Key Insights

The German high-performance electric vehicle (EV) market is experiencing robust growth, propelled by stringent emission standards, increasing consumer preference for sustainable mobility, and substantial government incentives. The market, projected to reach 55.6 billion by 2025, is forecast to achieve a Compound Annual Growth Rate (CAGR) of 45% from 2025 to 2033. This expansion is driven by technological advancements enhancing battery range, charging speeds, and overall performance, making high-performance EVs increasingly attractive. The German government's commitment to vehicle electrification and investments in charging infrastructure further accelerate market adoption. Leading manufacturers like Volkswagen, BMW, Mercedes-Benz, and Porsche are making significant R&D and production investments, fostering competition and innovation.

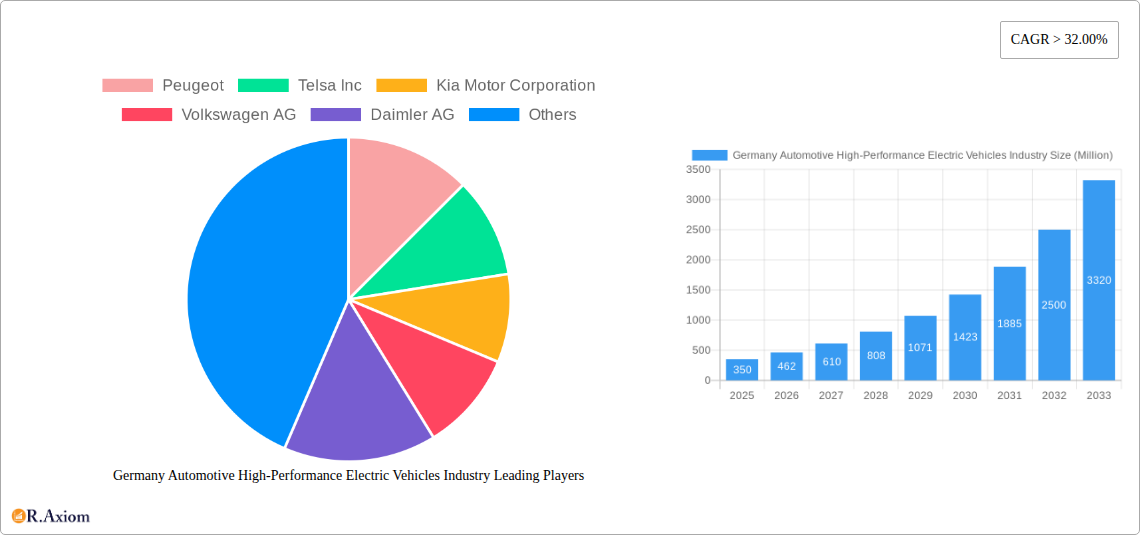

Germany Automotive High-Performance Electric Vehicles Industry Market Size (In Billion)

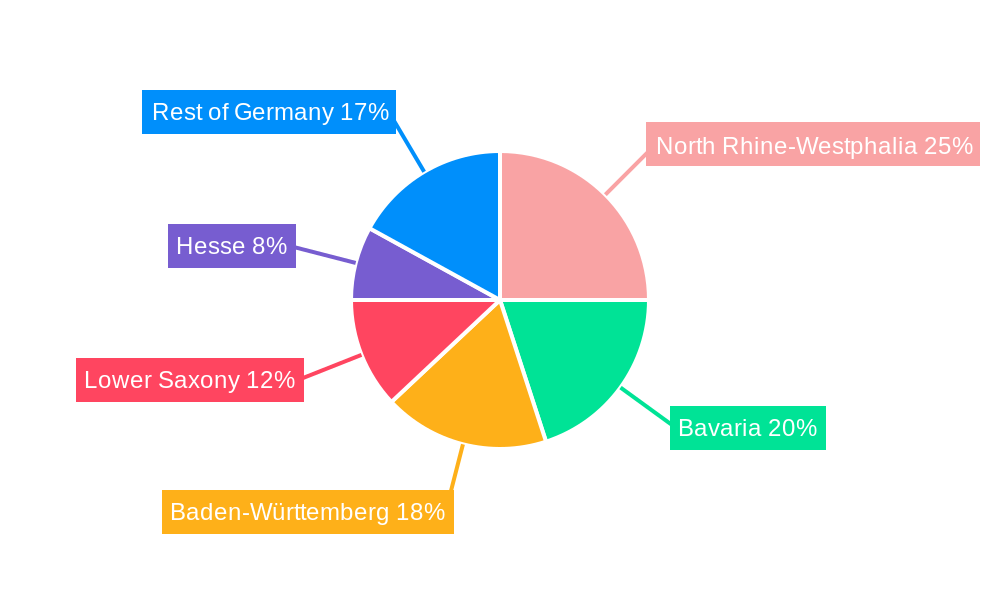

Market segmentation indicates strong growth across passenger and commercial vehicles, with plug-in hybrids and Battery Electric Vehicles (BEVs) showing significant uptake. Regional automotive hubs in North Rhine-Westphalia, Bavaria, and Baden-Württemberg contribute to the market's dynamism.

Germany Automotive High-Performance Electric Vehicles Industry Company Market Share

Key challenges include the higher initial purchase price of high-performance EVs compared to traditional vehicles, range anxiety, charging infrastructure availability, and longer charging times. However, ongoing advancements in battery technology, decreasing production costs, and supportive government policies are expected to mitigate these restraints, ensuring continued market expansion. Enhanced charging infrastructure and addressing consumer concerns are crucial for maximizing market penetration.

Germany Automotive High-Performance Electric Vehicle Market: Analysis and Forecast 2025-2033

This report provides an in-depth analysis of the German automotive high-performance EV industry, including market size, segmentation, growth drivers, challenges, and key players. Utilizing data from the base year 2025, it forecasts market trends through 2033. This report is an essential resource for industry stakeholders, investors, and decision-makers navigating this dynamic market.

Germany Automotive High-Performance Electric Vehicles Industry Market Concentration & Innovation

The German high-performance electric vehicle market exhibits a moderately concentrated landscape, with established automotive giants like Volkswagen AG, Daimler AG, and BMW Group holding significant market share. However, the emergence of Tesla Inc. and other innovative players like Rimac Automobili is increasing competition and driving innovation. Market share data for 2024 indicates Volkswagen AG holds approximately xx%, Daimler AG xx%, BMW Group xx%, Tesla Inc. xx%, and others xx%. The total market value in 2024 was estimated at xx Million.

Several factors drive innovation:

- Stringent emission regulations: The EU's ambitious emission reduction targets are pushing manufacturers to invest heavily in high-performance EVs.

- Technological advancements: Continuous improvements in battery technology, electric motor efficiency, and charging infrastructure are key enablers.

- Consumer demand: Growing consumer preference for sustainable and high-performance vehicles fuels market growth.

Mergers and acquisitions (M&A) play a vital role in shaping the industry landscape. Notable examples include Meritor, Inc.'s acquisition of Siemens' Commercial Vehicles business in May 2022 for USD 203.3 Million, demonstrating a strategic move to enhance electric drive system capabilities. The total value of M&A deals in the German high-performance EV sector during 2019-2024 was approximately xx Million.

Germany Automotive High-Performance Electric Vehicles Industry Industry Trends & Insights

The German high-performance EV market is experiencing robust growth, driven by factors such as government incentives, increasing environmental awareness, and technological advancements. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 was estimated at xx%, and is projected to remain strong at xx% during the forecast period (2025-2033). Market penetration, currently at xx% in 2024, is expected to reach xx% by 2033. Technological disruptions, such as the introduction of 800V electric compressors (as seen in Mahle Holding Co.’s announcements) and superior continuous torque (SCT) E-motors (MAHLE GmbH), are significantly improving performance and efficiency. Consumer preferences are shifting towards vehicles with longer ranges, faster charging times, and advanced features. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants, leading to continuous product improvements and price competition.

Dominant Markets & Segments in Germany Automotive High-Performance Electric Vehicles Industry

Within the German high-performance EV market, passenger cars currently represent the dominant segment, accounting for approximately xx% of the total market value in 2024, driven primarily by strong consumer demand and diverse model offerings. The Battery or Pure Electric drive type is steadily gaining traction, surpassing plug-in hybrids in market share.

Key Drivers for Passenger Car Dominance:

- Strong consumer demand for high-performance EVs: German consumers show a preference for technologically advanced and luxurious electric vehicles.

- Government incentives and subsidies: Financial support programs promote EV adoption.

- Extensive charging infrastructure development: Growing access to charging stations enhances convenience.

Key Drivers for Battery or Pure Electric Drive Type Dominance:

- Technological advancements: Improvements in battery technology lead to longer ranges and faster charging.

- Consumer preference for zero-emission vehicles: Environmental consciousness drives demand for fully electric vehicles.

- Government regulations favoring fully electric vehicles: Policies incentivize the adoption of Battery or Pure Electric vehicles over hybrids.

Germany Automotive High-Performance Electric Vehicles Industry Product Developments

Recent product innovations include the Mercedes-AMG S 63 E PERFORMANCE, showcasing advanced hybrid powertrains and high-performance battery technology. Mahle Holding Co.’s 800V electric compressor and MAHLE GmbH’s superior continuous torque (SCT) E-motor signify advancements in key vehicle components. These developments enhance vehicle performance, efficiency, and range, making high-performance EVs increasingly attractive to consumers. The focus is shifting towards improving battery technology, optimizing electric motor designs, and integrating advanced driver-assistance systems.

Report Scope & Segmentation Analysis

This report segments the German high-performance EV market by drive type (Plug-in Hybrid, Battery or Pure Electric) and vehicle type (Passenger Cars, Commercial Vehicles). Growth projections for each segment are provided, taking into account technological advancements, government policies, and consumer preferences. Competitive dynamics within each segment are also analyzed, highlighting key players and their market strategies. The market size for each segment is detailed, with projections showing significant growth for Battery or Pure Electric vehicles and Passenger Cars.

Key Drivers of Germany Automotive High-Performance Electric Vehicles Industry Growth

Several factors contribute to the growth of the German high-performance EV market: Government incentives, including subsidies and tax breaks, are driving consumer adoption. Technological breakthroughs, such as improved battery technology and faster charging infrastructure, are enhancing the practicality and desirability of EVs. Stringent emission regulations and growing environmental awareness are also significant drivers. Furthermore, increasing investment in research and development is leading to continuous product innovation.

Challenges in the Germany Automotive High-Performance Electric Vehicles Industry Sector

Challenges include the high initial cost of EVs, the limited availability of charging infrastructure in certain regions, and the dependence on critical raw materials for battery production. Supply chain disruptions can impact production, and intense competition from both domestic and international players necessitates continuous innovation and cost optimization. The challenge of achieving significant range improvements while simultaneously minimizing battery cost remains a critical hurdle.

Emerging Opportunities in Germany Automotive High-Performance Electric Vehicles Industry

Emerging opportunities include the growth of the commercial vehicle segment, the development of more affordable high-performance EVs, and the increasing integration of smart technologies and autonomous driving features. New market segments, such as high-performance electric motorcycles and delivery vehicles, offer significant potential. The focus on sustainable manufacturing practices and battery recycling also presents exciting opportunities.

Leading Players in the Germany Automotive High-Performance Electric Vehicles Industry Market

Key Developments in Germany Automotive High-Performance Electric Vehicles Industry Industry

- December 2022: Mahle Holding Co., Ltd. received new orders for its 800V electric compressor, expected to reach mass production in 2023 and 2024. This signifies growing demand for advanced components in high-performance EVs.

- December 2022: Mercedes-Benz revealed the Mercedes-AMG S 63 E PERFORMANCE, highlighting advancements in hybrid powertrains and high-performance battery technology. This showcases the trend towards luxury high-performance electric vehicles.

- July 2022: MAHLE GmbH announced a superior continuous torque (SCT) E-motor, suitable for both passenger and commercial vehicles, pointing towards enhanced efficiency and performance across various segments.

- May 2022: Meritor, Inc. acquired Siemens' Commercial Vehicles business for USD 203.3 Million, indicating increased investment in high-performance electric drive systems for the commercial vehicle segment.

Strategic Outlook for Germany Automotive High-Performance Electric Vehicles Industry Market

The future of the German high-performance EV market looks promising. Continued technological advancements, supportive government policies, and growing consumer demand will fuel market growth. The expansion of charging infrastructure and the development of innovative battery technologies will further enhance the appeal of high-performance EVs. The increasing focus on sustainability and the integration of autonomous driving features will also contribute to significant market expansion in the coming years.

Germany Automotive High-Performance Electric Vehicles Industry Segmentation

-

1. Drive Type

- 1.1. Plug-in Hybrid

- 1.2. Battery or Pure Electric

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

Germany Automotive High-Performance Electric Vehicles Industry Segmentation By Geography

- 1. Germany

Germany Automotive High-Performance Electric Vehicles Industry Regional Market Share

Geographic Coverage of Germany Automotive High-Performance Electric Vehicles Industry

Germany Automotive High-Performance Electric Vehicles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Commercial Vehicle Sales

- 3.3. Market Restrains

- 3.3.1. The Rise in demand for Electric Vehicle Sale Will Hinder the Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Popularity of Electric Vehicles in Germany will Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Automotive High-Performance Electric Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drive Type

- 5.1.1. Plug-in Hybrid

- 5.1.2. Battery or Pure Electric

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Drive Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Peugeot

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Telsa Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kia Motor Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Volkswagen AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Daimler AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nissan Motor Company Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Renault

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BMW Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mitsubishi Motors Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rimac Automobili

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ford Motor Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Peugeot

List of Figures

- Figure 1: Germany Automotive High-Performance Electric Vehicles Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Automotive High-Performance Electric Vehicles Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Automotive High-Performance Electric Vehicles Industry Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 2: Germany Automotive High-Performance Electric Vehicles Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Germany Automotive High-Performance Electric Vehicles Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Automotive High-Performance Electric Vehicles Industry Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 5: Germany Automotive High-Performance Electric Vehicles Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Germany Automotive High-Performance Electric Vehicles Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Automotive High-Performance Electric Vehicles Industry?

The projected CAGR is approximately 45%.

2. Which companies are prominent players in the Germany Automotive High-Performance Electric Vehicles Industry?

Key companies in the market include Peugeot, Telsa Inc, Kia Motor Corporation, Volkswagen AG, Daimler AG, Nissan Motor Company Ltd, Renault, BMW Group, Mitsubishi Motors Corporation, Rimac Automobili, Ford Motor Company.

3. What are the main segments of the Germany Automotive High-Performance Electric Vehicles Industry?

The market segments include Drive Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 55.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Commercial Vehicle Sales.

6. What are the notable trends driving market growth?

Increasing Popularity of Electric Vehicles in Germany will Drive the Market.

7. Are there any restraints impacting market growth?

The Rise in demand for Electric Vehicle Sale Will Hinder the Market Growth.

8. Can you provide examples of recent developments in the market?

December 2022: Mahle Holding Co., Ltd. announced that it had received new orders for its 800V electric compressor from multiple international customers (including Germany). It will be applied to high-end intelligent electric vehicle (EV) and high-performance EV brands and is expected to reach mass production in 2023 and 2024, respectively.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Automotive High-Performance Electric Vehicles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Automotive High-Performance Electric Vehicles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Automotive High-Performance Electric Vehicles Industry?

To stay informed about further developments, trends, and reports in the Germany Automotive High-Performance Electric Vehicles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence