Key Insights

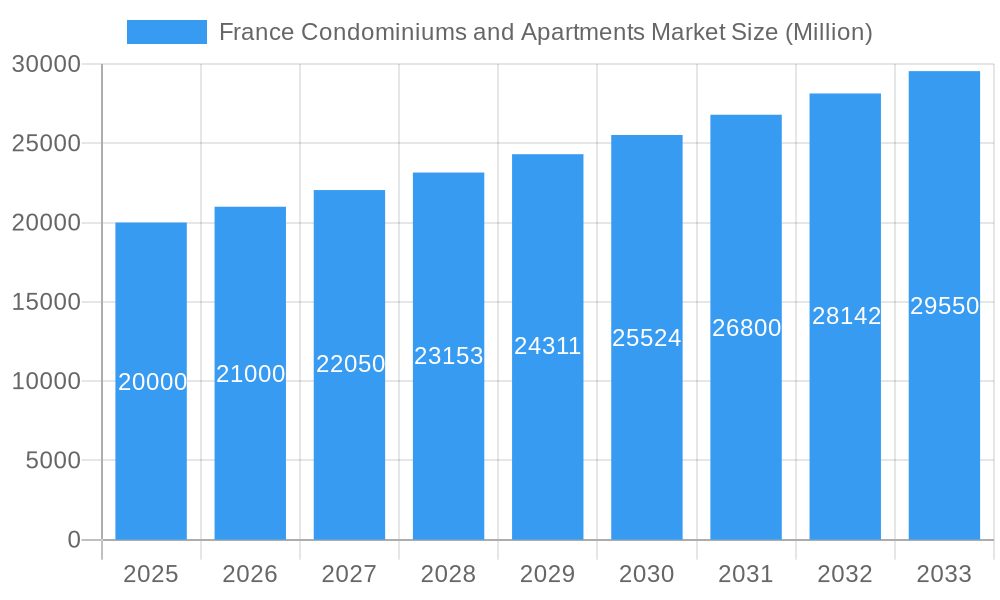

The French condominiums and apartments market is projected to reach $1279.93 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.9% from 2025 to 2033. This growth is driven by increasing urbanization, government support for sustainable housing, and favorable mortgage accessibility. Key urban centers such as Paris, Lyon, and Marseille are experiencing significant demand for residential properties. Government initiatives promoting energy-efficient and sustainable housing are also bolstering new construction and renovation projects. However, high construction costs and limited land availability in prime locations, coupled with stringent building regulations, pose considerable challenges to market expansion.

France Condominiums and Apartments Market Market Size (In Million)

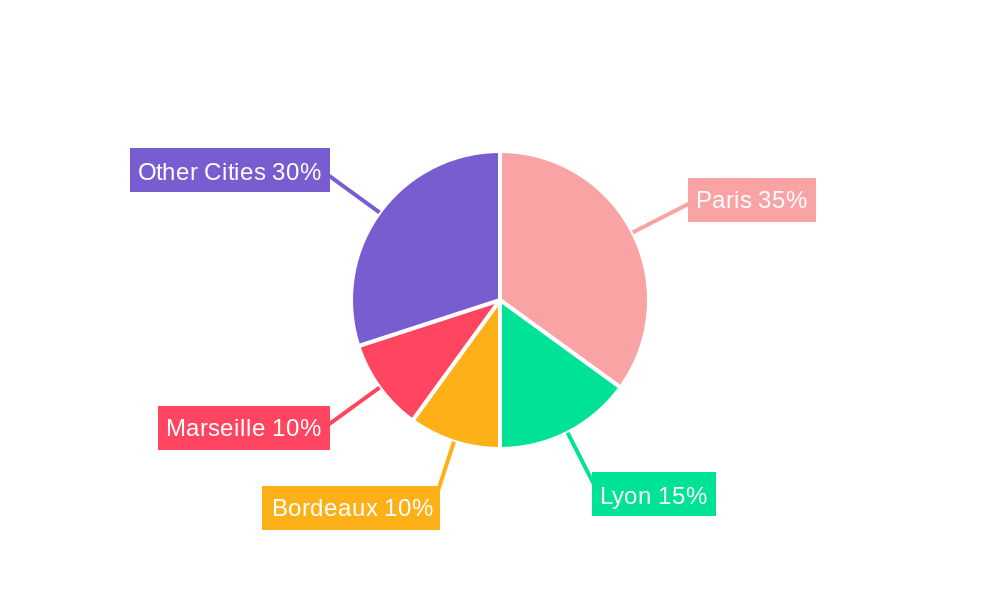

Geographically, the market is dominated by Paris and Lyon, with Bordeaux and Marseille also showing substantial activity. The competitive landscape features major players including GTM Batiment, Bouygues Batiment Ile De France, and Vinci Construction France, indicating a consolidated yet competitive market structure.

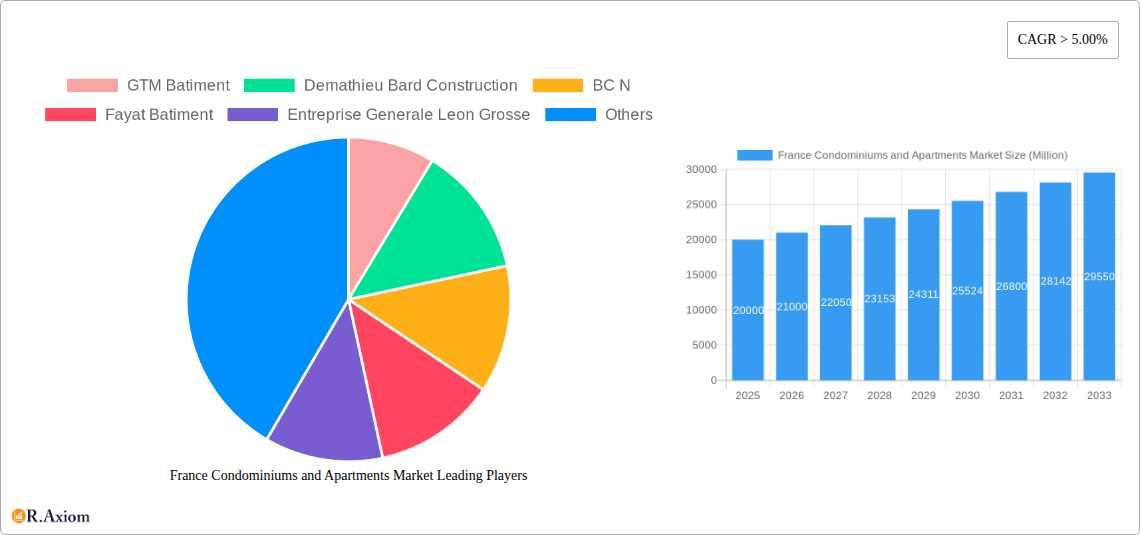

France Condominiums and Apartments Market Company Market Share

The sustained growth forecast underscores ongoing urbanization trends and the persistent demand for modern, efficient housing solutions across France. Regional disparities in market activity highlight the strategic importance of location. Navigating construction cost and regulatory hurdles will be critical for sustained market expansion, alongside the adoption of innovative construction techniques and streamlined approval processes. Companies capable of delivering high-quality, sustainable housing that meets evolving consumer demands are well-positioned for success.

This comprehensive report analyzes the France condominiums and apartments market from 2019 to 2033, offering detailed insights into market dynamics, key players, emerging trends, and future growth prospects. The analysis includes extensive data on market sizing, CAGR projections, and segmentation across major cities, with a base year of 2025 and forecasts extending to 2033. The historical period covered is 2019-2024, with the estimated year being 2025.

France Condominiums and Apartments Market Market Concentration & Innovation

The French condominiums and apartments market exhibits a moderately concentrated structure, with several major players commanding significant market share. While precise market share figures for individual companies are unavailable for this report, we estimate that the top five players (Bouygues Batiment Ile de France, Vinci Construction France, Eiffage Construction Sud-Est, GTM Batiment, and Demathieu Bard Construction) collectively account for approximately xx% of the market. Smaller players and regional developers make up the remaining share, showcasing a dynamic competitive landscape.

Innovation within the market is driven by several factors, including:

- Sustainable building practices: Increasing demand for eco-friendly and energy-efficient buildings is pushing innovation in materials, construction techniques, and building management systems.

- Smart home technology integration: The integration of smart home technology is enhancing the appeal of new and renovated apartments and condominiums.

- Changing consumer preferences: Shifting preferences toward larger living spaces, flexible layouts, and amenities are influencing design and development strategies.

Regulatory frameworks, such as building codes and environmental regulations, play a significant role in shaping the market. Product substitutes, such as rental housing and co-living spaces, add another layer of competition. Mergers and acquisitions (M&A) activity remains moderate, with deal values averaging approximately xx Million annually over the last five years (2019-2024). However, strategic partnerships, such as the Nexity-Meridiam collaboration, highlight an increasing focus on collaborative approaches for urban renewal projects.

France Condominiums and Apartments Market Industry Trends & Insights

The French condominiums and apartments market is characterized by steady growth, driven primarily by robust urbanization, increasing household incomes, and supportive government policies aimed at boosting housing supply. While the exact CAGR for the period 2019-2024 is unavailable at this time, we project a CAGR of xx% for the forecast period (2025-2033).

Technological disruptions are transforming the sector. The adoption of Building Information Modeling (BIM) improves project efficiency, and the emergence of modular construction accelerates development timelines. Consumer preferences are shifting toward luxury amenities, sustainable features, and smart home technology. The market exhibits strong competitive dynamics, with established players vying for market share through innovation, strategic partnerships, and acquisitions. Market penetration of smart home technologies in new constructions stands at approximately xx% in 2024, projecting an increase to xx% by 2033.

Dominant Markets & Segments in France Condominiums and Apartments Market

Paris remains the dominant market for condominiums and apartments in France, accounting for a significant share of total transactions and investment. This dominance stems from a number of key drivers:

- Strong economic activity: Paris’s position as a major economic hub attracts high levels of investment and population growth.

- High demand: A limited supply of housing, coupled with high demand from both domestic and international buyers, drives up prices.

- Well-developed infrastructure: Excellent transportation networks, educational institutions, and healthcare facilities enhance the desirability of living in Paris.

Other major cities, including Lyon, Bordeaux, and Marseille, also exhibit considerable growth, albeit at a slower pace than Paris. The "Other Cities" segment demonstrates steady growth driven by regional economic development and urbanization trends.

France Condominiums and Apartments Market Product Developments

Product innovations focus on sustainable building materials, smart home technology integration, and flexible living spaces. The emphasis is on energy efficiency, eco-friendly design, and enhanced comfort. These developments cater to growing consumer demand for sustainable and technologically advanced living spaces, contributing to improved market fit and competitive advantage.

Report Scope & Segmentation Analysis

This report segments the French condominiums and apartments market by city: Paris, Lyon, Bordeaux, Marseille, and Other Cities. Each segment is analyzed in terms of its growth projections, market size, and competitive dynamics. Growth rates vary across cities, with Paris expected to see sustained, albeit potentially moderating, growth, while other cities display a steady growth trajectory. Competitive landscapes differ, with Paris exhibiting a high level of competition and the other cities characterized by a more fragmented market structure.

Key Drivers of France Condominiums and Apartments Market Growth

Several factors fuel the growth of the France condominiums and apartments market. Robust urbanization, a burgeoning population, and increasing disposable incomes consistently drive demand. Government initiatives aimed at supporting housing development and urban renewal initiatives play a crucial role, creating a positive environment for market expansion. Technological advancements, like modular construction and smart home integration, further enhance efficiency and market appeal.

Challenges in the France Condominiums and Apartments Market Sector

The market faces several challenges. Regulatory hurdles, including lengthy approval processes and complex building codes, can delay projects. Supply chain disruptions and rising material costs exert upward pressure on construction prices, affecting affordability. Intense competition among developers, particularly in major cities, can limit profit margins. The overall impact of these factors leads to an estimated xx Million in annual project delays and cost overruns.

Emerging Opportunities in France Condominiums and Apartments Market

The market presents several promising opportunities. The growing demand for sustainable housing presents a significant opportunity for developers offering eco-friendly designs and building materials. The expansion of the aparthotel sector, as exemplified by Edyn's Locke brand, signals a growing market niche. Furthermore, the increasing adoption of smart home technologies offers further avenues for innovation and differentiation.

Leading Players in the France Condominiums and Apartments Market Market

- GTM Batiment

- Demathieu Bard Construction

- BC N

- Fayat Batiment

- Entreprise Generale Leon Grosse

- Demathieu & Bard Bat Ile De France

- Sicra Ile De France

- Eiffage Construction Sud-Est

- Vinci Construction France

- DP R

- Entreprise Petit

- Bouygues Batiment Ile de France

- GCC

- Brezillon

Key Developments in France Condominiums and Apartments Market Industry

October 2022: Edyn's expansion of its Locke aparthotel brand in Paris signals growing interest in the extended-stay market and signifies Brookfield and Goldman Sachs's entry into this segment. This development is anticipated to increase the competition in the luxury segment of the Paris accommodation market and drive innovation within the aparthotel space.

January 2022: The Nexity-Meridiam partnership for urban renewal projects highlights the increasing focus on sustainable development and the collaborative approach to revitalizing aging infrastructure and housing stock. This partnership is expected to stimulate the demand for both new constructions and renovations, impacting various market segments.

Strategic Outlook for France Condominiums and Apartments Market Market

The France condominiums and apartments market is poised for continued growth, driven by sustained urbanization, economic development, and increasing demand for high-quality housing. Opportunities abound in sustainable development, smart home technology integration, and specialized accommodation segments like aparthotels. Strategic partnerships and innovation will be critical for success in this dynamic market.

France Condominiums and Apartments Market Segmentation

-

1. City

- 1.1. Paris

- 1.2. Lyon

- 1.3. Brodeaux

- 1.4. Marseille

- 1.5. Other Cities

France Condominiums and Apartments Market Segmentation By Geography

- 1. France

France Condominiums and Apartments Market Regional Market Share

Geographic Coverage of France Condominiums and Apartments Market

France Condominiums and Apartments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for New Dwellings Units; Government Initiatives are driving the market

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions; Lack of Skilled Labour

- 3.4. Market Trends

- 3.4.1. France's Rising Apartment Prices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by City

- 5.1.1. Paris

- 5.1.2. Lyon

- 5.1.3. Brodeaux

- 5.1.4. Marseille

- 5.1.5. Other Cities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. France

- 5.1. Market Analysis, Insights and Forecast - by City

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 GTM Batiment

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Demathieu Bard Construction

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BC N

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fayat Batiment

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Entreprise Generale Leon Grosse

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Demathieu & Bard Bat Ile De France

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sicra Ile De France

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eiffage Construction Sud-Est**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Vinci Construction France

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DP R

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Entreprise Petit

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Bouygues Batiment Ile De France

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 GCC

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Brezillon

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 GTM Batiment

List of Figures

- Figure 1: France Condominiums and Apartments Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Condominiums and Apartments Market Share (%) by Company 2025

List of Tables

- Table 1: France Condominiums and Apartments Market Revenue billion Forecast, by City 2020 & 2033

- Table 2: France Condominiums and Apartments Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: France Condominiums and Apartments Market Revenue billion Forecast, by City 2020 & 2033

- Table 4: France Condominiums and Apartments Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Condominiums and Apartments Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the France Condominiums and Apartments Market?

Key companies in the market include GTM Batiment, Demathieu Bard Construction, BC N, Fayat Batiment, Entreprise Generale Leon Grosse, Demathieu & Bard Bat Ile De France, Sicra Ile De France, Eiffage Construction Sud-Est**List Not Exhaustive, Vinci Construction France, DP R, Entreprise Petit, Bouygues Batiment Ile De France, GCC, Brezillon.

3. What are the main segments of the France Condominiums and Apartments Market?

The market segments include City.

4. Can you provide details about the market size?

The market size is estimated to be USD 1279.93 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand for New Dwellings Units; Government Initiatives are driving the market.

6. What are the notable trends driving market growth?

France's Rising Apartment Prices.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions; Lack of Skilled Labour.

8. Can you provide examples of recent developments in the market?

October 2022: Edyn, the pioneer of the hybrid extended stay and a private real estate fund of Brookfield, announced the expansion of its lifestyle aparthotel brand Locke in Paris. A historic building in the city's fifth arrondissement has been purchased, and construction is now underway on a 145-room aparthotel that will debut in 2024. This is a particularly exciting acquisition because it signals Brookfield and Goldman Sachs's continuous support and endorsement while also marking their first foray into the long-desired market. As they continue to expand throughout Europe, they look forward to opening this historic building.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Condominiums and Apartments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Condominiums and Apartments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Condominiums and Apartments Market?

To stay informed about further developments, trends, and reports in the France Condominiums and Apartments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence