Key Insights

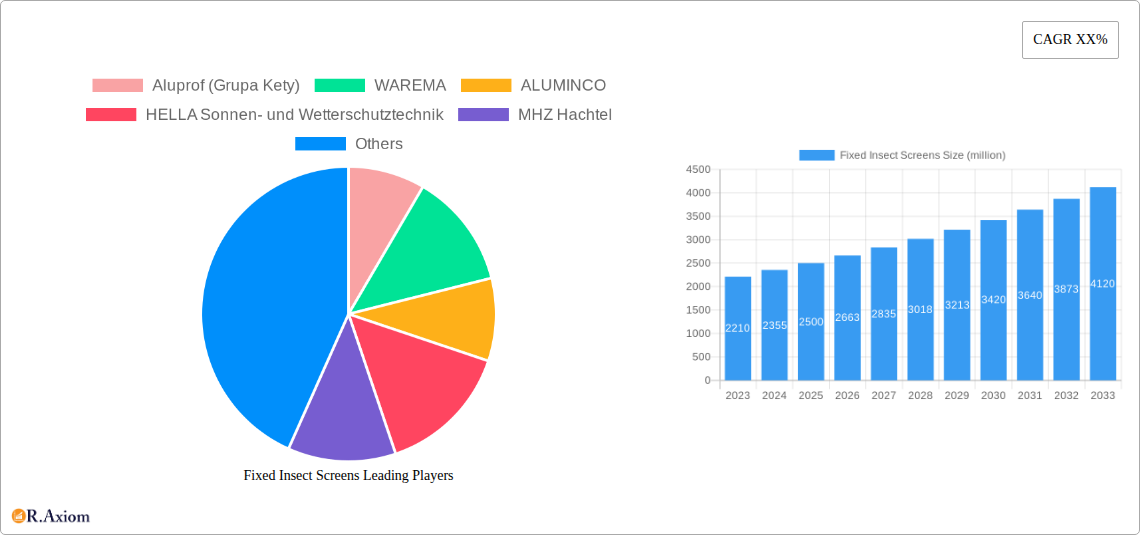

The global Fixed Insect Screens market is poised for substantial growth, with an estimated market size of USD 2,500 million in 2025, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This robust expansion is primarily fueled by the escalating demand for enhanced indoor comfort and hygiene, driven by increasing awareness of vector-borne diseases and the desire for pest-free living and working environments. Growing urbanization and a concurrent rise in disposable incomes in emerging economies are further accelerating adoption. The market is segmented by application into Residential and Commercial sectors, with the Residential segment holding a dominant share due to a strong emphasis on home improvement and renovation trends. Within the types, Spring-loaded Corner Plates are gaining traction for their ease of installation and maintenance, contributing to their growing market presence. Key market players like Aluprof (Grupa Kety), WAREMA, and ALUMINCO are actively investing in product innovation and expanding their distribution networks to cater to this burgeoning demand.

Geographically, the market exhibits strong performance across regions, with Asia Pacific anticipated to be the fastest-growing segment due to rapid infrastructure development and increasing consumer spending on home amenities. Europe and North America represent mature markets with consistent demand driven by stringent building codes and a high standard of living. The Middle East & Africa region is showing promising growth, attributed to a rising awareness of public health and increasing construction activities. Restraints such as the availability of cheaper alternatives and perceived installation complexities in certain regions are being addressed through innovative product designs and enhanced consumer education. The market is characterized by a competitive landscape with established players and emerging companies vying for market share through strategic partnerships and technological advancements. The forecast period indicates a sustained upward trajectory, underscoring the enduring importance of insect screens in modern living.

Fixed Insect Screens Market Concentration & Innovation

The fixed insect screens market, while mature in certain regions, exhibits dynamic concentration driven by ongoing innovation and evolving consumer demands. Major players like Aluprof (Grupa Kety), WAREMA, and ALUMINCO command significant market share, estimated at over 35% collectively within the study period of 2019-2033. Innovation is a key differentiator, with a focus on enhanced durability, aesthetic integration into architectural designs, and improved functionality. Regulatory frameworks, particularly those concerning building codes and energy efficiency, subtly influence product development, encouraging the adoption of screens that offer insulation benefits. Product substitutes, such as electronic pest control or rudimentary netting, exist but lack the comprehensive protection and aesthetic appeal of fixed insect screens. End-user trends indicate a growing preference for integrated solutions within modern construction and renovation projects, particularly in residential and home units segments. Mergers and acquisitions (M&A) activity, while not overtly dominant, are strategically undertaken by larger entities to consolidate market position or acquire specialized technological capabilities, with estimated M&A deal values reaching into the tens of millions annually.

Fixed Insect Screens Industry Trends & Insights

The fixed insect screens industry is poised for steady growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 4.8% between 2025 and 2033. This upward trajectory is primarily fueled by increasing urbanization, a heightened awareness of health and hygiene concerns related to insect-borne diseases, and the growing trend of seamless indoor-outdoor living. As economies expand and disposable incomes rise, particularly in emerging markets, the demand for residential insect screens for comfort and protection will continue to surge. Technological disruptions are playing a significant role, with advancements in material science leading to lighter, stronger, and more weather-resistant screen materials. Innovations in framing systems, such as improved corner plate designs (e.g., Spring-loaded Corner Plates offering easier installation and maintenance), are enhancing product appeal and functionality. Consumer preferences are shifting towards customized solutions that seamlessly integrate with architectural aesthetics, demanding a wider range of colors, finishes, and design options. The competitive landscape is characterized by a mix of established global manufacturers and regional specialists, each vying for market penetration through product differentiation, strategic partnerships, and robust distribution networks. The market penetration of sophisticated insect screen solutions is expected to rise from approximately 22% in the base year of 2025 to an estimated 30% by 2033, indicating a significant untapped potential for growth. The increasing adoption of energy-efficient building practices also indirectly benefits the insect screen market, as these screens can contribute to a building's thermal performance by preventing heat loss and gain when properly integrated. Furthermore, the growing awareness of allergies and respiratory issues attributed to airborne particles, including pollen and dust, is further bolstering the demand for effective insect and particle barrier solutions.

Dominant Markets & Segments in Fixed Insect Screens

The Residential application segment stands out as the dominant force within the fixed insect screens market, driven by robust new construction and renovation activities across the globe. Countries with a high density of single-family homes and a growing middle class, such as those in North America and parts of Europe, lead this demand. Key drivers include the desire for enhanced home comfort, protection against disease-carrying insects, and the increasing trend of extending living spaces to outdoor areas like patios and balconies. Economic policies promoting homeownership and disposable income growth directly correlate with increased investment in home improvement, including insect screens. Infrastructure development that facilitates easier installation and wider availability of these products further strengthens the dominance of the residential sector.

Within the Home Units segment, which encompasses apartments and multi-family dwellings, market penetration is steadily increasing. This growth is propelled by developers recognizing the added value insect screens bring to modern living spaces, especially in urban environments where insect prevalence can be a concern. Regulatory mandates or incentives for energy-efficient and healthy living environments also contribute to the adoption of insect screens in these developments.

The Commercial application segment, though currently smaller, is witnessing significant growth potential. This includes applications in hospitality (hotels, restaurants), healthcare facilities, and offices, where hygiene and pest control are paramount. Stringent health regulations and the increasing emphasis on creating comfortable working and public environments are key drivers. The adoption of insect screens in commercial settings is often linked to specific industry standards and the need to maintain a pest-free environment to ensure operational continuity and customer satisfaction.

In terms of product types, Standard Corner Plates have historically dominated due to their cost-effectiveness and widespread availability. However, Spring-loaded Corner Plates are rapidly gaining traction. This shift is driven by their superior ease of installation, maintenance, and the ability to accommodate minor structural movements, offering a more user-friendly and adaptable solution for both installers and end-users. The convenience and enhanced functionality of spring-loaded designs are increasingly appealing to consumers and professionals alike, contributing to their growing market share.

Fixed Insect Screens Product Developments

Recent product developments in the fixed insect screens market focus on enhanced durability, lightweight designs, and improved aesthetic integration. Innovations include the use of advanced aluminum alloys for frames and robust, weather-resistant mesh materials that offer superior protection against insects and debris while maintaining excellent visibility. Manufacturers are also emphasizing customization options, allowing screens to be tailored to specific architectural styles and window dimensions. These developments cater to the growing demand for integrated and unobtrusive solutions that complement modern building aesthetics and offer long-term value.

Report Scope & Segmentation Analysis

This report segments the fixed insect screens market across key applications and product types. The Residential segment, comprising single-family homes and individual housing units, is expected to maintain its leading market position with a projected market size exceeding fifty million dollars by 2033. The Home Units segment, encompassing apartments and multi-dwelling buildings, is a rapidly growing area, with projected growth driven by urban development and increasing consumer demand for comfortable living environments. The Commercial segment, including hospitality, healthcare, and office spaces, offers significant future potential, fueled by stringent hygiene regulations and the need for pest-free environments.

In terms of product types, Spring-loaded Corner Plates are a key area of innovation and growth, offering enhanced user convenience and ease of installation, with projected market growth outpacing standard options. Standard Corner Plates continue to hold a significant market share due to their cost-effectiveness and established presence, particularly in cost-sensitive markets. Competitive dynamics within each segment vary, with manufacturers strategically targeting specific application areas and product preferences.

Key Drivers of Fixed Insect Screens Growth

The fixed insect screens market is propelled by several interconnected drivers. Rising health consciousness and awareness of insect-borne diseases are paramount, leading consumers to seek effective protection solutions. Urbanization and the trend towards indoor-outdoor living create demand for screens that facilitate comfortable use of balconies, patios, and gardens. Advancements in material science and manufacturing technologies enable the production of more durable, aesthetically pleasing, and cost-effective screens. Furthermore, increasing disposable incomes and a growing middle class, particularly in emerging economies, translate into greater spending on home improvement and comfort. Finally, favorable building codes and energy efficiency initiatives in some regions indirectly promote the adoption of insect screens as part of integrated building solutions.

Challenges in the Fixed Insect Screens Sector

Despite robust growth prospects, the fixed insect screens sector faces several challenges. Intense price competition among manufacturers, especially for standard models, can erode profit margins. Supply chain disruptions and volatility in raw material costs, particularly for aluminum and specialized mesh materials, pose significant operational hurdles. Stringent quality control and standardization requirements in certain markets can increase production costs and complexity. Furthermore, limited awareness or perceived necessity in certain regions can hinder market penetration. The emergence of alternative, albeit less effective, insect control methods also presents a mild competitive pressure.

Emerging Opportunities in Fixed Insect Screens

The fixed insect screens market is ripe with emerging opportunities. The growing demand for smart home integration presents a niche for insect screens with automated or sensor-driven functionalities. Increased focus on sustainable and eco-friendly materials offers a pathway for product differentiation and appeals to environmentally conscious consumers. The expansion into emerging economies with nascent construction sectors represents a significant untapped market. Furthermore, development of specialized screens for niche applications, such as pet-resistant meshes or screens with enhanced UV protection, can cater to specific consumer needs and create new revenue streams. The potential for integrated solutions that combine insect screening with other building functionalities, like enhanced ventilation or sound insulation, also holds considerable promise.

Leading Players in the Fixed Insect Screens Market

- Aluprof (Grupa Kety)

- WAREMA

- ALUMINCO

- HELLA Sonnen- und Wetterschutztechnik

- MHZ Hachtel

- SERVIS CLIMAX

- ISOTRA

- Roletarstvo Medle

- BECK+HEUN

- Tehrol

- SAMER

- Brombal

- Ecowindows

- Thermoplastiki

- Pronema

- MEGASTIL doo

- ENERsign

Key Developments in Fixed Insect Screens Industry

- 2023 Q4: Launch of new, ultra-fine mesh materials offering enhanced insect protection and improved visibility.

- 2024 Q1: Several manufacturers introduce enhanced spring-loaded corner plate systems for easier DIY installation.

- 2024 Q2: Strategic partnerships formed to integrate insect screens into broader home automation systems.

- 2024 Q3: Increased investment in R&D for sustainable and recycled material options for frames and meshes.

- 2024 Q4: Expansion of color and finish options to better match contemporary architectural designs.

- 2025 Q1: Introduction of advanced coatings for increased UV resistance and weatherability in key markets.

Strategic Outlook for Fixed Insect Screens Market

The strategic outlook for the fixed insect screens market is exceptionally positive, characterized by sustained growth driven by evolving consumer lifestyles and increased awareness of health and comfort. The market's future hinges on continuous innovation in materials, design, and functionality to meet the demand for aesthetically pleasing, durable, and user-friendly solutions. Manufacturers will need to focus on expanding their reach into emerging economies, adapting product offerings to local needs and affordability. Strategic collaborations, particularly in smart home technology integration and sustainable material development, will be crucial for maintaining a competitive edge and capitalizing on new market opportunities. The emphasis on health, well-being, and seamless indoor-outdoor living will continue to be the primary growth catalysts for the foreseeable future.

Fixed Insect Screens Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Home Units

- 1.3. Commercial

-

2. Types

- 2.1. Spring-loaded Corner Plates

- 2.2. Standard Corner Plates

Fixed Insect Screens Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fixed Insect Screens REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fixed Insect Screens Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Home Units

- 5.1.3. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Spring-loaded Corner Plates

- 5.2.2. Standard Corner Plates

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Fixed Insect Screens Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential

- 6.1.2. Home Units

- 6.1.3. Commercial

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Spring-loaded Corner Plates

- 6.2.2. Standard Corner Plates

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Fixed Insect Screens Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential

- 7.1.2. Home Units

- 7.1.3. Commercial

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Spring-loaded Corner Plates

- 7.2.2. Standard Corner Plates

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Fixed Insect Screens Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential

- 8.1.2. Home Units

- 8.1.3. Commercial

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Spring-loaded Corner Plates

- 8.2.2. Standard Corner Plates

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Fixed Insect Screens Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential

- 9.1.2. Home Units

- 9.1.3. Commercial

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Spring-loaded Corner Plates

- 9.2.2. Standard Corner Plates

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Fixed Insect Screens Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential

- 10.1.2. Home Units

- 10.1.3. Commercial

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Spring-loaded Corner Plates

- 10.2.2. Standard Corner Plates

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Aluprof (Grupa Kety)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 WAREMA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ALUMINCO

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HELLA Sonnen- und Wetterschutztechnik

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 MHZ Hachtel

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SERVIS CLIMAX

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ISOTRA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Roletarstvo Medle

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BECK+HEUN

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tehrol

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SAMER

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Brombal

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Ecowindows

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Thermoplastiki

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Pronema

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 MEGASTIL doo

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 ENERsign

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Aluprof (Grupa Kety)

List of Figures

- Figure 1: Global Fixed Insect Screens Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Fixed Insect Screens Revenue (million), by Application 2024 & 2032

- Figure 3: North America Fixed Insect Screens Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Fixed Insect Screens Revenue (million), by Types 2024 & 2032

- Figure 5: North America Fixed Insect Screens Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Fixed Insect Screens Revenue (million), by Country 2024 & 2032

- Figure 7: North America Fixed Insect Screens Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Fixed Insect Screens Revenue (million), by Application 2024 & 2032

- Figure 9: South America Fixed Insect Screens Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Fixed Insect Screens Revenue (million), by Types 2024 & 2032

- Figure 11: South America Fixed Insect Screens Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Fixed Insect Screens Revenue (million), by Country 2024 & 2032

- Figure 13: South America Fixed Insect Screens Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Fixed Insect Screens Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Fixed Insect Screens Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Fixed Insect Screens Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Fixed Insect Screens Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Fixed Insect Screens Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Fixed Insect Screens Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Fixed Insect Screens Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Fixed Insect Screens Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Fixed Insect Screens Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Fixed Insect Screens Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Fixed Insect Screens Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Fixed Insect Screens Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Fixed Insect Screens Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Fixed Insect Screens Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Fixed Insect Screens Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Fixed Insect Screens Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Fixed Insect Screens Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Fixed Insect Screens Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fixed Insect Screens Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Fixed Insect Screens Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Fixed Insect Screens Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Fixed Insect Screens Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Fixed Insect Screens Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Fixed Insect Screens Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Fixed Insect Screens Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Fixed Insect Screens Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Fixed Insect Screens Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Fixed Insect Screens Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Fixed Insect Screens Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Fixed Insect Screens Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Fixed Insect Screens Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Fixed Insect Screens Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Fixed Insect Screens Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Fixed Insect Screens Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Fixed Insect Screens Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Fixed Insect Screens Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Fixed Insect Screens Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Fixed Insect Screens Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fixed Insect Screens?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Fixed Insect Screens?

Key companies in the market include Aluprof (Grupa Kety), WAREMA, ALUMINCO, HELLA Sonnen- und Wetterschutztechnik, MHZ Hachtel, SERVIS CLIMAX, ISOTRA, Roletarstvo Medle, BECK+HEUN, Tehrol, SAMER, Brombal, Ecowindows, Thermoplastiki, Pronema, MEGASTIL doo, ENERsign.

3. What are the main segments of the Fixed Insect Screens?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fixed Insect Screens," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fixed Insect Screens report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fixed Insect Screens?

To stay informed about further developments, trends, and reports in the Fixed Insect Screens, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence