Key Insights

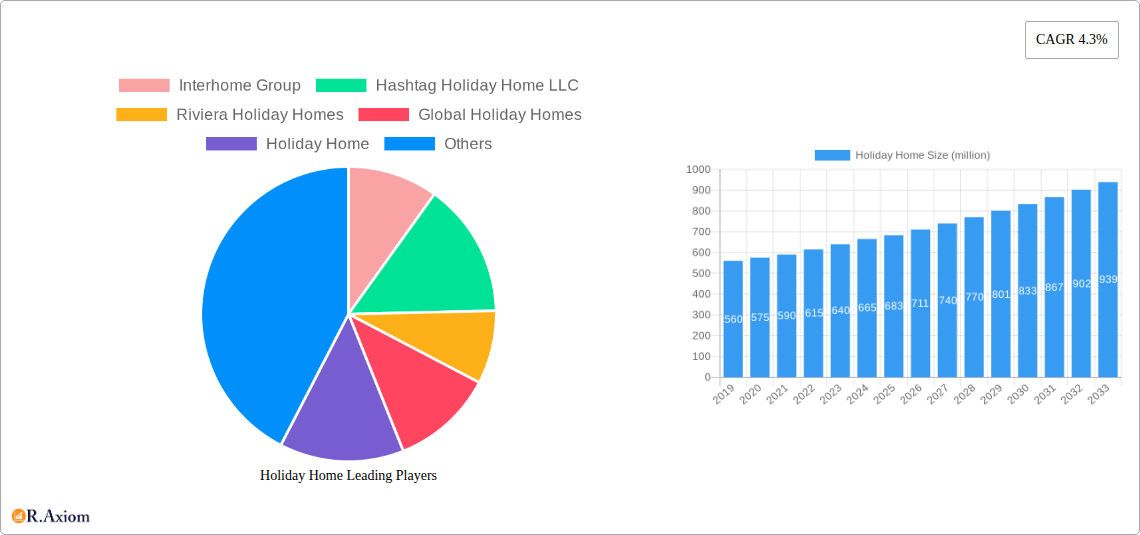

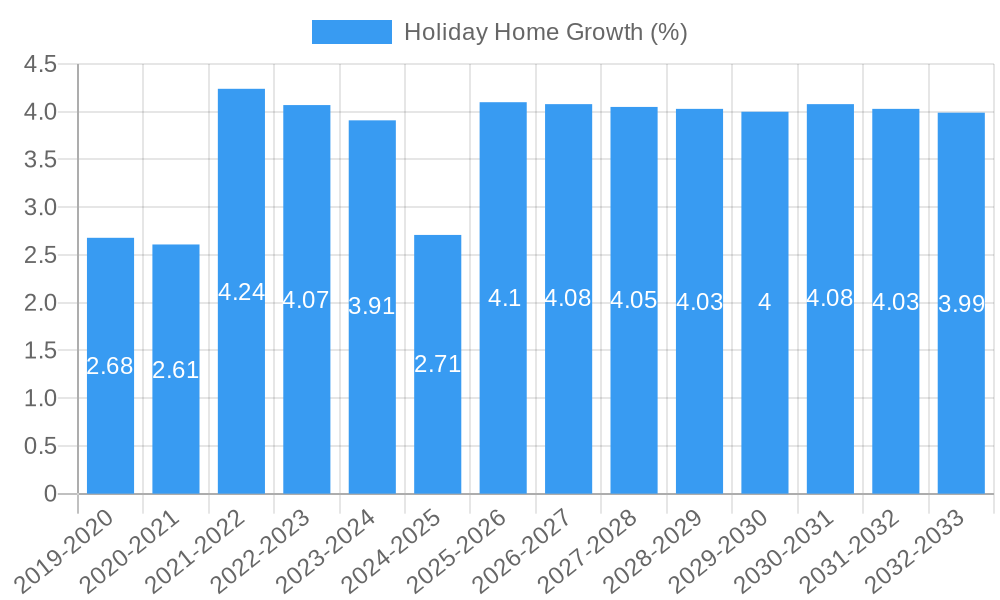

The global holiday home market is poised for significant expansion, projected to reach a substantial valuation of $683 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 4.3% through 2033. This upward trajectory is primarily fueled by evolving consumer preferences for personalized and authentic travel experiences, moving beyond conventional hotel stays. The increasing demand for unique accommodations such as charming castles, rustic farmhouses, and spacious country houses reflects a growing desire for immersive getaways. Furthermore, the proliferation of online travel agencies (OTAs) and specialized holiday home platforms has democratized access, making diverse property types readily available to a wider audience. This surge in accessibility, coupled with a post-pandemic resurgence in leisure travel, creates a fertile ground for continued market growth. Key drivers include the desire for greater privacy, space, and the ability to engage in self-catering, catering to families, groups of friends, and digital nomads seeking flexible living arrangements.

The market's growth is further bolstered by technological advancements in property management and booking systems, enhancing user experience and operational efficiency for both property owners and travelers. The luxury cottage segment, in particular, is experiencing a notable upswing as affluent travelers seek exclusive and high-end vacation experiences. While the market is largely driven by these positive trends, certain factors could temper growth. Increased competition from alternative accommodation providers, evolving regulatory landscapes in different regions, and potential economic downturns could pose challenges. However, the underlying appeal of unique, private, and customizable holiday accommodations remains strong, suggesting that the market is well-positioned to navigate these potential headwinds and continue its expansion throughout the forecast period. The diverse range of property types available, from intimate B&Bs to expansive barns, ensures a broad appeal across various traveler demographics and preferences.

Holiday Home Market Concentration & Innovation

The global holiday home market exhibits a moderate concentration with a blend of large, established players and a growing number of niche operators. Key companies like Interhome Group, Hashtag Holiday Home LLC, Riviera Holiday Homes, Global Holiday Homes, and Trident Holiday Homes dominate significant market shares, estimated to be in the hundreds of millions of dollars collectively. Innovation is primarily driven by the increasing demand for unique travel experiences, personalized services, and seamless booking platforms. Willerby, Pathfinder Homes, Lissett Homes, and Pemberton are at the forefront of product innovation, focusing on sustainable building practices, smart home technology integration, and flexible design options for modular and prefabricated holiday homes. Regulatory frameworks, particularly concerning short-term rental regulations and environmental standards, play a crucial role in shaping market dynamics and can act as both barriers and accelerators for innovation. Product substitutes, such as hotels and serviced apartments, continue to exert competitive pressure, pushing holiday home providers to differentiate through unique offerings and enhanced guest experiences. End-user trends point towards a preference for authentic local experiences, wellness-focused stays, and pet-friendly accommodations. Mergers and acquisitions (M&A) activity is present, with deal values in the tens of millions, as larger entities seek to expand their portfolios and market reach.

Holiday Home Industry Trends & Insights

The holiday home industry is experiencing robust growth, fueled by several key market growth drivers. The millions of travelers seeking alternative accommodation to traditional hotels, desiring more space, privacy, and a sense of home, are a primary catalyst. This trend is further amplified by the millions of global digital nomads and remote workers who require longer-stay accommodations with reliable internet and workspace amenities, significantly impacting the market penetration of holiday homes. Technological disruptions are revolutionizing the sector. Online Travel Agencies (OTAs) and specialized holiday home booking platforms have democratized access, allowing smaller operators to reach a global audience. Furthermore, the integration of Artificial Intelligence (AI) for personalized recommendations, dynamic pricing, and automated guest communication is enhancing efficiency and guest satisfaction. The millions of vacation rental management software solutions available are streamlining operations for property owners. Consumer preferences are shifting towards experiential travel, with guests seeking unique stays in Castles, Country Houses, Farmhouses, Large Barns, and Luxury Cottages that offer local immersion and distinct character. The rise of sustainable tourism also influences choices, with an increasing demand for eco-friendly properties and practices. Competitive dynamics are intensifying, marked by strategic partnerships between property managers and OTAs, and the continuous innovation in property types and guest services. The projected Compound Annual Growth Rate (CAGR) for the holiday home market is estimated to be in the high single digits, signifying sustained expansion. Market penetration is projected to increase substantially over the forecast period, driven by evolving travel habits and increased accessibility. The millions of available properties globally represent a significant opportunity for continued investment and growth.

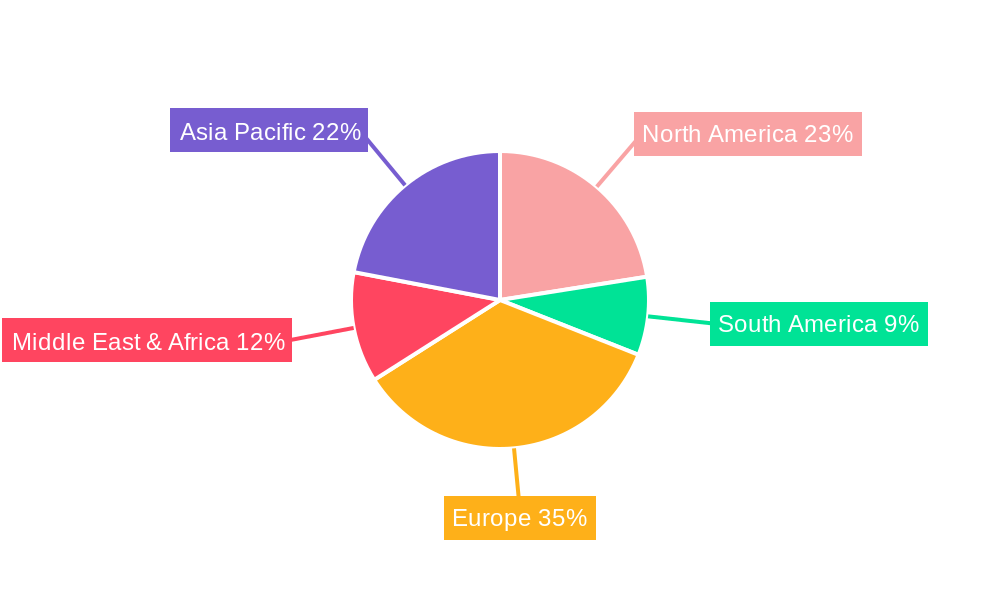

Dominant Markets & Segments in Holiday Home

The holiday home market demonstrates significant regional and segment-specific dominance. North America and Europe currently represent the leading regions, driven by established tourism infrastructure, high disposable incomes, and a strong culture of vacationing. Within these regions, Luxury Cottages and Country Houses are experiencing particularly strong demand, reflecting a preference for premium, comfortable, and aesthetically pleasing properties.

- Key Drivers for Dominance:

- Economic Policies: Favorable tourism policies and investment in infrastructure within leading countries support market expansion.

- Infrastructure Development: Well-developed transportation networks and the availability of amenities in tourist hotspots contribute to high occupancy rates.

- Consumer Disposable Income: Higher disposable incomes in developed nations allow for increased spending on travel and leisure.

- Digitalization of Bookings: The widespread adoption of online booking platforms has made these segments more accessible to a global customer base.

The Travel Agency segment, when acting as intermediaries for holiday home rentals, plays a crucial role in facilitating bookings and offering curated packages, contributing millions to the overall market value. While B&Bs represent a more traditional segment, they are increasingly incorporating holiday home-like offerings to cater to evolving guest needs.

- Dominance Analysis of Segments:

- Luxury Cottages: These properties command premium pricing and attract a discerning clientele seeking high-end amenities and exclusivity. The market for luxury cottages is projected to grow significantly, with estimated market sizes in the hundreds of millions.

- Country Houses: Offering tranquility and space, country houses appeal to families and groups looking for a retreat from urban life. Their dominance is sustained by their appeal for self-catering holidays and rural experiences, with an estimated market value in the hundreds of millions.

- Castles: While niche, the segment of castle rentals holds a significant appeal for unique, experiential travel, attracting high-spending tourists. Their impact on the market is in the tens of millions, often driven by special events and luxury tourism.

- Farmhouses: Emphasizing authenticity and connection with nature, farmhouses are a growing segment, particularly for families and those seeking rural escapes. Their market contribution is in the tens of millions.

- Large Barns: These rustic yet often luxuriously converted spaces offer unique accommodation for larger groups, contributing to the market in the tens of millions.

The continued growth and penetration of these segments are expected to be in the high single-digit to low double-digit percentages over the forecast period, contributing billions to the global holiday home market.

Holiday Home Product Developments

The holiday home sector is witnessing innovative product developments driven by the demand for unique and personalized experiences. Companies are focusing on creating sustainable and eco-friendly properties, incorporating smart home technology for enhanced guest convenience, and offering flexible configurations for diverse group sizes. Advancements in modular and prefabricated construction are enabling faster deployment and cost-effectiveness. The integration of outdoor living spaces, such as private gardens and swimming pools, is a key competitive advantage. Furthermore, a trend towards themed accommodations and immersive experiences is emerging, allowing properties to cater to specific niche interests. These developments aim to enhance guest satisfaction, increase booking rates, and capture higher rental yields, contributing millions in added value.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global holiday home market, encompassing various segmentation criteria to offer detailed insights. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033.

Application Segmentation:

- Travel Agency: This segment focuses on the role of travel agencies in facilitating holiday home bookings, including package deals and curated experiences. Growth projections for this segment are estimated at a high single-digit percentage, with a market size in the hundreds of millions.

- B&B: Analyzes the traditional bed and breakfast sector and its evolution into offering more self-contained holiday home-like units. This segment is expected to show moderate growth, with a market size in the hundreds of millions.

Type Segmentation:

- Castles: A niche but high-value segment focusing on unique historical accommodations. Projected growth is in the low double digits, with a market size in the tens of millions.

- Country Houses: A significant segment offering rural retreats and spacious accommodations. Expected growth is in the high single digits, with a market size in the hundreds of millions.

- Farmhouses: Appeals to those seeking authentic rural experiences. Projected growth is in the high single digits, with a market size in the tens of millions.

- Large Barns: Offers unique, often converted, spacious accommodations for groups. Expected growth is in the high single digits, with a market size in the tens of millions.

- Luxury Cottages: Focuses on premium, high-end cottage accommodations. This segment is projected for strong double-digit growth, with a market size in the hundreds of millions.

Competitive dynamics within each segment vary, with some being highly fragmented and others dominated by specialized providers.

Key Drivers of Holiday Home Growth

The growth of the holiday home sector is propelled by several interconnected factors. Technologically, the proliferation of online booking platforms and property management software has significantly lowered barriers to entry for property owners and increased accessibility for travelers, driving millions in bookings. Economically, rising disposable incomes and a desire for value-for-money accommodations compared to traditional hotels are key drivers. The trend towards experiential travel, where travelers seek authentic local experiences and unique stays, further fuels demand for diverse holiday home types. Regulatory factors, when supportive of short-term rentals and tourism, also contribute positively. For instance, streamlined local regulations in popular tourist destinations can encourage investment and expansion, leading to millions of new listings and increased revenue.

Challenges in the Holiday Home Sector

The holiday home sector faces several significant challenges that can impact growth and profitability. Regulatory hurdles, including increasingly stringent local ordinances, licensing requirements, and taxation policies in popular destinations, can create uncertainty and deter investment, potentially impacting market expansion by tens of millions annually. Supply chain issues, particularly for construction materials and furnishings in the development of new properties, can lead to project delays and increased costs, affecting the availability of new units. Competitive pressures from established hotel chains and the emergence of new short-term rental platforms continuously challenge market share. Furthermore, concerns around guest safety and property maintenance require significant investment and operational oversight, adding to the cost of doing business and potentially limiting the growth of smaller operators.

Emerging Opportunities in Holiday Home

Emerging opportunities in the holiday home market are diverse and offer significant potential for growth. The increasing demand for sustainable and eco-friendly travel presents a strong opportunity for properties that adopt green practices, attracting a growing segment of environmentally conscious travelers. The rise of remote work and digital nomadism creates a sustained demand for longer-term stays, offering opportunities for properties equipped with dedicated workspaces and high-speed internet. Niche markets, such as pet-friendly accommodations, wellness retreats, and adventure-focused stays, are expanding rapidly and can be tapped into by specialized providers. Furthermore, leveraging technology for hyper-personalized guest experiences, from AI-driven recommendations to on-demand services, can create a competitive edge and unlock new revenue streams, contributing millions in incremental bookings.

Leading Players in the Holiday Home Market

- Interhome Group

- Hashtag Holiday Home LLC

- Riviera Holiday Homes

- Global Holiday Homes

- Holiday Home

- Trident Holiday Homes

- Willerby

- Pathfinder Homes

- Lissett Homes

- Pemberton

Key Developments in Holiday Home Industry

- 2023/Q4: Increased investment in technology for personalized guest experiences and AI-driven booking recommendations.

- 2023/Q3: Launch of new sustainable building initiatives by manufacturers like Willerby, focusing on eco-friendly materials and energy efficiency.

- 2023/Q2: Strategic partnerships formed between major OTAs and holiday home rental aggregators to expand inventory and reach.

- 2023/Q1: Emergence of flexible cancellation policies and enhanced hygiene protocols as standard offerings due to evolving traveler confidence.

- 2022/Q4: Significant M&A activity as larger entities acquire smaller, specialized holiday home management companies to consolidate market share.

- 2022/Q3: Growing adoption of smart home technology in luxury cottages and country houses, enhancing guest convenience and security.

- 2022/Q2: Increased focus on pet-friendly accommodations and family-oriented amenities to cater to evolving traveler needs.

Strategic Outlook for Holiday Home Market

The strategic outlook for the holiday home market is exceptionally positive, driven by persistent shifts in consumer travel preferences and technological advancements. The ongoing trend towards personalized, experiential, and self-catered accommodations over traditional hotels provides a strong foundation for sustained growth. Opportunities lie in expanding into emerging markets, catering to the increasing demand for sustainable tourism, and leveraging technology for hyper-personalization and operational efficiency. The integration of smart home technologies and the development of unique property types like luxury cottages and country houses will remain key differentiators. Strategic investments in property management software and digital marketing will be crucial for capturing market share and maximizing revenue potential, collectively contributing billions to the global economy.

Holiday Home Segmentation

-

1. Application

- 1.1. Travel Agency

- 1.2. B&B

-

2. Type

- 2.1. Castles

- 2.2. Country Houses

- 2.3. Farmhouses

- 2.4. Large Barns

- 2.5. Luxury Cottages

Holiday Home Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Holiday Home REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Holiday Home Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Travel Agency

- 5.1.2. B&B

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Castles

- 5.2.2. Country Houses

- 5.2.3. Farmhouses

- 5.2.4. Large Barns

- 5.2.5. Luxury Cottages

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Holiday Home Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Travel Agency

- 6.1.2. B&B

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Castles

- 6.2.2. Country Houses

- 6.2.3. Farmhouses

- 6.2.4. Large Barns

- 6.2.5. Luxury Cottages

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Holiday Home Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Travel Agency

- 7.1.2. B&B

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Castles

- 7.2.2. Country Houses

- 7.2.3. Farmhouses

- 7.2.4. Large Barns

- 7.2.5. Luxury Cottages

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Holiday Home Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Travel Agency

- 8.1.2. B&B

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Castles

- 8.2.2. Country Houses

- 8.2.3. Farmhouses

- 8.2.4. Large Barns

- 8.2.5. Luxury Cottages

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Holiday Home Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Travel Agency

- 9.1.2. B&B

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Castles

- 9.2.2. Country Houses

- 9.2.3. Farmhouses

- 9.2.4. Large Barns

- 9.2.5. Luxury Cottages

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Holiday Home Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Travel Agency

- 10.1.2. B&B

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Castles

- 10.2.2. Country Houses

- 10.2.3. Farmhouses

- 10.2.4. Large Barns

- 10.2.5. Luxury Cottages

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Interhome Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hashtag Holiday Home LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Riviera Holiday Homes

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Global Holiday Homes

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Holiday Home

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Trident Holiday Homes

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Willerby

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pathfinder Homes

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Lissett Homes

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pemberton

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Interhome Group

List of Figures

- Figure 1: Global Holiday Home Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Holiday Home Revenue (million), by Application 2024 & 2032

- Figure 3: North America Holiday Home Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Holiday Home Revenue (million), by Type 2024 & 2032

- Figure 5: North America Holiday Home Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Holiday Home Revenue (million), by Country 2024 & 2032

- Figure 7: North America Holiday Home Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Holiday Home Revenue (million), by Application 2024 & 2032

- Figure 9: South America Holiday Home Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Holiday Home Revenue (million), by Type 2024 & 2032

- Figure 11: South America Holiday Home Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Holiday Home Revenue (million), by Country 2024 & 2032

- Figure 13: South America Holiday Home Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Holiday Home Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Holiday Home Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Holiday Home Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Holiday Home Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Holiday Home Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Holiday Home Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Holiday Home Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Holiday Home Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Holiday Home Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Holiday Home Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Holiday Home Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Holiday Home Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Holiday Home Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Holiday Home Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Holiday Home Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Holiday Home Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Holiday Home Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Holiday Home Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Holiday Home Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Holiday Home Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Holiday Home Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Holiday Home Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Holiday Home Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Holiday Home Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Holiday Home Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Holiday Home Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Holiday Home Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Holiday Home Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Holiday Home Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Holiday Home Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Holiday Home Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Holiday Home Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Holiday Home Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Holiday Home Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Holiday Home Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Holiday Home Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Holiday Home Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Holiday Home Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Holiday Home?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Holiday Home?

Key companies in the market include Interhome Group, Hashtag Holiday Home LLC, Riviera Holiday Homes, Global Holiday Homes, Holiday Home, Trident Holiday Homes, Willerby, Pathfinder Homes, Lissett Homes, Pemberton.

3. What are the main segments of the Holiday Home?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 683 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Holiday Home," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Holiday Home report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Holiday Home?

To stay informed about further developments, trends, and reports in the Holiday Home, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence