Key Insights

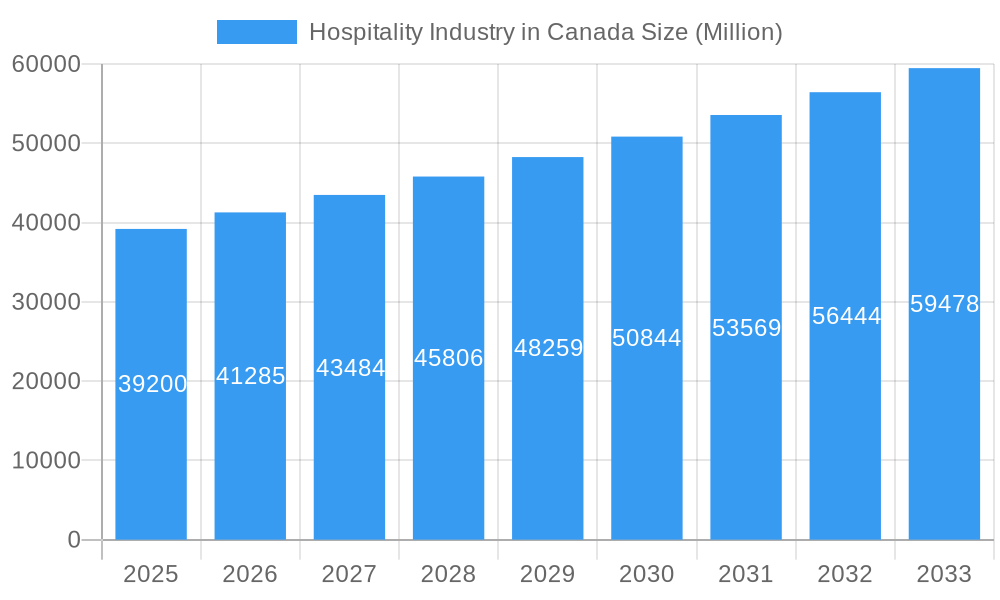

The Canadian hospitality industry, valued at $39.20 billion in 2025, is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.27% from 2025 to 2033. This expansion is fueled by several key drivers. Increased domestic and international tourism, driven by Canada's diverse landscapes and cultural attractions, is a significant contributor. The burgeoning business travel sector, particularly in major urban centers like Toronto, Montreal, and Vancouver, further bolsters demand. Furthermore, the rise of experiential travel and the increasing popularity of eco-tourism are creating new market segments and opportunities for hotels catering to these trends. The industry is segmented by type (chain and independent hotels) and by service level (budget/economy, mid-scale, luxury, and service apartments). While the dominance of established chains like Hilton, Marriott, and Hyatt is undeniable, independent hotels and boutique accommodations are carving a niche by appealing to a discerning clientele seeking unique experiences. However, challenges remain. Fluctuations in currency exchange rates, economic downturns, and increasing operating costs (labor and supplies) pose potential restraints to growth. Moreover, competition from alternative accommodations such as Airbnb and short-term rentals necessitates continuous innovation and adaptation by traditional hotels. Strategic investments in technology, sustainable practices, and personalized guest experiences are crucial for navigating these challenges and capturing market share in the years to come. Regional variations exist within Canada, with Eastern and Western Canada likely exhibiting different growth trajectories based on specific tourism patterns and economic conditions.

Hospitality Industry in Canada Market Size (In Billion)

The forecast for the Canadian hospitality market through 2033 suggests a considerable expansion, with the segment breakdown likely reflecting the existing trends. Luxury hotels will probably experience higher growth rates driven by increased high-net-worth individual travel, while budget and economy hotels will likely experience stable growth tied to budget-conscious travelers and the continued popularity of accessible travel options. The service apartment segment will likely see growth tied to extended-stay business travelers and those seeking more residential accommodation options. Chain hotels will benefit from economies of scale and brand recognition, while independent hotels will need to maintain their differentiation through unique offerings and personalized services to maintain competitiveness. The regional breakdown will be largely determined by tourism trends and economic performance within each region of Canada, with Western Canada potentially benefitting from continued growth in tourism associated with the Rocky Mountains and Pacific Coast. Effective strategies for the future must include adapting to changing travel preferences, leveraging technology for enhanced guest experiences, and actively managing operating costs to ensure profitability.

Hospitality Industry in Canada Company Market Share

Hospitality Industry in Canada: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canadian hospitality industry, covering market size, segmentation, key players, growth drivers, challenges, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is crucial for industry stakeholders, investors, and strategists seeking a clear understanding of this dynamic market.

Hospitality Industry in Canada Market Concentration & Innovation

The Canadian hospitality market exhibits a moderate level of concentration, with a mix of large international chains and smaller independent operators. Major players like Hilton Worldwide Holdings Inc, Hyatt Hotels Corporation, Marriott International Inc, Wyndham Hotel Group LLC, Intercontinental Hotels Group, Best Western International Inc, Choice Hotels International Inc, Coast Hotels Limited, The Sandman Group, and Accor SA hold significant market share, although precise figures vary by segment. However, independent hotels still represent a substantial portion of the market. Market share data for 2025 estimates Hilton at 15%, Marriott at 12%, and Wyndham at 10%, with the remaining share distributed among other chains and independent operators.

Innovation in the Canadian hospitality sector is driven by several factors:

- Technological advancements: Adoption of online booking platforms, revenue management systems, and personalized guest experiences through mobile apps.

- Sustainability initiatives: Growing demand for eco-friendly practices and certifications.

- Experiential travel: Focus on creating unique and memorable guest experiences beyond basic accommodation.

Regulatory frameworks, such as licensing and health & safety standards, play a significant role in shaping the industry landscape. Product substitutes, including Airbnb and other short-term rental platforms, pose a competitive challenge, impacting occupancy rates, especially in the budget and mid-scale segments. End-user trends show a growing preference for personalized services, flexible booking options, and authentic local experiences. M&A activity in the Canadian hospitality sector has been relatively moderate in recent years, with deal values fluctuating between xx Million and xx Million annually, driven primarily by expansion strategies and consolidation among smaller chains.

Hospitality Industry in Canada Industry Trends & Insights

The Canadian hospitality industry is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 5% during the forecast period (2025-2033). Several key factors contribute to this growth:

- Increased tourism: Canada's popularity as a tourist destination continues to rise, boosting demand for accommodation.

- Economic growth: A robust economy generally leads to increased business travel and leisure spending.

- Urbanization: Growth in urban centers fuels demand for hotels and serviced apartments.

Technological disruptions, including the rise of online travel agencies (OTAs) and the increasing use of data analytics for revenue management, are transforming the industry. Consumer preferences are shifting towards personalized experiences, sustainable practices, and value-for-money options. Competitive dynamics are characterized by increased competition from both established chains and emerging players, including boutique hotels and short-term rentals. Market penetration by OTAs is estimated at 60%, reflecting their dominant role in bookings.

Dominant Markets & Segments in Hospitality Industry in Canada

While precise, granular data remains proprietary to specialized market research firms, the economic powerhouses of Ontario and British Columbia consistently emerge as leading markets within Canada's hospitality landscape. This dominance is fueled by a confluence of factors including robust international and domestic tourism, a thriving business travel sector, and sustained population growth, particularly in urban centers.

In terms of market share, the Mid and Upper Mid-scale hotel segment currently holds a significant lead, capturing approximately 40% of the market. This segment's broad appeal and ability to cater to a diverse customer base, from budget-conscious travelers seeking value to those desiring enhanced amenities, underpins its success.

Key Drivers of Dominance:

-

World-Class Tourism Infrastructure: Canada boasts well-developed international airports, extensive transportation networks, and a wealth of globally recognized tourist attractions, making it an accessible and appealing destination.

-

Resilient Economic Climate: Strong regional and national economies provide a stable foundation for both business travel and discretionary leisure spending, directly benefiting the hospitality sector.

-

Concentrated Urban Hubs: High population density in major metropolitan areas like Toronto, Vancouver, and Montreal creates consistent demand for accommodation, catering to residents and visitors alike.

-

By Property Type: Chain hotels generally command a larger market share than independent establishments. This is attributed to the power of brand recognition, established loyalty programs, and the operational efficiencies and economies of scale that large brands can leverage. However, independent hotels continue to thrive by carving out niche markets and offering unique, personalized guest experiences that resonate with specific traveler demographics.

-

By Segment: The market is broadly segmented to cater to varied traveler needs. Budget and Economy hotels effectively serve price-sensitive travelers, while the Luxury segment targets high-net-worth individuals seeking premium services and amenities. A particularly noteworthy and growing niche is that of serviced apartments, which are increasingly attracting business travelers and families requiring extended stays, offering a blend of hotel services with residential comfort.

Hospitality Industry in Canada Product Developments

The Canadian hospitality sector is actively embracing innovation to elevate guest experiences and operational efficiency. Recent product developments highlight a dual focus on technological integration and sustainability. We're seeing a surge in the adoption of smart technologies, including seamless keyless entry systems, personalized in-room entertainment platforms, and AI-powered guest service applications. Simultaneously, there's a pronounced emphasis on sustainable design and operational practices, ranging from energy-efficient building materials and waste reduction programs to locally sourced food and water conservation initiatives. These forward-thinking developments not only enhance the guest journey but also appeal to an increasingly environmentally conscious consumer base, ultimately creating a distinct competitive advantage for establishments that proactively integrate these trends into their offerings.

Report Scope & Segmentation Analysis

This report segments the Canadian hospitality market by type (Chain Hotels and Independent Hotels) and by segment (Service Apartments, Budget and Economy Hotels, Mid and Upper Mid-scale Hotels, and Luxury Hotels). Each segment is analyzed based on historical data, market size, growth projections, and competitive dynamics. For example, the luxury hotel segment is anticipated to experience a moderate growth rate, driven by increasing high-net-worth individuals and rising disposable incomes. Market sizes for each segment are presented in Millions of dollars for the period 2019-2033. Competitive dynamics within each segment are examined to offer insights into the key players and market share distribution.

Key Drivers of Hospitality Industry in Canada Growth

Several factors drive the growth of the Canadian hospitality industry: a rise in domestic and international tourism, a growing economy that fuels business travel, increasing urbanization leading to higher accommodation demand, and technological advancements that enhance customer experiences and operational efficiency.

Challenges in the Hospitality Industry in Canada Sector

The Canadian hospitality industry navigates a complex landscape of challenges. Rising operational costs, encompassing everything from utilities and supplies to labor expenses, exert constant pressure on profitability. The burgeoning popularity of alternative accommodation providers, such as Airbnb and other short-term rental platforms, presents significant competition. Furthermore, persistent labor shortages across various roles, from frontline staff to management, and the difficulty in attracting and retaining talent remain critical issues. The sector is also susceptible to fluctuations in tourism patterns, which can be influenced by external factors like global economic downturns, geopolitical events, or even localized issues. These multifaceted challenges can significantly impact revenue and necessitate ongoing strategic adaptation, with estimates suggesting that these pressures could potentially temper the Compound Annual Growth Rate (CAGR) by approximately 1% in certain periods.

Emerging Opportunities in Hospitality Industry in Canada

Emerging opportunities exist in the areas of sustainable tourism, wellness tourism, and the development of unique, experiential hospitality offerings. The rising demand for eco-friendly and health-conscious travel experiences is a significant market driver. Technological advancements, such as AI-powered customer service and data analytics for personalized offers, present further growth opportunities.

Leading Players in the Hospitality Industry in Canada Market

- Hilton Worldwide Holdings Inc

- Hyatt Hotels Corporation

- Best Western International Inc

- Choice Hotels International Inc

- Coast Hotels Limited

- Mariott International Inc

- Wyndham Hotel Group LLC

- Intercontinental Hotels Group

- The Sandman Group

- Accor SA

Key Developments in Hospitality Industry in Canada Industry

-

July 2023: Wyndham Hotels & Resorts marked a significant expansion into Canada's extended-stay market by announcing the addition of 60 new hotels under its Echo Suites brand, including its initial Canadian locations. This strategic move signals substantial investment and confidence in the Canadian lodging sector.

-

January 2024: APA Hotel Canada Inc., operating as a subsidiary of Coast Hotels Limited, celebrated the opening of two new franchise properties in Dawson City, Yukon. This expansion underscores the growing reach of the Coast Hotels brand and highlights development activity in regions historically considered less saturated by major hotel chains.

Strategic Outlook for Hospitality Industry in Canada Market

The outlook for Canada's hospitality industry remains robust and optimistic, driven by sustained growth in tourism, a stable economic environment, and the continuous advancement of technological solutions. Strategic opportunities abound for forward-thinking companies that demonstrate agility in adapting to the evolving preferences of modern travelers. Embracing sustainable practices is no longer optional but a crucial differentiator. Furthermore, leveraging technology to personalize the guest experience, streamline operations, and enhance overall efficiency will be paramount. The long-term trajectory of this dynamic sector is overwhelmingly positive, promising continued innovation and lucrative prospects for those prepared to meet the demands of the future.

Hospitality Industry in Canada Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Segment

- 2.1. Service Apartments

- 2.2. Budget and Economy Hotels

- 2.3. Mid and Upper Mid-scale Hotels

- 2.4. Luxury Hotels

Hospitality Industry in Canada Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hospitality Industry in Canada Regional Market Share

Geographic Coverage of Hospitality Industry in Canada

Hospitality Industry in Canada REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Awareness among Hotels & Resorts to Implement Eco-Friendly Measures; Rising Mobile Reservations & Contactless Check-In/Out

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labour; Reputation Management is One of the Most Important Tasks in the Hospitality industry

- 3.4. Market Trends

- 3.4.1. The Increase in Tourist Arrivals and Hotel Occupancy also Results in an Increase in Spending

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospitality Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Service Apartments

- 5.2.2. Budget and Economy Hotels

- 5.2.3. Mid and Upper Mid-scale Hotels

- 5.2.4. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hospitality Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Chain Hotels

- 6.1.2. Independent Hotels

- 6.2. Market Analysis, Insights and Forecast - by Segment

- 6.2.1. Service Apartments

- 6.2.2. Budget and Economy Hotels

- 6.2.3. Mid and Upper Mid-scale Hotels

- 6.2.4. Luxury Hotels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Hospitality Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Chain Hotels

- 7.1.2. Independent Hotels

- 7.2. Market Analysis, Insights and Forecast - by Segment

- 7.2.1. Service Apartments

- 7.2.2. Budget and Economy Hotels

- 7.2.3. Mid and Upper Mid-scale Hotels

- 7.2.4. Luxury Hotels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Hospitality Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Chain Hotels

- 8.1.2. Independent Hotels

- 8.2. Market Analysis, Insights and Forecast - by Segment

- 8.2.1. Service Apartments

- 8.2.2. Budget and Economy Hotels

- 8.2.3. Mid and Upper Mid-scale Hotels

- 8.2.4. Luxury Hotels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Hospitality Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Chain Hotels

- 9.1.2. Independent Hotels

- 9.2. Market Analysis, Insights and Forecast - by Segment

- 9.2.1. Service Apartments

- 9.2.2. Budget and Economy Hotels

- 9.2.3. Mid and Upper Mid-scale Hotels

- 9.2.4. Luxury Hotels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Hospitality Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Chain Hotels

- 10.1.2. Independent Hotels

- 10.2. Market Analysis, Insights and Forecast - by Segment

- 10.2.1. Service Apartments

- 10.2.2. Budget and Economy Hotels

- 10.2.3. Mid and Upper Mid-scale Hotels

- 10.2.4. Luxury Hotels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hilton Worldwide Holdings Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hyatt Hotels Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Best Western International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Choice Hotels International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Coast Hotels Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mariott International Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Wyndham Hotel Group LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Intercontinental Hotels Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Sandman Group**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Accor SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Hilton Worldwide Holdings Inc

List of Figures

- Figure 1: Global Hospitality Industry in Canada Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hospitality Industry in Canada Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Hospitality Industry in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hospitality Industry in Canada Revenue (Million), by Segment 2025 & 2033

- Figure 5: North America Hospitality Industry in Canada Revenue Share (%), by Segment 2025 & 2033

- Figure 6: North America Hospitality Industry in Canada Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Hospitality Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hospitality Industry in Canada Revenue (Million), by Type 2025 & 2033

- Figure 9: South America Hospitality Industry in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Hospitality Industry in Canada Revenue (Million), by Segment 2025 & 2033

- Figure 11: South America Hospitality Industry in Canada Revenue Share (%), by Segment 2025 & 2033

- Figure 12: South America Hospitality Industry in Canada Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Hospitality Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hospitality Industry in Canada Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Hospitality Industry in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Hospitality Industry in Canada Revenue (Million), by Segment 2025 & 2033

- Figure 17: Europe Hospitality Industry in Canada Revenue Share (%), by Segment 2025 & 2033

- Figure 18: Europe Hospitality Industry in Canada Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Hospitality Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hospitality Industry in Canada Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa Hospitality Industry in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Hospitality Industry in Canada Revenue (Million), by Segment 2025 & 2033

- Figure 23: Middle East & Africa Hospitality Industry in Canada Revenue Share (%), by Segment 2025 & 2033

- Figure 24: Middle East & Africa Hospitality Industry in Canada Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hospitality Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hospitality Industry in Canada Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific Hospitality Industry in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Hospitality Industry in Canada Revenue (Million), by Segment 2025 & 2033

- Figure 29: Asia Pacific Hospitality Industry in Canada Revenue Share (%), by Segment 2025 & 2033

- Figure 30: Asia Pacific Hospitality Industry in Canada Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Hospitality Industry in Canada Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospitality Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Hospitality Industry in Canada Revenue Million Forecast, by Segment 2020 & 2033

- Table 3: Global Hospitality Industry in Canada Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Hospitality Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Hospitality Industry in Canada Revenue Million Forecast, by Segment 2020 & 2033

- Table 6: Global Hospitality Industry in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Hospitality Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Hospitality Industry in Canada Revenue Million Forecast, by Segment 2020 & 2033

- Table 12: Global Hospitality Industry in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Hospitality Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Hospitality Industry in Canada Revenue Million Forecast, by Segment 2020 & 2033

- Table 18: Global Hospitality Industry in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Hospitality Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Hospitality Industry in Canada Revenue Million Forecast, by Segment 2020 & 2033

- Table 30: Global Hospitality Industry in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Hospitality Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Hospitality Industry in Canada Revenue Million Forecast, by Segment 2020 & 2033

- Table 39: Global Hospitality Industry in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospitality Industry in Canada?

The projected CAGR is approximately 5.27%.

2. Which companies are prominent players in the Hospitality Industry in Canada?

Key companies in the market include Hilton Worldwide Holdings Inc, Hyatt Hotels Corporation, Best Western International Inc, Choice Hotels International Inc, Coast Hotels Limited, Mariott International Inc, Wyndham Hotel Group LLC, Intercontinental Hotels Group, The Sandman Group**List Not Exhaustive, Accor SA.

3. What are the main segments of the Hospitality Industry in Canada?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 39.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Awareness among Hotels & Resorts to Implement Eco-Friendly Measures; Rising Mobile Reservations & Contactless Check-In/Out.

6. What are the notable trends driving market growth?

The Increase in Tourist Arrivals and Hotel Occupancy also Results in an Increase in Spending.

7. Are there any restraints impacting market growth?

Lack of Skilled Labour; Reputation Management is One of the Most Important Tasks in the Hospitality industry.

8. Can you provide examples of recent developments in the market?

January 2024 - APA Hotel Canada Inc., a wholly owned subsidiary of Coast Hotels Limited, is one of the fastest-growing hotel brands in North America and one of the largest hotel brands in Canada. Coast Hotels announced the opening of two brand new franchise properties, Eldorado (a Coast Hotel) and Midnight Sun (a Coast Hotel), in the historic and vibrant downtown area of Dawson City, Yukon, Canada.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospitality Industry in Canada," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospitality Industry in Canada report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospitality Industry in Canada?

To stay informed about further developments, trends, and reports in the Hospitality Industry in Canada, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence