Key Insights

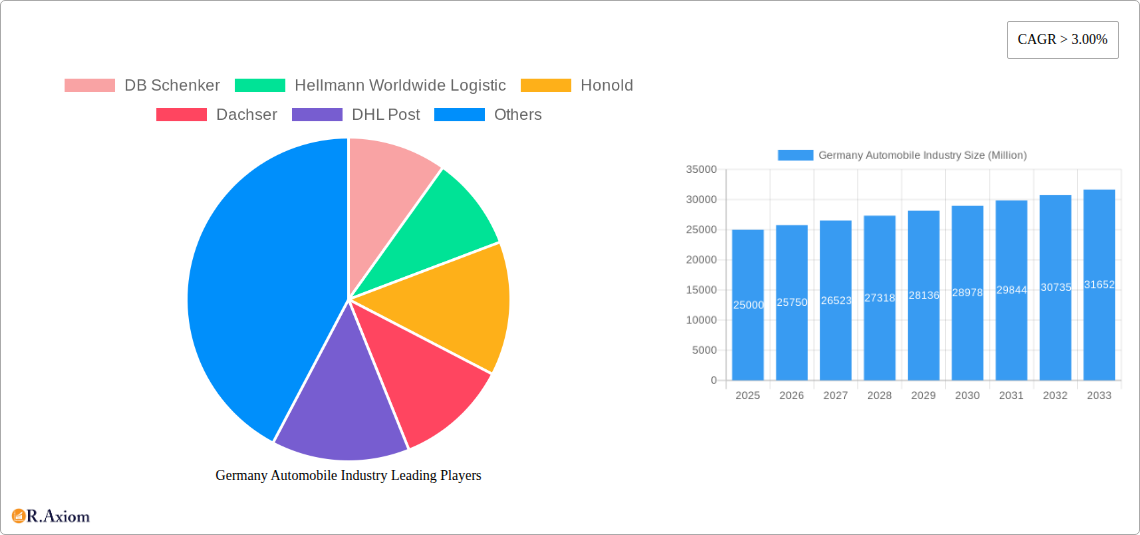

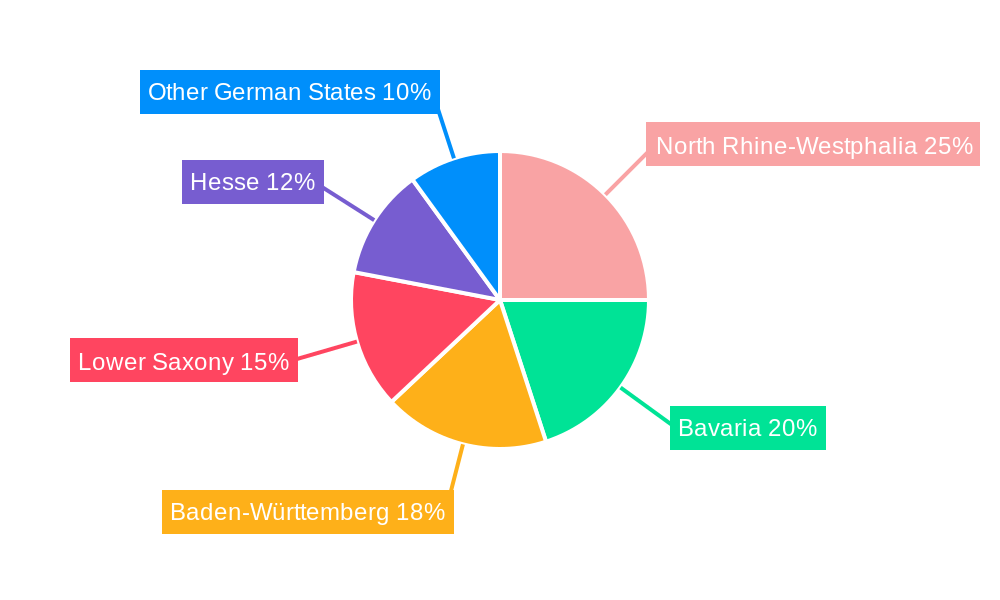

The German automobile logistics market, encompassing finished vehicle transportation, auto component logistics, and associated warehousing, distribution, and inventory management services, exhibits robust growth potential. Driven by increasing vehicle production, a strong domestic automotive industry, and the rising demand for efficient supply chain solutions, the market is projected to maintain a compound annual growth rate (CAGR) exceeding 3.00% from 2025 to 2033. Key players like DB Schenker, DHL, Kuehne + Nagel, and others are strategically positioned to capitalize on this growth, investing in advanced technologies like automation and digitalization to optimize their operations and enhance service offerings. The market segmentation reveals a significant reliance on finished vehicle transportation and warehousing services, reflecting the importance of efficient vehicle delivery and inventory management within Germany's established automotive ecosystem. Regional variations exist, with states like North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse contributing significantly to overall market volume due to their established automotive manufacturing hubs. The market’s continued expansion is contingent upon factors such as sustained economic growth, government policies supporting the automotive industry, and the ongoing adoption of sustainable logistics practices.

Germany Automobile Industry Market Size (In Billion)

The competitive landscape is intensely competitive, with established global players alongside regional specialists vying for market share. Success hinges on providing tailored logistics solutions that address the specific needs of automotive manufacturers and suppliers. Factors such as increasing fuel costs, fluctuating demand due to global economic uncertainty, and the growing need for environmentally friendly transportation methods pose challenges to market growth. Despite these headwinds, the long-term outlook remains positive, driven by the continuous innovation within the automotive industry, the ongoing shift towards electric vehicles, and Germany's strategic importance as a global automotive manufacturing powerhouse. A continuous focus on efficiency, technological integration, and sustainability will be crucial for players to maintain a competitive edge in this dynamic market.

Germany Automobile Industry Company Market Share

Germany Automobile Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the German automobile industry, encompassing market dynamics, key players, emerging trends, and future growth prospects. The study period covers 2019-2033, with 2025 as the base and estimated year. The report leverages extensive data analysis and industry expertise to offer actionable insights for stakeholders across the automotive value chain. The report covers a market valued at xx Million in 2025, projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Germany Automobile Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the German automobile industry, examining market concentration, innovation drivers, regulatory frameworks, and key M&A activities. The German automotive market displays a high level of concentration, with a few major players holding significant market share. However, the presence of numerous smaller specialized firms and the continuous entry of new players contributes to a dynamic competitive environment.

- Market Concentration: The top 5 players control approximately xx% of the market.

- Innovation Drivers: Electrification, autonomous driving, and digitalization are major innovation drivers, pushing companies to invest heavily in R&D.

- Regulatory Framework: Stringent emission regulations and safety standards influence innovation and product development strategies.

- Product Substitutes: The emergence of alternative transportation modes (e.g., e-bikes, public transport) presents a growing competitive threat.

- End-User Trends: Increasing demand for sustainable and technologically advanced vehicles shapes product development.

- M&A Activities: Recent acquisitions, such as the EUR 81 Million acquisition of Sesé Auto Logistics by Noatum (October 2023) and Samvardhana Motherson's acquisition of SAS Autosystemtechnik GmbH (February 2023), reflect industry consolidation and expansion efforts. The total value of M&A deals within the last 5 years is estimated at xx Million.

Germany Automobile Industry Industry Trends & Insights

This section explores the key trends shaping the German automobile industry's evolution. The market is undergoing a period of significant transformation, driven by technological advancements, shifting consumer preferences, and intensifying global competition. The increasing adoption of electric vehicles (EVs) and autonomous driving technologies is a primary growth driver, impacting the entire automotive ecosystem. However, challenges remain, including supply chain disruptions and the need for substantial investments in new technologies. The industry is also facing pressure to reduce its environmental impact and improve sustainability practices.

Dominant Markets & Segments in Germany Automobile Industry

The German automobile industry is characterized by its robust and diverse market landscape. The Finished Vehicle segment remains the undisputed leader, propelled by a persistent high demand from both domestic consumers and international markets. Complementing this, the Auto Component segment is experiencing significant and consistent growth. This expansion is primarily fueled by rapid technological advancements that necessitate increasingly complex and specialized vehicle parts, as well as the growing demand for advanced safety and emission-reducing technologies.

In terms of services, Transportation services command the largest market share, underscoring the critical role of efficient logistics in moving vehicles and components globally. This is closely followed by Warehousing and distribution, which are essential for managing the extensive supply chains of the automotive sector. Inventory management and a range of other crucial services, including vehicle repair and maintenance, also represent substantial and vital components of the industry's service offerings.

Key Drivers:

- Economic Policies: Progressive government incentives, particularly for electric vehicles (EVs), and substantial investments in developing comprehensive charging infrastructure are potent catalysts stimulating market growth and encouraging the adoption of sustainable mobility solutions.

- Infrastructure: Germany's world-class transportation networks, coupled with highly developed logistics infrastructure, provide a foundational advantage. This enables the seamless and efficient movement of finished vehicles and the timely delivery of automotive components, supporting the industry's operational excellence.

Germany Automobile Industry Product Developments

The German automobile industry consistently stands at the vanguard of technological innovation, actively pushing the boundaries of vehicle and component development. A central focus of current product development revolves around the seamless integration of autonomous driving features, promising enhanced safety and convenience. Simultaneously, there is a pronounced emphasis on the increased use of lightweight materials to improve fuel efficiency and performance, alongside the creation of highly sophisticated and intuitive infotainment systems that elevate the in-car experience. These cutting-edge innovations collectively aim to boost vehicle performance, bolster safety standards, and optimize fuel efficiency, all while proactively aligning with the escalating consumer demand for advanced technological integration and unwavering commitment to sustainability.

Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the German automobile industry to provide in-depth insights. The analysis is structured around two primary pillars: vehicle type, encompassing Finished Vehicle and Auto Component segments, and service type, which includes Transportation, Warehousing, Distribution, Inventory Management, and Other Services. For each identified segment, the report offers a detailed evaluation of market size, projected growth trajectories, and the intricate dynamics of the competitive landscape. The Finished Vehicle segment is projected to experience a compound annual growth rate (CAGR) of approximately [Insert Specific CAGR for Finished Vehicle]% during the forecast period. Concurrently, the Auto Component segment is anticipated to grow at a CAGR of around [Insert Specific CAGR for Auto Component]%. The Transportation service segment is expected to maintain its leading position, primarily due to its indispensable role and critical function within the intricate automotive supply chain.

Key Drivers of Germany Automobile Industry Growth

Several factors drive the growth of the German automobile industry. Technological advancements in electric vehicles, autonomous driving, and connected car technologies are major catalysts. Government support through incentives and investments in infrastructure further boosts the market. Furthermore, the strong presence of established automotive manufacturers and a skilled workforce contributes to the industry's competitiveness.

Challenges in the Germany Automobile Industry Sector

The German automobile industry faces challenges including stringent emission regulations necessitating significant investments in cleaner technologies. Supply chain disruptions and the increasing complexity of vehicle production pose significant operational challenges. Intense competition, both domestically and internationally, requires constant innovation and efficiency improvements to maintain market share. These factors can collectively impact profitability and competitiveness.

Emerging Opportunities in Germany Automobile Industry

Emerging opportunities include the growth of the electric vehicle market, advancements in autonomous driving technologies, and increasing demand for connected car features. The development of innovative mobility solutions, including ride-sharing and shared mobility services, represents a significant growth opportunity. Expanding into new markets and leveraging digital technologies to enhance customer experiences also presents substantial potential.

Leading Players in the Germany Automobile Industry Market

- DB Schenker

- Hellmann Worldwide Logistics

- Honold

- Dachser

- DHL Post

- Kuehne + Nagel International AG

- Rhenus Logistics

- Geodis

- DSV Panalpina

- Rudolph Logistics Group

Key Developments in Germany Automobile Industry Industry

October 2023: The strategic acquisition of Sesé Auto Logistics by AD Ports Group marks a significant consolidation within the finished vehicle logistics market. This strategic move is poised to enhance operational efficiencies and substantially increase market share for Noatum within the highly competitive European automotive logistics sector.

February 2023: Samvardhana Motherson's acquisition of SAS Autosystemtechnik GmbH represents a pivotal development, significantly bolstering its standing in automotive assembly and logistics services. This acquisition not only expands its global footprint but also augments its service capabilities, broadens its customer base, and secures access to established, valuable relationships with leading Original Equipment Manufacturers (OEMs).

Strategic Outlook for Germany Automobile Industry Market

The German automobile industry is strategically positioned for sustained and robust growth, propelled by a confluence of factors including relentless technological advancements, evolving consumer preferences, and supportive government policies. The long-term viability and success of this dynamic market are intrinsically linked to its capacity to adeptly navigate and embrace the transformative shifts in the mobility landscape. This includes a strong imperative to champion sustainability initiatives and accelerate digitalization efforts, thereby actively shaping the future trajectory of transportation. A steadfast focus on pioneering innovation, cultivating strategic partnerships, and optimizing supply chain management will be paramount for achieving enduring success in this constantly evolving and highly competitive market.

Germany Automobile Industry Segmentation

-

1. Type

- 1.1. Finished Vehicle

- 1.2. Auto Component

-

2. Service

- 2.1. Transportation

- 2.2. Warehous

- 2.3. Other Services

Germany Automobile Industry Segmentation By Geography

- 1. Germany

Germany Automobile Industry Regional Market Share

Geographic Coverage of Germany Automobile Industry

Germany Automobile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Cost Constraints4.; Infrastructure Accessibility

- 3.4. Market Trends

- 3.4.1. Automotive Exports driving logistics market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Automobile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Finished Vehicle

- 5.1.2. Auto Component

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Transportation

- 5.2.2. Warehous

- 5.2.3. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hellmann Worldwide Logistic

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Honold

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dachser

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DHL Post

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kuehne + Nagel International AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rhenus Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Geodis**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DSV Panalpina

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rudolph Logistics Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Germany Automobile Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Germany Automobile Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Automobile Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Germany Automobile Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 3: Germany Automobile Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Germany Automobile Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Germany Automobile Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 6: Germany Automobile Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Automobile Industry?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the Germany Automobile Industry?

Key companies in the market include DB Schenker, Hellmann Worldwide Logistic, Honold, Dachser, DHL Post, Kuehne + Nagel International AG, Rhenus Logistics, Geodis**List Not Exhaustive, DSV Panalpina, Rudolph Logistics Group.

3. What are the main segments of the Germany Automobile Industry?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Automotive Exports driving logistics market.

7. Are there any restraints impacting market growth?

4.; Cost Constraints4.; Infrastructure Accessibility.

8. Can you provide examples of recent developments in the market?

October 2023: AD Ports Group (ADX: ADPORTS), one of the world's premier facilitator of logistics, industry, and trade, announces that Noatum, which now leads its Logistics Cluster operations, has signed the agreement for the acquisition of the 100% equity ownership of Sesé Auto Logistics, the Finished Vehicles Logistics (FVL) business of Grupo Logístico Sesé, for a total purchase consideration (Enterprise Value - EV) of EUR 81 million. The transaction is expected to be completed by Q1 2024, subject to regulatory approvals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Automobile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Automobile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Automobile Industry?

To stay informed about further developments, trends, and reports in the Germany Automobile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence