Key Insights

The Fixed Wireless Access (FWA) market is poised for substantial expansion, driven by escalating demand for high-speed broadband, particularly in regions with limited wired infrastructure. The market, valued at $183.78 billion in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 26.7% from 2025 to 2033. Key growth catalysts include the widespread adoption of 5G technology and advancements in wireless infrastructure, positioning FWA as a compelling alternative to traditional broadband. Increased affordability of FWA solutions, flexible deployment strategies, and significant investments in network infrastructure by telecommunications providers further propel market penetration. Segmentation analysis highlights strong demand for FWA hardware and services, with residential applications currently dominating revenue, though commercial and industrial sectors demonstrate considerable growth potential.

Fixed Wireless Access Market Market Size (In Billion)

While opportunities abound, the FWA market faces certain challenges, including regulatory complexities, potential signal interference, and the imperative for consistent network quality. Nevertheless, continuous technological innovation, such as enhanced spectrum management and advanced antenna solutions, is actively addressing these constraints. Emerging business models, including bundled service offerings, are anticipated to stimulate further adoption and revenue generation. Leading market participants such as AT&T, Ericsson, Samsung, Verizon, and Nokia are prioritizing research and development and strategic alliances to sustain competitive leadership. Geographic expansion is expected to be most prominent in Asia Pacific and North America, reflecting robust demand and infrastructure development. Overall, the FWA market presents a dynamic landscape for innovation and growth, characterized by a sustained focus on technological progress and expanded market reach.

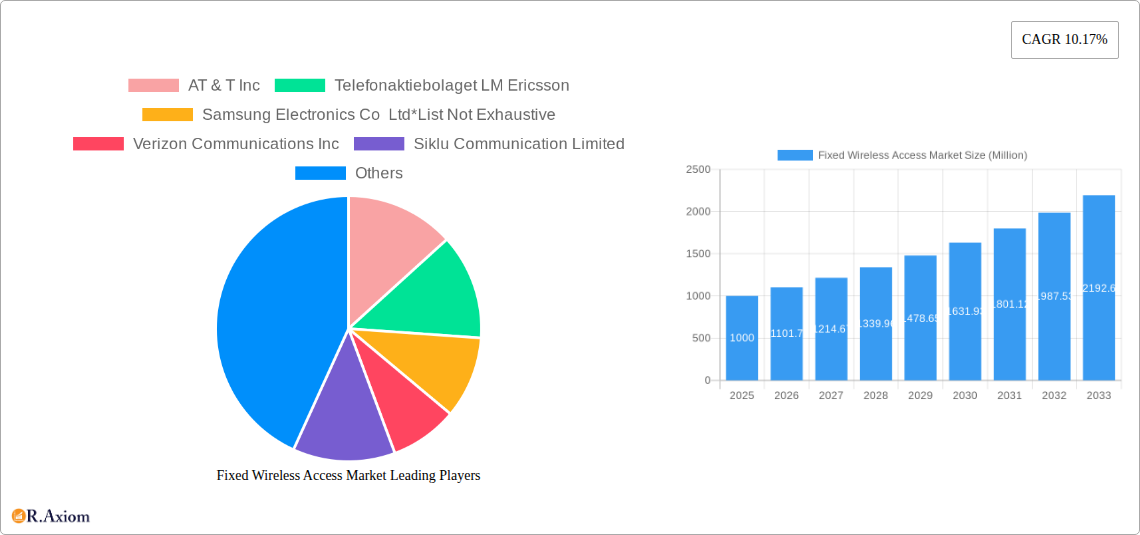

Fixed Wireless Access Market Company Market Share

Fixed Wireless Access Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Fixed Wireless Access (FWA) market, offering invaluable insights for stakeholders across the value chain. Spanning the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study meticulously examines market dynamics, growth drivers, challenges, and emerging opportunities. The report covers key segments, leading players, and significant industry developments, enabling informed strategic decision-making. The global FWA market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Fixed Wireless Access Market Concentration & Innovation

The Fixed Wireless Access market exhibits a moderately concentrated landscape, with several major players holding significant market share. However, the presence of numerous smaller, specialized firms indicates a dynamic competitive environment. Market share estimations for 2025 suggest that AT&T Inc., Verizon Communications Inc., and Nokia Corporation collectively hold approximately xx% of the market, while smaller players like Siklu Communication Limited and Airspan Networks Inc. compete fiercely in niche segments. Innovation is driven by advancements in 5G technology, increased demand for high-speed broadband access in underserved areas, and the development of more efficient and cost-effective hardware.

Regulatory frameworks, varying across different geographies, significantly influence market expansion. The availability of spectrum licenses and government initiatives promoting broadband deployment play a crucial role. Product substitutes, primarily traditional wired broadband connections and satellite internet services, pose a competitive threat, particularly in areas with robust wired infrastructure. End-user trends, such as increasing demand for higher bandwidth and reliable connectivity for both residential and commercial applications, propel market growth. The FWA market has witnessed several M&A activities in recent years, with deal values ranging from xx Million to xx Million. These mergers and acquisitions are primarily driven by the need to consolidate market share, expand technological capabilities, and enhance geographical reach. Examples include the December 2022 merger between NBN Co Limited and Ericsson.

Fixed Wireless Access Market Industry Trends & Insights

The Fixed Wireless Access market is experiencing robust growth, fueled by several key factors. The increasing penetration of 5G technology offers higher speeds and lower latency, making FWA a more attractive option compared to traditional technologies. A significant driver is the rising demand for high-speed internet access in underserved rural and suburban areas where wired infrastructure is limited or non-existent. Furthermore, the increasing adoption of smart devices and the growth of the Internet of Things (IoT) are contributing to the increased need for reliable and high-bandwidth connectivity. The market's expansion is also influenced by the continuous decline in the cost of FWA equipment and services, making it more accessible to a wider range of consumers. However, challenges such as regulatory hurdles in securing spectrum licenses and infrastructure deployment costs pose potential impediments to market growth. Consumer preferences are increasingly shifting towards higher data allowances and faster download speeds, pushing service providers to upgrade their infrastructure and service offerings. Competitive dynamics are characterized by fierce competition among major telecommunications companies and specialized FWA equipment providers. The market is expected to experience a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033.

Dominant Markets & Segments in Fixed Wireless Access Market

The North American region is currently the dominant market for Fixed Wireless Access, driven by significant investments in 5G infrastructure, favorable regulatory environments, and the presence of large telecommunication companies.

- Key Drivers in North America:

- Robust 5G infrastructure deployment.

- High demand for high-speed internet in suburban and rural areas.

- Favorable government policies supporting broadband expansion.

The residential segment holds the largest market share within the FWA market, reflecting the growing demand for high-speed internet access in homes. The commercial segment is also witnessing significant growth, driven by the increasing need for reliable connectivity for businesses of all sizes. The industrial segment, while smaller, displays high growth potential due to the expanding adoption of IoT and smart manufacturing technologies.

- Dominance Analysis:

- By Type: The Hardware segment currently dominates, reflecting the importance of FWA infrastructure. However, the Services segment is expected to experience faster growth due to increased demand for managed services and support.

- By Application: The residential segment currently holds the largest market share, followed by the commercial and industrial sectors. The growth rate for the commercial segment is projected to be higher than the residential segment over the forecast period due to increased business adoption of FWA.

Fixed Wireless Access Market Product Developments

Recent product innovations focus on improving network performance, expanding coverage, and enhancing user experience. The introduction of 5G-based FWA systems with advanced antenna technologies, such as the Nokia FastMile 5G receiver, demonstrates this trend. These advancements are enabling higher speeds, greater capacity, and improved reliability, particularly in challenging environments. The market is witnessing the integration of software-defined networking (SDN) and network function virtualization (NFV) technologies to enhance network flexibility and efficiency. This technological trend aims to meet the growing demand for personalized and adaptable network solutions, providing a competitive advantage for FWA service providers.

Report Scope & Segmentation Analysis

This report segments the Fixed Wireless Access market based on type (Hardware, Access units (Femto & Picocells), Services) and application (Residential, Commercial, Industrial).

By Type: The Hardware segment encompasses access points, antennas, and other related equipment, with xx Million market value in 2025. The Access units (Femto & Picocells) segment focuses on small-cell solutions. The Services segment includes installation, maintenance, and support services.

By Application: The Residential segment caters to individual households, the Commercial segment serves businesses, and the Industrial segment targets industrial applications with specific needs and growth expectations.

Key Drivers of Fixed Wireless Access Market Growth

The growth of the Fixed Wireless Access market is driven by several key factors: the expanding 5G network infrastructure, increasing demand for high-speed internet access in underserved areas, and the decreasing cost of FWA equipment. Government initiatives promoting broadband deployment and the rising adoption of IoT devices further propel market expansion. The shift towards cloud-based services also fuels the need for reliable and high-bandwidth connectivity.

Challenges in the Fixed Wireless Access Market Sector

The Fixed Wireless Access market faces several challenges, including regulatory hurdles in securing spectrum licenses, especially in congested urban areas. Supply chain disruptions can impact the availability of critical components, leading to delays in project implementation. Furthermore, intense competition among existing and emerging players exerts significant pressure on pricing and profitability. These challenges, if not adequately addressed, could affect the overall market growth trajectory. The predicted impact of these challenges on market growth is a reduction in the CAGR by approximately xx percentage points by 2033.

Emerging Opportunities in Fixed Wireless Access Market

Emerging opportunities exist in expanding FWA services to underserved rural communities, utilizing advanced antenna technologies like massive MIMO for improved capacity, and integrating FWA with other technologies such as satellite internet for hybrid solutions. The growing adoption of private 5G networks in enterprise and industrial settings presents a substantial opportunity for FWA providers. Furthermore, the development of innovative business models, such as fixed wireless as a service (FWaaS), can unlock further market potential.

Leading Players in the Fixed Wireless Access Market Market

- AT&T Inc.

- Telefonaktiebolaget LM Ericsson

- Samsung Electronics Co Ltd

- Verizon Communications Inc.

- Siklu Communication Limited

- Qualcomm Technologies

- Arqiva (UK)

- Nokia Corporation

- Huawei Technologies Co Limited

- Airspan Networks Inc

Key Developments in Fixed Wireless Access Market Industry

June 2023: Nokia announced the launch of the FastMile 5G receiver, expanding high-speed internet access to underserved communities. This launch significantly impacts market competition and broadens access to underserved populations.

December 2022: The merger between NBN Co Limited and Ericsson signifies a major step towards enhancing Australia's fixed wireless access network, leveraging 5G technology for improved coverage and speed. This partnership represents a strategic move toward deploying next-generation FWA technologies.

Strategic Outlook for Fixed Wireless Access Market Market

The Fixed Wireless Access market is poised for significant growth, driven by technological advancements, increasing demand for high-speed internet, and supportive government policies. The expansion of 5G networks, coupled with the development of innovative FWA solutions, will unlock new opportunities in both developed and emerging markets. Strategic investments in infrastructure development and technological innovation will be crucial for companies seeking to capitalize on this market's immense potential. The market is expected to witness increased consolidation through mergers and acquisitions, further shaping the competitive landscape.

Fixed Wireless Access Market Segmentation

-

1. Type

-

1.1. Hardware

- 1.1.1. Consumer Premise Equipment (CPE)

- 1.1.2. Access units (Femto & Picocells)

- 1.2. Services

-

1.1. Hardware

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

Fixed Wireless Access Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Fixed Wireless Access Market Regional Market Share

Geographic Coverage of Fixed Wireless Access Market

Fixed Wireless Access Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for High-speed Data Connectivity Through Advanced Technologies; Strategic Collaborations Between Various Stakeholders in the 5G Industry to Drive Adoption

- 3.3. Market Restrains

- 3.3.1. ; High Infrastructure Setup Cost During the Initial Rollout Phase; Lack of User Handheld Devices Compatible to 5 GNR Infrastructure

- 3.4. Market Trends

- 3.4.1. Residential Segment Expected to Depict the Maximum Application

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fixed Wireless Access Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.1.1. Consumer Premise Equipment (CPE)

- 5.1.1.2. Access units (Femto & Picocells)

- 5.1.2. Services

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Fixed Wireless Access Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hardware

- 6.1.1.1. Consumer Premise Equipment (CPE)

- 6.1.1.2. Access units (Femto & Picocells)

- 6.1.2. Services

- 6.1.1. Hardware

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Industrial

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Fixed Wireless Access Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hardware

- 7.1.1.1. Consumer Premise Equipment (CPE)

- 7.1.1.2. Access units (Femto & Picocells)

- 7.1.2. Services

- 7.1.1. Hardware

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Industrial

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Fixed Wireless Access Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hardware

- 8.1.1.1. Consumer Premise Equipment (CPE)

- 8.1.1.2. Access units (Femto & Picocells)

- 8.1.2. Services

- 8.1.1. Hardware

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Industrial

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Fixed Wireless Access Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hardware

- 9.1.1.1. Consumer Premise Equipment (CPE)

- 9.1.1.2. Access units (Femto & Picocells)

- 9.1.2. Services

- 9.1.1. Hardware

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Industrial

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 AT & T Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Telefonaktiebolaget LM Ericsson

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Samsung Electronics Co Ltd*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Verizon Communications Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Siklu Communication Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Qualcomm Technologies

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Arqiva (UK)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Nokia Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Huawei Technologies Co Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Airspan Networks Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 AT & T Inc

List of Figures

- Figure 1: Global Fixed Wireless Access Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Fixed Wireless Access Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Fixed Wireless Access Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Fixed Wireless Access Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Fixed Wireless Access Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Fixed Wireless Access Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Fixed Wireless Access Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Fixed Wireless Access Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Fixed Wireless Access Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Fixed Wireless Access Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Fixed Wireless Access Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Fixed Wireless Access Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Fixed Wireless Access Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Fixed Wireless Access Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Fixed Wireless Access Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Fixed Wireless Access Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Fixed Wireless Access Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Fixed Wireless Access Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Fixed Wireless Access Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Fixed Wireless Access Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Rest of the World Fixed Wireless Access Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Fixed Wireless Access Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Rest of the World Fixed Wireless Access Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Fixed Wireless Access Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Fixed Wireless Access Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fixed Wireless Access Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Fixed Wireless Access Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Fixed Wireless Access Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Fixed Wireless Access Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Fixed Wireless Access Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Fixed Wireless Access Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Fixed Wireless Access Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Fixed Wireless Access Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Fixed Wireless Access Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Fixed Wireless Access Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Fixed Wireless Access Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Fixed Wireless Access Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Fixed Wireless Access Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Fixed Wireless Access Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Fixed Wireless Access Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fixed Wireless Access Market?

The projected CAGR is approximately 26.7%.

2. Which companies are prominent players in the Fixed Wireless Access Market?

Key companies in the market include AT & T Inc, Telefonaktiebolaget LM Ericsson, Samsung Electronics Co Ltd*List Not Exhaustive, Verizon Communications Inc, Siklu Communication Limited, Qualcomm Technologies, Arqiva (UK), Nokia Corporation, Huawei Technologies Co Limited, Airspan Networks Inc.

3. What are the main segments of the Fixed Wireless Access Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 183.78 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for High-speed Data Connectivity Through Advanced Technologies; Strategic Collaborations Between Various Stakeholders in the 5G Industry to Drive Adoption.

6. What are the notable trends driving market growth?

Residential Segment Expected to Depict the Maximum Application.

7. Are there any restraints impacting market growth?

; High Infrastructure Setup Cost During the Initial Rollout Phase; Lack of User Handheld Devices Compatible to 5 GNR Infrastructure.

8. Can you provide examples of recent developments in the market?

June 2023: Nokia announced the launch of a fixed wireless access receiver for the North American market named FastMile 5G receiver. This receiver uses a high-gain antenna that delivers high-speed internet to suburban and rural underserved communities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fixed Wireless Access Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fixed Wireless Access Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fixed Wireless Access Market?

To stay informed about further developments, trends, and reports in the Fixed Wireless Access Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence