Key Insights

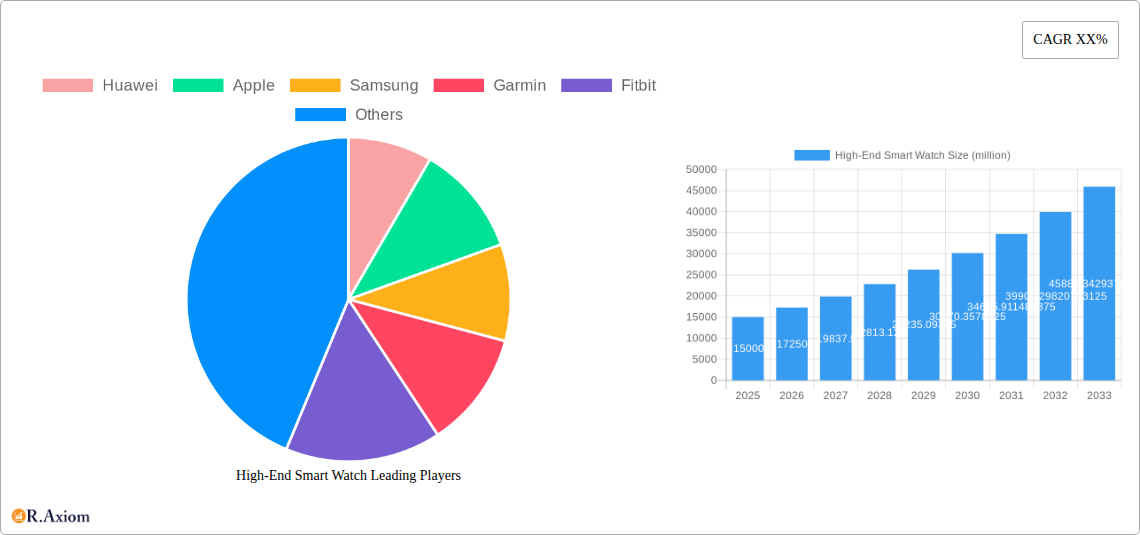

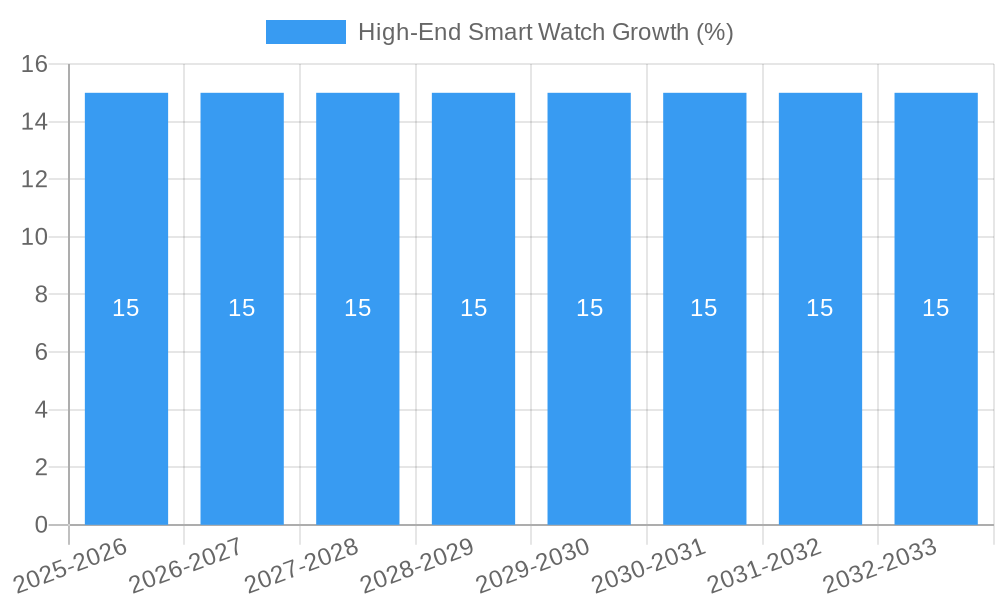

The high-end smartwatch market is poised for significant expansion, projected to reach an estimated market size of $15,000 million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 15% anticipated from 2025 to 2033. This robust growth is fueled by a confluence of factors, chief among them the increasing consumer demand for sophisticated wearable technology that seamlessly integrates with their digital lives. The core drivers include the rising disposable incomes, particularly in emerging economies, and a growing awareness of the health and fitness benefits offered by advanced smartwatch features like continuous heart rate monitoring, sleep tracking, and blood oxygen saturation measurement. Furthermore, the continuous innovation by leading tech giants such as Apple, Samsung, and Huawei, who are consistently introducing premium models with enhanced functionalities, superior design aesthetics, and greater ecosystem integration, is a pivotal catalyst for market expansion. The appeal extends beyond mere functionality, encompassing a desire for status symbols and personal expression through technologically advanced accessories.

The high-end smartwatch landscape is characterized by a dynamic segmentation, with Android and iOS system smartwatches dominating the market, catering to the vast user bases of their respective mobile ecosystems. Offline sales still hold a significant share, driven by the tangible experience and expert advice available in retail stores, though online sales are rapidly gaining momentum due to convenience and competitive pricing. Key restraints to even more rapid growth include the high price points of premium devices, which can be a barrier for some consumers, and the relatively shorter upgrade cycles compared to other personal electronics, leading to potential saturation in certain segments. However, the ongoing technological advancements, such as improved battery life, enhanced durability, and the integration of more advanced health sensors and AI-powered features, are expected to mitigate these restraints. The market is also witnessing a trend towards specialization, with smartwatches catering to specific niche applications like extreme sports, professional diving, or advanced medical monitoring, further diversifying the offerings and attracting a wider customer base within the premium segment.

High-End Smart Watch Market Concentration & Innovation

The high-end smartwatch market is characterized by a moderate concentration, with a few dominant players holding substantial market share, estimated to be over $50 billion in 2025. Innovation serves as the primary catalyst for growth, driven by advancements in wearable technology, health monitoring sensors, AI integration, and sophisticated display technologies. Key innovation drivers include the miniaturization of components, enhanced battery life, and the development of seamless integration with other smart devices and ecosystems. Regulatory frameworks, while still evolving, are increasingly focusing on data privacy and security, impacting product development and market entry strategies. Product substitutes, such as advanced fitness trackers and traditional luxury watches with limited smart functionalities, present a mild competitive threat. End-user trends indicate a growing demand for smartwatches that offer comprehensive health and wellness tracking, personalized insights, and premium design aesthetics. Merger and acquisition (M&A) activities in the high-end segment are moderately active, with strategic acquisitions aimed at consolidating market share and acquiring innovative technologies. Estimated M&A deal values are projected to reach several hundred million dollars annually, signaling a dynamic and consolidating market.

- Market Share Dominance: Top players like Apple, Samsung, and Huawei collectively hold over 70% of the market share by value in 2025.

- Innovation Hotspots: Focus areas include advanced ECG sensors, blood oxygen monitoring, contactless payment capabilities, and extended battery life solutions.

- Regulatory Impact: Evolving data privacy laws (e.g., GDPR, CCPA) necessitate robust data security measures and transparent user policies.

- M&A Drivers: Acquisitions are primarily driven by the need to secure intellectual property in areas like health sensors, AI algorithms, and novel operating systems.

High-End Smart Watch Industry Trends & Insights

The high-end smartwatch industry is experiencing robust growth, fueled by a confluence of technological advancements, shifting consumer preferences, and an increasing awareness of health and wellness. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15% during the forecast period of 2025–2033. Market penetration, particularly in developed economies, continues to rise, with an estimated 45% of the target demographic owning a high-end smartwatch by 2025. Technological disruptions are at the forefront, with the integration of advanced biometric sensors for continuous health monitoring, including ECG, SpO2, and even non-invasive blood glucose monitoring in the pipeline, driving significant adoption. The pursuit of seamless integration with the broader Internet of Things (IoT) ecosystem, enabling smart home control and enhanced personal productivity, is another critical trend. Consumer preferences are evolving beyond basic notification delivery; users now demand sophisticated health insights, personalized coaching, advanced fitness tracking, and premium design that aligns with their lifestyle and status. The competitive landscape is intense, characterized by fierce innovation races and strategic marketing campaigns from established tech giants and luxury watchmakers. Companies like Huawei, Apple, Samsung, and Garmin are consistently pushing the boundaries with new feature sets and aesthetic designs. The increasing adoption of AI and machine learning algorithms for personalized health recommendations and predictive analytics is also a significant trend shaping consumer engagement and product differentiation. Furthermore, the growing focus on mental wellness, with features like stress tracking and guided meditation, is expanding the appeal of high-end smartwatches to a wider audience. The durability and premium materials used in these devices also contribute to their appeal among discerning consumers. The shift towards online sales channels, facilitated by e-commerce platforms and direct-to-consumer strategies, is growing, though offline sales in premium retail environments continue to hold a significant share. The development of more intuitive user interfaces and the expansion of app ecosystems further enhance the value proposition of high-end smartwatches. The historical period of 2019–2024 saw steady growth, with early adopters and tech enthusiasts driving initial demand. The base year of 2025 represents a significant inflection point, with mass-market adoption accelerating due to improved affordability and a wider range of compelling features. The estimated year of 2025 reflects this accelerated growth trajectory.

- Market Growth Drivers: Increasing disposable income, rising health consciousness, the proliferation of smartphones, and the demand for connected lifestyle devices.

- Technological Disruptions: Advanced AI for personalized insights, miniaturized health sensors, 5G connectivity for faster data transfer, and improved battery efficiency.

- Consumer Preferences: Desire for premium design, comprehensive health and fitness tracking, seamless ecosystem integration, and enhanced personal safety features.

- Competitive Dynamics: Intense rivalry between tech giants and traditional luxury brands, with a focus on feature innovation, brand perception, and ecosystem lock-in.

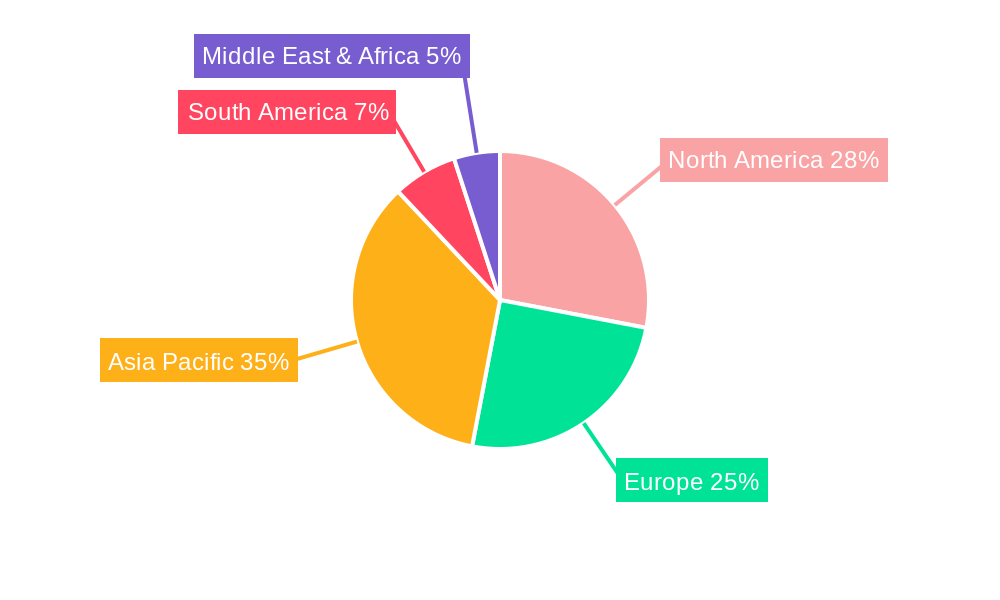

Dominant Markets & Segments in High-End Smart Watch

The high-end smartwatch market exhibits distinct regional and segment dominance, with North America leading in terms of market penetration and consumer spending, driven by high disposable incomes and a strong affinity for wearable technology. Within this region, the United States remains the largest single market. The application segment of Online Sales is experiencing rapid growth, projected to capture over 60% of the market by 2025, owing to the convenience, wider selection, and competitive pricing offered by e-commerce platforms. However, Offline Sales, particularly in premium retail stores and authorized dealerships, still command a significant share, catering to consumers who prefer a tactile experience and expert consultation before purchase. The primary driver for the dominance of online sales includes widespread internet access, sophisticated logistics networks, and the increasing trust consumers place in online purchasing for high-value items. In terms of product types, the Android System Smart Watch segment is a major contributor, driven by the vast Android user base and the diverse range of manufacturers offering devices. However, the IOS Smart Watch segment, dominated by Apple, exhibits exceptional strength due to brand loyalty, a tightly integrated ecosystem, and a premium user experience that resonates strongly with its target demographic. The estimated market share for IOS Smart Watches in the high-end segment is projected to remain exceptionally strong, exceeding 40% in 2025, due to the consistent innovation and brand equity of Apple. Windows System Smart Watches have a negligible presence in the high-end market, primarily due to limited manufacturer support and a shrinking Windows mobile ecosystem. Other smart watch categories, encompassing niche or proprietary operating systems, also hold a small but growing share, often catering to specific functionalities like extreme sports or specialized enterprise solutions. Economic policies in developed nations, such as favorable trade agreements and supportive innovation ecosystems, contribute to the market's strength. Infrastructure, including reliable internet connectivity and efficient delivery networks, is crucial for both online and offline sales channels. Key drivers for segment dominance in high-end smartwatches include:

- North America:

- Key Drivers: High disposable income, strong adoption of smart devices, significant investment in health and wellness technology, and a robust retail infrastructure.

- Dominance Analysis: The US leads due to early technology adoption and a mature e-commerce landscape. Canada and Mexico also contribute significantly to regional growth.

- Application: Online Sale:

- Key Drivers: Convenience, competitive pricing, wider product selection, ease of comparison, and effective digital marketing strategies.

- Dominance Analysis: The increasing shift towards digital commerce, driven by younger demographics and the pandemic's acceleration of online shopping habits, solidifies online sales' leading position.

- Types: IOS Smart Watch:

- Key Drivers: Strong brand loyalty, seamless ecosystem integration (iPhone, iPad, Mac), advanced health and fitness features, intuitive user interface, and premium design aesthetics.

- Dominance Analysis: Apple's consistent product innovation, coupled with its dedicated user base, ensures its continued leadership in the premium smartwatch segment.

- Types: Android System Smart Watch:

- Key Drivers: Wide range of manufacturers (Huawei, Samsung, Xiaomi), diverse price points within the high-end segment, open-source nature of the OS allowing for customization, and integration with Google services.

- Dominance Analysis: The sheer variety of devices and manufacturers offering Android-based high-end smartwatches caters to a broader consumer base, making it a significant and competitive segment.

High-End Smart Watch Product Developments

Product developments in the high-end smartwatch market are rapidly advancing, focusing on enhanced health monitoring capabilities, extended battery life, and seamless integration with existing digital ecosystems. Innovations such as non-invasive blood glucose monitoring, advanced sleep tracking with detailed REM analysis, and improved ECG accuracy are becoming standard features. Companies are also investing in AI-powered health insights that offer personalized recommendations and predictive health alerts. The competitive advantage lies in proprietary sensor technology, advanced algorithms for data interpretation, and the integration of premium materials and customizable design options. The market is witnessing a trend towards smartwatches that double as sophisticated fashion accessories, blending cutting-edge technology with luxury aesthetics.

Report Scope & Segmentation Analysis

This report meticulously analyzes the high-end smartwatch market across various segmentation dimensions. The Application segment is divided into Online Sale and Offline Sale, with projections indicating a continued shift towards online channels, capturing over 60% of the market by 2025. Offline Sale will remain significant, particularly for luxury and personalized purchases. The Types segmentation includes Android System Smart Watch, IOS Smart Watch, and Windows System Smart Watch, along with Others. The IOS Smart Watch segment, led by Apple, is expected to maintain strong market share, while the Android System Smart Watch segment, driven by multiple manufacturers, will offer diverse options. Windows System Smart Watch has a negligible market presence in this segment. The Others category will encompass niche devices with specialized functionalities, projected for modest growth.

- Online Sale: Projected to reach over $30 billion in 2025, with a CAGR of approximately 18% during the forecast period. Competitive dynamics are driven by pricing, product availability, and e-commerce platform features.

- Offline Sale: Estimated at over $20 billion in 2025, with a CAGR of around 10%. Dominance is influenced by luxury retail presence, brand experience, and in-store customer service.

- Android System Smart Watch: Expected to hold a significant share of over 45% in 2025, with a CAGR of approximately 16%. Competitive dynamics are characterized by rapid feature innovation and diverse manufacturer offerings.

- IOS Smart Watch: Projected to command over 40% of the market share in 2025, with a CAGR of around 15%. Dominance is driven by strong brand loyalty, ecosystem integration, and premium user experience.

- Windows System Smart Watch: Negligible market share and growth projections.

- Others: Expected to grow at a CAGR of around 12%, catering to specialized functionalities and niche markets.

Key Drivers of High-End Smart Watch Growth

The high-end smartwatch market's growth is propelled by several key drivers. Firstly, the increasing consumer focus on health and wellness, coupled with the desire for proactive health monitoring, is a primary catalyst. Advanced health sensors, such as ECG and SpO2 monitors, are becoming essential features. Secondly, technological advancements, including AI integration for personalized insights and improved battery life, enhance user experience and utility. Thirdly, the growing disposable income in emerging economies and a rising trend of integrating technology into daily lifestyles contribute significantly. The continuous evolution of design and the positioning of smartwatches as fashion accessories further broaden their appeal.

- Health & Wellness Consciousness: Growing demand for personal health tracking and preventative care solutions.

- Technological Innovation: Miniaturization of sensors, AI-powered analytics, and enhanced connectivity options.

- Increasing Disposable Income: Greater purchasing power for premium electronic devices.

- Lifestyle Integration: Smartwatches as essential tools for connected living and personal productivity.

Challenges in the High-End Smart Watch Sector

Despite robust growth, the high-end smartwatch sector faces several challenges. Regulatory hurdles concerning data privacy and health data accuracy can impact product development and market entry. Supply chain disruptions, exacerbated by geopolitical factors and component shortages, can affect production volumes and costs. Intense competitive pressure from both established tech giants and emerging players necessitates continuous innovation and substantial R&D investment. Furthermore, consumer concerns regarding battery life and the perceived necessity of high-end features can moderate adoption rates in certain demographics.

- Data Privacy Regulations: Strict compliance requirements for handling sensitive health information.

- Supply Chain Volatility: Dependence on global supply chains for critical components.

- Intense Competition: Constant need for differentiation and rapid product iteration.

- Battery Life Limitations: User expectations for extended usage between charges remain a significant factor.

Emerging Opportunities in High-End Smart Watch

Emerging opportunities in the high-end smartwatch market are abundant, driven by new technological frontiers and evolving consumer needs. The integration of advanced AI for personalized preventative healthcare and predictive diagnostics presents a significant growth avenue. Expansion into new demographic segments, such as the elderly population, through simplified interfaces and specialized health monitoring, offers untapped potential. The development of smartwatches with enhanced contactless payment functionalities and seamless integration with the metaverse are also key emerging trends. Furthermore, the growing demand for sustainable and ethically sourced materials in premium electronics opens up opportunities for eco-conscious brands.

- Preventative Healthcare: AI-driven health insights and early disease detection.

- Elderly Care Solutions: Simplified interfaces and dedicated health monitoring features for seniors.

- Metaverse Integration: Enhanced connectivity and interaction within virtual environments.

- Sustainable Technology: Demand for eco-friendly materials and manufacturing processes.

Leading Players in the High-End Smart Watch Market

- Huawei

- Apple

- Samsung

- Garmin

- Fitbit

- Xiaomi

- Mobvoi

- TAG Heuer

- Montblanc

- Asus

- Motorola (Lenovo)

Key Developments in High-End Smart Watch Industry

- 2023 Q4: Apple launches new Apple Watch models with enhanced health sensors, including improved blood oxygen tracking.

- 2024 Q1: Samsung introduces its latest Galaxy Watch series featuring advanced sleep analysis and stress management tools.

- 2024 Q2: Huawei releases a new smartwatch focusing on long-lasting battery life and comprehensive fitness tracking for outdoor enthusiasts.

- 2024 Q3: Garmin expands its premium multisport watch lineup with advanced navigation and performance metrics.

- 2025 Q1: Mobvoi's TicWatch series showcases advancements in AI-powered health insights and contactless payments.

- 2025 Q2: Luxury brands like TAG Heuer and Montblanc continue to innovate, blending high-end watchmaking with cutting-edge wearable technology.

- 2025 Q3: Industry analysts predict further consolidation through strategic acquisitions as companies seek to secure market share and innovative technologies.

Strategic Outlook for High-End Smart Watch Market

The strategic outlook for the high-end smartwatch market remains exceptionally bright, driven by sustained innovation and a deepening integration into consumers' daily lives. Future growth will be fueled by the relentless pursuit of miniaturized, more accurate health sensors, and the expansion of AI capabilities for personalized health and wellness management. Strategic partnerships between technology companies and healthcare providers are likely to emerge, further solidifying the smartwatch's role in proactive health monitoring. The continued evolution of design aesthetics, catering to luxury and fashion-conscious consumers, will also be a crucial growth catalyst. Expanding into emerging markets and addressing the specific needs of diverse demographic groups will unlock significant new revenue streams, ensuring a dynamic and promising future for the high-end smartwatch sector.

High-End Smart Watch Segmentation

-

1. Application

- 1.1. Online Sale

- 1.2. Offline Sale

-

2. Types

- 2.1. Android System Smart Watch

- 2.2. IOS Smart Watch

- 2.3. Windows System Smart Watch

- 2.4. Others

High-End Smart Watch Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

High-End Smart Watch REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High-End Smart Watch Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sale

- 5.1.2. Offline Sale

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Android System Smart Watch

- 5.2.2. IOS Smart Watch

- 5.2.3. Windows System Smart Watch

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America High-End Smart Watch Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sale

- 6.1.2. Offline Sale

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Android System Smart Watch

- 6.2.2. IOS Smart Watch

- 6.2.3. Windows System Smart Watch

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America High-End Smart Watch Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sale

- 7.1.2. Offline Sale

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Android System Smart Watch

- 7.2.2. IOS Smart Watch

- 7.2.3. Windows System Smart Watch

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe High-End Smart Watch Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sale

- 8.1.2. Offline Sale

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Android System Smart Watch

- 8.2.2. IOS Smart Watch

- 8.2.3. Windows System Smart Watch

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa High-End Smart Watch Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sale

- 9.1.2. Offline Sale

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Android System Smart Watch

- 9.2.2. IOS Smart Watch

- 9.2.3. Windows System Smart Watch

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific High-End Smart Watch Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sale

- 10.1.2. Offline Sale

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Android System Smart Watch

- 10.2.2. IOS Smart Watch

- 10.2.3. Windows System Smart Watch

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Huawei

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Apple

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Samsung

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Garmin

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fitbit

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Xiaomi

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mobvoi

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TAG Heuer

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Montblanc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Asus

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Motorola (Lenovo)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Huawei

List of Figures

- Figure 1: Global High-End Smart Watch Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America High-End Smart Watch Revenue (million), by Application 2024 & 2032

- Figure 3: North America High-End Smart Watch Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America High-End Smart Watch Revenue (million), by Types 2024 & 2032

- Figure 5: North America High-End Smart Watch Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America High-End Smart Watch Revenue (million), by Country 2024 & 2032

- Figure 7: North America High-End Smart Watch Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America High-End Smart Watch Revenue (million), by Application 2024 & 2032

- Figure 9: South America High-End Smart Watch Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America High-End Smart Watch Revenue (million), by Types 2024 & 2032

- Figure 11: South America High-End Smart Watch Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America High-End Smart Watch Revenue (million), by Country 2024 & 2032

- Figure 13: South America High-End Smart Watch Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe High-End Smart Watch Revenue (million), by Application 2024 & 2032

- Figure 15: Europe High-End Smart Watch Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe High-End Smart Watch Revenue (million), by Types 2024 & 2032

- Figure 17: Europe High-End Smart Watch Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe High-End Smart Watch Revenue (million), by Country 2024 & 2032

- Figure 19: Europe High-End Smart Watch Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa High-End Smart Watch Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa High-End Smart Watch Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa High-End Smart Watch Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa High-End Smart Watch Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa High-End Smart Watch Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa High-End Smart Watch Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific High-End Smart Watch Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific High-End Smart Watch Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific High-End Smart Watch Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific High-End Smart Watch Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific High-End Smart Watch Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific High-End Smart Watch Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global High-End Smart Watch Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global High-End Smart Watch Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global High-End Smart Watch Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global High-End Smart Watch Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global High-End Smart Watch Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global High-End Smart Watch Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global High-End Smart Watch Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global High-End Smart Watch Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global High-End Smart Watch Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global High-End Smart Watch Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global High-End Smart Watch Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global High-End Smart Watch Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global High-End Smart Watch Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global High-End Smart Watch Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global High-End Smart Watch Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global High-End Smart Watch Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global High-End Smart Watch Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global High-End Smart Watch Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global High-End Smart Watch Revenue million Forecast, by Country 2019 & 2032

- Table 41: China High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific High-End Smart Watch Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High-End Smart Watch?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the High-End Smart Watch?

Key companies in the market include Huawei, Apple, Samsung, Garmin, Fitbit, Xiaomi, Mobvoi, TAG Heuer, Montblanc, Asus, Motorola (Lenovo).

3. What are the main segments of the High-End Smart Watch?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High-End Smart Watch," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High-End Smart Watch report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High-End Smart Watch?

To stay informed about further developments, trends, and reports in the High-End Smart Watch, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence