9.2.4. Retail

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Cloud Service Providers

- 9.3.2. Telecom Service Providers

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 10. Middle East Fabric Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 10.1.1. Router

- 10.1.2. Switches

- 10.1.3. Storage Area Networking

- 10.1.4. Other Solutions

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. IT & Communication

- 10.2.2. Banking & Financial Services

- 10.2.3. Healthcare

- 10.2.4. Retail

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Cloud Service Providers

- 10.3.2. Telecom Service Providers

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 11. North America Fabric Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Fabric Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Fabric Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Fabric Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Fabric Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Fabric Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 IBM Corporation

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Alcatel-Lucent Holdings Inc

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Unisys Corporation

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Cisco Systems Inc

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Avaya Inc

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Extreme Networks Inc

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Dell Inc

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Huawei Technologies Co Ltd

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Hewlett-Packard Enterprise Company

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Oracle Corporation

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Brocade Communications Systems

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.1 IBM Corporation

List of Figures

- Figure 1: Global Fabric Data Center Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Fabric Data Center Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Fabric Data Center Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Fabric Data Center Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Fabric Data Center Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Fabric Data Center Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Fabric Data Center Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Fabric Data Center Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Fabric Data Center Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Fabric Data Center Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Fabric Data Center Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Fabric Data Center Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Fabric Data Center Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Fabric Data Center Industry Revenue (Million), by Solution 2024 & 2032

- Figure 15: North America Fabric Data Center Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 16: North America Fabric Data Center Industry Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Fabric Data Center Industry Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Fabric Data Center Industry Revenue (Million), by End User 2024 & 2032

- Figure 19: North America Fabric Data Center Industry Revenue Share (%), by End User 2024 & 2032

- Figure 20: North America Fabric Data Center Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Fabric Data Center Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Fabric Data Center Industry Revenue (Million), by Solution 2024 & 2032

- Figure 23: Europe Fabric Data Center Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 24: Europe Fabric Data Center Industry Revenue (Million), by Application 2024 & 2032

- Figure 25: Europe Fabric Data Center Industry Revenue Share (%), by Application 2024 & 2032

- Figure 26: Europe Fabric Data Center Industry Revenue (Million), by End User 2024 & 2032

- Figure 27: Europe Fabric Data Center Industry Revenue Share (%), by End User 2024 & 2032

- Figure 28: Europe Fabric Data Center Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Fabric Data Center Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Pacific Fabric Data Center Industry Revenue (Million), by Solution 2024 & 2032

- Figure 31: Asia Pacific Fabric Data Center Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 32: Asia Pacific Fabric Data Center Industry Revenue (Million), by Application 2024 & 2032

- Figure 33: Asia Pacific Fabric Data Center Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: Asia Pacific Fabric Data Center Industry Revenue (Million), by End User 2024 & 2032

- Figure 35: Asia Pacific Fabric Data Center Industry Revenue Share (%), by End User 2024 & 2032

- Figure 36: Asia Pacific Fabric Data Center Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Asia Pacific Fabric Data Center Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Fabric Data Center Industry Revenue (Million), by Solution 2024 & 2032

- Figure 39: Latin America Fabric Data Center Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 40: Latin America Fabric Data Center Industry Revenue (Million), by Application 2024 & 2032

- Figure 41: Latin America Fabric Data Center Industry Revenue Share (%), by Application 2024 & 2032

- Figure 42: Latin America Fabric Data Center Industry Revenue (Million), by End User 2024 & 2032

- Figure 43: Latin America Fabric Data Center Industry Revenue Share (%), by End User 2024 & 2032

- Figure 44: Latin America Fabric Data Center Industry Revenue (Million), by Country 2024 & 2032

- Figure 45: Latin America Fabric Data Center Industry Revenue Share (%), by Country 2024 & 2032

- Figure 46: Middle East Fabric Data Center Industry Revenue (Million), by Solution 2024 & 2032

- Figure 47: Middle East Fabric Data Center Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 48: Middle East Fabric Data Center Industry Revenue (Million), by Application 2024 & 2032

- Figure 49: Middle East Fabric Data Center Industry Revenue Share (%), by Application 2024 & 2032

- Figure 50: Middle East Fabric Data Center Industry Revenue (Million), by End User 2024 & 2032

- Figure 51: Middle East Fabric Data Center Industry Revenue Share (%), by End User 2024 & 2032

- Figure 52: Middle East Fabric Data Center Industry Revenue (Million), by Country 2024 & 2032

- Figure 53: Middle East Fabric Data Center Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fabric Data Center Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Fabric Data Center Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 3: Global Fabric Data Center Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Fabric Data Center Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Global Fabric Data Center Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Fabric Data Center Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Fabric Data Center Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Belgium Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Netherland Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Nordics Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Fabric Data Center Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: India Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Korea Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Southeast Asia Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Australia Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Phillipes Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailandc Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Asia Pacific Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Fabric Data Center Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Brazil Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Argentina Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Peru Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Chile Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Colombia Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Ecuador Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Venezuela Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of South America Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Fabric Data Center Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: United States Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Canada Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Mexico Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Fabric Data Center Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 47: United Arab Emirates Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Saudi Arabia Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Africa Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Middle East and Africa Fabric Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Fabric Data Center Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 52: Global Fabric Data Center Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 53: Global Fabric Data Center Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 54: Global Fabric Data Center Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Global Fabric Data Center Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 56: Global Fabric Data Center Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 57: Global Fabric Data Center Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 58: Global Fabric Data Center Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Fabric Data Center Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 60: Global Fabric Data Center Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 61: Global Fabric Data Center Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 62: Global Fabric Data Center Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 63: Global Fabric Data Center Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 64: Global Fabric Data Center Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 65: Global Fabric Data Center Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 66: Global Fabric Data Center Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 67: Global Fabric Data Center Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 68: Global Fabric Data Center Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 69: Global Fabric Data Center Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 70: Global Fabric Data Center Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fabric Data Center Industry?

The projected CAGR is approximately 28.90%.

2. Which companies are prominent players in the Fabric Data Center Industry?

Key companies in the market include IBM Corporation, Alcatel-Lucent Holdings Inc, Unisys Corporation, Cisco Systems Inc, Avaya Inc, Extreme Networks Inc, Dell Inc, Huawei Technologies Co Ltd, Hewlett-Packard Enterprise Company, Oracle Corporation, Brocade Communications Systems.

3. What are the main segments of the Fabric Data Center Industry?

The market segments include Solution, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Data Storage and Adoption of Cloud Computing; Need for High Speed Data Transfer; Increasing Demand of Fabric Switches.

6. What are the notable trends driving market growth?

Increasing Demand of Fabric Switches is Driving the Market.

7. Are there any restraints impacting market growth?

Security issues.

8. Can you provide examples of recent developments in the market?

July 2023: Huawei's announced three innovative data center facility solutions as unveiled the next-generation indirect evaporative cooling solution EHU and the mobile intelligent management solution iManager-M. These scenario-based data center solutions promise optimal reliability throughout the lifecycle and aim to drive the high-quality development of the data center industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fabric Data Center Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fabric Data Center Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fabric Data Center Industry?

To stay informed about further developments, trends, and reports in the Fabric Data Center Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence