Key Insights

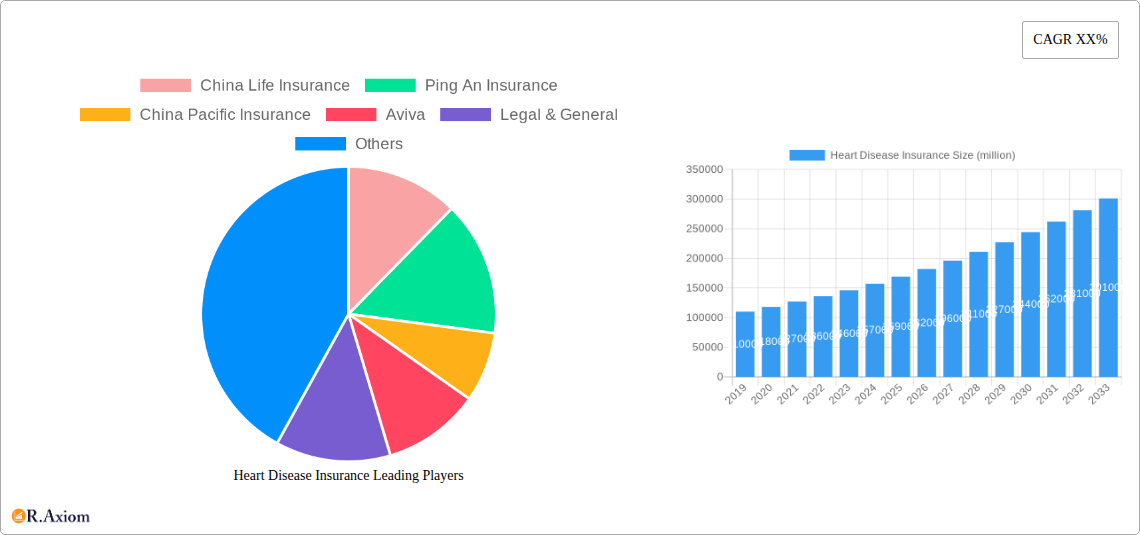

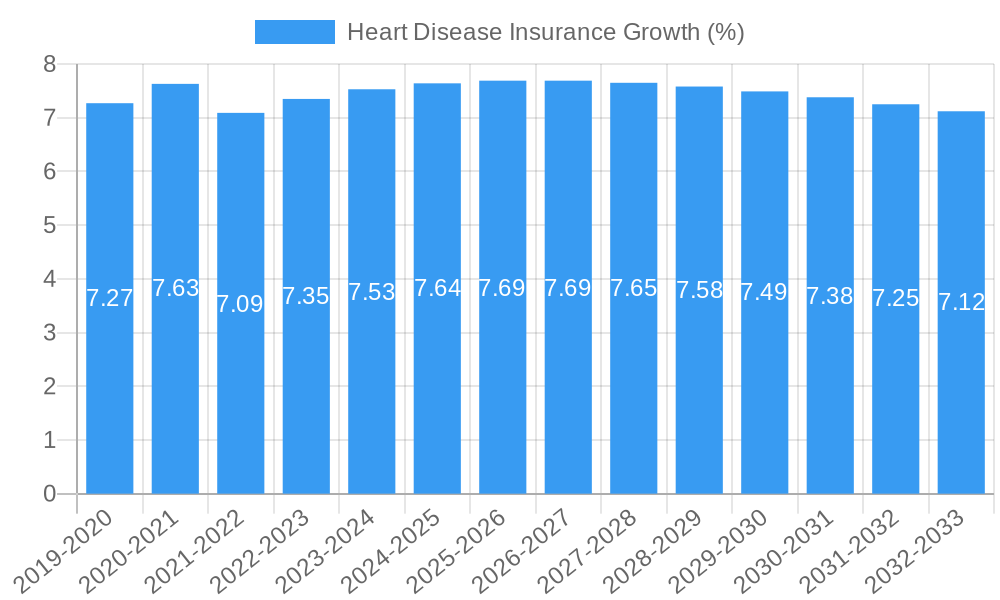

The global Heart Disease Insurance market is poised for significant expansion, projected to reach a market size of approximately $200 billion by 2033, driven by a Compound Annual Growth Rate (CAGR) of around 8% from 2025. This robust growth trajectory is underpinned by a confluence of escalating healthcare expenditures, a rising global prevalence of cardiovascular diseases, and increasing consumer awareness regarding the financial protection offered by specialized insurance products. As populations age and lifestyle-related health issues become more pronounced, the demand for comprehensive heart disease coverage, encompassing conditions like heart bypass surgery and heart attacks, is expected to surge. The market's expansion will be further fueled by product innovation, with insurers increasingly offering tailored policies that address specific risk factors and treatment needs, making these plans more attractive and accessible to a broader demographic.

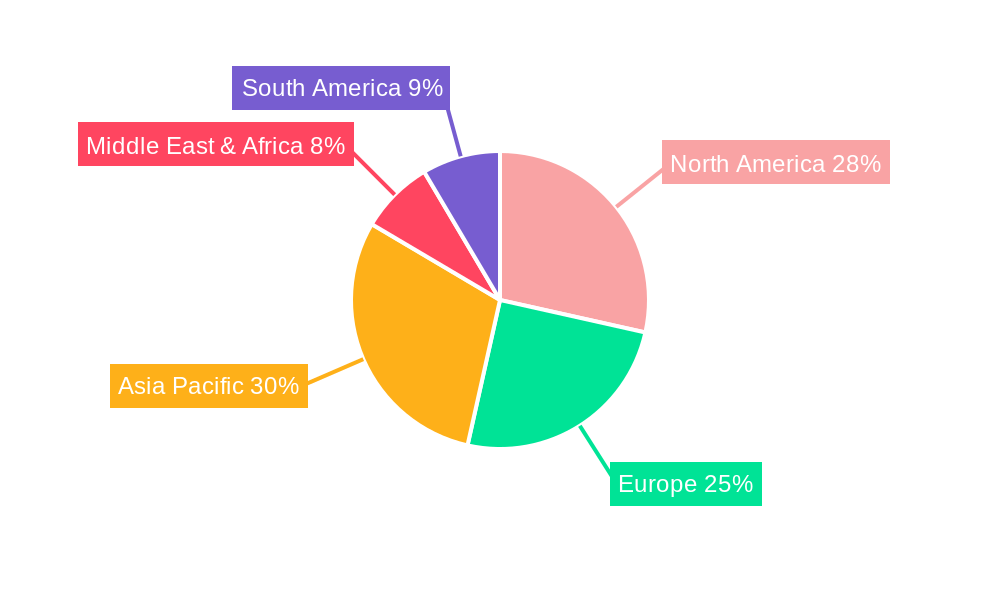

The market's dynamism is further shaped by key drivers such as advancements in medical technology, which enable more effective treatments and diagnostics, thus increasing the perceived value of insurance. Conversely, factors like the high cost of premiums in certain regions and the complexity of policy terms can act as restraints. However, strategic initiatives by insurance providers to simplify offerings and promote financial literacy are expected to mitigate these challenges. The Asia Pacific region, particularly China and India, is anticipated to be a major growth engine due to rapidly expanding economies, growing middle-class populations, and increasing access to healthcare services. North America and Europe will continue to represent substantial markets, characterized by mature insurance penetration and a focus on advanced treatment coverage. The competitive landscape is dominated by well-established global players like Ping An Insurance, China Life Insurance, and UnitedHealthcare, alongside regional leaders, all vying for market share through diverse product portfolios and strategic partnerships.

This in-depth report provides a thorough analysis of the global Heart Disease Insurance market, encompassing market concentration, innovation, industry trends, dominant segments, product developments, growth drivers, challenges, and emerging opportunities. The study leverages a robust methodology covering the historical period from 2019 to 2024, with the base year at 2025 and a forecast period extending to 2033. It offers actionable insights for industry stakeholders, including insurers, reinsurers, investors, and policymakers, aiming to navigate this critical and evolving sector. The report includes a detailed market segmentation by application (Children, Adult) and by type of heart disease covered (Heart Bypass, Heart Attack), and examines the strategies of key players such as China Life Insurance, Ping An Insurance, China Pacific Insurance, Aviva, Legal & General, New China Life Insurance, AXA, Prudential plc, Aegon, Allianz, AIG, UnitedHealthcare, Zurich, MetLife, Dai-ichi Life Group, Sun Life Financial, Huaxia life Insurance, Aflac, Liberty Mutual, and HCF.

Heart Disease Insurance Market Concentration & Innovation

The Heart Disease Insurance market exhibits a moderate concentration, with leading players like China Life Insurance and Ping An Insurance holding significant market shares, estimated to be over 20% combined. Innovation is a key driver, fueled by advancements in medical technology and a growing understanding of cardiovascular health. Regulatory frameworks, while providing a stable operating environment, also present a barrier to entry for new participants. Product substitutes, such as comprehensive critical illness policies and general health insurance, pose a constant competitive threat. End-user trends are shifting towards personalized policies and preventive care integration. Mergers and acquisitions (M&A) are shaping the market landscape, with an estimated total deal value of over 500 million in the historical period, indicating consolidation and strategic expansion.

- Market Share of Top 3 Players: Estimated at over 30%

- Innovation Drivers: AI-powered risk assessment, wearable device integration, personalized wellness programs.

- Regulatory Frameworks: Stringent solvency requirements, product approval processes.

- Product Substitutes: Critical Illness Insurance, Universal Life Insurance with riders.

- End-User Trends: Demand for preventative care, mental health integration, flexible premium options.

- M&A Deal Value (Historical): Over 500 million

Heart Disease Insurance Industry Trends & Insights

The Heart Disease Insurance industry is poised for robust growth, driven by an aging global population and the increasing prevalence of cardiovascular diseases. The Compound Annual Growth Rate (CAGR) for the market is projected to be approximately 7.5% during the forecast period. Market penetration remains relatively low in emerging economies, presenting a significant untapped potential. Technological disruptions, including tele-health, remote monitoring, and predictive analytics, are revolutionizing underwriting and claims processing, leading to greater efficiency and personalized customer experiences. Consumer preferences are evolving towards policies that offer holistic wellness support, early detection benefits, and financial protection against severe cardiac events. Competitive dynamics are intensifying as insurers strive to differentiate through innovative product features, enhanced customer service, and strategic partnerships. The industry is also witnessing a surge in demand for specialized heart disease coverage, reflecting the growing awareness and concern surrounding these conditions. The rising healthcare costs associated with treating heart conditions further underscore the importance and demand for dedicated insurance solutions.

- Projected CAGR (2025-2033): 7.5%

- Market Penetration (Global Average): Estimated at 15%

- Technological Disruptions: AI for risk assessment, IoT for remote patient monitoring, blockchain for claims transparency.

- Consumer Preferences: Demand for wellness incentives, preventative screenings, mental health support, flexible payment plans.

- Competitive Dynamics: Increased product innovation, focus on customer engagement, strategic alliances with healthcare providers.

Dominant Markets & Segments in Heart Disease Insurance

The Adult segment is overwhelmingly dominant in the Heart Disease Insurance market, accounting for an estimated 90% of the total market size, primarily due to the higher incidence of heart disease in older demographics. Within this segment, Heart Attack coverage represents the largest sub-segment, driven by its widespread recognition and the significant financial burden associated with treatment. North America and Europe are currently the leading geographic regions, with an estimated market share of over 60% combined, owing to advanced healthcare infrastructure, higher disposable incomes, and greater awareness of insurance needs. However, the Asia-Pacific region is witnessing the fastest growth, projected to grow at a CAGR of over 9%, fueled by rising living standards, increasing healthcare expenditure, and a growing middle class. Economic policies in these regions, such as government initiatives promoting health insurance, are also contributing to market expansion. Infrastructure development in healthcare facilities and technological adoption are further strengthening the market.

- Dominant Application Segment: Adult (Estimated 90% market share)

- Dominant Type of Coverage: Heart Attack (Estimated 70% of coverage types)

- Leading Regions: North America and Europe (Combined over 60% market share)

- Fastest Growing Region: Asia-Pacific (Projected CAGR over 9%)

- Key Drivers of Regional Dominance/Growth:

- North America/Europe: High disposable income, advanced healthcare systems, established insurance markets, strong public health awareness campaigns.

- Asia-Pacific: Rapid economic growth, increasing urbanization, rising healthcare expenditure, growing middle class, government push for insurance penetration.

- Infrastructure Impact: Development of advanced cardiac care units, availability of specialized medical professionals.

- Economic Policy Influence: Tax benefits on insurance premiums, subsidized health insurance schemes.

Heart Disease Insurance Product Developments

Product innovation in Heart Disease Insurance is primarily focused on enhancing coverage inclusivity and customer value. Insurers are increasingly incorporating preventive care benefits, such as annual cardiac check-ups and wellness program discounts, into their policies. Technological integration, including remote health monitoring and AI-driven personalized risk assessments, is a key competitive advantage, allowing for more accurate underwriting and proactive health management. The competitive landscape is characterized by a race to offer comprehensive packages that address the multifaceted needs of individuals at risk of or diagnosed with heart conditions, differentiating through advanced features and wider applicability.

- Key Innovation Areas: Preventive care benefits, wellness program integration, tele-health services, AI-powered risk assessment.

- Competitive Advantage: Enhanced customer engagement, personalized policy offerings, early detection support.

- Market Fit: Addressing a growing demand for proactive health management and comprehensive financial protection.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Heart Disease Insurance market segmented by Application and Type. The Adult segment, projected to grow at a CAGR of 7.2%, encompasses individuals aged 18 and above, representing the largest market share estimated at 1.2 million policies in the base year. The Children segment, while smaller, is expected to exhibit a higher CAGR of 8.5%, driven by increasing awareness of congenital heart defects and proactive family health planning, with an estimated market size of 50,000 policies in the base year.

Within the coverage types, Heart Attack insurance is projected to grow at 7.0%, holding the largest market share, estimated at 1.1 million policies in the base year, due to the high incidence and treatment costs. Heart Bypass surgery coverage, projected to grow at 7.8%, represents a significant niche, with an estimated market size of 150,000 policies in the base year, reflecting the specialized nature of this intervention and its associated expenses.

- Adult Segment: CAGR of 7.2%, Base Year Market Size of 1.2 million policies.

- Children Segment: CAGR of 8.5%, Base Year Market Size of 50,000 policies.

- Heart Attack Coverage: CAGR of 7.0%, Base Year Market Size of 1.1 million policies.

- Heart Bypass Coverage: CAGR of 7.8%, Base Year Market Size of 150,000 policies.

Key Drivers of Heart Disease Insurance Growth

The growth of the Heart Disease Insurance market is propelled by several key factors. Technologically driven advancements in diagnostics and treatment have led to better patient outcomes but also increased healthcare costs, necessitating robust insurance coverage. The aging global population is a significant demographic driver, as the risk of heart disease escalates with age. Furthermore, increasing health awareness and education campaigns are prompting individuals to proactively seek financial protection against critical illnesses. Supportive government policies, including tax incentives for insurance purchases and initiatives promoting public health, further stimulate market expansion.

- Technological Advancements: Improved diagnostic tools and treatment methods lead to higher medical costs.

- Demographic Shifts: Growing elderly population with a higher propensity for cardiovascular issues.

- Increased Health Awareness: Greater consumer understanding of the risks and financial implications of heart disease.

- Government Policies: Tax benefits, subsidies, and public health initiatives encouraging insurance uptake.

Challenges in the Heart Disease Insurance Sector

Despite its growth potential, the Heart Disease Insurance sector faces several challenges. Stringent regulatory environments in some regions can lead to higher compliance costs and slower product innovation cycles. The rising cost of healthcare, while driving demand, also puts pressure on insurers to maintain profitability. Emerging challenges include the increasing prevalence of lifestyle-related diseases and the need for sophisticated underwriting models to accurately assess risk in a diverse population. Intense competition among established players and the emergence of insurtech startups also pose competitive pressures, necessitating continuous adaptation and value proposition enhancement.

- Regulatory Hurdles: Complex approval processes and varying solvency requirements across jurisdictions.

- Rising Healthcare Costs: Escalating medical expenses can strain insurer profitability.

- Lifestyle Disease Trends: Increasing incidence of obesity, diabetes, and hypertension impacting risk profiles.

- Competitive Pressures: Intense market competition and the rise of innovative Insurtech players.

Emerging Opportunities in Heart Disease Insurance

Emerging opportunities in the Heart Disease Insurance market lie in the untapped potential of developing economies, where market penetration is still low. The integration of wearable technology and AI for continuous health monitoring presents a significant opportunity for personalized insurance products and proactive risk management. Furthermore, there is a growing consumer demand for holistic wellness solutions that extend beyond traditional medical coverage, creating opportunities for insurers to partner with wellness providers and offer integrated health and insurance packages. The development of specialized insurance products tailored to specific demographic groups or at-risk populations also represents a promising avenue for growth.

- Untapped Markets: Significant growth potential in emerging economies with low insurance penetration.

- Technological Integration: Leveraging wearables and AI for personalized health management and risk assessment.

- Holistic Wellness Solutions: Bundling insurance with preventive health and wellness services.

- Niche Product Development: Tailored policies for specific demographics and high-risk groups.

Leading Players in the Heart Disease Insurance Market

- China Life Insurance

- Ping An Insurance

- China Pacific Insurance

- Aviva

- Legal & General

- New China Life Insurance

- AXA

- Prudential plc

- Aegon

- Allianz

- AIG

- UnitedHealthcare

- Zurich

- MetLife

- Dai-ichi Life Group

- Sun Life Financial

- Huaxia life Insurance

- Aflac

- Liberty Mutual

- HCF

Key Developments in Heart Disease Insurance Industry

- 2023/08: Ping An Insurance launches a new critical illness policy with enhanced coverage for cardiovascular events, incorporating AI-driven health risk assessment tools.

- 2023/06: Aviva partners with a leading telehealth provider to offer remote consultations and personalized health advice for policyholders, focusing on cardiovascular health management.

- 2022/12: AXA announces a significant investment in digital health startups to accelerate innovation in predictive analytics for heart disease risk.

- 2022/09: China Life Insurance expands its product portfolio to include specialized insurance for children's congenital heart conditions, addressing a growing market need.

- 2021/05: Allianz introduces a new wellness program for its policyholders, offering incentives for maintaining healthy lifestyles to reduce the risk of heart disease.

- 2020/11: UnitedHealthcare enhances its existing heart disease insurance plans with expanded coverage for cardiac rehabilitation services and mental health support.

- 2019/07: Prudential plc establishes a dedicated research unit to study the impact of environmental factors on cardiovascular health and inform product development.

Strategic Outlook for Heart Disease Insurance Market

- 2023/08: Ping An Insurance launches a new critical illness policy with enhanced coverage for cardiovascular events, incorporating AI-driven health risk assessment tools.

- 2023/06: Aviva partners with a leading telehealth provider to offer remote consultations and personalized health advice for policyholders, focusing on cardiovascular health management.

- 2022/12: AXA announces a significant investment in digital health startups to accelerate innovation in predictive analytics for heart disease risk.

- 2022/09: China Life Insurance expands its product portfolio to include specialized insurance for children's congenital heart conditions, addressing a growing market need.

- 2021/05: Allianz introduces a new wellness program for its policyholders, offering incentives for maintaining healthy lifestyles to reduce the risk of heart disease.

- 2020/11: UnitedHealthcare enhances its existing heart disease insurance plans with expanded coverage for cardiac rehabilitation services and mental health support.

- 2019/07: Prudential plc establishes a dedicated research unit to study the impact of environmental factors on cardiovascular health and inform product development.

Strategic Outlook for Heart Disease Insurance Market

The strategic outlook for the Heart Disease Insurance market remains exceptionally strong, driven by escalating healthcare needs and evolving consumer expectations. Future growth will be characterized by deeper integration of technology for personalized risk assessment and proactive health management, alongside a continued focus on expanding coverage to underserved populations. Insurers who can effectively leverage data analytics, offer comprehensive wellness programs, and adapt to dynamic regulatory landscapes will be best positioned for success. Strategic partnerships with healthcare providers and a commitment to customer-centric product innovation will be paramount in capturing market share and ensuring long-term viability in this vital sector.

Heart Disease Insurance Segmentation

-

1. Application

- 1.1. Children

- 1.2. Adult

-

2. Types

- 2.1. Heart Bypass

- 2.2. Heart Attack

Heart Disease Insurance Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Heart Disease Insurance REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Heart Disease Insurance Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Children

- 5.1.2. Adult

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Heart Bypass

- 5.2.2. Heart Attack

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Heart Disease Insurance Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Children

- 6.1.2. Adult

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Heart Bypass

- 6.2.2. Heart Attack

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Heart Disease Insurance Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Children

- 7.1.2. Adult

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Heart Bypass

- 7.2.2. Heart Attack

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Heart Disease Insurance Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Children

- 8.1.2. Adult

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Heart Bypass

- 8.2.2. Heart Attack

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Heart Disease Insurance Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Children

- 9.1.2. Adult

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Heart Bypass

- 9.2.2. Heart Attack

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Heart Disease Insurance Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Children

- 10.1.2. Adult

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Heart Bypass

- 10.2.2. Heart Attack

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 China Life Insurance

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ping An Insurance

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 China Pacific Insurance

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aviva

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Legal & General

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 New China Life Insurance

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AXA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Prudential plc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aegon

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Allianz

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AIG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 UnitedHealthcare

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Zurich

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 MetLife

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Dai-ichi Life Group

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Sun Life Financial

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Huaxia life Insurance

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Aflac

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Liberty Mutual

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 HCF

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 China Life Insurance

List of Figures

- Figure 1: Global Heart Disease Insurance Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Heart Disease Insurance Revenue (million), by Application 2024 & 2032

- Figure 3: North America Heart Disease Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Heart Disease Insurance Revenue (million), by Types 2024 & 2032

- Figure 5: North America Heart Disease Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Heart Disease Insurance Revenue (million), by Country 2024 & 2032

- Figure 7: North America Heart Disease Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Heart Disease Insurance Revenue (million), by Application 2024 & 2032

- Figure 9: South America Heart Disease Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Heart Disease Insurance Revenue (million), by Types 2024 & 2032

- Figure 11: South America Heart Disease Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Heart Disease Insurance Revenue (million), by Country 2024 & 2032

- Figure 13: South America Heart Disease Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Heart Disease Insurance Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Heart Disease Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Heart Disease Insurance Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Heart Disease Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Heart Disease Insurance Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Heart Disease Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Heart Disease Insurance Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Heart Disease Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Heart Disease Insurance Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Heart Disease Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Heart Disease Insurance Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Heart Disease Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Heart Disease Insurance Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Heart Disease Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Heart Disease Insurance Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Heart Disease Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Heart Disease Insurance Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Heart Disease Insurance Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Heart Disease Insurance Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Heart Disease Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Heart Disease Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Heart Disease Insurance Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Heart Disease Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Heart Disease Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Heart Disease Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Heart Disease Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Heart Disease Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Heart Disease Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Heart Disease Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Heart Disease Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Heart Disease Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Heart Disease Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Heart Disease Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Heart Disease Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Heart Disease Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Heart Disease Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Heart Disease Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Heart Disease Insurance Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Heart Disease Insurance?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Heart Disease Insurance?

Key companies in the market include China Life Insurance, Ping An Insurance, China Pacific Insurance, Aviva, Legal & General, New China Life Insurance, AXA, Prudential plc, Aegon, Allianz, AIG, UnitedHealthcare, Zurich, MetLife, Dai-ichi Life Group, Sun Life Financial, Huaxia life Insurance, Aflac, Liberty Mutual, HCF.

3. What are the main segments of the Heart Disease Insurance?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Heart Disease Insurance," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Heart Disease Insurance report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Heart Disease Insurance?

To stay informed about further developments, trends, and reports in the Heart Disease Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence