Key Insights

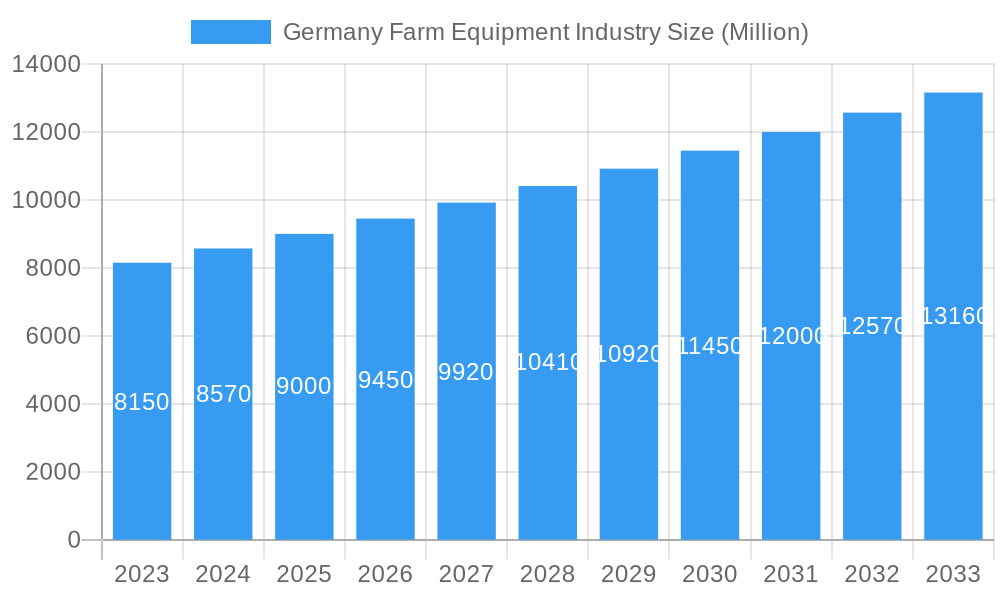

The German farm equipment industry is poised for significant growth, projected to reach a market size of approximately $9,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of 4.90% expected to drive it forward through 2033. This expansion is primarily fueled by increasing demand for advanced agricultural machinery to enhance operational efficiency and productivity, alongside the growing adoption of precision farming techniques. Investments in modernizing aging farm infrastructure and the necessity to comply with evolving environmental regulations also play a crucial role in shaping market dynamics. The trend towards sustainable agriculture and the need for equipment that minimizes resource consumption, such as intelligent irrigation systems and fuel-efficient tractors, are key drivers. Furthermore, government initiatives and subsidies aimed at supporting farmers in adopting new technologies are providing a substantial impetus to market growth.

Germany Farm Equipment Industry Market Size (In Billion)

Despite the optimistic outlook, the German farm equipment market faces certain restraints. High initial investment costs for sophisticated machinery can be a barrier for small to medium-sized farms. Additionally, the availability of skilled labor to operate and maintain advanced equipment, coupled with the complex integration of digital technologies, presents ongoing challenges. The market is also influenced by fluctuating commodity prices, which can impact farmers' purchasing power and investment decisions. Key players in this dynamic market, including FMC Corporation, Deere & Company, Kubota Corporation, and Mahindra & Mahindra Ltd, are actively innovating and expanding their product portfolios to cater to these evolving needs, focusing on areas such as autonomous farming solutions, smart sensors, and data analytics to optimize agricultural output and sustainability.

Germany Farm Equipment Industry Company Market Share

Germany Farm Equipment Industry Market Concentration & Innovation

The German farm equipment industry exhibits a moderate to high market concentration, with a few dominant global players like Deere & Company, CNH Industrial NV, AGCO Corporation, and CLAAS Group holding substantial market share. Innovation is a key differentiator, driven by the increasing demand for precision agriculture technologies, automation, and sustainable farming practices. Regulatory frameworks, particularly EU directives on emissions and safety, are significant drivers of innovation, pushing manufacturers towards developing more efficient and environmentally friendly machinery. Product substitutes, such as advanced robotics and alternative tillage methods, are emerging but currently cater to niche segments. End-user trends strongly favor smart farming solutions, data-driven decision-making, and equipment that enhances operational efficiency and reduces labor costs. Mergers and acquisition (M&A) activities are notable, with companies seeking to expand their product portfolios, technological capabilities, and geographical reach. For instance, recent M&A deals in the broader European farm equipment sector have ranged from tens of millions to hundreds of millions of Euros, consolidating market power and fostering innovation ecosystems. The German Design Awards 2023 recognizing New Holland Agriculture's Straddle tractor concept exemplifies the focus on innovative design meeting specific agricultural needs, such as narrow vineyard operations.

Germany Farm Equipment Industry Industry Trends & Insights

The Germany Farm Equipment Industry is poised for significant growth driven by the imperative for enhanced agricultural productivity and sustainability. The market is characterized by a strong emphasis on technological advancements, including the integration of Artificial Intelligence (AI), the Internet of Things (IoT), and robotics into farm machinery. This surge in technological adoption is aimed at optimizing resource utilization, minimizing environmental impact, and addressing the growing labor shortage in the agricultural sector. Consumer preferences are shifting towards smart farming solutions that offer precise application of inputs, real-time monitoring, and automated operations. Farmers are increasingly investing in GPS-guided tractors, drone technology for crop monitoring, and intelligent harvesting systems to improve yields and reduce operational costs. The competitive landscape is dynamic, with established players continuously innovating and smaller, specialized technology firms emerging as significant disruptors. The Compound Annual Growth Rate (CAGR) for the German farm equipment market is projected to be between 4.5% and 6.0% over the forecast period. Market penetration of advanced technologies, particularly in areas like precision spraying and autonomous operations, is expected to rise substantially, from an estimated 15% in 2025 to over 30% by 2033. The increasing adoption of data analytics for farm management further fuels the demand for integrated equipment solutions. German farmers, renowned for their progressive adoption of new technologies, are at the forefront of this transformation, demanding sophisticated and efficient machinery. The push towards organic farming and reduced chemical usage is also a key trend, necessitating specialized equipment for sustainable practices.

Dominant Markets & Segments in Germany Farm Equipment Industry

The German farm equipment market is dominated by tractors and harvesting machinery, reflecting the country's sophisticated agricultural practices and the need for efficient crop production.

Production Analysis: Germany is a leading producer of high-quality farm equipment, with a strong emphasis on innovation and engineering excellence. Key production hubs are concentrated in regions with a strong manufacturing base, supported by robust supply chains and skilled labor. Government incentives for agricultural modernization and a focus on export markets contribute to high production volumes.

Consumption Analysis: Consumption is driven by the need for advanced machinery to maintain high productivity levels across diverse agricultural landscapes. The adoption of precision agriculture technologies is a significant consumer trend, with farmers investing in smart solutions to optimize yields and reduce input costs. Large-scale agricultural enterprises and specialized crop producers are key consumers, demanding equipment that offers versatility and efficiency.

Import Market Analysis (Value & Volume): Germany imports a considerable volume and value of specialized farm equipment that may not be produced domestically or where international suppliers offer competitive pricing or unique technological advantages. Imports often include components for machinery assembly and specific types of automated systems. In 2023, the import value of farm machinery and parts to Germany was estimated at over €5,000 Million, with a significant portion originating from other European Union countries.

Export Market Analysis (Value & Volume): Germany is a major exporter of farm equipment, renowned for its quality and technological sophistication. Key export markets include other EU nations, North America, and Asia. The export value of German farm equipment in 2023 surpassed €10,000 Million, highlighting the global competitiveness of its manufacturers. Growth in export markets is driven by increasing global demand for efficient agricultural solutions and Germany's reputation for engineering prowess.

Price Trend Analysis: Price trends are influenced by factors such as technological complexity, raw material costs, currency fluctuations, and the overall demand-supply dynamics. Advanced machinery with integrated digital solutions commands premium pricing. The average price of a new tractor in Germany has seen an upward trend, likely in the range of 5% to 8% annually over the historical period, driven by enhanced features and technological integrations. The Straddle tractor concept for narrow vineyards signifies a niche but high-value segment where innovative design justifies premium pricing.

Germany Farm Equipment Industry Product Developments

Recent product developments in the German farm equipment industry are characterized by a strong focus on automation, precision farming, and sustainability. Innovations include advanced autonomous tractors capable of performing complex tasks with minimal human intervention, smart sensor technologies for real-time crop and soil monitoring, and energy-efficient machinery that reduces carbon footprints. New Holland Agriculture's Straddle tractor concept, recognized for its "Excellent Product Design," exemplifies innovation tailored for specific challenges like narrow vineyard cultivation, showcasing a seamless blend of form and function for high-value agriculture. These developments aim to enhance operational efficiency, reduce reliance on manual labor, and promote environmentally responsible farming practices, offering significant competitive advantages to early adopters.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Germany Farm Equipment Industry, segmented across crucial areas including Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. Each segment offers detailed insights into market dynamics from 2019 to 2033, with a base year of 2025. The Production Analysis segment forecasts a growth of approximately 3-4% annually, driven by technological advancements. Consumption Analysis projects a CAGR of 4-5%, fueled by the adoption of smart farming. The Import Market is expected to grow at 2-3%, focusing on specialized equipment, while the Export Market is anticipated to expand at 5-6%, capitalizing on global demand. Price Trend Analysis indicates a steady increase of 4-7% annually for technologically advanced machinery.

Key Drivers of Germany Farm Equipment Industry Growth

The growth of the Germany Farm Equipment Industry is propelled by several key drivers.

- Technological Advancements: The relentless pursuit of precision agriculture, automation, and digitalization, including AI and IoT integration, is paramount.

- Government Policies and Subsidies: EU and national agricultural policies encouraging modernization, efficiency, and sustainability provide significant financial and regulatory impetus.

- Increasing Labor Shortages: The need for automated and efficient machinery to compensate for a shrinking agricultural workforce is a critical driver.

- Demand for Increased Food Production: Growing global and domestic demand for food necessitates higher agricultural productivity, which farm equipment directly enables.

- Focus on Sustainability: Environmental regulations and consumer preferences are pushing for equipment that minimizes resource usage and environmental impact.

Challenges in the Germany Farm Equipment Industry Sector

Despite robust growth prospects, the Germany Farm Equipment Industry faces several challenges.

- High Initial Investment Costs: Advanced machinery with sophisticated technologies requires substantial capital expenditure, posing a barrier for some farmers.

- Skilled Labor Shortage for Operation and Maintenance: The complexity of modern equipment necessitates a skilled workforce for effective operation and maintenance.

- Supply Chain Disruptions: Global events and geopolitical factors can lead to delays and increased costs in the supply of components and finished goods.

- Cybersecurity Risks: Increased connectivity of farm equipment raises concerns about data security and potential cyber threats.

- Regulatory Compliance: Navigating evolving environmental and safety regulations, while driving innovation, can also add complexity and cost.

Emerging Opportunities in Germany Farm Equipment Industry

The Germany Farm Equipment Industry is ripe with emerging opportunities.

- Autonomous Farming Solutions: The development and adoption of fully autonomous tractors and robotic systems represent a significant growth frontier.

- Data Analytics and AI-Powered Solutions: Leveraging big data for predictive maintenance, optimized resource allocation, and yield forecasting offers immense value.

- Sustainable and Bio-Based Equipment: Growing demand for environmentally friendly machinery, including electric and hydrogen-powered options, presents a nascent but expanding market.

- Precision Viticulture and Horticulture Equipment: Tailored solutions for high-value crop sectors, like the New Holland Straddle tractor concept, cater to specialized and profitable niches.

- After-Sales Services and Digital Support: Offering advanced telematics, remote diagnostics, and comprehensive digital support packages can create new revenue streams and enhance customer loyalty.

Leading Players in the Germany Farm Equipment Industry Market

- FMC Corporation

- Deere & Company

- Kubota Corporation

- Tractors and Farm Equipment Limited

- CLAAS Group

- AGCO Corporation

- CNH Industrial NV

- Mahindra & Mahindra Ltd

- Valent Biosciences Corporation

Key Developments in Germany Farm Equipment Industry Industry

- December 2022: The Straddle tractor concept from New Holland Agriculture, a global brand of CNH Industrial, won the gold medal for "Excellent Product Design" at the German Design Awards 2023. This award, presented by the German Design Council (GDC), recognizes outstanding innovation and the seamless integration of form and function. New Holland collaborated with Pininfarina to develop the concept, specifically addressing the challenges of narrow vineyards (rows less than 1.5 meters wide) often situated on steep slopes, crucial for producing high-quality, high-value wines.

- March 2022: According to data analyzed by the Verband Deutscher Maschinen- und Anlagenbau (VDMA), the German engineering industry trade body, farmers and custom operators in Germany purchased approximately 24,800 tractor units. This figure from the country's road vehicle registrations authority indicates robust demand for agricultural machinery in the German market.

Strategic Outlook for Germany Farm Equipment Industry Market

The strategic outlook for the Germany Farm Equipment Industry is highly promising, driven by an unwavering commitment to technological innovation and agricultural efficiency. The increasing adoption of smart farming technologies, coupled with governmental support for sustainable agricultural practices, will continue to fuel market expansion. Focus on automation, precision agriculture, and data-driven solutions will remain central to competitive advantage. Opportunities lie in developing advanced robotics, AI-powered farm management systems, and eco-friendly machinery. Strategic partnerships and acquisitions are expected to play a crucial role in consolidating market share and expanding technological capabilities. The industry is well-positioned to meet the evolving demands of modern agriculture, both domestically and on the global stage, by embracing digital transformation and sustainability.

Germany Farm Equipment Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Germany Farm Equipment Industry Segmentation By Geography

- 1. Germany

Germany Farm Equipment Industry Regional Market Share

Geographic Coverage of Germany Farm Equipment Industry

Germany Farm Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization

- 3.3. Market Restrains

- 3.3.1. Heavy Initial Procurement Cost and High Expenditure on Maintenance

- 3.4. Market Trends

- 3.4.1. Increasing Agricultural Labour Cost

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Farm Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 FMC Corporatio

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Deere & Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kubota Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tractors and Farm Equipment Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CLAAS Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AGCO Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CNH Industrial NV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mahindra & Mahindra Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Valent Biosciences Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 FMC Corporatio

List of Figures

- Figure 1: Germany Farm Equipment Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Germany Farm Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Farm Equipment Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Germany Farm Equipment Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Germany Farm Equipment Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Germany Farm Equipment Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Germany Farm Equipment Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Germany Farm Equipment Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Germany Farm Equipment Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Germany Farm Equipment Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Germany Farm Equipment Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Germany Farm Equipment Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Germany Farm Equipment Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Germany Farm Equipment Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Farm Equipment Industry?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the Germany Farm Equipment Industry?

Key companies in the market include FMC Corporatio, Deere & Company, Kubota Corporation, Tractors and Farm Equipment Limited, CLAAS Group, AGCO Corporation, CNH Industrial NV, Mahindra & Mahindra Ltd, Valent Biosciences Corporation.

3. What are the main segments of the Germany Farm Equipment Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization.

6. What are the notable trends driving market growth?

Increasing Agricultural Labour Cost.

7. Are there any restraints impacting market growth?

Heavy Initial Procurement Cost and High Expenditure on Maintenance.

8. Can you provide examples of recent developments in the market?

December 2022: The Straddle tractor concept from New Holland Agriculture, a global brand of CNH Industrial, won the gold medal for "Excellent Product Design" at the German Design Awards 2023. The German Design Council (GDC) gives this prestigious award to products that display outstanding innovation and a seamless marriage of form and function. New Holland collaborated with the internationally renowned design firm Pininfarina to create the Straddle tractor concept. The tractor is intended to address the challenging constraints posed by narrow vineyards, known for producing high-quality, high-value wines from grapes grown in rows less than 1.5 meters wide, often on steep slopes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Farm Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Farm Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Farm Equipment Industry?

To stay informed about further developments, trends, and reports in the Germany Farm Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence