Key Insights

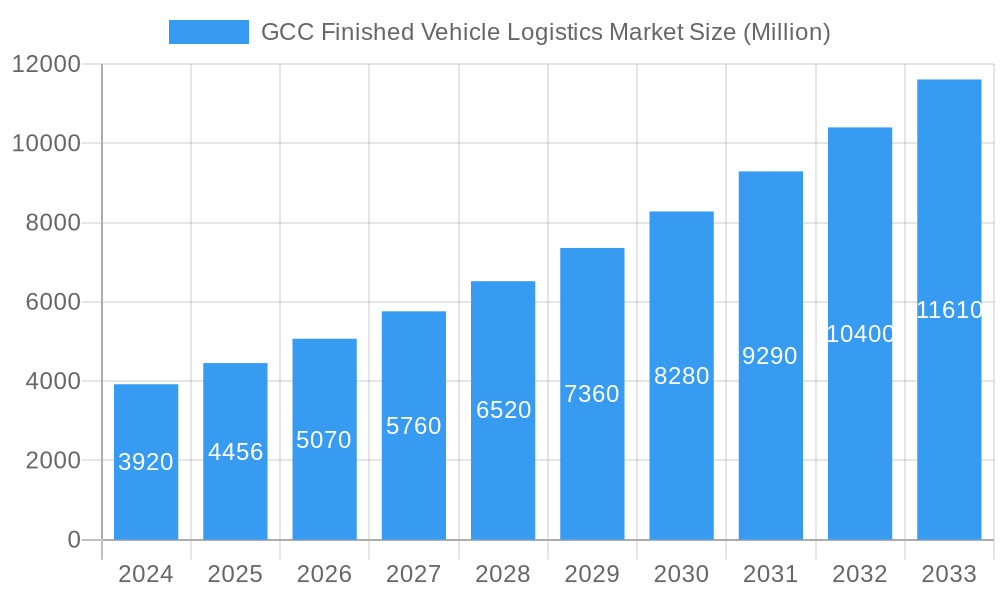

The GCC Finished Vehicle Logistics Market is poised for significant expansion, currently estimated at USD 3.92 billion in 2024, and projected to grow at a robust Compound Annual Growth Rate (CAGR) of 13.8% through 2033. This dynamic market is propelled by several key drivers, including the burgeoning automotive sales within the GCC, an increasing demand for sophisticated supply chain solutions to manage the complexities of vehicle transportation and storage, and substantial government investments in infrastructure development across the region. The region's strategic location as a global trade hub further enhances its appeal for finished vehicle logistics. The market is characterized by a growing emphasis on technological integration, with advancements in real-time tracking, fleet management systems, and warehouse automation playing a crucial role in improving efficiency and transparency. Furthermore, the rising adoption of electric vehicles (EVs) introduces new logistical challenges and opportunities, necessitating specialized handling and charging infrastructure.

GCC Finished Vehicle Logistics Market Market Size (In Billion)

The market's growth trajectory is supported by its diverse segments, encompassing transportation (roadways, railways, maritime, and airways), warehousing, and other value-added services like pre-delivery inspections and customs clearance. Roadways are expected to dominate the transportation segment due to their flexibility and extensive reach within the GCC. However, maritime logistics will remain critical for intercontinental vehicle movements. Leading companies such as DHL, Yusen Logistics, and Kuehne + Nagel are actively investing in expanding their capabilities and networks within the region to capitalize on this growth. Restraints, such as potential geopolitical instability and fluctuating fuel prices, are being mitigated by strategic planning and diversification of logistics operations. The market is witnessing a trend towards integrated logistics solutions, where companies are seeking end-to-end services that streamline the entire finished vehicle supply chain, from manufacturing plant to dealership.

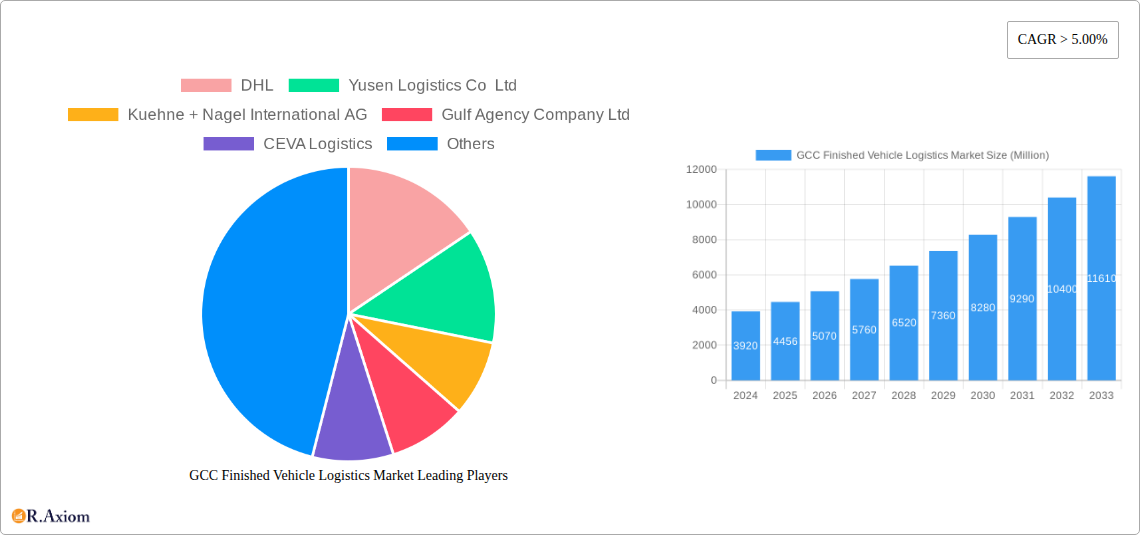

GCC Finished Vehicle Logistics Market Company Market Share

This in-depth report provides a thorough analysis of the GCC Finished Vehicle Logistics Market, a critical sector supporting the region's booming automotive industry. Covering the historical period of 2019–2024, base and estimated year of 2025, and a detailed forecast from 2025–2033, this research offers unparalleled insights into market dynamics, growth drivers, and future opportunities. We delve into segmentation by activity, including transportation (roadways, railways, maritime, airways), warehousing, and other value-added services, providing a granular view of each segment's performance and potential. Key industry developments, leading players, and strategic outlooks are meticulously examined to empower stakeholders with actionable intelligence.

GCC Finished Vehicle Logistics Market Market Concentration & Innovation

The GCC Finished Vehicle Logistics Market exhibits a moderate to high market concentration, with a few dominant players like DHL, Yusen Logistics Co Ltd, Kuehne + Nagel International AG, Gulf Agency Company Ltd, and CEVA Logistics holding significant market share. These key entities are instrumental in shaping the competitive landscape through strategic investments in technology and infrastructure. Innovation is primarily driven by the adoption of advanced supply chain management software, real-time tracking systems, and automation in warehousing facilities, aiming to enhance efficiency and reduce lead times. Regulatory frameworks in GCC countries are evolving to support the growth of logistics, focusing on streamlining customs procedures and improving cross-border trade. However, the threat of product substitutes is low in finished vehicle logistics, as specialized handling and transportation are essential. End-user trends are increasingly leaning towards just-in-time delivery, enhanced visibility throughout the supply chain, and sustainable logistics solutions. Merger and acquisition (M&A) activities are notable, with deals in the multi-billion dollar range, as larger players seek to expand their geographical reach and service portfolios. For instance, the acquisition of specialized automotive logistics firms by established global players signifies a consolidation trend, aiming to achieve economies of scale and integrated service offerings. The market is poised for further consolidation as companies seek to strengthen their competitive edge.

GCC Finished Vehicle Logistics Market Industry Trends & Insights

The GCC Finished Vehicle Logistics Market is experiencing robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period. This expansion is fueled by several intertwined industry trends and insights. A primary growth driver is the ever-increasing automotive sales volume across the GCC region, spurred by a growing population, rising disposable incomes, and a strong demand for new vehicles, particularly SUVs and luxury cars. Furthermore, the region's strategic location as a gateway for both import and export of vehicles, especially to and from Asia and Africa, significantly bolsters the throughput of finished vehicles, necessitating efficient and reliable logistics solutions. Technological disruptions are playing a pivotal role. The integration of Artificial Intelligence (AI) and Machine Learning (ML) in route optimization, predictive maintenance for fleets, and demand forecasting is enhancing operational efficiency and cost-effectiveness. The adoption of Internet of Things (IoT) devices for real-time cargo monitoring, temperature control, and security is also gaining traction, ensuring the pristine condition of high-value vehicles during transit. Consumer preferences are shifting towards enhanced customer experience, demanding faster delivery times, greater transparency, and personalized logistics services. This pushes logistics providers to invest in digital platforms and customer-centric solutions. Competitive dynamics are intensifying, with established global players competing fiercely against emerging regional specialists. The focus is increasingly on offering end-to-end solutions, encompassing pre-delivery inspections, customization, and final mile delivery. The market penetration of advanced logistics technologies is steadily increasing, with early adopters realizing substantial benefits in terms of reduced operational costs and improved service delivery. For example, the implementation of automated warehousing solutions has led to a decrease in handling times by up to 20% in some facilities. The shift towards environmentally conscious logistics is also a growing trend, with companies exploring the use of alternative fuel vehicles and optimized shipping routes to minimize their carbon footprint. This evolving landscape requires continuous adaptation and innovation from all stakeholders in the GCC Finished Vehicle Logistics Market.

Dominant Markets & Segments in GCC Finished Vehicle Logistics Market

The GCC Finished Vehicle Logistics Market is characterized by the dominance of certain regions and activities, driven by significant economic and infrastructural factors. Road transportation stands out as the most dominant segment within the Transportation activity, accounting for an estimated 65% of the total transportation volume. This is primarily attributed to the extensive road networks connecting major cities and industrial hubs across Saudi Arabia, UAE, and Qatar, coupled with the flexibility and cost-effectiveness of road freight for shorter to medium-haul deliveries. The United Arab Emirates (UAE), particularly Dubai and Abu Dhabi, emerges as the leading dominant market within the GCC, driven by its advanced infrastructure, free trade zones, and its pivotal role as a regional hub for automotive distribution and re-export.

Transportation:

- Roadways: Dominant due to extensive road infrastructure, direct connectivity between major cities, and flexibility for last-mile delivery. Key drivers include the high volume of intra-GCC vehicle trade and the concentration of automotive dealerships in urban centers. Market penetration of specialized car carriers is near 90%.

- Maritime: Significant for long-haul imports and exports, especially from Asia and Europe. Major ports like Jebel Ali (UAE) and King Abdullah Port (Saudi Arabia) handle a substantial volume of Roll-on/Roll-off (Ro-Ro) vessels. The growth in global automotive production directly impacts this segment.

- Airways: While less dominant for mass finished vehicle logistics due to cost, it's crucial for high-value, low-volume shipments and urgent deliveries of specialized vehicles. Its role is expected to grow with the increasing demand for luxury and niche automotive segments.

- Railways: Currently a nascent segment with limited infrastructure for finished vehicle transport across the GCC. However, future investments in rail networks, such as the GCC Railway project, could significantly boost its importance for bulk transportation.

Warehousing: The warehousing segment is another cornerstone, with its market share estimated at 25% of the overall logistics value. The growth in demand for covered and secure storage facilities to protect vehicles from environmental factors and potential damage is a key driver. The UAE and Saudi Arabia lead in warehousing capacity, driven by significant investments in state-of-the-art logistics parks and bonded warehouses. The development of specialized vehicle processing centers (VPCs) offering pre-delivery inspections, PDI, and customization services further strengthens this segment. The average utilization rate of specialized vehicle warehousing facilities is around 80%.

Other Value-added Services: This segment, comprising approximately 10% of the market, includes services like customs clearance, vehicle inspection, PDI, remarketing, and fleet management. The increasing complexity of international trade and the demand for comprehensive supply chain solutions make these services critical for end-to-end logistics provision. The adoption of digital platforms for managing these services is a key trend, enhancing efficiency and customer satisfaction. The market size for these services is projected to grow at a CAGR of 7%.

The dominance of these segments and markets is underpinned by favorable economic policies, government initiatives to boost trade and logistics, and continuous infrastructure development across the GCC.

GCC Finished Vehicle Logistics Market Product Developments

Product developments in the GCC Finished Vehicle Logistics Market are focused on enhancing efficiency, security, and sustainability. Innovations include the deployment of advanced fleet management systems integrating telematics and GPS tracking for real-time visibility and route optimization, leading to an estimated 15% reduction in fuel consumption. The development of specialized, multi-deck car carriers with improved safety features and capacity is enhancing road transportation efficiency. Furthermore, the introduction of smart warehousing solutions utilizing AI-powered inventory management and automated guided vehicles (AGVs) is streamlining loading and unloading processes. The application of these developments extends to improved handling of electric vehicles (EVs), requiring specific charging and storage protocols, thereby catering to evolving market demands and offering a competitive advantage.

Report Scope & Segmentation Analysis

This report meticulously analyzes the GCC Finished Vehicle Logistics Market, segmented by key operational activities. The Transportation segment, encompassing Roadways, Railways, Maritime, and Airways, represents the largest portion of the market, driven by the sheer volume of finished vehicles moved across the region. Growth in this segment is projected at a healthy 9% CAGR. Warehousing facilities, crucial for temporary storage, pre-delivery inspections, and distribution, constitute the second-largest segment, expected to grow at a CAGR of 7.5%. This segment benefits from the increasing complexity of supply chains and the need for secure storage solutions. Other Value-added Services, including customs clearance, PDI, and remarketing, form the third segment, demonstrating robust growth at a CAGR of 8%. These services are vital for end-to-end logistics solutions and are increasingly being digitized.

Key Drivers of GCC Finished Vehicle Logistics Market Growth

Several key factors are propelling the growth of the GCC Finished Vehicle Logistics Market. The burgeoning automotive sector, fueled by increasing domestic demand and the GCC's role as a re-export hub, is a primary driver. Government initiatives aimed at diversifying economies and positioning the region as a global logistics powerhouse, such as Saudi Vision 2030 and the UAE's National Strategy for Advanced Transportation and Logistics, are creating a conducive environment for market expansion. Significant investments in state-of-the-art port infrastructure, airports, and road networks are enhancing connectivity and efficiency. Furthermore, the growing adoption of advanced technologies like AI, IoT, and blockchain for supply chain visibility and optimization is improving operational effectiveness and reducing costs. The surge in e-commerce is indirectly contributing by increasing the demand for last-mile delivery solutions for vehicles.

Challenges in the GCC Finished Vehicle Logistics Market Sector

Despite the positive outlook, the GCC Finished Vehicle Logistics Market faces several challenges. Stringent and sometimes varying customs regulations across different GCC countries can lead to delays and increased operational costs. The scarcity of skilled labor in specialized logistics operations and the high cost of advanced technology adoption can pose barriers, particularly for smaller players. Intense competition from both established global logistics providers and emerging regional companies puts pressure on profit margins. Furthermore, geopolitical uncertainties and fluctuations in global oil prices can indirectly impact consumer spending on vehicles, thus affecting logistics demand. The environmental impact of extensive logistics operations is also a growing concern, pushing for more sustainable practices which require significant investment and adaptation.

Emerging Opportunities in GCC Finished Vehicle Logistics Market

The GCC Finished Vehicle Logistics Market is ripe with emerging opportunities. The rapid growth of the Electric Vehicle (EV) market in the region presents a unique opportunity for logistics providers to develop specialized handling, charging, and storage solutions. The ongoing development of integrated logistics hubs and free zones across the GCC offers enhanced connectivity and streamlined operations. The increasing demand for end-to-end logistics solutions, including pre-delivery inspections, customization, and final-mile delivery, creates avenues for service diversification. Furthermore, the potential of cross-border e-commerce for automotive parts and accessories could open new logistics avenues. The strategic focus on developing the automotive manufacturing sector within the GCC could also lead to increased demand for inbound and outbound logistics services.

Leading Players in the GCC Finished Vehicle Logistics Market Market

- DHL

- Yusen Logistics Co Ltd

- Kuehne + Nagel International AG

- Gulf Agency Company Ltd

- CEVA Logistics

- Al-Futtaim Logistics

- Almajdouie Logistics

- Gallega Global Logistics

- RSA Global

- GEFCO

Key Developments in GCC Finished Vehicle Logistics Market Industry

- September 2022: Bahri Logistics and MOSOLF Group signed a Memorandum of Understanding (MoU) to establish and develop an automotive logistics framework initially for Saudi Arabia, with plans to expand across the GCC. This collaboration aims to fortify the Kingdom's automotive logistics supply chain.

- March 2022: A.P. Moller - Maersk inaugurated its first Integrated Logistics Centre in Dubai, UAE, at DP World's Jafza. This 10,000 sq. m. facility caters to various sectors, including automotive, enhancing warehousing and distribution capabilities in the region.

Strategic Outlook for GCC Finished Vehicle Logistics Market Market

The strategic outlook for the GCC Finished Vehicle Logistics Market remains highly optimistic, driven by sustained economic growth, significant government investment in infrastructure, and the expanding automotive sector. The increasing focus on technological integration, particularly in areas like AI-driven route optimization and IoT for real-time tracking, will be crucial for competitive advantage. The growing demand for sustainable logistics solutions and the rapid rise of the EV market present substantial growth catalysts. Companies that can offer end-to-end, technology-enabled, and eco-friendly logistics services are well-positioned to capitalize on the market's potential. Further consolidation through strategic partnerships and M&A activities is anticipated as players strive for market leadership and operational synergies, ensuring efficient and cost-effective delivery of finished vehicles across the GCC.

GCC Finished Vehicle Logistics Market Segmentation

-

1. Activity

-

1.1. Transportation

- 1.1.1. Roadways

- 1.1.2. Railways

- 1.1.3. Maritime

- 1.1.4. Airways

- 1.2. Warehousing

- 1.3. Other Value-added Services

-

1.1. Transportation

GCC Finished Vehicle Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

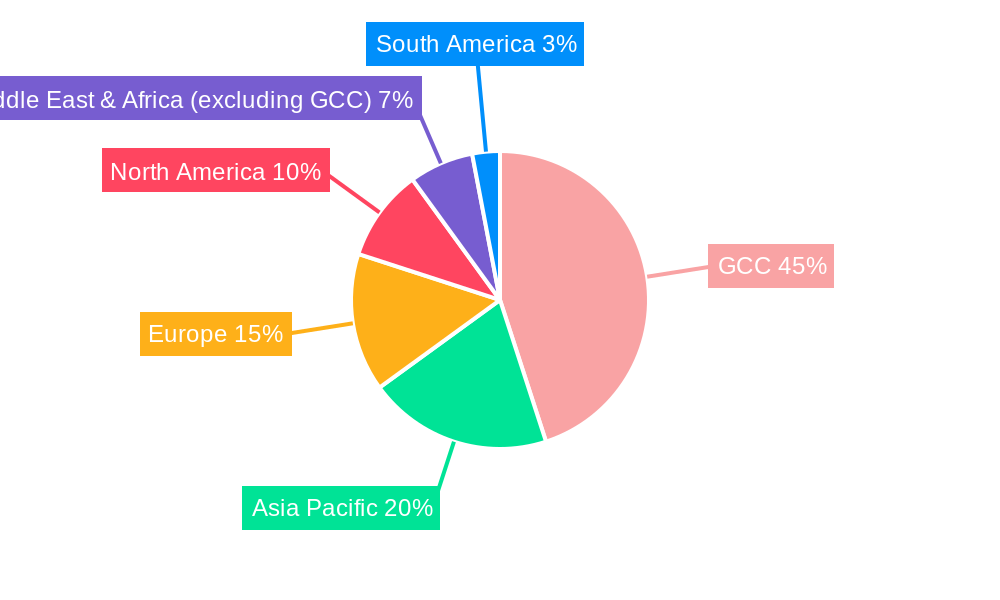

GCC Finished Vehicle Logistics Market Regional Market Share

Geographic Coverage of GCC Finished Vehicle Logistics Market

GCC Finished Vehicle Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for Perishable Goods; Expanding E-commerce Market

- 3.3. Market Restrains

- 3.3.1. Infrastructure Limitations; Skilled Labor Shortage

- 3.4. Market Trends

- 3.4.1. Growing Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Finished Vehicle Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Activity

- 5.1.1. Transportation

- 5.1.1.1. Roadways

- 5.1.1.2. Railways

- 5.1.1.3. Maritime

- 5.1.1.4. Airways

- 5.1.2. Warehousing

- 5.1.3. Other Value-added Services

- 5.1.1. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Activity

- 6. North America GCC Finished Vehicle Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Activity

- 6.1.1. Transportation

- 6.1.1.1. Roadways

- 6.1.1.2. Railways

- 6.1.1.3. Maritime

- 6.1.1.4. Airways

- 6.1.2. Warehousing

- 6.1.3. Other Value-added Services

- 6.1.1. Transportation

- 6.1. Market Analysis, Insights and Forecast - by Activity

- 7. South America GCC Finished Vehicle Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Activity

- 7.1.1. Transportation

- 7.1.1.1. Roadways

- 7.1.1.2. Railways

- 7.1.1.3. Maritime

- 7.1.1.4. Airways

- 7.1.2. Warehousing

- 7.1.3. Other Value-added Services

- 7.1.1. Transportation

- 7.1. Market Analysis, Insights and Forecast - by Activity

- 8. Europe GCC Finished Vehicle Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Activity

- 8.1.1. Transportation

- 8.1.1.1. Roadways

- 8.1.1.2. Railways

- 8.1.1.3. Maritime

- 8.1.1.4. Airways

- 8.1.2. Warehousing

- 8.1.3. Other Value-added Services

- 8.1.1. Transportation

- 8.1. Market Analysis, Insights and Forecast - by Activity

- 9. Middle East & Africa GCC Finished Vehicle Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Activity

- 9.1.1. Transportation

- 9.1.1.1. Roadways

- 9.1.1.2. Railways

- 9.1.1.3. Maritime

- 9.1.1.4. Airways

- 9.1.2. Warehousing

- 9.1.3. Other Value-added Services

- 9.1.1. Transportation

- 9.1. Market Analysis, Insights and Forecast - by Activity

- 10. Asia Pacific GCC Finished Vehicle Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Activity

- 10.1.1. Transportation

- 10.1.1.1. Roadways

- 10.1.1.2. Railways

- 10.1.1.3. Maritime

- 10.1.1.4. Airways

- 10.1.2. Warehousing

- 10.1.3. Other Value-added Services

- 10.1.1. Transportation

- 10.1. Market Analysis, Insights and Forecast - by Activity

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DHL

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Yusen Logistics Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kuehne + Nagel International AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Gulf Agency Company Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CEVA Logistics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Al-Futtaim Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Almajdouie Logistics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Gallega Global Logistics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 RSA Global

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GEFCO**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 DHL

List of Figures

- Figure 1: Global GCC Finished Vehicle Logistics Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America GCC Finished Vehicle Logistics Market Revenue (undefined), by Activity 2025 & 2033

- Figure 3: North America GCC Finished Vehicle Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 4: North America GCC Finished Vehicle Logistics Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America GCC Finished Vehicle Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America GCC Finished Vehicle Logistics Market Revenue (undefined), by Activity 2025 & 2033

- Figure 7: South America GCC Finished Vehicle Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 8: South America GCC Finished Vehicle Logistics Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: South America GCC Finished Vehicle Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe GCC Finished Vehicle Logistics Market Revenue (undefined), by Activity 2025 & 2033

- Figure 11: Europe GCC Finished Vehicle Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 12: Europe GCC Finished Vehicle Logistics Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe GCC Finished Vehicle Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa GCC Finished Vehicle Logistics Market Revenue (undefined), by Activity 2025 & 2033

- Figure 15: Middle East & Africa GCC Finished Vehicle Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 16: Middle East & Africa GCC Finished Vehicle Logistics Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Middle East & Africa GCC Finished Vehicle Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific GCC Finished Vehicle Logistics Market Revenue (undefined), by Activity 2025 & 2033

- Figure 19: Asia Pacific GCC Finished Vehicle Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 20: Asia Pacific GCC Finished Vehicle Logistics Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Asia Pacific GCC Finished Vehicle Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Activity 2020 & 2033

- Table 2: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Activity 2020 & 2033

- Table 4: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Activity 2020 & 2033

- Table 9: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Brazil GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Argentina GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Activity 2020 & 2033

- Table 14: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United Kingdom GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Germany GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Spain GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Russia GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Benelux GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Nordics GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Activity 2020 & 2033

- Table 25: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Turkey GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Israel GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: GCC GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: North Africa GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Activity 2020 & 2033

- Table 33: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: China GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: India GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Japan GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Korea GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: ASEAN GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Oceania GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Finished Vehicle Logistics Market?

The projected CAGR is approximately 13.8%.

2. Which companies are prominent players in the GCC Finished Vehicle Logistics Market?

Key companies in the market include DHL, Yusen Logistics Co Ltd, Kuehne + Nagel International AG, Gulf Agency Company Ltd, CEVA Logistics, Al-Futtaim Logistics, Almajdouie Logistics, Gallega Global Logistics, RSA Global, GEFCO**List Not Exhaustive.

3. What are the main segments of the GCC Finished Vehicle Logistics Market?

The market segments include Activity.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for Perishable Goods; Expanding E-commerce Market.

6. What are the notable trends driving market growth?

Growing Automotive Industry.

7. Are there any restraints impacting market growth?

Infrastructure Limitations; Skilled Labor Shortage.

8. Can you provide examples of recent developments in the market?

September 2022: Bahri Logistics (a business unit of the national shipping carrier of Saudi Arabia), and the MOSOLF Group (one of the leading system service providers for the automotive industry in Europe) announced the signing of a Memorandum of Understanding (MoU) aims to establish and develop an automotive logistics framework initially focused on Saudi Arabia with plans to expand across the Gulf Cooperation Council (GCC). The MoU between Bahri Logistics and MOSOLF seeks to further fortify the Kingdom's current automotive logistics supply chain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Finished Vehicle Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Finished Vehicle Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Finished Vehicle Logistics Market?

To stay informed about further developments, trends, and reports in the GCC Finished Vehicle Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence