Key Insights

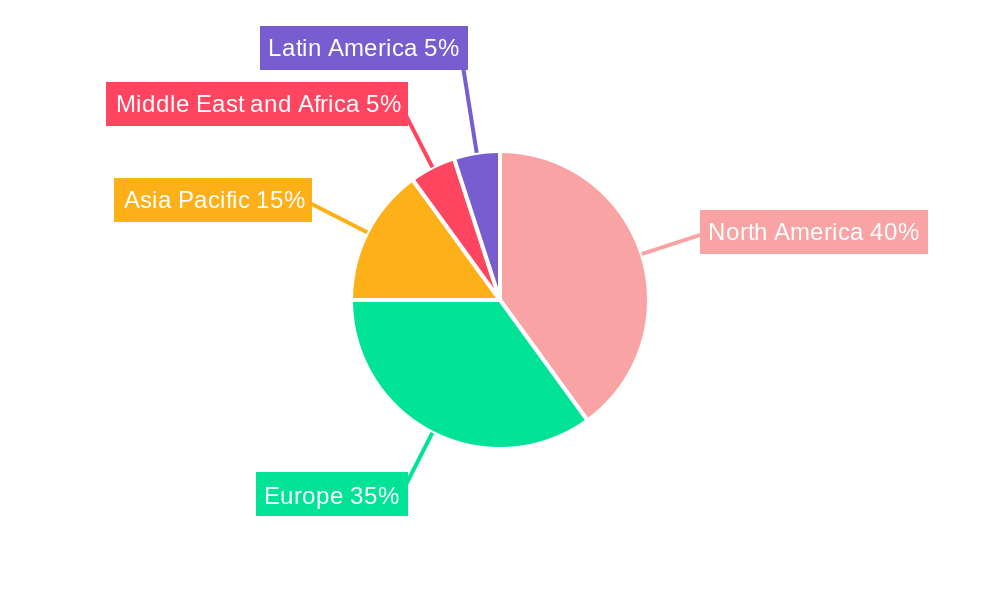

The global Fine Art Logistics market is projected for significant expansion, with an estimated Compound Annual Growth Rate (CAGR) of 4.97% between 2025 and 2033. The market size was valued at 2.88 billion in the base year 2025. This growth is driven by the thriving global art market, characterized by increasing auction sales and art fair activity, which necessitates specialized logistics for secure artwork transportation, packing, and storage. Heightened awareness regarding climate-controlled environments and expert handling to preserve artwork integrity further propels market demand. The market is segmented by application, including Art Dealers and Galleries, Auction Houses, Museums, and Art Fairs, and by service type, encompassing Transportation, Packing, and Storage. North America and Europe currently lead market share, supported by mature art markets and robust infrastructure. However, the Asia-Pacific region exhibits substantial growth potential, fueled by a rapidly expanding collector base and escalating art investments in key markets such as China and India. The competitive environment is intense, featuring global logistics leaders and specialized fine art providers. Future growth trajectories will be shaped by economic influences on art investments, technological innovations in tracking and security, and the growing importance of sustainable logistics practices.

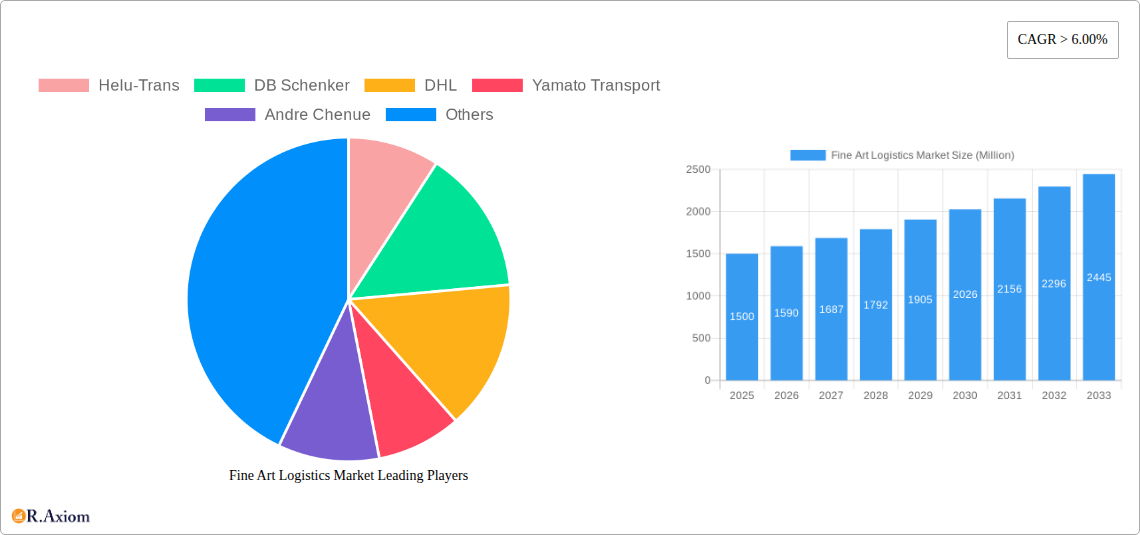

Fine Art Logistics Market Market Size (In Billion)

The competitive landscape is dynamic, with established providers continuously innovating to offer enhanced services, including insurance, specialized art handling, and climate-controlled transport. Niche companies dedicated exclusively to fine art logistics often possess a competitive advantage due to their profound understanding of artwork preservation requirements and insurance intricacies. Future market success will depend on adapting to evolving regulations, shifting client demands, and technological advancements. The proliferation of online art sales presents both opportunities and challenges, requiring logistics partners to cater to the unique demands of digital art marketplaces and changing delivery expectations. Companies that excel will prioritize client relationship building, ensure secure and timely deliveries, and develop innovative solutions tailored to the evolving art industry. Strategic expansion into emerging markets with burgeoning art scenes will also be critical for sustained growth.

Fine Art Logistics Market Company Market Share

Fine Art Logistics Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Fine Art Logistics market, offering actionable insights for industry stakeholders. Covering the period 2019-2033, with a focus on 2025, this report examines market dynamics, growth drivers, competitive landscapes, and future trends. The study incorporates data from key players like Helu-Trans, DB Schenker, DHL, Yamato Transport, Andre Chenue, U.S. Art, Gander & White, Agility Logistics, Hasenkamp, Sinotrans, LP ART, Masterpiece International, and 73 other companies.

Fine Art Logistics Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities within the Fine Art Logistics market. The highly specialized nature of the industry results in a moderately concentrated market, with a few major players holding significant market share. However, smaller, specialized firms cater to niche segments, fostering innovation.

- Market Share: The top 5 players account for approximately xx% of the global market share in 2025, with DHL and DB Schenker leading the pack. Smaller players often excel in specific niches like high-value art transportation or specialized packing solutions.

- Innovation Drivers: Technological advancements in tracking, climate control, and secure transportation are key drivers. The increasing demand for sustainable practices also fuels innovation in packaging and transportation methods.

- Regulatory Frameworks: International regulations regarding the transport of cultural artifacts, customs procedures, and insurance requirements significantly impact market operations. Compliance and adherence to these regulations are critical for market participants.

- M&A Activities: The market has witnessed a moderate level of M&A activity in recent years, with deal values averaging around xx Million USD. These transactions primarily involve smaller companies being acquired by larger players to expand their service offerings or geographic reach. The average deal size is expected to increase by xx% by 2033, driven by the consolidation trend within the industry.

- Product Substitutes: The primary substitute for professional fine art logistics is DIY handling, but this is rarely practical given the high value and fragility of artworks. This limits direct substitution but creates pricing pressures.

- End-User Trends: Increased demand for art from private collectors and institutional buyers is driving market growth, creating significant opportunities for expansion. A greater emphasis on transparency and provenance verification amongst consumers also influences market dynamics.

Fine Art Logistics Market Industry Trends & Insights

The global Fine Art Logistics market is witnessing robust and sustained growth, propelled by the escalating worldwide appreciation and investment in art and cultural heritage. Projections indicate a Compound Annual Growth Rate (CAGR) of approximately **10-12%** over the forecast period of 2025-2033. This upward trajectory is underpinned by a confluence of powerful drivers, including the burgeoning wealth creation in emerging economies, the dynamic expansion of the international art market, and the increasing perception of art as a strategic asset class for wealth preservation and growth.

Technological advancements are profoundly reshaping the industry's operational fabric. Innovations such as sophisticated real-time tracking and monitoring systems, AI-driven predictive risk assessment for transit and storage, and the adoption of eco-friendly and advanced packaging solutions are setting new benchmarks for efficiency and security. The evolving landscape also includes the burgeoning interest in digital art and Non-Fungible Tokens (NFTs), presenting unique logistical challenges and opportunities for specialized handling, secure storage, and insured transit. The competitive arena is characterized by a dynamic interplay between established global players offering comprehensive services and nimble, specialized startups introducing niche solutions. Market penetration is steadily increasing, particularly in burgeoning art hubs within developing nations, although infrastructural development remains a key consideration for comprehensive service delivery.

Dominant Markets & Segments in Fine Art Logistics Market

The North American region currently holds the largest market share within the global fine art logistics industry. Its dominance stems from the mature art market, robust infrastructure, and a high concentration of art dealers, auction houses, and museums. The European market is a close second, while Asia-Pacific is experiencing rapid growth, spurred by the expanding middle class and increasing art investments in countries like China and India.

By Application:

- Art Dealers and Galleries: This segment accounts for the largest share of the market owing to their frequent shipment of art pieces for exhibitions and sales. High value and delicate nature of art drives higher demand for specialist logistical services.

- Auction Houses: These are key players, needing secure, high-profile transportation for high-value items. Stringent insurance and security needs push prices upward for this sector.

- Museums: Their logistical needs often involve large-scale and complex transfers, including transportation, storage, and often climate-controlled environments.

- Art Fairs: These events create concentrated spikes in logistical demand requiring highly efficient solutions. Global nature of many events means international transport is crucial.

By Type:

- Transportation: This is a core element, with specialized vehicles and climate control adding to costs and complexity.

- Packing: This is highly specialized to safeguard against damage during transit, requiring unique expertise and materials.

- Storage: Climate-controlled and secure warehousing is essential for long-term art preservation. Location and security are important differentiators.

Key Drivers (Regional Dominance):

- Robust infrastructure (transportation networks, warehousing facilities)

- Strong legal frameworks and regulatory compliance processes

- Well-established art market with a high concentration of key players

- Favorable economic policies and a culture of art appreciation

Fine Art Logistics Market Product Developments

Recent product and service innovations in Fine Art Logistics are heavily focused on enhancing transparency, security, and bespoke client experiences. Key developments include the widespread integration of IoT sensors within transportation and storage solutions, offering granular, real-time data on environmental conditions (temperature, humidity, light exposure) and physical security. Advanced, custom-engineered climate-controlled containers and shock-absorbent, archival-quality packaging materials are now standard for high-value and fragile pieces. These technological integrations are pivotal in mitigating transit risks, minimizing potential damage, reducing insurance premiums, and delivering unparalleled peace of mind to collectors, galleries, and institutions. The emphasis is on creating highly specialized, end-to-end solutions that not only safeguard artworks but also streamline the entire logistical process, from provenance verification to final installation, thereby solidifying competitive advantages and fostering unique market differentiation.

Report Scope & Segmentation Analysis

This report segments the Fine Art Logistics market by application (Art Dealers and Galleries, Auction Houses, Museums, Art Fairs) and by type (Transportation, Packing, Storage). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics. For example, the Transportation segment is projected to witness significant growth due to increased art shipments globally, while the Packing segment will see innovation driven by a need for sustainable materials. The Storage segment will see growth from museums and private collectors needing long term storage.

Key Drivers of Fine Art Logistics Market Growth

The Fine Art Logistics market's growth is driven by several factors. The increasing global wealth and investment in art as an asset class contribute significantly. Technological advancements, such as improved tracking systems and specialized packaging, enhance security and efficiency. Finally, the strengthening of global trade and cross-border art transactions fuels the need for reliable fine art logistics solutions.

Challenges in the Fine Art Logistics Market Sector

Challenges include the high value and fragility of artworks requiring specialized handling, which increases costs. Supply chain disruptions and regulatory complexities in international art transport pose additional challenges. Intense competition from established players and emerging startups also impacts profitability.

Emerging Opportunities in Fine Art Logistics Market

Emerging opportunities include expanding into new markets, particularly in developing economies with rapidly growing art markets. The integration of blockchain technology for provenance verification and the use of sustainable practices throughout the supply chain will create new opportunities. The rise of digital art also presents innovative opportunities for logistics providers to adapt their strategies.

Leading Players in the Fine Art Logistics Market Market

- Helu-Trans

- DB Schenker

- DHL

- Yamato Transport

- Andre Chenue

- U S Art

- Gander & White

- Agility Logistics

- Hasenkamp

- Sinotrans

- LP ART

- 73 Other Companies

- Masterpiece International

Key Developments in Fine Art Logistics Market Industry

- November 2023: Masterpiece International significantly bolstered its operational capabilities with the grand opening of a new, comprehensive full-service facility at Chicago Gateway. This strategic expansion underscores a deep commitment to enhancing service delivery and market presence in a key art hub.

- October 2023: DHL Supply Chain unveiled a substantial investment of EUR 350 Million (approximately USD 378 Billion) earmarked for its Southeast Asian operations. This significant capital injection is designated for expanding logistics capacity, enhancing sustainability initiatives, and further solidifying its market leadership in a rapidly growing region.

- Q4 2023: Several niche players and startups have introduced AI-powered platforms for automated customs clearance and compliance checks, aiming to reduce transit times and administrative burdens for international art shipments.

- Ongoing: A growing number of logistics providers are investing in advanced climate-controlled warehousing and specialized transportation fleets designed to handle the unique requirements of fragile and sensitive artworks, reflecting a heightened focus on preservation and security.

Strategic Outlook for Fine Art Logistics Market Market

The Fine Art Logistics market presents significant growth potential. Continued investment in technology, expansion into new markets, and a focus on sustainability will be critical for success. The increasing global demand for art and collectibles will ensure robust market growth for the foreseeable future.

Fine Art Logistics Market Segmentation

-

1. Type

- 1.1. Transportation

- 1.2. Packing

- 1.3. Storage

-

2. application

- 2.1. Art Dealers and Galleries

- 2.2. Auction Houses

- 2.3. Museums

- 2.4. Art Fairs

Fine Art Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. Spain

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Singapore

- 3.6. Malaysia

- 3.7. Thailand

- 3.8. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. Qatar

- 4.3. United Arab Emirates

- 4.4. Egypt

- 4.5. Rest of Middle East and Africa

-

5. Latin Maerica

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of Latin America

Fine Art Logistics Market Regional Market Share

Geographic Coverage of Fine Art Logistics Market

Fine Art Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Demand for Secure Storage Facilities is Driven by the Increase in Art Collection Value; Specialized Expertise is the Key to Better Handling and Market Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Transportation Costs; Securing the Packaging and Transport of Fragile Goods is Difficult

- 3.4. Market Trends

- 3.4.1. A Growing Number of Collectors are Supporting the Growth of the Art Logistics Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fine Art Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Transportation

- 5.1.2. Packing

- 5.1.3. Storage

- 5.2. Market Analysis, Insights and Forecast - by application

- 5.2.1. Art Dealers and Galleries

- 5.2.2. Auction Houses

- 5.2.3. Museums

- 5.2.4. Art Fairs

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. Latin Maerica

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Fine Art Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Transportation

- 6.1.2. Packing

- 6.1.3. Storage

- 6.2. Market Analysis, Insights and Forecast - by application

- 6.2.1. Art Dealers and Galleries

- 6.2.2. Auction Houses

- 6.2.3. Museums

- 6.2.4. Art Fairs

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Fine Art Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Transportation

- 7.1.2. Packing

- 7.1.3. Storage

- 7.2. Market Analysis, Insights and Forecast - by application

- 7.2.1. Art Dealers and Galleries

- 7.2.2. Auction Houses

- 7.2.3. Museums

- 7.2.4. Art Fairs

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Fine Art Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Transportation

- 8.1.2. Packing

- 8.1.3. Storage

- 8.2. Market Analysis, Insights and Forecast - by application

- 8.2.1. Art Dealers and Galleries

- 8.2.2. Auction Houses

- 8.2.3. Museums

- 8.2.4. Art Fairs

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Fine Art Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Transportation

- 9.1.2. Packing

- 9.1.3. Storage

- 9.2. Market Analysis, Insights and Forecast - by application

- 9.2.1. Art Dealers and Galleries

- 9.2.2. Auction Houses

- 9.2.3. Museums

- 9.2.4. Art Fairs

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin Maerica Fine Art Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Transportation

- 10.1.2. Packing

- 10.1.3. Storage

- 10.2. Market Analysis, Insights and Forecast - by application

- 10.2.1. Art Dealers and Galleries

- 10.2.2. Auction Houses

- 10.2.3. Museums

- 10.2.4. Art Fairs

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Helu-Trans

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DB Schenker

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DHL

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Yamato Transport

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Andre Chenue

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 U S Art

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gander & White

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Agility Logistics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hasenkamp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sinotrans

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 LP ART*List Not Exhaustive 7 3 Other Companie

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Masterpiece International

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Helu-Trans

List of Figures

- Figure 1: Global Fine Art Logistics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Fine Art Logistics Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Fine Art Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Fine Art Logistics Market Revenue (billion), by application 2025 & 2033

- Figure 5: North America Fine Art Logistics Market Revenue Share (%), by application 2025 & 2033

- Figure 6: North America Fine Art Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Fine Art Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Fine Art Logistics Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Fine Art Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Fine Art Logistics Market Revenue (billion), by application 2025 & 2033

- Figure 11: Europe Fine Art Logistics Market Revenue Share (%), by application 2025 & 2033

- Figure 12: Europe Fine Art Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Fine Art Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Fine Art Logistics Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Fine Art Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Fine Art Logistics Market Revenue (billion), by application 2025 & 2033

- Figure 17: Asia Pacific Fine Art Logistics Market Revenue Share (%), by application 2025 & 2033

- Figure 18: Asia Pacific Fine Art Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Fine Art Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Fine Art Logistics Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Middle East and Africa Fine Art Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East and Africa Fine Art Logistics Market Revenue (billion), by application 2025 & 2033

- Figure 23: Middle East and Africa Fine Art Logistics Market Revenue Share (%), by application 2025 & 2033

- Figure 24: Middle East and Africa Fine Art Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East and Africa Fine Art Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin Maerica Fine Art Logistics Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Latin Maerica Fine Art Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin Maerica Fine Art Logistics Market Revenue (billion), by application 2025 & 2033

- Figure 29: Latin Maerica Fine Art Logistics Market Revenue Share (%), by application 2025 & 2033

- Figure 30: Latin Maerica Fine Art Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Latin Maerica Fine Art Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fine Art Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Fine Art Logistics Market Revenue billion Forecast, by application 2020 & 2033

- Table 3: Global Fine Art Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Fine Art Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Fine Art Logistics Market Revenue billion Forecast, by application 2020 & 2033

- Table 6: Global Fine Art Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Fine Art Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Fine Art Logistics Market Revenue billion Forecast, by application 2020 & 2033

- Table 12: Global Fine Art Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Spain Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Fine Art Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 19: Global Fine Art Logistics Market Revenue billion Forecast, by application 2020 & 2033

- Table 20: Global Fine Art Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: China Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: India Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Australia Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Singapore Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Malaysia Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Thailand Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Fine Art Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 30: Global Fine Art Logistics Market Revenue billion Forecast, by application 2020 & 2033

- Table 31: Global Fine Art Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Saudi Arabia Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Qatar Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: United Arab Emirates Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Egypt Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East and Africa Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Fine Art Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global Fine Art Logistics Market Revenue billion Forecast, by application 2020 & 2033

- Table 39: Global Fine Art Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Brazil Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Argentina Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Rest of Latin America Fine Art Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fine Art Logistics Market?

The projected CAGR is approximately 4.97%.

2. Which companies are prominent players in the Fine Art Logistics Market?

Key companies in the market include Helu-Trans, DB Schenker, DHL, Yamato Transport, Andre Chenue, U S Art, Gander & White, Agility Logistics, Hasenkamp, Sinotrans, LP ART*List Not Exhaustive 7 3 Other Companie, Masterpiece International.

3. What are the main segments of the Fine Art Logistics Market?

The market segments include Type, application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.88 billion as of 2022.

5. What are some drivers contributing to market growth?

The Demand for Secure Storage Facilities is Driven by the Increase in Art Collection Value; Specialized Expertise is the Key to Better Handling and Market Growth.

6. What are the notable trends driving market growth?

A Growing Number of Collectors are Supporting the Growth of the Art Logistics Market.

7. Are there any restraints impacting market growth?

High Cost of Transportation Costs; Securing the Packaging and Transport of Fragile Goods is Difficult.

8. Can you provide examples of recent developments in the market?

November 2023: The opening of a new full-service operation at Chicago Gateway is a proud moment for Masterpiece International. The strategically located facility provides an enhanced and comprehensive set of logistics capabilities in the market. The company Masterpiece International, which has a state-of-the-art 75,000 sq f fulfillment center located at Chicago O'Hare Airport near some of the region's largest intermodal terminals, continues to invest in innovative supply chain innovation for aviation, energy, life sciences, and customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fine Art Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fine Art Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fine Art Logistics Market?

To stay informed about further developments, trends, and reports in the Fine Art Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence