Key Insights

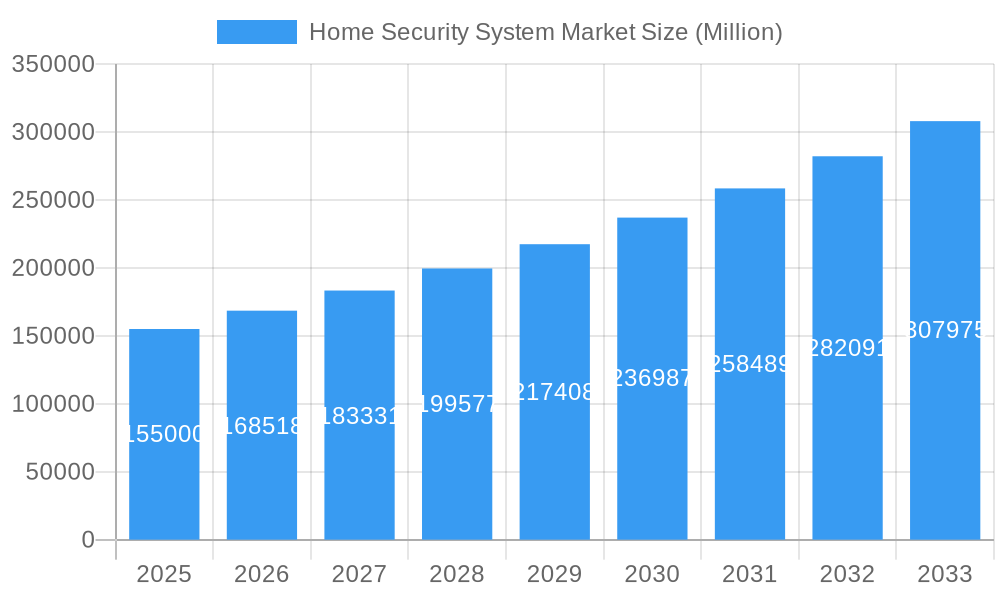

The global Home Security System Market is experiencing robust expansion, projected to reach a substantial market size of approximately $155 billion by the end of 2025, and is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 8.92% through 2033. This impressive trajectory is fueled by a confluence of factors, primarily driven by escalating consumer awareness regarding personal safety and property protection. The increasing adoption of smart home technology, coupled with a growing preference for integrated security solutions that offer remote monitoring and control capabilities, is a significant growth catalyst. Furthermore, the rising incidence of crime, both petty and organized, in urban and suburban areas, is compelling homeowners to invest in advanced security measures. Government initiatives promoting safety and security, alongside declining prices of sophisticated security devices due to technological advancements and economies of scale, are also contributing to market growth. The market is segmented across various components, including hardware, software, and services, with video surveillance systems and alarm systems holding significant shares. The distribution channels are also diversifying, with a notable shift towards online sales alongside traditional offline retail.

Home Security System Market Market Size (In Billion)

The market's expansion is further propelled by emerging trends such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) for enhanced threat detection and anomaly recognition, the proliferation of DIY (Do-It-Yourself) security systems offering cost-effectiveness and ease of installation, and the increasing demand for comprehensive smart home ecosystems where security systems seamlessly integrate with other connected devices. Leading companies like Google LLC, Honeywell International, and Johnson Controls International PLC are at the forefront, innovating and expanding their product portfolios to cater to evolving consumer needs. While the market presents immense opportunities, certain restraints, such as the initial high cost of some advanced systems and concerns surrounding data privacy and cybersecurity, need to be addressed by industry players. The North America and Europe regions currently dominate the market share, owing to higher disposable incomes and established infrastructure for smart home adoption. However, the Asia Pacific region is poised for significant growth, driven by rapid urbanization and increasing disposable incomes.

Home Security System Market Company Market Share

This in-depth report provides a detailed analysis of the global Home Security System Market, offering strategic insights into market dynamics, growth trajectories, and competitive landscapes from 2019 to 2033. With a base year of 2025, the report delves into historical trends, current estimations, and future forecasts, making it an essential resource for stakeholders seeking to capitalize on the burgeoning smart home security and residential security solutions sector. The smart home security market is experiencing unprecedented growth driven by increasing awareness of safety concerns, advancements in IoT technology, and the demand for integrated home automation systems.

Home Security System Market Market Concentration & Innovation

The Home Security System Market exhibits a moderate to high concentration, characterized by the presence of established global players and innovative emerging companies. Key drivers of innovation include the rapid integration of Artificial Intelligence (AI) and Machine Learning (ML) into video surveillance systems and alarm systems, enabling features like facial recognition, anomaly detection, and predictive security. The increasing adoption of IoT devices fuels the demand for interconnected smart home security solutions. Regulatory frameworks, such as data privacy laws and product safety standards, influence product development and market entry. While the market benefits from high demand for advanced residential security solutions, the availability of DIY home security kits and competitive pricing strategies from various providers pose challenges. Mergers and acquisitions (M&A) are pivotal in shaping the market landscape, with recent deals focusing on acquiring cutting-edge technologies and expanding market reach. For instance, the acquisition of smaller tech firms by larger players has helped consolidate market share and accelerate the development of next-generation smart home security offerings. The total M&A deal value in the past two years is estimated to be over $2,500 Million, indicating significant strategic consolidation. Market share is distributed with key players holding significant portions, but the growing number of startups introduces dynamic shifts.

Home Security System Market Industry Trends & Insights

The Home Security System Market is poised for robust expansion, driven by a confluence of technological advancements, evolving consumer preferences, and a heightened sense of security awareness. The Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is projected to be approximately 15.7%, reflecting substantial market penetration and increasing adoption rates. The increasing prevalence of smart home security devices, including wireless security cameras, smart locks, and integrated alarm systems, is a primary growth catalyst. Consumers are increasingly seeking convenience and advanced functionality, leading to a surge in demand for DIY home security systems and professionally monitored solutions alike. The integration of AI and cloud-based services is transforming residential security solutions from passive deterrents into proactive, intelligent systems capable of learning user behavior and identifying potential threats. Furthermore, the proliferation of the Internet of Things (IoT) ecosystem allows for seamless integration of security systems with other smart home devices, creating a more comprehensive and automated living environment. The growing concern over rising crime rates and the desire for remote monitoring capabilities further bolster the market. Cybersecurity concerns, while present, are being addressed through enhanced encryption and data security measures by leading providers. The market penetration of smart security devices is expected to exceed 60% in developed economies by 2030. The competitive landscape is dynamic, with both traditional security providers and technology giants vying for market share through product innovation, strategic partnerships, and aggressive marketing campaigns. The emphasis on user-friendly interfaces, affordable pricing, and subscription-based services further fuels market growth.

Dominant Markets & Segments in Home Security System Market

The Home Security System Market is segmented across various components, system types, and distribution channels, each exhibiting distinct growth patterns and dominance.

Component Dominance:

- Hardware: The Hardware segment, encompassing security cameras, sensors, control panels, and smart locks, currently dominates the market due to its foundational role in any security system. The market size for hardware is estimated to be over $18,000 Million in 2025. Key drivers include the increasing affordability and technological sophistication of these devices, such as high-resolution cameras with night vision and AI-powered analytics. The demand for integrated hardware solutions that work seamlessly with other smart home devices is a significant growth factor.

- Software: The Software segment, which includes mobile applications, cloud-based analytics, and AI algorithms, is experiencing rapid growth. Its market size is projected to reach over $8,000 Million by 2025. Software is crucial for enabling remote access, intelligent alerts, and data analysis, enhancing the overall functionality and user experience of smart home security.

- Services: The Services segment, including professional monitoring, installation, and cloud storage, is also a substantial contributor and shows strong growth potential. The market size for services is expected to be over $7,000 Million in 2025. The increasing preference for hassle-free, professionally managed security solutions drives the demand for these services.

Type of System Dominance:

- Video Surveillance System: Video Surveillance Systems are the leading segment, driven by the demand for visual verification and evidence collection. The market size for video surveillance systems is estimated to be over $16,000 Million in 2025. Advancements in camera technology, such as 4K resolution and AI-powered object detection, are propelling this segment.

- Alarm System: Alarm Systems, including motion detectors and door/window sensors, remain a core component of home security. Their market size is projected to be over $9,000 Million in 2025. The integration of smart alarms with mobile notifications provides real-time alerts to homeowners.

- Access Control System: Access Control Systems, such as smart locks and key card readers, are gaining traction due to the demand for keyless entry and remote access management. The market size is estimated to be over $5,000 Million in 2025.

- Fire Protection System: Fire Protection Systems, including smoke detectors and carbon monoxide sensors, are vital for comprehensive home safety. Their market size is projected to be over $3,000 Million in 2025.

Distribution Channel Dominance:

- Online: The Online distribution channel, encompassing e-commerce platforms and direct-to-consumer websites, is experiencing the fastest growth. Its market share is rapidly increasing due to the convenience of online purchasing and the widespread availability of DIY home security kits. The market size for online sales is estimated to be over $15,000 Million in 2025.

- Offline: Offline channels, including retail stores and professional security installers, still hold a significant market share. The market size for offline sales is projected to be over $18,000 Million in 2025. These channels offer personalized advice and installation services, which are crucial for complex security setups.

Geographical Dominance: North America currently leads the Home Security System Market, driven by high disposable incomes, strong consumer awareness of security, and rapid adoption of smart home technologies. The United States, in particular, represents a significant portion of this market. Asia Pacific is emerging as a high-growth region due to increasing urbanization, a growing middle class, and rising disposable incomes, leading to a greater demand for advanced residential security solutions.

Home Security System Market Product Developments

Recent product developments in the Home Security System Market emphasize integration, intelligence, and user convenience. Innovations focus on multi-functional sensors, AI-powered analytics for proactive threat detection, and seamless integration with broader smart home ecosystems. The aim is to provide homeowners with comprehensive, intuitive, and highly responsive security solutions. These developments offer competitive advantages by enhancing product features, improving reliability, and meeting the evolving demand for advanced smart home security. For instance, the introduction of combined alarm and video monitoring services with advanced sensing capabilities provides a significant market differentiator.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Home Security System Market across key segments:

- Component: Hardware (security cameras, sensors, control panels, smart locks), Software (mobile apps, AI analytics, cloud platforms), and Services (professional monitoring, installation, maintenance). Growth projections for hardware are robust, driven by device affordability, while software and services are expected to exhibit higher CAGR due to increasing demand for intelligent features and managed security.

- Type of System: Video Surveillance System, Alarm System, Access Control System, and Fire Protection System. Video surveillance leads in market size, with significant growth expected from access control due to smart home integration.

- Distribution Channel: Online (e-commerce, direct sales) and Offline (retail stores, professional installers). The online channel is projected for higher growth rates, while offline channels maintain a strong presence due to installation and support services.

Key Drivers of Home Security System Market Growth

The Home Security System Market is propelled by several key factors. The escalating global crime rates and a growing public awareness of personal safety are primary drivers. Technological advancements, particularly in IoT, AI, and cloud computing, are enabling more sophisticated and integrated smart home security solutions. The increasing adoption of smart home devices and the desire for seamless home automation create a natural synergy with security systems. Furthermore, government initiatives promoting smart city development and the increasing availability of affordable and user-friendly DIY home security systems are significantly boosting market growth. Economic factors such as rising disposable incomes in emerging economies also play a crucial role in enabling consumers to invest in these solutions.

Challenges in the Home Security System Market Sector

Despite its strong growth trajectory, the Home Security System Market faces several challenges. Cybersecurity threats remain a significant concern, as breaches can compromise sensitive user data and system integrity. High installation costs and the perceived complexity of some systems can deter adoption, particularly in price-sensitive markets. Fierce competition from numerous players, including established security firms and tech giants, intensifies pricing pressure. Furthermore, evolving regulatory landscapes concerning data privacy and surveillance can create compliance hurdles for manufacturers and service providers. Ensuring interoperability between different smart home security platforms also presents a technical challenge.

Emerging Opportunities in Home Security System Market

The Home Security System Market is ripe with emerging opportunities. The expansion of the smart home ecosystem offers fertile ground for integrating advanced security features into everyday devices. The growing demand for remote and contactless solutions, accelerated by recent global events, presents an opportunity for enhanced access control systems and video monitoring services. The untapped potential in developing economies, where awareness and affordability are increasing, offers significant growth avenues. Furthermore, the development of AI-powered predictive analytics and behavioral analysis for security purposes can create highly differentiated and valuable offerings. The increasing adoption of subscription-based services for monitoring and cloud storage also presents a recurring revenue opportunity.

Leading Players in the Home Security System Market Market

- ABB Ltd

- Google LLC

- ADT Inc

- SimpleSafe Inc

- Honeywell International

- Bosch Service Solutions GmbH

- Abode Systems Inc

- Johnson Controls International PLC

- Zmodo Technology Corporation Ltd

- Arlo Technologies Inc

Key Developments in Home Security System Market Industry

- June 2023: Volt, a smart home solution provider, announced a strategic partnership with Ring, an Amazon company, to expand its smart home security solutions. Through this partnership, Volt will likely introduce smart home security products, including security cameras and video doorbells, to meet the increasing demand for advanced home security systems and aims to strengthen its position in the market.

- November 2022: Arlo Technologies Inc. unveiled the Arlo Home Security System. The system had a first-of-its-kind multi-sensor that could perform eight separate sensing functions. The system works in conjunction with Arlo's new 24/7 professional monitoring service, giving users access to highly qualified security experts who monitor and respond to emergencies.

Strategic Outlook for Home Security System Market Market

The strategic outlook for the Home Security System Market is exceptionally positive. Continued investment in research and development, focusing on AI-driven intelligence, enhanced cybersecurity, and seamless integration, will be crucial. Strategic partnerships and potential M&A activities will further consolidate market leadership and drive innovation. The increasing consumer demand for personalized and integrated smart home security solutions presents significant growth catalysts. Expanding into emerging markets and offering a tiered range of products and services to cater to diverse customer needs will be key to sustained success. The market is expected to evolve towards more proactive, predictive, and user-friendly security experiences, solidifying its position as an indispensable component of modern living.

Home Security System Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Type of System

- 2.1. Video Surveillance System

- 2.2. Alarm System

- 2.3. Access Control System

- 2.4. Fire Protection System

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

Home Security System Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Nordics

- 2.7. Benelux

- 2.8. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Rest of the World

Home Security System Market Regional Market Share

Geographic Coverage of Home Security System Market

Home Security System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence of Internet of Things (IoT) and Wireless Technology; Growing Awareness Regarding Home Security Systems

- 3.3. Market Restrains

- 3.3.1 Risks of Cybersecurity; High Installation

- 3.3.2 Maintenance and Operational Costs

- 3.4. Market Trends

- 3.4.1. Access Control System is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Home Security System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Type of System

- 5.2.1. Video Surveillance System

- 5.2.2. Alarm System

- 5.2.3. Access Control System

- 5.2.4. Fire Protection System

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Home Security System Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by Type of System

- 6.2.1. Video Surveillance System

- 6.2.2. Alarm System

- 6.2.3. Access Control System

- 6.2.4. Fire Protection System

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Online

- 6.3.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Home Security System Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by Type of System

- 7.2.1. Video Surveillance System

- 7.2.2. Alarm System

- 7.2.3. Access Control System

- 7.2.4. Fire Protection System

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Online

- 7.3.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Home Security System Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by Type of System

- 8.2.1. Video Surveillance System

- 8.2.2. Alarm System

- 8.2.3. Access Control System

- 8.2.4. Fire Protection System

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Online

- 8.3.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Rest of the World Home Security System Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by Type of System

- 9.2.1. Video Surveillance System

- 9.2.2. Alarm System

- 9.2.3. Access Control System

- 9.2.4. Fire Protection System

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Online

- 9.3.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ABB Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Google LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 ADT Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 SimpleSafe Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Honeywell International

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Bosch Service Solutions GmbH

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Abode Systems Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Johnson Controls International PLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Zmodo Technology Corporation Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Arlo Technologies Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 ABB Ltd

List of Figures

- Figure 1: Global Home Security System Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Home Security System Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Home Security System Market Revenue (Million), by Component 2025 & 2033

- Figure 4: North America Home Security System Market Volume (K Unit), by Component 2025 & 2033

- Figure 5: North America Home Security System Market Revenue Share (%), by Component 2025 & 2033

- Figure 6: North America Home Security System Market Volume Share (%), by Component 2025 & 2033

- Figure 7: North America Home Security System Market Revenue (Million), by Type of System 2025 & 2033

- Figure 8: North America Home Security System Market Volume (K Unit), by Type of System 2025 & 2033

- Figure 9: North America Home Security System Market Revenue Share (%), by Type of System 2025 & 2033

- Figure 10: North America Home Security System Market Volume Share (%), by Type of System 2025 & 2033

- Figure 11: North America Home Security System Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 12: North America Home Security System Market Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 13: North America Home Security System Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: North America Home Security System Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 15: North America Home Security System Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Home Security System Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Home Security System Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Home Security System Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Home Security System Market Revenue (Million), by Component 2025 & 2033

- Figure 20: Europe Home Security System Market Volume (K Unit), by Component 2025 & 2033

- Figure 21: Europe Home Security System Market Revenue Share (%), by Component 2025 & 2033

- Figure 22: Europe Home Security System Market Volume Share (%), by Component 2025 & 2033

- Figure 23: Europe Home Security System Market Revenue (Million), by Type of System 2025 & 2033

- Figure 24: Europe Home Security System Market Volume (K Unit), by Type of System 2025 & 2033

- Figure 25: Europe Home Security System Market Revenue Share (%), by Type of System 2025 & 2033

- Figure 26: Europe Home Security System Market Volume Share (%), by Type of System 2025 & 2033

- Figure 27: Europe Home Security System Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 28: Europe Home Security System Market Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 29: Europe Home Security System Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Europe Home Security System Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 31: Europe Home Security System Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Home Security System Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Home Security System Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Home Security System Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Home Security System Market Revenue (Million), by Component 2025 & 2033

- Figure 36: Asia Pacific Home Security System Market Volume (K Unit), by Component 2025 & 2033

- Figure 37: Asia Pacific Home Security System Market Revenue Share (%), by Component 2025 & 2033

- Figure 38: Asia Pacific Home Security System Market Volume Share (%), by Component 2025 & 2033

- Figure 39: Asia Pacific Home Security System Market Revenue (Million), by Type of System 2025 & 2033

- Figure 40: Asia Pacific Home Security System Market Volume (K Unit), by Type of System 2025 & 2033

- Figure 41: Asia Pacific Home Security System Market Revenue Share (%), by Type of System 2025 & 2033

- Figure 42: Asia Pacific Home Security System Market Volume Share (%), by Type of System 2025 & 2033

- Figure 43: Asia Pacific Home Security System Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 44: Asia Pacific Home Security System Market Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 45: Asia Pacific Home Security System Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Asia Pacific Home Security System Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Asia Pacific Home Security System Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Home Security System Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Home Security System Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Home Security System Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Rest of the World Home Security System Market Revenue (Million), by Component 2025 & 2033

- Figure 52: Rest of the World Home Security System Market Volume (K Unit), by Component 2025 & 2033

- Figure 53: Rest of the World Home Security System Market Revenue Share (%), by Component 2025 & 2033

- Figure 54: Rest of the World Home Security System Market Volume Share (%), by Component 2025 & 2033

- Figure 55: Rest of the World Home Security System Market Revenue (Million), by Type of System 2025 & 2033

- Figure 56: Rest of the World Home Security System Market Volume (K Unit), by Type of System 2025 & 2033

- Figure 57: Rest of the World Home Security System Market Revenue Share (%), by Type of System 2025 & 2033

- Figure 58: Rest of the World Home Security System Market Volume Share (%), by Type of System 2025 & 2033

- Figure 59: Rest of the World Home Security System Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 60: Rest of the World Home Security System Market Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 61: Rest of the World Home Security System Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 62: Rest of the World Home Security System Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 63: Rest of the World Home Security System Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Rest of the World Home Security System Market Volume (K Unit), by Country 2025 & 2033

- Figure 65: Rest of the World Home Security System Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Rest of the World Home Security System Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Home Security System Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Home Security System Market Volume K Unit Forecast, by Component 2020 & 2033

- Table 3: Global Home Security System Market Revenue Million Forecast, by Type of System 2020 & 2033

- Table 4: Global Home Security System Market Volume K Unit Forecast, by Type of System 2020 & 2033

- Table 5: Global Home Security System Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Home Security System Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Home Security System Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Home Security System Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Home Security System Market Revenue Million Forecast, by Component 2020 & 2033

- Table 10: Global Home Security System Market Volume K Unit Forecast, by Component 2020 & 2033

- Table 11: Global Home Security System Market Revenue Million Forecast, by Type of System 2020 & 2033

- Table 12: Global Home Security System Market Volume K Unit Forecast, by Type of System 2020 & 2033

- Table 13: Global Home Security System Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Home Security System Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Home Security System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Home Security System Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Home Security System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Home Security System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Home Security System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Home Security System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Global Home Security System Market Revenue Million Forecast, by Component 2020 & 2033

- Table 22: Global Home Security System Market Volume K Unit Forecast, by Component 2020 & 2033

- Table 23: Global Home Security System Market Revenue Million Forecast, by Type of System 2020 & 2033

- Table 24: Global Home Security System Market Volume K Unit Forecast, by Type of System 2020 & 2033

- Table 25: Global Home Security System Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 26: Global Home Security System Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global Home Security System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Home Security System Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: United Kingdom Home Security System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Home Security System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Germany Home Security System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Home Security System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: France Home Security System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France Home Security System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Italy Home Security System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Italy Home Security System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Spain Home Security System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Spain Home Security System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Nordics Home Security System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Nordics Home Security System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Benelux Home Security System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Benelux Home Security System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Rest of Europe Home Security System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Rest of Europe Home Security System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Global Home Security System Market Revenue Million Forecast, by Component 2020 & 2033

- Table 46: Global Home Security System Market Volume K Unit Forecast, by Component 2020 & 2033

- Table 47: Global Home Security System Market Revenue Million Forecast, by Type of System 2020 & 2033

- Table 48: Global Home Security System Market Volume K Unit Forecast, by Type of System 2020 & 2033

- Table 49: Global Home Security System Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 50: Global Home Security System Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 51: Global Home Security System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: Global Home Security System Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 53: China Home Security System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: China Home Security System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Japan Home Security System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Japan Home Security System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: India Home Security System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: India Home Security System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: Rest of Asia Pacific Home Security System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Rest of Asia Pacific Home Security System Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Global Home Security System Market Revenue Million Forecast, by Component 2020 & 2033

- Table 62: Global Home Security System Market Volume K Unit Forecast, by Component 2020 & 2033

- Table 63: Global Home Security System Market Revenue Million Forecast, by Type of System 2020 & 2033

- Table 64: Global Home Security System Market Volume K Unit Forecast, by Type of System 2020 & 2033

- Table 65: Global Home Security System Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 66: Global Home Security System Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 67: Global Home Security System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 68: Global Home Security System Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Home Security System Market?

The projected CAGR is approximately 8.92%.

2. Which companies are prominent players in the Home Security System Market?

Key companies in the market include ABB Ltd, Google LLC, ADT Inc, SimpleSafe Inc, Honeywell International, Bosch Service Solutions GmbH, Abode Systems Inc, Johnson Controls International PLC, Zmodo Technology Corporation Ltd, Arlo Technologies Inc.

3. What are the main segments of the Home Security System Market?

The market segments include Component, Type of System, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Emergence of Internet of Things (IoT) and Wireless Technology; Growing Awareness Regarding Home Security Systems.

6. What are the notable trends driving market growth?

Access Control System is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Risks of Cybersecurity; High Installation. Maintenance and Operational Costs.

8. Can you provide examples of recent developments in the market?

June 2023: Volt, a smart home solution provider, announced a strategic partnership with Ring, an Amazon company, to expand its smart home security solutions. Through this partnership, Volt will likely introduce smart home security products, including security cameras and video doorbells, to meet the increasing demand for advanced home security systems and aims to strengthen its position in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Home Security System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Home Security System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Home Security System Market?

To stay informed about further developments, trends, and reports in the Home Security System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence