Key Insights

The GCC Courier, Express, and Parcel (CEP) market is experiencing robust growth, projected to reach $10.12 billion by 2025, fueled by a significant Compound Annual Growth Rate (CAGR) of 10.94%. This expansion is primarily driven by the burgeoning e-commerce sector, which necessitates efficient and reliable delivery networks. Increased cross-border trade within the GCC, coupled with the growing demand for same-day and next-day delivery services, further propels market expansion. The region's increasing digitalization and the adoption of advanced logistics technologies, such as AI-powered route optimization and real-time tracking, are enhancing operational efficiency and customer satisfaction, contributing to the market's upward trajectory. Furthermore, government initiatives aimed at fostering economic diversification and promoting trade are creating a conducive environment for CEP service providers.

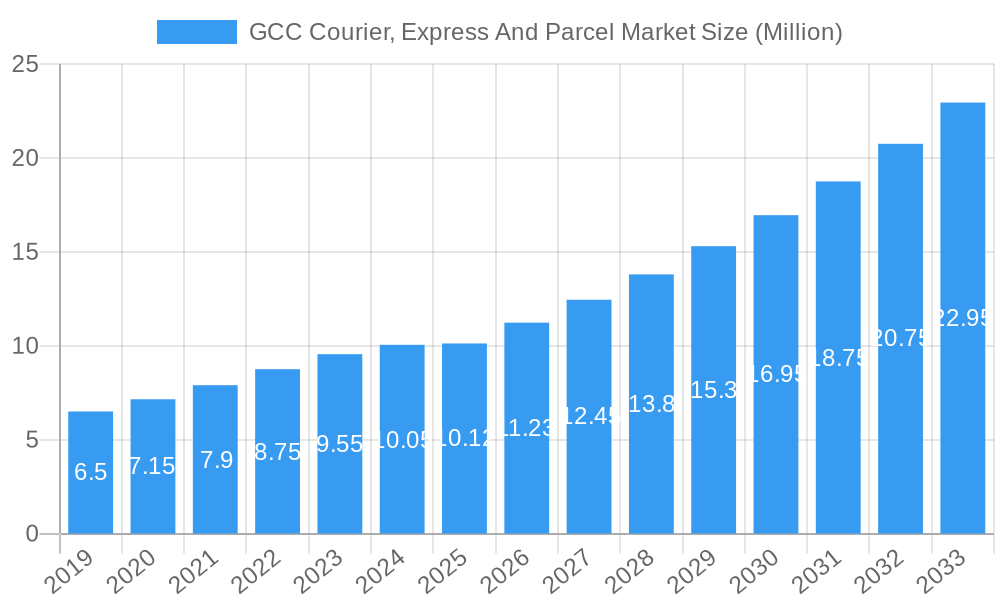

GCC Courier, Express And Parcel Market Market Size (In Million)

The market is segmented across various business models, including B2B, B2C, and C2C, with B2B transactions constituting a substantial portion due to the extensive logistics needs of businesses. Destinations are broadly categorized into International and Domestic, with both segments witnessing strong demand. Key end-users span Services, Wholesale and Retail Trade, Lifescience and Healthcare, Industrial Manufacturing, and Others, each contributing to the diverse application of CEP services. Major players like Naqel Express, DHL, Aramex, and FedEx are actively investing in infrastructure expansion and technological innovation to capture market share. However, challenges such as rising operational costs, regulatory complexities in certain cross-border movements, and intense competition among established and emerging players could pose restraints. Despite these, the market is poised for sustained growth, driven by innovation and the evolving demands of a dynamic regional economy.

GCC Courier, Express And Parcel Market Company Market Share

This comprehensive report provides an in-depth analysis of the GCC Courier, Express, and Parcel Market, meticulously examining its trajectory from 2019 to 2033, with 2025 as the base and estimated year. Covering a historical period from 2019 to 2024 and a forecast period from 2025 to 2033, this study offers critical insights into market dynamics, growth drivers, challenges, and future opportunities. With a focus on high-traffic keywords such as "GCC courier market," "express parcel delivery," "logistics GCC," "B2B logistics," "B2C delivery," "international shipping GCC," and "last-mile delivery," this report is designed to be a definitive resource for industry stakeholders, investors, and decision-makers seeking to navigate and capitalize on the burgeoning GCC logistics landscape. The report incorporates specific data points and actionable intelligence on market concentration, innovation, dominant segments, product developments, key players like Naqel Express, DHL, Max Express, UPS, Bahri, Agility Logistics, Zajil Express, Century Express, SMSA Express, Aramex, PostaPlus, Fedex, and DP World, and pivotal industry developments.

GCC Courier, Express And Parcel Market Market Concentration & Innovation

The GCC courier, express, and parcel market is characterized by a moderate level of market concentration, with a few dominant players holding significant market share, while a growing number of smaller and regional companies vie for niche segments. Innovation is a key differentiator, driven by the rapid adoption of technology to enhance efficiency, speed, and customer experience. Factors such as e-commerce growth, increased cross-border trade, and evolving consumer expectations are fueling innovation in areas like automation, AI-powered route optimization, drone delivery research, and smart locker solutions. Regulatory frameworks across the GCC countries are evolving to support the logistics sector, fostering fair competition and ensuring compliance. However, the threat of product substitutes, such as freight forwarding for larger shipments or direct sales channels bypassing traditional delivery, exists, though less impactful for express parcels. End-user trends, particularly the surge in B2C e-commerce deliveries, are a major innovation driver. Mergers and acquisitions (M&A) activity is a notable strategy for consolidating market share and expanding service offerings, with deal values in the hundreds of millions of dollars reflecting the strategic importance of this sector. The market's competitive intensity is expected to drive further consolidation and innovation in the coming years.

GCC Courier, Express And Parcel Market Industry Trends & Insights

The GCC courier, express, and parcel market is experiencing robust growth, propelled by a confluence of powerful industry trends and evolving consumer preferences. The e-commerce boom remains a primary growth driver, with online retail penetration steadily increasing across the region. This surge in online shopping directly translates to a higher volume of parcel deliveries, making express and same-day delivery services increasingly essential. Technological disruptions are reshaping the operational landscape; advancements in artificial intelligence (AI) for route optimization, blockchain for supply chain transparency, and the Internet of Things (IoT) for real-time tracking are enhancing efficiency and reducing costs. Furthermore, the adoption of automated sorting facilities and advanced warehouse management systems is critical for handling the escalating volume. Consumer preferences are shifting towards convenience and speed, with a growing demand for flexible delivery options, including scheduled deliveries and unattended drop-offs. This necessitates a focus on last-mile delivery optimization, a critical component of customer satisfaction. The competitive dynamics are intensifying, with established global players and agile local companies fiercely competing for market share. Key players are investing heavily in infrastructure, technology, and workforce development to meet these evolving demands. The market penetration of digital logistics solutions is high, and the Compound Annual Growth Rate (CAGR) for the express parcel segment is projected to remain strong, estimated at over 15% for the forecast period. The increasing disposable income and young, tech-savvy population in the GCC are further fueling demand for swift and reliable delivery services. The market size is expected to reach several tens of billions of dollars by 2033.

Dominant Markets & Segments in GCC Courier, Express And Parcel Market

The GCC courier, express, and parcel market exhibits distinct dominance across various geographical regions and industry segments, largely driven by economic development, government initiatives, and consumer behavior.

Dominant Regions and Countries:

- United Arab Emirates (UAE): Consistently a leading market due to its advanced infrastructure, thriving e-commerce sector, and status as a regional business hub. Its supportive regulatory environment and high consumer spending power contribute significantly to its dominance.

- Saudi Arabia (KSA): Emerging as a major growth engine, fueled by Vision 2030 initiatives aimed at diversifying the economy and boosting e-commerce. Significant investments in logistics infrastructure are enhancing its capabilities.

Key Business Segments:

- B2C (Business-to-Consumer): This segment is the primary driver of growth, propelled by the burgeoning e-commerce market. The demand for fast, reliable, and convenient delivery of goods from online retailers to individual consumers is immense.

- Key Drivers: Increasing online shopping penetration, desire for same-day and next-day delivery, return logistics management.

- B2B (Business-to-Business): Represents a substantial portion of the market, encompassing the movement of goods and documents between businesses. This includes deliveries for manufacturing, wholesale trade, and inter-branch corporate shipments.

- Key Drivers: Growth in industrial manufacturing, expansion of wholesale and retail networks, demand for efficient supply chain management.

- C2C (Consumer-to-Consumer): While smaller than B2C or B2B, this segment is gaining traction with the rise of online marketplaces for pre-owned goods and peer-to-peer transactions.

- Key Drivers: Growth of online marketplaces, demand for affordable shipping options for individual sellers.

Dominant Destination Segments:

- Domestic: The largest segment, reflecting the significant intra-GCC trade and local delivery needs driven by e-commerce and business operations within individual countries.

- Key Drivers: Expanding local economies, increasing consumer base for online purchases, efficient national logistics networks.

- International: Experiencing rapid growth, facilitated by trade agreements and the increasing global reach of GCC businesses and online retailers.

- Key Drivers: Growing international e-commerce, global supply chain integration, demand for efficient cross-border express services.

Dominant End-User Segments:

- Wholesale and Retail Trade: This sector is the largest consumer of courier, express, and parcel services, driven by the need to move goods from suppliers to distributors, retailers, and ultimately, end consumers.

- Key Drivers: E-commerce growth, expansion of retail chains, efficient inventory management.

- Services: Includes the delivery of documents, sensitive materials, and small parcels for various service industries like banking, legal, and consulting.

- Key Drivers: Digitalization of services, demand for secure and time-sensitive document delivery.

- Lifescience and Healthcare: A critical and growing segment, involving the urgent and often temperature-controlled delivery of medical supplies, pharmaceuticals, and biological samples.

- Key Drivers: Expanding healthcare infrastructure, increasing demand for specialized medical logistics, regulatory compliance.

- Industrial Manufacturing: Encompasses the delivery of spare parts, components, and urgent equipment for manufacturing operations.

- Key Drivers: Supply chain resilience, just-in-time manufacturing processes, maintenance and repair operations.

GCC Courier, Express And Parcel Market Product Developments

Product developments in the GCC courier, express, and parcel market are increasingly focused on enhancing speed, convenience, and sustainability. Innovations include the deployment of advanced tracking technologies offering real-time visibility, the introduction of temperature-controlled logistics for sensitive goods like pharmaceuticals, and the expansion of automated parcel locker networks for convenient pick-up and drop-off. Companies are also exploring drone technology for last-mile deliveries in select urban and remote areas. The development of integrated digital platforms that streamline booking, payment, and tracking for both businesses and consumers provides a significant competitive advantage. Furthermore, a growing emphasis on eco-friendly logistics solutions, such as the use of electric vehicles and optimized delivery routes, aligns with regional sustainability goals and appeals to environmentally conscious consumers.

Report Scope & Segmentation Analysis

This report meticulously segments the GCC Courier, Express, and Parcel Market to provide a granular understanding of its dynamics. The analysis spans across Business Segments including Business-to-Business (B2B), Business-to-Consumer (B2C), and Consumer-to-Consumer (C2C). The Destination Segments examined are International and Domestic shipments, highlighting the flow of goods across borders and within countries. Furthermore, the report delves into End-User Segments, dissecting the market's application in Services, Wholesale and Retail Trade, Lifescience and Healthcare, Industrial Manufacturing, and Other End-Users. Each segment's market size, growth projections, and competitive landscape are thoroughly analyzed, offering actionable insights into specific growth opportunities and market penetration strategies for each area.

Key Drivers of GCC Courier, Express And Parcel Market Growth

The GCC courier, express, and parcel market's growth is propelled by several significant drivers. The rapid expansion of e-commerce, fueled by increasing internet penetration and a young, tech-savvy population, creates a consistent demand for efficient delivery services. Government initiatives promoting economic diversification and digital transformation across the GCC region, such as Saudi Vision 2030, are fostering investments in logistics infrastructure and creating a more conducive environment for the sector. Technological advancements, including AI-powered route optimization, automation in warehousing, and real-time tracking systems, are enhancing operational efficiency and reducing costs, making services more attractive. Furthermore, a growing demand for faster delivery options, including same-day and next-day services, is pushing innovation in last-mile logistics. The increasing volume of international trade and cross-border e-commerce also contributes significantly to the growth of international courier and parcel services.

Challenges in the GCC Courier, Express And Parcel Market Sector

Despite its robust growth, the GCC courier, express, and parcel market faces several challenges. Intense competition among established players and new entrants can lead to price wars and pressure on profit margins. The rapid growth of e-commerce, while a driver, also strains existing infrastructure, leading to potential delays and service disruptions, particularly in last-mile delivery within densely populated urban areas. Regulatory hurdles and varying customs procedures across different GCC countries can complicate international shipments. The high cost of talent acquisition and retention, especially for specialized roles in logistics technology and operations, poses another challenge. Furthermore, ensuring the security and integrity of high-value or sensitive shipments, such as pharmaceuticals, requires significant investment in specialized equipment and processes, impacting operational costs. Supply chain disruptions, whether due to geopolitical events or natural disasters, can also significantly impact delivery timelines and costs.

Emerging Opportunities in GCC Courier, Express And Parcel Market

The GCC courier, express, and parcel market is ripe with emerging opportunities. The continued growth of e-commerce, particularly in cross-border transactions, presents a significant avenue for expansion. The increasing demand for specialized logistics services, such as temperature-controlled deliveries for the growing Lifescience and Healthcare sector, offers lucrative niche markets. The development of smart city initiatives across the GCC provides opportunities for integrating advanced logistics solutions, including drone delivery and autonomous vehicles for last-mile fulfillment. Furthermore, the focus on sustainability by regional governments and consumers opens doors for eco-friendly logistics solutions and services, creating a competitive advantage for environmentally conscious providers. The digital transformation agenda across the region also encourages the adoption of advanced technologies like AI and blockchain, leading to opportunities for innovative service offerings and enhanced supply chain visibility.

Leading Players in the GCC Courier, Express And Parcel Market Market

- Naqel Express

- DHL

- Max Express

- UPS

- Bahri

- Agility Logistics

- Zajil Express

- Century Express

- SMSA Express

- Aramex

- PostaPlus

- Fedex

- DP World

Key Developments in GCC Courier, Express And Parcel Market Industry

- October 2023: The Saudi Post (SPS) signed a strategic partnership agreement with ABANA Enterprises Group (BEG) and Proceed Logistics Co. (PRC), a subsidiary of Aldawaha Medical Services Co. (AMS Co.), during the Global Health Exhibition (GHEX) in Riyadh. This collaboration aims to elevate the quality of delivery services in the Kingdom and extend last-mile delivery capabilities, ultimately enhancing customer satisfaction. Parcelat will facilitate secure and convenient parcel delivery and pickup through a technology-supported network of parcel stations, serving the needs of local and international industry companies. The network will establish automated pickup and parcel delivery points for their customers.

- December 2023: Aramex inaugurated its new Express Courier Handling facility, spanning 5,900 square meters, in Model Cargo Village at King Khalid International Airport. This state-of-the-art facility is equipped with cutting-edge technologies to cater to Aramex's expanding customer base. Aligned with Aramex's continuous efforts to streamline operations and serve both B2C and B2B customers, this facility signifies a significant step forward in the company's commitment to excellence.

Strategic Outlook for GCC Courier, Express And Parcel Market Market

The strategic outlook for the GCC courier, express, and parcel market is exceptionally positive, driven by sustained e-commerce growth and significant government investment in logistics infrastructure. Key growth catalysts include the ongoing digital transformation across the region, which is increasing the demand for integrated and technology-driven logistics solutions. The continuous expansion of B2C e-commerce, coupled with the increasing sophistication of consumer expectations for faster and more flexible delivery options, will further fuel market expansion. Strategic partnerships and M&A activities are anticipated to continue as companies seek to consolidate their market positions and expand their service offerings. The focus on sustainability and the adoption of eco-friendly logistics will become increasingly important differentiators. Emerging opportunities in specialized logistics, such as cold chain and pharmaceutical deliveries, alongside the potential for advanced delivery technologies like drones, represent significant future growth avenues. The market is poised for continued innovation and substantial value creation in the coming years.

GCC Courier, Express And Parcel Market Segmentation

-

1. Business

- 1.1. B2B

- 1.2. B2C

- 1.3. C2C

-

2. Destination

- 2.1. International

- 2.2. Domestic

-

3. End-User

- 3.1. Services

- 3.2. Wholesale and Retail Trade

- 3.3. Lifescience and Healthcare

- 3.4. Industrial Manufacturing

- 3.5. Other End-Users

GCC Courier, Express And Parcel Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GCC Courier, Express And Parcel Market Regional Market Share

Geographic Coverage of GCC Courier, Express And Parcel Market

GCC Courier, Express And Parcel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in E-commerce is Driving the Market; Government Investments Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labor

- 3.4. Market Trends

- 3.4.1. User-centric e-commerce to revolutionize the GCC retail sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Courier, Express And Parcel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Business

- 5.1.1. B2B

- 5.1.2. B2C

- 5.1.3. C2C

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. International

- 5.2.2. Domestic

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Services

- 5.3.2. Wholesale and Retail Trade

- 5.3.3. Lifescience and Healthcare

- 5.3.4. Industrial Manufacturing

- 5.3.5. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Business

- 6. North America GCC Courier, Express And Parcel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Business

- 6.1.1. B2B

- 6.1.2. B2C

- 6.1.3. C2C

- 6.2. Market Analysis, Insights and Forecast - by Destination

- 6.2.1. International

- 6.2.2. Domestic

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Services

- 6.3.2. Wholesale and Retail Trade

- 6.3.3. Lifescience and Healthcare

- 6.3.4. Industrial Manufacturing

- 6.3.5. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Business

- 7. South America GCC Courier, Express And Parcel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Business

- 7.1.1. B2B

- 7.1.2. B2C

- 7.1.3. C2C

- 7.2. Market Analysis, Insights and Forecast - by Destination

- 7.2.1. International

- 7.2.2. Domestic

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Services

- 7.3.2. Wholesale and Retail Trade

- 7.3.3. Lifescience and Healthcare

- 7.3.4. Industrial Manufacturing

- 7.3.5. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Business

- 8. Europe GCC Courier, Express And Parcel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Business

- 8.1.1. B2B

- 8.1.2. B2C

- 8.1.3. C2C

- 8.2. Market Analysis, Insights and Forecast - by Destination

- 8.2.1. International

- 8.2.2. Domestic

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Services

- 8.3.2. Wholesale and Retail Trade

- 8.3.3. Lifescience and Healthcare

- 8.3.4. Industrial Manufacturing

- 8.3.5. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Business

- 9. Middle East & Africa GCC Courier, Express And Parcel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Business

- 9.1.1. B2B

- 9.1.2. B2C

- 9.1.3. C2C

- 9.2. Market Analysis, Insights and Forecast - by Destination

- 9.2.1. International

- 9.2.2. Domestic

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Services

- 9.3.2. Wholesale and Retail Trade

- 9.3.3. Lifescience and Healthcare

- 9.3.4. Industrial Manufacturing

- 9.3.5. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Business

- 10. Asia Pacific GCC Courier, Express And Parcel Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Business

- 10.1.1. B2B

- 10.1.2. B2C

- 10.1.3. C2C

- 10.2. Market Analysis, Insights and Forecast - by Destination

- 10.2.1. International

- 10.2.2. Domestic

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Services

- 10.3.2. Wholesale and Retail Trade

- 10.3.3. Lifescience and Healthcare

- 10.3.4. Industrial Manufacturing

- 10.3.5. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Business

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Naqel Express

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DHL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Max Express

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 UPS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bahri

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Agility Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zajil Express

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Century Express

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SMSA Express

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Aramex

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 PostaPlus

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Fedex

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 DP World

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Naqel Express

List of Figures

- Figure 1: Global GCC Courier, Express And Parcel Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America GCC Courier, Express And Parcel Market Revenue (Million), by Business 2025 & 2033

- Figure 3: North America GCC Courier, Express And Parcel Market Revenue Share (%), by Business 2025 & 2033

- Figure 4: North America GCC Courier, Express And Parcel Market Revenue (Million), by Destination 2025 & 2033

- Figure 5: North America GCC Courier, Express And Parcel Market Revenue Share (%), by Destination 2025 & 2033

- Figure 6: North America GCC Courier, Express And Parcel Market Revenue (Million), by End-User 2025 & 2033

- Figure 7: North America GCC Courier, Express And Parcel Market Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America GCC Courier, Express And Parcel Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America GCC Courier, Express And Parcel Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America GCC Courier, Express And Parcel Market Revenue (Million), by Business 2025 & 2033

- Figure 11: South America GCC Courier, Express And Parcel Market Revenue Share (%), by Business 2025 & 2033

- Figure 12: South America GCC Courier, Express And Parcel Market Revenue (Million), by Destination 2025 & 2033

- Figure 13: South America GCC Courier, Express And Parcel Market Revenue Share (%), by Destination 2025 & 2033

- Figure 14: South America GCC Courier, Express And Parcel Market Revenue (Million), by End-User 2025 & 2033

- Figure 15: South America GCC Courier, Express And Parcel Market Revenue Share (%), by End-User 2025 & 2033

- Figure 16: South America GCC Courier, Express And Parcel Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America GCC Courier, Express And Parcel Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe GCC Courier, Express And Parcel Market Revenue (Million), by Business 2025 & 2033

- Figure 19: Europe GCC Courier, Express And Parcel Market Revenue Share (%), by Business 2025 & 2033

- Figure 20: Europe GCC Courier, Express And Parcel Market Revenue (Million), by Destination 2025 & 2033

- Figure 21: Europe GCC Courier, Express And Parcel Market Revenue Share (%), by Destination 2025 & 2033

- Figure 22: Europe GCC Courier, Express And Parcel Market Revenue (Million), by End-User 2025 & 2033

- Figure 23: Europe GCC Courier, Express And Parcel Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Europe GCC Courier, Express And Parcel Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe GCC Courier, Express And Parcel Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa GCC Courier, Express And Parcel Market Revenue (Million), by Business 2025 & 2033

- Figure 27: Middle East & Africa GCC Courier, Express And Parcel Market Revenue Share (%), by Business 2025 & 2033

- Figure 28: Middle East & Africa GCC Courier, Express And Parcel Market Revenue (Million), by Destination 2025 & 2033

- Figure 29: Middle East & Africa GCC Courier, Express And Parcel Market Revenue Share (%), by Destination 2025 & 2033

- Figure 30: Middle East & Africa GCC Courier, Express And Parcel Market Revenue (Million), by End-User 2025 & 2033

- Figure 31: Middle East & Africa GCC Courier, Express And Parcel Market Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Middle East & Africa GCC Courier, Express And Parcel Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa GCC Courier, Express And Parcel Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific GCC Courier, Express And Parcel Market Revenue (Million), by Business 2025 & 2033

- Figure 35: Asia Pacific GCC Courier, Express And Parcel Market Revenue Share (%), by Business 2025 & 2033

- Figure 36: Asia Pacific GCC Courier, Express And Parcel Market Revenue (Million), by Destination 2025 & 2033

- Figure 37: Asia Pacific GCC Courier, Express And Parcel Market Revenue Share (%), by Destination 2025 & 2033

- Figure 38: Asia Pacific GCC Courier, Express And Parcel Market Revenue (Million), by End-User 2025 & 2033

- Figure 39: Asia Pacific GCC Courier, Express And Parcel Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Asia Pacific GCC Courier, Express And Parcel Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific GCC Courier, Express And Parcel Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by Business 2020 & 2033

- Table 2: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 3: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by Business 2020 & 2033

- Table 6: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 7: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by Business 2020 & 2033

- Table 13: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 14: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 15: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by Business 2020 & 2033

- Table 20: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 21: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 22: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by Business 2020 & 2033

- Table 33: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 34: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 35: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by Business 2020 & 2033

- Table 43: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 44: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 45: Global GCC Courier, Express And Parcel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific GCC Courier, Express And Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Courier, Express And Parcel Market?

The projected CAGR is approximately 10.94%.

2. Which companies are prominent players in the GCC Courier, Express And Parcel Market?

Key companies in the market include Naqel Express, DHL, Max Express, UPS, Bahri, Agility Logistics, Zajil Express, Century Express, SMSA Express, Aramex, PostaPlus, Fedex, DP World.

3. What are the main segments of the GCC Courier, Express And Parcel Market?

The market segments include Business, Destination, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in E-commerce is Driving the Market; Government Investments Driving the Market Growth.

6. What are the notable trends driving market growth?

User-centric e-commerce to revolutionize the GCC retail sector.

7. Are there any restraints impacting market growth?

Lack of Skilled Labor.

8. Can you provide examples of recent developments in the market?

October 2023: The Saudi Post (SPS) signed a strategic partnership agreement with ABANA Enterprises Group (BEG) and Proceed Logistics Co. (PRC), a subsidiary of Aldawaha Medical Services Co. (AMS Co.), during the Global Health Exhibition (GHEX) in Riyadh. This collaboration aims to elevate the quality of delivery services in the Kingdom and extend last-mile delivery capabilities, ultimately enhancing customer satisfaction. Parcelat will facilitate secure and convenient parcel delivery and pickup through a technology-supported network of parcel stations, serving the needs of local and international industry companies. The network will establish automated pickup and parcel delivery points for their customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Courier, Express And Parcel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Courier, Express And Parcel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Courier, Express And Parcel Market?

To stay informed about further developments, trends, and reports in the GCC Courier, Express And Parcel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence