Key Insights

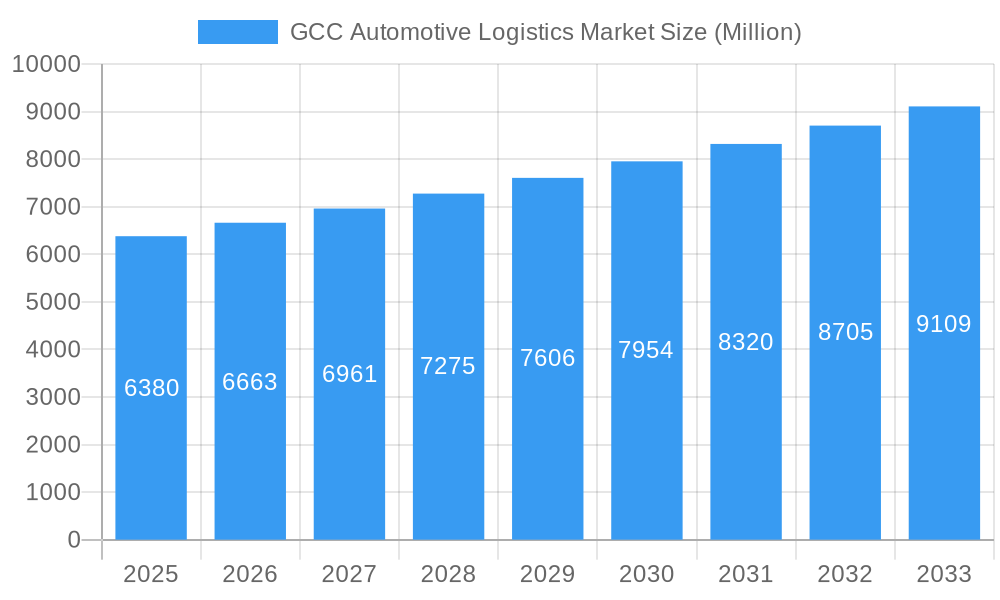

The GCC Automotive Logistics market, valued at $6.38 billion in 2025, is projected to experience robust growth, driven by the expanding automotive manufacturing and assembly sectors in the region, coupled with a surge in vehicle sales and the rising popularity of e-commerce for automotive parts. The market's Compound Annual Growth Rate (CAGR) of 4.51% from 2025 to 2033 indicates a steady expansion, fueled by increasing government investments in infrastructure development, particularly in transportation and warehousing facilities. Key growth drivers include the diversification of the GCC economies beyond oil, leading to increased disposable incomes and a higher demand for vehicles. Furthermore, the development of sophisticated logistics networks, including advanced technologies like IoT and AI in supply chain management, contributes significantly to efficiency and cost reduction, further stimulating market growth. The market is segmented by service type (transportation, warehousing, distribution, inventory management, and others), vehicle type (finished vehicles, auto components, and others), and country (Saudi Arabia, UAE, Qatar, Kuwait, Oman). Competition is intense, with global logistics giants like DB Schenker, UPS, CEVA Logistics, DHL, and others vying for market share. However, challenges remain, including potential fluctuations in oil prices, regional geopolitical factors, and the need for continuous adaptation to evolving technological advancements and customer expectations.

GCC Automotive Logistics Market Market Size (In Billion)

The dominance of finished vehicle logistics is expected, reflecting the robust automotive sales within the region. However, the segment for auto components is poised for significant growth, driven by the increasing localization of automotive production within the GCC. Saudi Arabia and the UAE currently hold the largest market shares, benefiting from well-established infrastructure and strategic location. However, other GCC nations are witnessing rapid development in their automotive logistics sectors, creating substantial growth opportunities. Looking ahead, the GCC Automotive Logistics market is likely to benefit from continued economic diversification, technological innovation, and the ongoing expansion of the automotive industry. This will lead to an increase in the demand for efficient and reliable logistics solutions, shaping the competitive landscape in the coming years.

GCC Automotive Logistics Market Company Market Share

GCC Automotive Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the GCC Automotive Logistics market, offering actionable insights for stakeholders across the automotive and logistics industries. Covering the period from 2019 to 2033, with a focus on 2025, this report examines market trends, competitive dynamics, and future growth potential. The study period is 2019-2033, with 2025 as the base and estimated year, and 2025-2033 as the forecast period. The historical period covered is 2019-2024. The market is segmented by service (Transportation, Warehousing, Distribution & Inventory Management, Other Services), type (Finished Vehicle, Auto Components, Other Types), and country (Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman). Key players include DB Schenker, United Parcel Service Inc, CEVA Logistics AG, DHL, Yusen Logistics, GEODIS, Nippon Express Co Ltd, KUEHNE + NAGEL International AG, DSV, and Ryder System Inc. (List not exhaustive). The report projects a market size of xx Million in 2025 and a CAGR of xx% during the forecast period.

GCC Automotive Logistics Market Market Concentration & Innovation

The GCC automotive logistics market exhibits a moderately concentrated landscape, with a few major players holding significant market share. The market share of the top five players is estimated at xx%. Innovation is driven by the need for enhanced efficiency, technological advancements, and stringent regulatory compliance. Several key factors shape market concentration:

- Mergers and Acquisitions (M&A): Recent years have witnessed significant M&A activity, with deals valued at xx Million. For example, DHL's acquisition of AEI Emirates in January 2024 significantly bolstered its operational capacity in the region. Similarly, Noatum’s acquisition of Grupo Sesé's FVL business in October 2023 expanded its finished vehicle logistics capabilities.

- Regulatory Frameworks: Government regulations regarding logistics, trade, and environmental sustainability significantly impact market players' operations and investments.

- Product Substitutes: While direct substitutes are limited, technological advancements constantly introduce new solutions, pressuring traditional players to innovate.

- End-User Trends: Growing demand for efficient and reliable logistics solutions from automotive manufacturers and dealers fuels market growth and innovation.

- Technological Disruptions: The adoption of technologies like blockchain, AI, and IoT is transforming logistics operations, increasing efficiency and transparency.

GCC Automotive Logistics Market Industry Trends & Insights

The GCC automotive logistics market is experiencing robust growth, driven by several key factors. The automotive industry's expansion within the GCC, coupled with rising vehicle production and sales, fuels the demand for logistics services. Technological advancements, particularly in automation and digitization, are transforming operational efficiency. Consumer preferences towards faster delivery times and greater transparency in supply chains exert pressure on market players to innovate and improve their service offerings.

The market is witnessing increased competition among both established players and new entrants. This competition intensifies pressure on pricing and necessitates continuous improvements in service quality and technology. The market is projected to reach xx Million by 2033, driven by a CAGR of xx% from 2025 to 2033. Market penetration of advanced logistics technologies is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Markets & Segments in GCC Automotive Logistics Market

The United Arab Emirates (UAE) currently holds the largest market share within the GCC region, attributed to its well-developed infrastructure, strategic location, and thriving automotive industry.

- Key Drivers for UAE Dominance:

- Advanced logistics infrastructure.

- Strategic geographic location.

- Strong government support for logistics development.

- Large automotive manufacturing and distribution hub.

- By Service: Transportation currently commands the largest segment of the market, driven by high volumes of vehicle movement and component shipping.

- By Type: The Finished Vehicle segment is the largest, fueled by significant automotive sales and production in the region.

- By Country: The UAE's dominance is largely due to the factors mentioned above. However, Saudi Arabia is expected to experience significant growth due to major infrastructure projects and industrial diversification.

GCC Automotive Logistics Market Product Developments

Recent product innovations focus on technology integration to enhance efficiency and transparency. This includes the implementation of advanced tracking systems, automated warehousing solutions, and optimized routing algorithms. The use of AI and machine learning for predictive analytics is gaining traction, allowing for proactive issue management and resource allocation. The competitive advantage hinges on offering tailored solutions that meet the specific needs of clients, alongside superior service quality, efficiency, and cost-effectiveness.

Report Scope & Segmentation Analysis

This report segments the GCC automotive logistics market in several ways:

- By Service: Transportation, Warehousing, Distribution & Inventory Management, and Other Services. Each segment shows distinct growth projections and competitive dynamics. Transportation currently holds the largest market share.

- By Type: Finished Vehicle, Auto Components, and Other Types. Finished Vehicles dominate due to high vehicle sales.

- By Country: Saudi Arabia, UAE, Qatar, Kuwait, and Oman, each with varying market sizes and growth trajectories. The UAE is currently the largest, followed by Saudi Arabia.

Key Drivers of GCC Automotive Logistics Market Growth

Several factors propel the growth of the GCC automotive logistics market. These include:

- Expanding Automotive Sector: Growth in vehicle production, sales, and related industries directly correlates with increased demand for logistics services.

- Infrastructure Development: Investments in ports, roads, and other transportation infrastructure facilitate efficient logistics operations.

- Government Initiatives: Policies aimed at enhancing logistics efficiency and attracting foreign investment positively influence market growth.

Challenges in the GCC Automotive Logistics Market Sector

The GCC automotive logistics market faces several challenges:

- Supply Chain Disruptions: Global supply chain vulnerabilities impact the timely delivery of automotive components and vehicles.

- Labor Shortages: A lack of skilled labor in some areas restricts operational capacity and efficiency.

- Geopolitical Risks: Regional political instability and uncertainties can disrupt logistics operations. This causes potential delays and cost increases.

Emerging Opportunities in GCC Automotive Logistics Market

Several opportunities exist for growth in the GCC automotive logistics market:

- Technological Advancements: Adoption of advanced technologies, such as blockchain and IoT, creates opportunities for improved efficiency and transparency.

- E-commerce Growth: The expansion of online vehicle sales and parts distribution demands efficient last-mile delivery solutions.

- Sustainable Logistics: Growing awareness of environmental issues drives the adoption of eco-friendly logistics practices, representing a significant growth area.

Leading Players in the GCC Automotive Logistics Market Market

- DB Schenker

- United Parcel Service Inc

- CEVA Logistics AG

- DHL

- Yusen Logistics

- GEODIS

- Nippon Express Co Ltd

- KUEHNE + NAGEL International AG

- DSV

- Ryder System Inc

Key Developments in GCC Automotive Logistics Market Industry

- January 2024: DHL Global finalized the acquisition of AEI Emirates, increasing its operational capacity and employee count.

- October 2023: Noatum acquired Grupo Sesé's Finished Vehicles Logistics (FVL) business, strengthening its position in the finished vehicle sector.

Strategic Outlook for GCC Automotive Logistics Market Market

The GCC automotive logistics market is poised for continued growth, driven by a robust automotive sector and ongoing infrastructure development. The adoption of new technologies and a focus on sustainability will shape the competitive landscape. Opportunities exist for players who can offer tailored, efficient, and environmentally conscious logistics solutions. The market's future is bright, with significant potential for expansion and innovation.

GCC Automotive Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehous

- 1.3. Other Services

-

2. Type

- 2.1. Finished Vehicle

- 2.2. Auto Components

- 2.3. Other Types

GCC Automotive Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GCC Automotive Logistics Market Regional Market Share

Geographic Coverage of GCC Automotive Logistics Market

GCC Automotive Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Automobile in the GCC Region; Growing Population

- 3.3. Market Restrains

- 3.3.1. Lack of Standardized Regulations; Varying Infrastructure Levels

- 3.4. Market Trends

- 3.4.1 Electric and Hybrid Vehicle Adoption Accelerates in the Gulf

- 3.4.2 Led by UAE and Saudi Arabia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Automotive Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehous

- 5.1.3. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Finished Vehicle

- 5.2.2. Auto Components

- 5.2.3. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America GCC Automotive Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Warehous

- 6.1.3. Other Services

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Finished Vehicle

- 6.2.2. Auto Components

- 6.2.3. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. South America GCC Automotive Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Warehous

- 7.1.3. Other Services

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Finished Vehicle

- 7.2.2. Auto Components

- 7.2.3. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Europe GCC Automotive Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Warehous

- 8.1.3. Other Services

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Finished Vehicle

- 8.2.2. Auto Components

- 8.2.3. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East & Africa GCC Automotive Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Warehous

- 9.1.3. Other Services

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Finished Vehicle

- 9.2.2. Auto Components

- 9.2.3. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Asia Pacific GCC Automotive Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Transportation

- 10.1.2. Warehous

- 10.1.3. Other Services

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Finished Vehicle

- 10.2.2. Auto Components

- 10.2.3. Other Types

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 United Parcel Service Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CEVA Logistics AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DHL

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Yusen Logistics**List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GEODIS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nippon Express Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 KUEHNE + NAGEL International AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DSV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ryder System Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global GCC Automotive Logistics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America GCC Automotive Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 3: North America GCC Automotive Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America GCC Automotive Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America GCC Automotive Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America GCC Automotive Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America GCC Automotive Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America GCC Automotive Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 9: South America GCC Automotive Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 10: South America GCC Automotive Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 11: South America GCC Automotive Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America GCC Automotive Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America GCC Automotive Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe GCC Automotive Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 15: Europe GCC Automotive Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 16: Europe GCC Automotive Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 17: Europe GCC Automotive Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe GCC Automotive Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe GCC Automotive Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa GCC Automotive Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 21: Middle East & Africa GCC Automotive Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 22: Middle East & Africa GCC Automotive Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Middle East & Africa GCC Automotive Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa GCC Automotive Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa GCC Automotive Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific GCC Automotive Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 27: Asia Pacific GCC Automotive Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 28: Asia Pacific GCC Automotive Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 29: Asia Pacific GCC Automotive Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific GCC Automotive Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific GCC Automotive Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Automotive Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global GCC Automotive Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global GCC Automotive Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global GCC Automotive Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Global GCC Automotive Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global GCC Automotive Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global GCC Automotive Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 11: Global GCC Automotive Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global GCC Automotive Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global GCC Automotive Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 17: Global GCC Automotive Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global GCC Automotive Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global GCC Automotive Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 29: Global GCC Automotive Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 30: Global GCC Automotive Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global GCC Automotive Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 38: Global GCC Automotive Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 39: Global GCC Automotive Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific GCC Automotive Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Automotive Logistics Market?

The projected CAGR is approximately 4.51%.

2. Which companies are prominent players in the GCC Automotive Logistics Market?

Key companies in the market include DB Schenker, United Parcel Service Inc, CEVA Logistics AG, DHL, Yusen Logistics**List Not Exhaustive, GEODIS, Nippon Express Co Ltd, KUEHNE + NAGEL International AG, DSV, Ryder System Inc.

3. What are the main segments of the GCC Automotive Logistics Market?

The market segments include Service, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Automobile in the GCC Region; Growing Population.

6. What are the notable trends driving market growth?

Electric and Hybrid Vehicle Adoption Accelerates in the Gulf. Led by UAE and Saudi Arabia.

7. Are there any restraints impacting market growth?

Lack of Standardized Regulations; Varying Infrastructure Levels.

8. Can you provide examples of recent developments in the market?

January 2024: DHL Global, the freight division of DHL Group, finalized the acquisition of AEI Emirates from Danzas, and all facilities are now DHL branded. Full integration with DHL Global Forwarding has resulted in changes to the logo and name of DHL, as well as increasing operational capacity by transferring 1,100 employees and taking ownership of more than 20 facilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Automotive Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Automotive Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Automotive Logistics Market?

To stay informed about further developments, trends, and reports in the GCC Automotive Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence