Key Insights

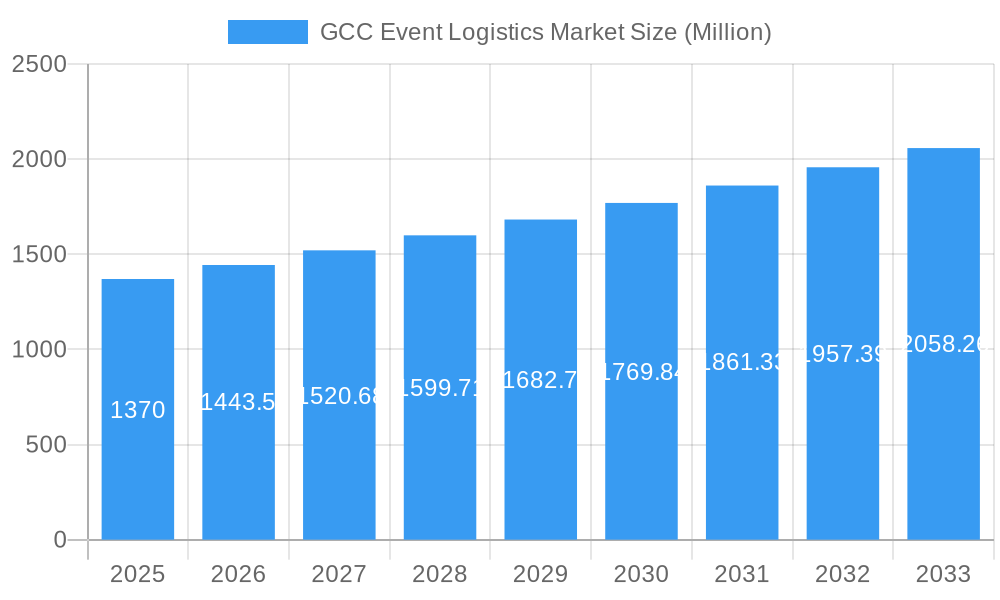

The GCC event logistics market, valued at $1.37 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 5% from 2025 to 2033. This expansion is fueled by several key factors. The region's burgeoning tourism sector, hosting numerous large-scale events like sporting competitions (e.g., the FIFA World Cup in Qatar), trade fairs (e.g., Expo 2020 Dubai), and entertainment concerts, significantly boosts demand for efficient logistics solutions. Furthermore, increasing government investments in infrastructure development and a focus on diversifying economies are creating a favorable environment for the industry. Growth within specific segments, such as inventory control and distribution systems for the entertainment and sports applications, is expected to outpace the overall market average. However, challenges remain, including potential fluctuations in oil prices which can influence overall economic activity and therefore event planning budgets. Competition among established players and emerging logistics providers will also shape market dynamics in the coming years. The market's segmentation by type (Inventory Control, Distribution Systems, Logistics Solutions) and application (Entertainment, Sports, Trade Fair, Others) offers opportunities for specialized service providers to cater to niche demands. The geographic breakdown across Qatar, UAE, Saudi Arabia, Kuwait, and the rest of the GCC region highlights the varying market maturity and growth potential within the individual nations.

GCC Event Logistics Market Market Size (In Billion)

The forecast period of 2025-2033 presents significant opportunities for growth in the GCC event logistics market. Continued investment in infrastructure, such as improved transportation networks and warehousing facilities, will streamline logistics operations and enhance efficiency. Technological advancements, including the adoption of advanced tracking systems, data analytics, and automation, will further optimize the supply chain. The increasing adoption of sustainable practices within the event industry will also drive demand for eco-friendly logistics solutions. Competition is likely to intensify, with established players focusing on strategic partnerships and acquisitions to expand their market share and leverage technological advancements. New entrants will need to differentiate themselves through specialized services, innovative technology, or strong regional expertise. The market's success will depend on effective collaboration between event organizers, logistics providers, and government entities to ensure seamless and efficient logistics management for all types of events in the GCC region.

GCC Event Logistics Market Company Market Share

GCC Event Logistics Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the GCC Event Logistics Market, offering invaluable insights for stakeholders across the industry. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report forecasts market trends until 2033, utilizing data from the historical period of 2019-2024. The report covers key segments, dominant players, and emerging opportunities within the GCC region, encompassing countries like Saudi Arabia, the UAE, Qatar, Kuwait, and the rest of the GCC. Expect granular insights into market size, growth projections, and competitive dynamics, making this an indispensable resource for informed decision-making.

GCC Event Logistics Market Market Concentration & Innovation

The GCC event logistics market exhibits a moderately concentrated landscape, with several established players commanding significant market share. Companies like GWC Logistics, DP World, and 4Events hold substantial influence, while numerous smaller, specialized firms cater to niche segments. Market share fluctuates based on event size, type, and geographic location. For instance, GWC's success in the 2022 FIFA World Cup significantly boosted its market standing. However, the market shows potential for increased competition as new entrants and technology providers emerge.

Innovation is driven by the need for enhanced efficiency, cost reduction, and improved sustainability within event logistics. Technological advancements such as real-time tracking, AI-powered route optimization, and blockchain solutions are transforming the sector. Furthermore, the regulatory environment, focused on streamlining processes and enhancing security, encourages continuous innovation. Substitute products and services include self-service event management platforms, though the core demand for specialized logistics solutions remains. Growing sophistication of event organizers and rising end-user expectations also fuel market innovation.

Mergers and acquisitions (M&A) activity has been relatively modest in recent years, with deal values averaging xx Million. However, we anticipate increased consolidation as larger firms seek to expand their service offerings and geographic reach. Examples include strategic partnerships between logistics providers and technology firms, enhancing their capabilities.

GCC Event Logistics Market Industry Trends & Insights

The GCC event logistics market is experiencing robust growth, driven by a surge in mega-events, increasing tourism, and substantial investments in infrastructure. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This expansion is fueled by several factors, including:

- Government Initiatives: The Saudi Arabian master plan for logistics centers (December 2023) exemplifies government support in improving infrastructure and simplifying logistical processes. This will lead to increased foreign investment and more events.

- Technological Disruptions: Automation and digitalization are enhancing efficiency and transparency across the supply chain.

- Consumer Preferences: Demand for sustainable and tech-enabled logistics solutions is rising.

- Competitive Dynamics: The market is seeing intensified competition, fostering innovation and driving down costs for clients. Market penetration of various segments is expected to reach xx% by 2033.

The increasing adoption of advanced technologies, coupled with government support, is expected to shape the industry's future trajectory. This trend towards digitization and improved efficiency will continue to attract both local and international players.

Dominant Markets & Segments in GCC Event Logistics Market

The UAE and Saudi Arabia currently dominate the GCC event logistics market, driven by their robust infrastructure, higher concentration of events, and favorable business environments. Qatar, while smaller in scale, is also a significant contributor, particularly in the sports events segment after the 2022 FIFA World Cup. Kuwait and the rest of the GCC hold smaller but still notable market shares.

By Type:

- Logistics Solutions: This segment is the largest and fastest-growing, driven by the need for comprehensive and customized solutions for large-scale events.

- Distribution Systems: Significant growth is expected due to the increasing volume of goods and materials required for events.

- Inventory Control: Steady growth is anticipated as event organizers focus on efficient inventory management to minimize costs and reduce waste.

By Application:

- Entertainment: This sector accounts for a substantial portion of the market, encompassing concerts, festivals, and exhibitions.

- Sports: The market is witnessing considerable expansion due to the increasing number of regional and international sporting events.

- Trade Fairs: This sector contributes significantly due to the growing importance of business events in the region.

- Others: This segment includes smaller events such as conferences and corporate gatherings.

Key Drivers:

- Robust Infrastructure: The UAE and Saudi Arabia's well-developed transportation networks and port facilities support efficient logistics.

- Government Support: Favorable government policies, including investments in infrastructure and ease of doing business, attract event organizers and logistics providers.

- Economic Growth: Strong economic growth in the region drives increased demand for event-related services.

- Tourism Boom: The rise in tourism fuels demand for event logistics related to travel and accommodation.

GCC Event Logistics Market Product Developments

Recent product innovations have focused on integrating technology to enhance visibility, efficiency, and sustainability. This includes real-time tracking systems, AI-powered route optimization, and sustainable packaging solutions. These innovations provide competitive advantages by improving service quality, reducing costs, and appealing to environmentally conscious event organizers. The trend toward customized logistics solutions, tailored to the specific needs of each event, is also gaining traction.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the GCC event logistics market across various segments.

By Type: Inventory Control, Distribution Systems, and Logistics Solutions are analyzed, covering their market size, growth projections, and competitive landscapes.

By Application: Entertainment, Sports, Trade fairs, and Others are assessed, detailing their market dynamics and growth prospects.

By Country: Qatar, UAE, Saudi Arabia, Kuwait, and the Rest of GCC are studied, revealing regional differences in market size and growth drivers. Growth projections for each segment are detailed throughout the report.

Key Drivers of GCC Event Logistics Market Growth

The GCC event logistics market's growth is propelled by several key factors:

- Rising event numbers: A surge in major events (sports, entertainment, and trade shows) is driving demand for logistics services.

- Government investments: Infrastructure development and supportive policies are creating a favorable environment for the sector.

- Technological advancements: Digitalization and automation are increasing efficiency and transparency.

- Growing tourism: A rising number of tourists translates into increased demand for event-related logistics.

Challenges in the GCC Event Logistics Market Sector

The GCC event logistics market faces several challenges:

- Infrastructure limitations: In some areas, infrastructure may not fully support the rapidly growing event sector.

- Regulatory complexities: Navigating various regulations can pose difficulties for logistics providers.

- Competition: Intense competition among various providers necessitates continuous innovation and efficiency improvements.

- Supply chain disruptions: Global events like the pandemic can impact the availability of resources and equipment, thus impacting profitability.

Emerging Opportunities in GCC Event Logistics Market

Several exciting opportunities are emerging within the GCC event logistics market:

- Sustainable solutions: Demand for environmentally friendly logistics services is growing.

- Technology integration: Adopting AI, blockchain, and IoT solutions can create new efficiencies and value-added services.

- Niche markets: Specializing in specific types of events can create competitive advantages.

- Cross-border partnerships: Collaborations with logistics providers across the region can facilitate growth.

Leading Players in the GCC Event Logistics Market Market

- 4Events

- Sasat Logistics

- SOS Global Logistics

- Handle Logistics

- Bin Yousef Cargo

- Gulf Agency Company

- Glaube Logistics

- Clarion Integrated Logistics Solutions

- CSS Group

- GWC logistics

- MENO Logistics

- DP World

Key Developments in GCC Event Logistics Market Industry

- December 2023: Saudi Arabia's unveiling of a master plan for 59 logistics centers will significantly reshape the market, creating opportunities for both local and international players and boosting the overall market size.

- November 2023: GWC's successful logistics operation for the 2022 FIFA World Cup showcased the sector's capabilities and highlighted the potential for future mega-events.

Strategic Outlook for GCC Event Logistics Market Market

The GCC event logistics market holds significant growth potential driven by sustained economic growth, increased tourism, and continuing governmental support for infrastructure development. The integration of advanced technologies and the focus on sustainability will play crucial roles in shaping the industry's future. Strategic partnerships and acquisitions are expected to accelerate market consolidation and drive further innovation. Focusing on niche market segments and adopting cutting-edge technology will be vital for companies to thrive in this dynamic sector.

GCC Event Logistics Market Segmentation

-

1. Type

- 1.1. Inventory Control

- 1.2. Distribution Systems

- 1.3. Logistics Solutions

-

2. Application

- 2.1. Entertainment

- 2.2. Sports

- 2.3. Trade fair

- 2.4. Others

GCC Event Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GCC Event Logistics Market Regional Market Share

Geographic Coverage of GCC Event Logistics Market

GCC Event Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exhibitions and Conferences are driving the market; Sports Events are driving the market growth

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labor

- 3.4. Market Trends

- 3.4.1. Sports Events are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Inventory Control

- 5.1.2. Distribution Systems

- 5.1.3. Logistics Solutions

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Entertainment

- 5.2.2. Sports

- 5.2.3. Trade fair

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America GCC Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Inventory Control

- 6.1.2. Distribution Systems

- 6.1.3. Logistics Solutions

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Entertainment

- 6.2.2. Sports

- 6.2.3. Trade fair

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America GCC Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Inventory Control

- 7.1.2. Distribution Systems

- 7.1.3. Logistics Solutions

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Entertainment

- 7.2.2. Sports

- 7.2.3. Trade fair

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe GCC Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Inventory Control

- 8.1.2. Distribution Systems

- 8.1.3. Logistics Solutions

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Entertainment

- 8.2.2. Sports

- 8.2.3. Trade fair

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa GCC Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Inventory Control

- 9.1.2. Distribution Systems

- 9.1.3. Logistics Solutions

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Entertainment

- 9.2.2. Sports

- 9.2.3. Trade fair

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific GCC Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Inventory Control

- 10.1.2. Distribution Systems

- 10.1.3. Logistics Solutions

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Entertainment

- 10.2.2. Sports

- 10.2.3. Trade fair

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 4Events

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sasat Logistics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SOS Global Logistics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Handle Logistics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bin Yousef Cargo

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Gulf Agency Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Glaube Logistics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Clarion Integrated Logistics Solutions

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CSS Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GWC logistics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 MENO Logistics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 DP World

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 4Events

List of Figures

- Figure 1: Global GCC Event Logistics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America GCC Event Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America GCC Event Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America GCC Event Logistics Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America GCC Event Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America GCC Event Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America GCC Event Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America GCC Event Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 9: South America GCC Event Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America GCC Event Logistics Market Revenue (Million), by Application 2025 & 2033

- Figure 11: South America GCC Event Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: South America GCC Event Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America GCC Event Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe GCC Event Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe GCC Event Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe GCC Event Logistics Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe GCC Event Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe GCC Event Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe GCC Event Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa GCC Event Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa GCC Event Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa GCC Event Logistics Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Middle East & Africa GCC Event Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East & Africa GCC Event Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa GCC Event Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific GCC Event Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific GCC Event Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific GCC Event Logistics Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Asia Pacific GCC Event Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific GCC Event Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific GCC Event Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global GCC Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global GCC Event Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global GCC Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global GCC Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global GCC Event Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global GCC Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global GCC Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global GCC Event Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global GCC Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global GCC Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global GCC Event Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global GCC Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global GCC Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global GCC Event Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global GCC Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global GCC Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 39: Global GCC Event Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific GCC Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Event Logistics Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the GCC Event Logistics Market?

Key companies in the market include 4Events, Sasat Logistics, SOS Global Logistics, Handle Logistics, Bin Yousef Cargo, Gulf Agency Company, Glaube Logistics, Clarion Integrated Logistics Solutions, CSS Group, GWC logistics, MENO Logistics, DP World.

3. What are the main segments of the GCC Event Logistics Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Exhibitions and Conferences are driving the market; Sports Events are driving the market growth.

6. What are the notable trends driving market growth?

Sports Events are Driving the Market.

7. Are there any restraints impacting market growth?

Lack of Skilled Labor.

8. Can you provide examples of recent developments in the market?

December 2023: Saudi Arabia has unveiled a master plan for logistics centers, to improve the infrastructure of the logistics sector, diversifying the economy, and positioning the Kingdom as a major investment destination and global center for logistics. The master plan will involve the construction of 59 centers, with the majority of them located in the Saudi Royal City of Riyadh, with 17 centers in the Eastern region and 18 in the rest of Saudi Arabia. 21 centers are currently in the process of being built, and all centers will be completed by 2030. The logistics centers will offer unified logistics licenses through the Fasah Customs electronic platform, which will simplify import and export processes, shorten shipment clearance times, and make electronic document verification easier. Additionally, more than 1,500 logistics companies from the local, regional, and international sectors will be registered, allowing for more efficient exports of Saudi products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Event Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Event Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Event Logistics Market?

To stay informed about further developments, trends, and reports in the GCC Event Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence