Key Insights

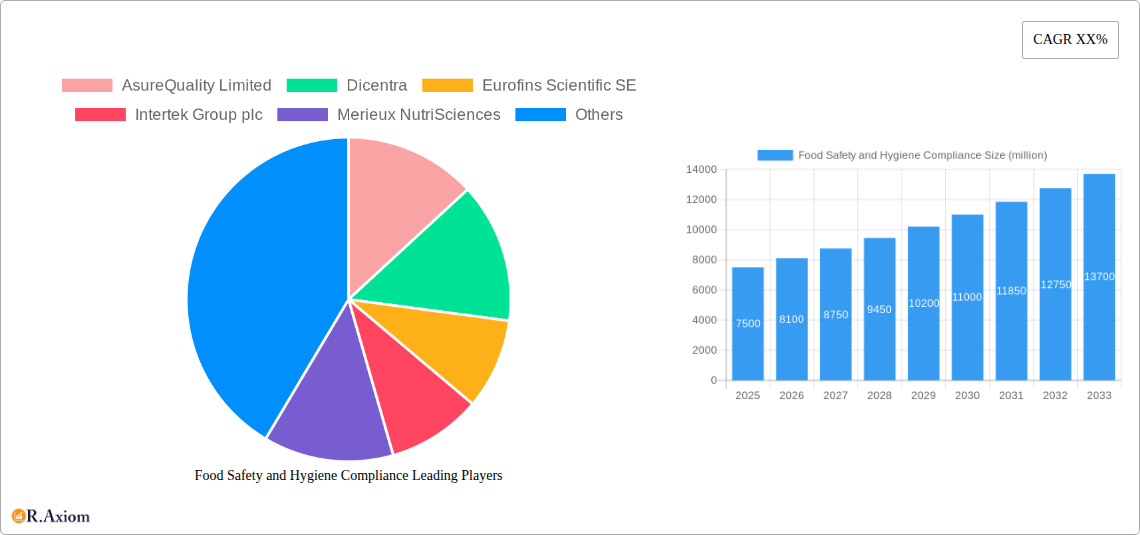

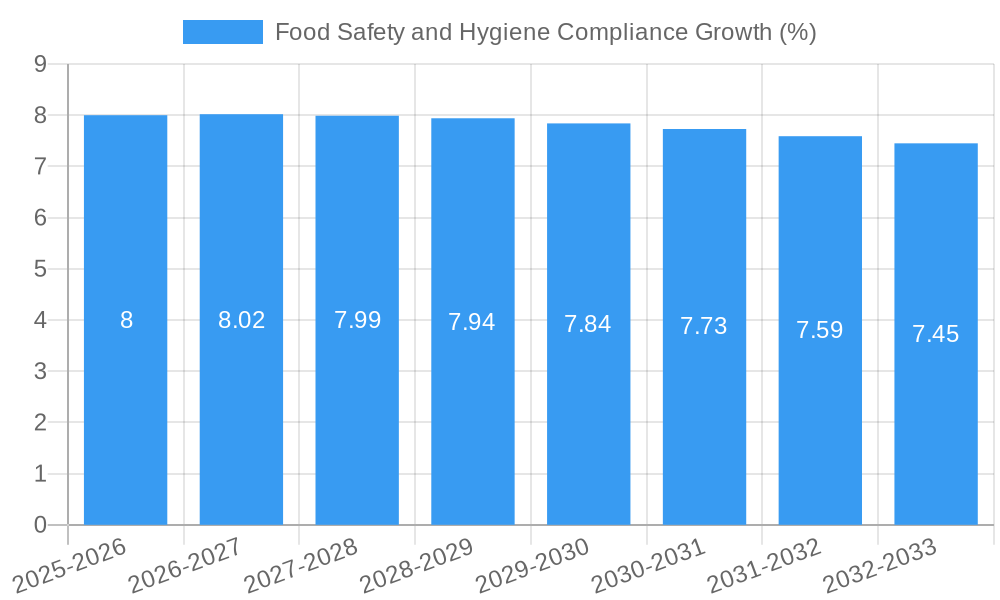

The global Food Safety and Hygiene Compliance market is poised for substantial growth, projected to reach an estimated XXX million by 2025, and expanding at a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025-2033. This robust expansion is fueled by a confluence of critical drivers. Rising consumer awareness regarding foodborne illnesses and a growing demand for safe, traceable food products are paramount. Stringent government regulations and international standards are compelling businesses across the food value chain to invest heavily in compliance solutions. Furthermore, the increasing complexity of global food supply chains, coupled with the potential for rapid dissemination of contamination, necessitates advanced safety and hygiene measures. Technological advancements in areas like IoT-enabled monitoring, AI-driven analytics, and blockchain for traceability are also playing a pivotal role in enhancing food safety protocols and driving market adoption.

The market segmentation reveals diverse opportunities across various applications and solutions. The Laboratory segment is expected to witness significant traction, driven by the need for accurate and reliable testing for contaminants and pathogens. The Food Industry and Food Service Industry are also key beneficiaries, as they directly interact with consumers and face the brunt of regulatory scrutiny and consumer trust. In terms of types, the demand for comprehensive Solutions encompassing software, hardware, and services is anticipated to dominate, offering end-to-end compliance management. Key players such as Eurofins Scientific SE, Intertek Group plc, and Merieux NutriSciences are at the forefront, investing in R&D and strategic partnerships to cater to evolving market needs. While the market presents immense potential, challenges such as the high cost of implementing advanced compliance systems and the need for skilled personnel could pose restraints. However, the overwhelming emphasis on public health and food security ensures a sustained upward trajectory for this vital market.

Here is an SEO-optimized, detailed report description for Food Safety and Hygiene Compliance, designed for immediate use:

Food Safety and Hygiene Compliance Market Concentration & Innovation

The global food safety and hygiene compliance market exhibits a moderate to high concentration, driven by a sophisticated regulatory landscape and increasing consumer demand for traceable and safe food products. Innovation is primarily fueled by advancements in laboratory testing technologies, digital traceability solutions, and predictive analytics for identifying potential foodborne hazards. Regulatory frameworks, such as HACCP, ISO 22000, and regional food safety standards, continue to shape market dynamics, pushing companies to invest in robust compliance systems. Product substitutes are limited, with the core offerings revolving around testing, auditing, and compliance software. End-user trends lean towards integrated solutions that streamline compliance processes, reduce operational risks, and enhance brand reputation. Significant M&A activities, with a cumulative deal value estimated in the millions of USD annually, are observed as larger players acquire specialized technology providers to expand their service portfolios and geographical reach. Key M&A transactions in the historical period (2019-2024) have seen companies like Eurofins Scientific SE and Intertek Group plc strategically enhance their food testing and certification capabilities. The market's focus on proactive risk management and supply chain integrity underscores a mature yet dynamic competitive environment.

Food Safety and Hygiene Compliance Industry Trends & Insights

The food safety and hygiene compliance industry is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately xx.xx% from 2025 to 2033. This growth is propelled by a confluence of factors, including increasingly stringent government regulations worldwide, rising consumer awareness of foodborne illnesses, and a growing global population that necessitates greater efficiency and safety in food production and distribution. Technological disruptions are a major trend, with the integration of Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) revolutionizing how food safety is monitored and managed. For instance, AI-powered analytics are now capable of predicting potential contamination hotspots within supply chains, while IoT sensors can provide real-time data on temperature, humidity, and other critical parameters throughout the food journey. Consumer preferences are increasingly favoring transparency and sustainability, driving demand for blockchain-based traceability solutions that offer end-to-end visibility of food products from farm to fork. Competitive dynamics are characterized by a blend of established players offering comprehensive services and agile startups introducing novel, technology-driven solutions. Market penetration of advanced food safety technologies is steadily increasing across all segments, from primary producers to food service providers, reflecting a proactive shift towards preventing outbreaks rather than merely reacting to them. The global market size is estimated to reach over xx,xxx million USD by 2033, with significant investments pouring into research and development to address emerging pathogens and evolving food production methods. The industry is witnessing a digital transformation, where data analytics and cloud-based platforms are becoming indispensable tools for ensuring food safety and maintaining consumer trust.

Dominant Markets & Segments in Food Safety and Hygiene Compliance

The Food Industry segment is the dominant market within the food safety and hygiene compliance sector, accounting for an estimated xx% of the total market share in 2025. This dominance is driven by the sheer volume of food production, processing, and distribution activities that fall under its purview, alongside the intricate supply chains that demand rigorous oversight. Economic policies promoting food security and export have further bolstered the need for robust compliance measures within this segment.

- Key Drivers of Dominance in the Food Industry:

- Regulatory Mandates: Strict adherence to national and international food safety regulations (e.g., FSMA in the US, GFSI globally) is non-negotiable for market access.

- Supply Chain Complexity: Globalized supply chains require sophisticated systems for traceability and hazard control at multiple points.

- Brand Reputation & Consumer Trust: Food manufacturers invest heavily in compliance to protect their brand image and build consumer confidence.

- Technological Adoption: Increasing adoption of digital solutions for risk assessment, monitoring, and record-keeping.

The Laboratory application segment also holds significant sway, projected to represent xx% of the market by 2025. This is due to the critical role of laboratory testing in verifying food quality, detecting contaminants, and validating safety protocols.

- Key Drivers of Dominance in the Laboratory Segment:

- Testing Accuracy & Speed: Demand for rapid and accurate detection of pathogens, allergens, and chemical contaminants.

- Advancements in Analytical Techniques: Innovations in methods like PCR, ELISA, and mass spectrometry are enhancing testing capabilities.

- Third-Party Certification: Laboratories are essential for providing independent verification and certification required by regulators and buyers.

In terms of Types, Services are the leading segment, capturing an estimated xx% of the market in 2025. This encompasses a broad range of offerings including consulting, auditing, training, and testing services, which are essential for implementing and maintaining compliance programs.

- Key Drivers of Dominance for Services:

- Expertise Gap: Many organizations lack in-house expertise to navigate complex regulations, relying on external consultants and auditors.

- Compliance Outsourcing: A growing trend where companies outsource compliance management to specialized service providers.

- Adaptability to Regulations: Service providers continuously update their offerings to align with evolving regulatory landscapes.

The Food Service Industry is a rapidly growing segment, driven by increased public awareness and the direct impact of foodborne illnesses on consumers. Government regulations, while primarily targeting production, increasingly influence service standards.

- Key Drivers of Growth in Food Service:

- Public Health Concerns: High visibility of foodborne illness outbreaks.

- Staff Training & Certification: Mandatory training programs for food handlers.

- Supply Chain Traceability: Pressure to ensure the safety of ingredients sourced from various suppliers.

Food Safety and Hygiene Compliance Product Developments

Product developments in food safety and hygiene compliance are focused on enhancing accuracy, efficiency, and traceability. Innovations include rapid detection kits for pathogens and allergens using advanced biosensor technology, predictive analytics platforms powered by AI to forecast contamination risks, and blockchain-based traceability solutions offering immutable records from farm to fork. Software solutions are increasingly integrating IoT data for real-time monitoring of critical control points. These advancements offer significant competitive advantages by reducing testing times, minimizing false positives, and providing unparalleled transparency, thereby strengthening brand trust and ensuring proactive risk mitigation.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global food safety and hygiene compliance market across key segments. The Laboratory segment, valued at approximately xx,xxx million USD in 2025, is projected to grow at a CAGR of xx.xx% through 2033, driven by demand for advanced testing technologies. The Food Industry segment, the largest at an estimated xx,xxx million USD in 2025, is expected to grow at xx.xx% CAGR. The Food Service Industry segment, currently valued at xx,xxx million USD, is anticipated to expand at xx.xx% CAGR, fueled by increasing consumer and regulatory scrutiny. The Government segment, essential for policy enforcement, is projected to grow at xx.xx% CAGR. In terms of product Types, Hardware solutions, including testing equipment, are expected to reach xx,xxx million USD by 2033 with a xx.xx% CAGR. Solution offerings, such as software and integrated platforms, are projected to dominate, reaching xx,xxx million USD with a xx.xx% CAGR. Services, encompassing consulting, auditing, and training, are estimated at xx,xxx million USD and are projected to grow at xx.xx% CAGR.

Key Drivers of Food Safety and Hygiene Compliance Growth

The food safety and hygiene compliance market is propelled by several critical growth drivers. Escalating consumer demand for safe and transparent food products is a primary catalyst. Stringent government regulations and international standards, such as FSMA and GFSI, compel businesses to invest in robust compliance systems. Technological advancements, including IoT sensors, AI-driven analytics, and blockchain technology, are enabling more effective monitoring, traceability, and risk prediction throughout the food supply chain. Furthermore, a heightened awareness of the economic and reputational consequences of foodborne outbreaks incentivizes proactive compliance measures, leading to substantial investments in testing, auditing, and compliance management solutions.

Challenges in the Food Safety and Hygiene Compliance Sector

Despite significant growth, the food safety and hygiene compliance sector faces several challenges. The ever-evolving and complex global regulatory landscape can be difficult and costly for businesses to navigate and consistently adhere to. Ensuring complete traceability across increasingly fragmented and international supply chains presents logistical hurdles. The high initial investment required for advanced testing equipment and sophisticated compliance software can be a barrier, particularly for small and medium-sized enterprises (SMEs). Additionally, a shortage of skilled professionals with expertise in food safety science and regulatory affairs can impede effective implementation and enforcement of compliance programs, impacting the overall market expansion.

Emerging Opportunities in Food Safety and Hygiene Compliance

Emerging opportunities in the food safety and hygiene compliance sector are abundant. The growing demand for plant-based and alternative proteins creates new avenues for specialized testing and compliance protocols. The expansion of e-commerce and food delivery services necessitates enhanced safety measures and traceability for perishable goods transported under varying conditions. The increasing global focus on sustainability and ethical sourcing is driving demand for compliance solutions that integrate environmental and social governance (ESG) factors. Furthermore, the development of portable and rapid on-site testing devices offers significant potential for real-time decision-making and cost reduction across the entire food value chain, opening new markets and applications.

Leading Players in the Food Safety and Hygiene Compliance Market

- AsureQuality Limited

- Dicentra

- Eurofins Scientific SE

- Intertek Group plc

- Merieux NutriSciences

- Microbac Laboratories Inc.

- Neogen Corporation

- PathSensors

- rfxcel Corporation

- SafetyChain Software

Key Developments in Food Safety and Hygiene Compliance Industry

- 2024: Launch of AI-powered predictive analytics for early detection of foodborne pathogens by several software providers.

- 2023: Increased adoption of blockchain technology for enhanced food traceability and transparency in supply chains.

- 2023: Expansion of rapid allergen testing kits with improved sensitivity and specificity.

- 2022: Several mergers and acquisitions focused on integrating IoT sensor technology with compliance management platforms.

- 2021: Growing emphasis on digital certification and remote auditing processes due to global events.

- 2020: Significant investment in rapid testing solutions for novel viruses and emerging contaminants.

- 2019: Introduction of advanced molecular diagnostic techniques for faster and more accurate pathogen identification.

Strategic Outlook for Food Safety and Hygiene Compliance Market

The strategic outlook for the food safety and hygiene compliance market is exceptionally positive, driven by an unwavering global commitment to public health and food security. The integration of digital technologies, including AI, IoT, and blockchain, will continue to revolutionize risk management and traceability, creating more intelligent and proactive compliance systems. The expanding scope of regulations and increasing consumer expectations for transparency will fuel sustained demand for comprehensive testing, auditing, and consulting services. Strategic partnerships between technology providers, testing laboratories, and food businesses will be crucial for developing integrated solutions that address the complex challenges of modern food supply chains, ensuring a safer and more trustworthy global food system.

Food Safety and Hygiene Compliance Segmentation

-

1. Application

- 1.1. Laboratory

- 1.2. Food Industry

- 1.3. Food Service Industry

- 1.4. Government

- 1.5. Other

-

2. Types

- 2.1. Hardware

- 2.2. Solution

- 2.3. Services

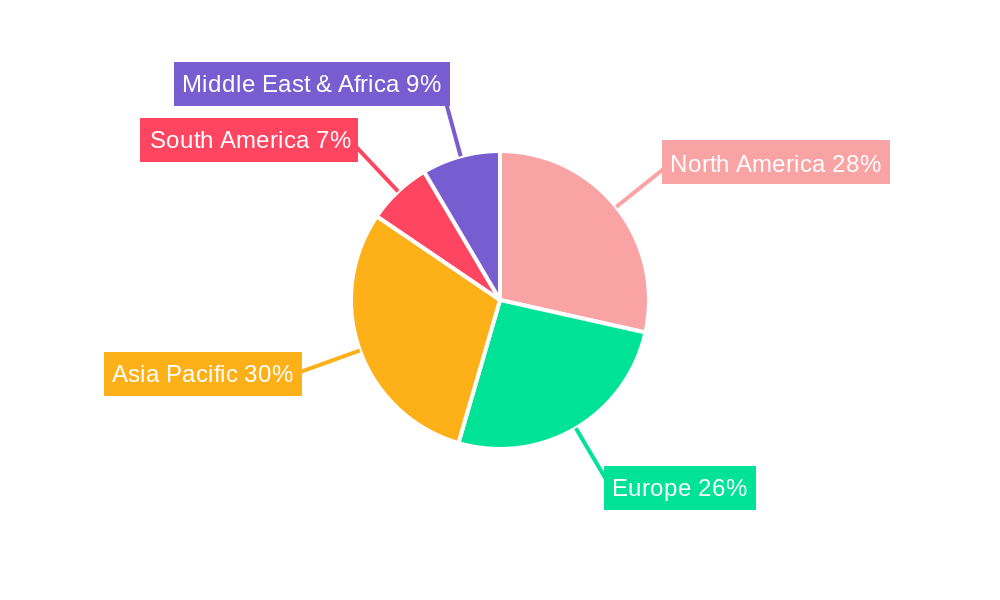

Food Safety and Hygiene Compliance Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Food Safety and Hygiene Compliance REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food Safety and Hygiene Compliance Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Laboratory

- 5.1.2. Food Industry

- 5.1.3. Food Service Industry

- 5.1.4. Government

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Hardware

- 5.2.2. Solution

- 5.2.3. Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Food Safety and Hygiene Compliance Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Laboratory

- 6.1.2. Food Industry

- 6.1.3. Food Service Industry

- 6.1.4. Government

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Hardware

- 6.2.2. Solution

- 6.2.3. Services

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Food Safety and Hygiene Compliance Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Laboratory

- 7.1.2. Food Industry

- 7.1.3. Food Service Industry

- 7.1.4. Government

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Hardware

- 7.2.2. Solution

- 7.2.3. Services

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Food Safety and Hygiene Compliance Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Laboratory

- 8.1.2. Food Industry

- 8.1.3. Food Service Industry

- 8.1.4. Government

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Hardware

- 8.2.2. Solution

- 8.2.3. Services

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Food Safety and Hygiene Compliance Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Laboratory

- 9.1.2. Food Industry

- 9.1.3. Food Service Industry

- 9.1.4. Government

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Hardware

- 9.2.2. Solution

- 9.2.3. Services

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Food Safety and Hygiene Compliance Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Laboratory

- 10.1.2. Food Industry

- 10.1.3. Food Service Industry

- 10.1.4. Government

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Hardware

- 10.2.2. Solution

- 10.2.3. Services

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 AsureQuality Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dicentra

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eurofins Scientific SE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Intertek Group plc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Merieux NutriSciences

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Microbac Laboratories Inc.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Neogen Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PathSensors

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 rfxcel Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SafetyChain Software

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 AsureQuality Limited

List of Figures

- Figure 1: Global Food Safety and Hygiene Compliance Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Food Safety and Hygiene Compliance Revenue (million), by Application 2024 & 2032

- Figure 3: North America Food Safety and Hygiene Compliance Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Food Safety and Hygiene Compliance Revenue (million), by Types 2024 & 2032

- Figure 5: North America Food Safety and Hygiene Compliance Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Food Safety and Hygiene Compliance Revenue (million), by Country 2024 & 2032

- Figure 7: North America Food Safety and Hygiene Compliance Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Food Safety and Hygiene Compliance Revenue (million), by Application 2024 & 2032

- Figure 9: South America Food Safety and Hygiene Compliance Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Food Safety and Hygiene Compliance Revenue (million), by Types 2024 & 2032

- Figure 11: South America Food Safety and Hygiene Compliance Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Food Safety and Hygiene Compliance Revenue (million), by Country 2024 & 2032

- Figure 13: South America Food Safety and Hygiene Compliance Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Food Safety and Hygiene Compliance Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Food Safety and Hygiene Compliance Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Food Safety and Hygiene Compliance Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Food Safety and Hygiene Compliance Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Food Safety and Hygiene Compliance Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Food Safety and Hygiene Compliance Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Food Safety and Hygiene Compliance Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Food Safety and Hygiene Compliance Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Food Safety and Hygiene Compliance Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Food Safety and Hygiene Compliance Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Food Safety and Hygiene Compliance Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Food Safety and Hygiene Compliance Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Food Safety and Hygiene Compliance Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Food Safety and Hygiene Compliance Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Food Safety and Hygiene Compliance Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Food Safety and Hygiene Compliance Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Food Safety and Hygiene Compliance Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Food Safety and Hygiene Compliance Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Food Safety and Hygiene Compliance Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Food Safety and Hygiene Compliance Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Food Safety and Hygiene Compliance Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Food Safety and Hygiene Compliance Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Food Safety and Hygiene Compliance Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Food Safety and Hygiene Compliance Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Food Safety and Hygiene Compliance Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Food Safety and Hygiene Compliance Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Food Safety and Hygiene Compliance Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Food Safety and Hygiene Compliance Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Food Safety and Hygiene Compliance Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Food Safety and Hygiene Compliance Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Food Safety and Hygiene Compliance Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Food Safety and Hygiene Compliance Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Food Safety and Hygiene Compliance Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Food Safety and Hygiene Compliance Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Food Safety and Hygiene Compliance Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Food Safety and Hygiene Compliance Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Food Safety and Hygiene Compliance Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Food Safety and Hygiene Compliance Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Safety and Hygiene Compliance?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Food Safety and Hygiene Compliance?

Key companies in the market include AsureQuality Limited, Dicentra, Eurofins Scientific SE, Intertek Group plc, Merieux NutriSciences, Microbac Laboratories Inc., Neogen Corporation, PathSensors, rfxcel Corporation, SafetyChain Software.

3. What are the main segments of the Food Safety and Hygiene Compliance?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food Safety and Hygiene Compliance," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food Safety and Hygiene Compliance report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food Safety and Hygiene Compliance?

To stay informed about further developments, trends, and reports in the Food Safety and Hygiene Compliance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence